false

0001823365

Generations Bancorp NY, Inc.

0001823365

2024-07-19

2024-07-19

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): July 19, 2024

GENERATIONS BANCORP NY, INC.

(Exact Name of Registrant as Specified in Charter)

| Maryland |

|

001-39883 |

|

85-3659943 |

|

(State or Other Jurisdiction

of Incorporation) |

|

(Commission File No.) |

|

(I.R.S. Employer

Identification No.) |

| |

|

|

| 20 East Bayard Street, Seneca Falls, New York |

|

13148 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant's telephone number, including area code: (315) 568-5855

Not Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

| ¨ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading symbol(s) |

Name of each exchange on which registered |

| Common Stock, Par Value $0.01 Per Share |

GBNY |

The Nasdaq Stock Market, LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company x

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

Item 1.01 Entry into a Material Definitive Agreement.

Effective as of July 19, 2024, Generations Bank

(the “Bank”), the wholly owned subsidiary of Generations Bancorp NY, Inc., entered into a written agreement (the “Agreement”)

with the Office of the Comptroller of the Currency (the “OCC”), the Bank’s primary regulator. The Agreement provides,

among other things, that the Bank and/or its Board of Directors:

| · | Establish a Compliance Committee to monitor and oversee the Bank’s compliance with the provisions of the Agreement, and to submit

written progress reports to the Board that must be transmitted to the OCC; |

| · | Prepare a written board oversight and corporate governance program to provide for the overall direction, oversight, and corporate

governance of the Bank; |

| · | Prepare a written strategic plan for the Bank covering at least a three-year period, and to submit evaluations of the Bank’s

performance against the Strategic Plan to the Board and to the OCC; |

| · | Develop a written liquidity risk management program for the Bank, to include, among other things, a contingency funding plan; and |

| · | Develop a written interest rate risk management program for the Bank, to include risk management systems to identify, measure, monitor,

and control interest rate risk. |

The foregoing description of the Agreement is qualified

in its entirety by reference to the Agreement which is attached hereto as Exhibit 10.1 and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto

duly authorized.

| |

GENERATIONS BANCORP NY, INC. |

| |

|

| |

|

| DATE: July 22, 2024 |

By: |

/s/ Angela M. Krezmer |

| |

|

Angela M. Krezmer |

|

|

Chief Executive Officer |

Exhibit 10.1

AGREEMENT BY AND BETWEEN

Generations Bank

Seneca Falls, New York

The Office of the

Comptroller of the Currency

Generations Bank, Seneca Falls, New York (“Bank”)

and the Office of the Comptroller of the Currency (“OCC”) wish to assure the safety and soundness of the Bank and its compliance

with laws and regulations.

The Comptroller of the Currency (“Comptroller”)

has found unsafe or unsound practices, including those relating to board oversight; strategic planning; liquidity risk management; and

interest rate risk management.

Therefore, the OCC, through the duly authorized

representative of the Comptroller, and the Bank, through its duly elected and acting Board of Directors (“Board”), hereby

agree that the Bank shall operate at all times in compliance with the following:

ARTICLE I

JURISDICTION

(1) The

Bank is an “insured depository institution” as that term is defined in 12 U.S.C. § 1813(c)(2).

(2) The

Bank is a Federal savings association within the meaning of 12 U.S.C. § 1813(q)(1)(C), and is chartered and examined by the OCC.

See 12 U.S.C. §§ 1461 et seq., 5412(b)(2)(B).

(3) The

OCC is the “appropriate Federal banking agency” as that term is defined in 12 U.S.C. § 1813(q).

ARTICLE II

COMPLIANCE COMMITTEE

(1) Within

fifteen (15) days of the date of this Agreement, the Board shall appoint a Compliance Committee of at least three (3) members of

which a majority shall be directors who are not employees, officers, or controlling shareholders of the Bank or any of its subsidiaries

or affiliates, or family members of any such person. The Board shall submit in writing to the Assistant Deputy Comptroller the names

of the members of the Compliance Committee within ten (10) days of their appointment. In the event of a change of the Compliance

Committee’s membership, the Board shall submit in writing to the Assistant Deputy Comptroller within ten (10) days the name

of any new or resigning committee member. The Compliance Committee shall monitor and oversee the Bank’s compliance with the provisions

of this Agreement. The Compliance Committee shall meet at least quarterly and maintain minutes of its meetings.

