false

0001597846

0001597846

2024-05-31

2024-05-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date

of report (Date of earliest event reported):

May 31, 2024

Commission

File Number 001-38308

Greenpro

Capital Corp.

(Exact

name of registrant issuer as specified in its charter)

| Nevada |

|

98-1146821 |

(State

or other jurisdiction of

incorporation or organization) |

|

(I.R.S.

Employer

Identification No.) |

B-23A-02,

G-Vestor,

Pavilion

Embassy, 200 Jalan Ampang,

50450,

W.P. Kuala Lumpur, Malaysia

(Address

of principal executive offices, including zip code)

Registrant’s

phone number, including area code (60) 3 8408 -1788

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405)

or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of Each Class |

|

Trading

Symbol(s) |

|

Name

of Each Exchange on Which Registered |

| Common

Stock, $0.0001 par value |

|

GRNQ |

|

NASDAQ

Capital Market |

Item

5.02 Departure of Directors or Certain Officers: Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of

Certain Officers.

On

May 31, 2024, the Company’s board of directors (the “Board”) unanimously resolved that Prabodh Kumar Kantilal H. Sheth

(“Mr. Sheth”) will be re-designated from an independent director to a non-executive director and will resign from his positions

as chairman of the Board’s Audit Committee and Compensation Committee and member of the Nominating and Corporate Governance Committee

effective June 1, 2024. On the same day, the Board also resolved to appoint our independent director and chairman of the Nominating and

Corporate Governance Committee, Mean Kwong Han (Mr. Han) as chairman of the Audit Committee and to appoint Chee Wah Chew (“Mr.

Chew”) and Christopher Yu Nien Wong (“Mr. Wong”) as independent directors to the Board effective June 1, 2024. Both

Mr. Chew and Mr. Wong will serve on the Audit Committee, Compensation Committee and the Nominating and Corporate Governance Committee.

Mr. Chew will serve as chairman of the Compensation Committee effective June 1, 2024.

Mr.

Chew is a fellow member of the Association of Taxation and Management Accountants (ATMA), Australia. Mr. Chew has over 30 years of experience

in corporate management, advisory and restructuring. He started his career at Crestline Corporation Sdn. Bhd., a Malaysian company providing

general contracting, computer equipment and printing services, as one of the co-founders and a director from January to October in 1985

and subsequently founded another Malaysian company, Unique Computer House Sdn. Bhd., specializing in computer hardware and software selling,

as a major shareholder and director from October 1985 to December 1990.

From

July 1993 to September 2008, Mr. Chew served as an advisor in both public and private entities including a role of personal advisor to

managing director in Shougang Concord Grand (Group) Limited (0730.HK), a company listed on the Main Board (the “Main Board”)

of the Stock Exchange of Hong Kong Limited (the “SEHK”) for the year of 1993 and Shenzhen International Holdings Limited

(0152.HK), a red chip company listed on the Main Board of the SEHK for the years of 1993 to 1995, respectively. During 2003 to 2004,

Mr. Chew served as China advisor of University of Wales, UK and Binary University College, Malaysia, respectively, principally responsible

for recruiting overseas students from China for the universities. From March 2006 to September 2008, he was appointed by another Main

Board company, Uni-Bio Science Group Limited (0690.HK) as group general manager and subsequently promoted to become group advisor from

2007.

From

December 2011 to April 2014, he served as corporate finance advisory manager of Deloitte & Touche Financial Advisory Services Limited

(“Deloitte”). During his tenure in Deloitte, he principally worked in Shenzhen, China and provided advisory services to both

corporate and private clients on mergers and acquisitions (M&A) or securities listing projects.

Since

November 2014, Mr. Chew has served as a director of various companies listed on the Main Board or the Growth Enterprise Market (the “GEM”)

of the SEHK. From November 2014 to May 2015, Mr. Chew was appointed as a non-executive director and chairman of the board of the directors

(the “BOD”) by a Main Board company, Golden Shield Holdings (Industrial) Limited (2123.HK), primarily responsible for overseeing

the company’s restructuring exercise and legal proceedings. From May 2014 to April 2016, he was appointed as an executive director

and chairman of the BOD of hmvod Limited (formerly known as, “Tai Shing International (Holdings) Limited”), a company listed

on the GEM of the SEHK (8103.HK). From March 2017 to November 2022, he was appointed as an executive director of another Main Board company,

Natural Dairy (NZ) Holdings Limited (0462.HK) and primarily responsible for restructuring of the company.

