UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

SCHEDULE 14A

Proxy

Statement Pursuant to Section 14(a)

of the

Securities Exchange Act of 1934

Filed by the Registrant x

Filed

by a Party other than the Registrant ¨

Check the appropriate box:

x

¨

¨

¨

¨ |

Preliminary Proxy Statement

Confidential, for Use of

the SEC Only (as permitted by Rule 14a-6(e)(2))

Definitive Proxy Statement

Definitive Additional Materials

Soliciting Material Pursuant to 14a-12 |

FIRST

WAVE BIOPHARMA, INC.

(Name of Registrant as Specified

in Its Charter)

(Name of Person(s) Filing

Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check

all boxes that apply):

| ¨ | Fee

paid previously with preliminary materials |

| ¨ | Fee

computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and

0-11. |

First

Wave BioPharma, Inc.

777

Yamato Road, Suite 502

Boca Raton,

Florida 33431

(561)

589-7020

| Dear Fellow Stockholder, | October___,

2023 |

On behalf

of the Board of Directors and management of First Wave BioPharma, Inc. (the “Company,” “we,” “us,”

or “our”), a Delaware corporation, you are invited to attend our Special Meeting of Stockholders including any adjournment

or postponement thereof (the “Special Meeting”) to be held on November 21, 2023 at 9:00 A.M. Eastern Time located at 777

Yamato Rd, Suite 502, Boca Raton, FL 33431.

Details

of the business to be conducted at the Special Meeting are described in this proxy statement.

Your

vote is important. Regardless of whether you plan to attend the Special Meeting, please read the accompanying proxy statement

and then submit your proxy to vote by Internet, telephone or mail as promptly as possible. Returning your proxy will help us assure

that a quorum will be present at the Special Meeting and avoid the additional expense of duplicate proxy solicitations. Any stockholder

attending the Special Meeting may vote during the meeting, even if he or she has previously voted. Please refer to your proxy card for

voting instructions. Submitting your proxy promptly may save us additional expense in soliciting proxies and will ensure that your shares

are represented at the Special Meeting.

Our Board

of Directors has unanimously approved the proposals set forth in the proxy statement and recommends that you vote in favor of each such

proposal.

| |

Sincerely, |

| |

|

| |

|

| |

JAMES SAPIRSTEIN |

| |

President, Chief Executive Officer and |

| |

Chairman of the Board of Directors |

If you have

any questions or require any assistance in voting your shares, please call:

Alliance

Advisors LLC

200 Broadacres

Drive, 3rd Floor, Bloomfield, NJ 07003

866-407-1875

NOTICE OF THE FIRST WAVE BIOPHARMA, INC.

SPECIAL MEETING OF STOCKHOLDERS

Date and Time

Place

Items of Business |

November 21, 2023 at 9:00 A.M., Eastern Time.

777 Yamato Rd, Suite 502, Boca Raton, FL 33431.

1. Approval

to amend our Amended and Restated Certificate of Incorporation to increase the total number of authorized shares of our common stock,

par value $0.0001 (the “Common Stock”), by 50,000,000 shares to 100,000,000 shares;

2. Adoption

and approval of an amendment to our Amended and Restated Certificate of Incorporation, as amended (the “Charter”), to effect

a reverse stock split of our issued and outstanding shares of Common Stock, at a specific ratio, ranging from one-for ten (1:10) to

one-for-twenty (1:20), at any time prior to the one-year anniversary date of the special meeting, with the exact ratio to be determined

by the Board without further approval or authorization of our stockholders (the “Reverse Split”); and

3. Approval

of the adjournment of the Special Meeting of the Stockholders (the “Special Meeting”) to the extent there are insufficient

proxies at the Special Meeting to approve any one or more of the foregoing proposals. |

| |

|

| Adjournments

and Postponements |

Any action

on the items of business described above may be considered at the Special Meeting at the time and on the date specified above or

at any time and date to which the Special Meeting may be properly adjourned or postponed. |

| |

|

| Record

Date |

October

16, 2023 (the “Record Date”). Only stockholders of record holding shares of our Common Stock, as of the close of business

on the Record Date are entitled to notice of and to vote at the Special Meeting. |

| |

|

| Meeting

Admission |

You are invited

to attend the Special Meeting if you are a stockholder of record or a beneficial owner of shares of our Common Stock as of the Record

Date. |

| |

|

| Availability

of Proxy Materials |

Our proxy

materials are also available on the internet at: proxyvote.com. |

| |

|

| Voting |

If your shares

are held in the name of a bank, broker or other fiduciary, please follow the instructions on the proxy card. Whether or not you expect

to attend, we urge you to submit your proxy to vote your shares as promptly as possible by following the instructions on your proxy card

so that your shares may be represented and voted at the Special Meeting. Your vote is very important. |

| |

BY ORDER OF THE BOARD OF DIRECTORS, |

| |

|

| |

|

| Boca Raton, Florida |

JAMES SAPIRSTEIN |

| October____, 2023 |

President, Chief Executive Officer and |

| |

Chairman of the Board of Directors |

First

Wave BioPharma, Inc.

777 Yamato

Road, Suite 502

Boca Raton,

Florida 33431

(561)

589-7020

PROXY

STATEMENT

The enclosed proxy is

solicited on behalf of the Board of Directors (the “Board”) of First Wave BioPharma, Inc. (the “Company,”

“we,” “us,” or “our”), for use at the upcoming Special Meeting of Stockholders

including any adjournment or postponement thereof (the “Special Meeting”) to be held on November 21, 2023, at 9:00 A.M.

Eastern Time located at 777 Yamato Rd, Suite 502, Boca Raton, FL 33431. In addition, unless the context otherwise requires,

references to “stockholders” are to the holders of our common stock, par value $0.0001 per share (the “Common

Stock”).

This proxy statement and the enclosed

proxy card are first being mailed on or about October___, 2023 to stockholders entitled to vote as of the close of business on October

16, 2023 (the “Record Date”). These proxy materials contain instructions on how to access this proxy statement online at:

proxyvote.com, and how to submit your proxy to vote via the internet, telephone and/or mail.

Voting

The specific proposals to be considered and acted

upon at our Special Meeting are each described in this proxy statement. Only stockholders holding shares of Common Stock as of the close

of business on the Record Date are entitled to notice of and to vote at the Special Meeting. As of October 12, 2023, there were 13,499,979

shares of Common Stock issued and outstanding, and as of the Record Date, there were ______shares of Common Stock issued and outstanding.

Holders of record of shares of Common Stock have the right to vote on all matters brought before the Special Meeting.

Each holder of record of our Common

Stock is entitled to one vote per share of Common Stock on each matter to be acted upon at the Special Meeting.

Quorum

In order for any business to be

conducted at the Special Meeting, both (i) the holders of one-third of the voting power of the shares of the capital stock of the Company

issued and outstanding and entitled to vote at the Special Meeting, and (ii) the holders of at least one-third of the shares of Common

Stock issued and outstanding and entitled to vote at the Special Meeting must be represented at the Special Meeting, either in person,

by means of remote communication in a manner, if any, authorized by the Board in its sole discretion, or represented by proxy. If a quorum

is not present at the scheduled time of the Special Meeting, the Board, the chairman of the meeting or, if directed to be voted on by

the chairman of the meeting, the stockholders present or represented at the Special Meeting and entitled to vote thereon, although less

than a quorum, may adjourn the Special Meeting until a quorum is present. The date, time and place and the means of remote communication,

if any, of the adjourned Special Meeting will be announced at the time the adjournment is taken, and no other notice will be given unless

the adjournment is for more than 30 days, in which case a notice of the adjourned meeting will be given to each stockholder of record

entitled to vote at the Special Meeting. An adjournment will have no effect on the business that may be conducted at the Special Meeting.

