GRAVITY REPORTS THIRD QUARTER OF 2017 RESULTS AND BUSINESS

UPDATES

Seoul, South Korea – October 30, 2017 – GRAVITY

Co., Ltd. (NasdaqCM: GRVY) (“Gravity” or “Company”), a developer

and publisher of online and mobile games based in South Korea,

today announced its unaudited financial results for the third

quarter ended September 30, 2017, prepared in accordance with

generally accepted accounting principles in the United States.

THIRD QUARTER 2017 HIGHLIGHTS

- Total revenues were KRW 23,723 million (US$ 20,762 thousand),

representing a 12.2% decrease from the second quarter ended June

30, 2017 (“QoQ”) and a 50.7% increase from the third quarter ended

September 30, 2016 (“YoY”).

- Operating income was KRW 3,422 million (US$ 2,996 thousand),

representing a 21.7% decrease QoQ and a 3.5% decrease YoY.

- Income before income tax expenses was KRW 3,621 million (US$

3,169 thousand), representing a 20.6% decrease QoQ and a 2.8%

increase YoY.

- Net Income attributable to parent company was KRW 2,696 million

(US$ 2,359 thousand), representing a 24.2% decrease QoQ and a 12.7%

decrease YoY.

REVIEW OF THIRD QUARTER 2017 FINANCIAL

RESULTS

Revenues

Subscription revenues were KRW 9,126 million

(US$ 7,986 thousand), representing a 6.7% decrease QoQ from KRW

9,786 million and a 7.4% increase YoY from KRW 8,497million. The

decrease QoQ was mainly attributable to lower revenue from Ragnarok

Prequel in Taiwan, which was partially offset by higher revenues

derived from Ragnarok Online in Taiwan. The increase YoY was

largely due to strong growth of revenues from Ragnarok Prequel in

Taiwan and from Ragnarok Online in the United States and Canada,

which was partially offset by decreased revenues from Ragnarok

Online in Taiwan.

Royalty and license fee revenues were KRW 3,492

million (US$ 3,056 thousand), representing a 1.5% decrease QoQ from

KRW 3,546 million and a 6.7% decrease YoY from KRW 3,743 million.

The decrease QoQ was primarily due to lower revenues from Ragnarok

online in Japan and Indonesia, which was partially offset by higher

revenue derived from Ragnarok Online in Philippines. Ragnarok

Online was re-launched in Philippines on June 20, 2017. The

decrease YoY was mainly attributable to decreased revenues from

Ragnarok Online in Thailand, which was partially offset by

increased revenues from Ragnarok Online in Philippines and

Brazil.

Mobile game and application revenues were KRW

9,730 million (US$ 8,517 thousand), representing a 20.5%

decrease QoQ from KRW 12,239 million and a 243.8% increase YoY from

KRW 2,830 million. The decrease QoQ resulted primarily from

decreased revenues from Ragnarok R in Taiwan and Thailand. Such

decrease was partially offset by increased revenues from RO: Idle

Poring, which is offered globally except for Korea and Japan, and

also from Ragnarok R in Korea. The increase YoY was primarily due

to strong revenue growth from Ragnarok R in Korea, Taiwan and

Thailand.

Character merchandising and other revenues were

KRW 1,375 million (US$ 1,203 thousand), representing 5.6% decrease

QoQ from KRW 1,457 million and a 103.4 % increase YoY from KRW 676

million.

Cost of Revenue

Cost of revenue was KRW 14,335 million (US$

12,546 thousand), representing a 7.3% decrease QoQ from KRW 15,463

million and a 112.9% increase YoY from KRW 6,734 million.

The decrease QoQ was mainly due to i) decrease

in commission paid to mobile platforms, royalty payments and

outsourcing fees for Ragnarok R in Korea, Taiwan and Thailand; and

ii) decreased game channeling service fees and royalty payments for

Ragnarok Prequel in Taiwan, which was partially offset by increased

outsourcing fees and commission paid to mobile platforms for the

global service of RO: Idle Poring. The increase YoY was mostly from

i) increased commission paid to mobile platforms, outsourcing fees

and royalty payments for service of Ragnarok R and RO: Idle Poring;

and ii) higher game channeling service fees related to Ragnarok

Prequel.

