Form 8-K - Current report

September 11 2024 - 5:29PM

Edgar (US Regulatory)

0001575965FALSE00015759652022-02-252022-02-25

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): 9/11/2024

Gaming and Leisure Properties, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Pennsylvania | | 001-36124 | | 46-2116489 |

(State or Other Jurisdiction of

Incorporation or Organization) | | (Commission File Number) | | (IRS Employer Identification No.) |

845 Berkshire Blvd., Suite 200

Wyomissing, PA 19610

(Address of principal executive offices)

610-401-2900

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2 below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, par value $.01 per share | | GLPI | | Nasdaq |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01 Other Events.

As previously announced, on July 11, 2024 GLP Capital, L.P. (together with its affiliates, “GLP”), a Pennsylvania limited partnership and the operating partnership of Gaming and Leisure Properties, Inc., a Pennsylvania corporation (“GLPI”), entered into a binding term sheet with Bally’s Corporation (together with its affiliates, “Bally’s”) pursuant to which, among other matters, GLP would acquire the land under Bally’s Chicago development (“Bally’s Chicago”) from a third party and provide funding for the development of Bally’s Chicago, for aggregate overall consideration of approximately $1.585 billion.

On September 11, 2024, GLP closed on the acquisition of the land underlying Bally’s Chicago from such third party, subject to the lease in place with Bally’s, for an aggregate purchase price of $250 million, subject to customary real estate prorations and adjustments. Pursuant to the terms of the binding term sheet, GLP and Bally’s intend to enter into a new lease (the “Chicago Lease”) with a 15-year initial term, plus renewals, and initial annual base rent of $20 million, subject to annual escalations similar to those under GLP’s current master lease with Bally’s.

As previously disclosed, the binding term sheet further provides that GLP and Bally’s will enter into a development agreement pursuant to which GLP will fund construction hard costs of up to $940 million towards the development of Bally’s Chicago, with funding expected to occur through December 2026. Amounts funded by GLP under the development agreement will be added to the lease base of the Chicago Lease, with rent commencing at a rate of 8.5% as advancements are made. Upon completion of the development, GLP will own the land and substantially all of the buildings and other improvements underlying Bally’s Chicago.

Consummation of the transactions contemplated by the Chicago Lease and the development agreement are subject to satisfaction of customary conditions, including without limitation, receipt of all necessary gaming regulatory and other third-party approvals. For further details about the proposed transactions, please refer to the full text of the binding term sheet, which was attached as an exhibit to GLPI’s Current Report on Form 8-K filed with the SEC on July 11, 2024.

Forward-Looking Statements

This Current Report on Form 8-K includes “forward-looking statements” within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange, including GLPI’s expectations regarding the benefits of the foregoing transaction. Forward-looking statements can be identified by the use of forward-looking terminology such as “expects,” “believes,” “estimates,” “intends,” “may,” “will,” “should” or “anticipates” or the negative or other variation of these or similar words, or by discussions of future events, strategies or risks and uncertainties. Such forward-looking statements are inherently subject to risks, uncertainties and assumptions about GLPI and its subsidiaries, including risks related to the following: (i) GLPI’s ability to successfully consummate the announced transactions with Bally’s, including the ability of the parties to satisfy the various conditions to advancing loan proceeds, including receipt of all required approvals and consents, or other delays or impediments to completing the proposed transactions; (ii) the potential negative impact of recent high levels of inflation on our tenants’ operations; (iii) GLPI’s ability to maintain its status as a real estate investment trust (“REIT”); (iv) our ability to access capital through debt and equity markets in amounts and at rates and costs acceptable to us; (v) the impact of our substantial indebtedness on our future operations; (vi) changes in the U.S. tax law and other state, federal or local laws, whether or not specific to REITs or to the gaming or lodging industries; and (vii) other factors described in GLPI’s Annual Report on Form 10-K for the year ended December 31, 2023, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, each as filed with the Securities and Exchange Commission. GLPI undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. In light of these risks, uncertainties and assumptions, the forward-looking events discussed in this Current Report on Form 8-K may not occur as presented or at all.

| | | | | |

Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

| | |

104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| Dated: September 11, 2024 | GAMING AND LEISURE PROPERTIES, INC. |

| | |

| | |

| | By: | /s/ Desiree A. Burke |

| | Name: | Desiree A. Burke |

| | Title: | Chief Financial Officer |

v3.24.2.u1

Cover Cover

|

Feb. 25, 2022 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Sep. 11, 2024

|

| Entity Registrant Name |

Gaming and Leisure Properties, Inc.

|

| Entity Incorporation, State or Country Code |

PA

|

| Entity File Number |

001-36124

|

| Entity Tax Identification Number |

46-2116489

|

| Entity Address, Address Line One |

845 Berkshire Blvd., Suite 200

|

| Entity Address, City or Town |

Wyomissing

|

| Entity Address, State or Province |

PA

|

| Entity Address, Postal Zip Code |

19610

|

| City Area Code |

610

|

| Local Phone Number |

401-2900

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $.01 per share

|

| Trading Symbol |

GLPI

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001575965

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

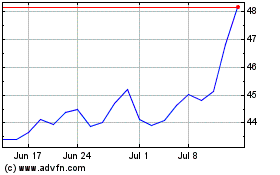

Gaming and Leisure Prope... (NASDAQ:GLPI)

Historical Stock Chart

From Nov 2024 to Dec 2024

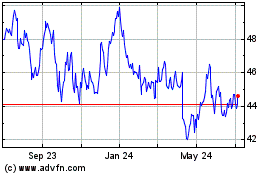

Gaming and Leisure Prope... (NASDAQ:GLPI)

Historical Stock Chart

From Dec 2023 to Dec 2024