FirstService Corporation (TSX: FSV; NASDAQ: FSV) today reported

strong results for its first quarter ended March 31, 2021. All

amounts are in US dollars.

Consolidated revenues for the first quarter were

$711.1 million, up 12% relative to the same quarter in the prior

year, with organic growth accounting for half of the increase.

Adjusted EBITDA (note 1) increased 36% to $59.8 million, and

Adjusted EPS (note 2) was $0.66, representing 78% growth over the

prior year quarter. GAAP Operating Earnings were $33.9 million,

relative to $16.0 million in the prior year period. GAAP diluted

earnings per share was $0.50 per share in the quarter, versus $0.13

in the same quarter a year ago.

“We are pleased to have kicked off the year with

a strong first quarter,” said Scott Patterson, Chief Executive

Officer of FirstService. “We saw growing momentum in our home

improvement brands and capitalized on increased restoration

activity, while our FirstService Residential platform showed

continued strength and resilience in countering the impact of the

pandemic,” he concluded.

About FirstService

CorporationFirstService Corporation is a

North American leader in the essential outsourced property services

sector, serving its customers through two industry-leading service

platforms: FirstService Residential - North

America’s largest manager of residential communities; and

FirstService Brands - one of North America’s

largest providers of essential property services delivered through

individually branded franchise systems and company-owned

operations.

FirstService generates approximately US$2.8

billion in annual revenues and has approximately 24,000 employees

across North America. With significant insider ownership and an

experienced management team, FirstService has a long-term track

record of creating value and superior returns for shareholders. The

Common Shares of FirstService trade on the NASDAQ and the Toronto

Stock Exchange under the symbol “FSV”. More information is

available at www.firstservice.com.

Segmented Quarterly

ResultsFirstService Residential revenues were $350.5

million for the first quarter, an increase of 3% versus the prior

year quarter, including 1% organic growth. Top-line performance

continued to be moderated by temporary COVID-19-driven amenity

closures and management contract suspensions in certain regions,

particularly in the northeast U.S. and Canada. Adjusted EBITDA for

the quarter was $29.4 million, up from $23.9 million in the prior

year period. GAAP Operating Earnings were $23.2 million, up from

$17.4 million versus the first quarter of last year. Operating

margins were positively impacted by ancillary revenue, primarily

driven by increased home resale activity.

FirstService Brands revenues for the first

quarter totalled $360.6 million, up 23% relative to the prior year

period. The revenue increase was comprised of 13% organic growth,

with the balance from recent tuck-under acquisitions. Revenue was

driven by robust growth at our home improvement brands, and further

bolstered by increased weather-related activity across our

restoration operations. Adjusted EBITDA was $33.4 million, up from

$21.9 million in the prior year quarter. GAAP Operating Earnings

were $16.5 million, versus $4.9 million in the prior year quarter.

Operating margin expansion reflected the benefit of operating

leverage in our businesses tied to strong home remodelling

activity, as well as the increased contribution mix of restoration

operations to the Brands division for the current quarter.

Corporate costs, as presented in Adjusted

EBITDA, were $3.0 million in the first quarter, relative to $2.0

million in the prior year period. On a GAAP basis, corporate costs

for the quarter were $5.9 million, relative to $6.3 million in the

prior year period.

Conference CallFirstService

will be holding a conference call on Tuesday, April 27, 2021 at

11:00 a.m. Eastern Time to discuss results for the first quarter of

2021. The numbers to use for this call are 1) toll-free

1-888-241-0551; or 2) for international callers, 647-427-3415, with

the conference ID number 1932237 for all participants. The call

will be simultaneously web cast and can be accessed live or after

the call at www.firstservice.com in the “Investors / Newsroom”

section.

Forward-looking StatementsThis

press release includes or may include forward-looking statements.

