UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the month of June 2024

Commission File Number: 000-29442

FORMULA SYSTEMS (1985) LTD.

(Translation of registrant’s name into English)

Terminal Center, 1 Yahadut Canada St., Or Yehuda

6037501, Israel

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒

Form 40-F ☐

CONTENTS

Special General Meeting of Shareholders

In compliance with the Companies

Law, 5759-1999 of the State of Israel and the regulations promulgated thereunder (the “Companies Law”), Formula Systems

(1985) Ltd. (“Formula”) hereby notifies the holders of its ordinary shares, par value NIS 1.00 per share (“Ordinary

Shares”) (including Ordinary Shares represented by American Depositary Shares) regarding its upcoming special general meeting

of shareholders (the “Meeting”). The Meeting will be held at Formula’s offices, located at Terminal Center, 1

Yahadut Canada St., Or Yehuda 6037501, Israel, at 2:00 p.m. (Israel time) on Thursday, July 11, 2024. The record date for the determination

of the holders of Ordinary Shares entitled to vote at the Meeting is Monday, June 24, 2024.

The

formal notice and proxy statement, and proxy card, for the Meeting are furnished as exhibits to this Report of Foreign Private Issuer

on Form 6-K, as listed below:

Exhibits

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| |

FORMULA SYSTEMS (1985) LTD. |

| |

|

|

| Date: June 20, 2024 |

By: |

/s/ Asaf Berenstin |

| |

|

Name: |

Asaf Berenstin |

| |

|

Title: |

Chief Financial Officer |

2

Exhibit 99.1

FORMULA SYSTEMS (1985) LTD.

Terminal Center, 1 Yahadut Canada St., Or Yehuda

6037501, Israel

June 20, 2024

NOTICE OF SPECIAL GENERAL MEETING OF SHAREHOLDERS

TO BE HELD ON JULY 11, 2024

Formula Systems (1985) Ltd. Shareholders:

We hereby inform you that

a Special General Meeting, or the Meeting, of Formula Systems (1985) Ltd., referred to as Formula or the Company, will be held at 2:00

p.m. (Israel time) on Thursday, July 11, 2024, at Formula’s offices at Terminal Center, 1 Yahadut Canada St., Or Yehuda 6037501,

Israel, for the following purpose:

| 1. | Replacement of Kost Forer Gabbay & Kasierer, registered

public accounting firm, a member of Ernst & Young Global, and appointment, in its stead, of Ziv Haft Certified Public Accountants,

a member firm of BDO International Limited, or BDO Israel, as the Company’s independent auditor for the year ending December 31,

2024, and authorization of the Company’s Board of Directors, or the Board, with the right to delegate such authority to the audit

committee of the Board, to fix BDO Israel’s compensation in accordance with the nature of its services. |

Our shareholders will furthermore

transact such other business as may properly come before the Meeting or any adjournment thereof.

Our Board unanimously recommends

that you vote in favor of the above proposal, which is described in the proxy statement attached to this notice. The proxy statement and

a related proxy card are being furnished to the Securities and Exchange Commission, or SEC, in a report of foreign private issuer on Form

6-K, or a Form 6-K, which may be obtained for free from the SEC’s website at www.sec.gov or at the Company’s website—

at http://www.formulasystems.com. The full text of the proposed resolution, together with the form of proxy card for the Meeting, may

also be viewed beginning on Tuesday, June 25, 2024, at the registered office of the Company, Terminal Center, 1 Yahadut Canada Street,

Or Yehuda 6037501, Israel, from Sunday to Thursday, 10:00 a.m. to 3:00 p.m. (Israel time). Our telephone number at our registered office

is +972-3-538-9487.

Holders of record of our ordinary

shares (including ordinary shares represented by American Depositary Shares, or ADSs) at the close of business on Monday, June 24, 2024

are entitled to vote at the Meeting.

The affirmative vote of the

holders of a majority of the voting power represented at the Meeting in person or by proxy and voting on the proposal (which excludes

abstentions and broker non-votes) is necessary for the approval of such proposal.

If you are a shareholder of

record voting by mail, your proxy card must be received at our registered office at least six (6) hours prior to the appointed time of

the Meeting to be validly included in the tally of ordinary shares voted at the Meeting. Your proxy, if properly executed, will be voted

in the manner directed by you. If no direction is made, your proxy will not be voted. If you attend the Meeting, you may vote in person

and your proxy will not be used. Detailed proxy voting instructions are provided both in the proxy statement and on the accompanying proxy

card.

Beneficial owners who hold

ordinary shares through members of the Tel Aviv Stock Exchange, or the TASE, may vote their shares by sending a certificate signed by

the TASE Clearing House member through which the shares are held, which complies with the Israel Companies Regulations (Proof of Ownership

for Voting in General Meetings)-2000 as proof of ownership of the shares, along with a duly executed proxy (in the form filed by us on

MAGNA, the distribution site of the Israeli Securities Authority, at www.magna.isa.gov.il), to the Company at Terminal Center, 1 Yahadut

Canada Street, Or Yehuda, 6037501, Israel, Attention: Chief Financial Officer. The foregoing certificate signed by the TASE Clearing House

member may instead be presented at the Meeting by a shareholder who wishes to vote at the Meeting itself. Alternatively, shares held through

a member of the TASE may be voted by means of an electronic vote, through the electronic voting system of the Israel Securities Authority

(votes.isa.gov.il), subject to proof of ownership of the shares on the record date, as required by law. Voting through the electronic

voting system will be allowed until 8:00 a.m., Israel time, on July 11, 2024 (that is, six (6) hours before the Meeting). You may receive

guidance on the use of the electronic voting system from the TASE member through which you hold your shares.

