As filed with the Securities and Exchange Commission on November 9, 2011

Registration No. 333 –

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-8

REGISTRATION STATEMENT UNDER

THE SECURITIES ACT OF 1933

GULF RESOURCES, INC.

[Missing Graphic Reference]

(Exact name of registrant as specified in its charter)

|

Delaware

|

13-3637458

|

2800

|

|

|

|

|

|

(State or Other Jurisdiction of

Incorporation or Organization)

|

(IRS Employer Identification No.)

|

(Primary Standard Industrial

Classification Code Number)

|

99 Wenchang Road, Chenming Industrial Park, Shouguang City, Shandong, China, 262714

+86 (536) 567-0008

(Address, including zip code, and Telephone Number, including area code, of Registrant’s Principal Executive Offices)

345 Park Avenue

New York, New York 10154

(212) 407-4000

(Name, Address, including zip code, and Telephone Number, including area code, of Agent for Service)

With a copy to:

Mitchell S. Nussbaum, Esq.

Loeb & Loeb LLP

345 Park Avenue

New York, New York 10154

Tel: (212) 407-4159

Fax: (212) 407-4990

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

¨

|

Accelerated filer

ý

|

Non-accelerated filer

¨

(Do not check if smaller reporting company)

|

Smaller reporting company

¨

|

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of Securities to Be Registered

|

|

Title of Plan

|

|

Amount to

Be Registered (1)

|

|

Proposed

Maximum

Offering

Price Per

Share (2)

|

|

Proposed

Maximum

Aggregate

Offering Price

|

|

Amount of

Registration

Fee (3)

|

|

|

Common stock, par value $0.0005

|

|

Amended and Restated 2007 Equity Incentive Plan(4)

|

|

1,841,989

|

|

$

|

2.57

|

|

$

|

4,733,912

|

|

$

|

542.51

|

|

|

Total

|

|

|

|

|

|

|

|

$

|

4,733,912

|

|

$

|

542.51

|

|

|

(1)

|

This Registration Statement, pursuant to Rule 416 under the Securities Act of 1933, as amended (the “Securities Act”), covers an indeterminate number of additional shares of Common Stock with respect to the shares registered hereunder in the event of a stock split, stock dividend or similar transaction. This Registration Statement also covers the resale by certain selling stockholders named in the Prospectus included in and filed with this Form S-8 of certain shares of the Company’s Common Stock subject to this Registration Statement, for which no additional registration fee is required pursuant to Rule 457(h)(3). The share totals in this column reflect a 2-for-1 stock split in November 2007 and a 1-for-4 reverse stock split in October 2009, and consists of 1,841,989 shares of Common Stock issuable under the Company’s Amended and Restated 2007 Equity Incentive Plan.

|

|

(2)

|

Estimated solely for the purpose of computing the registration fee pursuant to Rules 457(c) and (h), based on the average of the high and low prices of the Common Stock of Gulf Resources, Inc. on November 8, 2011, as reported on the Nasdaq Global Select Market, under the symbol “GURE”.

|

|

(3)

|

The registration fee is applicable only to the 1,841,989 additional shares to be registered herein. $268.63 was previously paid.

|

|

(4)

|

The 2007 Equity Incentive Plan was amended and restated on March 29, 2011 to increase the number of shares of Common Stock reserved for issuance under the plan to 4,341,989 shares.

|

|

|

|

EXPLANATORY NOTE

Pursuant to Rule 429 under the Securities Act of 1933, the prospectus included in this registration statement is a combined prospectus relating to registration statement no. 333-140971 previously filed by the registrant on Form S-8 on February 28, 2007, under which sales will cease upon the filing of this registration statement. This registration statement, which is a new registration statement, also constitutes post-effective amendment no. 2 to registration statement no. 333-140971, and such post-effective amendment shall hereafter become effective concurrently with the effectiveness of this registration statement and in accordance with Rule 464 of the Securities Act of 1933. This registration statement includes 2,500,000 shares of common stock which were previously included in registration statement no. 333-140971 and 1,841,989 shares of common stock which are being registered herein.

The Company completed a 2-for-1 stock split in November 2007 and a 1-for-4 reverse stock split in October 2009.

The Amended and Restated 2007 Incentive Stock Plan filed herewith as Exhibit 4.2 replaces the Exhibit 4.2 previously filed with Registration Statement No. 333-140971.

The reoffer prospectus contained herein has been prepared in accordance with the requirements of Part I of Form S-3 and, pursuant to General Instruction C of Form S-8, may be used for reoffers or resales of the shares that have been or will be acquired by the selling stockholders.

PART I

INFORMATION REQUIRED IN THE SECTION 10(a) PROSPECTUS

Item 1. Plan Information

The documents containing the information specified in Part I of this Registration Statement will be sent or given to eligible employees as specified by Rule 428(b)(1) of the Securities Act of 1933, as amended as of the date of this Registration Statement (the “Securities Act”). Such documents are not required to be and are not filed with the Securities and Exchange Commission (the “SEC”) either as part of this Registration Statement or as prospectuses or prospectus supplements pursuant to Rule 424. These documents and the documents incorporated by reference in this Registration Statement pursuant to Item 3 of Part II of this Form S-8, taken together, constitute a prospectus that meets the requirements of Section 10(a) of the Securities Act.