Required

Vote for Approval

| No. | Proposal |

| 1. | Approval

to our Amended and Restated Certificate of Incorporation (the “Charter”) to Increase

the Total Number of Authorized Shares of our Common Stock, par value $0.0001 (the “Common

Stock”) by 50,000,000 Shares to 100,000,000 Shares (such proposal is referred to

herein as the “Authorized Shares Proposal”). To approve an amendment to our

Charter to increase the number of authorized shares of Common Stock by 50,000,000 shares

to 100,000,000 shares. This proposal requires the affirmative (“FOR”) vote

of a majority of votes cast by shares of our Common Stock present or represented by proxy

and entitled to vote at the Special Meeting. Shares that are not represented at the Special

Meeting, abstentions and broker non-votes, if any, with respect to this proposal are not

counted as votes cast and will not affect the outcome of the voting on the Authorized Shares

Proposal. |

| 2. | Adoption

and approval of an amendment to our Amended and Restated Certificate of Incorporation, as

amended (the “Charter”), to effect a reverse stock split of our issued and outstanding

shares of Common Stock, at a specific ratio, ranging from one-for-ten (1:10) to one-for-twenty

(1:20), at any time prior to the one-year anniversary date of the Special Meeting, with

the exact ratio to be determined by the Board without further approval or authorization of

our stockholders (the “Reverse Split” and such proposal is referred to herein

as the “Reverse Stock Split Proposal”). This proposal requires the affirmative

(“FOR”) vote of a majority of votes cast by shares of our Common Stock present

or represented by proxy and entitled to vote at the Special Meeting. Shares that are not

represented at the Special Meeting, abstentions and broker non-votes, if any, with respect

to this proposal are not counted as votes cast and will not affect the outcome of the voting

on the Reverse Split Proposal. |

| 3. | Approval

of the Adjournment of the Special Meeting to the Extent There Are Insufficient Proxies at

the Special Meeting to Approve Any One or More of the Foregoing Proposals (such proposal

is referred to herein as the “Adjournment Proposal”). To

approve the adjournment of the Special Meeting in the event that the number of shares of

Common Stock present or represented by proxy at the Special Meeting and voting “FOR”

the adoption of any one or more of the foregoing proposals are insufficient to approve any

proposal. This proposal requires the affirmative (“FOR”) vote of a majority of

votes cast by shares of our Common Stock present or represented by proxy and entitled to

vote at the Special Meeting. Shares that are not represented at the Special Meeting, abstentions

and broker non-votes, if any, with respect to this proposal are not counted as votes cast

and will not affect the outcome of the voting on the Adjournment Proposal. |

Abstentions

and Broker Non-Votes

All votes will be tabulated by

the inspector of election appointed for the Special Meeting, who will separately tabulate affirmative and negative votes, abstentions

and broker non-votes. An abstention is the voluntary act of not voting for or against a particular matter by a stockholder who is present,

in person or by proxy, at the Special Meeting and entitled to vote. A broker “non-vote” occurs when a broker nominee holding

shares for a beneficial owner submits a proxy to vote on at least one “routine” proposal but does not vote on a given proposal

because the nominee does not have discretionary power for that particular item and has not received instructions from the beneficial

owner. If you hold your shares in “street name” through a broker or other nominee, your broker or nominee may not be permitted

to exercise voting discretion with respect to some of the matters to be acted upon. If you do not give your broker or nominee specific

instructions regarding such matters, your broker may submit a proxy to vote on “routine” matters but not on “non-routine”

matters and such proxy will be deemed a “broker non-vote” with respect to such “non-routine” proposals.

The question of whether your broker

or nominee may be permitted to exercise voting discretion with respect to a particular matter depends on whether the New York Stock Exchange

(the “NYSE”) deems the particular proposal to be a “routine” matter and how your broker or nominee exercises

any discretion they may have in the voting of the shares that you beneficially own. Brokers and nominees can use their discretion to

vote “uninstructed” shares with respect to matters that are considered to be “routine,” but not with respect

to “non-routine” matters. Under the rules and interpretations of the NYSE, “non-routine” matters are matters

that may substantially affect the rights or privileges of stockholder, such as mergers, stockholder proposals, elections of directors

(even if not contested), executive compensation (including any advisory stockholder votes on executive compensation and on the frequency

of stockholder votes on executive compensation), and certain corporate governance proposals, even if management-supported. The determination

of which proposals are deemed “routine” versus “non-routine” may not be made by the NYSE until after the date

on which this proxy statement has been mailed to you. As such, it is important that you provide voting instructions to your bank, broker

or other nominee, if you wish to determine the voting of your shares.

For any proposal that is considered

a “routine” matter, your broker or nominee may vote your shares in its discretion either for or against the proposal in the

absence of your instruction. For a proposal that is considered a “non-routine” matter for which you do not give your broker

instructions, the shares will be treated as broker non-votes. “Broker non-votes” occur when a broker or other nominee submits

a proxy to vote on at least one “routine” proposal and indicates that it does not have, or is not exercising, voting authority

on matters deemed “non-routine.” Broker non-votes will not be counted as having been voted on the applicable proposal. Therefore,

if you are a beneficial owner and want to ensure that shares you beneficially own are voted in favor or against any or all of the proposals

in this proxy statement, the only way you can do so is to give your broker or nominee specific instructions as to how the shares are

to be voted.

Under

Delaware law and our Amended and Restated Bylaws (our “Bylaws”), abstentions and, if such proposal is deemed to be

“nonroutine” as described above, broker non-votes, if any, are not counted as votes cast on the matter and therefore will

not affect the outcome of the voting on any of Proposals 1 through 3. Abstention and broker non-votes will be counted for purposes of

determining whether there is a quorum present at the Special Meeting.

Voting,

Revocation and Solicitation of Proxies

The enclosed proxy is solicited

by and on behalf of the Board, with the cost of solicitation borne by us. Solicitation may also be made by our directors and officers

without additional compensation for such services. In addition to mailing proxy materials, the directors, officers and employees may

solicit proxies in person, by telephone or otherwise.

We have engaged Alliance Advisors

LLC, to assist in the solicitation of proxies and provide related advice and informational support, for a services fee, plus customary

disbursements, which are not expected to exceed $55,000 in total. Alliance Advisors LLC will solicit proxies on our behalf from individuals,

brokers, bank nominees and other institutional holders in the same manner described above. We have also agreed to indemnify Alliance

Advisors LLC against certain claims.

If your proxy is properly returned

to us, the shares represented thereby will be voted at the Special Meeting in accordance with the instructions specified thereon. If

you return your proxy without specifying how the shares represented thereby are to be voted, the proxy will be voted (i) FOR the

increase in the number of authorized shares of our Common Stock to 100,000,000; (ii) FOR the Reverse Stock Split Proposal;

(iii) FOR the approval of the Adjournment Proposal to the extent there are insufficient proxies at the Special Meeting to approve

any one or more of the foregoing proposals; and (iv) at the discretion of the proxy holders, on any other matter that may properly

come before the Special Meeting or any adjournment or postponement thereof.

If you have

additional questions, need assistance in submitting your proxy or voting your shares of Common Stock, or need additional copies of the

proxy statement or the enclosed proxy card, please contact Alliance Advisors LLC.

Alliance

Advisors LLC

200 Broadacres

Drive, 3rd Floor, Bloomfield, NJ 07003

866-407-1875

If you are a stockholder of record,

you may revoke or change your proxy at any time before the Special Meeting by filing, with our Chief Financial Officer at 777 Yamato

Road, Suite 502, Boca Raton, Florida 33431, a notice of revocation or another signed proxy with a later date. If you are a stockholder

of record, you may also revoke your proxy by attending the Special Meeting and voting. Attendance at the Special Meeting alone will not

revoke your proxy.

No Appraisal

Rights

Our stockholders have no dissenters’

or appraisal rights in connection with any of the proposals described herein.

Solicitation

We will bear the entire cost of

solicitation, including the preparation, assembly, printing and mailing of this proxy statement, as well as the preparation and posting

of this proxy statement and any additional solicitation materials furnished to the stockholders. Copies of any solicitation materials

will be furnished to brokerage houses, fiduciaries and custodians holding shares in their names that are beneficially owned by others

so that they may forward this solicitation material to such beneficial owners. In addition, we may reimburse such persons for their costs

in forwarding the solicitation materials to such beneficial owners. The original solicitation of proxies may be supplemented by a solicitation

by telephone, e-mail or other means by our directors, officers or employees. No additional compensation will be paid to these individuals

for any such services. Except as described above, we do not presently intend to solicit proxies other than by e-mail, telephone and mail.

