false

0001506983

0001506983

2024-07-30

2024-07-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

United

States

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date

of Report (Date of earliest event reported): July 30, 2024

GLUCOTRACK,

INC.

(Exact

Name of Registrant as Specified in its Charter)

| Delaware |

|

001-41141 |

|

98-0668934 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(I.R.S.

Employer

Identification

No.) |

301

Rte 17 North, Suite 800

Rutherford,

NJ |

|

07070 |

| (Address

of Principal Executive Offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: 201-842-7715

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock |

|

GCTK |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405)

or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2). Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

1.01 Entry into a Material Definitive Agreement.

On

July 30, 2024, Glucotrack, Inc. (the “Company”) entered into a convertible promissory note and three warrant agreements (the

“Warrants”) with an investor (the “Holder”), providing for the private placement of a secured convertible promissory

note in the aggregate principal amount of 4,000,000 (the “Note”. The Note is not convertible until and unless approved at

a meeting of the Company’s stockholders (“Stockholder Approval). The Company has agreed to hold such a meeting to seek Stockholder

Approval within 90 days.

The

Note bears simple interest at the rate of eight percent (8%) per annum and is due and payable in cash on the earlier of: (a) the twelve

(12) month anniversary of Note, or (b) the date of closing of a Sale Transaction (defined below) (the “Maturity Date”). Interest

will be computed on the basis of a 365-day year. The Note is secured by a first-priority security interest on all Company assets.

Except

with regard to conversion of the Notes a or a Sale Transaction as discussed below, the Company may not prepay the Notes without the written

consent of the holder. If Stockholder Approval is obtained, the Note (i) is convertible at the discretion of the Holder at a price equal

to the closing price of the Common Stock on the date of conversion and, (ii) if the Closing Price of the Common stock exceeds $5.00 per

share for a period of five (5) consecutive trading days, will automatically convert at a price equal to the five-day (5) VWAP (subject

to adjustment for any stock split, stock dividend, reverse stock split, combination or similar transaction). “VWAP” means

the daily volume weighted average price of the Common Stock.

In

the event of a Sale Transaction on or prior to the Maturity Date, the Company will repay the Holder, at the Holder’s election,

as follows: (a) cash equal to 200% of the Note balance, or (b) transaction consideration in the amount to be received by the Holder in

such Sale Transaction if the Note was converted pursuant to an optional conversion. “Sale Transaction” means a merger or

consolidation of the Company with or into any other entity, or a sale of all or substantially all of the assets of the Company, or any

other transaction or series of related transactions in which the Company’s stockholders immediately prior to such transaction(s)

receive cash, securities or other property in exchange for their shares and, immediately after such transaction(s), own less than 50%

of the equity securities of the surviving corporation or its parent.

Upon

the occurrence of an Event of Default (defined below), a holder may, by written notice to the Company, declare the Note to be due immediately

and payable with respect to the Note balance. An “Event of Default” means (i) failure by the Company to pay the Note balance

on the Maturity Date, (ii) the Company becomes subject to a judgement of more than $50,000, (iii) voluntary bankruptcy, or (iv) involuntary

bankruptcy. Upon the occurrence of an Event of Default specified in clause (iii) above, the Note balance shall automatically and immediately

become due and payable, in all cases without any action on the part of the holder.

Each

Warrant becomes exercisable 12 months after its issuance and has term of 10 years. The Warrants are exercisable for cash only and have

no price-based antidilution. The first Warrant is for 2,133,334 shares at $1.875 per share. The second Warrant is for 1,523,810 shares

at $2.625 per share. The third Warrant is for 1,185,186 shares at $3.375 per share.

As

part of the transaction, the Company agreed to appoint two individuals nominated by the Holder to the Company’s board of directors.

The Holder has not yet nominated any candidates.

The

foregoing description of the Notes does not purport to be complete and is qualified in its entirety by reference to the full text of

the form of Note, which is filed as Exhibit 10.1 to this Current Report on Form 8-K.

Item

2.03. Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The

information provided in Item 1.01 of this Current Report on Form 8-K is hereby incorporated by reference in this Item 2.03.

Item

3.02 Unregistered Sales of Equity Securities.

The

information provided in Item 1.01 of this Current Report on Form 8-K is hereby incorporated by reference in this Item 3.02.

