UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE

13D

Under the Securities Exchange Act of 1934

(Amendment No. )*

Genetron Holdings Limited

(Name of Issuer)

Ordinary Shares, par value US$0.00002 per share

(Title of Class

of Securities)

37186H100**

(CUSIP Number)

|

Johnson Huang

25th Floor and 26th Floor, China World Tower

B, No.1 Jian Guo Men Wai Avenue

Beijing 100004, People’s Republic of China

Tel: +86 (10) 6505-1166 |

(Name, Address and

Telephone Number of Person Authorized to Receive Notices and Communications)

October 11, 2023

(Date of Event which

Requires Filing of this Statement)

If the filing

person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing

this schedule because of Rule 13d-1(e), Rule 13-d1(f) or Rule 13d-1(g), check the following box. ☒

Note: Schedules

filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See Rule 13d-7 for other

parties to whom copies are to be sent.

| * | The

remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject

class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover

page. |

| ** | There

is no CUSIP number assigned to the ordinary shares. CUSIP number 37186H100 has been assigned to the American depositary shares (“ADSs”)

of the Issuer, which are quoted on Nasdaq Stock Market under the symbol “GTH.” Each ADS represents five ordinary shares,

par value US$0.00002 per share (“ordinary shares”). On October 11, 2023, the Issuer announced a change of the ratio of its

ADS to ordinary shares from one ADS representing five ordinary shares to one ADS representing fifteen ordinary shares effective on or

about October 26, 2023. |

The information

required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities

Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all

other provisions of the Act (however, see the Notes).

CUSIP No. 37186H100

| 1. |

NAME OF REPORTING PERSONS |

|

| China International Capital Corporation Limited |

|

| 2. |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

| (a) ☐ |

| (b) ☐ |

| 3. |

SEC USE ONLY |

| |

| 4. |

SOURCE OF FUNDS |

| AF |

| 5. |

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM

2(d) OR 2(e) |

| ☐ |

| 6. |

CITIZENSHIP OR PLACE OF ORGANIZATION |

People’s Republic of China |

NUMBER

OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON

WITH |

7. |

SOLE

VOTING POWER |

| 0 |

| 8. |

SHARED VOTING POWER |

| 57,824,500 |

| 9. |

SOLE DISPOSITIVE POWER |

| 0 |

| 10. |

SHARED DISPOSITIVE POWER |

| 57,824,500 |

| 11. |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

| 57,824,500 |

| 12. |

CHECK IF THE AGGREGATE

AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

| ☐ |

| 13. |

PERCENT OF CLASS

REPRESENTED BY AMOUNT IN ROW (11) |

| 12.6% |

| 14. |

TYPE OF REPORTING

PERSON |

| CO |

CUSIP No. 37186H100

| 1. |

NAME OF REPORTING PERSONS |

|

CICC Capital Management Co., Ltd. |

|

| 2. |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

| (a) ☐ |

| (b) ☐ |

| 3. |

SEC USE ONLY |

| |

| 4. |

SOURCE OF FUNDS |

| AF |

| 5. |

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM

2(d) OR 2(e) |

| ☐ |

| 6. |

CITIZENSHIP OR PLACE OF ORGANIZATION |

People’s Republic of China |

NUMBER

OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON

WITH |

7. |

SOLE

VOTING POWER |

| 0 |

| 8. |

SHARED VOTING POWER |

| 57,824,500 |

| 9. |

SOLE DISPOSITIVE POWER |

| 0 |

| 10. |

SHARED DISPOSITIVE POWER |

| 57,824,500 |

| 11. |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

| 57,824,500 |

| 12. |

CHECK IF THE AGGREGATE

AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

| ☐ |

| 13. |

PERCENT OF CLASS

REPRESENTED BY AMOUNT IN ROW (11) |

| 12.6% |

| 14. |

TYPE OF REPORTING

PERSON |

| CO |

CUSIP No. 37186H100

| 1. |

NAME OF REPORTING PERSONS |

|

CICC Kangzhi (Ningbo) Equity Investment Management Co., Ltd. |

|

| 2. |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

| (a) ☐ |

| (b) ☐ |

| 3. |

SEC USE ONLY |

| |

| 4. |

SOURCE OF FUNDS |

| AF |

| 5. |

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM

2(d) OR 2(e) |

| ☐ |

| 6. |

CITIZENSHIP OR PLACE OF ORGANIZATION |

People’s Republic of China |

NUMBER

OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON

WITH |

7. |

SOLE

VOTING POWER |

| 0 |

| 8. |

SHARED VOTING POWER |

44,165,500 |

| 9. |

SOLE DISPOSITIVE POWER |

| 0 |

| 10. |

SHARED DISPOSITIVE POWER |

44,165,500 |

| 11. |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

44,165,500 |

| 12. |

CHECK IF THE AGGREGATE

AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

| ☐ |

| 13. |

PERCENT OF CLASS

REPRESENTED BY AMOUNT IN ROW (11) |

| 9.6% |

| 14. |

TYPE OF REPORTING

PERSON |

| CO |

CUSIP No. 37186H100

| 1. |

NAME OF REPORTING PERSONS |

|

CICC Kangrui (No.1) Ningbo Equity Investment Fund Partnership (Limited Partnership)

|

| 2. |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

| (a) ☐ |

| (b) ☐ |

| 3. |

SEC USE ONLY |

| |

| 4. |

SOURCE OF FUNDS |

| AF |

| 5. |

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM

2(d) OR 2(e) |

| ☐ |

| 6. |

CITIZENSHIP OR PLACE OF ORGANIZATION |

People’s Republic of China |

NUMBER

OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON

WITH |

7. |

SOLE

VOTING POWER |

| 0 |

| 8. |

SHARED VOTING POWER |

44,165,500 |

| 9. |

SOLE DISPOSITIVE POWER |

| 0 |

| 10. |

SHARED DISPOSITIVE POWER |

44,165,500 |

| 11. |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

44,165,500 |

| 12. |

CHECK IF THE AGGREGATE

AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

| ☐ |

| 13. |

PERCENT OF CLASS

REPRESENTED BY AMOUNT IN ROW (11) |

| 9.6% |

| 14. |

TYPE OF REPORTING

PERSON |

| PN |

CUSIP No. 37186H100

| 1. |

NAME OF REPORTING PERSONS |

|

Tianjin Kangyue Business Management Partnership (Limited Partnership)

