false

0001559998

0001559998

2024-08-16

2024-08-16

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report:

August

16, 2024

Gaucho

Group Holdings, Inc.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-40075 |

|

52-2158952 |

State

of

Incorporation |

|

Commission

File

Number |

|

IRS

Employer

Identification

No. |

112

NE 41st Street, Suite 106

Miami,

FL 33137

Address

of principal executive offices

212-739-7700

Telephone

number, including Area code

Former

name or former address if changed since last report

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| |

☐ |

Written communication pursuant

to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

|

| |

☐ |

Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

|

| |

☐ |

Pre-commencement communication

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

|

| |

☐ |

Pre-commencement communication

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405)

or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common Stock |

|

VINO |

|

The Nasdaq Stock Market

LLC |

Item

8.01 Other Events

On

August 16, 2024, the Company gave an update to its stockholders. The full text of the update and the full text of the article referenced

therein are furnished hereto as Exhibits 99.1 and 99.2, respectively, and incorporated herein by reference.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized, on the 16th day of August 2024.

| |

Gaucho Group Holdings, Inc. |

| |

|

|

| |

By: |

/s/ Scott

L. Mathis |

| |

|

Scott L. Mathis, President & CEO |

Exhibit 99.1

Exhibit

99.2

Argentina

Could Lead Global Returns in 5 Years, According to Explorador Capital

Andrew

Cummins, founder of Explorador Capital, stated in an interview with Bloomberg Línea that the country’s bonds and stocks

could stand out on a global scale

Argentina

Could Lead Global Returns in 5 Years, According to Explorador Capital

By

Francisco Aldaya

August

15, 2024 | 05:00 AM

Buenos

Aires — Explorador Capital Management, an investment fund focused on Latin America since 1997, sees a promising future for Argentine

assets under Javier Milei’s presidency. Founder Andrew Cummins, a veteran investor with deep roots in the region, says the reduction

in the size of government could unlock the country’s human and economic potential. What’s more, if current economic policy

changes continue and are successfully upheld, Argentina could become one of the best performing markets globally in the next five years.

His

fund has a particular interest in Argentina, which accounts for a quarter of the US$300 million deployed across the region over the last

decade. Explorador has invested in stocks and bonds as well as private opportunities, betting on a region it sees as key to future global

growth. Its director’s connection to Latin America dates back to his days as a student in Chile.

“I

believe that in the next 60 to 90 days, we will receive a signal based on the results of the tax amnesty, the outcomes of the conversations

happening with the IMF, and the results related to the agricultural sector’s liquidation. As we get indications of success on these

three fronts, I believe the removal of capital controls becomes inevitable. Therefore, even before they are lifted, we will increase

our position in Argentina.”

Andrew

Cummins, Explorador Capital

Cummins

says that reducing public spending in Argentina will be crucial to continue attracting investments, while the “Bases”

omnibus reform Law, the Incentive Regime for Large Investments (RIGI), and an eventual lifting of capital controls would facilitate a

considerable inflow of capital from abroad.

The

investor also expressed his support regarding of an initiative for investment projects that the government doesn’t approve or reject

within 45 days to be deemed automatically approved, a component of the “Bases” law. This would be very important in

speeding up approvals, which will encourage new investments, Cummins stated.

PUBLICIDAD

Argentina

is on the threshold of significant change, provided that the necessary political support is maintained, he added.

Despite

short-term challenges, such as dollar-denominated debt obligations in 2025 and limited central bank liquidity, Explorador Capital remains

optimistic.

Explorador

is confident that if Argentina can secure dollar accumulation and reduce country risk, local assets could offer very attractive returns.

Among the sectors with the greatest potential are energy, agriculture, and financial services.

PUBLICIDAD

The

following interview was edited for length and clarity.

¿Cuál

ha sido tu experiencia invirtiendo en Argentina y de qué se trata Explorador Capital?