The

Notes, the Warrants and any equity securities issuable upon conversion of the Notes or exercise of the Warrants (the “Securities”)

were not registered under the Securities Act of 1933, as amended (the “Securities Act”), and were issued in reliance on the

exemption from registration requirements thereof provided by Section 4(a)(2) of the Securities Act. The Company relied on this exemption

from registration based in part on representations made by the Holder. Accordingly, the Securities may not be offered or sold in the

United States except pursuant to an effective registration statement or an applicable exemption from the registration requirements of

the Securities Act and such applicable state securities laws.

Item

5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of

Certain Officers.

On

July 29, 2024, Shimon Rapp and Andrew Sycoff resigned from the board of directors. Mr. Rapp and Mr. Sycoff’s resignation was not

the result of any dispute or disagreement with the Company or the board of directors on any matter relating to the operations, policies

or practices of the Company.

Item

7.01 Regulation FD Disclosure

On

July 31, 2024, the Company issued a press release (the “Press Release”) regarding the financing. The Press Release is furnished

as Exhibit 99.1 and incorporated into this Item 7.01 by reference.

The

information in this Item 7.01, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities

Exchange Act of 1934, as amended, and shall not be deemed incorporated by reference into any filing with the Securities and Exchange

Commission, except as expressly set forth by specific reference in such a filing.

Item

9.01. Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

Glucotrack,

Inc. |

| |

|

|

| Date:

July 31, 2024 |

By: |

/s/

Paul Goode |

| |

Name: |

Paul

Goode |

| |

Title: |

Chief

Executive Officer |

Exhibit

10.1

NEITHER

THIS NOTE NOR THE SECURITIES ISSUABLE UPON CONVERSION OF THIS NOTE HAVE BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED

(THE “ACT”), OR APPLICABLE STATE SECURITIES LAWS AND HAVE BEEN ACQUIRED FOR INVESTMENT AND NOT WITH A VIEW TO, OR IN CONNECTION

WITH, THE SALE OR DISTRIBUTION THEREOF. SUCH SECURITIES MAY NOT BE SOLD, OFFERED FOR SALE, PLEDGED OR HYPOTHECATED IN THE ABSENCE OF

AN EFFECTIVE REGISTRATION STATEMENT RELATED THERETO OR AN EXEMPTION THEREFROM UNDER THE ACT AND ANY APPLICABLE SECURITIES LAWS.

SECURED

CONVERTIBLE PROMISSORY NOTE

| $4,000,000.00 |

|

July 30, 2024 |

For

value received Glucotrack, Inc., a Delaware corporation (the “Company”),

promises to pay to _______________ or their successors or assigns (“Holder”) the principal sum of US $4,000,000.00

(the “Principal Amount”) with simple interest on the outstanding principal amount at the rate of eight percent (8%)

per annum. The Note Balance (to the extent not converted in accordance with the terms of this Note) shall be due and payable twelve (12)

months from the date of issuance of this Note (the “Maturity Date”). Interest will commence on the date hereof and

will continue on the outstanding principal until paid in full or otherwise converted pursuant to the terms set forth herein. All interest

on the Principal Amount will accrue and, unless converted earlier as set forth below, be due and payable on the Maturity Date. Interest

will be computed on the basis of a 365-day year.

1. Instrument.

This Convertible Promissory Note (the “Note”) is issued pursuant to the Note and Warrant Purchase Agreement, dated

on or about the date hereof (the “Purchase Agreement”) between the Company and the Holder. Capitalized terms used

but not defined herein shall have the meanings ascribed to them in the Purchase Agreement.

2. Definitions.

(a) “Collateral”

means whether now existing or hereafter arising, all of the Company’s right, title and interest, in and to, (i) all fixtures (as

defined in the UCC) and equipment (as defined in the UCC), (ii) all Intellectual Property, (iii) all other tangible or intangible assets

and (iv) all proceeds of the foregoing.

(b) “Common

Stock” means the Company’s common stock, par value $0.001 per share.

