false

Q1

--12-31

0001506983

0001506983

2024-01-01

2024-03-31

0001506983

2024-05-14

0001506983

2024-03-31

0001506983

2023-12-31

0001506983

2023-01-01

2023-03-31

0001506983

us-gaap:CommonStockMember

2022-12-31

0001506983

us-gaap:AdditionalPaidInCapitalMember

2022-12-31

0001506983

GCTK:ReceiptsOnAccountOfSharesMember

2022-12-31

0001506983

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-12-31

0001506983

us-gaap:RetainedEarningsMember

2022-12-31

0001506983

2022-12-31

0001506983

us-gaap:CommonStockMember

2023-12-31

0001506983

us-gaap:AdditionalPaidInCapitalMember

2023-12-31

0001506983

GCTK:ReceiptsOnAccountOfSharesMember

2023-12-31

0001506983

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-12-31

0001506983

us-gaap:RetainedEarningsMember

2023-12-31

0001506983

us-gaap:CommonStockMember

2023-01-01

2023-03-31

0001506983

us-gaap:AdditionalPaidInCapitalMember

2023-01-01

2023-03-31

0001506983

GCTK:ReceiptsOnAccountOfSharesMember

2023-01-01

2023-03-31

0001506983

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-01-01

2023-03-31

0001506983

us-gaap:RetainedEarningsMember

2023-01-01

2023-03-31

0001506983

us-gaap:CommonStockMember

2024-01-01

2024-03-31

0001506983

us-gaap:AdditionalPaidInCapitalMember

2024-01-01

2024-03-31

0001506983

GCTK:ReceiptsOnAccountOfSharesMember

2024-01-01

2024-03-31

0001506983

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2024-01-01

2024-03-31

0001506983

us-gaap:RetainedEarningsMember

2024-01-01

2024-03-31

0001506983

us-gaap:CommonStockMember

2023-03-31

0001506983

us-gaap:AdditionalPaidInCapitalMember

2023-03-31

0001506983

GCTK:ReceiptsOnAccountOfSharesMember

2023-03-31

0001506983

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-03-31

0001506983

us-gaap:RetainedEarningsMember

2023-03-31

0001506983

2023-03-31

0001506983

us-gaap:CommonStockMember

2024-03-31

0001506983

us-gaap:AdditionalPaidInCapitalMember

2024-03-31

0001506983

GCTK:ReceiptsOnAccountOfSharesMember

2024-03-31

0001506983

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2024-03-31

0001506983

us-gaap:RetainedEarningsMember

2024-03-31

0001506983

2023-01-01

2023-12-31

0001506983

us-gaap:SubsequentEventMember

us-gaap:PrivatePlacementMember

2024-04-01

2024-04-30

0001506983

srt:MaximumMember

2021-09-27

0001506983

GCTK:PrefundedWarrantsMember

2024-01-03

2024-01-03

0001506983

GCTK:ExchangeAgreementMember

us-gaap:CommonStockMember

2024-02-13

2024-02-13

0001506983

GCTK:ExchangeAgreementMember

2024-02-13

0001506983

GCTK:ExchangeAgreementMember

2024-02-13

2024-02-13

0001506983

us-gaap:LeaseAgreementsMember

2024-02-19

2024-02-19

0001506983

us-gaap:LeaseAgreementsMember

2024-02-19

0001506983

2024-02-19

0001506983

GCTK:PremisesMember

2023-12-31

0001506983

GCTK:PremisesMember

2024-01-01

2024-03-31

0001506983

GCTK:PremisesMember

2024-03-31

0001506983

GCTK:LessThanOneYearMember

2024-03-31

0001506983

GCTK:BetweenOneYearToTwoYearsMember

2024-03-31

0001506983

GCTK:MoreThanTwoYearsMember

2024-03-31

0001506983

GCTK:IsraeliInnovationAuthorityMember

2004-03-04

0001506983

GCTK:IsraeliInnovationAuthorityMember

srt:MinimumMember

2004-03-03

2004-03-04

0001506983

GCTK:IsraeliInnovationAuthorityMember

srt:MaximumMember

2004-03-03

2004-03-04

0001506983

GCTK:IsraeliInnovationAuthorityMember

2004-03-04

0001506983

GCTK:IsraeliInnovationAuthorityMember

2024-03-31

0001506983

GCTK:IntellectualPropertyPurchaseAgreementMember

us-gaap:CommonStockMember

2022-10-06

2022-10-07

0001506983

GCTK:IntellectualPropertyPurchaseAgreementMember

us-gaap:CommonStockMember

srt:MinimumMember

2022-10-06

2022-10-07

0001506983

GCTK:IntellectualPropertyPurchaseAgreementMember

us-gaap:CommonStockMember

srt:MinimumMember

2022-10-07

0001506983

GCTK:IntellectualPropertyPurchaseAgreementMember

us-gaap:CommonStockMember

srt:MinimumMember

GCTK:TrueupSharesMember

2022-10-07

0001506983

2023-06-01

2023-06-20

0001506983

GCTK:PrivatePlacementAgreementMember

us-gaap:SubsequentEventMember

2024-04-21

2024-04-22

0001506983

GCTK:PrivatePlacementAgreementMember

us-gaap:SubsequentEventMember

2024-04-22

0001506983

us-gaap:SubsequentEventMember

2024-04-25

2024-04-26

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

iso4217:ILS

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-Q

(Mark

One)

| ☒ |

QUARTERLY

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| |

|

| |

For

the quarterly period ended March 31, 2024 |

or

| ☐ |

TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| |

|

| |

For

the transition period from ________________ to ________________ |

Commission

File Number: 001-41141

GLUCOTRACK,

INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

98-0668934 |

(State

or other jurisdiction of

incorporation or organization) |

|

(I.R.S.

Employer

Identification No.) |

| |

|

|

301

Route 17 North, Suite 800

Rutherford, NJ |

|

07070 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

(201)

842-7715

(Registrant’s

telephone number, including area code)

N/A

(Former

name, former address and former fiscal year, if changed since last report)

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock |

|

GCTK |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate

by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data

File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding

12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company,

or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller

reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| |

Large

accelerated filer ☐ |

|

Accelerated

filer ☐ |

| |

Non-accelerated

filer ☒ |

|

Smaller

reporting company ☒ |

| |

Emerging

growth company ☐ |

|

|

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As

of May 14, 2024, 27,393,002 shares of the Company’s common stock, par value $0.001 per share, were outstanding.

GLUCOTRACK

INC.

TABLE

OF CONTENTS

CAUTIONARY

NOTE REGARDING FORWARD LOOKING STATEMENTS

This

Quarterly Report on Form 10-Q includes forward-looking statements. These forward-looking statements include statements about our expectations,

beliefs or intentions regarding our product development efforts, business, financial condition, results of operations, strategies or

prospects. All statements other than statements of historical fact included in this Quarterly Report on Form 10-Q, including statements

regarding our future activities, events or developments, including such things as future revenues, product development, clinical trials,

regulatory approval, market acceptance, responses from competitors, capital expenditures (including the amount and nature thereof), business

strategy and measures to implement strategy, competitive strengths, goals, expansion and growth of our business and operations, plans,

references to future success, projected performance and trends, and other such matters, are forward-looking statements. The words “believe,”

“expect,” “intend,” “anticipate,” “estimate,” “plan,” “may,”

“will,” “could,” “would,” “should” and other similar words and phrases or the negative

of such terms, are intended to identify forward-looking statements. The forward-looking statements made in this Quarterly Report on Form

10-Q are based on certain historical trends, current conditions and expected future developments, as well as other factors we believe

are appropriate in the circumstances. These statements relate only to events as of the date on which the statements are made and we undertake

no obligation to update publicly any forward-looking statements, whether as a result of new information, future events or otherwise,

except as required by law. All of the forward-looking statements made in this Quarterly Report on Form 10-Q are qualified by these cautionary

statements and there can be no assurance that the actual results anticipated by us will be realized or, even if substantially realized,

that they will have the expected consequences to or effects on us or our business or operations. Whether actual results will conform

to our expectations and predictions is subject to a number of risks and uncertainties that may cause actual results to differ materially.