From

July 2021 to May 2022, Mr. Chew served Solomon Financial Press Limited, a subsidiary of the GEM company, Jisheng Group Holdings Limited

(8133.HK) as Chief Operating Officer for the period of July 2021 to February 2022 and subsequently transferred to be Chief Investment

Officer.

Since

October 2023, Mr. Chew has served as an independent and non-executive director of Imperial Pacific International Holding Limited (1076.HK),

a company listed on the Main Board of the SEHK.

Mr.

Chew earned a Doctor of Philosophy (PhD) degree in business administration from Nueva Ecija University of Science and Technology (NEUST)

in Republic of the Philippines in 2013.

As

compensation for services as an independent director, Mr. Chew shall receive a monthly fee of $1,000 in cash payable quarterly, commencing

on June 1, 2024.

Mr.

Wong is a Chartered Member (Chartered MCSI) of the Chartered Institute of Securities & Investment (CISI), United Kingdom (UK) and

is a registered Trust and Estate Practitioner (TEP) of the Society of Trust and Estate Practitioners (STEP). Mr. Wong was conferred the

Knight Companion of The Most Esteemed Order of the Crown of Pahang, Darjah Indera Mahkota Pahang (DIMP) for his rendering meritorious

service to the State of Pahang in Malaysia and carries the title Dato’.

From

1999 to 2002, Mr. Wong worked in Hong Kong as a registered foreign lawyer in the global capital markets practice group in a global law

firm, Allen & Overy. In 2001, he called to the English Bar as a barrister-at-law with The Honourable Society of Lincoln’s Inn.

For the next decade from 2002 to 2011, he worked as transaction and execution counsel in a global European financial institution, Deutsche

Bank AG (Deutsche Bank) and served as a director of one of Deutsche Bank’s branch companies in Hong Kong, DB Trustees (Hong Kong)

Limited. From 2011 to 2020, he moved to The Bank of New York Mellon (BNY Mellon), a global US trust and custody bank, initially served

as managing director and associate general counsel responsible for the bank’s issuer and collateral support legal teams in Asia

Pacific and subsequently was promoted to become Asia Pacific head of relationship management for the bank’s corporate trust business

in the Asia Pacific region. He also served as a director of one of BNP Mellon’s branch companies in Hong Kong, BNY Mellon Trustee

Company (Hong Kong) Limited.

From

2020 to 2021, Mr. Wong served as general counsel in Claritas HealthTech Pte. Ltd., an emerging Artificial Intelligence (AI) Healthtech

startup company in Singapore. During 2021 to 2023, he served as Head of Capital Markets North Asia of Intertrust Group, a European corporate

service firm as founder of its capital markets and corporate trust business in North Asia based in Hong Kong, building a new client base

and servicing platform from ground-up, covering client segments such as investment banks, sovereign agencies, regulatory technology (RegTech)

companies and financial technology (FinTech) companies.

Mr.

Wong founded FYDUS Group, a fiduciary and professional solution provider in Asia and the Middle East and has served as Chief Commercial

Officer since 2023.

Mr.

Wong was admitted as an Advocate and Solicitor of the High Court of Malaya in December 2021. He has been a partner of a legal firm in

Kuala Lumpur, Malaysia Chow Kok Leong & Co. with a focus on cross-border banking, trust, and capital markets transactions since early

2024.

Currently,

Mr. Wong serves on the board of Bauhinia ILBS 1 Limited, the first Hong Kong public listed company sponsored by a Hong Kong government

agency to issue the first Hong Kong-listed asset-backed securities based on infrastructure project loans.

Mr.

Wong was awarded a Bachelor of Laws (LLB) degree from University of Leicester, UK in July 1997.

As

compensation for services as an independent director, Mr. Wong shall receive a monthly fee of $1,000 in cash payable quarterly, commencing

on June 1, 2024.

Both

Mr. Chew and Mr. Wong do not have any family relationships with any of the Company’s directors or executive officers, or any person

nominated or chosen by the Company to become a director or executive director, and there are no arrangements or understandings with any

person pursuant to which they were selected as director of the Company. Both Mr. Chew and Mr. Wong are not a party to any transactions

listed in Item 404(a) of Regulation S-K.