Much of this information can be identified by words such as “expect

to,” “expected,” “will,” “estimated” or similar expressions

suggesting future outcomes or events. FirstService believes the

expectations reflected in such forward-looking statements are

reasonable but no assurance can be given that these expectations

will prove to be correct and such forward-looking statements should

not be unduly relied upon. These statements involve known and

unknown risks, uncertainties and other factors which may cause the

actual results to be materially different from any future results,

performance or achievements contemplated in the forward-looking

statements. Such factors include: (i) the magnitude and length of

economic and operational disruption resulting from the COVID-19

pandemic; (ii) general economic and business conditions, which

will, among other things, impact demand for FirstService’s services

and the cost of providing services; (iii) the ability of

FirstService to implement its business strategy, including

FirstService’s ability to acquire suitable acquisition candidates

on acceptable terms and successfully integrate newly acquired

businesses with its existing businesses; (iv) changes in or the

failure to comply with government regulations; and (v) other

factors which are described in FirstService’s annual information

form for the year ended December 31, 2020 under the heading “Risk

factors” (a copy of which may be obtained at www.sedar.com) and

Annual Report on Form 40-F filed with the United States Securities

and Exchange Commission (a copy of which may be obtained at

www.sec.gov), and subsequent filings (which factors are adopted

herein). Forward-looking statements contained in this press release

are made as of the date hereof and are subject to change. All

forward-looking statements in this press release are qualified by

these cautionary statements. Unless otherwise required by

applicable securities laws, we do not intend, nor do we undertake

any obligation, to update or revise any forward-looking statements

contained in this press release to reflect subsequent information,

events, results or circumstances or otherwise.

Summary financial information is provided in

this press release. Our interim consolidated financial statements

and related management’s discussion and analysis will be made

available on SEDAR at www.sedar.com.

Notes1. Reconciliation of net

earnings to Adjusted EBITDA:

Adjusted EBITDA is defined as net earnings,

adjusted to exclude: (i) income tax; (ii) other (income) expense;

(iii) interest expense; (iv) depreciation and amortization; (v)

acquisition-related items; and (vi) stock-based compensation

expense. The Company uses adjusted EBITDA to evaluate its own

operating performance, its ability to service debt, and as an

integral part of its planning and reporting systems. Additionally,

this measure is used in conjunction with discounted cash flow

models to determine the Company’s overall enterprise valuation and

to evaluate acquisition targets. Adjusted EBITDA is presented as a

supplemental measure because the Company believes such a measure is

useful to investors as a reasonable indicator of operating

performance, due to the low capital intensity of the Company’s

service operations. The Company believes this measure is a

financial metric used by many investors to compare companies,

especially in the services industry. This measure is not a

recognized measure of financial performance under GAAP in the

United States, and should not be considered as a substitute for

operating earnings, net earnings or cash flow from operating

activities, as determined in accordance with GAAP. The Company’s

method of calculating adjusted EBITDA may differ from other issuers

and accordingly, this measure may not be comparable to measures

used by other issuers. A reconciliation of net earnings (loss) to

adjusted EBITDA appears below.

| |

Three months ended |

| (in thousands of US

dollars) |

March 31 |

| |

2021 |

|

2020 |

| |

|

|

|

|

|

|

Net earnings |

$ |

23,843 |

|

|

$ |

5,780 |

|

| Income tax |

|

7,720 |

|

|

|

1,546 |

|

| Other income |

|

(1,868 |

) |

|

|

(229 |

) |

| Interest expense, net |

|

4,187 |

|

|

|

8,887 |

|

| Operating earnings |

|

33,882 |

|

|

|

15,984 |

|

| Depreciation and

amortization |

|

23,225 |

|

|

|

23,507 |

|

| Acquisition-related items |

|

(99 |

) |

|

|

405 |

|

| Stock-based compensation

expense |

|

2,787 |

|

|

|

3,969 |

|

| Adjusted EBITDA |

$ |

59,795 |

|

|

$ |

43,865 |

|

2. Reconciliation of net earnings and net earnings per share to

adjusted net earnings and adjusted EPS:

