UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of August 2023

Commission File Number: 001-38820

Futu Holdings Limited

11/F, Bangkok Bank Building

No. 18 Bonham Strand W, Sheung Wan

Hong Kong S.A.R., People’s Republic of

China

+852 2523-3588

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F x

Form 40-F ¨

Exhibit Index

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

FUTU HOLDINGS LIMITED |

| |

|

|

|

| |

By |

: |

/s/ Leaf Hua Li |

| |

Name |

: |

Leaf Hua Li |

| |

Title |

: |

Chairman of the Board of Directors and Chief Executive Officer |

Date: August 24, 2023

Exhibit 99.1

Futu Announces Second Quarter 2023 Unaudited

Financial Results

HONG KONG, August 24, 2023 (GLOBE NEWSWIRE) -- Futu

Holdings Limited (“Futu” or the “Company”) (Nasdaq: FUTU), a leading tech-driven online brokerage and wealth

management platform, today announced its unaudited financial results for the second quarter ended June 30, 2023.

Second Quarter 2023 Operational Highlights

| ● | Total

number of paying clients1

increased 14.3% year-over-year to 1,586,001 as of June 30, 2023. |

| ● | Total

number of registered clients2

increased 12.4% year-over-year to 3,395,654 as of June 30, 2023. |

| ● | Total

number of users3

increased 10.1% year-over-year to 20.5 million as of June 30, 2023. |

| ● | Total

client assets increased 7.5% year-over-year to HK$466.2 billion as of June 30, 2023. |

| ● | Daily

average client assets were HK$450.1 billion in the second quarter of 2023, an increase

of 18.3% from the same period in 2022. |

| ● | Total

trading volume in the second quarter of 2023 declined 28.7% year-over-year to HK$1.0

trillion, in which trading volume for U.S. stocks was HK$675.9 billion, trading volume for

Hong Kong stocks was HK$258.5 billion, and trading volume for stocks under the Stock Connect

was HK$22.3 billion. |

| ● | Daily

average revenue trades (DARTs)4

in the second quarter of 2023 declined 32.1% year-over-year to 389,748. |

| ● | Margin

financing and securities lending balance increased 17.6% year-over-year to HK$34.0 billion

as of June 30, 2023. |

Second Quarter 2023 Financial Highlights

| ● | Total

revenues increased 42.3% year-over-year to HK$ 2,484.9 million (US$317.1 million). |

| ● | Total gross profit

increased 37.1% year-over-year to HK$2,110.4 million (US$269.3 million). |

| ● | Net income increased

74.5% year-over-year to HK$1,119.6 million (US$142.9 million). |

| ● | Non-GAAP adjusted

net income5

increased 73.3% year-over-year to HK$1,193.4 million (US$152.3 million). |

Mr. Leaf Hua Li,

Futu’s Chairman and Chief Executive Officer, said, “In the second quarter, we added over 57 thousand paying clients, bringing

the total number of paying clients to nearly 1.6 million. The sequential acceleration in client acquisition was mostly due to robust

organic client growth. In Hong Kong, we leveraged offline marketing campaigns to build brand equity and attract clients that don’t

typically engage with online promotional events. Client acquisition in Singapore also picked up, underpinned

by strong U.S. equity market performance and attractive yields of money market funds. In the U.S., we maintained robust client

growth while meaningfully improved new client quality.”

1 The number of paying clients refers

to the number of clients with assets in their trading accounts with Futu.

2 The number of registered clients

refers to the number of users who open one or more trading accounts with Futu.

3

The number of users refers to the number of user accounts registered with Futu.

4

The number of Daily Average Revenue Trades (DARTs) refers to the number of average trades per day that generate commissions

or fees.

5

Non-GAAP adjusted net income is defined as net income excluding share-based compensation expenses.

“Total client assets increased by 7.5% year-over-year to HK$466.2

billion. Despite the negative mark-to-market impact on clients’ Hong Kong stock holdings, total asset balance was flattish quarter-over-quarter,

thanks to accelerated net asset inflow across all overseas markets. Total and average client assets in Singapore increased by 20.5% and

12.5% quarter-over-quarter, respectively. We are encouraged to see that Singapore market recorded its fourth consecutive quarter of double-digit

sequential growth in total client assets despite market volatility. Margin financing and securities lending balance declined marginally

by 1.4% sequentially as some clients unwound their securities lending positions.”