Item 2. Registrant Information and Employee Plan Annual Information.

Upon written or oral request, any of the documents incorporated by reference in Item 3 of Part II of this Registration Statement (which documents are incorporated by reference in this Section 10(a) Prospectus), other documents required to be delivered to eligible employees pursuant to Rule 428(b) or additional information about the Offering are available without charge by contacting:

Secretary

Gulf Resources, Inc.

99 Wenchang Road, Chenming Industrial Park

Shouguang City, Shandong, People’s Republic of China, 262714

Tel:

+ 86-536-567-0008

REOFFER PROSPECTUS

4,341,989 Shares of Common Stock

Gulf Resources, Inc.

Common Stock $0.0005 Par Value Per Share

This Prospectus relates to 4,341,989 shares (the “Shares”) of Common Stock, par value $0.0005 per share (“Common Stock”), of Gulf Resources, Inc., a Delaware corporation (the “Company,”) which may be offered and sold from time to time by certain stockholders of the Company (the “Selling Stockholders”) who have acquired or will acquire such Shares pursuant to stock options and stock awards issued or issuable under the Company’s Amended and Restated 2007 Equity Incentive Plan (the “2007 Plan”). See “Selling Stockholders.” It is anticipated that the Selling Stockholders will offer Shares for sale at prevailing prices on the NASDAQ Global Select Market on the date of sale, in negotiated transactions or otherwise, at market prices prevailing at the time of the sale or at prices otherwise negotiated. See “Plan of Distribution.” We will receive no part of the proceeds from sales made under this reoffer prospectus. The Selling Stockholders will bear all sales commissions and similar expenses. Any other expenses incurred by us in connection with the registration and offering and not borne by the Selling Stockholders will be borne by us.

We have agreed to pay the expenses in connection with the registration of these Shares. Our Common Stock is traded on the Nasdaq Global Select Market under the symbol “GURE.” On November 8, 2011, the last reported sale price of the Common Stock on the Nasdaq Global Select Market was $2.54 per share.

Our principal executive office is located at 99 Wenchang Road, Chenming Industrial Park, Shouguang City, Shandong, China, 262714 and our telephone number is +86 (536) 567 0008.

INVESTING IN OUR SECURITIES INVOLVES A HIGH DEGREE OF RISK. SEE “RISK FACTORS” BEGINNING ON PAGE 5 OF THIS PROSPECTUS FOR CERTAIN RISKS THAT SHOULD BE CONSIDERED BY PROSPECTIVE PURCHASERS OF THE SECURITIES OFFERED HEREBY.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR DETERMINED IF THIS PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The Date of This Prospectus is November 9, 2011.

Table of Contents

|

|

Page

|

|

Prospectus Summary

|

1

|

|

The Offering

|

2

|

|

Forward-Looking Statements

|

3

|

|

Risk Factors

|

3

|

|

Use of Proceeds

|

3

|

|

Selling Stockholders

|

4

|

|

Plan of Distribution

|

5

|

|

Limitation on Liability and Indemnification Matters

|

6

|

|

Experts

|

6

|

|

Legal Matters

|

6

|

|

Incorporation of Documents by Reference

|

6

|

|

Where You Can Find More Information

|

7

|

You should rely only on the information contained in this prospectus. We have not authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. The Selling Stockholders will not make an offer to sell these securities in any jurisdiction where an offer or sale is not permitted. You should assume that the information appearing in this prospectus is accurate as of the date on the front cover of this prospectus only, regardless of the time of delivery of this prospectus or of any sale of our Common Stock. Our business, financial condition, results of operations and prospects may have changed since that date.

PROSPECTUS SUMMARY

This summary may not contain all of the information that may be important to you. We urge you to read this entire prospectus carefully, including the risks of investing in our Common Stock discussed under “Risk Factors” and the financial statements and other information that is incorporated by reference into this prospectus, before making an investment decision. In addition, this prospectus summarizes other documents, incorporated by reference which we urge you to read.

Overview of Our Business

We conduct our operations through our two wholly-owned PRC subsidiaries, Shouguang City Haoyuan Chemical Company Limited (“SCHC”) and Shouguang Yuxin Chemical Industry Co., Limited (“SYCI”). Through SCHC we manufacture and trade bromine and crude salt, and we believe that we are one of the largest producers of bromine in China, as measured by production output. Through SYCI we manufacture and sell chemical products used in oil and gas field exploration, oil and gas distribution, oil field drilling, wastewater processing, papermaking chemical agents and inorganic chemicals. We report our business in three segments: Bromine, Crude Salt, and Chemical Products.

Bromine (Br

2

) is a halogen element and it is a red volatile liquid at standard room temperature which has reactivity between chlorine and iodine. Elemental bromine is used to manufacture a wide variety of bromine compounds used in industry and agriculture. Bromine is also used to form intermediates in organic synthesis, in which it is somewhat preferable over iodine due to its lower cost. Our bromine is commonly used in brominated flame retardants, fumigants, water purification compounds, dyes, medicines and disinfectants. According to figures published by the China Crude Salt Association, we are one of the largest manufacturers of bromine in the PRC, as measured by production output.