Explorador

Capital is an investment management firm that focuses exclusively on Latin America. I founded the firm in 1997 and since then I have

been investing full time and exclusively in South America and Mexico. We do this primarily in the equity markets, but from time to time

we also invest in private companies or other special situations that are not in the listed markets. My connection to the region began

when I was an exchange student in Chile for a year in high school, and after graduating from college and business school in the US, I

worked for a firm in Washington D.C. called Ashmore EMM. At the time, it was just called Emerging Markets Management, founded by Antoine

Van Actemael, who coined the term ‘Emerging Markets’ in 1983 to highlight the growing and emerging importance of developing

countries. I brought together my interest in investment, entrepreneurship and Latin America to form Explorador. We have an office in

Buenos Aires and I travel regularly between the US and Latin America.

Many

of the emerging markets desks at the big US banks were developed by Argentines in the early 1990s. I assume you remember some of them.

Yes,

we have dealt with them at Morgan Stanley, J.P. Morgan, Deutsche Bank, Santander, with the research and investment teams and with the

trading desks of many of those firms over the last two and a half decades.

What

does the success of these Argentines in global markets tell you, while Argentina itself has slowly degraded?

I

think it speaks to the crowding out effect of the private sector and its development when you have a government that is too big. My original

interest in Latin America came from seeing the significant poverty and wondering why some countries prosper and others do not. And one

of the observations is that no low-income country with a lot of poverty has become a high-income country without government spending

below 30% of GDP. And when you look at some of the relatively successful cases in Latin America, particularly in the Andean region, led

by Chile, government spending is 22-30% of GDP. In Argentina, to come back to your question, we saw that government spending went up

to around 45%. And I think we are in the midst of a painful process of transition to reduce the size of government spending to a level

that is appropriate for those of us who want to see Argentina’s human potential unlocked.

PUBLICIDAD

Part

of your focus is on Argentina.

A

very significant part.

What

do you see here in 2024. What has changed, and how lasting can those changes be?

Nobody

has a crystal ball. I am very optimistic about the prospects for Argentina, because the size of government is being reduced. And with

that, we will see the unlocking of human potential. When things are going well in a country, pundits like to attribute it to a supposed

cultural superiority. And the reverse is also true, when things are not going well, critics like to blame it on some cultural weakness.

I believe neither is true. Human beings, when they have a government of the right size, with a balanced budget, low inflation, free trade,

and proper regulations, can prosper. And they attract investment. And people organise themselves into businesses to figure out how to

meet the needs of other people in the economy. The beginnings, or the foundations of that process, are being put in place in Argentina.

I say we don’t have a crystal ball because we have to see in a democratic environment whether the support for this process will

be sustained. I am optimistic that it can be sustained, but it is a challenging change to implement. There are two approaches, gradualism

or shock therapy, that any country faces when it wants to implement significant change. And there are powerful arguments for both approaches,

and it depends on the circumstances. I think when you have the mandate and the tools, shock therapy is the ideal approach, because you

don’t know when they’re going to take away your support, so you need to get things done while you can. There’s a saying

in US politics that political capital, if it’s not spent, evaporates. And so when you’re given political capital, you need

to spend it the right way, quickly. I think that’s something that’s happening in Argentina. So I’m very hopeful about

the outcome, mainly for the Argentine people.

You

mentioned several of the points that Donald Trump and Elon Musk touched on in their conversation on Monday. How relevant is this international

attention for Argentina today?

It

can definitely move the needle and attract interest in the changes that are happening in Argentina, because part of being an investor

and part of starting a business is taking advantage of opportunities that other people are not seeing, and taking advantage of them in

advance. Some investors can move faster and others take longer. The more short-term investors are on the traders’ desks, then you

have those in the mid-term equity market, and then those who invest in private companies, where, because it’s harder to exit the

investment because it’s unlisted, you need to be more cautious and do more work to make sure that the changes you see are sustainable.