“Total trading

volume declined by 21.5% quarter-over-quarter to HK$1.0 trillion. Client’s interest in China technology names faded as they pared

back prior gains amid macro uncertainty. This led Hong Kong stock trading volume to drop by 30.5% sequentially to HK$258.5 billion. U.S.

stock trading volume was HK$675.9 billion, down 18.3% quarter-over-quarter, attributable to lower trading turnover in technology stocks

and leveraged and inverse ETFs.”

“Total client

assets in wealth management were HK$43.5 billion, up 98.8% year-over-year and 17.5% quarter-over-quarter. Money

market funds again drove the majority of this growth as their returns remained attractive amid a high interest rate environment.

In Hong Kong, we continued to expand structured product offerings by onboarding fund-linked notes and call/put spread notes to cater

to the diversified risk-return expectations of high-net-worth clients. In Singapore, an increasing proportion of paying clients invested in wealth management products, and average client assets in wealth management

more than doubled year-over-year.”

“We had 374 IPO

distribution and IR clients as of quarter end, up 35.5% year-over-year. In the past quarter, we acted as joint bookrunners of several

high-profile Hong Kong IPOs, including those of YSB Inc. and Edianyun Limited.”

Mr. Arthur Yu Chen,

Futu’s Chief Financial Officer, added, “We announced in March 2022 that our board of directors authorized a new share

repurchase program, under which we may repurchase up to US$500 million worth of our ADSs, until the end of 2023. As of June 30,

2023, we had repurchased an aggregate of 11 million ADSs with approximately US$360 million total repurchased amount in open market transactions.”

Second Quarter 2023 Financial Results

Revenues

Total revenues were

HK$2,484.9 million (US$317.1 million), an increase of 42.3% from HK$1,746.7 million in the second quarter of 2022.

Brokerage commission

and handling charge income was HK$952.6 million (US$121.6 million), a decrease of 7.9% from the second quarter of 2022. This was mainly

due to the 28.7% year-over-year decline in total trading volume, partially offset by the increase in blended

commission rate from 7.7bps to 9.9bps.

Interest income was

HK$1,405.7 million (US$179.4 million), an increase of 126.6% from the second quarter of 2022. The increase was mainly driven by higher

interest income from bank deposits and securities borrowing and lending business.

Other income was HK$126.6

million (US$16.2 million), an increase of 36.9% from the second quarter of 2022. The increase was largely due to higher fund distribution

service income.

Costs

Total costs were HK$374.5

million (US$47.8 million), an increase of 80.1% from HK$207.9 million in the second quarter of 2022.

Brokerage commission

and handling charge expenses were HK$55.3 million (US$7.1 million), a decrease of 36.6% from the second quarter of 2022. This was attributable

to lower trading volume and cost savings from our U.S. self-clearing business.

Interest expenses were

HK$220.4 million (US$28.1 million), an increase of 728.6% from the second quarter of 2022. The increase was mainly driven by higher expenses

associated with our securities borrowing and lending business.

Processing and servicing

costs were HK$98.8 million (US$12.6 million), an increase of 5.0% from the second quarter of 2022. The minor increase was primarily due

to higher system usage fee.

Gross Profit

Total gross profit was

HK$2,110.4 million (US$269.3 million), an increase of 37.1% from HK$1,538.8 million in the second quarter of 2022. Gross margin was 84.9%,

as compared to 88.1% in the second quarter of 2022.

Operating Expenses

Total operating expenses

were HK$851.8 million (US$108.7 million), an increase of 18.0% from HK$721.6 million in the second quarter of 2022.

Research and development

expenses were HK$363.3 million (US$46.4 million), an increase of 24.5% from the second quarter of 2022. This was primarily due to an

increase in research and development headcount to support infrastructure upgrade, overseas expansion and new product offerings.

Selling and marketing

expenses were HK$174.9 million (US$22.3 million), a decrease of 20.2% from the second quarter of 2022. The decrease was due to lower

customer acquisition costs.

General and administrative

expenses were HK$313.5 million (US$40.0 million), an increase of 48.7% from the second quarter of 2022. The increase was primarily due

to an increase in general and administrative personnel to support overseas expansion.