(c) “Intellectual

Property” means (a) all inventions (whether patentable or unpatentable and whether or not reduced to practice), all improvements

thereto, and all patents, patent applications, and patent disclosures, together with all reissuances, continuations, continuations-in-part,

revisions, extensions, and reexaminations thereof, (b) all trademarks, service marks, trade dress, logos, trade names, and corporate

names, together with all translations, adaptations, derivations, and combinations thereof and including all goodwill associated therewith,

and all applications, registrations, and renewals in connection therewith, (c) all copyrightable works, all copyrights, and all applications,

registrations, and renewals in connection therewith, (d) all trade secrets and confidential business information (including ideas, research

and development, know- how, formulas, compositions, manufacturing and production processes and techniques, technical data, designs, drawings,

specifications, customer and supplier lists, pricing and cost information, and business and marketing plans and proposals), (e) all computer

software (including data and related documentation), (f) all other proprietary rights, and (g) all copies and tangible embodiments thereof

(in whatever form or medium).

(d) “Note

Balance” means at any particular time the then outstanding principal balance and any accrued but unpaid interest on this Note.

(e) “Sale

Transaction” means a merger or consolidation of the Company with or into any other entity, or a sale of all or substantially

all of the assets of the Company, or any other transaction or series of related transactions in which the Company’s stockholders

immediately prior to such transaction(s) receive cash, securities or other property in exchange for their shares and, immediately after

such transaction(s), own less than 50% of the equity securities of the surviving corporation or its parent.

(f) “Securities

Act” means the Securities Act of 1933, as amended.

3. Prepayment;

Notes Pari Passu; Applicable of Payments. Except with regard to conversion of this Note in accordance with Section 5 below, the Company

may not prepay this Note without the written consent of the Holder. Upon payment in full of the Note Balance hereunder, this Note must

be surrendered to the Company for cancellation.

4. Seniority;

Security.

4.1 Seniority.

The Note Balance and all other obligations of the Company of any kind whatsoever under or in respect of this Note (the “Senior

Obligations”) constitute unsubordinated obligations of the Company, and except for any obligations which have priority under

applicable law, rank senior in right of payment to all other indebtedness of the Company and are senior and preferred in right of payment

to all equity securities of the Company, in each case, outstanding as of the date of this Note.

4.2 Security.

This Note, as that term is used in the Uniform Commercial Code, as the same may, from time to time, be enacted and in effect in the State

of Delaware (the “UCC”) and the Company hereby grants to the Holder, in order to secure the payment and performance

of any and all existing and future obligations and liabilities of the Company owed to Holder, including, without limitation, all existing

advances and future advances and the Company’s obligations under this Note, a first lien and continuing security interest in and

to the Collateral, whether now owned or hereafter acquired by the Company, wherever located, and whether now or hereafter existing or

arising (terms used in this Section 4.2 shall have the meaning provided in the UCC; provided, however, that in the event that, by reason

of mandatory provisions of law, any or all of the perfection or priority of, or remedies with respect to, any Collateral is governed

by the Uniform Commercial Code as enacted and in effect in a jurisdiction other than the State of Delaware, the term “UCC”

shall mean the Uniform Commercial Code as enacted and in effect in such other jurisdiction solely for purposes of the provisions hereof

relating to such perfection, priority or remedies).

4.3 Cooperation.

The Company will, at its own expense, make, execute, endorse, acknowledge, file and/or deliver to the Holder from time to time such confirmatory

assignments, conveyances, financing statements, powers of attorney, certificates and other assurances or instruments and take such further

steps relating to the Collateral and other property or rights covered by the interests hereby granted, which the Holder, upon written

discretion, deems reasonably appropriate or advisable to perfect, preserve or protect its security interest in the Collateral. Without

limiting the foregoing, the Company hereby authorizes the Holder to file any such financing statements as the Holder shall determine

to be necessary or advisable to perfect the security interest granted hereunder, without the signature of the Company.

4.4 Remedies.

In addition to all other rights, options, and remedies granted to the Holder under this Note, upon the occurrence and during the continuation

of an Event of Default, the Holder may exercise all other rights granted to it under this Note and all rights under the UCC in effect

in the applicable jurisdiction(s) and under any other applicable law, including the right to take possession of, send notices regarding,

and collect directly the Collateral, with or without judicial process, and to exercise all rights and remedies available to the Holder

with respect to the Collateral under the UCC in effect in the applicable jurisdiction(s)

5. Conversion.

5.1 Stockholder

Approval. The Note shall not be convertible unless and until the Company obtains such approval as may be required by the applicable

rules and regulations of the Principal Market Rules (or the applicable rules and regulations of any successor entity) from the stockholders

of the Company with respect to such conversion (“Stockholder Approval”). The Company shall hold a special meeting

of stockholders on or before the date that is ninety (90) days following the date of the Purchase Agreement. The Company shall use its

reasonable best efforts to obtain such Stockholder Approval. If the Company does not obtain Stockholder Approval at the first meeting,

the Company shall call a meeting as often as reasonably practicable thereafter to seek Stockholder Approval until the Stockholder Approval

is obtained.