But I definitely think that in a world where governments are expanding. The idea that the voters of Argentina voted to make the kinds

of changes that this administration is implementing is definitely attracting a lot of interest and promises a lot. As we have been saying,

it needs to be sustained and there is a clear framework that needs to be implemented.

PUBLICIDAD

Argentina’s

country risk dropped as low as 1,000 basis points, but is now close to 1,600. The main problem that’s been pointed out is a concern

about Argentina’s ability to pay its debt in 2025. The government has been talking about repo agreements to guarantee those payments.

What’s your take on that situation?

Argentina

has short-term debt obligations, and even if you are taking the right steps towards medium and long-term prosperity, you still have to

meet short-term commitments. The Central Bank’s net reserves are down to -4 to -5 billion dollars. So the question is, will those

payments be made next year or will they need to be rescheduled? For that you need hard currency. My expectation is that hard currency

can come from three sources: farm export liquidation, the blanqueo and a possible renegotiation of the IMF agreement, possibly releasing

between US$6-9 billion. If the dollars arrive, the expectation will be that Argentina will meet its obligations. It will become a self-fulfilling

prophecy that the country risk premium will fall. And that would give it the opportunity to roll over its debt by issuing new debt. Argentina

needs to bring its sovereign credit spread over US Treasuries below 1,000 points. Actually, under Milei it only touched the 1,150 range,

not 1,000. He needs to bring it down to the 600-800 range to issue new debt over a longer period of time. That would give the country

time for the effects of deregulation and the stabilisation of a balanced budget to take effect and foment investment and economic growth.

What

has Explorador done in this scenario? Have you increased your position over the last year, or are you taking a wait and see approach?

We

increased our position last year, under the assumption that asset prices were very asymmetric in terms of their expected return, which

meant that markets had completely lost confidence. The sovereign credit spread we have been talking about reached 2,600 basis points.

Prices reflected that outcome and the expectation that Argentina’s voters would choose change, one way or another, through one

candidate or another, was quite high. So we saw an upside opportunity in asset prices. When we look at what are the drivers of returns

measured in dollars, it is improvements in the discount rate for assets, devaluation or appreciation of real exchange rates and earnings

growth. Over the past year, we have benefited from the appreciation in real terms of the currency in the floating exchange rate known

as the CCL, or parallel financial market. We have also seen the country risk premium come down from 2,600 basis points to current levels

of around 1,500. And then, we have seen the odds of corporate earnings growth over the next 10 to 15 years increase with the expectation

that Argentines will vote for more responsible macroeconomic policies. That will create a better framework for companies to generate

earnings and those assets should increase in value.

And

in which assets specifically do you still see significant upside potential over the next year or two?

Assuming

that dollars enter the BCRA and the government from the sources I mentioned, then conditions will be created to remove capital controls,

which will stimulate more fixed investment both domestically and from abroad. That will lead to economic growth and a rise in living

standards. That scenario, which is not guaranteed, we believe is likely, with the government taking the right steps and going in the

right direction. The energy, agriculture, consumer, construction and financial services sectors will benefit. The transition in the execution

of public works projects, plus this year’s painful recession, has meant that companies such as cement producer Loma Negra have

lagged behind, while financial services companies, such as banks, have performed very well over the past year. That said, banks and financial

services companies, although they have performed well, offer very significant growth potential in a win-win scenario for Argentina, because

they are leveraged 8 to 1 and over time they can be leveraged 10 to 1, 12 to 1. Their ability to grow without diluting shareholders as

much as an industrial company is quite high. Banks should be one of the main beneficiaries. When you look at credit penetration in Argentina,

it’s a single digit percentage of GDP, whereas in neighbouring countries including Brazil, it’s closer to 50-80% of GDP.

What

about companies in the energy sector and do you see more room for growth for companies like Pampa, Vista and YPF?

Definitely.

In percentage terms, they might struggle to keep up with the banks if Argentina’s macroeconomic outlook is very, very successful.