Our executive offices are located at 99 Wenchang Road, Chenming Industrial Park, Shouguang City, Shandong, People's Republic of China. Our telephone number is +86 (536) 5670008. Our website address is www.gulfresourcesinc.cn.

THE OFFERING

|

Common Stock being offered by Selling Stockholders

|

|

Up to 4,341,989 shares

|

|

|

|

|

|

Use of Proceeds

|

|

We will not receive any proceeds from the sale of the Common Stock offered in this prospectus.

|

|

|

|

|

|

NASDAQ Global Select Market Symbol

|

|

GURE

|

|

|

|

|

|

Risk Factors

|

|

The securities offered by this prospectus are speculative and involve a high degree of risk. Investors purchasing securities should not purchase the securities unless they can afford the loss of their entire investment. See “Risk Factors” beginning on page 3.

|

FORWARD-LOOKING STATEMENTS

We believe that some of the information in this prospectus constitutes forward-looking statements within the definition of the Private Securities Litigation Reform Act of 1995. You can identify these statements by forward-looking words such as “may,” “expect,” “anticipate,” “contemplate,” “believe,” “estimate,” “intend,” “plan,” “project,” “target,” “can,” “could,” “should,” “will,” “would” and “continue” or similar words or expressions. You should read statements that contain these words carefully because they:

|

|

·

|

discuss future expectations;

|

|

|

·

|

contain information which could impact future results of operations or financial condition; or

|

|

|

·

|

state other “forward-looking” information.

|

You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this prospectus.

All forward-looking statements included herein attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this section. Except to the extent required by applicable laws and regulations, we undertake no obligation to update these forward-looking statements to reflect events or circumstances after the date of this document or to reflect the occurrence of unanticipated events.

RISK FACTORS

An investment in our common stock involves risk. Before making an investment decision, you should carefully consider the risks described under “Risk Factors” in our Annual Reports on Form 10-K, or any updates to our risk factors in our Quarterly Reports on Form 10-Q, together with all of the other information appearing in or incorporated by reference into this prospectus and any applicable prospectus supplement, in light of your particular investment objectives and financial circumstances. Our business, financial condition or results of operations could be materially adversely affected by any of these risks. The trading price of our securities could decline due to any of these risks, and you may lose all or part of your investment.

USE OF PROCEEDS

The Selling Stockholders are offering up to 662,500 shares of our Common Stock underlying stock options granted to the Selling Stockholders under our 2007 Equity Incentive Plan. We will not receive any proceeds from the sale of the Common Stock by the Selling Stockholders. However, if all of the Selling Stockholders exercise their options for cash we will receive proceeds of $3,363,750.

SELLING STOCKHOLDERS

This prospectus relates to shares of our Common Stock that are being registered for reoffers and resales by the Selling Stockholders named below who have acquired or may acquire securities pursuant to our 2007 Plan and/or 2011 Amended Plan. The Selling Stockholders may resell any or all of the shares of our Common Stock at any time they choose while the registration statement of which this prospectus forms a part is effective.

Affiliates that acquire shares of our Common Stock may be added to the Selling Stockholders list below by a prospectus supplement filed with the SEC. The number of shares to be sold by any Selling Stockholder under this prospectus also may be increased or decreased by a prospectus supplement.

Unless otherwise indicated in the footnotes to this table, to our knowledge, all persons named in the table have sole voting and investment power with respect to their shares of common stock, except to the extent authority is shared by spouses under applicable law. The inclusion of any shares in this table does not constitute an admission of beneficial ownership for the person named below. The Selling Stockholders may offer all or some portion of the shares of the Common Stock. Accordingly, no estimate can be given as to the amount or percentage of our Common Stock that will be held by the Selling Stockholders upon completion of sales pursuant to this prospectus.

As of November 4, 2011, there were 34,745,342 shares of our Common Stock outstanding.

|

Name and Title of Selling Stockholder

|

|

Number of

Shares

Beneficially

Owned Prior

to this

Offering (1)

|

|

|

Number of

Shares offered

Hereby

|

|

|

Number of

Shares Owned

After this

Offering

Assuming All

Shares Offered

Hereby are Sold

|

|

|

Percentage of

Ownership

After this

Offering (%)

|

|

Xiaobin Liu, CEO and Director

|

|

|

214,831 (3)

|

|

|

|

214,831

|

|

|

|

0

|

|

|

|

*

|

|

|

Naihui Miao, COO and Director

|

|

|

214,831 (3)

|

|

|

|

214,831

|

|

|

|

0

|

|

|

|

*

|

|

|

Min Li, CFO

|

|

|

214,831 (3)

|

|

|

|

214,831

|

|

|

|

0

|

|

|

|

*

|

|

|

Tengfei Zhang, Director

|

|

|

12,500 (2)

|

|

|

|

12,500

|

|

|

|

0

|

|

|

|

*

|

|

|

Nan Li, Director

|

|

|

12,500 (2)

|

|

|

|

12,500

|

|

|

|

0

|

|

|

|

*

|

|

|

Yang Zou, Director

|

|

|

12,500 (2)

|

|

|

|

12,500

|

|

|

|

0

|

|

|

|

*

|

|

|

Shitong Jiang, Director

|

|

|

25,000 (2)

|

|

|

|

25,000

|

|

|

|

0

|

|

|

|

*

|

|

______________

* Indicates less than 1%.

