0000038264

false

0000038264

2023-11-02

2023-11-02

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________

FORM 8-K

______________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event

reported): November 2,

2023

Forward

Industries, Inc.

(Exact name of registrant as specified in its charter)

| New York |

|

001-34780 |

|

13-1950672 |

| (State or Other Jurisdiction |

|

(Commission |

|

(I.R.S. Employer |

| of Incorporation) |

|

File Number) |

|

Identification No.) |

700 Veterans Memorial

Hwy. Suite 100

Hauppauge, New York

11788

(Address of Principal Executive Office) (Zip Code)

(631)

547-3055

(Registrant’s telephone number, including

area code)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock, par value $0.01 per share |

FORD |

The NASDAQ Capital Market |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities

Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company

☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry

into a Material Definitive Agreement.

On November 2, 2023, Forward Industries, Inc.

(the “Company”) and Forward Industries (Asia-Pacific) Corporation (“FC”) entered into a Buying Agency and Supply

Agreement (the “New Agreement”). FC is a company owned by Terence Wise, the Company’s Chairman and Chief Executive Officer.

In addition, Jenny P. Yu, a Managing Director of FC, owns more than 5% of the Company’s common stock. The New Agreement provides

that FC will act as the Company’s exclusive buying agent and supplier of products in the Asia Pacific region. The Company purchases

products at FC’s cost and pays FC a monthly fee for services it provides under the New Agreement. The monthly service fee is $65,833

plus 4% of “Adjusted Gross Profit”, which is defined as the revenues recognized by the Company from the sale of the product

less FC’s cost for the product (collectively, the “Service Fee”). The New Agreement expires October 31, 2024. The New

Agreement is substantially similar to the prior Buying Agency and Supply Agreement between the Company and FC except for the reduced monthly

fee payable to FC ($100,000 reduced to $65,833).

Additionally, on

November 2, 2023, the Company and FC entered into a Deferred Payment Agreement. As of October 30, 2023, the Company owed FC $7,365,238

(“Payables”) for the purchase of products in its OEM and Retail Divisions and the cancelation of open purchase orders related

to the Company’s exit from the Retail Division. To preserve the Company’s liquidity position in the future,

FC agreed to limit the amount of the Payables that it would seek to collect from the Company to $500,000 in any 12-month period.

Effective September 1, 2023, on November 3, 2023,

the Company and Justwise Group Ltd. (“Justwise”), a company owned by Mr. Wise, entered

into an agreement to extend its previously executed Consultancy Agreement. Under the Consultancy Agreement, Justwise

will provide inventory management, marketing support and other consulting services. In consideration

of their services, the Company shall pay Justwise $10,000 per month. The Consultancy Agreement is effective as of September 1, 2023, and

will continue on a month-to-month basis.

The foregoing description of the terms of the

New Agreement, the Deferred Payment Agreement, the Justwise Consultancy Extension Agreement and the transactions contemplated thereby

do not purport to be complete and are qualified in their entirety by reference to the form of New Agreement, the form of Deferred Payment

Agreement, and the extension to the Consultancy Agreement which are filed as Exhibits 10.1, 10.2 and 10.4 to this Current Report on Form

8-K and are incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

* Certain schedules, appendices and exhibits to

this agreement have been omitted in accordance with Item 601 of Regulation S-K. A copy of any omitted schedule and/or exhibit will be

furnished supplementally to the Securities and Exchange Commission staff upon request.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

FORWARD INDUSTRIES, INC. |

|

| |

|

|

|

| Date: November 8, 2023 |

By: |

/s/ Kathleen Weisberg |

|

| |

|

Name: Kathleen Weisberg |

|

| |

|

Title: Chief Financial Officer |

|

Exhibit 10.1

BUYING AGENCY AND SUPPLY AGREEMENT

This Agreement, made as of ________ by and between

FORWARD INDUSTRIES, INC. a New York corporation (hereafter referred to as “Principal”), having an address at 700 Veterans

Memorial Highway, Suite 100, Hauppauge, NY 11788 and FORWARD INDUSTRIES (ASIA-PACIFIC) CORPORATION, a BVI registered corporation wholly-owned

by Terence Bernard Wise (hereinafter referred to as “Agent”) having an address at 10F-5 No.16, Lane 609, Chung Shin Road,

Section 5, San Chung District, New Taipei City, Taiwan, Republic of China.

WHEREAS, Principal designs, markets and distributes

carry and protective solutions and various retail items (the "Products");

WHEREAS, Agent is established as a buying and supplier

agent in the Asia Pacific Region, consisting of Australia, New Zealand, Hong Kong, Taiwan, China, South Korea, Japan, Singapore, Malaysia,

Thailand, Indonesia, India, the Philippines and Vietnam (the “Territory”) for merchandise and is engaged in the exportation

of products for sale to the United States and elsewhere, including, but not limited to the Products; and

WHEREAS, the parties desire to enter into this

Agreement for Agent to source for Principal’s Products and to arrange for sourcing, manufacture and exportation of such Products

under and subject to all of the terms and conditions set forth herein.

NOW, THEREFORE, the parties hereto, in consideration

of the foregoing and of the mutual covenants contained herein, and intending to be legally bound hereby, agree as follows:

1.