(2) Within

thirty (30) days of the date of this Agreement, and thereafter within thirty (30) days after the end

of each quarter, the Compliance Committee shall submit to the Board a written progress report setting forth in detail:

| (a) | a description of the corrective actions needed to achieve compliance with each Article of this Agreement; |

| (b) | the specific corrective actions undertaken to comply with each Article of this Agreement; and |

| (c) | the results and status of the corrective actions. |

(3) Upon

receiving each written progress report, the Board shall forward a copy of the report, with any additional comments by the Board, to the

Assistant Deputy Comptroller within ten (10) days of the first Board meeting following the Board’s receipt of such report.

ARTICLE III

BOARD OVERSIGHT AND CORPORATE GOVERNANCE

(1) Within

ninety (90) days of the date of this Agreement, the Bank shall submit to the Assistant Deputy Comptroller for review and prior written

determination of no supervisory objection an acceptable written program to provide the overall direction, oversight, and corporate governance

of the Bank (“Board Oversight and Corporate Governance Program”).

(2) The

Board Oversight and Corporate Governance Program shall, at a minimum, include:

| (a) | periodic Board review and approval of the Bank’s risk appetite and risk limits; |

| (b) | Board-established strategic goals and objectives supported by analysis and projections with requirements for periodic review and revision

as needed or directed in writing by the Assistant Deputy Comptroller; |

| (c) | procedures to monitor management’s implementation of Board-established goals and objectives; |

| (d) | the retention of, at all times, a qualified Chief Executive Officer and senior management team, including

President and Chief Financial Officer. |

| (e) | proper lines of authority, reporting responsibilities, and delegation of duties for all officers; |

| (f) | procedures to ensure the Bank complies with the requirements of 12 C.F.R. § 5.51 for changes in directors and senior executive

officers, if applicable, as well as the restrictions in 12 C.F.R. part 359 for golden parachute payments, if applicable, and indemnification

payments; |

| (g) | procedures to ensure the Board receives and reviews sufficient Bank information from management (including scope, frequency and content)

on the operation of the Bank to enable it to provide proper oversight and fulfill its fiduciary duties and other responsibilities under

the law; |

| (h) | procedures to ensure the Board monitors the Bank’s operations and performance; |

| (i) | procedures to ensure the Bank maintains adequate internal controls and assigned accountability to monitor and hold management accountable

for adherence to Bank policies and procedures; and |

| (j) | procedures for the Board to periodically evaluate the size, composition, expertise, and independence of the Board, as well as individual

Board member participation and contributions, with additions or other changes to the Board, as appropriate. |

Refer to the “Corporate and Risk Governance” booklet of

the Comptroller’s Handbook; and OCC Bulletin 2020-97, “Corporate and Risk Governance: Revised and New Publications

in the Director’s Toolkit,” (Nov. 2020).

(3) Within thirty (30) days following

receipt of the Assistant Deputy Comptroller’s written determination of no supervisory objection to the Board Oversight and

Corporate Governance Program or to any subsequent amendment to the Board Oversight and Corporate Governance Program, the Board shall

immediately adopt, implement and thereafter monitor adherence to the Board Oversight and Corporate Governance Program. The Board

shall review the effectiveness of the Board Oversight and Corporate Governance Program at least annually, no later than

January 31 each year, and more frequently if necessary or if required by the OCC in writing, and amend the Board Oversight and

Corporate Governance Program as needed or directed by the OCC. Any amendment to the Board Oversight and Corporate Governance Program

must be submitted to the Assistant Deputy Comptroller for review and prior written determination of no supervisory objection.

ARTICLE IV

STRATEGIC PLAN

(1) Within one-hundred twenty (120) days of

the date of this Agreement, the Board shall submit to the Assistant Deputy Comptroller for review and prior written determination of no

supervisory objection an acceptable written strategic plan for the Bank, covering at least a three-year period (“Strategic Plan”).