Risks and uncertainties, the occurrence of which could adversely affect our business, include the risks identified in our Annual Report

on Form 10-K for year ended December 31, 2023, under the caption “Risk Factors.” We undertake no obligation to publicly update

or revise any forward-looking statements to reflect events or circumstances that may arise after the date of this report unless required

by law.

GLUCOTRACK

INC.

PART

I - FINANCIAL INFORMATION

Item

1. Financial Statements

GLUCOTRACK

INC.

CONDENSED

CONSOLIDATED BALANCE SHEETS

(in

thousands of US dollars except share data)

| | |

| | |

| |

| | |

In thousands of US dollars (except stock data) | |

| | |

March 31, 2024 | | |

December 31, 2023 | |

| | |

Unaudited | | |

| |

| | |

| | |

| |

| Current Assets | |

| | | |

| | |

| Cash and cash equivalents | |

| 1,497 | | |

| 4,492 | |

| Other current assets | |

| 440 | | |

| 376 | |

| Total current assets | |

| 1,937 | | |

| 4,868 | |

| | |

| | | |

| | |

| Operating lease right-of-use asset, net (Note 3C) | |

| 77 | | |

| - | |

| Property and equipment, net | |

| 82 | | |

| 27 | |

| Restricted cash | |

| 10 | | |

| 10 | |

| TOTAL ASSETS | |

| 2,106 | | |

| 4,905 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |

| | | |

| | |

| Current Liabilities | |

| | | |

| | |

| Accounts payable | |

| 1,014 | | |

| 839 | |

| Operating lease liability, current (Note 3C) | |

| 24 | | |

| - | |

| Other current liabilities | |

| 444 | | |

| 673 | |

| Total current liabilities | |

| 1,482 | | |

| 1,512 | |

| | |

| | | |

| | |

| Non-current Liabilities | |

| | | |

| | |

| Loans from stockholders | |

| 195 | | |

| 196 | |

| Operating lease liability, non-current (Note 3C) | |

| 53 | | |

| - | |

| Total liabilities | |

| 1,730 | | |

| 1,708 | |

| | |

| | | |

| | |

| Commitments and contingent liabilities (Note 4) | |

| - | | |

| - | |

| | |

| | | |

| | |

| Stockholders’ Equity | |

| | | |

| | |

| Common Stock of $ 0.001 par value (“Common Stock”): | |

| | | |

| | |

| 500,000,000 shares authorized as of March 31, 2024 and December 31, 2023; 26,756,369 and 20,892,193 shares issued and outstanding as of March 31, 2024 and December 31, 2023, respectively | |

| 27 | | |

| 20 | |

| Common Stock of $ 0.001

par value (“Common Stock”): 500,000,000 shares authorized as of March 31, 2024 and December 31, 2023; 26,756,369 and

20,892,193 shares issued and outstanding as of March 31, 2024 and December 31, 2023, respectively | |

| 27 | | |

| 20 | |

| Additional paid-in capital | |

| 113,029 | | |

| 112,966 | |

| Receipts on account of shares | |

| 78 | | |

| 48 | |

| Accumulated other comprehensive income | |

| 22 | | |

| 16 | |

| Accumulated deficit | |

| (112,780 | ) | |

| (109,853 | ) |

| Total stockholders’ equity | |

| 376 | | |

| 3,197 | |

| | |

| | | |

| | |

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY | |

| 2,106 | | |

| 4,905 | |

The accompanying notes are an integral part of these condensed interim

consolidated financial statements.

GLUCOTRACK

INC.

CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

(in

thousands of US dollars except share data) (unaudited)

| | |

2024 | | |

2023 | |

| | |

Three-month

period ended

March 31, | |

| | |

2024 | | |

2023 | |

| | |

| | |

| |

| Research and development | |

$ | 2,148 | | |

$ | 642 | |

| General and administrative | |

| 733 | | |

| 642 | |

| Selling and marketing expenses | |

| 70 | | |

| - | |

| Total operating expenses | |

| 2,951 | | |

| 1,284 | |

| | |

| | | |

| | |

| Operating loss | |

| 2,951 | | |

| 1,284 | |

| | |

| | | |

| | |

| Finance expenses (income), net | |

| (24 | ) | |

| 2 | |

| | |

| | | |

| | |

| Net Loss | |

| 2,927 | | |

| 1,286 | |

| Other comprehensive income: | |

| | | |

| | |

| Foreign currency translation adjustment | |

| (6 | ) | |

| (5 | ) |

| | |

| | | |

| | |

| Comprehensive loss for the period | |

$ | 2,921 | | |

$ | 1,281 | |

| | |

| | | |

| | |

| Basic and diluted net loss per common stock | |

$ | (0.12 | ) | |

$ | (0.08 | ) |

| | |

| | | |

| | |

| Weighted average number of common stock used in computing basic and diluted loss per common stock | |

| 24,959,768 | | |

| 15,503,632 | |

The accompanying notes are an integral part of these condensed interim

consolidated financial statements.

GLUCOTRACK

INC.

CONDENSED

CONSOLIDATED STATEMENT OF CHANGES IN STOCKHOLDERS’ EQUITY

(in

thousands of US Dollars except share data) (unaudited)

| | |

Numbers of

Shares | | |

Amount | | |

Paid-in

Capital | | |

account of

shares | | |

Comprehensive

Income | | |

Accumulated

Deficit | | |

Stockholders’

Equity | |

| | |

In thousands of US Dollars (except share data) | |

| | |

Common Stock | | |

Additional | | |

Receipts

on | | |

Accumulated

Other | | |

| | |

Total | |

| | |

Numbers of

Shares | | |

Amount | | |

Paid-in

Capital | | |

account of

shares | | |

Comprehensive

Income | | |

Accumulated

Deficit | | |

Stockholders’

Equity | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Balance as of January 1, 2023 | |

| 15,500,730 | | |

| 15 | | |

| 103,095 | | |

| 4 | | |

| 17 | | |

| (101,901 | ) | |

| 1,230 | |

| Loss for the period | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (1,286 | ) | |

| (1,286 | ) |

| Other comprehensive income | |

| - | | |

| - | | |

| - | | |

| - | | |

| 5 | | |

| - | | |

| 5 | |

| Stock-based compensation | |

| - | | |

| - | | |

| 57 | | |

| - | | |

| - | | |

| - | | |

| 57 | |

| Issuance of restricted shares as compensation towards directors | |

| 2,902 | | |

| (*) - | | |

| 4 | | |

| (4 | ) | |

| - | | |

| - | | |

| - | |

| Restricted shares to be issued as compensation towards directors | |

| - | | |

| - | | |

| - | | |

| 5 | | |

| - | | |

| - | | |

| 5 | |

| Balance as of March 31, 2023 | |

| 15,503,632 | | |

| 15 | | |

| 103,156 | | |

| 5 | | |

| 22 | | |

| (103,187 | ) | |

| 11 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance as of January 1, 2024 | |

