Forward Reports Fiscal 2021 First Quarter Results

February 12 2021 - 4:15PM

Forward Industries, Inc. (NASDAQ:FORD), a single source solution

provider for the full spectrum of hardware and software product

design and engineering services as well as a designer and

distributer of carry and protective solutions, today announced

financial results for its first quarter ended December 31,

2020.

First Quarter Fiscal 2021

Financial Highlights

- Revenues were $9.7 million, an

increase of 15.5% from $8.4 million for the three months ended

December 31, 2019.

- Gross margin improved to 23.3%

compared to 20.5% for the three months ended December 31,

2019.

- Loss from operations was $167

thousand compared to $29 thousand for the three months ended

December 31, 2019.

- Net income was $1.2 million

compared to a net loss of $82 thousand for the three months ended

December 31, 2019, the increase primarily resulting from the $1.4

million of other income recognized on the forgiveness of our PPP

loan in December 2020.

- Basic and diluted earnings/(loss)

per share were $0.12 compared to $(0.01) in the three months ended

December 31, 2019, the increase also resulting from the

aforementioned PPP loan forgiveness.

- Cash and cash equivalents totaled

$2.3 million at December 31, 2020.

Terry Wise, Chief Executive Officer of Forward Industries,

stated, “In spite of the ongoing trading challenges, I am pleased

to report a robust financial performance with year over year

increases in both revenues and gross margin for the quarter. We

continue to build momentum throughout retail and our design

division remains solid in terms of performance, with both IPS and

Kablooe collaborating to forge a strong pipeline.

As we progress through the fiscal year, and the trading

environment progressively eases, I continue to be hopeful for the

future.”

The tables below are derived from the Company’s

condensed consolidated financial statements included in its Form

10-Q filed on February 12, 2021 with the Securities and Exchange

Commission. Please refer to the Form 10-Q for complete financial

statements and further information regarding the Company’s results

of operations and financial condition relating to the fiscal

quarters ended December 31, 2020 and 2019. Please also refer to the

Company’s Form 10-K for a discussion of risk factors applicable to

the Company and its business.

About Forward

Industries

Forward is a fully integrated design,

development and manufacturing solution provider to top tier medical

and technology customers worldwide. Through its acquisition of

Intelligent Product Solutions, Inc. and Kablooe Design, Inc., the

Company has expanded its ability to design and develop solutions

for our existing multinational client base and expand beyond the

diabetic product line into a variety of industries with a full

spectrum of hardware and software product design and engineering

services. In addition to our existing design and distribution

of carry and protective solutions, primarily for hand-held

electronic devices, we are now a one-stop shop for design

development and manufacturing solutions serving a wide range of

clients in the industrial, commercial, medical and consumer

industries.

Contact:

Forward Industries,

Inc. Anthony

Camarda,

CFO (631)

547-3041

| |

| |

| FORWARD

INDUSTRIES, INC. AND SUBSIDIARIES |

| CONDENSED

CONSOLIDATED BALANCE SHEETS |

| |

|

|

|

|

|

|

| |

|

|

|

December

31, |

|

September

30, |

| |

|

|

|

|

2020 |

|

|

|

2020 |

|

|

Assets |

|

(Unaudited) |

|

|

| |

|

|

|

|

|

|

|

Current assets: |

|

|

|

| |

Cash |

|

$ |

2,332,324 |

|

|

$ |

2,924,627 |

|

| |

Accounts receivable, net |

|

7,729,140 |

|

|

|

7,602,316 |

|

| |

Inventories |

|

1,257,397 |

|

|

|

1,275,694 |

|

| |

Prepaid expenses and other current assets |

|

339,292 |

|

|

|

419,472 |

|

| |

|

|

Total

current assets |

|

11,658,153 |

|

|

|

12,222,109 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

Property and equipment, net |

|

205,057 |

|

|

|

215,323 |

|

|

Intangible assets, net |

|

1,478,227 |

|

|

|

1,531,415 |

|

|

Goodwill |

|

1,758,682 |

|

|

|

1,758,682 |

|

|

Operating lease right of use assets, net |

|

3,436,130 |

|

|

|

3,512,042 |

|

|

Other assets |

|

72,251 |

|

|

|

116,697 |

|

| |

|

|

Total

assets |

$ |

18,608,500 |

|

|

$ |

19,356,268 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

Liabilities and shareholders' equity |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