If your shares are represented

by ADSs, you should complete the voting instruction form being sent to you in order to direct the depositary for the ADSs, BNY Mellon,

to vote the number of shares represented by your ADSs in accordance with the instructions that you provide. If your ADSs are held in “street

name”, through a bank, broker or other nominee, you should follow the instructions in the proxy statement as to how to direct such

bank, broker or other nominee to arrange for the depositary to vote the ordinary shares represented by your ADSs in accordance with your

voting instructions.

In accordance with the Israeli

Companies Law, 5759-1999, and the Company’s amended and restated articles of association, any shareholder of the Company holding

at least 1% of the outstanding voting rights of the Company for the Meeting may submit to the Company a proposed additional agenda item

for the Meeting, to the Company’s offices at Terminal Center, 1 Yahadut Canada Street, Or Yehuda, 6037501, Israel, Attention: Chief

Financial Officer, email: ir@formula.co.il, no later than Sunday, June 23, 2024. To the extent that there are any additional agenda items

that the Board determines to add as a result of any such submission, the Company will publish an updated notice and proxy card with respect

to the Meeting, no later than Sunday, June 30, 2024, to be furnished to the SEC under cover of a Form 6-K.

| Sincerely, |

|

| |

|

| /s/ Asaf Berenstin |

|

| Asaf Berenstin |

|

| Chief Financial Officer |

|

FORMULA SYSTEMS (1985) LTD.

Terminal Center, 1 Yahadut Canada Street, Or Yehuda

6037501, Israel

+972-3-538-9487

PROXY STATEMENT

SPECIAL GENERAL MEETING OF SHAREHOLDERS

TO BE HELD ON JULY 11, 2024

This Proxy Statement is being

furnished in connection with the solicitation of proxies on behalf of the board of directors, or the Board, of Formula Systems (1985)

Ltd., to which we refer as Formula, the Company, our Company, us or we (or similar expressions), to be voted at a Special General Meeting

of Shareholders, or the Meeting, and at any adjournment thereof, pursuant to the accompanying Notice of Special General Meeting of Shareholders.

The Meeting will be held at 2:00 p.m. (Israel time) on Thursday, July 11, 2024, at our offices at Terminal Center, 1 Street, Or Yehuda

6037501, Israel.

This Proxy Statement, the

attached Notice of Special General Meeting of Shareholders, and the related proxy card or voting instruction form are being made available

to holders of Formula ordinary shares, par value NIS 1.00 per share, or ordinary shares, including ordinary shares that are represented

by American Depositary Shares, or ADSs, on a one-for-one basis, on or about Wednesday, June 26, 2024.

You are entitled to vote at

the Meeting if you hold ordinary shares as of the close of business on Monday, June 24, 2024, the record date for the Meeting. You can

vote your shares by attending the Meeting or by following the instructions under “How You Can Vote” below. Our Board urges

you to vote your shares so that they will be counted at the Meeting or at any postponements or adjournments of the Meeting.

Agenda Item

The following proposal is

on the agenda for the Meeting:

| 1. | Replacement of Kost Forer Gabbay & Kasierer, registered

public accounting firm, a member of Ernst & Young Global, and appointment, in its stead, of Ziv Haft Certified Public Accountants,

a member firm of BDO International Limited, or BDO Israel, as the Company’s independent auditor for the year ending December 31,

2024, and authorization of the Company’s Board of Directors, or the Board, with the right to delegate such authority to the audit

committee of the Board, to fix BDO Israel’s compensation in accordance with the nature of its services. |

Board Recommendation

Our Board unanimously recommends

that you vote “FOR” the Proposal.

Quorum

On June 1, 2024, we had 15,332,667

ordinary shares issued and outstanding (including shares represented by 130,540 ADSs as of that date, and shares subject to restrictions

and repurchase by us). The foregoing number of issued and outstanding ordinary shares excludes 568,620 ordinary shares that we repurchased

(24,780 in 2002 and 543,840 in 2011), as under applicable Israeli law, shares that are held by the Company have no voting rights. Each

ordinary share (including an ordinary share represented by an ADS) outstanding as of the close of business on the record date, June 24,

2024, is entitled to one vote upon each matter to be presented at the Meeting. Under our amended and restated articles of association,

or the Articles, the Meeting will be properly convened if at least two shareholders (including holders of ADSs that represent ordinary

shares) attend the Meeting in person or sign and return proxies, provided that they hold shares representing at least twenty-five percent

(25%) of our voting power. If such quorum is not present within one hour from the time scheduled for the Meeting, the Meeting will be

adjourned for one week (to the same day and time in the following week, and at the same place), or to a day, time and place proposed by

the Chairman with the consent of the holders of a majority of the voting power represented at the Meeting in person or by proxy and voting

on the adjournment. If 25% of our voting power is not present within one half-hour of the time designated for the adjourned meeting, any

two shareholders attending in person or by proxy will constitute a quorum, regardless of the number of shares they hold or represent.