5.2 Conversion

at Option of Holder. Once Stockholder Approval is obtained, this Note shall be convertible at any time into Common Stock at the price

equal to the closing price of the Common Stock on the Nasdaq Stock Market, or other Trading Market if not listed on Nasdaq, (the “Closing

Price”) on the date of conversion.

5.3 Mandatory

Conversion. Once Stockholder Approval is obtained, if the Closing Price of the Common stock exceeds $5.00 per share for a period

of five (5) consecutive trading days, the Note will automatically convert at a price equal to the five-day (5) VWAP (subject to adjustment

for any stock split, stock dividend, reverse stock split, combination or similar transaction) (the “Mandatory Conversion”).

5.4 Sale

Transaction. In the event of a Sale Transaction on or prior to the Maturity Date, the Company will repay the Holder, at the Holder’s

election, as follows: (a) cash equal to 200% of the Note Balance, or (b) transaction consideration in the amount to be received by the

Holder in such Sale Transaction if the Note was converted pursuant to an optional conversion as described in Section 5.2.

5.5 Effect

of Conversion. The Company will not issue fractional shares of equity securities but will round the amount of any fractional shares

otherwise issuable upon conversion of this Note up to the nearest whole share. Upon conversion of this Note pursuant to this Section

5, the applicable Note Balance will be converted without any further action by the Holder. The Company will, within one business day,

issue the securities to which the Holder will be entitled. The Holder will be treated for all purposes as the record holder of such securities

on such date.

6. Events

of Default. Each of the following will be deemed to constitute an “Event of Default” hereunder:

(a) Failure

to Pay. The Company fails to pay the Note Balance on the Maturity Date;

(b) Subject

to Judgment. The Company becomes subject to a judgment of more than $50,000.00;

(c) Voluntary

Bankruptcy or Insolvency Proceedings. The Company (i) applies for or consents to the appointment of a receiver, trustee, liquidator

or custodian of itself or of all or a substantial part of its property, or voluntarily terminate operations, (ii) makes a general assignment

for the benefit of any of its creditors, (iii) is dissolved or liquidated in full or in part, (iv) commences a voluntary case or other

proceeding seeking liquidation, reorganization or other relief with respect to itself or its debts under any bankruptcy, insolvency or

other similar law now or hereafter in effect or consents to any such relief or to the appointment of or taking possession of its property

by any official in an involuntary case or other proceeding commenced against it, (v) admits in writing its inability to pay debts as

the debts become due, or (vi) takes any action for the purpose of effecting any of the foregoing;

(d) Involuntary

Bankruptcy or Insolvency Proceedings. Proceedings for the appointment of a receiver, trustee, liquidator or custodian of the

Company of all or a substantial part of the property thereof, or an involuntary case or other proceedings seeking liquidation, reorganization

or other relief with respect to the Company or the debts thereof under any bankruptcy, insolvency or other similar law now or hereafter

in effect are commenced and an order for relief entered, or such case or proceeding is not dismissed or discharged within 20 days of

commencement;

(d) Performance

under Note. The Company defaults in the due observance or performance of any covenant, representation, warranty, condition or

agreement on the part of the Company to be observed or performed pursuant to the terms hereof, and such default is not remedied or waived

within 30 calendar days after the Company receives written notice of such default;

7. Remedies.

Upon the occurrence of an Event of Default, at the option and upon the written declaration of the Holder (or automatically without such

declaration if an Event of Default set forth in Section 6(d) occurs), the entire Note Balance will, without presentment, demand, protest,

or notice of any kind, all of which are hereby expressly waived, be forthwith due and payable, and such Holder may, immediately and without

expiration of any period of grace, enforce payment of all amounts due and owing under this Note and exercise any and all other remedies

granted to it at law, in equity or otherwise.

