Geron Corporation Announces Pricing of $150 Million Underwritten Offering of Common Stock and Pre-Funded Warrants

March 19 2024 - 9:07AM

Business Wire

Geron Corporation (Nasdaq: GERN), a late-stage clinical

biopharmaceutical company, today announced the pricing of an

underwritten offering consisting of 41,999,998 shares of its common

stock at a price of $3.00 per share and pre-funded warrants to

purchase 8,002,668 shares of its common stock. The pre-funded

warrants are being sold at a price of $2.999 per pre-funded

warrant. All of the securities in the offering are to be sold by

Geron. The offering included participation from RA Capital

Management, Fairmount, OrbiMed, Farallon Capital Management, Adage

Capital Partners, L.P., Boxer Capital, Vivo Capital, Deep Track

Capital, and multiple large investment management firms, in

addition to other new and existing investors. The offering is

expected to close on or about March 21, 2024, subject to the

satisfaction of customary closing conditions.

The gross proceeds to Geron from this underwritten offering,

before deducting the underwriting discount and other estimated

offering expenses, are expected to be approximately $150.0 million.

Geron currently intends to use the net proceeds from this offering,

together with its existing cash, cash equivalents, and current and

noncurrent marketable securities, to fund the potential

commercialization of imetelstat in low or intermediate-1 risk

myelodysplastic syndromes in the U.S, and potential launch and

commercialization of imetelstat in low or intermediate-1 risk

myelodysplastic syndromes in the EU, subject to receipt of

regulatory approvals, as well as continued development and

potential regulatory submissions for imetelstat in

relapsed/refractory myelofibrosis. Geron intends to use the

remaining proceeds, if any, for working capital and general

corporate purposes.

TD Cowen, Stifel and Barclays are acting as joint book-running

managers for the offering. Wedbush PacGrow is acting as co-manager

for the offering.

An automatically effective shelf registration statement on Form

S-3 relating to the offering of the shares of common stock and

pre-funded warrants described above was filed with the Securities

and Exchange Commission (SEC) on January 4, 2023. A prospectus

supplement and accompanying prospectus relating to and describing

the terms of the offering will be filed with the SEC and will be

available on the SEC’s website at www.sec.gov. When available,

copies of the prospectus supplement and accompanying prospectus

relating to the offering may be obtained from: Cowen and Company,

LLC, 599 Lexington Avenue, New York, NY 10022, by email at

Prospectus_ECM@cowen.com or by telephone at (833) 297-2926; and

Stifel, Nicolaus & Company, Incorporated, Attention: Syndicate,

One Montgomery Street, Suite 3700, San Francisco, California 94104,

by telephone at 415-364-2720 or by email at

syndprospectus@stifel.com.

This press release does not constitute an offer to sell or the

solicitation of an offer to buy any of these securities, nor will

there be any sale of these securities in any state or other

jurisdiction in which such offer, solicitation or sale would be

unlawful prior to the registration or qualification under the

securities laws of any such state or other jurisdiction.

About Geron

Geron is a late-stage biopharmaceutical company pursuing

therapies with the potential to extend and enrich the lives of

patients living with hematologic malignancies. Its investigational

first-in-class telomerase inhibitor, imetelstat, harnesses Nobel

Prize winning science in a treatment that may alter the underlying

drivers of disease.

Use of Forward-Looking Statements

Investors are cautioned that statements in this press release

regarding the anticipated gross proceeds from the offering, Geron’s

intended use of the net proceeds from this offering and completion

and timing of the offering constitute forward-looking statements

that involve risks and uncertainties, including, without

limitation, risks and uncertainties related to: market and other

conditions; the satisfaction of customary closing conditions

related to the offering and the impact of general economic,

industry or political conditions in the United States or

internationally and the current or evolving effects of

macroeconomic conditions, such as civil or political unrest or

military conflicts around the world, such as the military conflict

between Ukraine and Russia and in Israel, inflation, rising

interest rates or prospects of a recession, on Geron’s business

operations and activities. There can be no assurance that Geron

will be able to complete the offering on the anticipated terms, or

at all. Actual results may differ materially from the results

anticipated in these forward-looking statements. Additional

information on other potential factors that could affect Geron’s

results and other risks and uncertainties can be found under the

heading “Risk Factors” or other similar headings found in documents

Geron files from time to time with the SEC, including Geron’s

current report on Form 8-K filed with the SEC on March 19, 2024.

Geron expressly disclaims any obligation or undertaking to release

publicly any updates or revisions to any forward-looking statements

contained herein to reflect any change in its expectations with

regard thereto or any change in events, conditions or circumstances

on which any such statements are based.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240319588615/en/

Aron Feingold Vice President, Investor Relations and Corporate

Communications

Kristen Kelleher Associate Director, Investor Relations and

Corporate Communications

investor@geron.com media@geron.com

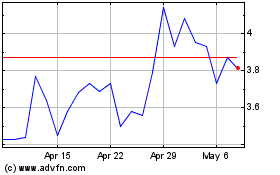

Geron (NASDAQ:GERN)

Historical Stock Chart

From Oct 2024 to Nov 2024

Geron (NASDAQ:GERN)

Historical Stock Chart

From Nov 2023 to Nov 2024