Forward Industries, Inc. (NASDAQ:FORD), a designer and

distributor of custom carry and protective solutions, today

announced financial results for its fiscal year ended September 30,

2011.

Fiscal 2011 Financial Results – Compared to fiscal

2010:

- Net sales increased $3.8 million, or

20%, to $22.8 million in fiscal 2011 due to higher sales of

diabetic products, which increased $2.5 million, or 18%, and higher

sales of Other Products, which increased $1.2 million, or 26%.

- Gross profit increased $0.8 million, or

20%, to $5.1 million in fiscal 2011 primarily due to the increase

in net sales, and to a lesser extent, decreases in certain

components of costs of goods sold as a percentage of sales. These

improvements to costs of goods sold were offset, in part, by higher

materials costs.

- Sales and marketing expenses increased

$1.2 million, or 56%, to $3.4 million in fiscal 2011 primarily due

to investments we made in personnel and the incurrence of related

travel and entertainment costs. To a lesser extent, additional

investments made with regard to office and telecommunication,

product development, and sampling and promotion also contributed to

the increase. Such investments were made in Fiscal 2011 in order to

expand our business, the beginnings of which we expect to see in

the first quarter of our 2012 fiscal year, with continued growth

thereafter.

- General and administrative expenses

increased $1.1 million, or 29%, to $4.7 million in fiscal 2011

primarily due to investments we made in personnel including the

payment of retention and inducement bonuses and the incurrence of

related travel and entertainment costs, which, in part, was related

to the relocation of our executive offices. To a lesser extent,

additional investments made with regard to telecommunication,

general office, and professional services also contributed to the

increase. Such investments are related to the anticipated growth

referred to in the preceding paragraph.

- Other income (expense) increased to $58

thousand of income in fiscal 2011 from $10 thousand of income in

fiscal 2010, due primarily to higher interest income resulting from

a note receivable.

- Net loss was $2.9 million, or ($0.36)

per share, in 2011 compared to net loss of $1.7 million, or ($0.21)

per share, in fiscal 2010. The increase in net loss was due

primarily to the investments in operating expenses made in respect

of fiscal 2011 and in anticipation of the growth we expect for our

fiscal 2012 year (primarily sales and marketing as well as general

and administrative expenses), which were offset, in part, by higher

gross profit and other income.

Brett M. Johnson, Forward’s President and Chief Executive

Officer, commented: “We are pleased with the growth in sales and

gross profit that we achieved in our OEM business for fiscal 2011,

which, on a standalone basis, would have been profitable in fiscal

2011. Our net loss in fiscal 2011 directly reflects the ongoing

investments we are making in diversifying our selling channels and

expanding our product portfolio.”

Mr. Johnson continued: “In our OEM business, we have recently

been awarded several large programs by two major customers. We

anticipate that these programs will begin to contribute

meaningfully to revenues in the second half of fiscal 2012. In

addition, we have experienced increased interest from several

existing customers in both diabetic and consumer electronics

products. We are committed to growing our OEM business and we are

encouraged by the momentum we are experiencing in this channel. At

the same time, there are also headwinds in this market, as we

continue to face a very price-constrained environment and are

looking at increases in supplier prices.”

“As previously announced, our strategy is to leverage our

design, logistics, and sourcing expertise to build a global,

multi-channel (retail, corporate, online and OEM) consumer

electronics accessory brand that defines itself through leading

edge technology. We have invested significantly in product

development and sales resources in order to launch a “Forward”

branded line of cases and accessories into the retail and corporate

marketplace. This product range will include an extensive

collection of cases for smartphones, tablets and portable

computers, incorporating our exclusive license of G-Form’s

revolutionary and patented protection technology.”

“We believe the investments we have made in experienced sales,

design, product development, operations, and administrative

personnel, will bear fruit in fiscal 2012 with the expansion of our

product range, customer base and geographic coverage. As a result,

we hope to achieve our goal of transitioning Forward from a

predominantly “in-box” medical OEM case company, to a

multi-channel, multi-product, geographically diverse business that

differentiates itself through cutting-edge technology, design and

innovation.”

The tables below are derived from the Company’s audited,

consolidated financial statements included in its Annual Report on

Form 10-K filed today with the Securities and Exchange Commission.

Please refer to the Form 10-K for complete financial statements and

further information regarding the Company’s results of operations

and financial condition relating to the fiscal years ended

September 30, 2011 and 2010. Please also refer to the Form 10-K for

a discussion of risk factors applicable to the Company and its

business.