Operating Expenses

Operating expenses were KRW 5,966 million (US$

5,220 thousand), representing a 17.0% decrease QoQ from KRW 7,192

million and a 9.1% increase YoY from KRW5,466 million.The decrease

QoQ was mainly attributable to lower advertising expenses related

to marketing for Ragnarok R in Korea, which was partially offset by

higher research and development cost. The increase YoY was mostly

resulted from higher research and development cost and from higher

advertising expenses, which was partially offset by decreased

payment gateway fees related to Ragnarok Online in Taiwan.

Income before income tax expenses

Income before income tax expenses was KRW 3,621

million (US$ 3,169 thousand) compared with income before income tax

expense of KRW 4,560 million for the second quarter of 2017 and

income before income tax expenses of KRW 3,524 million for the

third quarter of 2016.

Net Income

As a result of the foregoing factors, Gravity

recorded a net income attributable to parent company of KRW 2,696

million (US$ 2,359 thousand) compared with net income attributable

to parent company of KRW 3,555 million for the second quarter of

2017 and a net income attributable to parent company of KRW 3,087

million for the third quarter of 2016.

Liquidity

The balance of cash and cash equivalents and

short-term financial instruments was KRW 50,819 million (US$ 44,477

thousand) as of September 30, 2017.

Note: For convenience purposes only, the KRW

amounts have been expressed in U.S. dollars at the exchange rate of

KRW 1,142.57 to US$1.00, the noon buying rate in effect on

September 29, 2017 as quoted by the Federal Reserve Bank of New

York.

GRAVIY BUSINESS UPDATES

Ragnarok Online

Ragnarok Online was successfully re-launched in

Philippines on June 20, 2017, and such game has been one of the

most popular online games in such area. Electronics Extreme

Ltd.(“Extreme”) is our local licensee for Ragnarok Online in

Philippines as well as in Thailand. Gravity and Extreme are

preparing another re-launch of Ragnarok Online in Singapore and

Malaysia during the fourth quarter of 2017.

The Company expects to begin a service for

Ragnarok Zero in Korea during the fourth quarter of 2017. Ragnarok

Zero is a new version of Ragnarok Online, which has been

additionally developed to reflect various feedbacks from global

Ragnarok Online users. Gravity plans to offer Ragnarok Zero on a

new game server in Korea and to expand its service area in

2018.

Ragnarok Online

IP-based Games

- Ragnarok M, an MMORPG mobile game

The Company launched Ragnarok M in Taiwan, Hong

Kong and Macau on October 12, 2017. Based on revenues, Ragnarok M

ranked as first in both Apple’s App Store and Google Play Store in

Taiwan, Hong Kong and Macau, at its peak. The Company plans to

launch Ragnarok M in Korea during the first quarter of 2018 and in

Thailand during the first half of 2018.

- RO: Idle Poring, a text RPG mobile game

On September 13, 2017, Gravity commenced global

service of RO: Idle Poring, except for Korea, Japan and China.

Based on revenues, RO: Idle Poring ranked in the top 10 mobile

games in 12 countries on Apple’s App Store and in 7 countries on

Google Play Store, it its peak. RO: Idle Poring was initially

launched in China on April 28, 2017 by X.D. Network Inc.(“XD”).

Such game is expected to be launched in Korea and the launch

schedule is to be announced in the future.

- Ragnarok R, a card RPG mobile game

The Company plans to launch Ragnarok R in United

States and Canada during the fourth quarter of 2017 and in more

markets during 2018.

- Ragnarok Prequel, a web browser-based MMORPG game

Ragnarok Prequel is scheduled to be launched in

Philippines during the fourth quarter of 2017, under the name

Ragnarok Journey. Ragnarok Journey is to be the first game title

for which Gravity provides direct service in Philippines.

- Other Ragnarok Online IP-based games

Gravity, XD and Shanghai the Dream Network

Technology Co., Ltd.(“Partners”) plan to launch more Ragnarok

Online IP-based games, including a casual RPG HTML5 game. A closed

beta test is being conducted for such game and the Partners are in

discussion for a strategic launch plan in various markets.