PROPOSAL

NO. 1: APPROVAL TO AMEND OUR CHARTER TO INCREASE THE TOTAL NUMBER OF

AUTHORIZED SHARES OF COMMON STOCK BY 50,000,000 SHARES TO 100,000,000

SHARES

Overview

Our Board has approved, subject

to shareholder approval, to amend our Charter to increase the number of shares of Common Stock authorized for issuance thereunder by

50,000,000 shares, from 50,000,000 shares to 100,000,000 shares. If approved by our stockholders, the amendment will become effective

upon the filing of a certificate of amendment (the “Charter Amendment”) with the Delaware Secretary of State, which filing

is expected to occur promptly after stockholder approval of this Proposal No. 1.

The form of amendment to our Charter

relating to this Proposal No. 1 is attached to this Proxy Statement as Appendix A, subject to any changes required by applicable law.

All share and per-share figures in this Proposal 1 are reflected on a post-Reverse Stock Split basis.

Purpose

and Effect of the Amendment

We do not currently have a sufficient

number of authorized shares of Common Stock to adequately finance the Company to cover the costs of our operations including our product

development programs, business development, contractual obligations and other operating activities.

Our Charter currently authorizes us to issue

a maximum of 50,000,000 shares of common stock, par value $0.0001 per share (the “Common Stock”), and 10,000,000 shares of

preferred stock, $0.0001 par value per share. As of October 12, 2023, we had 521.72 shares of preferred stock issued and outstanding,

and the Charter Amendment does not affect the number of authorized shares of preferred stock. Our issued and outstanding securities,

as of October 12, 2023, are as follows:

| · | 13,499,979 shares of Common Stock; |

| · | 732

shares of Common Stock issuable upon exercise of stock options, with a weighted average exercise

price of $2,247.63 per share, under our Amended and Restated 2014 Omnibus Equity Incentive

Plan (the “2014 Plan”); |

| · | 37,326

shares of awarded but unissued restricted stock and restricted stock units under our 2014

Plan; |

| · | 8,224

shares of Common Stock issuable upon exercise of stock options, with a weighted average exercise

price of $232.64 per share, under our Amended and Restated 2020 Omnibus Equity Incentive

Plan (the “2020 Plan”); |

| · | 1,008,096

shares of Common Stock available for future issuance under our 2020 Plan; |

| · | 17,972,611

shares of Common Stock issuable upon exercise of outstanding warrants, with a weighted average

exercise price of $2.37 per share; |

| |

· |

3,090 shares of Common Stock issuable upon conversion of 521.72 shares of Series B Convertible Preferred Stock (the “Series B Preferred Stock”), including in respect of accrued and unpaid dividends of approximately $1,008,000 through October 12, 2023 at a conversion price of $1,617.00 per share; and |

| · | up

to 9,125 additional shares of Common Stock issued pursuant to an exchange right in excess

of amounts currently underlying Series B Preferred Stock if the holders of Series B Preferred

Stock elect to exchange into our sale of shares of Common Stock at $549.297 per share under

our At The Market Offering Agreement, dated November 30, 2021 (the “ATM Agreement”). |

Until we have

obtained approval of this Proposal No. 1, the limited number of remaining available shares of Common Stock will make it difficult or

impossible for us to raise the necessary capital needed to accomplish our goals, and suggest and/or respond to capital financing proposals

with potential investors. We will require substantial additional capital resources in order to conduct our operations, complete our product

development programs, and meet our contractual obligations.

Without substantial

additional capital resources, we may need to curtail capital expenditures and reduce business development and other operating activities.

Should the financing we require to sustain our working capital needs be unavailable or prohibitively expensive when we require it, the

consequences could have a material adverse effect on our business, operating results, financial condition and prospects. Because of our

funding requirements, we will try to raise additional capital through public or private financings, as well as collaborative relationships,

incurring debt and other available sources.

The increase

in authorized Common Stock will not have any immediate effect on the rights of existing stockholders. To the extent that additional authorized

shares are issued in the future, such additional issuances may decrease the existing stockholders' percentage equity ownership and, depending

on the price at which they are issued, could be dilutive to the existing stockholders. Holders of Common Stock have no preemptive rights

and the Board has no plans to grant such rights with respect to any such shares.

The increase

in the authorized number of shares of Common Stock and the subsequent issuance of such shares could have the effect of delaying or preventing

a change in control of the Company without further action by the stockholders. Shares of authorized and unissued Common Stock could,

within the limits imposed by applicable law, be issued in one or more transactions that would make a change in control of the Company

more difficult, and therefore less likely. Any such issuance of additional shares of Common Stock could have the effect of diluting the

earnings per share and book value per share of outstanding shares of Common Stock and such additional shares could be used to dilute

the stock ownership or voting rights of a person seeking to obtain control of us. While it may be deemed to have potential anti-takeover

effects, the proposed amendment to increase the number of shares of Common Stock authorized for issuance under the Charter is not prompted

by any specific effort or takeover threat currently perceived by management.

The additional

shares of Common Stock to be authorized pursuant to the proposed amendment will be of the same class of Common Stock as is currently

authorized under our Charter. These additional shares will be used to issue shares of our Common Stock in connection with our existing

stock option and award plans. In addition, we anticipate raising additional capital through future issuances and sales of shares of our

Common Stock, or securities convertible or exercisable for shares of our Common Stock, and we intend to use the additional shares of

Common Stock that will be available to undertake any such issuances and sales.

Other than

as described herein, we do not currently have any specific plan, commitment, arrangement, understanding or agreement, either oral or

written, regarding the issuance of any additional shares of Common Stock that may be authorized if this Proposal No. 1 to increase the

number of authorized shares of Common Stock is approved by stockholders.

Required

Vote and Recommendation

Pursuant to

changes to Section 242 of the Delaware General Corporation Law which became effective on August 1, 2023 (the “DGCL Change”),

the necessary stockholder vote to approve reverse stock splits and an increase in authorized share capital was reduced from a majority

of outstanding shares entitled to vote, to a majority of votes actually cast at a meeting. In addition to reducing the required shareholder

vote for approval of these actions, the DGCL Change has the effect of causing abstentions to have no effect on a stockholder vote. This

reduced vote requirement only applies to companies (like ours) whose stock is listed on a national securities exchange and who would

continue to meet the listing requirements of the exchange immediately after giving effect to such actions.

Pursuant to

the DCGL Change, approval and adoption of this Proposal No. 1 requires the affirmative vote of at least a majority of votes actually

cast at the meeting. Abstentions have no effect on a stockholder vote.

OUR BOARD

RECOMMENDS A VOTE “FOR” PROPOSAL ONE.

PROPOSAL

NO. 2: ADOPTION AND APPROVAL OF AN AMENDMENT TO OUR CHARTER TO EFFECT A

REVERSE

STOCK SPLIT OF OUR ISSUED AND OUTSTANDING SHARES OF COMMON STOCK, AT A

SPECIFIC

RATIO, RANGING FROM ONE-FOR-TEN (1:10) TO ONE-FOR-TWENTY (1:20), AT ANY TIME PRIOR TO THE ONE-YEAR ANNIVERSARY DATE OF THE SPECIAL

MEETING, WITH THE EXACT RATIO TO BE DETERMINED BY THE BOARD

Overview

Our Board has determined that it

is advisable and in the best interests of the Company and its stockholders, for us to amend our Charter to authorize our Board to effect

a reverse stock split (the “Charter Amendment”) of our issued and outstanding shares of Common Stock at a specific ratio,

ranging from one for-ten (1:10) to one-for-twenty (1:20) (the “Approved Split Ratios”), to be determined by the Board

(the “Reverse Split”). A vote for this Proposal No. 2 will constitute approval of the Reverse Split that, once authorized

by the Board and effected by filing the Charter Amendment with the Secretary of State of the State of Delaware, will combine between

ten and twenty shares of our Common Stock into one share of our Common Stock. If implemented, the Reverse Split will have the effect

of decreasing the number of shares of our Common Stock issued and outstanding.