Who Can Vote

You are entitled to vote at

the Meeting if you are a shareholder of record at the close of business on Monday, June 24, 2024. You are also entitled to vote at the

Meeting if you held ordinary shares through a bank, broker or other nominee that is one of our shareholders of record at the close of

business on Monday, June 24, 2024, or which appear in the participant listing of a securities depository on that date. If you hold ADSs

(whether the ADSs are registered directly in your name or are held in “street name”) as of that date, you are entitled to

receive notice of the Meeting and to direct the depositary for the ADSs, The Bank of New York Mellon, as to how to vote the ordinary shares

represented by your ADSs at the Meeting.

How You Can Vote

The method of ensuring that

your ordinary shares are voted at the Meeting will differ for shares held as a record holder, shares held in “street name”

(through a Tel Aviv Stock Exchange, or TASE, member) and shares underlying ADSs that you hold. Record holders of shares will need to complete

and execute proxy cards (accessible at the Company’s website) and submit them to the Company. Holders of shares in “street

name” through a TASE member will vote via a proxy card, but through a different procedure (as described below) or by electronic

voting via the electronic voting system of the Israel Securities Authority. Holders of ADSs (whether registered in their name or in “street

name”) will receive voting instruction forms in order to instruct the Depositary how to vote (as described below).

Shareholders of Record

If you are a shareholder of

record (that is, you hold a share certificate that is registered in your name or your shares are registered in your name in book-entry

form), you can submit your vote by attending the Meeting, or by completing, signing and submitting a proxy card, which will be accessible

at the “Investor Relations” section of the Company’s website, as described below under “Availability of Proxy

Materials”.

Please follow the instructions

on the proxy card. You may change your mind and cancel your proxy card by sending us written notice, by signing and returning a proxy

card with a later date, or by voting in person or by proxy at the Meeting. Except if the Chairman of the Meeting determines otherwise,

we will not be able to count a proxy card unless our registrar and transfer agent receives it in the enclosed envelope by 11:59 p.m.,

Eastern time, on Wednesday, July 10, 2024 (which is 6:59 a.m., Israel time, on July 11, 2024), or we receive it at our principal executive

offices at Terminal Center, 1 Yahadut Canada Street, Or Yehuda, 6037501, Israel, Attention: Chief Financial Officer, e-mail: ir@formula.co.il,

at least six hours prior to the time fixed for the Meeting (that is, by 8:00 a.m., Israel time, on Thursday, July 11, 2024). The chairman

of the Meeting may waive that six-hour deadline.

Shareholders Holding Through

the TASE

If you hold ordinary shares

through a bank, broker or other nominee that is admitted as a member of the TASE, your shares can be voted in one of the following three

manners: (i) by attending the Meeting and voting in person; (ii) by sending in your vote in advance of the Meeting; or (iii) by voting

electronically in advance of the Meeting via the electronic voting system of the Israel Securities Authority. Each of these possibilities

is described further in the next paragraph.

If you hold ordinary shares

via a member of the TASE, you may vote your shares in person at the Meeting, by presenting a certificate signed by the TASE Clearing House

member through which the shares are held, which complies with the Israel Companies Regulations (Proof of Ownership for Voting in General

Meetings)-2000 as proof of ownership of the shares (an “ishur baalut”). In the alternative, you may vote in advance

of the Meeting by sending that proof-of-ownership certificate, along with a duly executed proxy card (in the form filed by us on MAGNA,

the distribution site of the Israeli Securities Authority, at www.magna.isa.gov.il), to the Company at Terminal Center, 1 Yahadut Canada

Street, Or Yehuda, 6037501, Israel, Attention: Chief Financial Officer. If you utilize that method, your vote must be received by us at

least six (6) hours prior to the time fixed for the Meeting (that is, by 8:00 a.m., Israel time, on Thursday, July 11, 2024). The Chairman

of the Meeting may waive that six-hour deadline. As a third possibility, you may vote electronically in advance of the Meeting through

the electronic voting system of the Israel Securities Authority (votes.isa.gov.il), subject to proof of ownership of the shares on the

record date, as required by law. Voting through the electronic voting system will be allowed until six (6) hours before the Meeting (that

is, until 8:00 a.m., Israel time, on Thursday, July 11, 2024).

If you hold your shares through

a TASE member and you voted in advance of the Meeting and seek to change or revoke your vote, then (i) if you sent in your vote (together

with proof of ownership) originally to the Company, you can send in a later-dated proxy card and proof of ownership to the Company, or

(ii) if you voted originally via the electronic voting system of the Israel Securities Authority, you may change or revoke your vote using

the electronic voting system. In either case, you must complete the revocation of your vote before the deadline for submitting a vote

(which is described above).

Holders of ADSs

Under the terms of the Deposit

Agreement by and among our Company, The Bank of New York Mellon, as depositary, or the Depositary, and the holders of our ADSs, the Depositary

shall endeavor (insofar as is practicable and in accordance with applicable law and the Articles of Association of our Company) to vote

or cause to be voted the number of shares represented by ADSs in accordance with the instructions provided by the holders of ADSs to the

Depositary. For ADSs that are held in “street name”, through a bank, broker or other nominee, the voting process will be based

on the underlying beneficial holder of the ADSs directing the bank, broker or other nominee to arrange for the Depositary to vote the

ordinary shares represented by the ADSs in accordance with the beneficial holder’s voting instructions. If no instructions are received

by the Depositary from any holder of ADSs (whether held directly by a beneficial holder or in “street name”) with respect

to any of the shares represented by the ADSs on or before the date established by the Depositary for such purpose, the Depositary will

not vote the shares represented by such ADSs.