|

| 2. |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

| (a) ☐ |

| (b) ☐ |

| 3. |

SEC USE ONLY |

| |

| 4. |

SOURCE OF FUNDS |

OO |

| 5. |

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM

2(d) OR 2(e) |

| ☐ |

| 6. |

CITIZENSHIP OR PLACE OF ORGANIZATION |

People’s Republic of China |

NUMBER

OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON

WITH |

7. |

SOLE

VOTING POWER |

| 0 |

| 8. |

SHARED VOTING POWER |

44,165,500 |

| 9. |

SOLE DISPOSITIVE POWER |

| 0 |

| 10. |

SHARED DISPOSITIVE POWER |

44,165,500 |

| 11. |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

44,165,500 |

| 12. |

CHECK IF THE AGGREGATE

AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

| ☐ |

| 13. |

PERCENT OF CLASS

REPRESENTED BY AMOUNT IN ROW (11) |

| 9.6% |

| 14. |

TYPE OF REPORTING

PERSON |

| PN |

CUSIP No. 37186H100

| 1. |

NAME OF REPORTING PERSONS |

|

China International Capital Corporation (International) Limited

|

| 2. |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

| (a) ☐ |

| (b) ☐ |

| 3. |

SEC USE ONLY |

| |

| 4. |

SOURCE OF FUNDS |

AF |

| 5. |

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM

2(d) OR 2(e) |

| ☐ |

| 6. |

CITIZENSHIP OR PLACE OF ORGANIZATION |

Hong Kong |

NUMBER

OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON

WITH |

7. |

SOLE

VOTING POWER |

| 0 |

| 8. |

SHARED VOTING POWER |

13,659,000 |

| 9. |

SOLE DISPOSITIVE POWER |

| 0 |

| 10. |

SHARED DISPOSITIVE POWER |

13,659,000 |

| 11. |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

13,659,000 |

| 12. |

CHECK IF THE AGGREGATE

AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

| ☐ |

| 13. |

PERCENT OF CLASS

REPRESENTED BY AMOUNT IN ROW (11) |

| 3.0% |

| 14. |

TYPE OF REPORTING

PERSON |

| CO |

CUSIP No. 37186H100

| 1. |

NAME OF REPORTING PERSONS |

|

CICC Capital (Cayman) Limited

|

| 2. |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

| (a) ☐ |

| (b) ☐ |

| 3. |

SEC USE ONLY |

| |

| 4. |

SOURCE OF FUNDS |

AF |

| 5. |

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM

2(d) OR 2(e) |

| ☐ |

| 6. |

CITIZENSHIP OR PLACE OF ORGANIZATION |

Cayman Islands |

NUMBER

OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON

WITH |

7. |

SOLE

VOTING POWER |

| 0 |

| 8. |

SHARED VOTING POWER |

13,659,000 |

| 9. |

SOLE DISPOSITIVE POWER |

| 0 |

| 10. |

SHARED DISPOSITIVE POWER |

13,659,000 |

| 11. |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

13,659,000 |

| 12. |

CHECK IF THE AGGREGATE

AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

| ☐ |

| 13. |

PERCENT OF CLASS

REPRESENTED BY AMOUNT IN ROW (11) |

| 3.0% |

| 14. |

TYPE OF REPORTING

PERSON |

| CO |

CUSIP No. 37186H100

| 1. |

NAME OF REPORTING PERSONS |

|

CICC Healthcare Investment Management Limited

|

| 2. |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

| (a) ☐ |

| (b) ☐ |

| 3. |

SEC USE ONLY |

| |

| 4. |

SOURCE OF FUNDS |

AF |

| 5. |

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM

2(d) OR 2(e) |

| ☐ |

| 6. |

CITIZENSHIP OR PLACE OF ORGANIZATION |

Cayman Islands |

NUMBER

OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON

WITH |

7. |

SOLE

VOTING POWER |

| 0 |

| 8. |

SHARED VOTING POWER |

13,659,000 |

| 9. |

SOLE DISPOSITIVE POWER |

| 0 |

| 10. |

SHARED DISPOSITIVE POWER |

13,659,000 |

| 11. |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

13,659,000 |

| 12. |

CHECK IF THE AGGREGATE

AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

| ☐ |

| 13. |

PERCENT OF CLASS

REPRESENTED BY AMOUNT IN ROW (11) |

| 3.0% |

| 14. |

TYPE OF REPORTING

PERSON |

| CO |

CUSIP No. 37186H100

| 1. |

NAME OF REPORTING PERSONS |

|

CICC Healthcare Investment Fund, L.P.

|

| 2. |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

| (a) ☐ |

| (b) ☐ |

| 3. |

SEC USE ONLY |

| |

| 4. |

SOURCE OF FUNDS |

OO |

| 5. |

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM

2(d) OR 2(e) |

| ☐ |

| 6. |

CITIZENSHIP OR PLACE OF ORGANIZATION |

Cayman Islands |

NUMBER

OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON

WITH |

7. |

SOLE

VOTING POWER |

| 0 |

| 8. |

SHARED VOTING POWER |

13,659,000 |

| 9. |

SOLE DISPOSITIVE POWER |

| 0 |

| 10. |

SHARED DISPOSITIVE POWER |

13,659,000 |

| 11. |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

13,659,000 |

| 12. |

CHECK IF THE AGGREGATE

AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

| ☐ |

| 13. |

PERCENT OF CLASS

REPRESENTED BY AMOUNT IN ROW (11) |

| 3.0% |

| 14. |

TYPE OF REPORTING

PERSON |

| PN |

CUSIP No. 37186H100

Item 1. Security and Issuer

This Schedule 13D relates to the ordinary shares

of Genetron Holdings Limited, par value US$0.00002 (“Ordinary Shares”), an exempted company incorporated under the laws of

the Cayman Islands (the “Issuer”), whose principal executive offices are located at 1-2/F, Building 11, Zone 1, No.8 Life

Science Parkway, Changping District, Beijing, 102206, People’s Republic of China.

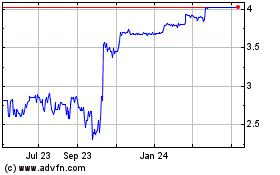

The Issuer’s ADS, each representing five

ordinary shares, are listed on NASDAQ Global Market under the symbol “GTH.” On October 11, 2023, the Issuer announced a change

of the ratio of its ADS to ordinary shares from one ADS representing five ordinary shares to one ADS representing fifteen ordinary shares

effective on or about October 26, 2023.

Item 2. Identity and Background

(a) This Schedule 13D is being

filed jointly by the following reporting persons (each a “Reporting Person” and collectively, the “Reporting Persons”):

| (1) | China International Capital Corporation Limited (“CICC Listco”), a company established in People’s Republic of China; |

| (2) | CICC Capital Management Co., Ltd. (“CICC Capital Management”), a company established in People’s Republic of China; |

| (3) | CICC Kangzhi (Ningbo) Equity Investment Management Co., Ltd. (“CICC Kangzhi”), a company established in People’s

Republic of China; |

| (4) | CICC Kangrui (No.1) Ningbo Equity Investment Fund Partnership (Limited Partnership) (“CICC Kangrui”), a partnership established

in People’s Republic of China; |

| (5) | Tianjin Kangyue Business Management Partnership (Limited Partnership) (“Tianjin Kangyue”), a partnership established in

People’s Republic of China; |

| (6) | China International Capital Corporation (International) Limited (“CICC International”), a company incorporated in Hong

Kong; |

| (7) | CICC Capital (Cayman) Limited (“CICC Capital Cayman”), a company incorporated in the Cayman Islands; |

| (8) | CICC Healthcare Investment Management Limited (“CICC HIM”), a company incorporated in the Cayman Islands; and |

| (9) | CICC Healthcare Investment Fund, L.P. (“CICC Healthcare Investment”), an entity incorporated in the Cayman Islands. |

(b) The principal business

address of CICC Listco is 27th and 28th Floor, China World Office 2, 1 Jianguomenwai Avenue, Chaoyang District, Beijing, People’s

Republic of China. The principal business address of CICC Capital Management is 25th Floor and 26th Floor, China World Tower B, No.1 Jian

Guo Men Wai Avenue, Beijing 100004, People’s Republic of China. The principal business address of CICC Kangzhi is Section A C0049,

Room 401, Building 1, 88 Qixing Road, Meishan, Beilun District, Ningbo, Zhejiang, People’s Republic of China. The principal business

address of CICC Kangrui is Section A C0866, Room 401, Building 1, 88 Qixing Road, Meishan, Beilun District, Ningbo, Zhejiang, People’s

Republic of China. The principal business address of Tianjin Kangyue is 113, Tower 2, Guotai Building, Yingbin Avenue (Ease Side), Tianjin

Pilot Free Trade Zone (Central Business District), Tianjin, People’s Republic of China. The principal business address of CICC International

is 29th Floor, One International Finance Centre, No.1 Harbour View Street, Central, Hong Kong. The registered address of each of CICC

Capital Cayman, CICC HIM and CICC Healthcare Investment is PO Box 309, Ugland House, Grand Cayman, KY1-1104, Cayman Islands.

CUSIP No. 37186H100

(c) The principal business

of Tianjin Kangyue is business management. The principal business of CICC Healthcare Investment is investment holding. The principal business

of CICC Kangrui is private equity investment. The principal business of CICC Kangzhi is equity investment management. The principal business

of CICC HIM is investment management. The principal business of CICC Capital Cayman is investment holding. The principal businesses of

CICC Capital Management are asset management, investment management, project investment and investment consulting. The principal business

of CICC International is overseas investment holding. The principal businesses of CICC Listco are investment banking, equities business,

fixed income, commodities and currency, asset management, private equity, wealth management and relevant financial services.

Attached hereto as Schedule A, and incorporated

herein by reference, is information concerning each director and executive officer of the Reporting Persons (collectively, the “Related

Persons”), which is required to be disclosed in response to Item 2 and General Instruction C to Schedule 13D.

(d)-(e) During the last five years, none of the Reporting Persons

nor, to the best of the Reporting Persons’ knowledge, any of the Related Persons, has been convicted in a criminal proceeding

(excluding traffic violations and similar misdemeanors) or been a party to a civil proceeding of a judicial or administrative body

of competent jurisdiction and as a result of such proceeding was or is subject to a judgment, decree, or final order enjoining

future violations of, or prohibiting or mandating activities subject to, federal or state securities laws or finding any violation

with respect to such laws.

Item 3. Source and Amount of Funds or Other Consideration

Prior to the Issuer’s initial public offering

(the “IPO”) on June 26, 2020, Tianjin Kangyue acquired 44,165,500 series C preferred shares of the Issuer at RMB300 million

in equivalent U.S. dollars and CICC Healthcare Investment acquired a total of 13,659,000 series D preferred shares of the Issuer at an

aggregate amount of US$20 million from the Issuer in certain private placements. Upon the completion of the IPO in June 2020, all of the

issued and outstanding preferred shares of the Issuer, including those preferred shares held by Tianjin Kangyue and CICC Healthcare Investment,

automatically converted into and were re-designated as Ordinary Shares on a one-to-one basis.