Adjusted EPS is defined as diluted net earnings

per share, adjusted for the effect, after income tax, of: (i) the

non-controlling interest redemption increment; (ii)

acquisition-related items; (iii) amortization expense related to

intangible assets recognized in connection with acquisitions; and

(iv) stock-based compensation expense. The Company believes this

measure is useful to investors because it provides a supplemental

way to understand the underlying operating performance of the

Company and enhances the comparability of operating results from

period to period. Adjusted EPS is not a recognized measure of

financial performance under GAAP, and should not be considered as a

substitute for diluted net earnings per share, as determined in

accordance with GAAP. The Company’s method of calculating this

non-GAAP measure may differ from other issuers and, accordingly,

this measure may not be comparable to measures used by other

issuers. A reconciliation of net earnings to adjusted net earnings

and of diluted net earnings per share to adjusted EPS appears

below.

| |

Three months ended |

| (in thousands of

US dollars) |

March 31 |

| |

2021 |

|

2020 |

| |

|

|

|

|

|

|

Net earnings |

$ |

23,843 |

|

|

$ |

5,780 |

|

| Non-controlling

interest share of earnings |

|

(3,767 |

) |

|

|

(1,755 |

) |

|

Acquisition-related items |

|

(99 |

) |

|

|

405 |

|

| Amortization of

intangible assets |

|

10,012 |

|

|

|

11,361 |

|

| Stock-based

compensation expense |

|

2,787 |

|

|

|

3,969 |

|

| Income tax on

adjustments |

|

(3,328 |

) |

|

|

(3,986 |

) |

| Non-controlling

interest on adjustments |

|

(175 |

) |

|

|

(222 |

) |

| Adjusted net

earnings |

$ |

29,273 |

|

|

$ |

15,552 |

|

| |

|

|

|

|

|

| |

Three months ended |

| (in US

dollars) |

March 31 |

| |

2021 |

|

2020 |

| |

|

|

|

|

|

| Diluted net

earnings per share |

$ |

0.50 |

|

|

$ |

0.13 |

|

| Non-controlling

interest redemption increment (decrement) |

|

(0.04 |

) |

|

|

(0.03 |

) |

|

Acquisition-related items |

|

- |

|

|

|

0.01 |

|

| Amortization of

intangible assets, net of tax |

|

0.16 |

|

|

|

0.19 |

|

| Stock-based

compensation expense, net of tax |

|

0.04 |

|

|

|

0.07 |

|

| Adjusted EPS |

$ |

0.66 |

|

|

$ |

0.37 |

|

|

FIRSTSERVICE CORPORATION |

|

|

|

|

|

|

|

| Operating

Results |

|

|

|

|

|

|

|

| (in thousands of US dollars,

except per share amounts) |

|

|

|

|

|

|

|

| |

Three months |

| |

ended March 31 |

| (unaudited) |

2021 |

|

2020 |

| |

|

|

|

|

|

|

| Revenues |

$ |

711,066 |

|

|

$ |

633,831 |

|

| |

|

|

|

|

|

|

| Cost of revenues |

|

490,812 |

|

|

|

435,149 |

|

| Selling, general and

administrative expenses |

|

163,246 |

|

|

|

158,786 |

|

| Depreciation |

|

13,213 |

|

|

|

12,146 |

|

| Amortization of intangible

assets |

|

10,012 |

|

|

|

11,361 |

|