Also, the Company is currently developing more

Ragnarok Online IP-based games including a 3D MO Action RPG mobile

game. A 3D MO Action RPG mobile game, Spear of Odin, is expected to

be launched in Asian markets during the first half of 2018.

Sword and Fairy: Mirror's Mirage, an

MORPG mobile game

Gravity plans to publish Sword and Fairy:

Mirror's Mirage in Korea during the fourth quarter of 2017. Sword

and Fairy: Mirror's Mirage was developed by SoftStar Technology

(Beijing) Co., Ltd. Such game was developed based on a well-known

Chinese IP, Sword and Fairy.

About GRAVITY Co., Ltd.

---------------------------------------------------

Based in Korea, Gravity is a developer and

publisher of online and mobile games. Gravity's principal product,

Ragnarok Online, is a popular online game in many markets,

including Japan and Taiwan, and is currently commercially offered

in 80 markets and countries. For more information about Gravity,

please visit http://www.gravity.co.kr.

Forward-Looking Statements:

Certain statements in this press release may

include, in addition to historical information, "forward-looking

statements" within the meaning of the "safe-harbor" provisions of

the U.S. Private Securities Litigation Reform Act 1995.

Forward-looking statements can generally be identified by the use

of forward-looking terminology, such as "may," "will," "expect,"

"intend," "estimate," "anticipate," "believe", "project," or

"continue" or the negative thereof or other similar words, although

not all forward-looking statements contain these words. Investors

should consider the information contained in our submissions and

filings with the United States Securities and Exchange Commission

(the "SEC"), including our annual report for the fiscal year ended

December 31, 2016 on Form 20-F, together with such other documents

that we may submit to or file with the SEC from time to time, on

Form 6-K. The forward-looking statements speak only as of this

press release and we assume no duty to update them to reflect new,

changing or unanticipated events or circumstances.

Contact:

Mr. Heung Gon Kim Chief Financial Officer

Gravity Co., Ltd. Email: kheung@gravity.co.kr

Ms. Ji Hee Kim IR Manager Gravity Co., Ltd.

Email: ircommunication@gravity.co.kr Telephone: +82-2-2132-7800

#

# #

GRAVITY Co.,

Ltd.Consolidated Balance Sheet

(In millions of KRW and thousands of US$)