Net Income

Net income increased

by 74.5% to HK$1,119.6 million (US$142.9 million) from HK$641.7 million in the second quarter of 2022. Net income margin for the second

quarter of 2023 expanded to 45.1% from 36.7% in the year-ago quarter primarily due to strong topline growth and lower selling and marketing

expenses.

Non-GAAP adjusted net

income increased by 73.3% to HK$1,193.4 million (US$152.3 million) from the second quarter of 2022. Non-GAAP adjusted net income is defined

as net income excluding share-based compensation expenses. For further information, see "Use of Non-GAAP Financial Measures"

at the bottom of this press release.

Net Income per ADS

Basic net income per

American Depositary Share (“ADS”) was HK$8.07 (US$1.03), compared with HK$4.50 in the second quarter of 2022. Diluted net

income per ADS was HK$7.99 (US$1.02), compared with HK$4.46 in the second quarter of 2022. Each ADS represents eight Class A ordinary

shares.

Conference Call and Webcast

Futu's management will hold an earnings conference

call on Thursday, August 24, 2023, at 7:30 AM U.S. Eastern Time (7:30 PM on the same day, Beijing/Hong Kong Time).

Please note that all participants will need to

pre-register for the conference call, using the link

https://register.vevent.com/register/BIc800f9f81e9441dc89861b258b292dbd.

It will automatically lead to the registration

page of "Futu Holdings Ltd Second Quarter 2023 Earnings Conference Call", where details for RSVP are needed.

Upon registering, all participants will be provided

in confirmation emails with participant dial-in numbers and personal PINs to access the conference call. Please dial in 10 minutes prior

to the call start time using the conference access information.

Additionally, a live and archived webcast of this conference call

will be available at https://ir.futuholdings.com/.

About Futu Holdings Limited

Futu Holdings Limited (Nasdaq: FUTU) is an advanced

technology company transforming the investing experience by offering fully digitalized financial services. Through its proprietary digital

platforms, Futubull and moomoo, the Company provides a full range of investment services, including trade execution and

clearing, margin financing and securities lending, and wealth management. The Company has embedded social media tools to create a network

centered around its users and provide connectivity to users, investors, companies, analysts, media and key opinion leaders. The Company

also provides corporate services, including IPO distribution, investor relations and ESOP solution services.

Use of Non-GAAP Financial Measures

In evaluating the business, the Company considers

and uses non-GAAP adjusted net income, a non-GAAP measure, as a supplemental measure to review and assess its operating performance.

The presentation of the non-GAAP financial measure is not intended to be considered in isolation or as a substitute for the financial

information prepared and presented in accordance with U.S. GAAP. The Company defines non-GAAP adjusted net income as net income excluding

share-based compensation expenses. The Company presents the non-GAAP financial measure because it is used by the management to evaluate

the operating performance and formulate business plans. Non-GAAP adjusted net income enables the management to assess the Company's operating

results without considering the impact of share-based compensation expenses, which are non-cash charges. The Company also believes that

the use of the non-GAAP measure facilitates investors' assessment of its operating performance. Non-GAAP adjusted net income is not defined

under U.S. GAAP and is not presented in accordance with U.S. GAAP. This non-GAAP financial measure has limitations as analytical tools.

One of the key limitations of using non-GAAP adjusted net income is that it does not reflect all items of expense that affect the Company's

operations. Share-based compensation expenses have been and may continue to be incurred in the business and is not reflected in the presentation

of non-GAAP adjusted net income. Further, the non-GAAP measure may differ from the non-GAAP information used by other companies, including

peer companies, and therefore their comparability may be limited.

The Company compensates for these limitations

by reconciling the non-GAAP financial measure to the nearest U.S. GAAP performance measure, all of which should be considered when evaluating

the Company's performance.

For more information on this non-GAAP financial

measure, please see the table captioned "Unaudited Reconciliations of Non-GAAP and GAAP Results" set forth at the end of this

press release.

Exchange Rate Information

This announcement contains translations of certain

HK dollars (“HK$”) amounts into U.S. dollars ("US$") at specified rates solely for the convenience of the reader.

Unless otherwise stated, all translations from HK$ to US$ were made at the rate of HK$7.8363 to US$1.00, the noon buying rate in effect

on June 30, 2023 in the H.10 statistical release of the Federal Reserve Board. The Company makes no representation that the HK$

or US$ amounts referred could be converted into US$ or HK$, as the case may be, at any particular rate or at all.