|

| |

Line of credit |

$ |

1,000,000 |

|

|

$ |

1,000,000 |

|

| |

Note payable to Forward China |

|

1,600,000 |

|

|

|

1,600,000 |

|

| |

Accounts payable |

|

212,928 |

|

|

|

197,022 |

|

| |

Due to Forward China |

|

3,451,724 |

|

|

|

3,622,401 |

|

| |

Deferred income |

|

169,769 |

|

|

|

485,078 |

|

| |

Current portion of notes payable |

|

114,894 |

|

|

|

983,395 |

|

| |

Current portion of finance lease liability |

|

13,231 |

|

|

|

18,411 |

|

| |

Current portion of deferred consideration |

|

- |

|

|

|

45,000 |

|

| |

Current portion of operating lease liability |

|

269,569 |

|

|

|

259,658 |

|

| |

Accrued expenses and other current liabilities |

|

594,647 |

|

|

|

615,401 |

|

| |

|

|

Total

current liabilities |

|

7,426,762 |

|

|

|

8,826,366 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

Other liabilities: |

|

|

|

|

|

|

|

| |

Notes payable, less current portion |

|

- |

|

|

|

529,973 |

|

| |

Operating lease liability, less current portion |

|

3,288,938 |

|

|

|

3,359,088 |

|

| |

Finance lease liability, less current portion |

|

7,560 |

|

|

|

12,769 |

|

| |

Deferred consideration, less current portion |

|

60,000 |

|

|

|

45,000 |

|

| |

|

Total other liabilities |

|

3,356,498 |

|

|

|

3,946,830 |

|

| |

|

|

Total

liabilities |

|

10,783,260 |

|

|

|

12,773,196 |

|

| |

|

|

|

|

|

|

|

|

|

Commitments and contingencies |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Shareholders' equity: |

|

|

|

|

|

| |

Common stock, par value $0.01 per share; 40,000,000 shares

authorized; |

|

|

|

|

|

| |

|

9,886,351 and 9,883,851 shares issued and outstanding at December

31, 2020 |

|

|

| |

|

and September 30, 2020, respectively |

|

98,863 |

|

|

|

98,838 |

|

| |

Additional paid-in capital |

|

19,622,791 |

|

|

|

19,579,684 |

|

| |

Accumulated deficit |

|

(11,896,414 |

) |

|

|

(13,095,450 |

) |

| |

|

|

Total

shareholders' equity |

|

7,825,240 |

|

|

|

6,583,072 |

|

| |

|

|

Total

liabilities and shareholders' equity |

$ |

18,608,500 |

|

|

$ |

19,356,268 |

|

| |

|

|

|

|

|

|

|

FORWARD INDUSTRIES, INC. AND SUBSIDIARIES |

|

CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS |

|

(UNAUDITED) |

|

|

|

|

|

For the Three Months Ended December 31, |

|

|

|

2020 |

|

|

|

2019 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues, net |

$ |

9,717,603 |

|

|

$ |

8,392,854 |

|

|

Cost of sales |

|

7,454,717 |

|

|

|

6,672,845 |

|

|

Gross profit |

|

2,262,886 |

|

|

|

1,720,009 |

|

|

|

|

|

|

|

|

|

|

|

Sales and marketing expenses |

|

602,961 |

|

|

|

535,172 |

|

|

General and administrative expenses |

|

1,827,418 |

|

|

|

1,213,966 |

|

|

Loss from operations |

|

(167,493 |

) |

|

|

(29,129 |

) |

|

|

|

|

|

|

|

|

|

|

Gain on forgiveness of note payable |

|

(1,356,570 |

) |

|

|

- |

|

|

Fair value adjustment of earn-out consideration |

|

(30,000 |

) |

|

|

- |

|

|

Interest income |

|

(22,747 |

) |

|

|

- |

|

| Interest expense |

|

46,392 |

|

|

|

50,949 |

|

|

Other (income)/expense, net |

|

(3,604 |

) |

|

|

1,579 |

|

|

Income/(loss) before income taxes |

|

1,199,036 |

|

|

|

(81,657 |

) |

|

Provision for/(benefit from) income taxes |

|

- |

|

|

|

- |

|

|

Net income/(loss) |

$ |

1,199,036 |

|

|

$ |

(81,657 |

) |

|

|

|

|

|

|

|

|

|

|

Earnings/(loss) per share: |

|

|

|

|

|

|

|

|

Basic |

$ |

0.12 |

|

|

$ |

(0.01 |

) |

|

Diluted |

$ |

0.12 |

|

|

$ |

(0.01 |

) |

|

|

|

|

|

|

|

|

|

|

Weighted average common shares outstanding: |

|

|

|

|

|

|

|

|

Basic |

|

9,885,563 |

|

|

|

9,533,851 |

|

|

Diluted |

|

10,039,799 |

|

|

|

9,533,851 |

|

|

|

|

|

|

|

|

|

|

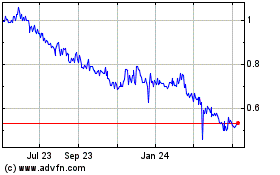

Forward Industries (NASDAQ:FORD)

Historical Stock Chart

From Jun 2024 to Jul 2024

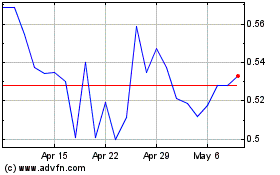

Forward Industries (NASDAQ:FORD)

Historical Stock Chart

From Jul 2023 to Jul 2024