Effective

June 1, 2024, the composition of the Board and each committee of the Board is set forth below:

Directors:

Chew,

Chee Wah (Chew)

Chuchottaworn,

Srirat (Chuchottaworn)

Han,

Mean Kwong (Han)

Lee,

Chong Kuang (Lee)

Loke,

Che Chan Gilbert (Loke)

Sheth,

Prabodh Kumar Kantilal H. (Sheth)

Wong,

Christopher Yu Nien (Wong)

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

| |

GREENPRO

CAPITAL CORP. |

| |

(Name

of Registrant) |

| |

|

|

| Date:

June 3, 2024 |

By: |

/s/

Lee Chong Kuang |

| |

Title: |

Chief

Executive Officer, |

| |

|

President,

Director |

| |

|

(Principal

Executive Officer) |

| |

|

|

| Date:

June 3, 2024 |

By: |

/s/

Loke Che Chan, Gilbert |

| |

Title: |

Chief

Financial Officer, Secretary, |

| |

|

Treasurer,

Director |

| |

|

(Principal

Financial Officer and |

| |

|

Principal

Accounting Officer) |

Exhibit

10.1

INDEPENDENT

DIRECTOR AGREEMENT

This

INDEPENDENT DIRECTOR AGREEMENT is dated on June 1, 2024 (the “Agreement”) by and between GREENPRO CAPITAL CORP., a Nevada

corporation (the “Company”), Chew Chee Wah, an individual resident of Hong Kong (the “Director”).

WHEREAS,

the Company desires to retain the Director for the duties of independent director effective as of the date hereof and member of the audit

committee effective as of 1st of June, 2024 (the “Effective Date”) and desires to enter into an agreement with the Director

with respect to such appointment; and

WHEREAS,

the Director is willing to accept such appointment and to serve the Company on the terms set forth herein and in accordance with the

provisions of this Agreement.

NOW,

THEREFORE, in consideration of the mutual covenants contained herein, the parties hereto agree as follows:

1.

Position. Subject to the terms and provisions of this Agreement, the Company shall cause the Director to be appointed, and the

Director hereby agrees to serve the Company in such position upon the terms and conditions hereinafter set forth, provided, however,

that the Director’s continued service on the Board of Directors of the Company (the “Board”) after the initial one-year

term on the Board shall be subject to any necessary approval by the Company’s stockholders.

2.

Duties. During the Directorship Term (as defined herein), the Director make reasonable business efforts to attend all Board meetings

and quarterly pre-scheduled Board and Management conference calls, serve on appropriate subcommittees as reasonably requested and agreed

upon by the Board, make himself available to the Company at mutually convenient times and places, attend external meetings and presentations

when agreed on in advance, as appropriate and convenient, and perform such duties, services and responsibilities, and have the authority

commensurate to such position.

3.

Compensation. For all services to be rendered by the Director in any capacity hereunder, the Compensation Committee of the Board

of Directors of the Company would determine the compensation packages of the Directors from time to time. This shall remain in effect

until the earlier of the date of the next annual stockholders meeting and the earliest of the following to occur: (a) the death of the

Director; (b) the termination of the Director from his membership on the Board by the mutual agreement of the Company and the Director;

(c) the removal of the Director from the Board by the majority stockholders of the Company; and (d) the resignation by the Director from

the Board.

4.

Directorship Term. The “Directorship Term,” as used in this Agreement, shall mean the period commencing on the Effective

Date and terminating on the earlier of the date of the next annual stockholders meeting and the earliest of the following to occur: (a)

the death of the Director; (b) the termination of the Director from his membership on the Board by the mutual agreement of the Company

and the Director; (c) the removal of the Director from the Board by the majority stockholders of the Company; and (d) the resignation

by the Director from the Board.

5.

Director’s Representation and Acknowledgment. The Director represents to the Company that his execution and performance

of this Agreement shall not be in violation of any agreement or obligation (whether or not written) that he may have with or to any person

or entity, including without limitation, any prior or current employer. The Director hereby acknowledges and agrees that this Agreement

(and any other agreement or obligation referred to herein) shall be an obligation solely of the Company, and the Director shall have

no recourse whatsoever against any stockholder of the Company or any of their respective affiliates with regard to this Agreement.

6.

Director Covenants.