Accordingly, stockholders are asked

to adopt and approve the Charter Amendment set forth in Appendix A to effect the Reverse Split as set forth in the Charter Amendment,

subject to the Board’s determination, in its sole discretion, whether or not to implement the Reverse Split, as well as the specific

ratio within the range of the Approved Split Ratios, and provided that the Reverse Split must be effected on or prior to the one-year

anniversary date of the Special Meeting. The text of Appendix A remains subject to modification to include such changes as may be required

by the Secretary of State of the State of Delaware and as our Board deems necessary or advisable to implement the Reverse Split.

If adopted and approved by the

holders of our outstanding voting securities, the Reverse Split would be applied at an Approved Split Ratio approved by the Board prior

to the one-year anniversary date of the Special Meeting. The Board reserves the right to elect to abandon the Reverse Split if it determines,

in its sole discretion, that the Reverse Split is no longer in the best interests of the Company and its stockholders.

Purpose

and Rationale for the Reverse Split

Avoid

Delisting from the Nasdaq. As we have previously reported, on August 18, 2023, we received notice from the Listing Qualifications

Staff (the “Staff”) of The Nasdaq Stock Market LLC (“Nasdaq”) indicating that we were not in compliance with

the $2.5 million minimum stockholders’ equity requirement for continued listing of the Common Stock on Nasdaq, as set forth in

Nasdaq Listing Rule 5550(b)(1) (the “Minimum Stockholders’ Equity Rule”).

On October

2, 2023, we submitted a plan to the Staff to regain compliance with the Minimum Stockholders’ Equity Rule

Additionally, on August 24, 2023,

we received notice from the Staff indicating that, based upon the closing bid price of the Common Stock for the prior 30 consecutive

business days, we were not in compliance with the requirement to maintain a minimum bid price of $1.00 per share for continued listing

on Nasdaq, as set forth in Nasdaq Listing Rule 5550(a)(2) (the “Bid Price Rule”). We have 180 days from August 24, 2023,

or through February 20, 2024, to regain compliance with the Bid Price Rule.

Failure

to approve the Reverse Split may potentially have serious, adverse effects on us and our stockholders. Our Common Stock could be delisted

from The Nasdaq Capital Market. Our shares may then trade on the OTC Bulletin Board or other small trading markets, such as the pink

sheets. In that event, our Common Stock could trade thinly as a microcap or penny stock, adversely decrease to nominal levels of trading

and may be avoided by retail and institutional investors, resulting in the impaired liquidity of our Common Stock.

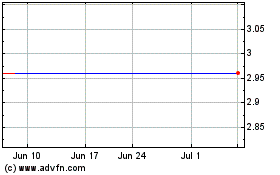

As of October 11, 2023, our Common Stock closed

at $0.32 per share on The Nasdaq Capital Market. The Reverse Split, if effected, would likely have the immediate effect of increasing

the price of our Common Stock as reported on The Nasdaq Capital Market, therefore reducing the risk that our Common Stock could be delisted

from The Nasdaq Capital Market.

Our Board strongly believes that

the Reverse Split is necessary to maintain our listing on The Nasdaq Capital Market. Accordingly, the Board has approved resolutions

proposing the Charter Amendment to effect the Reverse Split and directed that it be submitted to our stockholders for adoption and approval

at the Special Meeting. Management and the Board have considered the potential harm to us and our stockholders should Nasdaq delist our

Common Stock from trading. Delisting could adversely affect the liquidity of our Common Stock since alternatives, such as the OTC Bulletin

Board and the pink sheets, are generally considered to be less efficient markets. An investor likely would find it less convenient to

sell, or to obtain accurate quotations in seeking to buy, our Common Stock on an over-the-counter market. Many investors likely would

not buy or sell our Common Stock due to difficulty in accessing over-the-counter markets, policies preventing them from trading in securities

not listed on a national exchange, or other reasons.

Other

Effects. The Board also believes that the increased market price of our Common Stock expected as a result of implementing

the Reverse Split could improve the marketability and liquidity of our Common Stock and may encourage interest and trading in our Common

Stock. The Reverse Split, if effected, could allow a broader range of institutions to invest in our Common Stock (namely, funds that

are prohibited from buying stock whose price is below a certain threshold), potentially increasing the trading volume and liquidity of

our Common Stock. The Reverse Split could help increase analyst and broker interest in the Common Stock, as their policies can discourage

them from following or recommending companies with low stock prices. Because of the trading volatility often associated with low-priced

stocks, many brokerage houses and institutional investors have internal policies and practices that either prohibit them from investing

in lowpriced stocks or tend to discourage individual brokers from recommending low-priced stocks to their customers. Some of those policies

and practices may make the processing of trades in low-priced stocks economically unattractive to brokers. Additionally, because brokers’

commissions on low-priced stocks generally represent a higher percentage of the stock price than commissions on higher-priced stocks,

a low average price per share of our Common Stock can result in individual stockholders paying transaction costs representing a higher

percentage of their total share value than would be the case if the share price were higher.

Our Board does not intend for this

transaction to be the first step in a series of plans or proposals effect a “going private transaction” within the meaning

of Rule 13e-3 of the Exchange Act.

Risks of

the Proposed Reverse Split

We cannot assure you that the

proposed Reverse Split will increase the price of our Common Stock and have the desired effect of maintaining compliance with Nasdaq’s

Bid Price Rule.

If the Reverse Split is implemented,

our Board expects that it will increase the market price of our Common Stock so that we are able to regain and maintain compliance with

the Bid Price Rule. However, the effect of the Reverse Split upon the market price of our Common Stock cannot be predicted with any certainty,

and the Prior Reverse Split did not enable us to maintain compliance with the Bid Price Rule. The history of similar reverse stock splits

for companies in similar circumstances is varied. It is possible that (i) the per share price of our Common Stock after the Reverse Split

will not rise in proportion to the reduction in the number of shares of our Common Stock outstanding resulting from the Reverse Split,

(ii) the market price per post-Reverse Split share may not exceed or remain in excess of the $1.00 minimum bid price for a sustained

period of time, or (iii) the Reverse Split may not result in a per share price that would attract brokers and investors who do not trade

in lower priced stocks. Even if the Reverse Split is implemented, the market price of our Common Stock may decrease due to factors unrelated

to the Reverse Split. In any case, the market price of our Common Stock will be based on other factors which may be unrelated to the

number of shares outstanding, including our future performance. If the Reverse Split is consummated and the trading price of our Common

Stock declines, the percentage decline as an absolute number and as a percentage of our overall market capitalization may be greater

than would occur in the absence of the Reverse Split. Even if the market price per post-Reverse Split share of our Common Stock remains

in excess of $1.00 per share, we may be delisted due to a failure to meet other continued listing requirements, including Nasdaq requirements

related to the minimum stockholders’ equity, minimum number of shares that must be in the public float and the minimum market value

of the public float.

A decline in the market price

of our Common Stock after the Reverse Split is implemented may result in a greater percentage decline than would occur in the absence

of a reverse stock split.

If the Reverse Split is implemented

and the market price of our Common Stock declines, the percentage decline may be greater than would occur in the absence of a reverse

stock split. The market price of our Common Stock will, however, also be based upon our performance and other factors, which are unrelated

to the number of shares of Common Stock outstanding.

The proposed Reverse Split may

decrease the liquidity of our Common Stock.

The liquidity of our Common Stock

may be harmed by the proposed Reverse Split given the reduced number of shares of Common Stock that would be outstanding after the Reverse

Split, particularly if the stock price does not increase as a result of the Reverse Split.