Engagement. Principal hereby engages Agent and grants to Agent the right to act as the exclusive buying agent

for Principal for, and in connection with, Principal’s purchases, transactions and related dealings, directly or indirectly with

regard to the sourcing of Products in the Territory, including compliance and logistical services. Agent shall be required to maintain

an acceptable level of performance to maintain its exclusivity hereunder. Agent shall, only with the approval of Principal, be permitted

to appoint sub-agents to provide some, or all, of the services, which are required by this engagement.

A.

Agent shall:

| (1) | Visit manufacturers to determine their ability to manufacture and export Products of a type and quality appropriate for Principal,

use all reasonable effort to negotiate most favorable pricing for such Product, and provide Principal with samples and other material,

as may be reasonably necessary or appropriate with respect to such review. Agent shall visit such manufacturers and complete factory evaluations

in a form, manner and frequency that is acceptable to Principal; |

| (2) | Effectuate the execution by manufacturers of Principal’s Manufacturing Acknowledgment, annexed hereto as Exhibit B, or such

other form or amendments thereto as may from time to time be provided by Principal prior to placing any purchase orders for Products with

such manufacturers; |

| (3) | Familiarize itself with Principal’s needs and survey the potential markets to obtain the best available products. Agent shall

use all reasonable effort to negotiate the most favorable pricing for Products. Agent shall provide Principal with up-to-date information

on a timely basis concerning relevant aspects of business. This information includes, without limitation, that which relates to labor

rates and political situations, which may affect Principal’s business or investment prospects. |

| (4) | Arrange, as necessary, for the production and delivery of raw material, components, or sub-assemblies to manufacturers; the manufacture

and delivery to Principal of all necessary or appropriate production samples; and the manufacture and delivery to Principal of finished

Products in accordance with all applicable specifications and requirements set forth in Principal’s purchase orders to Agent. |

| (5) | Place purchase orders with manufacturers in Agent’s name and in a manner consistent with Principal’s Stock Planning principles

outlined in Appendix A hereto. |

| (6) | Quote to Principal F.O.B. factory prices in U.S. dollars (not including the buying Agent’s commission) pursuant to the explicit

request of Principal, and in a manner consistent with the best interests of Principal. |

| (7) | Establish and maintain a quality assurance plan that is acceptable to Principal and be in charge of the quality control of Products,

including the substantial conformity of Products to any approved samples and as to style, quantity, and other specifications in the applicable

purchase orders of Principal, all in a manner consistent with Principal’s Compliance Criteria principles outlined in Appendix B

hereto. Agent shall prepare and maintain written documentation of the results and timing of its quality control procedures for Principal’s

review (e.g. inspection reports/certificates) and shall update the Principal’s Logistics Collaboration Portal (“LCP”)

with such information, as required by Principal, in a timely manner. In the event of the shipment of defective or uncorrectable improperly

labeled goods, or the shipment of goods in nonconformity with the purchase order, Agent shall coordinate the return of such goods to manufacturer

or assist in other corrective action, as deemed necessary by Principal. |

| (8) | Submit delivery and other logistical data, as may be required by Principal, to Principal via Principal’s LCP, in a timely manner. |

| (9) | Arrange for all inland freight, hauling, lighterage, storage and consolidation, etc. at the lowest cost possible within the realm

of prudent delivery/shipping practices. |

| (10) | Arrange for the exportation and delivery of the Products in accordance with all time limitations and deadlines set forth in the applicable

purchase orders. |

| (11) | Facilitate the acquisition of the documentation necessary for importation of Product into the country in which Product is to be sold. |

| (12) | Be responsible for arranging all necessary globally recognized testing with manufacturers to ensure Product compliance. Any special

testing or certifications that are not industry standard or that is performed by Agent or third parties shall be Principal’s payment

responsibility. |

| (13) | Facilitate the acquisition of any raw materials, trimmings, labels, packaging materials or other components in a manner dictated by,

and in the best interests of, Principal. |

| (14) | Be responsible for the quality and timely delivery of raw materials in a manner dictated by, and in the best interests of, Principal. |

| (15) | In addition to the quality assurance responsibility described in Subparagraph 7, above, verify that Products are being manufactured

in the country and factory designated by Agent or Principal, in conformance with applicable laws and regulations of the country in which

it is to be sold and the country of manufacture, as well as the Foreign Corrupt Practices Act, and that the appropriate visa, export licenses,

etc. are used in connection with the exportation of the goods to the country designated by Principal for delivery. |

| (16) | Agent shall itself comply with and shall require that factories are in compliance with Principal’s Code of Conduct (the “Code”),

which is attached hereto as Exhibit A, including any modification of such as may be provided by Principal from time to time. Such steps

shall include, but are not limited to: |

| | a. Ensuring that all manufacturers, subcontractors and

suppliers working on, producing goods for or supplying goods to Principal execute and return to Principal or to its representative

all documents required to ensure compliance with the Code. Such documents include, but are not limited to, Manufacturing

Acknowledgements and Subcontractor Manufacturing Acknowledgements, in such form as Principal or its representative shall provide to

Agent from time to time and as often as Principal deems necessary to ensure compliance with the Code. |

| | |

| | b.