(a)

Unauthorized Disclosure. The Director agrees and understands that in the Director’s position with the Company, the Director

has been and will be exposed to and receive information relating to the confidential affairs of the Company, including, but not limited

to, technical information, business and marketing plans, strategies, customer information, other information concerning the Company’s

products, promotions, development, financing, expansion plans, business policies and practices, and other forms of information considered

by the Company to be confidential and in the nature of trade secrets. The Director agrees that during the Directorship Term and thereafter,

the Director will keep such information confidential and will not disclose such information, either directly or indirectly, to any third

person or entity without the prior written consent of the Company; provided, however, that (i) the Director shall have

no such obligation to the extent such information is or becomes publicly known or generally known in the Company’s industry other

than as a result of the Director’s breach of his obligations hereunder and (ii) the Director may, after giving prior notice to

the Company to the extent practicable under the circumstances, disclose such information to the extent required by applicable laws or

governmental regulations or judicial or regulatory process. This confidentiality covenant has no temporal, geographical or territorial

restriction. Upon termination of the Directorship Term, the Director will promptly return to the Company and/or destroy at the Company’s

direction all property, keys, notes, memoranda, writings, lists, files, reports, customer lists, correspondence, tapes, disks, cards,

surveys, maps, logs, machines, technical data, other product or document, and any summary or compilation of the foregoing, in whatever

form, including, without limitation, in electronic form, which has been produced by, received by or otherwise submitted to the Director

in the course or otherwise as a result of the Director’s position with the Company during or prior to the Directorship Term, provided

that the Company shall retain such materials and make them available to the Director if requested by him in connection with any litigation

against the Director under circumstances in which (i) the Director demonstrates to the reasonable satisfaction of the Company that the

materials are necessary to his defense in the litigation and (ii) the confidentiality of the materials is preserved to the reasonable

satisfaction of the Company.

(b)

Non-Solicitation. During the Directorship Term and for a period of three (3) years thereafter, the Director shall not interfere

with the Company’s relationship with, or endeavor to entice away from the Company, any person who, on the date of the termination

of the Directorship Term and/or at any time during the one year period prior to the termination of the Directorship Term, was an employee

or customer of the Company or otherwise had a material business relationship with the Company.

(c)

Non-Compete. The Director agrees that during the Directorship Term and for a period of three (3) years thereafter, he shall not

in any manner, directly or indirectly, through any person, firm or corporation, alone or as a member of a partnership or as an officer,

director, stockholder, investor or employee of or consultant to any other corporation or enterprise; engage in the business of developing,

marketing, selling or supporting technology to or for businesses in which the Company engages in or in which the Company has an actual

intention, as evidenced by the Company’s written business plans, to engage in, within any geographic area in which the Company

is then conducting such business. Nothing in this Section 6 shall prohibit the Director from being (i) a stockholder in a mutual fund

or a diversified investment company or (ii) a passive owner of not more than three percent of the outstanding stock of any class of securities

of a corporation, which are publicly traded, so long as the Director has no active participation in the business of such corporation.

(d)

Insider Trading Guidelines. Director agrees to execute the Company’s Insider Trading Guidelines in the form attached hereto.

(e)

Remedies. The Director agrees that any breach of the terms of this Section 6 would result in irreparable injury and damage to

the Company for which the Company would have no adequate remedy at law; the Director therefore also agrees that in the event of said

breach or any threat of breach, the Company shall be entitled to an immediate injunction and restraining order to prevent such breach

and/or threatened breach and/or continued breach by the Director and/or any and all entities acting for and/or with the Director, without

having to prove damages or paying a bond, in addition to any other remedies to which the Company may be entitled at law or in equity.

The terms of this paragraph shall not prevent the Company from pursuing any other available remedies for any breach or threatened breach

hereof, including, but not limited to, the recovery of damages from the Director. The Director acknowledges that the Company would not

have entered into this Agreement had the Director not agreed to the provisions of this Section 6.

(f)

The provisions of this Section 6 shall survive any termination of the Directorship Term, and the existence of any claim or cause of action

by the Director against the Company, whether predicated on this Agreement or otherwise, shall not constitute a defense to the enforcement

by the Company of the covenants and agreements of this Section 6.

7.

Indemnification. The Company agrees to indemnify the Director for his activities as a member of the Board to the fullest extent

permitted under applicable law and shall use its best efforts to maintain Directors and Officers Insurance benefitting the Board.

8.