|

|

|

|

As of |

|

|

|

|

31-Dec-16 |

|

30-Sep-17 |

|

|

|

|

KRW |

|

US$ |

|

KRW |

|

US$ |

| Assets |

(audited) |

|

(unaudited) |

|

(unaudited) |

|

(unaudited) |

| Current assets: |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

16,720 |

|

|

14,634 |

|

|

23,300 |

|

|

20,392 |

|

|

|

Short-term financial instruments |

22,000 |

|

|

19,255 |

|

|

27,519 |

|

|

24,085 |

|

|

|

Accounts receivable, net |

11,819 |

|

|

10,344 |

|

|

16,750 |

|

|

14,660 |

|

|

|

Other current assets |

2,852 |

|

|

2,496 |

|

|

4,395 |

|

|

3,847 |

|

|

|

|

Total

current assets |

53,391 |

|

|

46,729 |

|

|

71,964 |

|

|

62,984 |

|

|

|

|

|

|

|

|

|

|

|

|

| Property and equipment, net |

593 |

|

|

519 |

|

|

843 |

|

|

738 |

|

| Leasehold and other deposits |

962 |

|

|

842 |

|

|

987 |

|

|

864 |

|

| Intangible assets |

91 |

|

|

80 |

|

|

80 |

|

|

70 |

|

| Other non-current assets |

153 |

|

|

134 |

|

|

578 |

|

|

506 |

|

|

|

|

Total

assets |

55,190 |

|

|

48,304 |

|

|

74,452 |

|

|

65,162 |

|

|

|

|

|

|

|

|

|

|

|

|

| Liabilities and Equity |

|

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

|

|

Accounts payable |

10,033 |

|

|

8,781 |

|

|

13,032 |

|

|

11,406 |

|

|

|

Deferred revenue |

9,689 |

|

|

8,480 |

|

|

13,428 |

|

|

11,753 |

|

|

|

Other current liabilities |

964 |

|

|

844 |

|

|

2,561 |

|

|

2,241 |

|

|

|

|

Total

current liabilities |

20,686 |

|

|

18,105 |

|

|

29,021 |

|

|

25,400 |

|

| Long-term deferred revenue |

4,096 |

|

|

3,585 |

|

|

6,070 |

|

|

5,313 |

|

| Accrued severance benefits |

104 |

|

|

91 |

|

|

206 |

|

|

180 |

|

| Other non-current liabilities |

210 |

|

|

184 |

|

|

319 |

|

|

280 |

|

|

|

|

Total

liabilities |

25,096 |

|

|

21,965 |

|

|

35,616 |

|

|

31,173 |

|

| Common shares |

3,474 |

|

|

3,041 |

|

|

3,474 |

|

|

3,041 |

|

| Additional paid-in capital |

75,076 |

|

|

65,708 |

|

|

75,076 |

|

|

65,708 |

|

| Accumulated deficit |

(48,511 |

) |

|

(42,458 |

) |

|

(40,090 |

) |

|

(35,088 |

) |

| Accumulated other comprehensive income |

617 |

|

|

540 |

|

|

955 |

|

|

836 |

|

|

|

|

Total

parent company shareholders' equity |

30,656 |

|

|

26,831 |

|

|

39,415 |

|

|

34,497 |

|

| Non-controlling interest |

(562 |

) |

|

(492 |

) |

|

(579 |

) |

|

(508 |

) |

|

|

|

Total

equity |

30,094 |

|

|

26,339 |

|

|

38,836 |

|

|

33,989 |

|

|

|

|

Total

liabilities and equity |

55,190 |

|

|

48,304 |

|

|

74,452 |

|

|

65,162 |

|

* For convenience purposes only, the KRW amounts

are expressed in U.S. dollars at the rate of KRW 1,142.57 to US$

1.00, the noon buying rate in effect on September 29, 2017 as

quoted by the Federal Reserve Bank of New York.

GRAVITY CO.,

LTD.Consolidated Statements of

Operations

(In millions of KRW and in thousands of US$,

except for shares and ADS data)

|

|

|

|

Three months ended |

|

Nine months ended |

|

|

|

|

30-Jun-17 |

|

30-Sep-16 |

|

30-Sep-17 |

|

30-Sep-16 |

|

30-Sep-17 |

|

|

|

|

(KRW) |

|

(KRW) |

|

(KRW) |

|

(US$) |

|

(KRW) |

|

(KRW) |

|

(US$) |

|

|

|

|

(unaudited) |

|

(unaudited) |

|

(unaudited) |

|

(unaudited) |

|

(unaudited) |

|

(unaudited) |

|

(unaudited) |

| Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Online games-subscription revenue |