Periodically inspecting the facilities of all manufacturers and subcontractors every twelve months and providing a written

evaluation of these inspections to Principal or to its representative in such form as may be required by Principal or its

representative from time to time. |

| | |

| | c.

For all manufacturers and subcontractors to be used by Agent to produce Products at the time of the execution of this

Agreement, conducting a detailed evaluation of the production and residential facilities and providing a written evaluation of these

inspections in such form and as often as is required by Principal or its representative from time to time. |

| | |

| | d.

the event that Agent has knowledge that any manufacturer is not producing the Products in compliance with applicable local

laws and/or the Code of Conduct, Agent shall immediately notify Principal. Further, Agent shall provide to Principal a certificate

as to the country-of-origin of the Products. |

| | |

| | e.

Agent is responsible for costs associated with a third-party auditing firm providing Social Accountability and Security,

including without limitation CTPAT audits. However, Agent acknowledges that audits as requested by Principal will be no more

frequent than every six (6) months, however additional audits of Agent requested by Principal may be more frequent, in which case

the costs shall be borne by Principal. Costs for the initial audit, except associated travel expenses, and all costs associated with

remediation of deficiencies as identified as a result of the audit shall be incurred exclusively by Agent. Pricing of Products

hereunder shall not increase as a result of any audit activities or remediation costs. Principal will provide Agent with an invoice

from a third-party audit firm, audit results, and remediation requirements following any such audit. Principal shall assume

financial responsibility to make payment of said invoice within terms. If Principal pays any invoice, Principal will be entitled to

offset that amount from any amounts owing to Agent. If any such six-month audit reveals any material non-compliance on the part of

Agent or its manufacturers in respect of Social Accountability and Security and CTPAT standards, Principal may, within three months

of completion of such audit, request a follow-up audit to monitor Agent’s or its manufacturers progress in correcting such

violations, and all costs and expenses incurred in connection with such audit, including associated travel expense, shall be borne

by Agent. |

| (17) | Attend to the return and/or replacement of any Products deemed to be noncompliant or defective by Principal. Further, Agent shall

use best effort to effectuate from manufacturer a credit note or refund for defecting or noncompliant Product, Product shortages, etc.

and ensure manufacturers proper destruction and disposal thereof, when applicable. |

| (18) | Inform Principal of any overproduction or production of counterfeit or infringing goods by the manufacturers. |

| (19) | Agent shall perform all other services that may be reasonably necessary or appropriate to arrange for the manufacture, exportation,

quality control, and delivery of the Products consistent with regular practices in the trade. |

B.

Agent shall arrange to have produced for Principal samples and prototypes on a timely basis at a price agreed upon in writing by

Principal and consistent with Principal’s Product Development principles outlined in Appendix C. In the case of OEM business, there

is no charge for samples. For retail products, any individual product sample paid for by Principal and subsequently ordered for production,

Principal will receive refund exclusive of freight cost. If multiple samples are requested, either the factory will charge a development

fee or the Principal will be expected to pay for the samples.

C.

Agent shall act only upon the specific instructions of Principal and in no case shall the Agent act without such explicit instructions.

Agent acknowledges that it has no right, power or authority to make any contract or incur any obligation or liability, which shall be

binding upon Principal unless it has been specifically authorized in writing, and in advance by Principal.

D.

The parties shall use good faith efforts to develop a performance appraisal methodology that is based on key operating metrics

(such as quality, delivery, conduct, etc.) in order to evaluate Agent’s performance. Continued non-performance by Agent under such

methodology shall constitute a material breach hereunder.

2.

Compensation.

A.

“Invoice Price” shall mean the F.O.B. purchase price of the Products purchased by Agent for Principal, which price

shall be the same as the price paid by Agent for such products, excluding any Agent commissions.

B.

In consideration of the services rendered by Agent under this Agreement, Principal shall pay to Agent the sum of $65,833 per month

plus four percent (4%) of the Adjusted Gross Profit (hereinafter defined) of all Products sold pursuant to this Agreement (the “Service

Fee”). In no case shall the total Agent fee outlined in 2.B. exceed 10% of total Invoice Price in a given calendar year. For the

purpose of computing the Service Fee due hereunder, the following directions shall apply:

a.

“Adjusted Gross Profit” shall mean the amount which is equal to Net Sales less Material COGs.

b.

“Gross Sales” shall mean all revenues recognized by Principal from the sale of Products.

c.

“Material COGs” shall mean the amount which is equal to the cost of all materials, tooling, packaging, inbound freight,

customs and duties incurred by Agent to deliver Products to Principal at the agreed upon shipping point (e.g. Port of Hong Kong or Port

of Shen Zhen). Such “Material COGs” shall be equal to the amounts referenced in Principal’s approved purchase orders

to Agent and to the amounts referenced on Agent’s invoices to Principal. Such Material COGs shall exclude Agent’s Service

Fees and shall be equal to Agent’s actual cost basis as supported by the local supplier invoices.

d.

“Net Sales” should be defined as being equal to Gross Sales less returns, discounts and allowances and should be recorded

and recognized in accordance with Generally Accepted Accounting Principles in the United States.