Non-Waiver of Rights. The failure to enforce at any time the provisions of this Agreement or to require at any time performance

by the other party hereto of any of the provisions hereof shall in no way be construed to be a waiver of such provisions or to affect

either the validity of this Agreement or any part hereof, or the right of either party hereto to enforce each and every provision in

accordance with its terms. No waiver by either party hereto of any breach by the other party hereto of any provision of this Agreement

to be performed by such other party shall be deemed a waiver of similar or dissimilar provisions at that time or at any prior or subsequent

time.

9.

Notices. Every notice relating to this Agreement shall be in writing and shall be given by personal delivery or by registered

or certified mail, postage prepaid, return receipt requested; to:

If

to the Company:

Greenpro

Capital Corp.

B-23A-02,

G-Vestor Tower

Pavilion

Embassy, 200 Jalan Ampang

50450

W.P. Kuala Lumpur

Malaysia

Attn:

Lee Chong Kuang

If

to the Director:

Chew

Chee Wah

[***]

Either

of the parties hereto may change their address for purposes of notice hereunder by giving notice in writing to such other party pursuant

to this Section 9.

10.

Binding Effect/Assignment. This Agreement shall inure to the benefit of and be binding upon the parties hereto and their respective

heirs, executors, personal representatives, estates, successors (including, without limitation, by way of merger) and assigns. Notwithstanding

the provisions of the immediately preceding sentence, neither the Director nor the Company shall assign all or any portion of this Agreement

without the prior written consent of the other party.

11.

Entire Agreement. This Agreement (together with the other agreements referred to herein) sets forth the entire understanding of

the parties hereto with respect to the subject matter hereof and supersedes all prior agreements, written or oral, between them as to

such subject matter.

12.

Severability. If any provision of this Agreement, or any application thereof to any circumstances, is invalid, in whole or in

part, such provision or application shall to that extent be severable and shall not affect other provisions or applications of this Agreement.

13.

Governing Law. This Agreement shall be governed by and construed in accordance with the laws of the State of Nevada, without reference

to the principles of conflict of laws. All actions and proceedings arising out of or relating to this Agreement shall be heard and determined

in any court in Federal and the parties hereto hereby consent to the jurisdiction of such courts in any such action or proceeding; provided,

however, that neither party shall commence any such action or proceeding unless prior thereto the parties have in good faith attempted

to resolve the claim, dispute or cause of action which is the subject of such action or proceeding through mediation by an independent

third party.

14.

Legal Fees. The parties hereto agree that the non-prevailing party in any dispute, claim, action or proceeding between the parties

hereto arising out of or relating to the terms and conditions of this Agreement or any provision thereof (a “Dispute”), shall

reimburse the prevailing party for reasonable attorney’s fees and expenses incurred by the prevailing party in connection with

such Dispute; provided, however, that the Director shall only be required to reimburse the Company for its fees and expenses

incurred in connection with a Dispute if the Director’s position in such Dispute was found by the court, arbitrator or other person

or entity presiding over such Dispute to be frivolous or advanced not in good faith.

15.

Modifications. Neither this Agreement nor any provision hereof may be modified, altered, amended or waived except by an instrument

in writing duly signed by the party to be charged.

16.

Tense and Headings. Whenever any words used herein are in the singular form, they shall be construed as though they were also

used in the plural form in all cases where they would so apply. The headings contained herein are solely for the purposes of reference,

are not part of this Agreement and shall not in any way affect the meaning or interpretation of this Agreement.

17.

Counterparts. This Agreement may be executed in two or more counterparts, each of which shall be deemed to be an original but

all of which together shall constitute one and the same instrument.

[signature

page follows]

IN

WITNESS WHEREOF, the Company has caused this Director Agreement to be executed by authority of its Board of Directors, and the Director

has hereunto set his hand, on the day and year first above written.

| |

GREENPRO CAPITAL CORP. |

| |

|

|

| |

By: |

/s/

Lee Chong Kuang |

| |

|

Lee

Chong Kuang |

| |

|

Chief

Executive Officer and Director |

| |

|

|

| |

DIRECTOR |

| |

|

|

| |

|

/s/ Chew Chee Wah |

| |

|

Chew Chee Wah |

Exhibit

10.2

INDEPENDENT

DIRECTOR AGREEMENT

This

INDEPENDENT DIRECTOR AGREEMENT is dated on June 1, 2024 (the “Agreement”) by and between GREENPRO CAPITAL CORP., a Nevada

corporation (the “Company”), Wong Christopher Yu Nien, an individual resident of Hong Kong (the “Director”).