The Strategic Plan shall establish objectives for the Bank’s overall risk profile, earnings performance, growth, balance sheet mix,

off-balance sheet activities, liability structure, capital and liquidity adequacy, and product line development, and market segments that

the Bank intends to promote or develop, together with strategies to achieve those objectives, and shall, at a minimum, include:

| (a) | a mission statement that forms the framework for the establishment of strategic goals and objectives; |

| (b) | the strategic goals and objectives to be accomplished, including key financial indicators, risk tolerances,

and realistic strategies to improve the overall condition of the Bank; |

| (c) | a risk profile that evaluates credit, interest rate, liquidity, price, operational, compliance, strategic, and reputation risks in

relationship to capital; |

| (d) | an assessment of the Bank’s strengths, weaknesses, opportunities and threats that impact its strategic

goals and objectives; |

| (e) | an evaluation of the Bank’s internal operations, staffing requirements, board and management information systems, policies,

and procedures for their adequacy and contribution to the accomplishment of the strategic goals and objectives developed under paragraph

(1)(b) of this Article; |

| (f) | a management employment and succession plan designed to promote adequate staffing and continuity of capable

management; |

| (g) | a realistic and comprehensive budget that corresponds to the Strategic Plan’s goals and objectives; |

| (h) | an action plan to improve and sustain the Bank’s earnings and accomplish identified strategic goals

and objectives; |

| (i) | a financial forecast to include projections for significant balance sheet and income statement accounts and desired financial ratios

over the period covered by the Strategic Plan; |

| (j) | a detailed description and assessment of major capital expenditures required to achieve the goals and

objectives of the Strategic Plan; |

| (k) | an identification and prioritization of initiatives and opportunities, including timeframes that comply with the requirements of this

Agreement; |

| (l) | an identification and assessment of the present and planned product lines (assets and liabilities) and

the identification of appropriate risk management systems to identify, measure, monitor, and control

risks within the product lines; |

| (m) | concentration limits commensurate with the Bank’s strategic goals and objectives and risk profile; |

| (n) | assigned roles, responsibilities, and accountability for the strategic planning process; and |

| (o) | a description of systems and metrics designed to monitor the Bank’s progress in meeting the Strategic

Plan’s goals and objectives. |

(2) If

the Strategic Plan under paragraph (1) of this Article includes a proposed sale or merger of the Bank, the Strategic Plan shall,

at a minimum, address the steps that shall be taken and the associated timeline to affect the implementation of that alternative.

(3) Within

thirty (30) days following the Board’s receipt of the Assistant Deputy Comptroller’s written determination of no supervisory

objection to the Strategic Plan or to any subsequent update or amendment to the Strategic Plan, the Board shall adopt and Bank management,

subject to Board review and ongoing monitoring, shall immediately implement and thereafter ensure adherence to the Strategic Plan. The

Board shall review the effectiveness of the Strategic Plan and update the Strategic Plan at least annually, but no later than January 31

of each year, and more frequently if necessary or if required by the OCC in writing. The Board shall amend the Strategic Plan as needed

or directed by the OCC. Any update or amendment to the Strategic Plan must be submitted to the Assistant Deputy Comptroller for review

and prior written determination of no supervisory objection.

(4) Until

the Strategic Plan required under this Article has been submitted by the Bank for the Assistant Deputy Comptroller’s

review, has received a written determination of no supervisory objection from the Assistant Deputy Comptroller, and has been adopted

by the Board, the Bank shall not significantly deviate from the products, services, asset composition and size, funding sources,

structure, operations, policies, procedures, and markets of the Bank that existed immediately before the effective date of this

Agreement without first obtaining the Assistant Deputy Comptroller’s prior written determination of no supervisory objection

to such significant deviation.

(5) The

Bank may not initiate any action that significantly deviates from a Strategic Plan (that has received written determination of no supervisory

objection from the Assistant Deputy Comptroller and has been adopted by the Board) without a prior written determination of no supervisory

objection from the Assistant Deputy Comptroller.

(6) Any

request by the Bank for prior written determination of no supervisory objection to a significant deviation described in paragraphs (4) or

(5) of this Article shall be submitted in writing to the Assistant Deputy Comptroller at least thirty (30) days in advance of

the proposed significant deviation. Such written request by the Bank shall include an assessment of the effects of such proposed change

on the Bank’s condition and risk profile, including a profitability analysis and an evaluation of the adequacy of the Bank’s

organizational structure, staffing, management information systems, internal controls, and written policies and procedures to identify,

measure, monitor, and control the risks associated with the proposed change.