(1) Beneficial ownership is determined in accordance with the rules and regulations of the SEC. In computing the number of shares beneficially owned by a person and the percentage ownership of that person, securities that are currently convertible or exercisable into shares of our Common Stock, or convertible or exercisable into shares of our Common Stock within 60 days of the date hereof are deemed outstanding. Such shares, however, are not deemed outstanding for the purposes of computing the percentage ownership of any other person. Except as indicated in the footnotes to the following table, each stockholder named in the table has sole voting and investment power with respect to the shares set forth opposite such stockholder’s name.

(2) Represents shares underlying stock options.

(3) Represents 200,000 shares underlying stock options and 14,831 shares of Common Stock.

PLAN OF DISTRIBUTION

The Selling Stockholders and any of their pledgees, donees, transferees, assignees and successors-in-interest may, from time to time, sell any or all of their shares of Common Stock on any stock exchange, market or trading facility on which the shares are traded or in private transactions. These sales may be at fixed or negotiated prices. The Selling Stockholders may use any one or more of the following methods when selling shares:

|

|

(i)

|

ordinary brokerage transactions and transactions in which the broker-dealer solicits investors;

|

|

|

(ii)

|

block trades in which the broker-dealer will attempt to sell the shares as agent but may position and resell a portion of the block as principal to facilitate the transaction;

|

|

|

(iii)

|

purchases by a broker-dealer as principal and resale by the broker-dealer for its account;

|

|

|

(iv)

|

an exchange distribution in accordance with the rules of the applicable exchange;

|

|

|

(v)

|

privately negotiated transactions;

|

|

|

(vii)

|

broker-dealers may agree with the Selling Stockholders to sell a specified number of such shares at a stipulated price per share;

|

|

|

(viii)

|

a combination of any such methods of sale; and

|

|

|

(ix)

|

any other method permitted pursuant to applicable law.

|

The Selling Stockholders may also sell shares under Rule 144 under the Securities Act, if available, rather than under this prospectus.

Until such time as the Company satisfies the registrant requirements for use of Form S-3 under the Securities Act of 1933, the amount of our common stock to be reoffered or resold by means of this reoffer prospectus by each Selling Stockholder, may not exceed the amount specified in Rule 144(e) of the Securities Act of 1933.

Broker-dealers engaged by the Selling Stockholders may arrange for other brokers-dealers to participate in sales. Broker-dealers may receive commissions or discounts from the Selling Stockholders (or, if any broker-dealer acts as agent for the purchaser of shares, from the purchaser) in amounts to be negotiated. The Selling Stockholders do not expect these commissions and discounts to exceed what is customary in the types of transactions involved.

The Selling Stockholders may from time to time pledge or grant a security interest in some or all of the shares owned by them and, if they default in the performance of their secured obligations, the pledgees or secured parties may offer and sell shares of Common Stock from time to time under this prospectus, or under an amendment to this prospectus under Rule 424(b)(3) or other applicable provision of the Securities Act of 1933, as amended, amending the list of Selling Stockholders to include the pledgee, transferee or other successors in interest as Selling Stockholders under this prospectus.

The Selling Stockholders also may transfer the shares of Common Stock in other circumstances, in which case the transferees, pledgees or other successors in interest will be the selling beneficial owners for purposes of this prospectus.

The Selling Stockholders and any broker-dealers or agents that are involved in selling the shares may be deemed to be “underwriters” within the meaning of the Securities Act in connection with such sales. In such event, any commissions received by such broker-dealers or agents and any profit on the resale of the shares purchased by them may be deemed to be underwriting commissions or discounts under the Securities Act. Discounts, concessions, commissions and similar selling expenses, if any, that can be attributed to the sale of securities will be paid by the selling stockholder and/or the purchasers. At the time a particular offer of shares is made by the Selling Stockholders, to the extent required, a prospectus will be distributed. Each selling stockholder has represented and warranted to the Company that it acquired the securities subject to this registration statement in the ordinary course of such selling stockholder’s business and, at the time of its purchase of such securities such selling stockholder had no agreements or understandings, directly or indirectly, with any person to distribute any such securities.

LIMITATION ON LIABILITY AND INDEMNIFICATION MATTERS

Section 145 of the Delaware General Corporation Law authorizes a court to award, or a corporation’s board of directors to grant, indemnity to directors and officers in terms sufficiently broad to permit such indemnification under certain circumstances for liabilities (including reimbursement for expenses incurred) arising under the Securities Act of 1933, as amended (the “Securities Act”).

The Certificate of Incorporation and By-Laws of the Company provide that the registrant shall indemnify any person to the full extent permitted by the Delaware General Corporation Law (the “DGCL”). Section 145 of the DGCL, relating to indemnification, is hereby incorporated herein by reference.

Our Certificate of Incorporation eliminates the liability of a director for monetary damages for breach of duty as a director, subject to certain exceptions. In addition, our Certificate of Incorporation provides for indemnification, under certain conditions, of our directors, officers, employees and agents against all expenses, liabilities and losses reasonably incurred by them in the course of their duties. These provisions may reduce the likelihood of derivative litigation against directors and may discourage or deter stockholders or management from suing directors for breaches of their duty of care, even though such an action, if successful, might otherwise benefit us and our stockholders.