Determination

of the Ratio for the Reverse Split

If Proposal No. 2 is approved by stockholders

and the Board determines that it is in the best interests of the Company and its stockholders to move forward with the Reverse Split,

the Approved Split Ratio will be selected by the Board, in its sole discretion. However, the Approved Split Ratio will not be less than

a ratio of one-for-ten (1:10) or exceed a ratio of one-for-twenty (1:20). In determining which Approved Split Ratio to use, the Board

will consider numerous factors, including the historical and projected performance of our Common Stock, the effect of the Approved Split

Ratio on our compliance with other Nasdaq listing requirements, prevailing market conditions and general economic trends, and will place

emphasis on the expected closing price of our Common Stock in the period following the effectiveness of the Reverse Split. The Board will

also consider the impact of the Approved Split Ratios on investor interest. The purpose of selecting a range is to give the Board the

flexibility to meet business needs as they arise, to take advantage of favorable opportunities and to respond to a changing corporate

environment. Based on the number of shares of Common Stock issued and outstanding as of October 12, 2023, after completion of the Reverse

Split, we will have between 13,499,979 and 674,998 shares of Common Stock issued and outstanding, depending on the Approved Split Ratio

selected by the Board.

Principal

Effects of the Reverse Split

After the effective date of the

proposed Reverse Split, each stockholder will own a reduced number of shares of Common Stock. Except for adjustments that may result

from the treatment of fractional shares as described below, the proposed Reverse Split will affect all stockholders uniformly. The proportionate

voting rights and other rights and preferences of the holders of our Common Stock will not be affected by the proposed Reverse Split

(other than as a result of the payment of cash in lieu of fractional shares). For example, a holder of 2% of the voting power of the

outstanding shares of our Common Stock immediately prior to a Reverse Split would continue to hold 2% of the voting power of the outstanding

shares of our Common Stock immediately after such Reverse Split. The number of stockholders of record also will not be affected by the

proposed Reverse Split, except to the extent that any stockholder holds only a fractional share interest and receives cash for such interest

after the Reverse Split.

The following table contains approximate number

of issued and outstanding shares of Common Stock, and the estimated per share trading price following a 1:10 to 1:20 Reverse Split, without

giving effect to any adjustments for fractional shares of Common Stock or the issuance of any derivative securities, as of October 12,

2023.

After Each

Reverse Split Ratio

| |

|

Current |

|

|

1:10 |

|

|

1:20 |

|

|

Common Stock

Authorized (1) |

|

|

50,000,000 |

|

|

|

100,000,000 |

|

|

|

100,000,000 |

|

| Common Stock Issued and Outstanding |

|

|

13,499,979 |

|

|

|

13,499,979 |

|

|

|

674,998 |

|

|

Number of Shares of Common Stock

Reserved

for

Issuance (2) |

|

|

19,039,204 |

|

|

|

1,903,920 |

|

|

|

951,960 |

|

|

Number of Shares of

Common Stock

Authorized but Unissued and Unreserved |

|

|

17,460,817 |

|

|

|

1,746,082 |

|

|

|

873,041 |

|

| Price per share, based on the closing price of our Common Stock on the Record Date(3) |

|

|

$ |

_____ |

|

|

|

$ |

_____ |

|

|

|

$ |

_____ |

|

| (1) | The

Reverse Split will not have any impact on the number of shares of Common Stock we are authorized

to issue under our Charter. However, if Proposal 1 is approved at the Special Meeting, we

intend to increase our authorized shares of Common Stock to 100,000,000. |

| (2) |

Includes (i) 732 shares of Common Stock issuable upon exercise of stock options, with a weighted average exercise price of $2,247,63 per share, under our Amended and Restated 2014 Omnibus Equity Incentive Plan (the “2014 Plan”), (ii) 292 shares of awarded but unissued restricted stock under our 2014 Plan, (iii) 37,034 shares of awarded but unissued restricted stock units under our 2020 Plan, (iv) 8,224 shares of Common Stock issuable upon exercise of stock options, with a weighted average exercise price of $232.64 per share, under our Amended and Restated 2020 Omnibus Equity Incentive Plan (the “2020 Plan”), (v) 1,008,096 shares of Common Stock available for future issuance under our 2020 Plan, (vi) 17,972,611 shares of Common Stock issuable upon exercise of outstanding warrants, with a weighted average exercise price of $2.37 per share, (vii) 3,090 shares of Common Stock issuable upon conversion of 521.72 shares of Series B Convertible Preferred Stock (the “Series B Preferred Stock”), including in respect of accrued and unpaid dividends of approximately $1,008,000 through October 12, 2023 at a conversion price of $1,617.00 per share, and (viii) up to 9,125 additional shares of Common Stock issued pursuant to an exchange right in excess of amounts currently underlying Series B Preferred Stock if the holders of Series B Preferred Stock elect to exchange into our sale of shares of Common Stock at $549.297 per share under our At The Market Offering Agreement, dated November 30, 2021 (the “ATM Agreement”). |

| (3) | The

price per share indicated reflects solely the application of the applicable reverse split

ratio to the closing price of the Common Stock on the Record Date. |

After the effective date of the

Reverse Split, our Common Stock would have a new committee on uniform securities identification procedures (CUSIP) number, a number used

to identify our Common Stock.

Our Common Stock is currently registered

under Section 12(b) of the Exchange Act, and we are subject to the periodic reporting and other requirements of the Exchange Act. The

proposed Reverse Split will not affect the registration of our Common Stock under the Exchange Act. Our Common Stock would continue to

be reported on Nasdaq under the symbol “FWBI”, assuming that we are able to regain compliance with the minimum bid price

requirement, although it is likely that Nasdaq would add the letter “D” to the end of the trading symbol for a period of

twenty trading days after the effective date of the Reverse Split to indicate that the Reverse Split had occurred.

Effect on

Outstanding Derivative Securities

The Reverse Split will require that proportionate

adjustments be made to the conversion rate, the per share exercise price and the number of shares issuable upon the exercise or conversion

of the following outstanding derivative securities issued by us, in accordance with the Approved Split Ratio (all figures are as of October

12, 2023, and are on a pre-Reverse Split basis), including:

| · | 732

shares of Common Stock issuable upon exercise of stock options, with a weighted average exercise

price of $2,247.63 per share, under our Amended and Restated 2014 Omnibus Equity Incentive

Plan (the “2014 Plan”); |

| · | 292

shares of awarded but unissued restricted stock under our 2014 Plan; |

| · | 37,034

shares of awarded but unissued restricted stock units under our 2020 Plan; |

| · | 8,224

shares of Common Stock issuable upon exercise of stock options, with a weighted average exercise

price of $232.64 per share, under our Amended and Restated 2020 Omnibus Equity Incentive

Plan (the “2020 Plan”); |

| · | 1,008,096

shares of Common Stock available for future issuance under our 2020 Plan; |

| · | 17,972,611

shares of Common Stock issuable upon exercise of outstanding warrants, with a weighted average

exercise price of $2.37 per share; |

| |

· |

3,090 shares of Common Stock issuable upon conversion of 521.72 shares of Series B Convertible Preferred Stock (the “Series B Preferred Stock”), including in respect of accrued and unpaid dividends of approximately $1,008,000 through October 12, 2023 at a conversion price of $1,617.00 per share; and |

| · | up

to 9,125 additional shares of Common Stock issued pursuant to an exchange right in excess

of amounts currently underlying Series B Preferred Stock if the holders of Series B Preferred

Stock elect to exchange into our sale of shares of Common Stock at $549.297 per share under

our At The Market Offering Agreement, dated November 30, 2021 (the “ATM Agreement”). |

The adjustments to the above securities,

as required by the Reverse Split and in accordance with the Approved Split Ratio, would result in approximately the same aggregate price

being required to be paid under such securities upon exercise, and approximately the same value of shares of Common Stock being delivered

upon such exercise or conversion, immediately following the Reverse Split as was the case immediately preceding the Reverse Split.