Therefore, if you hold our

ADSs, please complete, sign and return the voting instruction form that you receive to the Depositary as soon as possible in order to

ensure that the ordinary shares underlying your ADSs are voted at the Meeting. If you seek to change or revoke your voting instructions,

please follow the instructions for doing so that are provided to you by the Depositary.

Multiple Record Shareholders or Accounts

You may receive more than

one set of voting materials, including multiple copies of this document and multiple voting instruction forms. For example, shareholders

who hold ADSs in more than one brokerage account will receive a separate voting instruction form for each brokerage account in which ADSs

are held. Shareholders of record whose shares are registered in more than one name should complete, sign, date and return one proxy card

for each name in which shares are held.

Vote Required for Approval of Proposal

The affirmative vote of the

holders of a majority of the voting power represented at the Meeting in person or by proxy and voting thereon (which excludes abstentions

and broker non-votes) is necessary for the approval of Proposal 1.

Various Voting Scenarios

If you are a shareholder of

record and do not return your proxy card, your shares will not be voted. If you provide specific instructions (mark boxes) with regard

to any of the proposals, your shares will be voted as you instruct. If you sign and return your proxy card without giving specific instructions,

your shares will not be voted. The proxy holders will furthermore vote in their discretion on any other matters that properly come before

the Meeting.

If you hold shares beneficially

via a member of the TASE, your shares will also not be voted at the Meeting if you do not follow the above-described instructions for

voting, and will not be voted with respect to a particular proposal if you do not indicate how you would like to vote on that proposal.

Similarly, in the case of

ordinary shares represented by ADSs, if you do not return your voting instruction form to instruct your broker how to cause the Depositary

to vote, the Depositary will not vote the shares represented by those ADSs.

Solicitation of Proxies

A form of proxy for use at

the Meeting or a voting instruction form for directing the Depositary has been filed publicly or mailed to you (as appropriate). Shareholders

may revoke the authority granted by their execution of proxies at any time before the effective exercise thereof by filing with us a written

notice of revocation or duly executed proxy bearing a later date, or by voting in person at the Meeting. Proxies are being made available

to shareholders on or about Wednesday, June 26, 2024. Certain officers, directors, employees, and agents of the Company, none of whom

will receive additional compensation therefor, may solicit proxies by telephone, emails, or other personal contact. We will bear the cost

for the solicitation of the proxies, including postage, printing, and handling, and will reimburse the reasonable expenses of brokerage

firms and others for forwarding material to beneficial owners of shares and ADSs.

Availability of Proxy Materials

Copies of the proxy card,

the notice of the Meeting and this Proxy Statement are available at the “Investor Relations” section of our Company website,

www.formulasystems.com. The contents of that website are not a part of this Proxy Statement.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

AND MANAGEMENT

The following table sets forth

the number of ordinary shares beneficially owned, directly or indirectly, by (i) each person known by us to be the owner of more than

5% of our outstanding ordinary shares, and (ii) all of our directors and executive officers as a group, as of June 1, 2024 (or as of such

earlier or later date as appears in the footnotes below).

| Name | |

Number

of

Ordinary Shares

Beneficially

Owned (1) | | |

Percentage of

Ownership (2) | |

| Asseco

Poland S.A. (3) | |

| 3,958,164 | | |

| 25.82 | % |

| Guy

Bernstein (4) | |

| 1,797,973 | | |

| 11.73 | % |

| Harel

Insurance Investments & Financial Services Ltd.(5) | |

| 1,328,268 | | |

| 8.66 | % |

| Menora

Mivtachim Holdings Ltd.(6) | |

| 1,088,760 | | |

| 7.10 | % |

| The

Phoenix Holdings Ltd. (7) | |

| 1,106,239 | | |

| 7.21 | % |

| Yelin

Lapidot Holdings Management Ltd. (8) | |

| 970,450 | | |

| 6.33 | % |

| Clal

Insurance Enterprises Holdings Ltd. and affiliates (9) | |

| 824,703 | | |

| 5.38 | % |

| All

directors and executive officers as a group (8 persons) (10) | |

| 1,829,306 | | |

| 11.93 | % |

| (1) | Beneficial ownership is determined in accordance with the

rules of the SEC, and generally includes voting or investment power with respect to securities. Ordinary shares underlying options currently

exercisable or exercisable within 60 days of the date of this table are deemed outstanding for computing the ownership percentage of

the person holding such options but are not deemed outstanding for computing the ownership percentage of any other person. Except as

indicated by footnote, and subject to community property laws where applicable, the persons named in the table above have sole voting

and investment power with respect to all shares shown as beneficially owned by them. |

| (2) | The percentages shown

are based on 15,332,667 ordinary shares (including 131,732 shares represented by ADSs, and shares subject to restrictions and repurchase

by us) issued and outstanding as of June 1, 2024. |

| (3) | Based on Amendment

No. 5 to Schedule 13D filed by Asseco Poland S.A., or Asseco, with the SEC on December 7, 2022. Due to the public ownership of its shares,