Note Regarding Forward-Looking Statements

In addition to the historical information contained herein, this

press release contains certain “forward-looking statements” within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended, that reflect Forward’s current expectations and

projections about its future results, performance, prospects and

opportunities. Forward has tried to identify these forward-looking

statements by using words such as “may”, “should,” “expect,”

“hope,” “anticipate,” “believe,” “intend,” “plan,” “estimate” and

similar expressions. These forward-looking statements are based on

information currently available to the Company and are subject to a

number of risks, uncertainties and other factors that could cause

its actual results, performance, prospects or opportunities in

fiscal 2012 and beyond to differ materially from those expressed

in, or implied by, these forward-looking statements. No assurance

can be given that the actual results will be consistent with the

forward-looking statements. Investors should read carefully the

factors described in the “Risk Factors” section of the Company’s

filings with the SEC, including the Company’s Form 10-K for the

year ended September 31, 2011 for information regarding risk

factors that could affect the Company’s results. Except as

otherwise required by Federal securities laws, Forward undertakes

no obligation to publicly update or revise any forward-looking

statements, whether as a result of new information, future events,

changed circumstances or any other reason.

About Forward Industries

Forward Industries, Inc. a designer and distributor of custom

carrying case solutions for hand held electronic devices, is

expanding into a multi- faceted product-focused company

specializing in power, protection and peripherals, is expert at

identifying new products that aim to make life more efficient with

superior function and smart design that enhance daily life.

Forward’s products, including those incorporating G-Form’s extreme

protection technology, can be viewed online at

www.forwardindustries.com.

FORWARD INDUSTRIES, INC.

CONSOLIDATED STATEMENTS OF

OPERATIONS

For the Fiscal Years

EndedSeptember 30,

2011 2010 Net sales $ 22,777,040 $

18,996,827

Cost of goods sold 17,712,425

14,764,840

Gross profit 5,064,615

4,231,987

Operating expenses:

Sales and marketing 3,391,396 2,166,542 General and administrative

4,688,236 3,636,309

Total operating

expenses 8,079,632 5,802,851

Loss from operations (3,015,017 ) (1,570,864 )

Other income (expense): Interest income 107,686

42,941 Other expense, net (49,258 ) (32,868 )

Total other income 58,428 10,073

Loss before income tax (benefit) expense

(2,956,589

)

(1,560,791

)

Income tax (benefit) expense (56,050 ) 124,032

Net loss $ (2,900,539 ) $ (1,684,823 )

Net

loss per common and common equivalent share Basic $ (0.36 ) $

(0.21 ) Diluted $ (0.36 ) $ (0.21 )

Weighted average

number of common and common equivalent shares outstanding

Basic 8,080,344 7,983,257 Diluted

8,080,344 7,983,257

FORWARD INDUSTRIES, INC.

CONSOLIDATED BALANCE SHEETS

September 30, September 30, 2011

2010

Assets

Current assets: Cash and cash equivalents $ 14,911,844 $

18,471,520 Accounts receivable, net 3,894,118 4,621,181 Inventories

1,045,219 1,036,386 Prepaid expenses and other current assets

1,018,227 240,651 Note receivable 1,000,000 --

Total current assets 21,869,408 24,369,738

Property and equipment, net 302,158 115,205 Other assets

88,716 46,032

Total assets $ 22,260,282

$ 24,530,975

Liabilities and

shareholders’ equity

Current liabilities: Accounts payable $ 2,947,562 $ 2,439,273

Accrued expenses and other current liabilities 630,031

885,332

Total current liabilities

3,577,593 3,324,605

Commitments and contingencies Shareholders’

equity:

Preferred stock, par value $0.01 per

share; 4,000,000 shares authorized;

no shares issued

-- --

Common stock, par value $0.01 per share;

40,000,000 shares authorized,

8,794,296 and 8,761,629 shares issued

(including 706,410 held in

treasury at both dates)

87,943 87,616 Capital in excess of par value 16,845,673 16,469,142

Treasury stock, 706,410 shares at cost (1,260,057 ) (1,260,057 )

Retained earnings 3,009,130 5,909,669

Total shareholders' equity 18,682,689

21,206,370

Total liabilities and shareholders’ equity

$ 22,260,282 $ 24,530,975

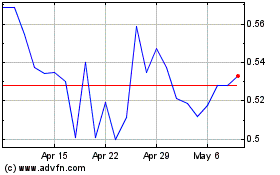

Forward Industries (NASDAQ:FORD)

Historical Stock Chart

From Jun 2024 to Jul 2024

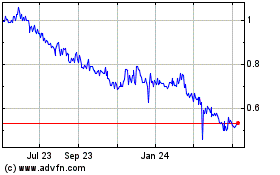

Forward Industries (NASDAQ:FORD)

Historical Stock Chart

From Jul 2023 to Jul 2024