| Acquisition-related items

(1) |

|

(99 |

) |

|

|

405 |

|

| Operating

earnings |

|

33,882 |

|

|

|

15,984 |

|

| Interest expense, net |

|

4,187 |

|

|

|

8,887 |

|

| Other income |

|

(1,868 |

) |

|

|

(229 |

) |

| Earnings before income

tax |

|

31,563 |

|

|

|

7,326 |

|

| Income tax |

|

7,720 |

|

|

|

1,546 |

|

| Net

earnings |

|

23,843 |

|

|

|

5,780 |

|

| Non-controlling interest share

of earnings |

|

3,767 |

|

|

|

1,755 |

|

| Non-controlling interest

redemption increment (decrement) |

|

(1,815 |

) |

|

|

(1,260 |

) |

| Net earnings

attributable to Company |

|

21,891 |

|

|

|

5,285 |

|

| |

|

|

|

|

|

|

| Net earnings per

share |

|

|

|

|

|

|

|

Basic |

$ |

0.50 |

|

|

$ |

0.13 |

|

|

Diluted |

|

0.50 |

|

|

|

0.13 |

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| Adjusted EPS

(2) |

$ |

0.66 |

|

|

$ |

0.37 |

|

| |

|

|

|

|

|

|

| Weighted average common shares

(thousands) |

|

|

|

|

|

|

|

Basic |

|

43,696 |

|

|

|

41,557 |

|

|

Diluted |

|

44,218 |

|

|

|

41,937 |

|

(1) Acquisition-related items include contingent

acquisition consideration fair value adjustments, and transaction

costs.

(2) See definition and reconciliation above.

|

Condensed Consolidated Balance Sheets |

|

|

|

|

|

| (in thousands of

US dollars) |

| |

|

|

|

|

|

| |

|

|

|

|

|

| (unaudited) |

March 31, 2021 |

|

December 31, 2020 |

| |

|

|

|

|

|

|

Assets |

|

|

|

|

|

| Cash and cash

equivalents |

$ |

152,712 |

|

$ |

184,295 |

| Restricted

cash |

|

24,714 |

|

|

24,643 |

| Accounts

receivable |

|

411,937 |

|

|

418,890 |

| Prepaid and other

current assets |

|

202,222 |

|

|

191,488 |

|

Current assets |

|

791,585 |

|

|

819,316 |

| Other non-current

assets |

|

11,807 |

|

|

12,922 |

| Deferred income

tax |

|

2,166 |

|

|

2,048 |

| Fixed assets |

|

128,153 |

|

|

126,569 |

| Operating lease

right-of-use assets |

|

154,035 |

|

|

153,185 |

| Goodwill and

intangible assets |

|

1,083,017 |

|

|

1,082,500 |

|

Total assets |

$ |

2,170,763 |

|

$ |

2,196,540 |

| |

|

|

|

|

|

| |

|

|

|

|

|

|

Liabilities and shareholders' equity |

|

|

|

|

|

| Accounts payable

and accrued liabilities |

$ |

324,897 |

|

$ |

349,692 |

| Unearned

revenues |

|

103,112 |

|

|

90,131 |

| Other current

liabilities |

|

9,765 |

|

|

12,135 |

| Operating lease

liabilities - current |

|

36,340 |

|

|

35,315 |

| Long-term debt -

current |

|

56,637 |

|

|

56,478 |

|

Current liabilities |

|

530,751 |

|

|

543,751 |

| Long-term debt -

non-current |

|

495,678 |

|

|

533,126 |

| Operating lease

liabilities - non-current |

|

128,623 |

|

|

128,793 |

| Other

liabilities |

|

94,768 |

|

|

96,093 |

| Deferred income

tax |

|

41,286 |

|

|

41,345 |

| Non-controlling

interests |

|

191,250 |

|

|

193,034 |

| Shareholders'