8. Governing

Law. The terms of this Note are governed by and construed in accordance with the laws of the State of Delaware.

9. Time

of Essence. Time is of the essence with respect to all of the Company’s obligations and agreements under this Note.

10. Successor

and Assigns. This Note and all provisions, conditions, promises and covenants hereof are binding in accordance with the terms hereof

upon the Company, its successors and assigns. The obligations of the Company set forth herein will not be assignable by the Company without

Holder’s prior written consent.

11. Collection

Expenses. The Company further agrees, subject only to any limitation imposed by applicable law, to pay all expenses, including reasonable

attorneys’ fees, incurred by the Holder in endeavoring to collect any amounts payable hereunder which are not paid when due.

12. Waiver.

The Company hereby waives presentment, protest, demand for payment, notice of dishonor, and any and all other notices or demands in connection

with the delivery, acceptance, performance, default, or enforcement of this Note.

13. Entire

Agreement. This Note contains the entire understanding of the Company and the Holder with respect to the subject matter hereof and

thereof and expressly supersede any and all prior agreements and understandings among them with respect to such subject matter. All pronouns

contained herein, and any variations thereof, are deemed to refer to the masculine, feminine or neutral, singular or plural, as to the

identity of the parties hereto may require.

[Remainder

of page intentionally left blank]

IN

WITNESS WHEREOF, the Company and the Holder have caused this Note to be executed and issued as a sealed instrument as of the date

and year first written above.

| |

GLUCOTRACK,

INC. |

| |

|

|

| |

By:

|

|

| |

Name:

|

Paul

Goode |

| |

Title:

|

Chief

Executive Officer |

[Signature

Page to Secured Convertible Promissory Note]

Exhibit

10.2

THIS

WARRANT AND THE SECURITIES ISSUABLE UPON EXERCISE HEREOF HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED, APPLICABLE

STATE SECURITIES LAWS, OR APPLICABLE LAWS OF ANY FOREIGN JURISDICTION. THIS WARRANT AND SUCH UNDERLYING SECURITIES HAVE BEEN ACQUIRED

FOR INVESTMENT AND NOT WITH A VIEW TO DISTRIBUTION OR RESALE, AND MAY NOT BE OFFERED, SOLD, PLEDGED, HYPOTHECATED, RENOUNCED OR OTHERWISE

TRANSFERRED IN THE ABSENCE OF AN EFFECTIVE REGISTRATION STATEMENT UNDER THE SECURITIES ACT AND ANY APPLICABLE STATE SECURITIES LAWS AND

IN THE ABSENCE OF COMPLIANCE WITH APPLICABLE LAWS OF ANY FOREIGN JURISDICTION, OR THE AVAILABILITY OF AN EXEMPTION FROM THE REGISTRATION

PROVISIONS OF THE SECURITIES ACT OF 1933, AS AMENDED, AND APPLICABLE STATE SECURITIES LAWS.

GLUCOTRACK,

INC.

COMMON

STOCK PURCHASE WARRANT

This

Common Stock Purchase Warrant (the “Warrant”) is issued as of the ___ day of July 2024, by GLUCOTRACK, Inc., a Delaware

corporation (the “Company”), to ____________________ (the “Holder”).

1.

Issuance of Warrant; Term; Price.

1.1.

Issuance. Concurrently herewith, the Holder is purchasing a convertible promissory note (the “Note”) pursuant

to the terms of that certain Note and Warrant Purchase Agreement dated as of July 30, 2024, by and among the Company, the Holder and

the other purchasers party thereto (the “Purchase Agreement”). In consideration of Holder’s agreement to purchase

the Note, the Company hereby grants to Holder the right to purchase [________________] shares of the Company’s Common Stock, $0.001

par value per share (the “Common Stock”). The shares of Common Stock or other securities for which this Warrant may

be exercisable from time to time shall be referred to herein as the “Warrant Stock.” The shares of Warrant Stock issuable

upon exercise of this Warrant are hereinafter referred to as the “Shares.” This Warrant is one of a series of Warrants

(the “Common Warrants”) issued by the Company pursuant to the Purchase Agreement.

1.2

Term. This Warrant shall become exercisable on the date twelve months from its issuance and terminate on July 30, 2034 (the “Termination

Date”).