Where Principal determines the Products to

be defective, no Service Fee shall be paid by the Principal and Agent shall provide a credit or refund to Principal for any commission

paid for Products by Principal.

C.

In the event of a significant increase or decrease in the Principal’s Gross Sales over two consecutive financial quarters,

such increase or decrease to be no less than 20% of Gross Sales from the prior quarter, Principal and Agent agree to negotiate in good

faith on a revised Service Fee that may be more or less than the Service Fee considering any savings that may be achieved by Agent as

a direct consequence of any significant reduction in Gross Sales and any additional resources that may be required by Agent as a direct

consequence of any significant increase in Gross Sales.

D.

The Service Fee above shall include all costs of travel and entertainment, telephone, telex, telecopies, postage, office space,

personnel (including salaries, benefits, overtime, and any related taxes), legal and professional services and all other costs deemed

necessary and incurred by Agent in the performance of its obligations hereunder.

E.

Agent shall pay all costs of conducting its agency and all taxes, including assessments, which may be made against the salary or

wages of those directly or indirectly employed by Agent.

3.

Payment. Principal shall pay Agent for amounts due under the terms of this Agreement as follows:

A.

For the purchase of Products, including samples and prototypes, Agent shall, at the end of each month, provide Principal with an

itemized invoice for all Products delivered in such month, which invoice shall not include any Service Fee. Principal shall pay Agent

within sixty (60) days of receipt of Agent’s monthly invoice.

B.

Agent shall provide to Principal on a monthly basis, a separate invoice for the Service Fees earned during the previous month.

Principal agrees to pay all Service Fees within sixty (60) days of receipt of the Agent’s invoice; provided however that

if Principal notifies Agent in writing that it objects to any invoice within ten (10) days of receipt of such invoice, payment on the

disputed invoice shall be made when the dispute is resolved.

4.

Purchases and Delivery.

A.

Principal’s order of Products shall be effectuated by Principal’s submission to Agent of a firm written purchase order

in advance of delivery. Principal may submit to Agent forecasts of Principal’s Product needs, however, any such forecasts shall

be an estimate only and not a commitment to purchase. Agent shall either confirm or reject Principal’s purchase orders within three

(3) business days via the Principals LCP. Agent shall promptly update Principal with purchase, production, inspection and logistic data

and documentation (e.g. Advanced Shipping Notification or Certificates of Origin), including via Principal’s LCP, as requested and

deemed necessary by Principal. No such purchase order may be changed or terminated without the prior written consent of Principal.

B.

Amended Purchase Orders. Principal shall have the right prior to delivery of the Products to make changes to the purchase

order. If any such changes cause an increase or decrease in cost or delivery time, Agent shall notify Principal in writing immediately

and explain the amount and basis for any such adjustment in cost or delivery time. If Principal accepts such adjustments, Principal and

Agent shall execute an amendment to the purchase order to evidence such adjustments or Principal shall issue a revised purchase order.

C.

Late Delivery. If Agent determines that it is unable to deliver Product timely as provided in an accepted purchase order,

Agent shall immediately notify Principal and Principal shall have the right to: (i) accept late delivery; (ii) specify a more rapid method

of shipment with Agent paying the additional transportation cost (subject to Agent’s use of best effort to effectuate manufacturers

agreement to such); (iii) terminate the purchase order without liability or penalty (subject to Agent’s use of best effort to effectuate

manufacturers agreement to such).

D.

Early Delivery. If Product is available for delivery to Principal prior to the specified or requested delivery date, Principal

shall make reasonable effort to accept the Product. Otherwise, Agent shall be responsible for arranging the Product to be properly stored

and redelivered on the specified or requested delivery date.

5.

Returns. Returns of defective and/or noncompliant Products that are under warranty by Agent (refer to Section 7 below)

shall be shipped pre-paid by Principal and Agent shall be charged back for shipping costs unless otherwise specifically agreed to by Principal

(subject to Agent’s use of best effort to effectuate manufacturers agreement to such). Prior to return of any Product, Principal

shall notify Agent in writing, and Agent shall provide Principal with a Return Authorization within five (5) business days of such written

notice. Under no circumstances is Agent or its manufacturers permitted to sell to any party other than Principal any Products or sample

Products manufactured under this Agreement, including Products, samples and prototypes that are returned by Principal and that Agent is

unable to rework to meet specifications and quality requirements. In addition, Agent agrees to submit to Principal a Certificate of Destruction

in which Agent identifies the defective Products and sample Products and verifies under oath that such Products and sample Products have

been destroyed.

6.

Representations by Agent. Agent represents and warrants the following, each of which shall be deemed to be independently

material and have been relied upon by Principal:

A.

Agent is a corporation duly organized and validly existing under the laws of the country in which it maintains the office from

which it shall perform its obligations under this Agreement.

B.

Agent has the full right, power and authority to execute and deliver, and perform fully and in accordance with all of the terms

of, this Agreement, and the performance by the Agent of all of its obligations and covenants hereunder does not and will not violate any

law or regulation, agreement or other instrument to which Agent is a party or by which Agent may be bound.