Safe Harbor Statement

This announcement contains forward-looking statements.

These statements are made under the "safe harbor" provisions of the United States Private Securities Litigation Reform Act

of 1995. These forward-looking statements can be identified by terminology such as "will," "expects," "anticipates,"

"future," "intends," "plans," "believes," "estimates" and similar statements. Among

other things, the quotations from the management team of the Company, contain forward-looking statements. Futu may also make written

or oral forward-looking statements in its periodic reports to the SEC, in its annual report to shareholders, in press releases and other

written materials and in oral statements made by its officers, directors or employees to third parties. Statements that are not historical

facts, including statements about Futu's beliefs and expectations, are forward-looking statements. Forward-looking statements involve

inherent risks and uncertainties. A number of factors could cause actual results to differ materially from those contained in any forward-looking

statement, including but not limited to the following: Futu's goal and strategies; Futu's expansion plans; Futu's future business development,

financial condition and results of operations; Futu's expectations regarding demand for, and market acceptance of, its credit products;

Futu's expectations regarding keeping and strengthening its relationships with borrowers, institutional funding partners, merchandise

suppliers and other parties it collaborate with; general economic and business conditions; and assumptions underlying or related to any

of the foregoing. Further information regarding these and other risks is included in Futu's filings with the SEC. All information provided

in this press release and in the attachments is as of the date of this press release, and Futu does not undertake any obligation to update

any forward-looking statement, except as required under applicable law.

For investor inquiries, please contact:

Investor Relations

Futu Holdings Limited

ir@futuholdings.com

FUTU HOLDINGS LIMITED

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands, except for share and per share

data)

| | |

As of December 31, | | |

As of June 30, | |

| | |

2022 | | |

2023 | | |

2023 | |

| | |

HK$ | | |

HK$ | | |

US$ | |

| ASSETS | |

| | |

| | |

| |

| Cash and cash equivalents | |

| 5,028,898 | | |

| 3,720,180 | | |

| 474,737 | |

| Cash held on behalf of clients | |

| 50,685,472 | | |

| 52,400,919 | | |

| 6,686,947 | |

| Restricted cash | |

| 1,215 | | |

| 1,199 | | |

| 153 | |

| Term deposit | |

| 5,860 | | |

| 5,430 | | |

| 693 | |

| Short-term investments | |

| 675,064 | | |

| 1,689,124 | | |

| 215,551 | |

| Securities purchased under agreements to resell | |

| 32,000 | | |

| 38,000 | | |

| 4,849 | |

| Loans and advances - current (net of

allowance of HK$27,840 thousand and HK$37,112 thousand as of December 31, 2022 and June 30, 2023, respectively) | |

| 26,676,358 | | |

| 30,995,245 | | |

| 3,955,342 | |

| Receivables: | |

| | | |

| | | |

| | |

| Clients | |

| 513,358 | | |

| 348,606 | | |

| 44,486 | |

| Brokers | |

| 5,914,963 | | |

| 11,073,137 | | |

| 1,413,057 | |

| Clearing organizations | |

| 3,066,953 | | |

| 2,190,599 | | |

| 279,545 | |

| Fund management companies and fund distributors | |

| 79,086 | | |

| 119,942 | | |

| 15,306 | |

| Interest | |

| 254,310 | | |

| 193,971 | | |

| 24,753 | |

| Prepaid assets | |

| 28,507 | | |

| 39,133 | | |

| 4,994 | |

| Other current assets | |

| 102,258 | | |

| 98,965 | | |

| 12,629 | |

| Total current assets | |

| 93,064,302 | | |

| 102,914,450 | | |

| 13,133,042 | |

| | |

| | | |

| | | |

| | |

| Operating lease right-of-use assets | |

| 196,864 | | |

| 173,140 | | |

| 22,095 | |

| Long-term investments | |

| 239,694 | | |

| 232,979 | | |

| 29,731 | |

| Loans and advances - non-current | |

| 36,765 | | |

| 18,986 | | |

| 2,423 | |

| Other non-current assets | |

| 965,205 | | |

| 1,038,826 | | |

| 132,567 | |

| Total non-current assets | |

| 1,438,528 | | |

| 1,463,931 | | |

| 186,816 | |

| Total assets | |

| 94,502,830 | | |

| 104,378,381 | | |

| 13,319,858 | |

FUTU HOLDINGS LIMITED

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS

(Continued)