(7) For

the purposes of this Article, changes that may constitute a significant deviation include, but are not limited to, a change in the

Bank’s markets, marketing strategies, products and services, marketing partners, underwriting practices and standards, credit

administration, account management, collection strategies or operations, fee structure or pricing, accounting processes and

practices, asset composition and size, or funding strategy, any of which, alone or in the aggregate, may have a material

effect on the Bank’s operations or financial performance; or any other changes in personnel, operations, or external factors

that may have a material effect on the Bank’s operations or financial performance.

(8) Within

thirty (30) days after the end of each quarter, a written evaluation of the Bank’s performance against the Strategic Plan

shall be prepared by Bank management and submitted to the Board. Within fifteen (15) days after submission of the evaluation, the

Board shall review the evaluation and determine the corrective actions the Board will require Bank management to take to address any

identified shortcomings. The Board’s review of the evaluation and discussion of any required corrective actions to address any

identified shortcomings shall be documented in the Board’s meeting minutes. Upon completion of the Board’s review, the

Board shall submit to the Assistant Deputy Comptroller a copy of the evaluation as well as a detailed description of the corrective

actions the Board will require the Bank to take to address any identified shortcomings.

ARTICLE V

LIQUIDITY RISK MANAGEMENT

(1) Within

ninety (90) days of the date of this Agreement, the Board shall submit to the Assistant Deputy Comptroller for review and prior

written determination of no supervisory objection an acceptable written Liquidity Risk Management Program (“Liquidity

Program”) for the Bank. The Liquidity Program shall provide for the identification, measurement, monitoring, and control of

the Bank’s liquidity risk exposure, and shall emphasize the importance of cash flow projections, diversified funding sources,

a cushion of highly liquid assets, robust liquidity stress testing scenario analyses, and a formal, well-developed contingency

funding plan as primary tools for measuring and managing liquidity risk. Refer to the “Interagency Policy Statement on Funding

and Liquidity Risk Management,” dated March 22, 2010, (OCC Bulletin 2010-13); the “Addendum to the Interagency

Policy Statement on Funding and Liquidity Risk Management: Importance of Contingency Funding Plans,” dated July 28,

2023, and the “Liquidity” booklet of the Comptroller’s Handbook, for guidance.

| (2) | In addition to the general requirements set forth above, the Bank’s Liquidity Program shall, at

a minimum: |

| (a) | provide specific assigned accountability for development, execution and oversight of liquidity risk management,

including oversight by both the Board and senior management; |

| (b) | include appropriate policies and procedures for identifying, measuring, monitoring, and controlling liquidity risk exposures, that

includes at a minimum: |

| (i) | assignment of accountability and processes for monitoring and managing intraday liquidity; |

| (ii) | procedures to ensure that sufficient funds or access to funds exist to meet such cash flow needs under both expected and adverse conditions,

including an adequate cushion to meet any unanticipated cash flow needs; and |

| (iii) | procedures and reporting to assess the risks related to deposit runoff, rollovers, wholesale, and alternative

funding sources; |

| (c) | identify appropriate funding strategies and provide limits to manage and control liquidity risk that are commensurate with the Bank’s

complexity and business activities that considers internal and external factors that

could affect the Bank’s liquidity, that include at a minimum: |

| (i) | limits or triggers placed on projected net cash flow positions over specified timeframes under both expected and adverse business

conditions that are based on realistic assumptions supported by sound historical economic data; |

| (ii) | limits or triggers on funding mismatches and guidelines for minimum and maximum average maturity of the Bank’s assets and liabilities

(by category); |

| (iii) | minimum levels of highly liquid assets; |

| (iv) | minimum levels of committed and collateralized contingent funding sources to meet funding needs in both expected and adverse conditions,

which are periodically tested to verify availability and operational capabilities; |

| (v) | limits or triggers on the structure of short-term and long-term funding of the Bank’s asset base, under both normal and stressed

conditions; |

| (vi) | limitations on funding concentrations and other strategies to ensure diversification of funding sources;

and |

| (vii) | limitations on contingent liabilities in aggregate and by individual category; |

| (d) | provide adequate risk measurement and monitoring systems, including processes and reporting to assess, on an ongoing basis, the Bank’s

current and projected funding needs, including the development of cash flow projections under both expected and adverse conditions, and

considering the changes in depositor behavior, interest rates and capital levels; |