C.

Agent is engaged in the business of sourcing products in the Territory. Agent has the requisite experience to properly supervise

the manufacture of the Products.

D.

Agent warrants and represents that it will not knowingly or intentionally make any statement or representation inconsistent with

the terms and provisions of this Agreement in any affidavit, special invoice, special Customs invoice, pro forma invoice, consular invoice

or any other document or communication, oral, written or otherwise. In addition, no part of the compensation paid, or to be paid, to Agent

pursuant to this Agreement shall in any manner be paid or payable directly or indirectly to any manufacturer of Products or to any government

agent.

E.

Agent, in executing this agreement, certifies that it has no ownership or direct financial interest in, nor any control of, the

factories making the commodities purchased with the assistance of the Agent and that the factories have no ownership or financial interest

in, or any control over, the Agent. In the event that any such interest is consummated, then the Agent will immediately inform Principal.

Failure to do so will result in the forfeiture of the Agent’s commission on the goods purchased from the related or controlled factories.

F.

Agent shall accept no remuneration for its services other than the commissions paid hereunder by Principal and will not share commissions

in any manner with the manufacturer or others.

7.

Claims, Inspections and Warranties.

A.

Principal may inform Agent of any claims against a manufacturer regarding the Products. Agent will, pursuant to the instructions

of the Principal, act on behalf of the Principal and use its best efforts to assist in the resolution of any claim.

B.

Agent shall allow, and shall require its manufacturers to allow, Principal or its designees the right to enter their manufacturing

and storage facilities during regular business hours, with or without notice, to inspect Products, tools, packaging and working conditions

in order to confirm Agent’s and Manufacturer’s compliance with this Agreement.

C.

Agent shall make all reasonable efforts to provide Principal with a one (1) year product warranty from the date of delivery to

Principal or Principal’s customers. Such warranty shall be predicated on Agent’s ability to secure equivalent or better terms

from its manufacturers in its manufacturing agreements. Agent shall make all reasonable efforts to ensure that the Products will be free

from defects in materials and workmanship, be merchantable, safe and fit for the particular uses and purposes for which the Products were

manufactured, and strictly conform to all approved samples and specifications. For Products under warranty, Principal may return defective

products for refund or credit, including shipping charges to return such defective product, if required.

8.

Term and Termination. The term of this Agreement shall begin on October 24, 2023 and continue until October 31, 2024

(the “Term”) subject to earlier termination as provided for in Section 9 below. Thereafter, provided the parties have reached

an agreement in writing as to the Service Fee at least one hundred twenty (60) days prior to the end of the then expiring Term, the Term

shall be eligible for renewal for one (1) two (2) year term (the “First Renewal Term”), unless terminated. Following the First

Renewal Term, in each instance, provided the parties have reached an agreement in writing as to the Service Fee at least one hundred twenty

(60) days prior to the end of then expiring Term, the Term shall be eligible for renewal for successive one (1) year terms (together with

the First Renewal Term, the “Renewal Terms”). Renewal Terms that have commenced shall be included in the Term. On expiration

or termination, this Agreement shall continue to apply to orders for Products placed during the Term, which may be shipped after expiration

or termination of the Term.

9.

Termination.

A.

Termination for Cause. This Agreement may be terminated for Cause at any time. For purposes hereof, "Cause” shall

mean: (i) a material breach by either party of the terms of this Agreement, (ii) a default by either party in the performance of any duties

or obligations hereunder that is not remedied within thirty (30) days of written notice, (iii) a failure by Agent to maintain an acceptable

level of performance in terms of price, quality, quantity or delivery; (iv) if Agent shall be insolvent or shall make an assignment for

the benefit of creditors or is adjudged bankrupt in any legal proceeding under any applicable law or a trustee or receiver of its business

or affairs or of a material part of its properties is appointed in any legal proceeding under any applicable law and any such proceeding

is not dismissed within thirty (30) days after its commencement; or (v) upon any change of control of Agent. For purposes hereof, the

term “change of control” shall mean the sale, transfer or conveyance of a majority of the presently existing voting stock

of Agent, this Agreement may be terminated by the non-breaching/defaulting party on written notice to the other party.

B.

Termination without Cause.

| (1) | As set forth in Section 8 above, in the event the parties do not reach an agreement on the Service Fee for the subsequent Renewal

Term, Principal may terminate this Agreement on ninety (90) days written notice to Agent. |

| (2) | No less than one hundred twenty (120) days prior to the expiration of the First Renewal Term or any Renewal Term thereafter, either

party may give the other written notice of its decision not to renew and thereupon the Agreement shall terminate at the end of the then

expiring Renewal Term. |

10.

Seconds, Thirds or Excess Goods. Agent agrees to use its best efforts to recover the cost of all seconds, thirds

or excess goods from the manufacturer on Principal’s behalf. Agent is not entitled to recover either the costs of reinspection or

costs associated with obtaining refunds from Principal. Agent covenants that it will ensure that no seconds will be released by the manufacturer.

11.

Proprietary Rights.

A.