In addition, the Company currently maintains an officers’ and directors’ liability insurance policy which insures, Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers or persons controlling the registrant, pursuant to the foregoing provisions, the Company has been informed that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Securities Act of 1933 and is, therefore, unenforceable.

EXPERTS

BDO Limited, an independent registered public accounting firm, has audited our financial statements incorporated by reference in this prospectus for the year ended December 31, 2010. Our financial statements are incorporated by reference in reliance on the respective report of BDO Limited and given upon their authority as experts in accounting and auditing.

LEGAL MATTERS

Loeb & Loeb LLP has passed upon the validity of the Common Stock being offered hereby.

INCORPORATION OF DOCUMENTS BY REFERENCE

This prospectus is part of a registration statement on Form S-8. The prospectus is prepared in accordance with the requirements of Part I of Form S-3 and General Instruction C of the instructions to Form S-8. The SEC allows this filing to “incorporate by reference” information that the Company previously has filed with the SEC. This means the Company can disclose important information to you by referring you to other documents that it has filed with the SEC. The information that is incorporated by reference is considered part of this prospectus, and information that the Company files later will automatically update and may supersede this information. For further information about the Company and the securities being offered, you should refer to the registration statement and the following documents that are incorporated by reference:

|

|

·

|

the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2010 filed with the SEC on March 16, 2011;

|

|

|

·

|

the Company’s Quarterly Reports on Form 10-Q for the quarterly period ended March 31, 2011 filed with the SEC on May 16, 2011, and for the quarterly period ended June 30, 2011 filed with the SEC on August 16, 2011;

|

|

|

·

|

the Company’s Current Reports on Form 8-K, filed with the SEC on March 17, 2011, March 31, 2011, April 4, 2011, April 21, 2011, April 28, 2011, May 2, 2011, May 11, 2011, May 17, 2011, June 8, 2011, June 13, 2011, June 23, 2011, June 29, 2011, July 6, 2011, July 13, 2011, August 25, 2011, September 20, 2011, September 27, 2011 and October 20, 2011; and

|

|

|

|

|

|

|

·

|

the description of the Company’s Common Stock contained in the Registration Statement on Form 8-A (File No. 001-34499), together with any amendments or reports filed for the purpose of updating such description.

|

All documents subsequently filed with the Securities and Exchange Commission by us pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act, (other than current reports or portions thereof furnished under Items 2.02 or 7.01 of Form 8-K), prior to the termination of this offering, shall be deemed to be incorporated by reference herein and to be part of this prospectus from the respective dates of filing of such documents. Any statement contained herein or in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for purposes hereof or of the related prospectus supplement to the extent that a statement in any other subsequently filed document which is also incorporated or deemed to be incorporated herein modifies or supersedes such statement. Any such statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this prospectus.

You may request a copy of all documents that are incorporated by reference in this prospectus by writing or telephoning us at the following address and telephone number: Xiaobin Liu,, Chief Executive Officer, Gulf Resources, Inc., 99 Wenchang Road, Chenming Industrial Park, Shouguang City, Shandong, China, 262714, Tel: +86 (536) 567-0008. We will provide copies of all documents requested (not including exhibits to those documents, unless the exhibits are specifically incorporated by reference into those documents or this prospectus) without charge.

WHERE YOU CAN FIND MORE INFORMATION

We have filed with the SEC a Post-Effective Registration Statement on Form S-8 under the Securities Act with respect to the shares of Common Stock offered hereby. This prospectus, which constitutes a part of the registration statement, does not contain all of the information set forth in the registration statement or the exhibits and schedules filed therewith. For further information about us and the Common Stock offered hereby, reference is made to the registration statement and the exhibits and schedules filed therewith.

We are required to file annual and quarterly reports, current reports, proxy statements, and other information with the SEC. You can read our SEC filings, including the registration statement, on the SEC’s website at http://www.sec.gov. You also may read and copy any document we file with the SEC at its public reference facility at:

U.S. Securities and Exchange Commission

100 F Street, N.E.

Washington, D.C. 20549.

You may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. Information contained on our web site should not be considered part of this prospectus. You may also request a copy of our filings at no cost, by writing or telephoning us at Gulf Resources, Inc., Attention: Secretary, 99 Wenchang Raod, Chenming Industrial Park, Shouguang City, Shandong, China, 262714, Tel: +86 (536) 567-0008.

No dealer, salesperson or other person is authorized to give any information or to make any representations other than those contained in this prospectus, and, if given or made, such information or representations must not be relied upon as having been authorized by us. This prospectus does not constitute an offer to buy any security other than the securities offered by this prospectus, or an offer to sell or a solicitation of an offer to buy any securities by any person in any jurisdiction where such offer or solicitation is not authorized or is unlawful. Neither delivery of this prospectus nor any sale hereunder shall, under any circumstances, create any implication that there has been no change in the affairs of our company since the date hereof.

GULF RESOURCES, INC.