Tianjin Kangyue’s source of fund was through

the capital contributions from its limited partner, CICC Kangrui. CICC Healthcare Investment’s source of fund was through the capital

contributions from its general partner, CICC HIM, and limited partners.

On October 11, 2023, the Issuer publicly announced

that it had entered into an agreement and plan of merger, dated as of October 11, 2023 (the “Merger Agreement”), among New

Genetron Holding Limited, an exempted company incorporated with limited liability under the laws of the Cayman Islands (“Parent”),

Genetron New Co Limited, an exempted company incorporated with limited liability under the laws of the Cayman Islands and a wholly-owned

subsidiary of Parent (“Merger Sub”) and the Issuer. Pursuant to the Merger Agreement, Merger Sub will merge with and into

the Issuer, with the Issuer continuing as the surviving company and a wholly owned subsidiary of Parent (the “Merger”).

It is anticipated that approximately US$50.9 million

will be expended in acquiring the outstanding Ordinary Shares other than the Rollover Shares (as defined below) pursuant to the Merger

Agreement. The Merger will be funded through cash contribution by Wealth Strategy Holding Limited, Surrich International Company Limited,

Tianjin Kangyue, CICC Healthcare Investment, CCB (Beijing) Investment Fund Management Co., Ltd. and Wuxi Huihongyingkang Investment Partnership

(Limited Partnership) or their respective affiliates (each a “Sponsor” and collectively the “Sponsors”). Parent

has entered into certain equity commitment letters with the Sponsors, each dated October 11, 2023 (the “Equity Commitment Letters”),

pursuant to which the Sponsors have agreed, subject to the terms and conditions thereof, to provide the financing amounts, up to US$52.4

million, for the purpose of financing the Merger consideration and certain other expenses in connection with the Merger. Each Sponsor

has entered into a limited guarantee (collectively, the “Limited Guarantees”) in favor of the Issuer or Genetron Health (Beijing)

Co., Ltd. (“Genetron Beijing”), a wholly-owned subsidiary of the Issuer, each dated October 11, 2023, with respect to a portion

of the payment obligations of Parent under the Merger Agreement for the termination fee that may become payable to the Issuer and/or Genetron

Beijing by Parent under certain circumstances and certain costs and expenses, as set forth in the Merger Agreement. Each of Tianjin Kangyue,

CICC Healthcare Investment and certain other shareholders of the Issuer has agreed to roll over certain ordinary shares (including ordinary

shares represented by ADS) he or it beneficially owns (the “Rollover Shares,” and the holder thereof, “Rollover Shareholders”)

in connection with the Merger in accordance with the terms and conditions of the relevant rollover and support agreement entered into

with Parent dated October 11, 2023 (the “Support Agreement”).

The descriptions of the Merger, the Merger Agreement,

the Equity Commitment Letters, the Limited Guarantees and the Support Agreement set forth in Item 4 below are incorporated by reference

in their entirety into this Item 3.

CUSIP No. 37186H100

Item 4. Purpose of Transaction

On October 11, 2023, the Issuer entered into the

Merger Agreement with Parent and Merger Sub. Pursuant to the Merger Agreement, Merger Sub will merge with and into the Issuer, with the

Issuer continuing as the surviving company and a wholly owned subsidiary of Parent. At the effective time of the Merger (the “Effective

Time”), each Ordinary Share and each ADS issued and outstanding immediately prior to the Effective Time will be cancelled and cease

to exist in exchange for the right to receive US$0.272 per Ordinary Share or US$1.36 per ADS (less applicable fees, charges and expenses

payable by ADS holders pursuant to the depositary agreement, dated June 18, 2020, entered into by and among the Issuer, the Bank of New

York Mellon (the “Depositary”) and all holders and beneficial owners of ADSs issued thereunder), in each case, in cash, without

interest and net of any applicable withholding taxes, except for (a) the Rollover Shares, which will be cancelled without payment of any

cash consideration therefor, (b) Ordinary Shares (including Ordinary Shares represented by ADSs) owned by Parent, Merger Sub or the Issuer

or any of their subsidiaries or held in the Issuer’s treasury, which will be cancelled without payment of any consideration therefor,

(c) Ordinary Shares (including Ordinary Shares represented by ADSs) recorded under the name of the Depositary as member in the register

of members of the Issuer and reserved for issuance and allocation pursuant to the Issuer share incentive plans, which will be cancelled

without payment of any consideration therefor (such ordinary shares set forth in (a), (b) and (c), the “Excluded Shares”),

and (d) Ordinary Shares that are issued and outstanding immediately prior to the Effective Time and that are held by shareholders of the

Issuer who shall have validly exercised and not effectively withdrawn or lost their rights to dissent from the Merger in accordance with

Section 238 of the Companies Act (as amended) of the Cayman Islands (the “Dissenting Shares”), which will be cancelled at

the Effective Time and will entitle the holders thereof to receive the payment of the fair value of such Dissenting Shares held by them

determined in accordance with the provisions of Section 238 of the Companies Act (as amended) of the Cayman Islands.

On October 11, 2023, the Issuer announced a change

of the ratio of its ADS to ordinary shares from one ADS representing five ordinary shares to one ADS representing fifteen ordinary shares

effective on or about October 26, 2023. Assuming the completion of such change of ratio, the holder of ADSs (other than the Excluded Shares)

shall be entitled to receive US$4.08 in cash per ADS.

The consummation of the Merger is subject to the

satisfaction or waiver of a number of conditions set forth in the Merger Agreement, including (a) the approval of the Merger by the affirmative

vote of holders of Ordinary Shares (including Ordinary Shares represented by ADSs) representing at least two-thirds of the voting power

of the outstanding Ordinary Shares present and voting in person or by proxy as a single class at the shareholders meeting of the Issuer

or any adjournment or postponement thereof, (b) the aggregate amount of Dissenting Shares shall be less than 15% of the total outstanding

Ordinary Shares immediately prior to the Effective Time, and (c) certain regulatory approvals. The Merger Agreement may be terminated

by the Issuer or Parent under certain circumstances.

The purpose of the transactions contemplated under

the Merger Agreement, including the Merger, is to acquire all of the outstanding Ordinary Shares other than the Rollover Shares. If the

Merger is completed, the Issuer will become a wholly owned subsidiary of Parent and Issuer’s ADSs would become eligible for termination

of registration pursuant to Section 12(g)(4) of the Act and would be delisted from the NASDAQ Global Market.

Concurrently with the execution of the Merger Agreement,

each of Tianjin Kangyue, CICC Healthcare Investment and other Rollover Shareholders entered into the Support Agreement with Parent, dated

as of October 11, 2023, pursuant to which, among other things and subject to the terms and conditions set forth therein, each of Tianjin

Kangyue and CICC Healthcare Investment has agreed to (a) vote all Rollover Shares (together with any other Ordinary Shares or equity securities

of the Issuer acquired, whether beneficially or of record, by such Rollover Shareholder after the date thereof and prior to the Effective

Time, including any Ordinary Shares acquired by means of purchase, dividend or distribution, or issued upon the exercise of any options

or warrants, or the conversion of any convertible securities or otherwise) held directly or indirectly by them in favor of the authorization

and approval of Merger Agreement and transactions contemplated thereunder, and (b) upon the terms and subject to the conditions of the

Support Agreement, cancel the Rollover Shares beneficially owned by him or it and receive no cash consideration for cancellation of the

Rollover Shares in accordance with the Merger Agreement in exchange for newly issued shares in Parent.

Concurrently with the execution of the Merger Agreement,

each of Tianjin Kangyue, CICC Healthcare Investment and other Sponsors entered into (a) certain Equity Commitment Letters, pursuant to

which the Sponsors will provide or cause to be provided, subject to the terms and on the conditions set forth therein, equity financing

to Parent in an aggregate amount of up to US$52.4 million in connection with the Merger, and (b) certain Limited Guarantees in favor of

the Issuer or Genetron Beijing with respect to each Sponsor’s respective portion of the payment obligations of Parent under the

Merger Agreement for the termination fee that may become payable to the Issuer and/or Genetron Beijing by Parent under certain circumstances

and certain costs and expenses, as set forth in the Merger Agreement.

After the Effective Time, Parent will be beneficially

owned by the Sponsors and other Rollover Shareholders.