Agent acknowledges that all patents, trademarks, tradenames, copyrights and designs relating to the merchandise shall be and remain

the property of Principal, or its customers. Agent agrees that any use or copy of these patents, trademarks, tradenames, copyrights or

designs must be accompanied by a statement of Principal’s rights thereto. Agent will not, during the term of this agreement or at

any time thereafter, claim any right or property interest in such patents, trademarks, tradenames, copyrights and designs, or take or

permit any action which will have an adverse effect on Principal’s rights to such owned or licensed patents, trademarks, tradenames,

copyrights and designs. In case such rights of Principal or its customers are abused, Agent will do its best to give notice to Principal

and to help Principal avoid the same, but all costs involved will be paid by Principal.

B.

Principal shall own the exclusive rights to the trade dress and visual design of the Products, Product materials, and related packaging

for the Products. Principal shall also own all right, title and interest in all tooling, molds or special equipment which have been furnished

or paid for by, or charged against, Principal in connection with the manufacture of the Products.

12.

Non-Compete. Agent agrees that during the Term of this Agreement and for twelve (12) months thereafter, neither it

nor its affiliates or subsidiaries shall source or supply to any party other than Principal, products that, in Principal’s sole

determination, incorporate or are similar in nature, use, appearance, construction, design or performance to the characteristics of any

of Principal’s products.

13.

Confidentiality.

A.

For the purposes hereof, “Confidential Information” shall mean all proprietary and confidential information and trade

secrets of a party about its business, including without limitation designs, drawings and graphics and information about colors, fabrics

and other materials, new and modified products financial and business data and plans and related reports.

B.

Each party acknowledges that the other party’s Confidential Information constitutes valuable and proprietary trade secrets

of such other party and, except as provided herein or in any other agreements between the parties or their affiliates, such party shall

not use or cause to be used or disclose or cause to be disclosed any Confidential Information unless otherwise authorized in writing.

Each party shall limit access to Confidential Information to the other party to those employees or agents whose duties require the possession

thereof, and such party shall inform them of the confidential nature thereof. Each party shall use commercially reasonable efforts to

safeguard the other party’s Confidential Information and to prevent the unauthorized, negligent or inadvertent use of disclosure

thereof. At the end of the Term hereof, each party will return or destroy the other parties Confidential Information.

C.

The parties recognize that remedy at law for any breach of the provisions of this paragraph will be inadequate and, accordingly,

agree that in addition to such other remedies that may be available, at law or in equity, any court of competent jurisdiction may enjoin,

without the necessity of requiring proof of actual damages or the posting of any bond or other security, any actual or threatened breach

of the provisions of any of this paragraph.

14.

Rights Upon Cancellation or Termination. Upon the cancellation or termination of this Agreement: (a) all rights and

obligations of the parties hereunder shall cease and terminate except as to rights and obligations accrued by either of the parties prior

to the date of such cancellation or termination, including rights and obligations under outstanding import contracts not yet performed;

(b) Principal shall have the right to deal with all manufacturers dealt with by Agent in connection with Principal’s business either

directly or through one or more other buying agents without further obligation to Agent; and (c) Agent shall turn over to Principal any

and all copies of contracts and other information in the Agent’s files relating to arrangements made by Agent with sellers of merchandise

on Principal’s behalf (it being understood that all such contracts and other information shall be treated by Agent as confidential

and shall not be disclosed by Agent to any third party either during or after the term hereof). Without limiting the generality of any

of the other terms of this Agreement, upon the expiration or termination of this Agreement, Agent shall not be entitled to, and hereby

waives its right, if any, to make any claim for damages, losses or compensation arising from any expectancy of continuation of this Agreement,

or for any other reason whatsoever (except with respect to Service Fees payable to Agent as a result of orders for Products placed prior

to the termination of this Agreement but not shipped until after the termination of this Agreement disregarding the shipment date of the

merchandise).

15.

No Joint Venture. Nothing contained herein shall be construed to place the parties in the relationship of partners

or joint ventures, it being agreed and understood that Agent is an independent contractor and not an employee of Principal. Agent shall

have no power to obligate or bind Principal in any manner whatsoever except as otherwise provided herein. Agent shall not hold itself

out as employed by or otherwise affiliated with Principal. Agent shall obtain all approvals and permits (if any) from any and all governmental

authorities that are necessary or appropriate in order that Agent shall be permitted under the local laws of the Territory to engage in

all activities provided for under this Agreement.

16.

Notices. All notices required or permitted under this Agreement shall be in writing and shall be mailed by overnight

delivery to the party to receive notice at the addresses first set forth above or at such other address as any party may, by written notice,

direct and shall be made in accordance with New York law. All notices given under this paragraph shall be deemed as given on the two business

days following the day on which the notice is mailed or faxed.

17.

Further Assurance. Each party agrees, upon the reasonable request of the other party, to take such action and to

execute and deliver such documents as may reasonably be necessary or appropriate to effectuate the terms of this Agreement and the transactions

contemplated hereby.

18.

Assignments.

A.

Principal may assign this Agreement to a successor to all or substantially all of that portion of its business which deals with

the Products. Agent may not assign this Agreement without the prior written consent of Principal.

B.