1.3

Exercise Price. Subject to adjustment as hereinafter provided, the exercise price (the “Warrant Price”) per

share for which all or any of the Shares may be purchased pursuant to the terms of this Warrant shall be equal to $[_____].

2.

Adjustment of Warrant Price, Number and Kind of Shares. The Warrant Price and the number and kind of Shares issuable upon the

exercise of this Warrant shall be subject to adjustment from time to time as follows.

2.1.

Dividends in Stock Adjustment. In case at any time or from time to time on or after the date on which this Warrant is exercisable

for Warrant Stock and while this Warrant is outstanding and unexpired, the holders of the Warrant Stock of the Company (or any shares

of stock or other securities at the time receivable upon the exercise of this Warrant) shall have received, or, on or after the record

date fixed for the determination of eligible stockholders, shall have become entitled to receive, without payment therefor, other or

additional securities or other property (other than cash) of the Company by way of dividend or distribution, then and in each case, the

holder of this Warrant shall, upon the exercise hereof, be entitled to receive, in addition to the number of shares of Warrant Stock

receivable thereupon, and without payment of any additional consideration therefor, the amount of such other or additional securities

or other property (other than cash) of the Company which such holder would have been entitled to receive if it had exercised this Warrant

on the date hereof and thereafter, during the period from the date hereof to and including the date of such exercise, retained such shares

and/or all other additional securities or other property receivable by it as aforesaid during such period, giving effect to all adjustments

called for during such period by this Section 2.

2.2.

Reclassification or Reorganization Adjustment. In case of any changes in the class or kind of securities issuable upon exercise

of this Warrant or any reclassification or change of the outstanding securities of the Company or of any merger, consolidation or reorganization

of the Company (or any other corporation the stock or securities of which are at the time receivable upon the exercise of this Warrant)

on or after the date hereof, then the holder of this Warrant, upon the exercise hereof at any time after the consummation of such reclassification,

change, merger, consolidation or reorganization, shall be entitled to receive, in lieu of the stock or other securities and property

receivable upon the exercise hereof prior to such consummation, the stock or other securities or property to which such holder would

have been entitled upon such consummation if such holder had exercised this Warrant immediately prior thereto, and the Warrant Price

therefore shall be appropriately adjusted, all subject to further adjustment as provided in this Section 2.

2.3.

Stock Splits and Reverse Stock Splits. If at any time on or after the date hereof the Company shall split, subdivide or otherwise

change its outstanding shares of any securities receivable upon exercise of this Warrant into a greater number of shares, the Warrant

Price in effect immediately prior to such subdivision shall thereby be proportionately reduced and the number of shares receivable upon

exercise of this Warrant shall thereby be proportionately increased; and, conversely, if at any time on or after the date hereof the

outstanding number of shares of any securities receivable upon exercise of this Warrant shall be combined into a smaller number of shares,

the Warrant Price in effect immediately prior to such combination shall thereby be proportionately increased and the number of shares

receivable upon exercise of this Warrant shall thereby be proportionately decreased, all subject to further adjustment as provided in

this Section 2.

2.4

Other Impairment. The Company will not, by amendment of its Certificate of Incorporation or Bylaws or through any reorganization,

transfer of assets, consolidation, merger, dissolution, issue or sale of securities or any other voluntary action, avoid or seek to avoid

the observance or performance of any of the terms of this Warrant, but will at all times in good faith assist in the carrying out of

all such terms and conditions and in the taking of all such action as may be necessary or appropriate in order to protect the rights

of the Holder against impairment.

3.

No Fractional Shares. No fractional shares of Warrant Stock will be issued in connection with any exercise hereunder. In lieu

of any fractional shares that would otherwise be issuable, the Company shall round up one share.

4.

No Stockholder Rights. This Warrant as such shall not entitle its holder to any of the rights of a stockholder of the Company

until the holder has exercised this Warrant in accordance with Section 6 hereof.

5.

Reservation of Stock. The Company covenants that during the period this Warrant is exercisable, the Company will reserve from

its authorized and unissued Warrant Stock a sufficient number of shares to provide for the issuance of Warrant Stock upon the exercise

of this Warrant. The Company agrees that its issuance of this Warrant shall constitute full authority to its officers who are charged

with the duty of executing stock certificates to execute and issue the necessary certificates for shares of Warrant Stock upon the exercise

of this Warrant.