Asseco is not controlled by any other corporation or any one individual or group of shareholders. |

| (4) | Based on Amendment

No. 4 to Schedule 13D filed by Mr. Bernstein with the SEC on December 7, 2022. Consists of (a) (i) 1,362,822 ordinary shares held in

trust for Mr. Bernstein, and (b) an additional 435,151 ordinary shares held by Mr. Bernstein. |

| (5) | Based on written notification

received from Harel Insurance Investments & Financial Services Ltd., or Harel Insurance, on April 2, 2024 with respect to its holdings

as of March 31, 2024. Harel Insurance is a publicly held Israeli company. Out of the 1,318,304 ordinary shares beneficially owned

by Harel Insurance as of March 31, 2024: (i) 1,196,494 ordinary shares are held for members of the public through, among others, provident

funds and/or mutual funds and/or pension funds and/or insurance policies and/or exchange traded funds, which are managed by subsidiaries

of Harel Insurance, each of which subsidiaries operates under independent management and makes independent voting and investment decisions;

and (ii) 131,774 ordinary shares are beneficially held for Harel Insurance’s own account. |

| (6) | Based on written notification

received from Menora Mivtachim Holdings Ltd., or Menora Holdings, on April 2, 2024 with respect to its holdings as of March 31, 2024.

As of March 31, 2024, the subject ordinary shares are beneficially owned by Menora Holdings or by entities that are direct or indirect,

wholly-owned or majority-owned, subsidiaries of Menora Holdings. Out of the 1,088,760 ordinary shares beneficially owned by Menora Holdings

as of March 31, 2024. |

| (7) | Based on written notification

received from The Phoenix Holdings Ltd., or Phoenix Holdings, on April 2, 2024 with respect to its holdings as of March 31, 2023. The

ordinary shares held by Phoenix Holdings are beneficially owned by various direct or indirect, majority or wholly-owned, subsidiaries

of Phoenix Holdings, or the Phoenix Subsidiaries. The Phoenix Subsidiaries manage their own funds and/or the funds of others, including

for holders of exchange-traded notes or various insurance policies, members of pension or provident funds, unit holders of mutual funds,

and portfolio management clients. Each of the Phoenix Subsidiaries operates under independent management and makes its own independent

voting and investment decisions. As of March 31, 2024, the subject ordinary shares were held as follows: (i) The Phoenix pension and

provident funds: 34,917; (ii) Partnership for Israeli shares: 757,176, and Partnership for investing in share indexes: 2,089 (all ownership

rights in these partnerships belong to companies that are part of the Phoenix Group, and the amount of ownership rights held by such

companies in the partnership changes frequently according to a mechanism provided in the partnership agreement); (iii) The Phoenix Investments

House - trust funds: 307,785; and (iv) The Phoenix “nostro” accounts: 4,272. |

| (8) | Based on written notification

received from Yelin Lapidot, or Yelin, on April 1, 2024 with respect to its holdings as of March 31, 2024. Out of the 970,450 ordinary

shares beneficially owned by Yelin as of March 31, 2024: (i) 680,901 are beneficially owned by provident funds managed by Yelin Lapidot

Provident Funds Management Ltd., or Yelin Provident; and (ii) 289,549 are beneficially owned by mutual funds managed by Yelin Lapidot

Mutual Funds Management Ltd., or Yelin Mutual. Each of Yelin Provident and Yelin Mutual is a wholly-owned subsidiary of Yelin. Each of

Messrs. Dov Yelin and Yair Lapidot owns 24.38% of the share capital and 25.004% of the voting rights of Yelin, and is responsible for

the day-to-day management of Yelin Lapidot Holdings. The ordinary shares beneficially owned are held for the benefit of the members of

the provident funds and the mutual funds managed by Yelin Provident and Yelin Mutual, respectively. Each of Yelin, Yelin Provident, Yelin

Mutual and Messrs. Yelin and Lapidot disclaims beneficial ownership of the subject ordinary shares. |

| (9) | Based on written notification received from Clal Insurance

Enterprises Holdings Ltd., or Clal, on April 1, 2024 with respect to its holdings as of March 31,

2024. Clal is a publicly held Israeli company. All 824,703 ordinary shares beneficially owned by Clal as of March 31, 2024 are

held for members of the public through, among others, provident funds and/or pension funds and/or insurance policies, which are managed

by subsidiaries of Clal, each of which subsidiaries operates under independent management and makes independent voting and investment

decisions. |

| (10) | Includes the shares

beneficially owned by Guy Bernstein described in footnote (4) above, as well as 21,333 vested restricted shares granted to Asaf Berenstin,

the Company’s Chief Financial Officer, on each of November 13, 2014, on August 17, 2017 and on March 14, 2022, under the Company’s

2011 and 2021 Employee and Officer Share Incentive Plans. Besides Mr. Bernstein, Mr. Berenstin, and Ms. Maya Solomon-Ella, the Company’s

Chief Operations Officer (who was granted 10,000 restricted shares in November 2018, all of which are vested), none of our other directors

or executive officers beneficially owns any ordinary shares (whether actual ordinary shares or shares issuable upon exercise of options). |

PROPOSAL 1

REPLACEMENT OF CURRENT INDEPENDENT AUDITOR

WITH NEW INDEPENDENT AUDITOR FOR FISCAL YEAR ENDING DECEMBER 31, 2024

Background

Under the Israeli Companies

Law, 5759-1999, as amended, or the Companies Law, a company’s independent auditor is responsible for auditing, and giving an opinion

on, the company’s annual financial statements. The Companies Law states that the auditor must be appointed by the shareholders at

a general meeting of shareholders. Usually, at each annual general meeting of shareholders, the shareholders must vote to re-appoint the

auditor to audit the annual financial statements and to serve for a term that extends until the following annual general meeting.