Except as provided for in Subparagraph (A), neither party shall assign or transfer all or any portion of this Agreement, whether

voluntarily, by operation of law, or otherwise, without the prior written consent of the other party.

19.

Headings. The paragraph headings of this Agreement are for convenience of reference only and do not form a part of

the terms and conditions of this Agreement or give full notice thereof.

20.

Construction. This Agreement shall be governed by and construed and take effect as an enforceable contract in accordance

with the laws of the State of New York governing such agreements, without regard to conflicts-of-law principles thereof that would require

applicability of any other law.

21.

Jurisdiction. Any legal action or proceeding with respect to this Agreement may be brought exclusively in the courts

of the State of New York County or of the United States for the Southern District of New York. Each party hereto irrevocably submit to

the exclusive jurisdiction of such courts, irrevocably waives any objection to the laying of venue of any such suit, action or proceeding

brought in such courts and irrevocably waives any claim that any such suit, action or proceeding brought in any such court has been brought

in an inconvenient forum. EACH OF THE PARTIES HERETO WAIVES ANY RIGHT TO REQUEST A TRIAL BY JURY IN ANY LITIGATION WITH RESPECT TO THIS

AGREEMENT AND REPRESENTS THAT COUNSEL HAS BEEN CONSULTED SPECIFICALLY AS TO THIS WAIVER. The parties agree that a final judgment in any

lawsuit, action or other proceeding arising out of or relating to this Agreement brought in such courts shall be conclusive and binding

upon each of the parties hereto and may be enforced in any other courts to the jurisdiction of which each of the parties is or may be

subject, by suit upon such judgment.

22.

Entire Agreement. This Agreement contains the entire understanding between the parties with respect to the subject

matter hereof. It may not be amended or modified in any manner, except by a written agreement duly executed by both parties hereto. No

custom or course of dealing shall be referred to as amending or altering the terms of this Agreement and no waiver shall be deemed to

apply to any matter other than or subsequent to the matter to which it relates.

23.

Indemnification.

A.

Agent shall indemnify Principal, its officers, agents, employees, directors, shareholders and representatives (collectively, the

“Principal Indemnified Parties”), and hold them harmless, from and against any and all losses, damages, liabilities, claims,

payments, liens, judgments, orders and decrees of every description, recoveries, costs and expenses (including attorneys’ fees incurred

by Principal Indemnified Parties both in connection with claims against Agent and as well as third party claims) arising out of or relating

to, in whole or in part, any act or omission, negligence, misconduct or fraud of any of its officers, agents, employees, directors, shareholders,

and representatives in performing its obligations under this Agreement.

B.

Principal shall indemnify Agent, its officers, agents, employees, directors, shareholders and representatives (collectively, the

“Agent Indemnified Parties”), and hold them harmless, from and against any and all losses, damages, liabilities, claims, payments,

liens, judgments, orders and decrees of every description, recoveries, costs and expenses (including attorneys’ fees incurred by

Agent Indemnified Parties both in connection with claims against Agent and as well as third party claims) arising out of or relating to,

in whole in part, any act or omission of any of Principal, its officers, agents, employees, directors, shareholders, and representatives

in performing its obligations under this Agreement.

24.

No Waiver. The failure by any party to complain of any act or omission on the part of the other, no matter how long

the same may continue, shall not be deemed to be a waiver by such party of any of its rights under this Agreement. The waiver by any party

at any time, expressed or implied, of any breach, attempted breach, or default of any provision of this agreement shall not be deemed

a waiver of any other provision of this agreement or a consent to any subsequent breach, attempted breach or default of the same or any

other type. If any action by Agent shall require the consent or approval of Principal, such consent or approval of Principal to such action

on any one occasion shall not be deemed a consent or approval of any other action on the same or any subsequent occasion.

25.

Invalidity. Should any term or provision of this agreement for any reason be held to be illegal, invalid, void or

unenforceable either in its entirety or in a particular application, the remainder of this agreement shall nonetheless remain in full

force.

26.

Counterparts. This Agreement may be executed in two or more counterparts, each of which shall be deemed an original

but all of which together shall constitute one and the same instrument.

| |

FORWARD INDUSTRIES, INC. |

| |

|

| |

By: |

|

| |

Name: |

Kathleen Weisberg |

| |

Title: |

Chief Financial Officer |

| |

FORWARD INDUSTRIES (ASIA-PACIFIC) CORPORATION |

| |

|

| |

By: |

|

| |

Name: |

Terence Bernard Wise |

| |

Title: |

Principal |

Exhibit 10.2

| Forward Industries, Inc. |

10F-5 No.16, Lane 609 |

| 700 Veterans Memorial Highway, Suite 100 |

Chung Shin Road, Section 5 |

| Hauppauge, NY 11788 |

San Chung District, New Taipei City |

| |

Taiwan, Republic of China. |

October 30, 2023

| Re: | Agreements regarding deferred payments under that certain Buying Agency and Supply Agreement made as of

September 9, 2015 (the “Original Agreement”) by and between Forward Industries, Inc., a New York corporation (“Principal”)

and Forward Industries (Asia-Pacific) Corporation, a BVI registered corporation (“Agent”) and that certain proposed successor