CUSIP No. 37186H100

Concurrently with the execution of the Merger Agreement,

Mr. Sizhen Wang and the Sponsors entered into an interim investor agreement (the “Interim Investor Agreement”), pursuant to

which the parties thereto agreed to certain terms and conditions that will govern the actions of such parties and the relationship among

such parties with respect to the Merger.

If the Merger is carried out and consummated, the

Ordinary Shares of the Issuer will no longer be traded on the Nasdaq Global Market and the registration of the Ordinary Shares of the

Issuer under Section 12 of the Act is expected to be terminated. No assurance can be given that any definitive agreement will be entered

into or the Merger will be consummated. In addition, consummation of the Merger could result in one or more of the actions specified in

clauses (a)-(j) of Item 4 of Schedule 13D, including the acquisition or disposition of securities of the Issuer, a merger or other extraordinary

transaction involving the Issuer, a change to the board of directors of the Issuer (as the surviving company in the Merger), and a change

in the Issuer’s memorandum and articles of association to reflect that the Issuer would become a privately held company.

References to the Merger Agreement, Interim Investors

Agreement, Support Agreement, and the Equity Committee Letters and Limited Guarantees issued and delivered by each of Tianjin Kangyue

and CICC Healthcare Investment in this Schedule 13D do not purport to be complete and are subject to, and are qualified in their entirety

by reference to, the full text of the Merger Agreement, Interim Investors Agreement, Support Agreement, and the Equity Committee Letters

and Limited Guarantees issued and delivered by Tianjin Kangyue and CICC Healthcare Investment, copies of which are attached hereto as

Exhibits 2 to 8 incorporated herein by reference in their entirety.

Item 5. Interest in Securities of the Issuer

(a), (b) The following table sets forth the beneficial

ownership of Ordinary Shares of the Issuer by each of the Reporting Persons as of the date hereof.

| | |

| | |

| | |

Number of Ordinary Shares Beneficially Owned by Each Reporting Person with: | |

| Reporting Person | |

Amount Beneficially

Owned(1) | | |

Percent of Class(2) | | |

Sole power

to vote or direct the vote | | |

Shared power to vote or to direct the vote | | |

Sole power to dispose or to direct the disposition of | | |

Shared power to dispose or to direct the

disposition of | |

| | |

(in Ordinary Shares) | | |

| | |

| | |

| | |

| | |

| |

| CICC Listco | |

| 57,824,500 | (3),

(4) | |

| 12.6 | % | |

| 0 | | |

| 57,824,500 | | |

| 0 | | |

| 57,824,500 | |

| CICC Capital Management | |

| 57,824,500 | (3),

(4) | |

| 12.6 | % | |

| 0 | | |

| 57,824,500 | | |

| 0 | | |

| 57,824,500 | |

| CICC Kangzhi | |

| 44,165,500 | (3) | |

| 9.6 | % | |

| 0 | | |

| 44,165,500 | | |

| 0 | | |

| 44,165,500 | |

| CICC Kangrui | |

| 44,165,500 | (3) | |

| 9.6 | % | |

| 0 | | |

| 44,165,500 | | |

| 0 | | |

| 44,165,500 | |

| Tianjin Kangyue | |

| 44,165,500 | (3) | |

| 9.6 | % | |

| 0 | | |

| 44,165,500 | | |

| 0 | | |

| 44,165,500 | |

| CICC International | |

| 13,659,000 | (4) | |

| 3.0 | % | |

| 0 | | |

| 13,659,000 | | |

| 0 | | |

| 13,659,000 | |

| CICC Capital Cayman | |

| 13,659,000 | (4) | |

| 3.0 | % | |

| 0 | | |

| 13,659,000 | | |

| 0 | | |

| 13,659,000 | |

| CICC HIM | |

| 13,659,000 | (4) | |

| 3.0 | % | |

| 0 | | |

| 13,659,000 | | |

| 0 | | |

| 13,659,000 | |

| CICC Healthcare Investment | |

| 13,659,000 | (4) | |

| 3.0 | % | |

| 0 | | |

| 13,659,000 | | |

| 0 | | |

| 13,659,000 | |

| (1) | Beneficial ownership is determined in accordance with Rule 13d-3 of the General Rules and Regulations under the Act, as amended. |

| (2) | Percentage is calculated based on the total number of 457,743,530 Ordinary Shares issued and outstanding as of March 31, 2023 as disclosed

in the annual report on Form 20-F filed with the SEC by the Issuer on May 12, 2023. |

| (3) | Represents 44,165,500 Ordinary Shares held of record by Tianjin Kangyue. |

| (4) | Represents 13,659,000 Ordinary Shares held of record by CICC Healthcare Investment. |

CUSIP No. 37186H100

The investment and voting decisions with respect

to the Ordinary Shares held by Tianjin Kangyue are made by CICC Kangzhi through an investment committee of CICC Kangrui, currently consisting

of four individuals, three of whom are employed by CICC Capital Management. CICC Kangrui is a limited partner of Tianjin Kangyue, of which

the general partner is CICC Kangzhi. CICC Kangzhi is also a general partner of Tianjin Kangyue and is controlled by CICC Capital Management

through contractual arrangements.

The general partner of CICC Healthcare Investment

is CICC HIM, which is in turn controlled by CICC Capital Cayman. The investment and voting decisions with respect to the Ordinary Shares

held by CICC Healthcare Investment are made by an investment committee of CICC HIM, currently consisting of four individuals, all employed

by CICC Capital Management, three of whom are the same individuals that serve on the investment committee of CICC Kangrui described above.

CICC Listco holds 100% of CICC Capital Management

and CICC International, which in turn holds 100% of CICC Capital Cayman.

CICC Kangzhi and CICC Kangrui may be deemed to

beneficially own the Ordinary Shares held by Tianjin Kangyue.

Each of CICC Listco, CICC International, CICC Capital

Cayman and CICC HIM may be deemed to beneficially own the Ordinary Shares held by CICC Healthcare Investment.

Each of CICC Listco and CICC Capital Management

may be deemed to beneficially own the Ordinary Shares held by Tianjin Kangyue and CICC Healthcare Investment.

Because of the arrangements in the Interim Investors

Agreement, the parties to that agreement may be deemed to have formed a “group” for purposes of Section 13(d)(3) of the Act.

Neither the filing of this Schedule 13D nor any of its contents, however, shall be deemed to constitute an admission by the Reporting

Persons that any of them is the beneficial owner of any of the Ordinary Shares beneficially owned by other members of the Buyer Consortium

and their respective affiliates for purposes of Section 13(d) of the Act or for any other purpose, and such beneficial ownership is expressly

disclaimed.

To the knowledge of the Reporting Persons, none

of the Related Persons beneficially owns any Ordinary Shares.

(c) To

the best of the Reporting Persons’ knowledge, except as set forth herein, there have been no transactions effected with respect

to any Ordinary Shares during the past 60 days by any of the persons named in response to Item 5(a)-(b).

(d) To

the best knowledge of the Reporting Persons, except as set forth herein, no person (other than the Reporting Persons) is known to the

Reporting Persons to have the right to receive or the power to direct the receipt of dividends from, or the proceeds from the sale of,

any securities covered by this Schedule 13D.

(e) Not

applicable.

Item 6. Contracts, Arrangements,

Understandings or Relationships with Respect to Securities of the Issuer.

The descriptions of the principal terms of the

Merger Agreement, Interim Investors Agreement, Support Agreement, Equity Committee Letters and Limited Guarantees under Item 4 are incorporated

herein by reference to this Item 6 in their entirety. Copies of the Merger Agreement, Interim Investors Agreement, Support Agreement,

and the Equity Committee Letters and Limited Guarantees issued and delivered by Tianjin Kangyue and CICC Healthcare Investment are attached

as exhibits to this Schedule 13D and incorporated herein by reference.

Except as set forth herein, none of the Reporting

Persons or Related Persons has any contracts, arrangements, understandings or relationships (legal or otherwise) with any person with

respect to any securities of the Issuer, including but not limited to any contracts, arrangements, understandings or relationships concerning

the transfer or voting of such securities, finder’s fees, joint ventures, loan or option arrangements, puts or calls, guarantees

of profits, division of profits or losses, or the giving or withholding of proxies.