WHEREAS,

the Company desires to retain the Director for the duties of independent director effective as of the date hereof and member of the audit

committee effective as of 1st of June, 2024 (the “Effective Date”) and desires to enter into an agreement with the Director

with respect to such appointment; and

WHEREAS,

the Director is willing to accept such appointment and to serve the Company on the terms set forth herein and in accordance with the

provisions of this Agreement.

NOW,

THEREFORE, in consideration of the mutual covenants contained herein, the parties hereto agree as follows:

1.

Position. Subject to the terms and provisions of this Agreement, the Company shall cause the Director to be appointed, and the

Director hereby agrees to serve the Company in such position upon the terms and conditions hereinafter set forth, provided, however,

that the Director’s continued service on the Board of Directors of the Company (the “Board”) after the initial one-year

term on the Board shall be subject to any necessary approval by the Company’s stockholders.

2.

Duties. During the Directorship Term (as defined herein), the Director make reasonable business efforts to attend all Board meetings

and quarterly pre-scheduled Board and Management conference calls, serve on appropriate subcommittees as reasonably requested and agreed

upon by the Board, make himself available to the Company at mutually convenient times and places, attend external meetings and presentations

when agreed on in advance, as appropriate and convenient, and perform such duties, services and responsibilities, and have the authority

commensurate to such position.

3.

Compensation. For all services to be rendered by the Director in any capacity hereunder, the Compensation Committee of the Board

of Directors of the Company would determine the compensation packages of the Directors from time to time. This shall remain in effect

until the earlier of the date of the next annual stockholders meeting and the earliest of the following to occur: (a) the death of the

Director; (b) the termination of the Director from his membership on the Board by the mutual agreement of the Company and the Director;

(c) the removal of the Director from the Board by the majority stockholders of the Company; and (d) the resignation by the Director from

the Board.

4.

Directorship Term. The “Directorship Term,” as used in this Agreement, shall mean the period commencing on the Effective

Date and terminating on the earlier of the date of the next annual stockholders meeting and the earliest of the following to occur: (a)

the death of the Director; (b) the termination of the Director from his membership on the Board by the mutual agreement of the Company

and the Director; (c) the removal of the Director from the Board by the majority stockholders of the Company; and (d) the resignation

by the Director from the Board.

5.

Director’s Representation and Acknowledgment. The Director represents to the Company that his execution and performance

of this Agreement shall not be in violation of any agreement or obligation (whether or not written) that he may have with or to any person

or entity, including without limitation, any prior or current employer. The Director hereby acknowledges and agrees that this Agreement

(and any other agreement or obligation referred to herein) shall be an obligation solely of the Company, and the Director shall have

no recourse whatsoever against any stockholder of the Company or any of their respective affiliates with regard to this Agreement.

6.

Director Covenants.

(a)

Unauthorized Disclosure. The Director agrees and understands that in the Director’s position with the Company, the Director

has been and will be exposed to and receive information relating to the confidential affairs of the Company, including, but not limited

to, technical information, business and marketing plans, strategies, customer information, other information concerning the Company’s

products, promotions, development, financing, expansion plans, business policies and practices, and other forms of information considered

by the Company to be confidential and in the nature of trade secrets. The Director agrees that during the Directorship Term and thereafter,

the Director will keep such information confidential and will not disclose such information, either directly or indirectly, to any third

person or entity without the prior written consent of the Company; provided, however, that (i) the Director shall have

no such obligation to the extent such information is or becomes publicly known or generally known in the Company’s industry other

than as a result of the Director’s breach of his obligations hereunder and (ii) the Director may, after giving prior notice to

the Company to the extent practicable under the circumstances, disclose such information to the extent required by applicable laws or

governmental regulations or judicial or regulatory process. This confidentiality covenant has no temporal, geographical or territorial

restriction. Upon termination of the Directorship Term, the Director will promptly return to the Company and/or destroy at the Company’s

direction all property, keys, notes, memoranda, writings, lists, files, reports, customer lists, correspondence, tapes, disks, cards,

surveys, maps, logs, machines, technical data, other product or document, and any summary or compilation of the foregoing, in whatever

form, including, without limitation, in electronic form, which has been produced by, received by or otherwise submitted to the Director

in the course or otherwise as a result of the Director’s position with the Company during or prior to the Directorship Term, provided

that the Company shall retain such materials and make them available to the Director if requested by him in connection with any litigation

against the Director under circumstances in which (i) the Director demonstrates to the reasonable satisfaction of the Company that the

materials are necessary to his defense in the litigation and (ii) the confidentiality of the materials is preserved to the reasonable

satisfaction of the Company.