Effect on

Equity Incentive Plans

As of October 12, 2023, we had 732 shares of Common

Stock reserved for issuance pursuant to the exercise of outstanding options issued under our 2014 Plan. Further, as of October 12, 2023,

we had 8,224 shares of Common Stock reserved for issuance pursuant to the exercise of outstanding options issued under our 2020 Plan,

as well as 1,008,096 shares of Common Stock available for issuance under the 2020 Plan. Pursuant to the terms of the 2014 Plan and the

2020 Plan, the Board, or a designated committee thereof, as applicable, will adjust the number of shares of Common Stock underlying outstanding

awards, the exercise price per share of outstanding stock options and other terms of outstanding awards issued pursuant to the 2014 Plan

and the 2020 Plan to equitably reflect the effects of the Reverse Split. The number of shares subject to vesting under restricted stock

awards and the number of shares issuable as contingent consideration as part of an acquisition by the Company will be similarly adjusted,

subject to our treatment of fractional shares. Furthermore, the number of shares available for future grant under the 2014 Plan and the

2020 Plan will be similarly adjusted.

Effective

Date

The proposed Reverse Split would

become effective on the date of filing of the Charter Amendment with the office of the Secretary of State of the State of Delaware unless

another effective date is set forth in the Charter Amendment. On the effective date, shares of Common Stock issued and outstanding shares

of Common Stock held in treasury, in each case, immediately prior thereto will be combined and reclassified, automatically and without

any action on the part of our stockholders, into new shares of Common Stock in accordance with the Approved Split Ratio set forth in

this Proposal No. 2. If the proposed Charter Amendment is not adopted and approved by our stockholders, the Reverse Split will not occur.

Treatment

of Fractional Shares

No fractional shares of Common

Stock will be issued as a result of the Reverse Split. Instead, in lieu of any fractional shares to which a stockholder of record would

otherwise be entitled as a result of the Reverse Split, we will pay cash (without interest) equal to such fraction multiplied by the

average of the closing sales prices of our Common Stock on The Nasdaq Capital Market during regular trading hours for the five consecutive

trading days immediately preceding the effective date of the Reverse Split (with such average closing sales prices being adjusted to

give effect to the Reverse Split). After the Reverse Split, a stockholder otherwise entitled to a fractional interest will not have any

voting, dividend or other rights with respect to such fractional interest except to receive payment as described above.

Upon stockholder adoption and approval

of this Proposal No. 2, if the Board elects to implement the proposed Reverse Split, stockholders owning fractional shares will be paid

out in cash for such fractional shares. For example, assuming the Board elected to consummate an Approved Split Ratio of 1:10, if a stockholder

held eleven shares of Common Stock immediately prior to the Reverse Split, then such stockholder would be paid in cash for the one share

of Common Stock but will maintain ownership of the remaining shares of Common Stock.

Record and

Beneficial Stockholders

If the Reverse Split is authorized

by our stockholders and our Board elects to implement the Reverse Split, stockholders of record holding some or all of their shares of

Common Stock electronically in bookentry form under the direct registration system for securities will receive a transaction statement

at their address of record indicating the number of shares of Common Stock they hold after the Reverse Split along with payment in lieu

of any fractional shares. Non-registered stockholders holding Common Stock through a bank, broker or other nominee should note that such

banks, brokers or other nominees may have different procedures for processing the consolidation and making payment for fractional shares

than those that would be put in place by us for registered stockholders. If you hold your shares with such a bank, broker or other nominee

and if you have questions in this regard, you are encouraged to contact your nominee.

If the Reverse Split is authorized

by the stockholders and our Board elects to implement the Reverse Split, stockholders of record holding some or all of their shares in

certificate form will receive a letter of transmittal, as soon as practicable after the effective date of the Reverse Split. Our transfer

agent will act as “exchange agent” for the purpose of implementing the exchange of stock certificates. Holders of pre-Reverse

Split shares will be asked to surrender to the exchange agent certificates representing pre-Reverse Split shares in exchange for post-Reverse

Split shares and payment in lieu of fractional shares (if any) in accordance with the procedures to be set forth in the letter of transmittal.

Until surrender, each certificate representing shares before the Reverse Split would continue to be valid and would represent the adjusted

number of whole shares based on the approved exchange ratio of the Reverse Split selected by the Board. No new post-Reverse Split share

certificates will be issued to a stockholder until such stockholder has surrendered such stockholder’s outstanding certificate(s)

together with the properly completed and executed letter of transmittal to the exchange agent.

STOCKHOLDERS

SHOULD NOT DESTROY ANY PRE-REVERSE SPLIT STOCK CERTIFICATE AND SHOULD NOT SUBMIT ANY CERTIFICATES UNTIL THEY ARE REQUESTED TO DO SO.

Accounting

Consequences

The par value per share of Common

Stock would remain unchanged at $0.0001 per share after the Reverse Split. As a result, on the effective date of the Reverse Split, the

stated capital on our balance sheet attributable to the Common Stock will be reduced proportionally, based on the Approved Split Ratio

selected by the Board, from its present amount, and the additional paid-in capital account shall be credited with the amount by which

the stated capital is reduced. The per share Common Stock net income or loss and net book value will be increased because there will

be fewer shares of Common Stock outstanding. The shares of Common Stock held in treasury, if any, will also be reduced proportionately

based on the Approved Split Ratio selected by the Board. Retroactive restatement will be given to all share numbers in the financial

statements, and accordingly all amounts including per share amounts will be shown on a post-split basis. We do not anticipate that any

other accounting consequences would arise as a result of the Reverse Split.

No Appraisal

Rights

Our stockholders are not entitled

to dissenters’ or appraisal rights under the Delaware General Corporation Law with respect to this Proposal No. 2 and we will not

independently provide our stockholders with any such right if the Reverse Split is implemented.

Material

Federal U.S. Income Tax Consequences of the Reverse Split

The following is a summary of certain

material U.S. federal income tax consequences of a Reverse Split to our stockholders. The summary is based on the Internal Revenue Code

of 1986, as amended (the “Code”), applicable Treasury Regulations promulgated thereunder, judicial authority and current

administrative rulings and practices as in effect on the date of this Proxy Statement. Changes to the laws could alter the tax consequences

described below, possibly with retroactive effect. We have not sought and will not seek an opinion of counsel or a ruling from the Internal

Revenue Service regarding the federal income tax consequences of a Reverse Split. This discussion only addresses stockholders who hold

Common Stock as capital assets. It does not purport to be complete and does not address stockholders subject to special tax treatment

under the Code, including, without limitation, financial institutions, tax-exempt organizations, insurance companies, dealers in securities,

foreign stockholders, stockholders who hold their pre-reverse stock split shares as part of a straddle, hedge or conversion transaction,

and stockholders who acquired their pre-reverse stock split shares pursuant to the exercise of employee stock options or otherwise as

compensation. If a partnership (or other entity treated as a partnership for U.S. federal income tax purposes) is the beneficial owner

of our Common Stock, the U.S. federal income tax treatment of a partner in the partnership will generally depend on the status of the

partner and the activities of the partnership. Accordingly, partnerships (and other entities treated as partnerships for U.S. federal

income tax purpose) holding our Common Stock and the partners in such entities should consult their own tax advisors regarding the U.S.

federal income tax consequences of the proposed Reverse Split to them. In addition, the following discussion does not address the tax

consequences of the Reverse Split under state, local and foreign tax laws. Furthermore, the following discussion does not address any

tax consequences of transactions effectuated before, after or at the same time as the Reverse Split, whether or not they are in connection

with the Reverse Split.

In general, the federal income

tax consequences of a Reverse Split will vary among stockholders depending upon whether they receive cash for fractional shares or solely

a reduced number of shares of Common Stock in exchange for their old shares of Common Stock. We believe that because the Reverse Split

is not part of a plan to increase periodically a stockholder’s proportionate interest in our assets or earnings and profits, the

Reverse Split should have the following federal income tax effects. The Reverse Split is expected to constitute a “recapitalization”

for U.S. federal income tax purposes pursuant to Section 368(a)(1) (E) of the Code. A stockholder who receives solely a reduced number

of shares of Common Stock will not recognize gain or loss. In the aggregate, such a stockholder’s basis in the reduced number of

shares of Common Stock will equal the stockholder’s basis in its old shares of Common Stock and such stockholder’s holding

period in the reduced number of shares will include the holding period in its old shares exchanged. The Treasury Regulations provide

detailed rules for allocating the tax basis and holding period of shares of common stock surrendered in a recapitalization to shares

received in the recapitalization. Stockholders of our Common Stock acquired on different dates and at different prices should consult

their tax advisors regarding the allocation of the tax basis and holding period of such shares.