CUSIP No. 37186H100

Item 7. Materials to be Filed as Exhibits.

| Exhibit Number |

|

Description |

| |

|

|

| 1 |

|

Joint Filing Agreement, dated October 20, 2023, by and among CICC Capital Management Co., Ltd., CICC Kangzhi (Ningbo) Equity Investment Management Co., Ltd., CICC Kangrui (No.1) Ningbo Equity Investment Fund Partnership (Limited Partnership), Tianjin Kangyue Business Management Partnership (Limited Partnership), CICC Capital (Cayman) Limited, CICC Healthcare Investment Management Limited and CICC Healthcare Investment Fund, L.P. |

| |

|

|

| 2 |

|

Agreement and Plan of Merger dated October 11, 2023 by and among Genetron Holdings Limited as the Issuer, New Genetron Holding Limited as Parent and Genetron New Co Limited as Merger Sub (incorporated by reference to Exhibit 99.2 to Form 6-K furnished to the SEC by the Issuer on October 11, 2023) |

| |

|

|

| 3 |

|

Interim Investors Agreement dated October 11, 2023 by and among Tianjin Kangyue Business Management Partnership (Limited Partnership), CICC Healthcare Investment Fund, L.P., and other Consortium Members named therein, New Genetron Holding Limited as Parent and Genetron New Co Limited Merger Sub |

| |

|

|

| 4 |

|

Rollover and Support Agreement dated October 11, 2023 by and among Tianjin Kangyue Business Management Partnership (Limited Partnership), CICC Healthcare Investment Fund, L.P., the other Rollover Shareholders named therein and New Genetron Holding Limited as Parent |

| |

|

|

| 5 |

|

Equity Commitment Letter dated October 11, 2023 between Tianjin Kangyue Business Management Partnership (Limited Partnership) and New Genetron Holding Limited |

| |

|

|

| 6 |

|

Equity Commitment Letter dated October 11, 2023 between CICC Healthcare Investment Fund, L.P. and New Genetron Holding Limited |

| |

|

|

| 7 |

|

Limited Guarantee dated October 11, 2023 issued and delivered by Tianjin Kangyue Business Management Partnership (Limited Partnership) |

| |

|

|

| 8 |

|

Limited Guarantee dated October 11, 2023 issued and delivered by CICC Healthcare Investment Fund, L.P. |

SIGNATURES

After reasonable inquiry and to the best of my

knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Dated: October 20, 2023

| |

CHINA INTERNATIONAL CAPITAL

CORPORATION LIMITED |

| |

|

| |

By: |

/seal/ China International Capital Corporation Limited |

| |

|

|

| |

|

/s/ Zhaohui Huang |

| |

|

Name: |

Zhaohui Huang |

| |

|

Title: |

President |

| |

|

| |

CICC CAPITAL MANAGEMENT CO., LTD. |

| |

|

| |

By: |

/seal/ CICC Capital Management Co., Ltd. |

| |

|

|

| |

|

/s/ Junbao Shan |

| |

|

Name: |

Junbao Shan |

| |

|

Title: |

Chairman of Board of Directors |

| |

|

| |

CICC KANGZHI (NINGBO) EQUITY

INVESTMENT MANAGEMENT CO., LTD. |

| |

|

| |

By: |

/seal/ CICC Kangzhi (Ningbo) Equity Investment Management Co., Ltd. |

| |

|

|

| |

|

/s/ Xia Wu |

| |

|

Name: |

Xia Wu |

| |

|

Title: |

Director |

| |

|

| |

CICC KANGRUI (NO.1) NINGBO EQUITY INVESTMENT FUND PARTNERSHIP

(LIMITED PARTNERSHIP) |

| |

|

| |

By: |

CICC Kangzhi (Ningbo) Equity Investment Management Co., Ltd., its general partner |

| |

|

|

| |

By: |

/seal/ CICC Kangzhi (Ningbo) Equity Investment Management Co., Ltd. |

| |

|

|

| |

|

/s/ Xia Wu |

| |

|

Name: |

Xia Wu |

| |

|

Title: |

Director |

[Signature Page to Schedule

13D – Genetron Holdings Limited]

| |

TIANJIN KANGYUE BUSINESS MANAGEMENT PARTNERSHIP (LIMITED PARTNERSHIP) |

| |

|

| |

By: |

CICC Kangzhi (Ningbo) Equity Investment Management Co., Ltd., its general partner |

| |

|

| |

By: |

/seal/ CICC Kangzhi (Ningbo) Equity Investment Management Co., Ltd. |

| |

|

|

| |

|

/s/ Xia Wu |

| |

|

Name: |

Xia Wu |

| |

|

Title: |

Director |

| |

|

| |

CHINA INTERNATIONAL CAPITAL CORPORATION (INTERNATIONAL) LIMITED |

| |

|

| |

By: |

/seal/ China International Capital Corporation (International) Limited |

| |

|

| |

|

/s/ Wing Fai Joseph Wong |

| |

|

Name: |

Wing Fai Joseph Wong |

| |

|

Title: |

Authorized Signatory |

| |

|

| |

CICC CAPITAL (CAYMAN) LIMITED |

| |

|

| |

By: |

/s/ Junbao Shan |

| |

|

Name: |

Junbao Shan |

| |

|

Title: |

Director |

| |

|

| |

CICC HEALTHCARE INVESTMENT MANAGEMENT LIMITED |

| |

|

| |

By: |

/s/ Xia Wu |

| |

|

Name: |

Xia Wu |

| |

|

Title: |

Director |

| |

|

| |

CICC HEALTHCARE INVESTMENT FUND, L.P., |

| |

acting through its general partner, CICC Healthcare Investment Management Limited |

| |

|

| |

By: |

/s/ Xia Wu |

| |

|

Name: |

Xia Wu |

| |

|

Title: |

Director of CICC Healthcare Investment Management Limited |

[Signature Page to Schedule

13D – Genetron Holdings Limited]

SCHEDULE

A

DIRECTORS

AND EXECUTIVE OFFICERS

In

this Schedule A, “CICC Listco” refers to China International Capital Corporation Limited, “CICC Capital Management”

refers to CICC Capital Management Co., Ltd.; “CICC Kangzhi” refers to CICC Kangzhi (Ningbo) Equity Investment Management

Co., Ltd.; “CICC International” refers to China International Capital Corporation (International) Limited; “CICC Capital

Cayman” refers to CICC Capital (Cayman) Limited; and “CICC HIM” refers to CICC Healthcare Investment Management Limited.

Directors

and Officers of CICC Listco

The

table below sets forth the name and present principal occupation or employment of each director and executive officer of CICC Listco.

Unless otherwise indicated below, the business address of each such person is 27th and 28th Floor, China World Office 2, 1 Jianguomenwai

Avenue, Chaoyang District, Beijing, People’s Republic of China (“PRC”), and each such person is a citizen of the PRC.

The business address of Zhaohui Huang, Jiaxing Zhou and Kui Ma is 29th Floor, One International Finance Centre, No.1 Harbour View Street,

Central, Hong Kong. Zhaohui Huang and Kong Ping Albert Ng are citizens of Hong Kong Special Administrative Region (“SAR”),

PRC. Peter Hugh Nolan is a citizen of United Kingdom. Gang Chu is a citizen of United States of America.

| Name |

|

Present

Principal Occupation or Employment |

| Directors: |

|

|

| Rujun Shen |

|

Chairman of the Board of Directors and Non-executive

Director of CICC Listco |

| Zhaohui Huang |

|

Executive Director and President of CICC Listco |

| Lixia Tan |

|

Non-executive Director of CICC Listco |

| Wenwu Duan |

|

Non-executive Director of CICC Listco |

| Wei Zhang |

|

Non-executive Director of CICC Listco |

| Lingyan Kong |

|

Non-executive Director of CICC Listco, Director of

CICC Capital Management |

| Yu Zhou |

|

Independent Non-executive Director of CICC Listco |

| Kong Ping Albert Ng |

|

Independent Non-executive Director of CICC Listco |

| Zhengfei Lu |

|

Independent Non-executive Director of CICC Listco |

| Peter Hugh Nolan |

|

Independent Non-executive Director of CICC Listco |

| |

|

|

| Executive Officers: |

|

|

| Zhaohui Huang |

|

Executive Director and President of CICC Listco |

| Gang Chu |

|

Chief Operating Officer of CICC Listco; Director of

CICC Capital Management; Director of CICC International |

| Bo Wu |

|

Chief Financial Officer of CICC Listco; Director of

CICC International |

| Long Cheng |

|

Chief Information Officer of CICC Listco |

| Jiaxing Zhou |

|

Chief Compliance Officer of CICC Listco |

| Fengwei Zhang |

|

Chief Risk Officer of CICC Listco |

| Kui Ma |

|

Financial Controller of CICC Listco; Director of CICC

Capital Management; Director of CICC International |

Directors

and Executive Officers of CICC Capital Management

The

table below sets forth the name and present principal occupation or employment of each director and executive officer of CICC Capital

Management. The business address of Lingyan Kong, Gang Chu, Kai Luo and Jing Zhou is 27th and 28th Floor, China World Office 2, 1 Jianguomenwai