| (e) | detailed identification of sources of liquidity to meet projected shortfalls from existing sources under

both expected and adverse conditions; and |

| (f) | include a Contingency Funding Plan that incorporates, at a minimum: |

| (i) | the identification of plausible stress events relating to internal and external events or circumstances, including systemic or market

events, that could lead to a Bank liquidity crisis; |

| (ii) | determinations of how each identified stress event will affect the Bank’s ability to obtain funding

needs under different levels of severity; |

| (iii) | a quantitative projection and evaluation of expected funding needs and funding capacity based on realistic assessments of the behaviors

of funding providers during stress events; and |

| (iv) | provision for management processes, reporting, and internal as well as external communication throughout

the stress event. |

(3) Within

thirty (30) days following receipt of the Assistant Deputy Comptroller’s written determination of no supervisory objection to

the Liquidity Program, the Board shall adopt and Bank management, subject to Board review and ongoing monitoring, shall immediately

implement and adhere to the Liquidity Program and any amendments or revisions thereto.

(4) The

Board shall review the effectiveness of the Liquidity Program at least annually but no later than January 31 of each year, and more

frequently if necessary or if required by the OCC in writing and amend the Liquidity Program as needed or directed by the Assistant Deputy

Comptroller in writing. The Bank shall submit the revised Liquidity Program to the Assistant Deputy Comptroller for prior written determination

of no supervisory objection. At the next Board meeting following receipt of the Assistant Deputy Comptroller’s written determination

of no supervisory objection, the Board shall adopt and Bank management, subject to Board review and ongoing monitoring, shall immediately

implement and adhere to the revised Liquidity Program and any amendments or revisions thereto.

ARTICLE VI

INTEREST RATE RISK MANAGEMENT

(1) Within

ninety (90) days of the date of this Agreement, the Bank shall submit to the Assistant Deputy Comptroller for review and prior written

determination of no supervisory objection an acceptable written Interest Rate Risk Management Program (“IRR Program”). Refer

to the “Interest Rate Risk,” booklet of the Comptroller’s Handbook; OCC Bulletin 2010-1, “Interagency

Advisory on Interest Rate Risk Management,” (Jan. 2010); OCC Bulletin 2012-5, “Interest Rate Risk Management: FAQs on

2010 Interagency Advisory on Interest Rate Risk Management,” (Jan. 2012); and “Model Risk Management,” booklet

of the Comptroller’s Handbook.

| (2) | The IRR Program shall include risk management systems to identify, measure, monitor, and control interest rate risk (“IRR”), to include

at a minimum: |

| (a) | the establishment of formal policies, procedures, and governance commensurate with the Bank’s complexity and business activities,

to include: |

| (i) | the establishment of IRR appetite and risk management objectives with specific approved and prohibited strategies for managing IRR; |

| (ii) | determinations of how the Bank will measure the quality of IRR management; and |

| (iii) | procedures to monitor, escalate, and address any breaches of established IRR limits; |

| (b) | accurate and timely risk identification which identify and quantify the major sources and types of IRR; |

| (c) | the establishment of risk monitoring processes to provide sufficient information on which to base sound IRR management decisions from

both an earnings and economic perspective with recognition and consideration of all risks (repricing, basis, yield-curve, and options),

to include: |

| (i) | limits or triggers on IRR exposures that consider the Bank’s risk appetite, complexity of operations, earnings performance,

liquidity position, and capital adequacy; and |

| (ii) | IRR reporting standards and procedures that specify the frequency and types of reports senior management

and the Board will use to monitor the Bank’s IRR that address: |

| a. | the level and trends of aggregate Bank IRR exposure; |

| b. | whether management’s strategies are within the Bank’s established risk appetite and policy; |

| c. | the sensitivity of any key assumptions; |

| d. | whether the Bank holds sufficient capital for its level of IRR; and |

| e. | whether management’s major interest rate strategies balance risk with reward, including at a minimum, an evaluation of a potential

adverse rate movement against the potential rewards of a favorable rate movement; |

| (d) | requirements for retention of qualified personnel with sufficient authority and responsibility to manage and monitor IRR, which may

include additional training or the addition of qualified staff; |

| (e) | the establishment of controls over the impact of changes in interest rates on liquid asset valuations, including but not limited to,

thresholds or triggers in asset valuation declines with specific action(s) to be taken by the Bank to ensure it maintains sufficient