A stockholder that, pursuant to

the proposed Reverse Split, receives cash in lieu of a fractional share of our Common Stock should recognize capital gain or loss in

an amount equal to the difference, if any, between the amount of cash received and the portion of the stockholder’s aggregate adjusted

tax basis in the shares of our Common Stock surrendered that is allocated to such fractional share. Such capital gain or loss will be

short term if the pre-Reverse Split shares were held for one year or less at the effective time of the Reverse Split and long term if

held for more than one year. Stockholders should consult their own tax advisors regarding the tax consequences to them of a payment for

fractional shares.

We will not recognize any gain or

loss as a result of the proposed Reverse Split.

A stockholder of our Common Stock

may be subject to information reporting and backup withholding on cash paid in lieu of a fractional share in connection with the proposed

Reverse Split. A stockholder of our Common Stock will be subject to backup withholding if such stockholder is not otherwise exempt and

such stockholder does not provide its taxpayer identification number in the manner required or otherwise fails to comply with backup

withholding tax rules. Backup withholding is not an additional tax. Any amounts withheld under the backup withholding rules may be refunded

or allowed as a credit against a stockholder’s U.S. federal income tax liability, if any, provided the required information is

timely furnished to the Internal Revenue Service. Stockholders of our Common Stock should consult their own tax advisors regarding their

qualification for an exemption from backup withholding and the procedures for obtaining such an exemption.

THE

PRECEDING DISCUSSION IS INTENDED ONLY AS A SUMMARY OF CERTAIN FEDERAL U.S. INCOME TAX CONSEQUENCES OF THE REVERSE SPLIT AND DOES NOT

PURPORT TO BE A COMPLETE ANALYSIS OR DISCUSSION OF ALL POTENTIAL TAX EFFECTS RELEVANT THERETO. YOU SHOULD CONSULT YOUR OWN

TAX ADVISORS AS TO THE PARTICULAR FEDERAL, STATE, LOCAL, FOREIGN AND OTHER TAX CONSEQUENCES OF THE REVERSE SPLIT IN LIGHT OF YOUR

SPECIFIC CIRCUMSTANCES.

Required

Vote and Recommendation

Pursuant

to changes to Section 242 of the Delaware General Corporation Law which became effective on August 1, 2023 (the “DGCL Change”),

the necessary stockholder vote to approve reverse stock splits and an increase in authorized share capital was reduced from a majority

of outstanding shares entitled to vote, to a majority of votes actually cast at a meeting. In addition to reducing the required shareholder

vote for approval of these actions, the DGCL Change has the effect of causing abstentions to have no effect on a stockholder vote. This

reduced vote requirement only applies to companies (like ours) whose stock is listed on a national securities exchange and who would

continue to meet the listing requirements of the exchange immediately after giving effect to such actions.

Pursuant

to the DCGL Change, approval and adoption of this Proposal No. 2 requires the affirmative vote of at least a majority of votes actually

cast at the meeting. Abstentions have no effect on a stockholder vote.

OUR BOARD

RECOMMENDS A VOTE “FOR” PROPOSAL TWO.

PROPOSAL

NO. 3: APPROVAL OF THE ADJOURNMENT OF THE SPECIAL MEETING TO THE EXTENT THERE ARE INSUFFICIENT PROXIES AT THE MEETING TO APPROVE ANY

ONE OR MORE OF THE FOREGOING PROPOSALS.

Adjournment

of the Special Meeting

In the event that the number of shares

of Common Stock present or represented by proxy at the Special Meeting and voting “FOR” the adoption of any one or more of

the foregoing proposals are insufficient to approve any such proposal, we may move to adjourn the Special Meeting in order to enable

us to solicit additional proxies in favor of the adoption of any such proposal. In that event, we may ask stockholders to vote only upon

the Adjournment Proposal and not on any other proposal discussed in this proxy statement. If the adjournment is for more than thirty

(30) days, a notice of the adjourned meeting shall be given to each stockholder of record entitled to vote at the meeting.

For the avoidance of doubt, any proxy

authorizing the adjournment of the Special Meeting shall also authorize successive adjournments thereof, at any meeting so adjourned,

to the extent necessary for us to solicit additional proxies in favor of the adoption of any such proposal.

Required

Vote and Recommendation

In

accordance with our Charter, Bylaws and Delaware law, and as further discussed above under “Abstentions and Broker Non-Votes”,

approval and adoption of this Proposal No. 3 requires the affirmative (“FOR”) vote of a majority of votes cast by shares

of our Common Stock present or represented by proxy and entitled to vote at the Special Meeting. Unless otherwise instructed on the proxy

or unless authority to vote is withheld, shares represented by executed proxies will be voted “FOR” this proposal. Abstentions

and broker non-votes, if any, with respect to this proposal are not counted as votes cast and will not affect the outcome of this proposal.

OUR BOARD

RECOMMENDS A VOTE “FOR” PROPOSAL THREE.

BENEFICIAL

OWNERSHIP OF PRINCIPAL STOCKHOLDERS AND

MANAGEMENT

AND RELATED STOCKHOLDER MATTERS

The following table sets forth information

regarding shares of our capital stock beneficially owned as of October 12, 2023 by:

| • | each

of our officers and directors; |

| • | all

officers and directors as a group; and |

| • | each

person known by us to beneficially own five percent or more of the outstanding shares of

our capital stock. |

Beneficial

ownership is determined in accordance with the rules and regulations of the SEC and includes voting or investment power with respect

to our Common Stock. Percentage of beneficial ownership is based on 13,499,979 shares of our Common Stock outstanding as of October 12,

2023. In addition, shares of Common Stock subject to options or other rights currently exercisable, or exercisable within 60 days of

October 12, 2023, are deemed outstanding and beneficially owned for the purpose of computing the percentage beneficially owned by (i)

the individual holding such options, warrants or other rights (but not any other individual) and (ii) the directors and executive officers

as a group. Except as otherwise noted, the persons and entities in this table have sole voting and investing power with respect to all

of the shares of our Common Stock beneficially owned by them, subject to community property laws, where applicable. Unless otherwise

indicated, the address of such individual is c/o First Wave BioPharma, Inc., 777 Yamato Road, Suite 502, Boca Raton, Florida 33431.

| Name and Address of Beneficial Owner | |

Shares of Common Stock Beneficially Owned | | |

Percentage of Common Stock | |

| Current Named Executive Officers and Directors: | |

| | | |

| | |

| James Sapirstein, President and Chief Executive Officer (1) | |

| 23,840 | | |

| | *% |

| Sarah Romano, Chief Financial Officer(2) | |

| 10,681 | | |

| | * |

| Edward J. Borkowski, Director (3) | |

| 9,961 | | |

| | * |

| Charles J. Casamento, Director (4) | |

| 3,307 | | |

| | * |

| Terry Coelho, Director (5) | |

| 9,248 | | |

| | * |

| Alastair Riddell, Director (6) | |

| 9,391 | | |

| | * |

| All Directors, Executive Officers and Former Named Executive Officers as a group (6 persons) | |

| 66,428 | | |

| | * |

* Less

than 1%.