9,786 |

|

|

8,497 |

|

|

9,126 |

|

|

7,986 |

|

|

12,957 |

|

|

28,766 |

|

|

25,177 |

|

|

|

Online games-royalties and license fees |

3,546 |

|

|

3,743 |

|

|

3,492 |

|

|

3,056 |

|

|

9,883 |

|

|

11,513 |

|

|

10,076 |

|

|

|

Mobile games and applications |

12,239 |

|

|

2,830 |

|

|

9,730 |

|

|

8,517 |

|

|

8,798 |

|

|

30,033 |

|

|

26,285 |

|

|

|

Character merchandising and other revenue |

1,457 |

|

|

676 |

|

|

1,375 |

|

|

1,203 |

|

|

2,259 |

|

|

3,791 |

|

|

3,318 |

|

|

|

|

Total

net revenue |

27,028 |

|

|

15,746 |

|

|

23,723 |

|

|

20,762 |

|

|

33,897 |

|

|

74,103 |

|

|

64,856 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of revenue |

15,463 |

|

|

6,734 |

|

|

14,335 |

|

|

12,546 |

|

|

20,199 |

|

|

43,767 |

|

|

38,306 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross profit |

11,565 |

|

|

9,012 |

|

|

9,388 |

|

|

8,216 |

|

|

13,698 |

|

|

30,336 |

|

|

26,550 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative |

6,498 |

|

|

4,982 |

|

|

4,942 |

|

|

4,324 |

|

|

10,875 |

|

|

16,955 |

|

|

14,839 |

|

|

|

Research and development |

695 |

|

|

484 |

|

|

1,024 |

|

|

896 |

|

|

1,339 |

|

|

2,287 |

|

|

2,002 |

|

|

|

Impairment losses on intangible assets |

ㅡ |

|

ㅡ |

|

ㅡ |

|

ㅡ |

|

5 |

|

|

ㅡ |

|

ㅡ |

|

|

|

Total

operating expenses |

7,192 |

|

|

5,466 |

|

|

5,966 |

|

|

5,220 |

|

|

12,219 |

|

|

19,242 |

|

|

16,841 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating Income |

4,373 |

|

|

3,546 |

|

|

3,422 |

|

|

2,996 |

|

|

1,479 |

|

|

11,094 |

|

|

9,709 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other income (expenses): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income |

139 |

|

|

128 |

|

|

136 |

|

|

118 |

|

|

391 |

|

|

407 |

|

|

356 |

|

|

|

Interest expense |

(3 |

) |

|

ㅡ |

|

(3 |

) |

|

(3 |

) |

|

ㅡ |

|

(9 |

) |

|

(8 |

) |

|

|

Foreign currency income (loss), net |

51 |

|

|

(153 |

) |

|

66 |

|

|

58 |

|

|

(848 |

) |

|

71 |

|

|

62 |

|

|

|

Others, net |

ㅡ |

|

3 |

|

|

|

|

|

|

3 |

|

|

ㅡ |

|

ㅡ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income before income tax expenses |

4,560 |

|

|

3,524 |

|

|

3,621 |

|

|

3,169 |

|

|

1,025 |

|

|

11,563 |

|

|

10,119 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income tax expenses |

1,017 |

|

|

465 |

|

|

914 |

|

|

800 |

|

|

1,308 |

|

|

3,159 |

|

|

2,765 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net

income(loss) |

3,543 |

|

|

3,059 |

|

|

2,707 |

|

|

2,369 |

|

|

(283 |

) |

|

8,404 |

|

|

7,354 |

|

| Net income (loss) attributable to: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-controlling interest |

(12 |

) |

|

(28 |

) |

|

11 |

|

|

10 |

|

|

(64 |

) |

|

(17 |

) |

|

(16 |

) |

|

|

Parent company |

3,555 |

|

|

3,087 |

|

|

2,696 |

|

|

2,359 |

|

|

(219 |

) |

|

8,421 |

|

|

7,370 |

|

| Earning(loss) per share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-

Basic and diluted |

512 |

|

|

444 |

|

|

388 |

|

|

0.34 |

|

|

(32 |

) |

|

1,212 |

|

|

1.06 |

|

| Weighted average number of shares outstanding |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-

Basic and diluted |

6,948,900 |

|

|

6,948,900 |

|

|

6,948,900 |

|

|

6,948,900 |

|

|

6,948,900 |

|

|

6,948,900 |

|

|

6,948,900 |

|

| Earning(loss) per ADS(1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-

Basic and diluted |

1,024 |

|

|

888 |

|

|

776 |

|

|

0.68 |

|

(64 |

) |

|

2,424 |

|

|

2.12 |

|

* For convenience, the KRW amounts are expressed

in U.S. dollars at the rate of KRW 1,142.57 to US$ 1.00, the noon

buying rate in effect on September 29, 2017 as quoted by the

Federal Reserve Bank of New York.

(1) Each ADS represents two common shares.

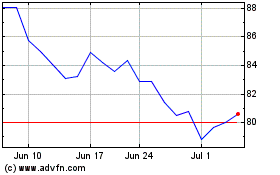

Gravity (NASDAQ:GRVY)

Historical Stock Chart

From Jun 2024 to Jul 2024

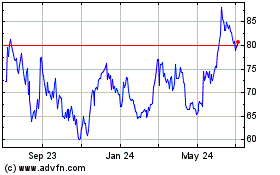

Gravity (NASDAQ:GRVY)

Historical Stock Chart

From Jul 2023 to Jul 2024