| 20,892,193 | | |

| 20 | | |

| 112,966 | | |

| 48 | | |

| 16 | | |

| (109,853 | ) | |

| 3,197 | |

| Balance | |

| 20,892,193 | | |

| 20 | | |

| 112,966 | | |

| 48 | | |

| 16 | | |

| (109,853 | ) | |

| 3,197 | |

| Loss for the period | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (2,927 | ) | |

| (2,927 | ) |

| Other comprehensive income | |

| - | | |

| - | | |

| - | | |

| - | | |

| 6 | | |

| - | | |

| 6 | |

| Stock-based compensation | |

| - | | |

| - | | |

| 22 | | |

| - | | |

| - | | |

| - | | |

| 22 | |

| Issuance of restricted shares as compensation towards directors | |

| 194,503 | | |

| - | | |

| 48 | | |

| (48 | ) | |

| - | | |

| - | | |

| - | |

| Issuance of restricted shares as payment for achievement of milestone pursuant to purchase agreement (Note 4B) | |

| 100,000 | | |

| 1 | | |

| (1 | ) | |

| - | | |

| - | | |

| - | | |

| - | |

| Restricted shares to be issued as compensation towards directors | |

| - | | |

| - | | |

| - | | |

| 78 | | |

| - | | |

| - | | |

| 78 | |

| Exercise of prefunded warrants into shares (Note 3A) | |

| 1,976,470 | | |

| 2 | | |

| (2 | ) | |

| - | | |

| - | | |

| - | | |

| - | |

| Exchange of warrants into shares (Note 3B) | |

| 3,593,203 | | |

| 4 | | |

| (4 | ) | |

| - | | |

| - | | |

| - | | |

| - | |

| Balance as of March 31, 2024 | |

| 26,756,369 | | |

| 27 | | |

| 113,029 | | |

| 78 | | |

| 22 | | |

| (112,780 | ) | |

| 376 | |

| Balance | |

| 26,756,369 | | |

| 27 | | |

| 113,029 | | |

| 78 | | |

| 22 | | |

| (112,780 | ) | |

| 376 | |

The accompanying notes are an integral part of these condensed interim

consolidated financial statements.

GLUCOTRACK

INC.

CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS

(in

thousands of US Dollars)

| | |

2024 | | |

2023 | |

| | |

Three-month period ended

March 31, | |

| | |

2024 | | |

2023 | |

| | |

(Unaudited) | |

| CASH FLOWS FROM OPERATING ACTIVITIES | |

| | | |

| | |

| Loss for the period | |

$ | (2,927 | ) | |

$ | (1,286 | ) |

| Adjustments to reconcile net loss to net cash used in operating activities: | |

| | | |

| | |

| Depreciation and amortization | |

| 4 | | |

| 4 | |

| Stock-based compensation | |

| 22 | | |

| 57 | |

| Issuance of restricted shares as compensation towards directors | |

| 78 | | |

| 5 | |

| Linkage difference on principal of loans from stockholders | |

| (1 | ) | |

| 2 | |

| Changes in assets and liabilities: | |

| | | |

| | |

| Increase in other current assets | |

| (64 | ) | |

| (137 | ) |

| Increase (decrease) in accounts payable | |

| 175 | | |

| (13 | ) |

| Increase (Decrease) in other current liabilities | |

| (229 | ) | |

| 55 | |

| Net cash used in operating activities | |

| (2,942 | ) | |

| (1,313 | ) |

| | |

| | | |

| | |

| CASH FLOWS FROM INVESTING ACTIVITIES: | |

| | | |

| | |

| Purchase of property and equipment | |

| (59 | ) | |

| - | |

| Net cash used in investing activities | |

| (59 | ) | |

| - | |

| | |

| | | |

| | |

| Effect of exchange rate changes on cash and cash equivalents, and restricted

cash | |

| 6 | | |

| (5 | ) |

| | |

| | | |

| | |

| Change in cash and cash equivalents, and restricted cash | |

| (2,995 | ) | |

| (1,318 | ) |

| | |

| | | |

| | |

| Cash and cash equivalents, and restricted cash at beginning of the period | |

| 4,502 | | |

| 2,331 | |

| | |

| | | |

| | |

| Cash and cash equivalents, and restricted cash, end of period | |

$ | 1,507 | | |

$ | 1,013 | |

| | |

Three-month period ended March 31, | |

| | |

2024 | | |

2023 | |

| | |

(Unaudited) | |

| Supplemental disclosure of cash flow activities: | |

| | | |

| | |

| | |

| | | |

| | |

| (a) Net cash paid during the year for: | |

| | | |

| | |

| | |

| | | |

| | |

| Interest | |

$ | 28 | | |

$ | - | |

| | |

| | | |

| | |

| (b) Non-cash activities: | |

| | | |

| | |

| | |

| | | |

| | |

| Recognition of right for usage asset against a lease liability | |

$ | 79 | | |

$ | - | |

The accompanying notes are an integral part of these condensed interim

consolidated financial statements.

GLUCOTRACK

INC.

NOTES

TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

(in thousands

of US Dollars)

NOTE

1 – GENERAL

| A. |

Glucotrack

Inc. (the “Company”) was incorporated on May 18, 2010 under the laws of the State of Delaware. The Company is a medical

device company, focused on the design, development and commercialization of novel technologies for use by people with diabetes. The

Company is currently developing an Implantable Continuous Blood Glucose Monitor (“CBGM”) for persons with Type 1 diabetes and

insulin-dependent Type 2 diabetes (the “Glucotrack CBGM Product”). |

| |

|

| B. |

Liquidity

and capital resources |

| |

|

| |

To

date, the Company has not yet commercialized the Glucotrack CBGM Product. Further development and commercialization efforts are

expected to require substantial additional expenditures. Therefore, the Company is dependent upon external sources for financing its

operations. As of March 31, 2024, the Company has incurred accumulated deficit of $112,780.

Furthermore, the Company has generated operating losses and negative operating cash flow for all reported periods. As of March 31,

2024, the balance of cash and cash equivalents which amounted to $1,497,000

is insufficient for the Company to realize its business plans for the twelve-month period subsequent to the reporting

period. |

| |

|

| |

Management

has considered the significance of such conditions in relation to the Company’s ability to meet its current obligations and to

achieve its business targets and has determined that these conditions raise substantial doubt about the Company’s ability to

continue as a going concern. |

| |

During

the year ended December 31, 2023, the Company raised net proceeds of $8,730

through completion of an underwritten public offering. In addition, during the year ended December 31, 2023, the Company entered

into exchange agreement with certain shareholders under which warrants with down round protection feature have been exchanged into

shares of common stock in order to improve its equity structure to enable the completion of a planned equity financing (see also

Note 3A). Moreover, in April 2024, the Company raised net proceeds of $500,000

through completion of private placement transaction (see also Note 5A).

The

Company plans to finance its operations through the sale of equity and/or debt securities (including shelf registration statement

on Form S-3 that was declared effective on September 27, 2021 by the Securities and Exchange Commission (“SEC”) and which allows the

Company to register up to $90,000 of certain equity and/or debt securities of the Company through prospectus supplement). There can

be no assurance that the Company will succeed in obtaining the necessary financing or generating sufficient revenues from sales of

its Glucotrack CBGM Product, if any, in order to continue its operations as a going concern.