| |

(1) |

Includes (i) 1,047 shares of Common Stock issuable upon exercise of vested options, (ii) 80 shares of Common Stock issuable upon conversion of approximately 13.528 shares of Series B Preferred Stock, which includes accrued and unpaid dividends through October 12, 2023, (iii) 30 shares of Common Stock issuable upon exercise of warrants, and (iv) 22,683 shares of Common Stock issuable upon vested Restricted Stock Units (RSUs). Excludes (i) 378 shares of Common Stock issuable upon exercise of unvested options, and (ii) 10,809 shares of Common Stock issuable upon unvested Restricted Stock and RSUs. Pursuant to the Series B Exchange Right, Mr. Sapirstein has the right to exchange the stated value, plus accrued and unpaid dividends, of the shares of Series B Preferred Stock beneficially owned by him for securities offered by the Company in any offering for cash proceeds that occurred between July 16, 2020 and January 1, 2023. |

| (2) | Includes

(i) 238 shares of Common Stock issuable upon exercise of vested options, and (ii) 10,443

shares of Common Stock issuable upon vested RSUs. Excludes (i) 476 shares of Common Stock

issuable upon exercise of unvested options, and (ii) 5,357 shares of Common Stock issuable

upon unvested RSUs. |

| |

(3) |

Includes (i) 195 shares of Common Stock, (ii) 145 shares of Common Stock issuable upon the exercise of warrants, (iii) 249 shares of Common Stock issuable upon exercise of vested options, (iv) 286 shares of Common Stock issuable upon conversion of approximately 48.043 shares of Series B Preferred Stock, which includes accrued and unpaid dividends through October 12, 2023, (v) 9,080 shares of Common Stock issuable upon vested RSUs, and (vi) 6 shares of Common Stock held by Mr. Borkowski’s spouse. Excludes 3,047 shares of Common Stock issuable upon unvested Restricted Stock and RSUs. Pursuant to the Series B Exchange Right, Mr. Borkowski has the right to exchange the stated value, plus accrued and unpaid dividends, of the shares of Series B Preferred Stock beneficially owned by him for securities offered by the Company in any offering for cash proceeds that occurred between July 16, 2020 and January 1, 2023. |

| (4) | Includes

(i) 41 shares of Common Stock, (ii) 235 shares of Common Stock issuable upon exercise of

vested options, (iii) 3,027 shares of Common Stock issuable upon vested RSUs, and (iv) 4

shares of Common Stock held by La Jolla Lenox Trust, a family trust of which the Trustee

is someone other than Mr. Casamento. Mr. Casamento and members of his immediate family are

the sole beneficiaries of the trust. Excludes 3,026 shares of Common Stock issuable upon

unvested RSUs. |

| (5) | Includes

(i)168 shares of Common Stock issuable upon exercise of vested options and (ii) 9,080 shares

of Common Stock issuable upon vested RSUs. Excludes 3,026 shares of Common Stock issuable

upon unvested RSUs. |

| (6) | Includes

(i) 62 shares of Common Stock, (ii) 9,080 shares of Common Stock issuable upon vested RSUs,

and (iii) 249 shares of Common Stock issuable upon exercise of vested options. Excludes 3,040

shares of Common Stock issuable upon unvested Restricted Stock and RSUs.

|

ADDITIONAL

INFORMATION

Householding

of Proxy Materials

The SEC has adopted rules that permit

companies and intermediaries (e.g., brokers) to satisfy the delivery requirements for proxy statements with respect to two or more stockholders

sharing the same address by delivering a single proxy statement addressed to those stockholders. This process, which is commonly referred

to as “householding,” potentially means extra convenience for stockholders and cost savings for companies.

A number of brokers with account holders

who are stockholders of the Company will be “householding” our proxy materials. A single set of our proxy materials will

be delivered to multiple stockholders sharing an address unless contrary instructions have been received from the affected stockholders.

Once you have received notice from your broker that they will be “householding” communications to your address, “householding”

will continue until you are notified otherwise or until you revoke your consent. If, at any time, you no longer wish to participate in

“householding” and would prefer to receive a separate set of our proxy materials at no charge, please notify your broker

or direct a written request to First Wave BioPharma, Inc., Attention: Chief Financial Officer - 777 Yamato Road, Suite 502,

Boca Raton, Florida 33431, or contact us at (561) 589-7020. We undertake to deliver promptly, upon any such verbal or written request,

a separate copy of our proxy materials to a stockholder at a shared address to which a single copy of these documents was delivered.

Stockholders who currently receive multiple copies of our proxy materials at their address and would like to request “householding”

of their communications should contact their broker, bank or other nominee, or contact us at the above address or phone number.

Other Matters

At the date of this proxy statement,

we know of no other matters, other than those described above, that will be presented for consideration at the Special Meeting. If any

other business should come before the Special Meeting, it is intended that the proxy holders will vote all proxies using their best judgment

in the interest of the Company and the stockholders.

Solicitation

of Proxies

The solicitation of proxies pursuant

to this proxy statement is being made by us. Proxies may be solicited, among other methods, by mail, facsimile, telephone, telegraph,

Internet and in person.

The expenses of preparing, printing and

distributing this proxy statement and the accompanying form of proxy and the cost of soliciting proxies will be borne by us.

Copies of soliciting materials will be

furnished to banks, brokerage houses and other custodians, nominees and fiduciaries for forwarding to the beneficial owners of shares

of Common Stock and Preferred Stock for whom they hold shares, and we will reimburse them for their reasonable out-of-pocket expenses

in connection therewith.

We have engaged

Alliance Advisors LLC, to assist in the solicitation of proxies and provide related advice and informational support, for a services

fee, plus customary disbursements, which are not expected to exceed $55,000 in total. Alliance Advisors LLC will solicit proxies on

our behalf from individuals, brokers, bank nominees and other institutional holders in the same manner described above. We have also

agreed to indemnify Alliance Advisors LLC against certain claims.

REGARDLESS

OF WHETHER YOU PLAN TO ATTEND THE SPECIAL MEETING,

PLEASE

READ THE PROXY STATEMENT AND THEN SUBMIT A PROXY TO VOTE BY INTERNET, TELEPHONE OR MAIL AS PROMPTLY AS POSSIBLE TO ENSURE THAT YOUR SHARES

ARE REPRESENTED AT THE SPECIAL MEETING.

BY ORDER

OF THE BOARD OF DIRECTORS,

Boca Raton, Florida

October_____,

2023

JAMES SAPIRSTEIN

President, Chief Executive

Officer and

Chairman of the Board of Directors

If you have any

questions or require any assistance in voting your shares, please call:

Alliance

Advisors LLC

200 Broadacres

Drive, 3rd Floor, Bloomfield, NJ 07003

866-407-1875

Appendix A

CERTIFICATE

OF AMENDMENT TO THE

AMENDED

AND RESTATED

CERTIFICATE

OF INCORPORATION

OF

FIRST

WAVE BIOPHARMA, INC.

First Wave BioPharma, Inc. (the “Corporation”),

a corporation organized and existing under and by virtue of the General Corporation Law of the State of Delaware, does hereby certify

as follows:

FIRST:

That a resolution was duly adopted on October [____], 2023, by the Board of Directors of the Corporation pursuant to Section

242 of the General Corporation Law of the State of Delaware setting forth an amendment to the Certificate of Incorporation of the Corporation

and declaring said amendment to be advisable. The stockholders of the Corporation duly approved said proposed amendment at a special

meeting of stockholders held on November 21, 2023, in accordance with Section 242 of the General Corporation Law of the State of Delaware.

The proposed amendment set forth as follows:

Article FOURTH

of the Amended and Restated Certificate of Incorporation of the Corporation, as amended to date, be and hereby is further amended

and restated in its entirety to read as follows:

The total number of shares which the

Corporation shall have authority to issue is one hundred and ten million (110,000,000) shares, of which a hundred million (100,000,000)

shares shall be common stock, par value $0.0001 per share, and ten million (10,000,000) shares shall be preferred stock, par value $0.0001

per share. The board of directors of the Corporation may divide the preferred stock into any number of series, fix the designation and

number of each such series, and determine or change the designation, relative rights, preferences, and limitations of any series of preferred

stock. The board of directors (within the limits and restrictions of the adopting resolutions) may increase or decrease the number of

shares initially fixed for any series, but no decrease may reduce the number below the shares then outstanding and duly reserved for

issuance.

Upon effectiveness (“Effective Time”) of this amendment to the Amended and Restated Certificate

of Incorporation of the Corporation, a one-for-[ ]1

reverse stock split (the “Reverse Split”) of the Corporation’s Common Stock shall become effective,

pursuant to which each [ ] shares of Common Stock outstanding and held of record by each stockholder of the Corporation

(including treasury shares) immediately prior to the Effective Time (“Old Common Stock”) shall automatically, and

without any action by the holder thereof, be reclassified and combined into one (1) validly issued, fully paid and non-assessable share