(In thousands, except for share and per share

data)

| | |

As of December 31, | | |

As of June 30, | |

| | |

2022 | | |

2023 | | |

2023 | |

| | |

HK$ | | |

HK$ | | |

US$ | |

| LIABILITIES | |

| | | |

| | | |

| | |

| Amounts due to related parties | |

| 52,725 | | |

| 55,127 | | |

| 7,035 | |

| Payables: | |

| | | |

| | | |

| | |

| Clients | |

| 57,209,066 | | |

| 55,281,990 | | |

| 7,054,604 | |

| Brokers | |

| 11,815,274 | | |

| 19,111,441 | | |

| 2,438,835 | |

| Clearing organizations | |

| 51,867 | | |

| 633,783 | | |

| 80,878 | |

| Fund management companies and fund distributors | |

| 90,801 | | |

| 193,047 | | |

| 24,635 | |

| Interest | |

| 9,864 | | |

| 35,761 | | |

| 4,564 | |

| Borrowings | |

| 2,480,532 | | |

| 4,563,875 | | |

| 582,402 | |

| Lease liabilities - current | |

| 109,416 | | |

| 93,997 | | |

| 11,995 | |

| Accrued expenses and other current liabilities | |

| 1,706,159 | | |

| 1,885,849 | | |

| 240,656 | |

| Total current liabilities | |

| 73,525,704 | | |

| 81,854,870 | | |

| 10,445,604 | |

| | |

| | | |

| | | |

| | |

| Lease liabilities - non-current | |

| 101,727 | | |

| 90,456 | | |

| 11,543 | |

| Other non-current liabilities | |

| 13,620 | | |

| 12,586 | | |

| 1,605 | |

| Total non-current liabilities | |

| 115,347 | | |

| 103,042 | | |

| 13,148 | |

| Total liabilities | |

| 73,641,051 | | |

| 81,957,912 | | |

| 10,458,752 | |

| | |

| | | |

| | | |

| | |

| SHAREHOLDERS’ EQUITY | |

| | | |

| | | |

| | |

| Class A ordinary shares | |

| 68 | | |

| 68 | | |

| 9 | |

| Class B ordinary shares | |

| 29 | | |

| 29 | | |

| 4 | |

| Additional paid-in capital | |

| 18,154,442 | | |

| 18,309,388 | | |

| 2,336,484 | |

| Treasury stock | |

| (4,324,565 | ) | |

| (5,173,786 | ) | |

| (660,233 | ) |

| Accumulated other comprehensive loss | |

| (47,846 | ) | |

| (106,286 | ) | |

| (13,563 | ) |

| Retained earnings | |

| 7,079,416 | | |

| 9,391,200 | | |

| 1,198,423 | |

| Total shareholders' equity | |

| 20,861,544 | | |

| 22,420,613 | | |

| 2,861,124 | |

| | |

| | | |

| | | |

| | |

| Non-controlling interest | |

| 235 | | |

| (144 | ) | |

| (18 | ) |

| Total equity | |

| 20,861,779 | | |

| 22,420,469 | | |

| 2,861,106 | |

| Total liabilities and equity | |

| 94,502,830 | | |

| 104,378,381 | | |

| 13,319,858 | |

FUTU HOLDINGS LIMITED

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS

OF COMPREHENSIVE INCOME

(In thousands, except for share and per share

data)

| | |

For the Three Months

Ended | | |

For the Six Months

Ended | |

| | |

June 30, 2022 | | |

June 30, 2023 | | |

June 30, 2023 | | |

June 30, 2022 | | |

June 30, 2023 | | |

June 30, 2023 | |

| | |

HK$ | | |

HK$ | | |

US$ | | |

HK$ | | |

HK$ | | |

US$ | |

| Revenues | |

| | |

| | |

| | |

| | |

| | |

| |

| Brokerage commission and

handling charge income | |

| 1,033,780 | | |

| 952,615 | | |

| 121,565 | | |

| 2,001,246 | | |

| 2,031,926 | | |

| 259,297 | |

| Interest income | |

| 620,439 | | |

| 1,405,716 | | |

| 179,385 | | |

| 1,195,661 | | |

| 2,699,976 | | |

| 344,547 | |

| Other income | |

| 92,505 | | |

| 126,557 | | |

| 16,150 | | |

| 190,821 | | |

| 252,839 | | |

| 32,265 | |

| Total revenues | |

| 1,746,724 | | |

| 2,484,888 | | |

| 317,100 | | |

| 3,387,728 | | |

| 4,984,741 | | |

| 636,109 | |

| Costs | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Brokerage commission and handling charge