The

condensed interim consolidated financial statements do not include any adjustments that might result from the outcome of this uncertainty. |

NOTE

2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

A. Basis of Presentation

| |

The

accompanying unaudited condensed interim consolidated financial statements and related notes should be read in conjunction with the

Company’s consolidated financial statements and related notes included in the Company’s Annual Report on Form 10-K for

the fiscal year ended December 31, 2023, as was filed with the SEC on March 28, 2024. The unaudited condensed interim consolidated

financial statements have been prepared in accordance with the rules and regulations of the SEC related to interim financial

statements. As permitted under those rules, certain information and footnote disclosures normally required or included in financial

statements prepared in accordance with U.S. GAAP have been condensed or omitted. The financial information contained herein is

unaudited; however, management believes all adjustments have been made that are considered necessary to present fairly the results

of the Company’s financial position and operating results for the interim periods. All such adjustments are of a normal

recurring nature. |

| |

|

| |

The

results for the period of three months ended March 31, 2024 are not necessarily indicative of the results to be expected for the

year ending December 31, 2024 or for any other interim period or for any future period. |

GLUCOTRACK INC.

NOTES

TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

(in thousands of US Dollars)

NOTE

2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONT.)

B. Use of Estimates in the Preparation of Financial Statements

| |

The

preparation of the condensed interim consolidated financial statements in conformity with US GAAP requires management to make estimates

and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities

at the dates of the financial statements, and the reported amounts of expenses during the reported periods. Actual results could

differ from those estimates. Management believes that there are no critical accounting estimates in these financial statements. |

C. Principles of Consolidation

| |

The

condensed interim consolidated financial statements include the accounts of the Company and its subsidiary. Significant intercompany

balances and transactions have been eliminated in consolidation. |

D. Cash and Cash Equivalents

| |

Cash

equivalents are short-term highly liquid investments which include short term bank deposits (up to three months from the date of

deposit), that are not restricted as to withdrawals or use that are readily convertible to cash with maturities of three months or

less as of the date acquired. |

E. Leases

| |

The

Company applies ASC Topic 842, “Leases” (“ASC 842”) under which the

Company determines if an arrangement is a lease at inception. The Company’s assessment

is based on: (i) whether the contract involves the use of an identified asset, (ii) whether

the Company obtains the right to substantially all of the economic benefits from the use

of the asset throughout the period of use, and (iii) whether the Company has the right to

direct the use of the asset.

Leases

are classified as either finance leases or operating leases. A lease is classified as a finance lease if any one of the following

criteria are met: (i) the lease transfers ownership of the asset by the end of the lease term, (ii) the lease contains an option

to purchase the asset that is reasonably certain to be exercised, (iii) the lease term is for a major part of the remaining useful

life of the asset, (iv) the present value of the lease payments equals or exceeds substantially all of the fair value of the asset,

or (v) the underlying asset is of such a specialized nature that it is expected to have no alternative use to the lessor at the end

of lease term. A lease is classified as an operating lease if it does not meet any one of these criteria. Since all the Company’s

lease contracts for premises do not meet any of the criteria above, the Company concluded that all its lease contracts should be

classified as operating leases.

Right

of Usage (“ROU”) assets and liabilities are recognized on the commencement date based on the present value of remaining

lease payments over the lease term. For this purpose, the Company considers only payments that are fixed and determinable at the

time of commencement. As the Company’s leases do not provide an implicit rate, the Company uses its Incremental Borrowing

Rate (“IBR”) based on the information available on the commencement date in determining the present value of lease payments.

The Company’s IBR is estimated to approximate the interest rate for collateralized borrowing with similar terms and payments

and in economic environments where the leased asset is located. The ROU asset also includes any lease payments made prior to commencement

and is recorded net of any lease incentives received. Moreover, the ROU asset may also include initial direct costs, which are incremental

costs of a lease that would not have been incurred if the lease had not been obtained. The Company uses the long-lived assets impairment

guidance in ASC 360-10, “Property, Plant, and Equipment - Overall”, to determine whether a ROU asset is impaired, and

if so, the amount of the impairment loss to recognize. Certain leases include options to extend or terminate the lease. An option

to extend the lease is considered in connection with determining the ROU asset and lease liability when it is reasonably certain

that the Company will exercise that option. An option to terminate is considered unless it is reasonably certain that the Company

will not exercise the option. |

GLUCOTRACK INC.

NOTES

TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

(in thousands of US Dollars)

NOTE

2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONT.)

F. Modification of equity-classified contracts

| |

The

modification or exchange of equity-classified contracts, such as warrants that were classified as equity before the modification or

exchange and remained eligible for equity classification after the modification, is accounted for in a similar manner to a

modification of stock-based compensation. Accordingly, the incremental fair value from the modification or exchange (the change in

the fair value of the instrument before and after the modification or exchange), if any, is recognized as a reduction of retained

earnings of increase of accumulated deficit as a deemed dividend. Modifications or exchanges that result in a decrease in the fair

value of an equity-classified instrument are not reflected in accumulated deficit. In

addition, the amount of the deemed dividend is also recognized as an adjustment to earnings available to common shareholders for

purposes of calculating earnings per share. |

G. Basic and diluted loss per share

| |

Basic

loss per share is computed by dividing the loss for the period applicable for Common Stockholders by the weighted average number of shares of Common Stock outstanding.

In

computing, diluted loss per share, basic earnings per share are adjusted to reflect the potential dilution that could occur upon

the exercise of options or warrants issued or granted using the “treasury stock method,” if the effect of each of such

financial instruments is dilutive.

In

computing diluted loss per share, the average stock price for the period is used in determining the number of Common Stock assumed

to be purchased from the proceeds to be received from the exercise of stock options or stock warrants.

Shares

that will be issued upon the exercise of all stock options and stock warrants (other than pre-funded warrants), have been excluded

from the calculation of the diluted net loss per share for all the reported periods for which net loss was reported because the

effect of the common shares issuable as result of the exercise or conversion of these instruments was anti-dilutive. |

GLUCOTRACK INC.

NOTES

TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)(CONT.)

(in thousands of US Dollars)

NOTE

3 - SIGNIFICANT TRANSACTIONS

| A. |

Exercise of pre-funded warrants |

| |

|

| |

On January 3, 2024, a number of 1,976,470 pre-funded warrants granted through underwritten public offering in April

2023 have been fully exercised into the same number of shares of Common Stock of the Company. |

| |

|

| B. |

Exchange

Agreement |

| |

|

| |

On

February 13, 2024, the Company entered into an Exchange Agreement with certain warrantholders (the “Holders”), pursuant

to which the Company and the Holders agreed to exchange (the “Exchange”) warrants with down round protection feature

exercisable to common shares (the “Warrants”) owned by the Holders for shares of Common Stock to be issued

by the Company. |

| |

|

| |

On

February 13, 2024, the Company closed the Exchange and issued to the Holders on February 15, 2024 an aggregate of 3,593,203 shares

of Common Stock in exchange for 4,381,953 Warrants (the “Shares”). |

| |

|

| |

It

was also agreed that the Holders will not, during the period (“Lock-Up Period”)

(i) offer, pledge, announce the intention to sell, sell, contract to sell, sell any option

or contract to purchase, purchase any option or contract to sell, grant any option, right

or warrant to purchase, or otherwise transfer or dispose of, directly or indirectly, any

Shares, (ii) enter into any swap or other agreement that transfers, in whole or in part,

any of the economic consequences of ownership of the Shares of, whether any such transaction

described in clause (i) or (ii) above is to be settled by delivery of Shares or such other

securities, in cash or otherwise, (iii) make any demand for or exercise any right with respect

to, the registration of any Shares or any security convertible into or exercisable or exchangeable

for shares of common stock, or (iv) publicly announce an intention to effect any transaction

specific in clause (i), (ii) or (iii) above, provided however that the Holder, during the

Lock-Up Period, may (a) sell or contract to sell Shares at a price higher than $0.50 per

Share on any trading day up to 10% of the daily volume of Shares or (b) sell or contract

to sell Shares at a price higher than $0.80 per Share on any trading day with no limitation

on volume.