access to asset-based and liability-based liquidity to meet funding needs in both expected and adverse conditions, to include at a minimum,

rapidly rising interest rate scenarios; |

| (f) | adequate and documented support for the reasonableness of assumptions used in the Bank’s IRR model; |

| (g) | periodic review and adjustment, when there are material changes to the Bank’s balance sheet and otherwise,

as needed, of the assumptions and inputs used in the Bank’s IRR model, that includes

sensitivity analysis and model stress testing, with appropriate documentation and governance that requires approval for changes; |

| (h) | procedures to test the Bank’s IRR model to compare, reconcile, and report actual performance to

simulated results; |

| (i) | procedures that require the Board to review and discuss, on at least a quarterly basis, the model test

results required by this Article; and |

| (j) | an annual review of the Bank’s adherence to the IRR Program. |

(3) Within

thirty (30) days following receipt of the Assistant Deputy Comptroller’s written determination of no supervisory objection to the

IRR Program or to any subsequent amendment to the IRR Program, the Board shall adopt and Bank management, subject to Board review and

ongoing monitoring, shall immediately implement and thereafter ensure adherence to the IRR Program. The Board shall review the effectiveness

of the IRR Program at least annually, but no later than January 31 of each year, and more frequently if necessary or if required

by the OCC in writing, and amend the IRR Program as needed or directed by the OCC. Any amendment to the IRR Program must be submitted

to the Assistant Deputy Comptroller for review and prior written determination of no supervisory objection.

ARTICLE VII

GENERAL BOARD RESPONSIBILITIES

(1) The

Board shall ensure that the Bank has timely adopted and implemented all corrective actions required by this Agreement and shall

verify that the Bank adheres to the corrective actions and they are effective in addressing the Bank’s deficiencies that

resulted in this Agreement.

(2) In each instance in which this Agreement

imposes responsibilities upon the Board, it is intended to mean that the Board shall:

| (a) | authorize, direct, and adopt corrective actions on behalf of the Bank as may be necessary to perform the obligations and undertakings

imposed on the Board by this Agreement; |

| (b) | ensure that the Bank has sufficient processes, management, personnel, control systems, and corporate and

risk governance to implement and adhere to all provisions of this Agreement; |

| (c) | require that Bank management and personnel have sufficient training and authority to execute their duties and responsibilities pertaining

to or resulting from this Agreement; |

| (d) | hold Bank management and personnel accountable for executing their duties and responsibilities pertaining to or resulting from this

Agreement; |

| (e) | require appropriate, adequate, and timely reporting to the Board by Bank management of corrective actions directed by the Board to

be taken under the terms of this Agreement; and |

| (f) | address any noncompliance with corrective actions in a timely and appropriate manner. |

ARTICLE VIII

OTHER PROVISIONS

(1) As a result of this Agreement, pursuant

to 12 C.F.R. § 5.51(c)(7)(ii), the Bank is in “troubled condition,” and is not an “eligible savings association”

for purposes of 12 C.F.R. § 5.3, unless otherwise informed in writing by the OCC.

ARTICLE IX

CLOSING

(1) This

Agreement is intended to be, and shall be construed to be, a “written agreement” within the meaning of 12 U.S.C. § 1818,

and expressly does not form, and may not be construed to form, a contract binding on the United States, the OCC, or any officer, employee,

or agent of the OCC. Notwithstanding the absence of mutuality of obligation, or of consideration, or of a contract, the OCC may enforce

any of the commitments or obligations herein undertaken by the Bank under its supervisory powers, including 12 U.S.C. § 1818(b)(1),

and not as a matter of contract law. The Bank expressly acknowledges that neither the Bank nor the OCC has any intention to enter into

a contract. The Bank also expressly acknowledges that no officer, employee, or agent of the OCC has statutory or other authority to bind

the United States, the U.S. Treasury Department, the OCC, or any other federal bank regulatory agency or entity, or any officer, employee,

or agent of any of those entities to a contract affecting the OCC’s exercise of its supervisory responsibilities.

(2) This

Agreement is effective upon its issuance by the OCC, through the Comptroller’s duly authorized representative. Except as

otherwise expressly provided herein, all references to “days” in this Agreement shall mean calendar days and the

computation of any period of time imposed by this Agreement shall not include the date of the act or event that commences the period

of time.