expenses | |

| (87,232 | ) | |

| (55,341 | ) | |

| (7,062 | ) | |

| (183,221 | ) | |

| (127,587 | ) | |

| (16,282 | ) |

| Interest expenses | |

| (26,602 | ) | |

| (220,386 | ) | |

| (28,124 | ) | |

| (65,827 | ) | |

| (351,226 | ) | |

| (44,820 | ) |

| Processing and servicing costs | |

| (94,058 | ) | |

| (98,807 | ) | |

| (12,609 | ) | |

| (186,799 | ) | |

| (186,531 | ) | |

| (23,803 | ) |

| Total costs | |

| (207,892 | ) | |

| (374,534 | ) | |

| (47,795 | ) | |

| (435,847 | ) | |

| (665,344 | ) | |

| (84,905 | ) |

| Total gross profit | |

| 1,538,832 | | |

| 2,110,354 | | |

| 269,305 | | |

| 2,951,881 | | |

| 4,319,397 | | |

| 551,204 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Operating expenses | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Research and development expenses | |

| (291,725 | ) | |

| (363,348 | ) | |

| (46,368 | ) | |

| (574,174 | ) | |

| (718,247 | ) | |

| (91,656 | ) |

| Selling and marketing expenses | |

| (219,090 | ) | |

| (174,925 | ) | |

| (22,322 | ) | |

| (507,235 | ) | |

| (316,203 | ) | |

| (40,351 | ) |

| General and administrative expenses | |

| (210,790 | ) | |

| (313,518 | ) | |

| (40,008 | ) | |

| (388,532 | ) | |

| (621,411 | ) | |

| (79,299 | ) |

| Total operating expenses | |

| (721,605 | ) | |

| (851,791 | ) | |

| (108,698 | ) | |

| (1,469,941 | ) | |

| (1,655,861 | ) | |

| (211,306 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Others, net | |

| (95,494 | ) | |

| 74,693 | | |

| 9,532 | | |

| (115,819 | ) | |

| 66,961 | | |

| 8,545 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Income before income

tax expense and share of loss from equity method investments | |

| 721,733 | | |

| 1,333,256 | | |

| 170,139 | | |

| 1,366,121 | | |

| 2,730,497 | | |

| 348,443 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Income tax expense | |

| (70,650 | ) | |

| (209,467 | ) | |

| (26,730 | ) | |

| (143,198 | ) | |

| (411,168 | ) | |

| (52,470 | ) |

| Share of loss from equity method investments | |

| (9,398 | ) | |

| (4,228 | ) | |

| (540 | ) | |

| (9,398 | ) | |

| (7,923 | ) | |

| (1,011 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net income | |

| 641,685 | | |

| 1,119,561 | | |

| 142,869 | | |

| 1,213,525 | | |

| 2,311,406 | | |

| 294,962 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Attributable to: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Ordinary shareholders of the Company | |

| 641,685 | | |

| 1,119,741 | | |

| 142,892 | | |

| 1,213,525 | | |

| 2,311,784 | | |

| 295,010 | |

| Non-controlling interest | |

| - | | |

| (180 | ) | |

| (23 | ) | |

| - | | |

| (378 | ) | |

| (48 | ) |

| | |

| 641,685 | | |

| 1,119,561 | | |

| 142,869 | | |

| 1,213,525 | | |

| 2,311,406 | | |

| 294,962 | |

FUTU HOLDINGS LIMITED

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS

OF COMPREHENSIVE INCOME (Continued)