Our current independent auditor,

Kost Forer Gabbay & Kasierer, registered public accounting firm, a member of Ernst & Young Global, which we refer to as EY Israel

or the current auditor, has served as our independent auditor since 2010, and was mostly recently re-appointed at our annual general meeting

of shareholders held on May 9, 2024 to audit our consolidated financial statements for the year ended December 31, 2023 and to serve for

the period until our next annual general meeting of shareholders.

While we are an Israeli company,

we are also part of the group of companies of Asseco Poland S.A. or Asseco, our controlling shareholder under the Companies Law, which

is a publicly-traded Polish company whose shares are listed on the Warsaw Stock Exchange. Due to its public listing in Poland, Asseco

is subject to European Union, or EU, rules that regulate the auditors of public-interest companies, as defined under EU Accounting Directive

2013/34/EU, which includes companies listed on European exchanges. EU Directive 2014/56/EU, which became effective on June 17, 2016, established

mandatory auditor firm rotation at least once every ten years, as a means towards improving the quality of practices related to the audit

of publicly-traded companies. The permitted duration of an audit engagement is calculated under the rule from the date of the first financial

year covered in the initial audit engagement letter. Under the applicable directive and regulations, member states of the EU may establish

shorter rotation periods or may allow publicly-traded companies to extend their audit engagement under certain circumstances. To date,

Polish law has implemented the general auditor EU directive with respect to the required replacement of a public-traded company’s

auditor firm at least once every ten years.

In light of the applicability

of the EU auditor rotation directive to Formula as a controlled company of Asseco, we are required to rotate our auditor once every ten

years.

Given that requirement, on

June 13, 2024, the audit committee of the Board met and determined that it is appropriate and in the best interest of the Company, and

recommended to the Board that our shareholders be requested to approve, the replacement of EY Israel with Ziv Haft Certified Public Accountants,

a member firm of BDO International Limited, which we refer to as BDO Israel or the new auditor. At that meeting, the committee approved,

and submitted to the Board for approval, BDO Israel’s replacement of EY Israel as our new auditor, and BDO Israel’s appointment

to audit our financial statements for the year ending December 31, 2024, and to serve as our independent auditor for the period from

the Meeting until our next annual general meeting of shareholders.

The audit committee’s

recommendation to appoint BDO Israel specifically was based upon the following factors:

(1) Quality, Consistency

and Efficiency. Asseco, which is our controlling shareholder, has appointed BDO and its affiliated firms to audit its consolidated

financial statements, such that our choice of BDO Israel will contribute towards the maintenance of audit quality, consistency and efficiency

across our group;

(2) Quality of Audit Policies

and Procedures. The audit committee felt assured by BDO Israel’s commitment to the quality of audit and the efforts that will

be dedicated by it to our audit process, including, among other items, the policies, processes, and procedures implemented by the new

auditor firm for supervising and controlling audit quality;

(3) Expertise of the Audit

Team. BDO Israel’s expertise, capabilities, and qualifications are proportional to the size, nature of activity, and scope of

our operations, and appropriate for treating the risks inherent in our activities, as BDO Israel is one of the five largest accounting

firms in Israel that services many public companies, including those with a significant size that is comparable to that of our company;

(4) Understanding of Our

Field of Activity. BDO Israel has the ability to understand our industry, including to identify significant risks and issues as part

of its audit process, and to provide an appropriate and adequate response to any identified risks and issues, taking into account our

industry and our status as a public company;

(5) Reasonable Proposed

Remuneration. The compensation proposed for BDO Israel’s services was deemed by our audit committee to be suitable and appropriate

based upon the scope and complexity of the audit of our company’s financial statements; and

(6) Auditor Independence.

Our management has inquired, and our audit committee has verified, various aspects of the independence of BDO Israel, and has determined

that BDO Israel’s independence from our company, as well as its policies and processes that it implements for ensuring adherence

to the rules of independence, are appropriate.

On June 13, 2024, the Board

accepted that recommendation of the audit committee and resolved that it is in the best interests of the Company, subject to the approval

of the Company’s shareholders at the Meeting, to replace the current auditor and to appoint the new auditor to audit the Company’s

financial statements for the fiscal year ending December 31, 2024, and to serve until the next annual general meeting of the shareholders

of the Company.

Following the recommendation

of the audit committee and Board, our shareholders will be asked to approve, at the Meeting: (i) the replacement of EY Israel with BDO

Israel, which would be appointed as our new independent registered public accountants for the year ending December 31, 2024 and the additional

period (if any) until our next annual general meeting of shareholders; and (ii) the authorization of our Board (or the audit committee

thereof) to fix BDO Israel’s compensation.

SEC-Mandated Disclosures for Non-Renewal of Current Auditor

As described above, the

proposed replacement of our auditor was entirely a result of our required compliance, as an affiliated company of Asseco, with the EU

directive mandating auditor rotations every ten years. As such, our proposed replacement of EY Israel did not result from any disagreement

between EY Israel and our Company and was agreed upon by both parties. On the contrary, we would like to thank EY Israel for the high-quality

audit, support and professional handling of our audits throughout its terms of service as our independent auditor. Furthermore, EY Israel’s

report on our financial statements for each of the past two years (the years ended December 31, 2022 and 2023) did not contain an adverse

opinion or a disclaimer of opinion, and was not qualified or modified as to uncertainty, audit scope or accounting principles. In the

years ended December 31, 2022 and 2023, and in the interim period from the start of 2024 to the current time, we have not had any disagreements

with EY Israel on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure. In

particular, we have not had any such disagreements (whether resolved or not) which, if not resolved to EY Israel’s satisfaction,

would have caused EY Israel to make reference to the subject matter of the disagreement in connection with its reports on our financial

statements. The disagreements referred to in this paragraph are disagreements at the decision-making level, i.e., between our personnel

who are responsible for presentation of our financial statements and personnel of EY Israel who are responsible for rendering its report

on those financial statements.