The

Lock-Up Period shall expire at the earliest of (i) 365 days after the date hereof or (ii) until the Shares traded above $1.00 per

Share for five consecutive trading days.

The

Company accounted for the Exchange of the aforesaid warrants as deemed dividend which was calculated at the closing date by the

management using the assistance of external appraiser as the excess of fair value of the share to be issued after taking into consideration a discount for lack of marketability at a rate of 16.81% over the Lock-Up Period

over the fair value of the original equity instrument (i.e. warrants which included down round protection feature). However, since the fair

value of the new equity instrument was estimated as lesser than the fair value of the replaced equity instrument, deemed dividend was not recorded. |

| |

On

February 19, 2024, the Company entered into Lease Agreement (the “Agreement”) with Tapsak Enterprises LLC dba Virginia

Analytical (the “Landlord”) under which it was agreed that the Company will lease from the Landlord a premises located

in Front Royal, Virginia area for a monthly rental fee of $2.5

over a period of 3-years

commencing March 1, 2024 through February 28, 2027 (the “Initial Lease Period”). A security deposit of $2.5

which represents a one month payment is held by the Landlord and will be returned to the Company at the end of the

Initial Lease Period. |

| |

|

| |

In

addition, the Company has an option to renew the Initial Lease Period for another two additional periods of 3-years each following

the Initial Lease Period (the “Option Term”), following advanced notice as defined in the Agreement. The monthly rental

fee over the Option Term shall be the fair market rate which is determined as the comparable cost for similar property in

the Front Royal, Virginia area. |

| |

|

| |

In

accordance with the provision of ASC 842, Leases, at the commencement date of the Agreement,

the Company recognized the right to usage asset equals to lease liability in total amount

of $79. The lease liability was measured at the present value of the future lease payments,

which are discounted based on an estimate of the estimated interest rate that the Company

would be required to pay in order to borrow a similar amount for a similar period in order

to obtain a similar amount on the date of first recognition of the lease (using a discount

rate of 9.03%).

As

part of the lease term, the Company considered only the Initial Lease Period, as the exercise of the option to extend the period

was not considered as reasonably certain. |

Right

of usage asset:

SCHEDULE

OF RIGHT OF USAGE ASSET

| | |

Premises | |

| Cost | |

| | |

| Balance as of January 1, 2024 | |

| - | |

| Additions | |

| 79 | |

| Balance as of March 31, 2024 | |

| 79 | |

| Accumulated amortization | |

| | |

| Balance as of January 1, 2024 | |

| - | |

| Additions | |

| 2 | |

| Balance as of March 31, 2024 | |

| 2 | |

| | |

| | |

| Amortized cost as of March 31, 2024 | |

| 77 | |

Lease

liability:

SCHEDULE

OF LEASE LIABILITY

| | |

Premises | |

| | |

| |

| Balance as of January 1, 2024 | |

| - | |

| Additions | |

| 79 | |

| Interest expenses | |

| 1 | |

| Lease payments | |

| (3 | ) |

| | |

| | |

| Balance as of March 31, 2024 | |

| 77 | |

Amounts

recognized in statements of cash flow:

SCHEDULE

OF AMOUNT RECOGNIZED OF OPERATING LEASE

| | |

Three months period ended

March 31, 2024 | |

| | |

| |

| Amortization of the right for usage asset | |

| 2 | |

| Interest expense in respect of lease liability | |

| 1 | |

| Repayment of principal in respect of lease liability | |

| 3 | |

Total

negative cash flows in respect of leasing for the period of three months ended March 31, 2024 are approximately $3.

Analysis

of contractual payment dates of lease liability as of March 31, 2024:

SCHEDULE

OF CONTRACTUAL PAYMENT LEASE LIABILITY

| | |

| | |

| Up to a year | |

$ | 30 | |

| Between 1-2 years | |

| 30 | |

| More than 2 years | |

| 28 | |

| Total (undiscounted) | |

$ | 88 | |

GLUCOTRACK INC.

NOTES

TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)(CONT.)

(in thousands of US Dollars)

NOTE

4 – COMMITMENTS AND CONTINGENT LIABILITIES

| |

A. |

On

March 4, 2004, the IIA provided Integrity Israel with a grant of approximately $93

(NIS 420,000),

for its plan to develop a non-invasive blood glucose monitor (the “Development Plan”). Integrity Israel is required to pay

royalties to the IIA at a rate ranging between 3-5%

of the proceeds from the sale of the Company’s products arising from the Development Plan up to an amount equal to $93

plus interest at LIBOR from the date of grant.

As to the replacement of the LIBOR benchmark rate, even though the IIA has not declared the alternative benchmark rate to replace the

LIBOR, the Company does not believe it will have a significant impact. As of March 31, 2024, the remaining contingent liability with

respect to royalty payment on future sales equals approximately $73

excluding interest. Such contingent obligation

has no expiration date. |

| |

|

|

| |

B. |

On

October 7, 2022 (“the Closing Date”), the Company entered into an Intellectual Property Purchase Agreement (the

“Agreement”) with Paul Goode, the Company’s Chief Executive Officer (the “Seller”), under which the

parties agreed that on and subject to the terms and conditions of the Agreement, at the Closing Date, the Seller shall sell, assign,

transfer, convey and deliver to the Company, all of the Seller’s right, title and interest in and to the following assets,

properties and rights (collectively, the “Purchased Assets”): |

| |

(a) |

All

rights, title, interests in all current and future intellectual property, including, but not limited to patents, trademarks, trade

secrets, industry know-how and other IP rights relating to an implantable continuous glucose sensor (collectively, the “Conveyed

Intellectual Property”); and |

| |

|

|

| |

(b) |

All

the goodwill relating to the Purchased Assets. |

| |

In

consideration for the sale by the Seller of the Purchased Assets to the Company, at the Closing Date, the Company paid to Seller

cash in the amount of one dollar and obligated the Company to issue up to 1,000,000

shares of its Common Stock to be issued based upon specified performance milestones as set forth in the Agreement (the

“Purchase Price”). In addition, if upon the final issuance, the aggregate 1,000,000

shares represent less than 1.5%

of the then outstanding Common Stock of the Company, the final issuance will include such number of additional shares so that the

total aggregate issuance equals 1.5%

of the outstanding shares (the “True-Up Shares”). All shares of Common Stock of the Company that will be issued under

this agreement shall be (i) restricted over a limited period of 1-year and issued in transactions exempt from registration under

Section 4(a)(2) of the Securities Act of 1933, as amended and (ii) subject to the lockup provisions.

When

the Company acquires net assets that do not constitute a business, as defined under ASU 2017-01 Business Combinations (Topic 805)

Clarifying the Definition of a Business (such as when there is no substantive process in the acquired entity) the transaction is

accounted for as an asset acquisition and no goodwill is recognized. The acquired In-Process Research and Development intangible

asset (“IPR&D”) to be used in research and development projects which have been determined not to have alternative

future use, is expensed immediately.

At

the Closing Date, it was determined that the asset acquisition represents the purchase of IPR&D with no alternative future use.

However, the achievement of each of the performance milestones is considered as a contingent event outside the Company’s

control and thus the contingent consideration which is equal to the fair value of the Purchase Price as measured at the Closing Date

will be recognized when it becomes probable that each target will be achieved within the reasonable period of time. Such additional

contingent consideration will be recognized in subsequent periods if and when the contingency (the achievement of targets) is

resolved, or when it will be considered as reasonably estimable under ASC 450, Contingencies.