Buying Agency and Supply Agreement by and between Principal and Agent (the “New Agreement”), which is being executed

simultaneously and as partial consideration for this Agreement. |

Gentlemen/Ladies:

This letter agreement (“Agreement”)

is being executed in connection and partial consideration for the entrance into the New Agreement by the undersigned parties for the purpose

of memorializing certain agreements and understandings between Principal and Agent regarding the payment of certain acknowledged and deferred

payments of certain Invoice Prices and Service Fees under the Original Agreement as well as any deferred payments which may be agreed

to related to the New Agreement (collectively, the “Outstanding Amounts”). The parties acknowledge and agree that as of the

date hereof the Outstanding Amounts equal $7,365,238. Capitalized terms used in this Agreement and not otherwise defined herein shall

have the meaning ascribed to them in the Original Agreement. Each of the Principal and Agent represent, warrant, covenant, and agree as

follows:

Notwithstanding anything in

the Original Agreement or the New Agreement to the contrary, Agent agrees that it will not require, invoice or demand the repayment by

Principal of more than $500,000 of Outstanding Amounts in any given 12-month period. Upon receipt of a payment request, within 30 days

of the request, Principal shall pay the requested payment amount. Agent releases and waives any right to enforce any default or breach

under the Original Agreement.

This Agreement shall be governed

by and construed in accordance with the laws of the State of New York. Each party irrevocably and unconditionally agrees that venue and

jurisdiction for the resolution of any dispute and the enforcement of any rights in any way arising from or relating to this Agreement

shall exclusively be the courts of the state of New York sitting in Suffolk County. Except as modified herein, all other terms and conditions

of the Original Agreement which survive its termination and the New Agreement shall remain in full force and effect. The parties consent

to the use of electronic signature on this Agreement, and counterparts of this Agreement, including via electronic signature, shall be

deemed to constitute signed original counterparts hereof and shall bind the parties signing and delivering in such manner. No provision

of this Agreement may be amended, modified, terminated or waived unless evidenced in a writing signed by the party to be charged with

such amendment, modification, termination or waiver.

This Agreement shall be binding

upon and inure to the benefit of the parties hereto and their respective successors and assigns (including personal representatives and

heirs). Neither party hereto may assign or otherwise transfer any of its rights under this Agreement, by operation of law or otherwise,

without the prior written consent of the other party. Any assignment without such prior written consent shall be void. This Agreement

is hereby acknowledged and agreed by the undersigned on the date first above specified.

FORWARD INDUSTRIES, INC.

By: _________________________________

Name: Kathleen Weisberg

Title: Chief Financial Officer

forward INDUSTRIES (ASIA-PACIFIC)

CORPORATION

By: _________________________________

Name: Terence Wise

Title: Principal

Exhibit 10.4

|

|

Forward

Industries, Inc.

700 Veterans

Hwy, Suite 100

Hauppauge,

NY 11788

www.forwardindustries.com

|

TO: JUSTWISE GROUP Ltd, 6,

The Shires, Shire Hill, Saffron Walden CB11 3AP. (“Consultant”)

FROM:

FORWARD INDUSTRIES, Inc. (the “holding company” and its subsidiaries) (Referred to herein

as “FORD”)

Date:

September 1, 2023

Dear Mr Morgan:

Regarding

the Consutancy Agreement (the “Agreement”) between FORD and Consultant effective September 1, 2022:

Whereas

the Agreement expired on August 31, 2023;

Whereas

FORD and the Consultant continued to perform their respective obligations under such Agreement;

Whereas

FORD and the Consultant wish to extend the Agreement;

It is hereby

agreed:

| 1. | Under Items

1 and 2 of the Agreement, James Berberian will be replaced by Kathleen Weisberg and/or James

Berberian. |

| 2. | The services

provided by the Consultant shall also include inventory management. |

| 3. | The term of

the agreement will begin September 1, 2023 and continue on a month-to-month basis as needed. |

All other

terms of the original Agreement that do not conflict with those set forth herein shall remain in full force and effect.

If you agree

to the above terms and conditions, please acknowledge your acceptance by signing and returning the enclosed copy of this letter.

Yours sincerely

_________________________________

Kathleen Weisberg

Chief Financial

Officer

for and on behalf

of FORWARD INDUSTRIES, Inc.

700

Veterans Memorial Hwy, Suite 100, Hauppauge, NY 11788

________________________________________________________

I accept the

above terms and conditions.

________________________________

Howard

Morgan (Mr)

for and on behalf

of Justwise Group Ltd.,

6,

The Shires, Shire Hill, Saffron Walden CB11 3AP

Dated __________________________

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

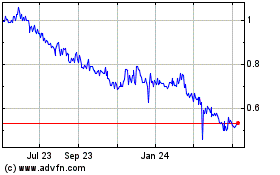

Forward Industries (NASDAQ:FORD)

Historical Stock Chart

From Jan 2025 to Feb 2025

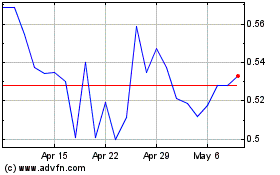

Forward Industries (NASDAQ:FORD)

Historical Stock Chart

From Feb 2024 to Feb 2025