4,341,989 SHARES OF COMMON STOCK

PROSPECTUS

November 9, 2011

Part II

Information required in the registration statement

Item 3. Incorporation of Documents by Reference

The following documents filed by the Company with the Securities and Exchange Commission (the “Commission”) are incorporated by reference in this Registration Statement.

|

|

·

|

the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2010 filed with the SEC on March 16, 2011;

|

|

|

·

|

the Company’s Quarterly Reports on Form 10-Q for the quarterly period ended March 31, 2011 filed with the SEC on May 16, 2011, and for the quarterly period ended June 30, 2011 filed with the SEC on August 16, 2011;

|

|

|

·

|

the Company’s Current Reports on Form 8-K, filed with the SEC on March 17, 2011, March 31, 2011, April 4, 2011, April 21, 2011, April 28, 2011, May 2, 2011, May 11, 2011, May 17, 2011, June 8, 2011, June 13, 2011, June 23, 2011, June 29, 2011, July 6, 2011, July 13, 2011, August 25, 2011, September 20, 2011, September 20, 2011 and October 20, 2011; and

|

|

|

·

|

the description of the Company’s Common Stock contained in the Registration Statement on Form 8-A (File No. 001-34499), together with any amendments or reports filed for the purpose of updating such description.

|

All reports and other documents subsequently filed by the Registrant pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act prior to the filing of a post-effective amendment that indicates that all securities offered have been sold or that deregisters all securities then remaining unsold, shall be deemed to be incorporated by reference in this Registration Statement and to be a part hereof from the date of the filing of such reports and documents. Unless expressly incorporated into this Registration Statement, a report furnished but not filed on Form 8-K shall not be incorporated by reference into this Registration Statement.

Item 4. Description of Securities.

Not applicable.

Item 5. Interests of Named Experts and Counsel.

Not applicable.

Item 6. Indemnification of Directors and Officers.

Our Amended and Restated Certificate of Incorporation provides that all directors, officers, employees and agents of the registrant shall be entitled to be indemnified by us to the fullest extent permitted by under Delaware law.

Section 145 of the Delaware General Corporation Law concerning indemnification of officers, directors, employees and agents is set forth below.

“Section 145. Indemnification of officers, directors, employees and agents; insurance.

(a) A corporation shall have power to indemnify any person who was or is a party or is threatened to be made a party to any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative or investigative (other than an action by or in the right of the corporation) by reason of the fact that the person is or was a director, officer, employee or agent of the corporation, or is or was serving at the request of the corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise, against expenses (including attorneys' fees), judgments, fines and amounts paid in settlement actually and reasonably incurred by the person in connection with such action, suit or proceeding if the person acted in good faith and in a manner the person reasonably believed to be in or not opposed to the best interests of the corporation, and, with respect to any criminal action or proceeding, had no reasonable cause to believe the person's conduct was unlawful. The termination of any action, suit or proceeding by judgment, order, settlement, conviction, or upon a plea of nolo contendere or its equivalent, shall not, of itself, create a presumption that the person did not act in good faith and in a manner which the person reasonably believed to be in or not opposed to the best interests of the corporation, and, with respect to any criminal action or proceeding, had reasonable cause to believe that the person's conduct was unlawful.

(b) A corporation shall have power to indemnify any person who was or is a party or is threatened to be made a party to any threatened, pending or completed action or suit by or in the right of the corporation to procure a judgment in its favor by reason of the fact that the person is or was a director, officer, employee or agent of the corporation, or is or was serving at the request of the corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise against expenses (including attorneys' fees) actually and reasonably incurred by the person in connection with the defense or settlement of such action or suit if the person acted in good faith and in a manner the person reasonably believed to be in or not opposed to the best interests of the corporation and except that no indemnification shall be made in respect of any claim, issue or matter as to which such person shall have been adjudged to be liable to the corporation unless and only to the extent that the Court of Chancery or the court in which such action or suit was brought shall determine upon application that, despite the adjudication of liability but in view of all the circumstances of the case, such person is fairly and reasonably entitled to indemnity for such expenses which the Court of Chancery or such other court shall deem proper.

(c) To the extent that a present or former director or officer of a corporation has been successful on the merits or otherwise in defense of any action, suit or proceeding referred to in subsections (a) and (b) of this section, or in defense of any claim, issue or matter therein, such person shall be indemnified against expenses (including attorneys' fees) actually and reasonably incurred by such person in connection therewith.

(d) Any indemnification under subsections (a) and (b) of this section (unless ordered by a court) shall be made by the corporation only as authorized in the specific case upon a determination that indemnification of the present or former director, officer, employee or agent is proper in the circumstances because the person has met the applicable standard of conduct set forth in subsections (a) and (b) of this section. Such determination shall be made, with respect to a person who is a director or officer at the time of such determination, (1) by a majority vote of the directors who are not parties to such action, suit or proceeding, even though less than a quorum, or (2) by a committee of such directors designated by majority vote of such directors, even though less than a quorum, or (3) if there are no such directors, or if such directors so direct, by independent legal counsel in a written opinion, or (4) by the stockholders.

(e) Expenses (including attorneys' fees) incurred by an officer or director in defending any civil, criminal, administrative or investigative action, suit or proceeding may be paid by the corporation in advance of the final disposition of such action, suit or proceeding upon receipt of an undertaking by or on behalf of such director or officer to repay such amount if it shall ultimately be determined that such person is not entitled to be indemnified by the corporation as authorized in this section. Such expenses (including attorneys' fees) incurred by former directors and officers or other employees and agents may be so paid upon such terms and conditions, if any, as the corporation deems appropriate.