(b)

Non-Solicitation. During the Directorship Term and for a period of three (3) years thereafter, the Director shall not interfere

with the Company’s relationship with, or endeavor to entice away from the Company, any person who, on the date of the termination

of the Directorship Term and/or at any time during the one year period prior to the termination of the Directorship Term, was an employee

or customer of the Company or otherwise had a material business relationship with the Company.

(c)

Non-Compete. The Director agrees that during the Directorship Term and for a period of three (3) years thereafter, he shall not

in any manner, directly or indirectly, through any person, firm or corporation, alone or as a member of a partnership or as an officer,

director, stockholder, investor or employee of or consultant to any other corporation or enterprise; engage in the business of developing,

marketing, selling or supporting technology to or for businesses in which the Company engages in or in which the Company has an actual

intention, as evidenced by the Company’s written business plans, to engage in, within any geographic area in which the Company

is then conducting such business. Nothing in this Section 6 shall prohibit the Director from being (i) a stockholder in a mutual fund

or a diversified investment company or (ii) a passive owner of not more than three percent of the outstanding stock of any class of securities

of a corporation, which are publicly traded, so long as the Director has no active participation in the business of such corporation.

(d)

Insider Trading Guidelines. Director agrees to execute the Company’s Insider Trading Guidelines in the form attached hereto.

(e)

Remedies. The Director agrees that any breach of the terms of this Section 6 would result in irreparable injury and damage to

the Company for which the Company would have no adequate remedy at law; the Director therefore also agrees that in the event of said

breach or any threat of breach, the Company shall be entitled to an immediate injunction and restraining order to prevent such breach

and/or threatened breach and/or continued breach by the Director and/or any and all entities acting for and/or with the Director, without

having to prove damages or paying a bond, in addition to any other remedies to which the Company may be entitled at law or in equity.

The terms of this paragraph shall not prevent the Company from pursuing any other available remedies for any breach or threatened breach

hereof, including, but not limited to, the recovery of damages from the Director. The Director acknowledges that the Company would not

have entered into this Agreement had the Director not agreed to the provisions of this Section 6.

(f)

The provisions of this Section 6 shall survive any termination of the Directorship Term, and the existence of any claim or cause of action

by the Director against the Company, whether predicated on this Agreement or otherwise, shall not constitute a defense to the enforcement

by the Company of the covenants and agreements of this Section 6.

7.

Indemnification. The Company agrees to indemnify the Director for his activities as a member of the Board to the fullest extent

permitted under applicable law and shall use its best efforts to maintain Directors and Officers Insurance benefitting the Board.

8.

Non-Waiver of Rights. The failure to enforce at any time the provisions of this Agreement or to require at any time performance

by the other party hereto of any of the provisions hereof shall in no way be construed to be a waiver of such provisions or to affect

either the validity of this Agreement or any part hereof, or the right of either party hereto to enforce each and every provision in

accordance with its terms. No waiver by either party hereto of any breach by the other party hereto of any provision of this Agreement

to be performed by such other party shall be deemed a waiver of similar or dissimilar provisions at that time or at any prior or subsequent

time.

9.

Notices. Every notice relating to this Agreement shall be in writing and shall be given by personal delivery or by registered

or certified mail, postage prepaid, return receipt requested; to:

If

to the Company:

Greenpro

Capital Corp.

B-23A-02,

G-Vestor Tower

Pavilion

Embassy, 200 Jalan Ampang

50450

W.P. Kuala Lumpur

Malaysia

Attn:

Lee Chong Kuang

If

to the Director:

Wong

Christopher Yu Nien

[***]

Either

of the parties hereto may change their address for purposes of notice hereunder by giving notice in writing to such other party pursuant

to this Section 9.

10.