During

June 2023, the Company achieved the first performance milestone out of the five performance milestones outlined in the Agreement

executed between the Company and the Seller as of the Closing Date. As a result, upon the date of the fulfilment of the first

performance milestone the Company was committed to issue 100,000

restricted shares to the Seller. Accordingly,

in 2023, the Company recorded an amount of $131

as research and development expenses with

a similar amount as an increase to additional paid-in capital. The shares were issued on February 6, 2024. As of March 31, 2024,

the achievement of all other remaining performance milestones was not considered probable and thus nothing was accrued with respect

to thereof. |

NOTE

5 - SUBSEQUENT EVENTS

The

Company evaluated subsequent events and transactions that occurred after the balance sheet date up to the date that the condensed interim

consolidated financial statements were issued May 15, 2024. Based upon this review, the Company did not identify any subsequent events

that would have required adjustment or disclosure in the financial statements, except as follows:

| A. |

Private Placement Agreement |

On

April 22, 2024, the Company entered into private placement agreement under which the Company issued 396,825

shares of its common stock at a price of $1.26

per share for aggregate gross proceeds of $500,000

(the “Offering”). The Offering included the participation of certain members of the Company’s executive

management, Board of Directors and existing shareholders.

There

were no warrants issued and no commissions or brokerage fees paid in connection with the Offering.

At

the Company’s annual meeting of stockholders held on April 26, 2024, the stockholders of the Company approved a proposal to authorize

the Company’s Board of Directors (the “Board”) to file a Certificate of Amendment to the Company’s Certificate

of Incorporation, as amended, to effect a reverse stock split of the Company’s common stock, par value $0.001 per share at a ratio

between 1-for-5 and 1-for-30, to be effected at such time and date, if at all, as determined by the Board in its sole discretion (the

“Reverse Stock Split”). On April 30, 2024, the Board approved the Reverse Stock Split.

As

of the date of the filing of this Quarterly Report on 10-Q, the Company has not filed the Certificate of Amendment to implement the Reverse

Stock Split, and the Reverse Stock Split is not effective as of the time of filing.

Item

2. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Cautionary

Note Regarding Forward-Looking Statements

This

Quarterly Report on Form 10-Q contains forward-looking statements. These forward-looking statements include statements about our expectations,

beliefs or intentions regarding our product development efforts, business, financial condition, results of operations, strategies and

prospects. All statements other than statements of historical fact included in this Quarterly Report on Form 10-Q, including statements

regarding our future activities, events or developments, including such things as future revenues, capital raising and financing, product

development, clinical trials, regulatory approval, market acceptance, responses from competitors, capital expenditures (including the

amount and nature thereof), business strategy and measures to implement strategy, competitive strengths, goals, expansion and growth

of our business and operations, plans, references to future success, projected performance and trends, and other such matters, are forward-looking

statements. The words “believe,” “expect,” “anticipate,” “intend,” “estimate,”

“plan,” “may,” “will,” “could,” “would,” “should” and other similar

words and phrases, are intended to identify forward-looking statements. The forward-looking statements made in this Quarterly Report

on Form 10-Q are based on certain historical trends, current conditions and expected future developments as well as other factors we

believe are appropriate in the circumstances. These statements relate only to events as of the date on which the statements are made

and we undertake no obligation to update publicly any forward-looking statements, whether as a result of new information, future events

or otherwise, except as required by law. All of the forward-looking statements made in this Quarterly Report on Form 10-Q are qualified

by these cautionary statements and there can be no assurance that the actual results anticipated by us will be realized or, even if substantially

realized, that they will have the expected consequences to or effects on us or our business or operations. Whether actual results will

conform to our expectations and predictions is subject to a number of risks and uncertainties that may cause actual results to differ

materially. Risks and uncertainties, the occurrence of which could adversely affect our business, include the risks identified under

the caption “Risk Factors” included in our Annual Report on Form 10-K for the year ended December 31, 2023. The following

discussion should be read in conjunction with the condensed consolidated financial statements and the notes thereto included in Item

1 of this Quarterly Report on Form 10-Q.

Overview

We

are a medical device company focused on the design, development and commercialization of novel technologies for use by people with diabetes.

We are currently developing an implantable (“CBGM”) for those with Type 1 diabetes and insulin-dependent Type 2 diabetes.

The

Company was founded with a mission to develop GlucoTrack®, a non-invasive glucose monitoring device designed to help people

with diabetes and pre-diabetics obtain glucose level readings without the pain, inconvenience, cost and difficulty of conventional (invasive)

spot finger stick devices. The first generation of GlucoTrack, which successfully received CE Mark approval, obtained glucose measurements

via a small sensor clipped onto one’s earlobe. A limited release beta test in Europe and the Middle East demonstrated the need

for an updated product with improved accuracy and human factors. As the glucose monitoring landscape rapidly moved away from point-in-time

measurement to continuous measurement since then, the Company recently determined that it would focus its efforts on developing its Implantable

CBGM. As such, we have since withdrawn our CE Mark for GlucoTrack and are no longer pursuing commercialization of this product or development

of any further iterations.

The

Company is currently developing an implantable CBGM for use by Type 1 diabetes patients as well as insulin-dependent Type 2

patients. Implant longevity is key to the success of such a device. We have recently completed a feasibility study successfully

demonstrating that a minimum two-year implant life is highly probable with the current sensor design. We have also initiated an

animal study with an initial prototype system that has thus far demonstrated a simple implant procedure and good functionality. The

Company will initiate a long-term animal trial in late Q4 2024 as well as initiate development of its commercial device, also in

late Q4, in preparation of regulatory submission in late 2024 for a first in human study. We believe our technology, if successful,

has the potential to be more accurate, more convenient and have a longer duration than other implantable glucose monitors that are

either in the market or currently under development.

We

are currently developing our own mobile companion application and a cloud-based solution platform to provide real time, data driven

personalized tools to effectively help users manage their diabetes. In addition to being a critical and effective management tool for

the end user, we believe that third parties such as insurers, pharmaceutical companies and advertisers would be willing to pay for

the de-identified data that we will obtain through our platform, and that this is an opportunity for us to develop an additional

revenue source.

Our

Senior Management team includes; CEO and President, Paul V. Goode PhD, who has a decorated career developing innovative medical technologies,

including at Dexcom and MiniMed, CFO, James Cardwell, CPA who has over 16 years of experience as a Chief Financial Officer and Chief

Operating Officer with a concentration in both SEC financial reporting and tax compliance, James P. Thrower PhD, Vice President of Engineering,

a seasoned executive formerly of Sterling Medical Devices, Mindray DS USA and Dexcom, Inc., Mark Tapsak PhD, Vice President of Sensor

Technology, a medical research scientist who brings over 25 years of experience in the diabetes industry, including previous senior roles

at Dexcom and Medtronic, and Drinda Benjamin, Vice President of Marketing, a medical device professional with over 20 years of experience

in the medical device and diabetes industry with senior roles at Intuity Medical, Senseionics, Abbott Diabetes, and Medtronic Diabetes. Several highly talented and accomplished

executives joined the Company as senior advisors to the Board. These include Daniel McCaffrey MBA MA, a world-renowned behavioral scientist

and digital health expert formerly at Samsung Health and Dexcom, Inc., Dr. Alexander Raykhman PhD, a measurement and artificial intelligence

expert and Dr. David C. Klonoff, world renowned endocrinologist and diabetes technology thought leader. We intend to continue to invest

in our talent and to expand and strengthen all areas within the Company.