6.

Exercise of Warrant. This Warrant may be exercised by Holder by the surrender of this Warrant at the principal office of the Company,

accompanied by payment in full of the purchase price of the shares purchased thereby, as described above. This Warrant shall be deemed

to have been exercised immediately prior to the close of business on the date of its surrender for exercise as provided above, and the

person or entity entitled to receive the shares or other securities issuable upon such exercise shall be treated for all purposes as

the holder of such shares of record as of the close of business on such date. As promptly as practicable, the Company shall issue and

deliver to the person or entity entitled to receive the same the full shares of Warrant Stock issuable upon such exercise. The shares

of Warrant Stock issuable upon exercise hereof shall, upon their issuance, be fully paid and nonassessable. If this Warrant shall be

exercised in part only, the Company shall, at the time of delivery of the certificate representing the Shares or other securities in

respect of which this Warrant has been exercised, deliver to the Holder a new Warrant evidencing the right to purchase the remaining

Shares or other securities purchasable under this Warrant, which new warrant shall, in all other respects, be identical to this Warrant.

7.

Sale Prior to Exercisability. If, during the time while this Warrant is not yet exercisable, the Company completes or enters into

an agreement to complete a merger or consolidation of the Company with or into any other entity, or a sale of all or substantially all

of the assets of the Company, or any other transaction or series of related transactions in which the Company’s stockholders immediately

prior to such transaction(s) receive cash, securities or other property in exchange for their shares and, immediately after such transaction(s),

own less than 50% of the equity securities of the surviving corporation or its parent. (each a “Sale Transaction”),

then immediately prior to such Sale Transaction, the Company will purchase this Warrant in cash or stock for its Black Scholes Value.

“Black Scholes Value” means the value of this Warrant based on the Black-Scholes Option Pricing Model obtained from

the “OV” function on Bloomberg, L.P. (“Bloomberg”) determined as of the day of consummation of the Sale

Transaction for pricing purposes and reflecting (A) a risk-free interest rate corresponding to the U.S. Treasury rate for a period equal

to the time between the date of the public announcement of the Sale Transaction and the Termination Date, (B) an expected volatility

equal to the greater of 100% and the 100 day volatility obtained from the HVT function on Bloomberg as of the trading day immediately

following the public announcement of the Sale Transaction, (C) the underlying price per share used in such calculation shall be the sum

of the price per share being offered in cash, if any, plus the value of any non-cash consideration, if any, being offered in such Sale

Transaction and (D) a remaining option time equal to the time between the date of the public announcement of the Sale Transaction and

the Termination Date.

8.

Certificate of Adjustment. Whenever the Warrant Price or number or type of securities issuable upon exercise of this Warrant is

adjusted, as herein provided, the Company shall promptly deliver to the record holder of this Warrant a certificate of an officer of

the Company setting forth the nature of such adjustment and a brief statement of the facts requiring such adjustment.

9.

Replacement of Warrants. Upon receipt by the Company of evidence reasonably satisfactory to the Company of the loss, theft, destruction

or mutilation of the Warrant, and in the case of any such loss, theft or destruction of the Warrant, on delivery of an indemnity agreement

or security reasonably satisfactory in form and amount to the Company, and reimbursement to the Company of all reasonable expenses incidental

thereto, and upon surrender and cancellation of the Warrant if mutilated, the Company will execute and deliver, in lieu thereof, a new

Warrant of like tenor.

11.

Miscellaneous. This Warrant shall be governed by the laws of the State of Delaware, without regard to the conflict of laws provisions

thereof. The headings in this Warrant are for purposes of convenience of reference only, and shall not be deemed to constitute a part

hereof. The invalidity or unenforceability of any provision hereof shall in no way affect the validity or enforceability of any other

provisions. All notices and other communications from the Company to the holder of this Warrant shall be given in writing and shall be

deemed effectively given as provided in the Purchase Agreement.

12.

Amendment; Waiver. Any term of this Warrant may be amended, and any provision hereof waived, with the written consent of the Company

and the Holder.