In addition to not having

any disagreements with our current auditor during the years ended December 31, 2022 and 2023, and in the interim period from the start

of 2024 to the current time, we have also not had any of the following events occur between us and our current auditor during those periods

of time:

(A) our current auditor having advised us that

the internal controls necessary for our Company to develop reliable financial statements do not exist;

(B) our current auditor having advised us that

information has come to its attention that has led it to no longer be able to rely on our management’s representations, or that

has made it unwilling to be associated with the financial statements prepared by our management;

(C) (1) our current auditor having advised us

of the need to expand significantly the scope of its audit, or that information has come to its attention that if further investigated

may:

(i) materially impact the

fairness or reliability of either: a previously issued audit report or the underlying financial statements; or the financial statements

issued or to be issued covering the fiscal period(s) subsequent to the date of the most recent financial statements covered by an audit

report (including information that may prevent it from rendering an unqualified audit report on those financial statements); or

(ii) cause it to be unwilling

to rely on our management’s representations or be associated with our financial statements; and

(2) due to the current auditor’s

dismissal, or for any other reason, the current auditor did not so expand the scope of its audit or conduct such further investigation;

or

(D) (1) The current auditor’s having advised

us that information has come to its attention that it has concluded materially impacts the fairness or reliability of either (i) a previously

issued audit report or the underlying financial statements, or (ii) the financial statements issued or to be issued covering the fiscal

period(s) subsequent to the date of the most recent financial statements covered by an audit report (including information that, unless

resolved to the current auditor’s satisfaction, would prevent it from rendering an unqualified audit report on those financial statements);

and

(2) Due to the current auditor’s

dismissal, or for any other reason, the issue has not been resolved to the current auditor’s satisfaction prior to its dismissal.

Prior to our prospective engagement

of BDO Israel, we (including anyone on our behalf) have not consulted BDO Israel regarding: either (i) the application of accounting principles

to a specified transaction, either completed or proposed; or the type of audit opinion that might be rendered on our financial statements,

or (ii) any matter that was either the subject of a disagreement with EY Israel or a reportable event (as described above with respect

to EY Israel).

As is required under the

rules of the SEC, we have provided to EY Israel a copy of the disclosures we are making in this part of Proposal 1 (under the heading

“SEC-Mandated Disclosures for Non-Renewal of Current Auditor”) and have requested that EY Israel furnish to

us a letter addressed to the SEC stating whether it agrees with the statements made by us in this Proposal 1 and, if not, stating the

respects in which it does not agree. That letter is attached as Appendix A to this Proxy Statement.

Companies Law-Mandated Procedures

for Change of Auditor

Under the Companies Law, when

the non-renewal of the term of an auditor of a public company (or the replacement of such auditor), is brought for approval of a

company’s shareholders, that auditor must be given reasonable opportunity to present its position regarding such non-renewal to

the company’s audit committee, in addition to being invited to present its position at the meeting of shareholders. Our current

auditor has been afforded the opportunity to present its position to the audit committee of our Board and to the Meeting regarding the

non-renewal of its term, and has waived such right in accordance with Sections 162(b) and 164(a) of the Companies Law, respectively.

BDO Israel has advised the

Company that the firm does not have any direct or indirect financial interest in the Company and has not had any such interest in the

Company during the past three fiscal years.

Auditor Fees in Last Two Fiscal Years

For

a summary of the fees for professional services (consisting of audit fees, and tax and other fees) rendered to us by EY Israel for the

years ended December 31, 2022 and 2023, please see Item 16C. “Principal Accountant Fees and Services” of our annual

report on Form 20-F for the year ended December 31, 2023, which we filed with the SEC on May 15,

2024, which information is incorporated by reference in this Proposal 1.

Proposed Resolutions

The Board recommends that

the shareholders of the Company adopt the following resolutions at the Meeting pursuant to Proposal 1:

“RESOLVED, that Kost Forer Gabbay

& Kasierer, registered public accounting firm, a member of Ernst & Young Global, be, and hereby is, replaced and Ziv Haft Certified

Public Accountants, a member firm of BDO International Limited, be, and hereby is, appointed as the Company’s independent auditor

for the fiscal year ending December 31, 2024, and for the additional period until the next annual general meeting of the shareholders

of the Company; and be it

“FURTHER RESOLVED, that the Company’s

Board of Directors, with power of delegation to the audit committee thereof, be, and hereby is, authorized to determine the remuneration

of Ziv Haft Certified Public Accountants, a member firm of BDO International Limited, in accordance

with the volume and nature of such firm’s services.”

Required Majority

The approval of Proposal

1 requires the affirmative vote of the holders of a majority of the voting power represented at the Meeting in person or by proxy and

voting thereon (which excludes abstentions and broker non-votes).

Board Recommendation

The Board unanimously

recommends that shareholders vote “FOR” the replacement of our current auditor and the appointment of our new auditor pursuant

to Proposal 1.