Recent

Events

As

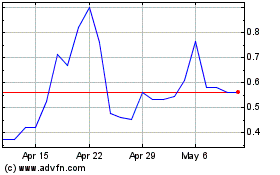

previously reported, on May 26, 2023, the Company received a staff deficiency notice from The Nasdaq Stock Market (“Nasdaq”)

indicating that the Company no longer complied with the $1.00 minimum bid price requirement for continued listing on the Nasdaq Capital

Market under Rule 5550(a)(2) of the Nasdaq Listing Rules (the “Bid Price Rule”). Pursuant to Nasdaq Marketplace Rule 5810(c)(3)(A),

the Company was provided with a compliance period of 180 calendar days, or until November 22, 2023, to regain compliance with the Bid

Price Rule.

On

November 24, 2023, the Company received a notice from Nasdaq stating that it has been granted an additional 180

calendar days, or until May 20, 2024, to regain compliance with the Bid Price Rule (the “Extended Compliance Period”). If at any time during the Extended Compliance

Period, the closing bid price of our Common Stock is at least $1.00 per share for a minimum of 10 consecutive business days, the Nasdaq will provide written confirmation that we have regained compliance with the Bid Price Rule. If we cannot demonstrate

compliance during the Extended Compliance Period, then Nasdaq will provide notice that our Common Stock will be subject

to delisting. At that time, the Company may appeal the Staff’s determination to a

hearings panel.

At

the Company’s annual meeting of stockholders held on April 26, 2024, the stockholders of the Company approved a proposal to authorize

the Company’s Board of Directors (the “Board”) to file a Certificate of Amendment to the Company’s Certificate

of Incorporation, as amended, to effect a reverse stock split of the Company’s common stock, par value $0.001 per share at a ratio

between 1-for-5 and 1-for-30, to be effected at such time and date, if at all, as determined by the Board in its sole discretion (the

“Reverse Stock Split”). On April 30, 2024, the Board approved the Reverse Stock Split. Among other considerations, the Company

plans to implement the Reverse Stock Split to satisfy the Bid Price Rule for continued listing on Nasdaq. There can be no assurance that

we will be able to regain and sustain compliance with all applicable requirements for continued listing on Nasdaq. In the event that

we are unable to regain and sustain compliance with all applicable requirements for continued listing on the Nasdaq, our common stock

may be delisted from Nasdaq.

On

February 13, 2024, the Company entered into an exchange agreement with certain shareholders (the “Holders”), pursuant to

which the Company and the Holders agreed to exchange 4,381,953 of common stock purchase warrants owned by the Holders for 3,593,203 shares

of the Company’s common stock, par value $0.001 per share.

The

summary of our significant accounting policies is included under Item 7 – Management’s Discussion and Analysis of Financial

Condition and Results of Operations of our fiscal 2023 Form 10-K. An accounting policy is deemed to be critical if it requires an accounting

estimate to be made based on assumptions about matters that are highly uncertain at the time the estimate is made, if different estimates

reasonably could have been used, or if changes in the estimate that are reasonably possible could materially impact the financial statements.

There have been no material changes to the critical accounting policies and estimates as filed in such report.

Results

of Operations

The

following discussion of our operating results explains material changes in our results of operations for the three-months ended March

31, 2024 compared with the same periods ended March 31, 2023. The discussion should be read in conjunction with the financial statements

and related notes included elsewhere in this report.

Consolidated

Results of Operations for the Three Months ended March 31, 2024 and 2023

Research

and development expenses

Research

and development expenses were approximately $2.1 million for the three-month period ended March 31, 2024, as compared to approximately

$642,000 for the prior-year period. The increase is attributable to consulting fees we accrued during the period.

Research

and development expenses consist primarily of salaries and other personnel-related expenses, materials, animal trials and other expenses.

We expect research and development expenses to increase in 2024 and beyond, primarily due to hiring additional personnel, as well the

development of Glucotrack CBGM; however, we may adjust or allocate the level of our research and development expenses based on available

financial resources and based on our commercial needs, including the FDA registration process, specific requirements from customers,

development of new Glucotrack CBGM models and others.

Marketing expenses

Marketing expenses were approximately $70,000

for the three-month period ended March 31, 2024, as compared to $0 for the prior-year period. This increase is primarily attributable

to business development personnel and professional marketing services.

General

and administrative expenses

General

and administrative expenses were approximately $733,000 for the three-month period ended March 31, 2024, as compared to approximately

$642,000 for the prior-year period. The increase is attributable to professional fees we accrued during the period.

General

and administrative expenses consist primarily of professional services, salaries, consulting fees, insurance, travel expenses and other

related expenses for executive, finance and administrative personnel, including stock-based compensation expenses. Other general and

administrative costs and expenses include facility-related costs not otherwise included in research and development costs and expenses,

and professional fees for legal and accounting services.

Financing

income (expenses), net

Financing

income, net was approximately $24,000 for the three-month period ended March 31, 2024, as compared to financing expense of approximately

$2,000 for the prior-year period. The increase is attributable to interest income received during the period.

Net

Loss

Net

loss was approximately $2.93 million for the three-month period ended March 31, 2024, as compared to approximately $1.31 million for

the prior-year period. The increase in net loss is attributable primarily to the increase in our research and development operating

expenses, as described above.

Cash

Flows for the Nine Months Ended March 31, 2024 and 2023

Operating

Activities

Net

cash used in operating activities was approximately $2.94 million and approximately $1.31 million for the three-month periods ended March

31, 2024 and 2023, respectively. Net cash used in operating activities primarily reflects the net loss for those periods of approximately

$2.93 million and approximately $1.29 million, respectively.

Investing

Activities

Net

cash used in investing activities was $59,000 and $0 for the three-month periods ended March 31, 2024 and 2023, respectively. Net cash

used in investing activities primarily reflects the purchasing of fixed assets.

Off-Balance

Sheet Arrangements

As

of March 31, 2024, we did not have any off-balance sheet arrangements as defined in Item 303(a)(4) of Regulation S-K.

Critical

Accounting Policies

This

Management’s Discussion and Analysis of Financial Condition and Results of Operations discuss our financial statements, which have

been prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”).

In connection with the preparation of our financial statements, we are required to make assumptions and estimates about future events

and apply judgments that affect the reported amounts of assets, liabilities, expenses and the related disclosures. We base our assumptions,

estimates and judgments on historical experience, current trends and other factors that management believes to be relevant at the time

our condensed consolidated financial statements are prepared. On a regular basis, management reviews the accounting policies, assumptions,

estimates and judgments to ensure that our financial statements are presented fairly and in accordance with U.S. GAAP. However, because

future events and their effects cannot be determined with certainty, actual results could differ from our assumptions and estimates,

and such differences could be material.

Liquidity

and Capital Resources

To

date, we have not generated any revenues and have experienced net losses and negative cash flows from our activities.

Since

our incorporation, we have devoted substantially all our resources to research and product development and to providing general and administrative

support for these activities. Since our incorporation, we have incurred significant losses and negative cash flows from operations. During

the three months ended March 31, 2024, we incurred a net loss of approximately $3.0 million and used $2.9 million of cash in our operations.

As of March 31, 2024, we had an accumulated deficit of approximately $112.8 million. We expect to continue to incur significant and increasing

losses and do not expect positive cash flows from operations for the foreseeable future, and our net losses may fluctuate significantly

from period to period depending on the timing of and expenditures on our research and development activities.