Binding Effect/Assignment. This Agreement shall inure to the benefit of and be binding upon the parties hereto and their respective

heirs, executors, personal representatives, estates, successors (including, without limitation, by way of merger) and assigns. Notwithstanding

the provisions of the immediately preceding sentence, neither the Director nor the Company shall assign all or any portion of this Agreement

without the prior written consent of the other party.

11.

Entire Agreement. This Agreement (together with the other agreements referred to herein) sets forth the entire understanding of

the parties hereto with respect to the subject matter hereof and supersedes all prior agreements, written or oral, between them as to

such subject matter.

12.

Severability. If any provision of this Agreement, or any application thereof to any circumstances, is invalid, in whole or in

part, such provision or application shall to that extent be severable and shall not affect other provisions or applications of this Agreement.

13.

Governing Law. This Agreement shall be governed by and construed in accordance with the laws of the State of Nevada, without reference

to the principles of conflict of laws. All actions and proceedings arising out of or relating to this Agreement shall be heard and determined

in any court in Federal and the parties hereto hereby consent to the jurisdiction of such courts in any such action or proceeding; provided,

however, that neither party shall commence any such action or proceeding unless prior thereto the parties have in good faith attempted

to resolve the claim, dispute or cause of action which is the subject of such action or proceeding through mediation by an independent

third party.

14.

Legal Fees. The parties hereto agree that the non-prevailing party in any dispute, claim, action or proceeding between the parties

hereto arising out of or relating to the terms and conditions of this Agreement or any provision thereof (a “Dispute”), shall

reimburse the prevailing party for reasonable attorney’s fees and expenses incurred by the prevailing party in connection with

such Dispute; provided, however, that the Director shall only be required to reimburse the Company for its fees and expenses

incurred in connection with a Dispute if the Director’s position in such Dispute was found by the court, arbitrator or other person

or entity presiding over such Dispute to be frivolous or advanced not in good faith.

15.

Modifications. Neither this Agreement nor any provision hereof may be modified, altered, amended or waived except by an instrument

in writing duly signed by the party to be charged.

16.

Tense and Headings. Whenever any words used herein are in the singular form, they shall be construed as though they were also

used in the plural form in all cases where they would so apply. The headings contained herein are solely for the purposes of reference,

are not part of this Agreement and shall not in any way affect the meaning or interpretation of this Agreement.

17.

Counterparts. This Agreement may be executed in two or more counterparts, each of which shall be deemed to be an original but

all of which together shall constitute one and the same instrument.

[signature

page follows]

IN

WITNESS WHEREOF, the Company has caused this Director Agreement to be executed by authority of its Board of Directors, and the Director

has hereunto set his hand, on the day and year first above written.

| |

GREENPRO CAPITAL CORP. |

| |

|

|

| |

By: |

/s/ Lee Chong Kuang |

| |

|

Lee

Chong Kuang |

| |

|

Chief

Executive Officer and Director |

| |

|

|

| |

DIRECTOR |

| |

|

|

| |

|

/s/

Wong Christopher Yu Nien |

| |

|

Wong

Christopher Yu Nien |

v3.24.1.1.u2

Cover

|

May 31, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

May 31, 2024

|

| Entity File Number |

001-38308

|

| Entity Registrant Name |

Greenpro

Capital Corp.

|

| Entity Central Index Key |

0001597846

|

| Entity Tax Identification Number |

98-1146821

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity Address, Address Line One |

B-23A-02,

G-Vestor

|

| Entity Address, Address Line Two |

Pavilion

Embassy, 200 Jalan Ampang

|

| Entity Address, City or Town |

W.P. Kuala Lumpur

|

| Entity Address, Country |

MY

|

| Entity Address, Postal Zip Code |

50450

|

| City Area Code |

(60) 3

|

| Local Phone Number |

8408 -1788

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, $0.0001 par value

|

| Trading Symbol |

GRNQ

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

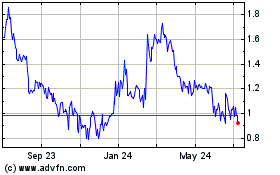

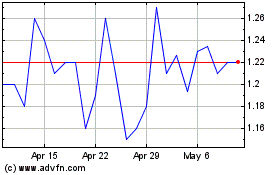

Greenpro Capital (NASDAQ:GRNQ)

Historical Stock Chart

From Feb 2025 to Mar 2025

Greenpro Capital (NASDAQ:GRNQ)

Historical Stock Chart

From Mar 2024 to Mar 2025