(3) The

provisions of this Agreement shall remain effective and enforceable except to the extent that, and until such time as, such

provisions are amended, suspended, waived, or terminated in writing by the OCC, through the Comptroller’s duly authorized

representative. If the Bank seeks an extension, amendment, suspension, waiver, or termination of any provision of this Agreement,

the Board or a Board-designee shall submit a written request to the Assistant Deputy Comptroller asking for the desired relief. Any

request submitted pursuant to this paragraph shall include a statement setting forth in detail the special circumstances that

warrant the desired relief or prevent the Bank from complying with the relevant provision(s) of the Agreement and shall be

accompanied by relevant supporting documentation. The OCC’s decision concerning a request submitted pursuant to this

paragraph, which will be communicated to the Board in writing, is final and not subject to further review.

(4) The

Bank will not be deemed to be in compliance with this Agreement until it has adopted, implemented, and adhered to all of the corrective

actions set forth in each Article of this Agreement; the corrective actions are effective in addressing the Bank’s deficiencies;

and the OCC has verified and validated the corrective actions. An assessment of the effectiveness of the corrective actions requires sufficient

passage of time to demonstrate the sustained effectiveness of the corrective actions.

(5) Each

citation, issuance, or guidance referenced in this Agreement includes any subsequent citation, issuance, or guidance that replaces, supersedes,

amends, or revises the referenced cited citation, issuance, or guidance.

(6) No

separate promise or inducement of any kind has been made by the OCC, or by its officers, employees, or agents, to cause or induce the

Bank to enter into this Agreement.

(7) All

reports, plans, or programs submitted to the OCC pursuant to this Agreement shall be forwarded, via email, to the following:

Assistant Deputy Comptroller at occsyr@occ.treas.gov

(8) The terms of this Agreement, including

this paragraph, are not subject to amendment or modification by any extraneous expression, prior agreements, or prior arrangements between

the parties, whether oral or written.

IN TESTIMONY WHEREOF, the undersigned, authorized by the Comptroller

as his duly authorized representative, has hereunto set his signature on behalf of the Comptroller.

| /s/ Jesse A. Anderson |

|

| Jesse

A. Anderson |

|

| Assistant

Deputy Comptroller |

|

| Syracuse

Office |

|

IN TESTIMONY WHEREOF, the undersigned, as the duly elected and acting

Board of Directors of Generations Bank have hereunto set their signatures on behalf of the Bank.

| /s/ Jose A. Acevedo |

|

July 19, 2024 |

| Jose A. Acevedo |

|

Date |

| |

|

|

| /s/ Cynthia S. Aikman |

|

July 15, 2024 |

| Cynthia S. Aikman |

|

Date |

| |

|

|

| /s/ James E. Gardner |

|

July 19, 2024 |

| James E. Gardner |

|

Date |

| |

|

|

| /s/ Bradford M. Jones |

|

July 19, 2024 |

| Bradford M. Jones |

|

Date |

| |

|

|

| /s/ Angela M. Krezmer |

|

July 19, 2024 |

| Angela M. Krezmer |

|

Date |

| |

|

|

| /s/ Gerald Macaluso |

|

July 19, 2024 |

| Gerald Macaluso |

|

Date |

| |

|

|

| /s/ Frank J. Nicchi |

|

July 19, 2024 |

| Frank J. Nicchi |

|

Date |

| |

|

|

| /s/ Alicia

H. Pender |

|

July 19, 2024 |

| Alicia

H. Pender |

|

Date |

| |

|

|

| /s/ Vincent P. Sinicropi |

|

July 19, 2024 |

| Vincent

P. Sinicropi |

|

Date |

v3.24.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

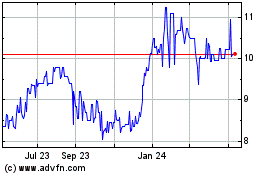

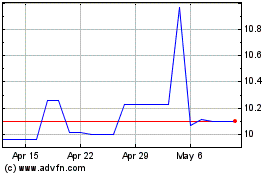

Generations Bancorp NY (NASDAQ:GBNY)

Historical Stock Chart

From Nov 2024 to Dec 2024

Generations Bancorp NY (NASDAQ:GBNY)

Historical Stock Chart

From Dec 2023 to Dec 2024