ADDITIONAL INFORMATION

Our annual report on Form

20-F for the year ended December 31, 2023, including our audited consolidated financial statements as of, and for the year ended, December

31, 2023, and the auditor’s report thereon, which we filed with the SEC on May 15, 2024, is available at the “Investor Relations”

portion of our website, at www.formulasystems.com, and through the EDGAR website of the SEC at www.sec.gov. To receive a hard copy of

that annual report free of charge upon request, please contact our Chief Financial Officer, Asaf Berenstin, at telephone +972-3-538-9487

or email ir@formula.co.il. None of the auditor’s report, our consolidated financial statements, the rest of that annual report,

or the contents of our website, forms or will form a part of the proxy solicitation material.

| By Order of the Board of Directors, |

|

| |

|

| /s/ Asaf Berenstin |

|

| Asaf Berenstin |

|

| Chief Financial Officer |

|

Dated: June 20, 2024

|

Kost Forer Gabbay & Kasierer

144 Menachem Begin St.

Tel-Aviv 6492102, Israel |

|

Tel: +972-3-6232525

Fax: +972-3-5622555

ey.com

|

Appendix A

Current Auditor’s Letter

June 20, 2024

Office of the Chief Accountant

Securities and Exchange Commission

100 F Street, NE

Washington, D.C. 20549

Ladies and Gentlemen:

We have read the statements

under the heading “SEC-Mandated Disclosures for Non-Renewal of Current Auditor” included in Exhibit No. 99.1 in the

Report of Foreign Private Issuer on Form 6-K of Formula Systems (1985) Ltd. to be furnished to the Securities and Exchange Commission

on June 20, 2024, and are in agreement with the statements contained therein as they relate to our firm. We have no basis to agree or

disagree with other statements of the registrant contained therein.

Sincerely,

| /s/ KOST, FORER, GABBAY & KASIERER | |

| A Member of EY Global | |

| | |

| Tel Aviv, Israel | |

Exhibit 99.2

FORMULA SYSTEMS (1985) LTD.

PROXY FOR SPECIAL GENERAL MEETING OF SHAREHOLDERS

TO BE HELD ON JULY 11, 2024

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD

OF DIRECTORS

The undersigned hereby constitutes

and appoints Asaf Berenstin, the true and lawful attorney, agent and proxy of the undersigned, with full power of substitution, to represent

and to vote, on behalf of the undersigned, all of the ordinary shares of Formula Systems (1985) Ltd. (the “Company”)

held of record in the name of the undersigned at the close of business on Monday, June 24, 2024, at the Special General Meeting of Shareholders

of the Company (the “Meeting”) to be held at the offices of the Company, Terminal Center, 1 Yahadut Canada St., Or

Yehuda 6037501, Israel, on Thursday, July 11, 2024, at 2:00 p.m. (local time), and at any and all adjournments or postponements thereof,

on the matters listed on the reverse side, which are more fully described in the Notice of Special General Meeting of Shareholders (the

“Notice”) and Proxy Statement (the “Proxy Statement”) relating to the Meeting.

The undersigned acknowledges

the availability to him, her or it of the Notice and Proxy Statement relating to the Meeting.

THIS PROXY, WHEN PROPERLY

EXECUTED, WILL BE VOTED IN THE MANNER DIRECTED HEREIN BY THE UNDERSIGNED. If no direction is made,

the undersigned will be deemed to have not participated in the voting.

Any and all proxies heretofore

given by the undersigned are hereby revoked.

(Continued and to be signed on the reverse side)

SPECIAL GENERAL MEETING OF SHAREHOLDERS OF

FORMULA SYSTEMS (1985) LTD.

JULY 11, 2024

Please date, sign and mail your proxy card in

the

envelope provided as soon as possible.

☐

Please detach along perforated line before mailing. ☐

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR”

EACH

OF THE PROPOSALS BELOW.

PLEASE MARK YOUR VOTE IN BLUE OR BLACK INK AS

SHOWN HERE ☐

| |

|

PROPOSAL |

|

FOR |

AGAINST |

ABSTAIN |

| |

1. |

Replacement of Kost Forer Gabbay & Kasierer, a member of Ernst & Young Global, and appointment, in its stead, of Ziv Haft Certified Public Accountants, a member firm of BDO International Limited (“BDO Israel”), as the Company’s independent auditor for the year ending December 31, 2024, and authorization of the Company’s Board of Directors, or the audit committee thereof, to fix BDO Israel’s compensation |

|

☐ |

☐ |

☐ |

Signature of

Shareholder |

|

|

Date |

|

|

Signature of

Shareholder |

|

|

Date |

|

| Note: |

Please sign exactly as your name or names appear on this Proxy. When shares are held jointly, each owner should sign. When signing as executor, administrator, attorney, trustee or guardian, please give full title as such. If the signer is a corporation, please sign full corporate name by a duly authorized officer, giving full title as such. If the signer is a partnership, please sign in partnership name by authorized person. |

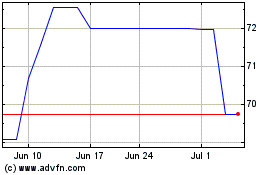

Formula Systems 1985 (NASDAQ:FORTY)

Historical Stock Chart

From Feb 2025 to Mar 2025

Formula Systems 1985 (NASDAQ:FORTY)

Historical Stock Chart

From Mar 2024 to Mar 2025