(f) The indemnification and advancement of expenses provided by, or granted pursuant to, the other subsections of this section shall not be deemed exclusive of any other rights to which those seeking indemnification or advancement of expenses may be entitled under any bylaw, agreement, vote of stockholders or disinterested directors or otherwise, both as to action in such person's official capacity and as to action in another capacity while holding such office. A right to indemnification or to advancement of expenses arising under a provision of the certificate of incorporation or a bylaw shall not be eliminated or impaired by an amendment to such provision after the occurrence of the act or omission that is the subject of the civil, criminal, administrative or investigative action, suit or proceeding for which indemnification or advancement of expenses is sought, unless the provision in effect at the time of such act or omission explicitly authorizes such elimination or impairment after such action or omission has occurred.

(g) A corporation shall have power to purchase and maintain insurance on behalf of any person who is or was a director, officer, employee or agent of the corporation, or is or was serving at the request of the corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise against any liability asserted against such person and incurred by such person in any such capacity, or arising out of such person's status as such, whether or not the corporation would have the power to indemnify such person against such liability under this section.

(h) For purposes of this section, references to "the corporation" shall include, in addition to the resulting corporation, any constituent corporation (including any constituent of a constituent) absorbed in a consolidation or merger which, if its separate existence had continued, would have had power and authority to indemnify its directors, officers, and employees or agents, so that any person who is or was a director, officer, employee or agent of such constituent corporation, or is or was serving at the request of such constituent corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise, shall stand in the same position under this section with respect to the resulting or surviving corporation as such person would have with respect to such constituent corporation if its separate existence had continued.

(i) For purposes of this section, references to "other enterprises" shall include employee benefit plans; references to "fines" shall include any excise taxes assessed on a person with respect to any employee benefit plan; and references to "serving at the request of the corporation" shall include any service as a director, officer, employee or agent of the corporation which imposes duties on, or involves services by, such director, officer, employee or agent with respect to an employee benefit plan, its participants or beneficiaries; and a person who acted in good faith and in a manner such person reasonably believed to be in the interest of the participants and beneficiaries of an employee benefit plan shall be deemed to have acted in a manner "not opposed to the best interests of the corporation" as referred to in this section.

(j) The indemnification and advancement of expenses provided by, or granted pursuant to, this section shall, unless otherwise provided when authorized or ratified, continue as to a person who has ceased to be a director, officer, employee or agent and shall inure to the benefit of the heirs, executors and administrators of such a person.

(k) The Court of Chancery is hereby vested with exclusive jurisdiction to hear and determine all actions for advancement of expenses or indemnification brought under this section or under any bylaw, agreement, vote of stockholders or disinterested directors, or otherwise. The Court of Chancery may summarily determine a corporation's obligation to advance expenses (including attorneys' fees).”

Paragraph 10 of our Amended and Restated Certificate of Incorporation provides:

“The corporation shall, to the fullest extent permitted by Section 145 of the General Corporation Law of the State of Delaware, as the same may be amended and supplemented, indemnify any and all persons whom it shall have power to indemnify under said section from and against any and all of the expenses, liabilities, or other matters referred to in or covered by said section, and the indemnification provided for herein shall not be deemed exclusive of any other rights to which those indemnified may be entitled under any By-law, agreement, vote of stockholders or disinterested directors or otherwise, both as to action in his official capacity and as to action in another capacity while holding such office, and shall continue as to a person who has ceased to be a director, officer, employee, or agent and shall inure to the benefit of the heirs, executors, and administrators of such a person.”

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to our directors, officers, and controlling persons pursuant to the foregoing provisions, or otherwise, we have been advised that in the opinion of the SEC such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment of expenses incurred or paid by a director, officer or controlling person in a successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, we will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to the court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

The underwriting agreement, if an underwriting agreement is utilized, may provide for indemnification by any underwriters of the company, our directors, our officers who sign the registration statement and our controlling persons (if any) for some liabilities, including liabilities arising under the Securities Act.

Item 7. Exemption From Registration Claimed.

Not applicable.

Item 8. Exhibits

|

Exhibit

Number

|

Description

|

|

|

|

|

4.1

|

Specimen Common Stock Certificate (1)

|

|

|

|

|

4.2

|

Gulf Resources, Inc. 2007 Equity Incentive Plan, as amended (2)

|

|

|

|

|

4.3

|

Gulf Resources, Inc. 2007 Equity Incentive Plan Stock Option Agreement (1)

|

|

|

|

|

5.1*

|

Consent of Loeb & Loeb LLP (1)

|

|

|

|

|

23.1*

|

Consent of BDO Limited

|

|

|

|

|

23.2*

|

Consent of Loeb & Loeb LLP is contained in Exhibit 5.1. (1)

|

|

|

|

|

24.1*

|

Power of Attorney (included on signature pages hereto.)

|

* Filed herewith

(1) Incorporated by reference from the Registration Statement on Form S-8 filed on February 28, 2007

(2) Incorporated by reference from the Definitive Proxy Statement on Schedule 14A filed on May 11, 2011

Item 9. Undertakings

A. The undersigned registrant hereby undertakes:

(1) to file, during any period in which offers or sales are being made, a post-effective amendment to this Registration Statement:

(i) to include any prospectus required by Section 10(a)(3) of the Securities Act;

(ii) to reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than 20% change in the maximum aggregate offering price set forth in the "Calculation of Registration Fee" table in the effective registration statement.; and

(iii) to include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement;

provided, however,

that paragraphs (a)(1)(i) and (a)(1)(ii) of this section do not apply if the registration statement is on Form S-8, and the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the Commission by the registrant pursuant to Section 13 or Section 15(d) of the Exchange Act that are incorporated by reference in this registration statement.