(In thousands, except for share and per share

data)

| | |

For the Three Months

Ended | | |

For the Six Months

Ended | |

| | |

June 30, 2022 | | |

June 30, 2023 | | |

June 30, 2023 | | |

June 30, 2022 | | |

June 30, 2023 | | |

June 30, 2023 | |

| | |

HK$ | | |

HK$ | | |

US$ | | |

HK$ | | |

HK$ | | |

US$ | |

| Net income per share

attributable to ordinary shareholders of the Company | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 0.56 | | |

| 1.01 | | |

| 0.13 | | |

| 1.05 | | |

| 2.08 | | |

| 0.27 | |

| Diluted | |

| 0.56 | | |

| 1.00 | | |

| 0.13 | | |

| 1.04 | | |

| 2.06 | | |

| 0.26 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net income per ADS | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 4.50 | | |

| 8.07 | | |

| 1.03 | | |

| 8.38 | | |

| 16.61 | | |

| 2.12 | |

| Diluted | |

| 4.46 | | |

| 7.99 | | |

| 1.02 | | |

| 8.30 | | |

| 16.44 | | |

| 2.10 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Weighted average number of ordinary

shares used in computing net income per share | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 1,139,418,888 | | |

| 1,110,112,831 | | |

| 1,110,112,831 | | |

| 1,158,972,163 | | |

| 1,113,421,781 | | |

| 1,113,421,781 | |

| Diluted | |

| 1,149,398,944 | | |

| 1,120,734,239 | | |

| 1,120,734,239 | | |

| 1,169,572,515 | | |

| 1,124,704,502 | | |

| 1,124,704,502 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net income | |

| 641,685 | | |

| 1,119,561 | | |

| 142,869 | | |

| 1,213,525 | | |

| 2,311,406 | | |

| 294,962 | |

| Other comprehensive

loss, net of tax | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Foreign currency translation adjustment | |

| (62,829 | ) | |

| (169,876 | ) | |

| (21,679 | ) | |

| (18,540 | ) | |

| (58,441 | ) | |

| (7,458 | ) |

| Total comprehensive

income | |

| 578,856 | | |

| 949,685 | | |

| 121,190 | | |

| 1,194,985 | | |

| 2,252,965 | | |

| 287,504 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Attributable to: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Ordinary shareholders of the Company | |

| 578,856 | | |

| 949,869 | | |

| 121,214 | | |

| 1,194,985 | | |

| 2,253,344 | | |

| 287,552 | |

| Non-controlling interest | |

| - | | |

| (184 | ) | |

| (24 | ) | |

| - | | |

| (379 | ) | |

| (48 | ) |

| | |

| 578,856 | | |

| 949,685 | | |

| 121,190 | | |

| 1,194,985 | | |

| 2,252,965 | | |

| 287,504 | |

FUTU HOLDINGS LIMITED

UNAUDITED RECONCILIATIONS OF NON-GAAP AND GAAP

RESULTS

(In thousands)

| | |

For the Three Months

Ended | | |

For the Six Months

Ended | |

| | |

June 30, 2022 | | |

June 30, 2023 | | |

June 30, 2023 | | |

June 30, 2022 | | |

June 30, 2023 | | |

June 30, 2023 | |

| | |

HK$ | | |

HK$ | | |

US$ | | |

HK$ | | |

HK$ | | |

US$ | |

| Net income | |

| 641,685 | | |

| 1,119,561 | | |

| 142,869 | | |

| 1,213,525 | | |

| 2,311,406 | | |

| 294,962 | |

| Add: Share-based compensation expenses | |

| 46,863 | | |

| 73,832 | | |

| 9,422 | | |

| 97,251 | | |

| 149,942 | | |

| 19,134 | |

| Adjusted net income | |

| 688,548 | | |

| 1,193,393 | | |

| 152,291 | | |

| 1,310,776 | | |

| 2,461,348 | | |

| 314,096 | |

Non-GAAP to GAAP reconciling items have no income tax effect.

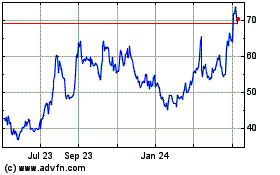

Futu (NASDAQ:FUTU)

Historical Stock Chart

From Oct 2024 to Nov 2024

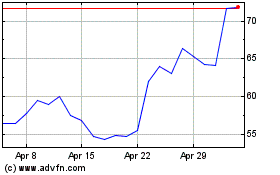

Futu (NASDAQ:FUTU)

Historical Stock Chart

From Nov 2023 to Nov 2024