But the growth potential in terms of output and income is very, very high. Argentina is moving from being a net importer of energy, facing

shortages at times, to becoming a very significant supplier of energy to its regional neighbours and the world. And the returns there

will be very attractive. And arguably, on a risk-adjusted basis, they could be even more attractive than banks, because leverage in banks

can play both ways. Whereas it is quite likely that, under a broader range of political and economic scenarios for Argentina, energy

producers will do quite well.

PUBLICIDAD

What

would be the main driver or trigger for you to increase this position? The removal of capital and foreign exchange controls?

The

removal of capital controls is something that, as investors, we need to see the signs that the conditions are being created for that

to happen. I think it is happening. And I think in the next 60 to 90 days, we’re going to get that signal depending on the results

of the tax amnesty to repatriate capital, the results of the talks that are happening with the IMF and the results in relation to the

winding down of the agricultural sector. As we get indications of success on those three fronts, I think the removal of capital controls

becomes a foregone conclusion. And therefore, even before they are removed, we will increase our position in Argentina.

There

are left-wing governments in the other three main Latin American economies: Colombia, Brazil, Mexico. What does this mean for Argentina

in terms of attracting investors’ attention?

I

guess my answer would be that it is not an either/or question. If Argentina does the job it needs to do and is able to sustain the transition

period, it will attract the capital needed to grow and improve living standards for all Argentines and provide attractive returns for

investors. It is not in contrast to Brazil or Mexico, although obviously the right policies and the right policy framework are going

to stand out more, but there is room for Brazil and Mexico to be strong and do the right things for growth as well as Argentina, even

if that is not the case today, where they are moving in one direction and Argentina in another.

What

is your view on the current international market environment? Are interest rate cuts on the horizon for the Federal Reserve, but a lot

of fear of a recession next year in the US?

Mohamed

El-Erian, a leading economist who worked at the IMF, is now at Oxford University and chairman of the Gramercy fund, said he expects about

a 35% chance of a US recession. I think that translates into there being more likelihood of a soft landing rather than a hard landing

in the United States. And I think the Fed is vigilant. We are going to see interest rates start to come down and which way and how fast

they come down will depend on the data. But we are entering an environment where emerging markets are going to be more attractive than

they have been in the last five to ten years, in absolute terms and relative to the US. While AI and other technological innovations

have been a big driver for the S&P500, and we’ve seen tremendous concentration of the performance of the top seven stocks in

the S&P500, I think as that subsides, people are going to look for better performance in emerging, but really on a selective, country-by-country

basis, picking and choosing who does their homework. When you look at the expected returns for an investor measured in dollars anywhere

in the world, there are really only three drivers and the rest is noise and news. The first is, can that asset generate more cash flow?

The second is, how are we going to discount that cash flow? And the third is, how do we translate that discounted cash flow back into

US dollars, adjusted for inflation? Argentina has some of the highest discount rates in the world, and rightly so, given its recent past.

But there is a clear policy path forward that would reduce that discount rate. Discount rates are probably one of the biggest drivers

of asset prices. So I think Argentina has a strong chance of being one of the best performers globally over the next five years, if Milei

can maintain political support and implement his program.

Is

there anything we haven’t covered that you would like to mention?

Yes,

the current administration deserves credit for trying to change circumstances, economic conditions within a democracy, when many of the

reforms that have been successfully carried out in other countries have been done under authoritarian regimes. So the people of Argentina

deserve some credit for choosing to support these changes, which are not easy and are painful. Like going to the gym, it pays off over

time. And so I have my fingers crossed for the success of the changes that are happening.

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

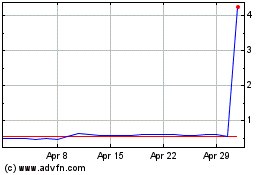

Gaucho (NASDAQ:VINO)

Historical Stock Chart

From Nov 2024 to Dec 2024

Gaucho (NASDAQ:VINO)

Historical Stock Chart

From Dec 2023 to Dec 2024