equity |

|

688,407 |

|

|

660,398 |

|

Total liabilities and equity |

$ |

2,170,763 |

|

$ |

2,196,540 |

| |

|

|

|

|

|

| |

|

|

|

|

|

|

Supplemental balance sheet information |

|

|

|

|

|

| Total debt |

$ |

552,315 |

|

$ |

589,604 |

| Total debt, net

of cash |

|

399,603 |

|

|

405,309 |

| Condensed

Consolidated Statements of Cash Flows |

|

|

|

|

|

| (in thousands of

US dollars) |

| |

|

Three months ended |

| |

|

March 31 |

| (unaudited) |

2021 |

|

2020 |

| |

|

|

|

|

|

| Cash

provided by (used in) |

|

|

|

|

|

| |

|

|

|

|

|

| Operating

activities |

|

|

|

|

|

|

Net earnings |

$ |

23,843 |

|

|

$ |

5,780 |

|

| Items not

affecting cash: |

|

|

|

|

|

|

Depreciation and amortization |

|

23,225 |

|

|

|

23,507 |

|

|

Deferred income tax |

|

(749 |

) |

|

|

(2,056 |

) |

|

Other |

|

2,974 |

|

|

|

3,824 |

|

| |

|

49,293 |

|

|

|

31,055 |

|

| |

|

|

|

|

|

| Changes in non

cash working capital |

|

|

|

|

|

|

Accounts receivable |

|

8,252 |

|

|

|

20,982 |

|

|

Payables and accruals |

|

(26,920 |

) |

|

|

(10,479 |

) |

|

Other |

|

(3,914 |

) |

|

|

(1,739 |

) |

| Net cash provided

by operating activities |

|

26,711 |

|

|

|

39,819 |

|

| |

|

|

|

|

|

| Investing

activities |

|

|

|

|

|

| Acquisition of

businesses, net of cash acquired |

|

(2,521 |

) |

|

|

- |

|

| Purchases of fixed

assets |

|

(13,337 |

) |

|

|

(15,348 |

) |

| Other investing

activities |

|

(2,066 |

) |

|

|

(183 |

) |

| Net cash used in

investing activities |

|

(17,924 |

) |

|

|

(15,531 |

) |

| |

|

|

|

|

|

| Financing

activities |

|

|

|

|

|

| Decrease in

long-term debt, net |

|

(37,653 |

) |

|

|

(16,852 |

) |

| Purchases of

non-controlling interests, net |

|

(3,391 |

) |

|

|

(3,751 |

) |

| Dividends paid to

common shareholders |

|

(7,192 |

) |

|

|

(6,224 |

) |

| Other financing

activities |

|

7,727 |

|

|

|

2,342 |

|

| Net cash used in

financing activities |

|

(40,509 |

) |

|

|

(24,485 |

) |

| |

|

|

|

|

|

| Effect of exchange

rate changes on cash |

|

210 |

|

|

|

(910 |

) |

| |

|

|

|

|

|

| Decrease in cash,

cash equivalents and restricted cash |

|

(31,512 |

) |

|

|

(1,107 |

) |

| |

|

|

|

|

|

| Cash, cash

equivalents and restricted cash, beginning of period |

|

208,938 |

|

|

|

134,291 |

|

| |

|

|

|

|

|

| Cash, cash

equivalents and restricted cash, end of period |

$ |

177,426 |

|

|

$ |

133,184 |

|

| Segmented

Results |

| (in thousands of

US dollars) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| |

|

FirstService |

|

FirstService |

|

|

|

|

| (unaudited) |

Residential |

|

Brands |

|

Corporate |

|

Consolidated |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Three

months ended March 31 |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

2021 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues |

$ |

350,480 |

|

$ |

360,586 |

|

$ |

- |

|

|

$ |

711,066 |

| |

Adjusted EBITDA |

|

29,407 |

|

|

33,407 |

|

|

(3,019 |

) |

|

|

59,795 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

Operating earnings |

|

23,244 |

|

|

16,506 |

|

|

(5,868 |

) |

|

|

33,882 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| 2020 |

|

|

|

|

|

|

|

|

|

|

|

| |

Revenues |

$ |

339,663 |

|

$ |

294,168 |

|

$ |

- |

|

|

$ |

633,831 |

| |

Adjusted EBITDA |

|

23,890 |

|

|

21,946 |

|

|

(1,971 |

) |

|

|

43,865 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

Operating earnings |

|

17,424 |

|

|

4,907 |

|

|

(6,347 |

) |

|

|

15,984 |

COMPANY CONTACTS:

D. Scott PattersonChief

Executive OfficerJeremy

RakusinChief Financial Officer

(416) 960-9566

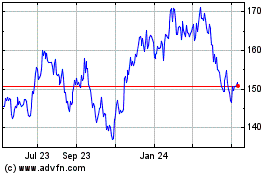

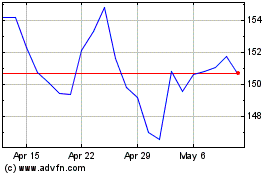

FirstService (NASDAQ:FSV)

Historical Stock Chart

From Jun 2024 to Jul 2024

FirstService (NASDAQ:FSV)

Historical Stock Chart

From Jul 2023 to Jul 2024