(2) that, for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof;

(3) to remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

B. The undersigned Registrant hereby undertakes that, for purposes of determining any liability under the Securities Act, each filing of the Registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Exchange Act that is incorporated by reference into this Registration Statement shall be deemed to be a new registration statement relating to the securities offered herein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

C. Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons of the registrant pursuant to the foregoing provisions, or otherwise, the Registrant has been advised that in the opinion of the Commission such indemnification is against public policy as expressed in the Securities Act, and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets the requirements for filing this Form S-8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Shouguang, People’s Republic of China, on the 9th day of November, 2011.

|

|

GULF RESOURCES, INC.

|

|

|

|

|

|

|

|

|

By

|

/s/ Xiaobin Liu

|

|

|

|

|

Name: Xiaobin Liu

|

|

|

|

|

Title: Chief Executive Officer

|

|

|

|

|

|

|

POWER OF ATTORNEY

KNOW ALL BY THESE PRESENTS, that each person whose signature appears below constitutes and appoints Xiaobin Liu and Min Li or either of them, as his or her true and lawful attorney-in-fact and agent, with full power of substitution and resubstitution, in any and all capacities, to sign any or all amendments (including post-effective amendments) to this registration statement, and to file the same with all exhibits thereto, and other documents in connection therewith, with the Securities and Exchange Commission, granting unto said attorney-in-fact and agent full power and authority to do and perform each and every act and thing requisite and necessary to be done in and about the premises, as fully to all intents and purposes as he or she might or could do in person, hereby ratifying and confirming all that said attorneys-in-fact and agents, or their substitutes, may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act of 1933, this registration statement has been signed by the following persons in the capacities and on the dates indicated.

|

Name

|

|

Position

|

Date

|

|

|

|

|

|

|

/s Xiaobin Liu

|

|

Chief Executive Officer (Principal

Executive Officer) and Director

|

November 9, 2011

|

|

Xiaobin Liu

|

|

|

|

|

|

|

|

|

/s/ Ming Yang

|

|

Chairman

|

November 9, 2011

|

|

Ming Yang

|

|

|

|

|

|

|

|

|

/s/ Min Li

|

|

Chief Financial Officer (Principal

Accounting Officer)

|

November 9, 2011

|

|

Min Li

|

|

|

|

|

|

|

|

|

|

/s/ Naihui Miao

|

|

Director

|

November 9, 2011

|

|

Naihui Miao

|

|

|

|

|

|

|

|

|

|

/s/ Nan Li

|

|

Director

|

November 9, 2011

|

|

Nan Li

|

|

|

|

|

|

|

|

|

|

/s/ Yang Zou

|

|

Director

|

November 9, 2011

|

|

Yang Zou

|

|

|

|

|

|

|

|

|

|

/s/ Shi Tong Jiang

|

|

Director

|

November 9, 2011

|

|

Shi Tong Jiang

|

|

|

|

|

|

|

|

|

|

/s/ Zhang Tengfei

|

|

Director

|

November 9, 2011

|

|

Zhang Tengfei

|

|

|

|

EXHIBIT INDEX

|

Exhibit

Number

|

Description

|

|

|

|

|

4.1

|

Specimen Common Stock Certificate (1)

|

|

|

|

|

4.2

|

Amended and Restated Gulf Resources, Inc. 2007 Equity Incentive Plan (2)

|

|

|

|

|

4.3

|

Gulf Resources, Inc. 2007 Equity Incentive Plan Stock Option Agreement (1)

|

|

|

|

|

5.1*

|

Consent of Loeb & Loeb LLP (1)

|

|

|

|

|

23.1*

|

Consent of BDO Limited

|

|

|

|

|

23.2*

|

Consent of Loeb & Loeb LLP is contained in Exhibit 5.1. (1)

|

|

|

|

|

24.1*

|

Power of Attorney (included on signature pages hereto.)

|

* Filed herewith

(1) Incorporated by reference from the Registration Statement on Form S-8 filed on February 28, 2007

(2) Incorporated by reference from the Definitive Proxy Statement on Schedule 14A filed on May 11, 2011

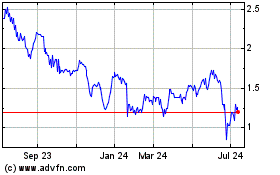

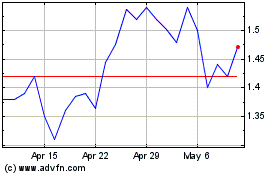

Gulf Resources (NASDAQ:GURE)

Historical Stock Chart

From Aug 2024 to Sep 2024

Gulf Resources (NASDAQ:GURE)

Historical Stock Chart

From Sep 2023 to Sep 2024