[THE

NEXT PAGE IS THE SIGNATURE PAGE]

IN

WITNESS WHEREOF, the undersigned officer of the Company has set his hand as of the date first above written.

| |

GLUCOTRACK,

INC. |

| |

|

| |

|

| |

Paul

Goode, Chief Executive Officer |

[Signature

Page to Common Stock Purchase Warrant]

Exhibit

99.1

GLUCOTRACK

ANNOUNCES NEW FUNDING FOR DEVELOPMENT OF ITS CONTINUOUS BLOOD GLUCOSE MONITOR

Rutherford,

NJ, July 31, 2024 (GLOBE NEWSWIRE) – Glucotrack, Inc. (Nasdaq: GCTK) (“Glucotrack” or the “Company”), a

medical technology company focused on the design, development, and commercialization of novel technologies for people with diabetes,

today announced that it has secured $4M in funding from its leading shareholder to support the upcoming First in Human clinical trial.

“This

year, we have made significant progress in the development of our groundbreaking Continuous Blood Glucose Monitor (CBGM) technology.

This funding, by long-standing investor John Ballantyne, provides increased financial flexibility for the Company as we embark on human

clinical trials for this less burdensome approach to glucose monitoring,” said CEO Paul V. Goode, PhD.

“Since

my initial investment, the Company has undergone a significant evolution in its technology and focus. This has accelerated development

of the innovative CBGM which has the potential to be disruptive in a large and growing diabetes market. I remain confident that the Company

and its leadership team are well positioned to deliver strong clinical value to the diabetes community and meaningful value to the shareholder

community,” said John Ballantyne.

For

more information about Glucotrack’s CBGM, visit glucotrack.com.

#

# #

About

Glucotrack, Inc.

Glucotrack,

Inc. (NASDAQ: GCTK) is focused on the design, development, and commercialization of novel technologies for people with diabetes. The

Company is currently developing a long-term implantable continuous blood glucose monitoring system for people living with diabetes.

Glucotrack’s

CBGM is a long-term, implantable system that continually measures blood glucose levels with a sensor longevity of 2+ years, no on-body

wearable component and with minimal calibration. For

more information, please visit http://www.glucotrack.com.

Forward-Looking

Statements

This

news release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Statements

contained in this news release that are not statements of historical fact may be deemed to be forward-looking statements. Without limiting

the generality of the foregoing, words such as “believe”, “expect”, “plan” and “will”

are intended to identify forward-looking statements. Such forward-looking statements are based on the beliefs of management, as well

as assumptions made by, and information currently available to, management. These statements relate only to events as of the date on

which the statements are made, and Glucotrack undertakes no obligation to publicly update any forward-looking statements, whether as

a result of new information, future events or otherwise, except as required by law. All of the forward-looking statements made in this

press release are qualified by these cautionary statements, and there can be no assurance that the actual results anticipated by Glucotrack

will be realized or, even if substantially realized, that they will have the expected consequences to or effects on us or our business

or operations. Readers are cautioned that certain important factors may affect Glucotrack’s actual results and could cause such

results to differ materially from any forward-looking statements that may be made in this news release. Factors that may affect Glucotrack’s

results include, but are not limited to, the ability of Glucotrack to raise additional capital to finance its operations (whether through

public or private equity offerings, debt financings, strategic collaborations or otherwise); risks relating to the receipt (and timing)

of regulatory approvals (including U.S. Food and Drug Administration approval); risks relating to enrollment of patients in, and the

conduct of, clinical trials; risks relating to Glucotrack’s future distribution agreements; risks relating to its ability to hire

and retain qualified personnel, including sales and distribution personnel; and the additional risk factors described in Glucotrack’s

filings with the U.S. Securities and Exchange Commission (the “SEC”), including its Annual Report on Form 10-K for the year

ended December 31, 2023 as filed with the SEC on March 28, 2024.

Contacts:

Investor

Relations:

investors@glucotrack.com

Media:

GlucotrackPR@icrinc.com

v3.24.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

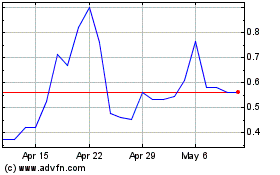

GlucoTrack (NASDAQ:GCTK)

Historical Stock Chart

From Dec 2024 to Jan 2025

GlucoTrack (NASDAQ:GCTK)

Historical Stock Chart

From Jan 2024 to Jan 2025