Avenue, Chaoyang District, Beijing, PRC. The business address of Junbao Shan and Liang Long is 25th Floor and 26th Floor, China World

Tower B, No.1 Jian Guo Men Wai Avenue, Beijing 100004, PRC. The business address of Kui Ma is 29th Floor, One International Finance Centre,

No.1 Harbour View Street, Central, Hong Kong. Unless otherwise indicated below, each such person is a citizen of the PRC. Gang Chu is

a citizen of United States of America.

| Name |

|

Present

Principal Occupation or Employment |

| Directors: |

|

|

| Lingyan Kong |

|

Director of CICC Capital

Management, Non-executive Director of CICC Listco |

| Junbao Shan |

|

Director and Chairman of

Board of Directors of CICC Capital Management; Director of CICC Capital Cayman |

| Kui Ma |

|

Director of CICC Capital

Management; Director of CICC International; Financial Controller of CICC Listco |

| Gang Chu |

|

Director of CICC Capital

Management; Chief Operating Officer of CICC Listco; Director of CICC International |

| Liang Long |

|

Director and Manager of

CICC Capital Management |

| |

|

|

| Executive Officers: |

|

|

| Junbao Shan |

|

Director and Chairman of Board of Directors of CICC

Capital Management; Director of CICC Capital Cayman |

| Kai Luo |

|

Finance Director of CICC

Capital Management |

| Jing Zhou |

|

Head of Compliance and

Risk Control of CICC Capital Management |

Directors

and Executive Officers of CICC Kangzhi

The

table below sets forth the name and present principal occupation or employment of the director of CICC Kangzhi. CICC Kangzhi does not

have any executive officers. The business address of Xia Wu is 25th Floor and 26th Floor, China World Tower B, No.1 Jian Guo Men Wai

Avenue, Beijing 100004, PRC. Xia Wu is a citizen of PRC.

| Name |

|

Present

Principal Occupation or Employment |

| Director: |

|

|

| Xia Wu |

|

Director of CICC Kangzhi; Director of CICC HIM |

| |

|

|

| Executive Officer: |

|

|

| N/A |

|

|

Directors

and Executive Officers of CICC International

The

table below sets forth the name and present principal occupation or employment of each director of CICC International. CICC International

does not have any executive officers. Unless otherwise indicated below, the business address of each such person is 29th Floor, One International

Finance Centre, No.1 Harbour View Street, Central, Hong Kong, and each such person is a citizen of the PRC. The business address of Xinhan

Xia is 25th Floor, 125 Old Broad Street, London EC2N 1AR, United Kingdom. The business address of Gang Chu, Qingchuan Liu, Bo Wu and

Nan Sun is 27th and 28th Floor, China World Office 2, 1 Jianguomenwai Avenue, Chaoyang District, Beijing, PRC. Xinhan Xia is a citizen

of the United Kingdom. Gang Chu is a citizen of United State of America. King Fung Wong is a citizen of Hong Kong SAR, PRC and the United

Kingdom.

| Name |

|

Present

Principal Occupation or Employment |

| Directors: |

|

|

| Xinhan Xia |

|

Director of CICC International |

| Kui Ma |

|

Director of CICC International; Director of CICC Capital

Management; Financial Controller of China CICC Listco |

| Gang Chu |

|

Director of CICC International; Chief Operating Officer

of CICC Listco; Director of CICC Capital Management |

| King Fung Wong |

|

Director of CICC International; Director of CICC Capital

Cayman |

| Qingchuan Liu |

|

Director of CICC International |

| Bo Wu |

|

Director of CICC International; Chief Financial Officer

of CICC Listco |

| Nan Sun |

|

Director of CICC International |

| Hanfeng Wang |

|

Director of CICC International |

| |

|

|

| Executive Officer: |

|

|

| N/A |

|

|

Directors

and Executive Officers of CICC Capital Cayman

The

table below sets forth the name and present principal occupation or employment of each director of CICC Capital Cayman. CICC Capital

Cayman does not have any executive officers. The business address of Soon Wei Stephen Ng is 6 Battery Road, #33-01, Singapore 049909.

The business address of King Fung Wong is 29th Floor, One International Finance Centre, No.1 Harbour View Street, Central, Hong Kong.

The business address of Junbao Shan is 25th Floor and 26th Floor, China World Tower B, No.1 Jian Guo Men Wai Avenue, Beijing 100004,

PRC. Soon Wei Stephen Ng is a citizen of Singapore. King Fung Wong is a citizen of Hong Kong SAR, PRC and the United Kingdom. Junbao

Shan is a citizen of PRC.

| Name |

|

Present

Principal Occupation or Employment |

| Directors: |

|

|

| Soon Wei Stephen Ng |

|

Director

of CICC Capital Cayman |

| King Fung Wong |

|

Director

of CICC Capital Cayman; Director of CICC International |

| Junbao Shan |

|

Director

of CICC Capital Cayman; Director and Chairman of Board of Directors of CICC Capital Management |

| |

|

|

| Executive Officer: |

|

|

| N/A |

|

|

Directors

and Executive Officers of CICC HIM

The

table below sets forth the name and present principal occupation or employment of each director of CICC HIM. CICC HIM does not have any

executive officers. The business address of Xia Wu is 25th Floor and 26th Floor, China World Tower B, No.1 Jian Guo Men Wai Avenue, Beijing

100004, PRC. The business address of Jin Wang is 29th Floor, One International Finance Centre, No.1 Harbour View Street, Central, Hong

Kong. The business address of Ho Man Vienna Lit is 6 Battery Road, #33-01, Singapore 049909. Xia Wu is a citizen of PRC. Jin Wang is

a citizen of Hong Kong SAR, PRC. Ho Man Vienna Lit is a citizen of Hong Kong SAR, PRC.

| Name |

|

Present

Principal Occupation or Employment |

| Directors: |

|

|

| Xia Wu |

|

Director of CICC HIM; Director of CICC Kangzhi |

| Jin Wang |

|

Director of CICC HIM |

| Ho Man Vienna Lit |

|

Director of CICC HIM |

| |

|

|

| Executive Officer: |

|

|

| N/A |

|

|

Schedule A-3

Exhibit 1

Joint

Filing Agreement

In

accordance with Rule 13d-1(k)(1) under the Securities Exchange Act of 1934, as amended, each of the undersigned parties hereby agree

to file jointly the statement on Schedule 13D (including any amendments thereto) with respect to the Ordinary Shares, par value $0.00002

per share, of Genetron Holdings Limited, an exempted company incorporated under the laws of the Cayman Islands.

It

is understood and agreed that each of the parties hereto is responsible for the timely filing of such statement on Schedule 13D and any

amendments thereto, and for the completeness and accuracy of the information concerning such party contained therein, but such party

is not responsible for the completeness and accuracy of information concerning another party making the filing unless such party knows

or has reason to believe that such information is inaccurate. It is understood and agreed that a copy of this agreement shall be attached

as an exhibit to the statement on Schedule 13D, and any amendments thereto, filed on behalf of the parties hereto.

This

Agreement may be executed in any number of counterparts, each of which shall be deemed to be an original, but all of which taken together

shall constitute one and the same instrument.

[Signature

page follows]

Date: October

20, 2023

| |

CHINA INTERNATIONAL CAPITAL

CORPORATION LIMITED |

| |

|

| |

By: |

/seal/ China International Capital

Corporation Limited |

| |

|

|

| |

|

/s/

Zhaohui Huang |

| |

|

Name: |

Zhaohui Huang |

| |

|

Title: |

President |

| |

CICC CAPITAL MANAGEMENT CO., LTD. |

| |

|

| |

By: |

/seal/ CICC Capital Management Co., Ltd. |

| |

|

|

| |

|

/s/

Junbao Shan |

| |

|

Name: |

Junbao Shan |

| |

|

Title: |

Chairman of Board of Directors |

| |

CICC KANGZHI (NINGBO) EQUITY INVESTMENT MANAGEMENT CO.,

LTD. |

| |

|

| |

By: |

/seal/ CICC Kangzhi (Ningbo) Equity Investment

Management Co., Ltd. |

| |

|

|

| |

|

/s/

Xia Wu |

| |

|

Name: |

Xia Wu |

| |

|

Title: |

Director |

| |

CICC KANGRUI (NO.1) NINGBO EQUITY INVESTMENT FUND PARTNERSHIP

(LIMITED PARTNERSHIP) |

| |

|

| |

By: |

CICC Kangzhi (Ningbo) Equity Investment

Management Co., Ltd., its general partner |

| |

By: |

/seal/ CICC Kangzhi (Ningbo) Equity Investment

Management Co., Ltd. |

| |

|

|

| |

|

/s/

Xia Wu |

| |

|

Name: |

Xia Wu |

| |

|

Title: |

Director |

[Signature

Page to Joint Filing Agreement to Schedule 13D – Genetron Holdings Limited]

