With his company's pursuit of Fox, CEO Robert Iger's formula

faces its biggest test.

By Erich Schwartzel and Ben Fritz

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (July 7, 2018).

LOS ANGELES -- Disney Chief Executive Robert Iger has a

signature formula for making deals. First, target a company that

few know is even for sale. Then, win over the top executive by

extolling Disney's vision for the company's future. Finally, figure

out how to integrate the new company and its distinctive culture

into Disney's money-making franchise machine, across the empire's

movie, television, consumer products and theme parks

businesses.

It's a strategy Mr. Iger pursued successfully in Disney's three

biggest acquisitions during his tenure: Pixar Animation Studios,

Marvel Entertainment and Lucasfilm Ltd. These deals allowed Disney

to dominate the Hollywood landscape with megahits like "Star Wars:

The Last Jedi," "Black Panther" and "The Incredibles 2" in the past

year alone.

Now, that dealmaking playbook is being put to the test by the

company's riskiest pursuit yet. Disney is locked in a protracted

bidding war with Comcast Corp. to win major assets of 21st Century

Fox Inc., a media fight that's driven Disney's bid to $71 billion.

In contrast, the acquisitions of Pixar, Marvel and Lucasfilm cost

Disney less than $16 billion combined.

In his pursuit of Fox, Mr. Iger once again saw an asset that no

one thought was for sale. He again sold an iconoclastic top

executive -- in this case, media titan Rupert Murdoch -- on his

vision.

"It's the same approach, just magnified," said a person close to

Disney's previous deals.

But with Fox, Mr. Iger is asking his company to swallow an

acquisition that transforms his company's business strategy and is

nearly 10 times bigger than any previous purchase he's made as

CEO.

Both Disney and Comcast think acquiring Fox would give them the

leverage and scale they need to compete in a digital landscape

where tech firms like Netflix Inc. rule. In response to Netflix's

dominance, Mr. Iger has reorganized his company around a

Disney-branded streaming service set to launch next year with

original programming.

Mr. Iger's legacy, once seemingly secure, is on the line. If the

deal goes south, he may well be remembered more as the executive

who lost Fox than the one who built Disney into the entertainment

empire of the early 2000s.

And if it goes through, he will need to convince some Wall

Street skeptics of his plan.

"Arguing that acquiring Fox will help win the war in the fight

for the [direct-to-consumer] market is similar to Bob McNamara

arguing in 1965 that he could win in Vietnam if he had more

troops," Doug Creutz of Cowen & Co. wrote in a recent report.

Disney declined to comment on Mr. Creutz's report but noted that

other Wall Street analysts support the plan.

After postponing his retirement four times, Mr. Iger is now

scheduled to leave Disney in 2021, assuming the Fox deal is

completed.

When Mr. Iger took over as Disney CEO in 2005, he quickly became

a stabilizing force for a company in turmoil. His predecessor,

Michael Eisner, spent his final years preoccupied by contentious

boardroom drama.

His first major test as CEO came in 2006, when Mr. Iger made a

deal to buy Pixar Animation Studios. The production company behind

hits like "Toy Story" and "The Incredibles" had upstaged Disney's

own animation house, and Mr. Iger thought the acquisition could

rejuvenate its core business of family entertainment.

Winning Pixar required wooing Steve Jobs, the Apple Inc.

co-founder and Pixar chairman. Mr. Iger promised Mr. Jobs that

Pixar's creative culture would remain untouched, and that Disney

would promote the studio's characters across its multiple

divisions.

"Steve Jobs didn't do the deal because of Bob Iger. He did it

because of the strategic vision Bob laid out," a former Disney

employee said.

The ultimate price tag of $7.4 billion in Disney stock was on

the high end of bankers' estimates of Pixar's worth, according to

people familiar with the negotiations.

It proved to be a savvy move. Pixar has since produced some of

Disney's biggest hits, including "Finding Dory." The company's

chief creative executive, John Lasseter, led Disney Animation

through a renaissance that brought "Zootopia" and "Frozen" to the

screen. (Mr. Lasseter left the company last year following

allegations of inappropriately touching subordinates.)

The Iger playbook also came in handy with the 2009 acquisition

of Marvel Entertainment. The $4 billion purchase caught Hollywood

by surprise, since Marvel wasn't officially for sale. Mr. Iger

personally wooed its chief executive and controlling shareholder,

Ike Perlmutter, much as he did Mr. Jobs, by promising him broad

autonomy along with access to Disney's vast resources, according to

people with knowledge of that deal.

And in 2012, Mr. Iger met George Lucas to discuss buying

Lucasfilm Ltd., another $4 billion deal that's resulted in megahits

like "The Force Awakens" and "Rogue One." Again, few knew Mr. Lucas

was considering retirement, and people close to Lucasfilm speculate

the company could have fetched a higher price if it had entertained

competing offers. Again, Mr. Iger won out.

The pursuit of Fox is one step in Mr. Iger's new quest: to

transform Disney into a digital powerhouse that can compete with

Netflix. By the time Messrs. Iger and Murdoch began hashing out a

possible deal at Mr. Murdoch's Los Angeles vineyard last year,

Disney had already announced plans to launch its own streaming

service. (21st Century Fox and Wall Street Journal parent News Corp

share common ownership.) Buying Fox fit into the existing plan, so

the talks moved forward.

Things quickly grew complicated when Comcast entered the fray.

Disney and Fox agreed to an all-stock deal in December valued at

$52.4 billion. Last month, Comcast put in an unsolicited $65

billion all-cash bid for the assets, prompting Disney to boost its

offer to a $71.3 billion mix of cash and stock. The move could

strain Disney's balance sheet. And the steeper price caused a few

credit ratings agencies to put Disney on a downgrade watch.

Unlike Pixar or Marvel, Fox is too big to have a single company

culture, and absorbing it may be prove more challenging for Disney

than its prior acquisitions. The Fox Searchlight specialty film

division behind "The Shape of Water" is very different than the FX

cable network that made "Atlanta" or the Star satellite TV service

that airs cricket in India.

But Fox's difference from Disney could prove to be a major

asset, since it builds out a library of programming the company can

use in its streaming strategy. Fox-produced edgy entertainment

could also help siphon users from Netflix, who wouldn't typically

sign up for a family-oriented service.

Write to Erich Schwartzel at erich.schwartzel@wsj.com and Ben

Fritz at ben.fritz@wsj.com

(END) Dow Jones Newswires

July 07, 2018 02:47 ET (06:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

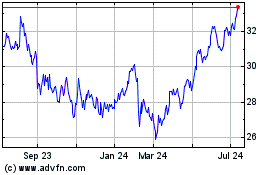

Fox (NASDAQ:FOX)

Historical Stock Chart

From May 2024 to Jun 2024

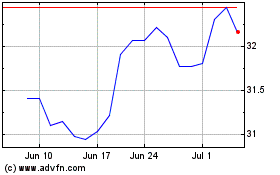

Fox (NASDAQ:FOX)

Historical Stock Chart

From Jun 2023 to Jun 2024