Based

on our operating plans, we do not expect that our current cash and cash equivalents as of March 31, 2024, will be sufficient to fund

our operating, investing, and financing cash flow needs for at least the next twelve months, assuming our programs advance as currently

contemplated. Based upon this review and our current financial condition, the Company has concluded that substantial doubt exists as

to our ability to continue as a going concern. We have and believe we will continue to be able to raise additional capital through debt

financing, private or public equity financings, license agreements, collaborative agreements or other arrangements with other companies,

or other sources of financing. However, there can be no assurances that such financing will be available or will be at terms acceptable

to us, or at all. If we are unable to raise capital when needed or on attractive terms, we would be forced to delay, reduce, or eliminate

our clinical trials or other operations. If any of these events occur, our ability to achieve our operational goals would be adversely

affected. Our future capital requirements and the adequacy of available funds will depend on many factors, including those described

in the section titled “Risk Factors.” Depending on the severity and direct impact of these factors on us, we may be unable

to secure additional financing to meet our operating requirements on commercially acceptable terms favorable to us, or at all.

Going

Concern Uncertainty

As

of December 31, 2023, cash on hand was $1,497,000. The development and commercialization of non-invasive glucose monitoring devices for

use by people, are expected to require substantial further expenditures. We remain dependent upon external sources for financing our

operations. Since inception, we have incurred substantial accumulated losses and negative operating cash flow and have a significant

accumulated deficit. These factors raise substantial doubt about our ability to continue as a going concern. The financial statements

do not include any adjustments that might result from the outcome of this uncertainty. We plan to finance our operations through the

sale of equity (including a shelf registration statement on Form S-3 that was declared effective on September 27, 2021 by the SEC which

allows the Company to register up to $90,000 of certain equity and/or debt securities of the Company). There can be no assurance that

we will succeed in obtaining the necessary financing to continue our operations.

However,

in April 2024, the Company raised net proceeds of $500,000 through the completion of a private placement transaction.

Item

3. Quantitative and Qualitative Disclosures About Market Risk.

As a smaller reporting company, we are not required to provide the information required by this Item.

Item

4. Controls and Procedures.

Evaluation

of Disclosure Controls and Procedures

Our

management, with the participation of our Principal Executive Officer and Chief Financial Officer, has evaluated the effectiveness of

our disclosure controls and procedures (as such term is defined in Rules 13a-15(e) and 15d-15(e) under the Exchange Act) as of March

31, 2024, or the Evaluation Date. Based on such evaluation, those officers have concluded that, as of the Evaluation Date, our disclosure

controls and procedures are ineffective in recording, processing, summarizing and reporting, on a timely basis, information required

to be included in periodic filings under the Exchange Act and that such information is not accumulated and communicated to management,

including our principal executive and financial officers, in a manner sufficient to allow timely decisions regarding required disclosure,

due to the material weaknesses in internal control over financial reporting related to lack of sufficient internal accounting personnel,

segregation of duties, and lack of sufficient internal controls (including IT general controls) that encompass the Company as a whole

with respect to entity and transactions level controls in order to ensure complete documentation of complex and non-routine transactions

and adequate financial reporting.

Management

has identified corrective actions to remediate such material weaknesses, which includes hiring additional employees and engaging in external

financial reporting consultants. Management intends to implement procedures to remediate such material weaknesses during the fiscal year

2024; however, the implementation of these initiatives may not fully address any material weaknesses that we may have in our internal

control over financial reporting.

Changes

in Internal Control over Financial Reporting

There

were no changes in our internal control over financial reporting during our most recent fiscal quarter that have materially affected,

or are reasonably likely to materially affect, our internal control over financial reporting.

PART

II - OTHER INFORMATION

Item

1. Legal Proceedings.

We

are not party to any material legal proceedings. From time to time, we may be involved in legal proceedings or subject to claims incident

to the ordinary course of business. The outcome of litigation is inherently uncertain, and there can be no assurances that favorable

outcomes will be obtained. In addition, regardless of the outcome, such proceedings or claims can have an adverse impact on us, which

may be material because of defense and settlement costs, diversion of resources and other factors.

Item

1A. Risk Factors.

You

should carefully consider the factors discussed in Part I, Item 1A., “Risk Factors” in our Annual Report for the fiscal year

ended December 31, 2023, which could materially affect our business, financial position, or future results of operations. The risks described

in our Annual Report for the fiscal year ended December 31, 2023, are not the only risks we face. Additional risks and uncertainties

not currently known to us or that we currently deem to be immaterial may also materially adversely affect our business, financial position,

or future results of operations. We may disclose changes to such factors or disclose additional factors from time to time in our future

filings with the SEC. The risk factors set forth below supplements and updates the risk factors previously disclosed and should be read

together with the risk factors described in our Annual Report for the fiscal year ended December 31, 2023 and with any risk factors we

may include in subsequent periodic filings with the SEC.

We

may fail to select or capitalize on the most scientifically, clinically or commercially promising or profitable product candidates.

Given

the current momentum for continuous blood glucose monitoring (“CBGM”) in the diabetes market, we have announced our

decision to reset our priorities, improve our commercial outlook and refine our business strategy to focus on our implantable CBGM

technology. Should our efforts to focus on this CBGM technology not be successful, we will need to further evaluate our business

strategy and, as a result, our Board of Directors may decide that it is in the best interest of our stockholders to dissolve our

Company and liquidate our assets or otherwise modify our strategy in the future. In this regard, we may, from time to time, focus

our product development efforts on different product candidates or may delay, suspend or terminate the future development of a

product candidate at any time for strategic, business, financial or other reasons. As a result of changes in our strategy, we have

and may in the future change or refocus our existing product development, commercialization and manufacturing activities. This could

require changes in our facilities and our personnel. Any product development changes that we implement may not be successful. In

particular, we may fail to select or capitalize on the most scientifically, clinically or commercially promising or profitable

product candidates. Our decisions to allocate our research and development, management and financial resources toward particular

product candidates may not lead to the development of viable commercial products and may divert resources from better opportunities.

Similarly, our decisions to delay or terminate product development programs may also prove to be incorrect and could cause us to

miss valuable opportunities.

Our

failure to maintain compliance with Nasdaq’s continued listing requirements could result in the delisting of our Common Stock.

Our

common stock is currently listed for trading on The Nasdaq Stock Market LLC. We must satisfy the continued listing requirements of Nasdaq,

to maintain the listing of our common stock on The Nasdaq Stock Market LLC.

As previously disclosed, on

May 26, 2023, we received notice from the Staff indicating that, based upon the closing bid price of our common stock for the prior 30

consecutive business days, we were not currently in compliance with the requirement to maintain a minimum bid price of $1.00 per share

for continued listing on Nasdaq as set forth in Nasdaq Listing Rule 5550(a)(2) (the “Bid Price Rule”).

We

initially had 180 days from May 26, 2023, or through November 22, 2023, to regain compliance with the Bid Price Rule. However, on November

24, 2023, we received a notice from Nasdaq stating that we were granted an additional 180 calendar days, or until May 20, 2024, to regain

compliance with the Bid Price Rule (the “Extended Compliance Period”). If at any time during the Extended Compliance Period,

the closing bid price of our Common Stock is at least $1.00 per share for a minimum of 10 consecutive business days, Nasdaq will provide

written confirmation that we have regained compliance with the Bid Price Rule. If we cannot demonstrate compliance during the Extended

Compliance Period, then Nasdaq will provide notice that our Common Stock will be subject to delisting. At that time, the Company may

appeal the Staff’s determination to a hearings panel.

At