| |

TIANJIN KANGYUE BUSINESS MANAGEMENT PARTNERSHIP (LIMITED

PARTNERSHIP) |

| |

|

|

|

| |

By: |

CICC Kangzhi (Ningbo) Equity Investment Management Co.,

Ltd., its general partner |

| |

|

|

| |

By: |

/seal/ CICC Kangzhi (Ningbo) Equity Investment

Management Co., Ltd. |

| |

|

|

| |

|

/s/

Xia Wu |

| |

|

Name: |

Xia Wu |

| |

|

Title: |

Director |

| |

CHINA INTERNATIONAL CAPITAL CORPORATION

(INTERNATIONAL) LIMITED |

| |

|

|

|

| |

By: |

/seal/ China International Capital Corporation

(International) Limited |

| |

|

|

|

| |

|

/s/

Wing Fai Joseph Wong |

| |

|

Name: |

Wing Fai Joseph Wong |

| |

|

Title: |

Authorized Signatory |

| |

|

|

|

| |

CICC CAPITAL (CAYMAN) LIMITED |

| |

|

|

|

| |

By: |

/s/

Junbao Shan |

| |

|

Name: |

Junbao Shan |

| |

|

Title: |

Director |

| |

|

|

|

| |

By: |

/s/

King Fung Wong |

| |

|

Name: |

King Fung Wong |

| |

|

Title: |

Director |

| |

|

|

|

| |

|

|

|

| |

CICC HEALTHCARE INVESTMENT MANAGEMENT

LIMITED |

| |

|

|

|

| |

By: |

/s/

Xia Wu |

| |

|

Name: |

Xia Wu |

| |

|

Title: |

Director |

| |

|

|

|

| |

|

/s/

Jin Wang |

| |

|

Name: |

Jin Wang |

| |

|

Title: |

Director |

[Signature

Page to Joint Filing Agreement to Schedule 13D – Genetron Holdings Limited]

| |

CICC HEALTHCARE INVESTMENT FUND, L.P., |

| |

acting through its general partner, CICC Healthcare Investment

Management Limited |

| |

|

| |

By: |

/s/

Xia Wu |

| |

|

Name: |

Xia Wu |

| |

|

Title: |

Director of CICC Healthcare Investment Management Limited |

| |

|

|

|

| |

|

/s/

Jin Wang |

| |

|

Name: |

Jin Wang |

| |

|

Title: |

Director of CICC Healthcare Investment Management

Limited |

[Signature

Page to Joint Filing Agreement to Schedule 13D – Genetron Holdings Limited]

Exhibit 3

Execution Version

INTERIM INVESTOR AGREEMENT

This Interim Investor Agreement (the “Agreement”)

is made as of October 11, 2023 by and among Mr. Sizhen Wang (the “Founder”), Tianjin Kangyue Business Management Partnership

(Limited Partnership) (“Tianjin Kangyue”), CICC Healthcare Investment Fund, L.P. (“CICC Healthcare,”

and together with Tianjin Kangyue, collectively, “CICC”), Surrich International Company Limited (“Wuxi Capital”),

Wuxi Huihongyingkang Investment Partnership (Limited Partnership) (“Wuxi Huishan”), CCB (Beijing) Investment Fund Management

Co., Ltd. (“CCB”) and Wealth Strategy Holding Limited (“Wealth Strategy”, together with CICC, Wuxi

Capital, Wuxi Huishan and CCB, collectively, “Investor Members”), New Genetron Holding Limited, an exempted company

incorporated with limited liability under the laws of the Cayman Islands (“Parent”) and Genetron New Co Limited, an

exempted company incorporated with limited liability under the laws of the Cayman Islands (“Merger Sub”). The Founder

and the Investor Members shall be collectively referred to hereinafter as the “Consortium” and individually as a “Consortium

Member.” Capitalized terms used herein but not otherwise defined shall have the meanings given to them in the Merger Agreement

(as defined below).

RECITALS

WHEREAS, on the date hereof, Genetron Holdings

Limited (the “Company”), Parent, and Merger Sub, have executed an Agreement and Plan of Merger (the “Merger

Agreement”), pursuant to which Merger Sub will be merged with and into the Company (the “Merger”), with the

Company continuing as the surviving corporation.

WHEREAS, concurrently with the execution and delivery

of the Merger Agreement, the Rollover Shareholders (including certain Consortium Members and/or their respective Affiliates) have executed

a Support Agreement in favor of Parent, pursuant to which each Rollover Shareholder agrees to, among other obligations, (i) cancel all

of their rollover shares as defined therein (the “Rollover Shares” of such Rollover Shareholder) for no cash consideration

in the Merger, (ii) subscribe for newly issued ordinary shares of Parent immediately prior to the Closing (the transactions described

in (i) and (ii), the “Equity Rollover” of such Rollover Shareholder) and (iii) vote in favor of approval of the Merger

Agreement, the Plan of Merger and the Transactions, in each case in accordance with the terms of the Support Agreement. The number of

the Rollover Shares of each Consortium Member is set out against its name in column (B) of Schedule 1 hereto.

WHEREAS, on the date hereof, certain Consortium

Members, namely Tianjin Kangyue, CICC Healthcare, Wuxi Capital, Wuxi Huishan, CCB and Wealth Strategy have executed equity commitment

letters in favor of Parent (the “Equity Commitment Letters”), pursuant to which each such Consortium Member or its

Affiliate agrees, subject to the terms and conditions set forth therein, to make an equity investment in Parent (the “Equity

Commitment” of such Consortium Member) immediately prior to the Closing in connection with the Transactions. The amount of the

Equity Commitment of each Consortium Member is set out against its name in column (C) of Schedule 1 hereto.

WHEREAS, on the date hereof, each of Tianjin Kangyue,

CICC Healthcare, Wuxi Capital, Wuxi Huishan, CCB and Wealth Strategy has executed a limited guarantee (each a “Limited Guarantee”,

and collectively, the “Limited Guarantees”) in favor of the Company or a designated wholly owned Subsidiary of the

Company with respect to certain obligations of Parent under the Merger Agreement.

WHEREAS, the parties wish to agree to certain terms

and conditions that will govern the actions of the Parent and the relationship among the parties with respect to the Transactions.

NOW, THEREFORE, in consideration of the premises

and of the mutual covenants and obligations hereinafter set forth, the parties hereby agree as follows:

1.1 From

the date of this Agreement until the Closing, Parent and the Merger Sub shall not, and the Founder shall cause Parent and the Merger Sub

not to, (i) determine that the closing conditions under the Merger Agreement, any other Transaction Document and other documents in connection

therewith have been satisfied, or amend or waive any such closing condition, (ii) terminate the Merger Agreement, any other Transaction

Document and other documents in connection therewith, or (iii) amend or modify the Merger Agreement, any other Transaction Document and

other documents in connection therewith so as to (u) increase or modify in a manner adverse to Parent, Merger Sub or the Investor Members

the form or amount of the Merger Consideration or increase in any way the obligations under the Equity Commitment Letters, (v) modify

or waive, in a manner adverse to Parent, Merger Sub or the Investor Members, any provisions relating to the Parent Termination Fee or

the aggregate cap on monetary damages recoverable by the Company, or otherwise increase the scope or amount of potential liability of

Parent, Merger Sub or the Investor Members, (w) materially modify the structure of the Transactions, (x) extend the Long Stop Date, (y)

modify treatment of the Company’s equity awards specified in Section 2.02 of the Merger Agreement, or (z) modify or grant any waiver

or consent with respect to any matter set forth in Sections 5.01(b), 5.01(j)(iv), 5.01(j)(v) and 5.01(t) (only to the extent relating

to the matters described in Sections 5.01(b), 5.01(j)(iv) or 5.01(j)(v)) of the Merger Agreement, or (iv) modify the Merger Agreement,

or grant any consent with respect to or waiver of any provision of the Merger Agreement in a manner that has a material and adverse impact

on any Investor Member that is disproportionate to the impact on the other Consortium Members, in each case of (i) through (iii), without

the prior written consent of each Investor Member, and in the case of (iv), without the prior written consent of the materially and adversely

impacted Investor Member, in each case subject to Section 6.2.

1.2 From

the date hereof until the Closing, except with the prior written consent of each Investor Member or as specifically required

by any of the Transaction Documents, the Founder, Parent and Merger Sub shall not issue (in the Founder’s case cause to be issued),

transfer or encumber (or take any action to attempt to transfer or encumber) any or all of the Equity Securities of Parent or Merger Sub

(or any beneficial interest therein) in any way, and Parent and Merger Sub shall not, and the Founder and Parent shall procure that each

of Parent and Merger Sub shall not, (i) increase, reduce, cancel or transfer any of its registered capital, purchase or redeem any shares

or grant any convertible securities, options or warrants over any portion of its share capital; (ii) alter, amend or supplement any of

its charter documents; (iii) merge or consolidate with other Person, or participate in any other type of corporate restructuring; (iv)

acquire or dispose of, or agree to acquire or dispose of, any assets; (v) create, or agree to create, an encumbrance over any assets;

(vi) directly or indirectly, incur any debt or any liability; or (vii) guarantee or secure the obligations of any Person, in each case

subject to Section 6.2.

1.3 Parent

shall enforce the provisions of the Equity Commitment Letters in accordance with the terms of the Merger Agreement and the Equity Commitment

Letters. Each Consortium Member shall (if it has delivered an Equity Commitment Letter) and shall cause each of its Affiliates that has

delivered an Equity Commitment Letter (if any) to comply with its obligations thereunder; provided, that no party shall have an

independent right under this Agreement to enforce the Equity Commitment Letters against any Consortium Member or its Affiliates, other

than as provided in the immediately preceding sentence. Notwithstanding anything in any Equity Commitment Letter to the contrary, prior

to the Closing, none of the Consortium Members shall be entitled to assign, sell-down or syndicate any part of its Equity Commitment to

any third party (except for any assignment, sell-down or syndication of all or any part of its Equity Commitment to its Affiliates or

limited partners of it or its Affiliates (each a “Permitted Syndication”)).

1.4 Parent

shall enforce the provisions of the Support Agreement in accordance with the terms of the Merger Agreement and the Support Agreement.

Each Consortium Member shall (if it is a Rollover Shareholder) and shall cause each of its Affiliates that is a Rollover Shareholder (if

any) to comply with such Rollover Shareholder’s obligations under the Support Agreement; provided, that no party shall

have an independent right under this Agreement to enforce the Support Agreement against any Consortium Member or its Affiliates, other

than as provided in the immediately preceding sentence.

1.5 Each

Consortium Member shall be entitled to receive, in consideration for its Equity Commitment and Equity Rollover, the number of ordinary

shares of Parent with a par value of US$0.0001 per share (“Parent Shares”) as set forth against its name in column

(D) of Schedule 1 hereto, representing an ownership percentage in Parent immediately following the Transaction (the “Contemplated

Ownership Percentage” of such Consortium Member) as set forth against the name of such Consortium Member in column (E) of Schedule

1 hereto, with such number of Parent Shares and Contemplated Ownership Percentage calculated based on the proportion that (i) the sum

of (x) such Consortium Member’s Equity Commitment, and (y) the deemed value of such Consortium Member’s Rollover Shares (based

on the Per Share Merger Consideration) contributed or deemed contributed to Parent by such Consortium Member, bears to (ii) the aggregate

value contributed or deemed contributed to Parent by all shareholders (whether in the form of cash, Shares or other consideration). Parent

shall issue each Consortium Member’s Parent Shares to such Consortium Member and/or any of its Affiliates as such Consortium Member

may designate by reasonably advance written notice to Parent.

1.6 Parent

shall use its commercially reasonable efforts to provide each Consortium Member with at least five (5) Business Days prior notice of the

Closing Date under the Merger Agreement. Any notices received by Parent pursuant to Section 9.2 of the Merger Agreement shall be promptly

provided to each Consortium Member at the address set forth in such Consortium Member’s Equity Commitment Letter and/or the Support

Agreement. The Founder shall use his reasonable efforts to notify the other Consortium Member promptly of any material developments regarding

the transactions contemplated by this Agreement, the Merger Agreement and the other transactions contemplated by the Equity Commitment

Letters, Limited Guarantees and the Support Agreement.

| 2. | REPRESENTATIONS AND WARRANTIES; COVENANTS |

2.1 Each

party hereby represents and warrants to the other parties that (i) such party has the requisite power and authority to execute, deliver

and perform this Agreement, (ii) the execution, delivery and performance of this Agreement by such party have been duly authorized by

all necessary actions on the part of such party and no additional proceedings are necessary to approve this Agreement (in each case to

the extent necessary), (iii) this Agreement has been duly executed and delivered by such party and constitutes a valid and binding agreement

enforceable in accordance with the terms hereof, and (iv) such party’s execution, delivery and performance of this Agreement will

not violate (a) any provision of its organizational documents (as applicable) or any material agreement to which such party is a party

or by which such party is bound; or (b) subject to obtaining the ODI Approvals (if applicable) any order, writ, injunction, decree or

statute, or any rule or regulation, applicable to such party.

2.2 Each

of the Investor Members, on behalf of itself and its respective Affiliates, agrees to promptly provide to Parent (consistent with the

timing required by the Merger Agreement or applicable Law, as applicable) any information about such Investor Member (or its Affiliates)

that Parent reasonably determines is required to be included in (i) the Proxy Statement, (ii) the Schedule 13E-3, or (iii) any other filing

or notification with any Governmental Authority in connection with the Transactions, this Agreement, or any other agreement or arrangement

to which it (or any of its Affiliates) is a party relating to the Transactions. Each Investor Member shall reasonably cooperate with Parent

in connection with the preparation of the foregoing documents to the extent such documents relate to such Investor Member (or any of its

Affiliates), and Parent shall notify the Investor Members of the form and terms of such documents and provide the Investor Members with

reasonable time and opportunity to review and comment on such documents, which Parent shall consider in good faith. Each Investor Member

agrees to permit the Parent and the Company to publish and disclose in the Proxy Statement (including all documents filed with the SEC

in accordance therewith), its respective Affiliates’ identity and beneficial ownership, and/or ultimate controller (as applicable),

of the Shares, ADSs or other Equity Securities of the Company and the nature of such party’s commitments, arrangements and understandings

under this Agreement, or any other agreement or arrangement to which he or it (or any of its Affiliates) is a party relating to the Transactions

(including a copy thereof), to the extent required by applicable Law or the SEC (or its staff). Notwithstanding the foregoing, no Investor

Member is required to make available to the other parties any of its internal investment committee materials or analyses or any information

which it considers to be commercially sensitive information, except where disclosure of such information is specifically required by applicable

Law or the SEC (or its staff).

2.3 Each

Consortium Member hereby represents, warrants and covenants to the other Consortium Members that none of the information supplied in writing

by such Consortium Member for inclusion or incorporation by reference in the Proxy Statement or Schedule 13E-3 will cause a breach of

the representations and warranties of Parent or Merger Sub set forth in the Merger Agreement.

2.4 Each

of Parent and Merger Sub hereby represents and warrants to each of Consortium Members that it was formed solely for the purpose of engaging

in the Transactions and has not conducted any business prior to the date hereof other than those in connection with the Transactions,

and has no, and prior to the Effective Time, will have no, assets (including any equity or other interest in any Person other than Parent’s

equity interests in Merger Sub), liabilities or obligations of any nature other than those incident to its formation and capitalization

pursuant to the Merger Agreement and the Transactions. The Founder hereby represents, warrants and covenants to the other Consortium Members

that he has not, and prior to the Effective Time, will not, cause Parent or Merger Sub to take any action inconsistent with the representations

and warranties of Parent and Merger Sub in this Section 2.4.

2.5 Each

Investor Member shall use its reasonable best efforts to apply for and obtain ODI Approval if such approval is needed for its (or its

Affiliates’) performance of obligations hereunder and under the Equity Commitment Letter. Each party shall use his or its commercially

reasonable efforts (without incurring any cost by such party) to cooperate with each Investor Member in connection with such Investor

Member’s application for any ODI Approval required for its consummation of the transactions contemplated by this Agreement, the

Merger Agreement and the other agreements entered into in connection therewith.

2.6 Each

of Parent and Merger Sub has been conducting business at all times in compliance with any anti-corruption laws and anti-money laundering

laws to which Parent or Merger Sub may be subject to (as applicable). None of Parent, Merger Sub or any of its respective directors, officers,

employees, agents and other persons acting on their behalf (collectively, “Representatives”) has, directly or indirectly,

offered, authorized, promised, condoned, participated in, consummated, or received notice of any allegation of, (i) the making of any

payment or gift or any money or anything of value to any public official for the purpose of influencing any official act or decision of

such official or inducing him or her to use his or her influence to affect any act or decision of a governmental authority, in order to