false

0000719402

0000719402

2024-08-29

2024-08-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 29, 2024

FIRST NATIONAL CORPORATION

(Exact name of registrant as specified in its charter)

|

Virginia

(State or other jurisdiction of incorporation)

|

1-38874

(Commission File Number)

|

54-1232965

(IRS Employer Identification No.)

|

|

112 West King Street

Strasburg, Virginia

(Address of principal executive offices)

|

22657

(Zip Code)

|

(540) 465-9121

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☒ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, par value $1.25 per share

|

FXNC

|

The Nasdaq Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.07 Submission of Matters to a Vote of Security Holders.

First National Corporation (“First National”) held a special meeting of its shareholders in virtual format on Thursday, August 29, 2024, at 10:00 a.m. related to the proposed merger (the “Merger”) of Touchstone Bankshares, Inc. (“Touchstone”) with and into First National. Of the 6,280,406 shares of First National’s common stock outstanding and entitled to vote at the special meeting, there were present, in person or by proxy, 5,686,231 shares, representing approximately 91% of the total outstanding shares. At the special meeting, First National shareholders voted on three proposals, as described in the prospectus and joint proxy statement of First National and Touchstone dated July 8, 2024, and cast their votes as described below.

|

Proposal 1 - The Agreement and Plan of Merger Proposal

|

First National’s shareholders approved the merger agreement, pursuant to which Touchstone will merge with and into First National, and the transactions contemplated by the merger agreement, including the issuance of shares of First National common stock in the Merger. The following is a tabulation of the voting results:

|

For

|

|

Against

|

|

Abstain

|

|

Broker Non-Votes

|

|

5,188,365

|

|

484,351

|

|

13,515

|

|

0

|

|

Proposal 2 - The Amendment of First National’s Articles of Incorporation Proposal

|

First National’s shareholders approved an amendment to the Articles of Incorporation of First National to increase the number of authorized common shares from 8,000,000 to 16,000,000. The following is a tabulation of the voting results:

|

For

|

|

Against

|

|

Abstain

|

|

Broker Non-Votes

|

|

5,477,561

|

|

192,467

|

|

16,203

|

|

0

|

|

Proposal 3 - The Adjournment Proposal

|

First National’s shareholders approved a proposal to adjourn the special meeting, if necessary, to permit further solicitation of proxies in favor of Proposal 1 or Proposal 2. The adjournment of the special meeting was not necessary because First National’s shareholders approved Proposal 1 and Proposal 2. The following is a tabulation of the voting results:

|

For

|

|

Against

|

|

Abstain

|

|

Broker Non-Votes

|

|

5,426,457

|

|

246,201

|

|

13,573

|

|

0

|

Item 8.01 Other Events.

On September 3, 2024, First National and Touchstone issued a joint press release announcing that each company’s shareholders, at separate meetings, approved the Merger. The joint press release announcing these shareholder approvals is attached as Exhibit 99.1 and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits. See Exhibit Index Below.

Exhibit No.Description

|

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

FIRST NATIONAL CORPORATION

|

|

|

|

|

|

|

|

|

|

|

|

|

Date: September 3, 2024

|

By:

|

/s/ M. Shane Bell

|

|

|

|

|

M. Shane Bell

|

|

|

|

|

Executive Vice President and Chief Financial Officer

|

|

Exhibit 99.1

First National Corporation and Touchstone Bankshares, Inc.

Announce Receipt of Shareholders Approvals for Merger

STRASBURG, Va. and PRINCE GEORGE, Va., September 3, 2024 --- At separate shareholder meetings held on August 29, 2024, First National Corporation (NASDAQ: FXNC) (the “Company” or “First National”), the bank holding company of First Bank, and Touchstone Bankshares, Inc. (“Touchstone”) (OTCPK: TSBA), the bank holding company of Touchstone Bank, received the required approval of each company’s shareholders to consummate the previously announced merger of Touchstone with and into First National in an all-stock transaction (the “Merger”). Immediately following the Merger, Touchstone Bank would then merge with and into First Bank. The parties expect the Merger to be effective in the fourth quarter of 2024.

ABOUT FIRST NATIONAL CORPORATION

First National Corporation (NASDAQ: FXNC) is the parent company and bank holding company of First Bank (the “Bank”), a community bank that first opened for business in 1907 in Strasburg, Virginia. The Bank offers loan and deposit products and services through its website, www.fbvirginia.com, its mobile banking platform, a network of ATMs located throughout its market area, a loan production office, a customer service center in a retirement community, and 20 bank branch office locations located throughout the Shenandoah Valley, the central regions of Virginia, the Roanoke Valley, and in the city of Richmond. In addition to providing traditional banking services, the Bank operates a wealth management division under the name First Bank Wealth Management. The Bank also owns First Bank Financial Services, Inc., which owns an interest in an entity that provides title insurance services.

ABOUT TOUCHSTONE BANKSHARES, INC.

Touchstone Bankshares, Inc., (OTCPK: TSBA) is the parent company and bank holding company of Touchstone Bank, which is headquartered in Prince George, Virginia, and has been a leading financial services provider in the south-central Virginia region since 1906 and more recently has operated in northern North Carolina. Touchstone Bank offers a full range of banking products through twelve full‐service branches, two loan centers, twelve ATM locations, and offers online deposit account opening, online real estate and consumer loan applications, online banking, mobile banking and 24/7 telephone banking. Touchstone Bank is a Member FDIC, Equal Housing Lender, and Equal Opportunity Employer.

CAUTION ABOUT FORWARD-LOOKING STATEMENTS

Certain information contained in this discussion may include “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements relate to First National’s and Touchstone’s respective plans, objectives, expectations and intentions and other statements that are not historical facts, and other statements identified by words such as “believes,” “expects,” “anticipates,” “estimates,” “intends,” “plans,” “targets,” and “projects,” as well as similar expression. Although each party believes that its expectations with respect to the forward-looking statements are based upon reliable assumptions within the bounds of its knowledge of its business and operations, there can be no assurance that actual results, performance, or achievements will not differ materially from any future results, performance or achievements expressed or implied by such forward-looking statements. Forward-looking statements are subject to a number of risks and uncertainties. For details on factors that could affect expectations, future events, or results, see the risk factors and other cautionary language included in First National’s Annual Report on Form 10-K for the year ended December 31, 2023, and other filings with the Securities and Exchange Commission (the “SEC”).

Additional risks and uncertainties may include, but are not limited to: (1) the risk that the cost savings and any revenue synergies from the proposed Merger may not be realized or take longer than anticipated to be realized, including due to the state of the economy or other competitive factors in the areas in which the parties operate, (2) disruption from the proposed Merger of customer, supplier, employee or other business partner relationships, including diversion of management's attention from ongoing business operations and opportunities due to the proposed merger, (3) the occurrence of any event, change or other circumstances that could give rise to the termination of the merger agreement, (4) the possibility that the costs, fees, expenses and charges related to the proposed Merger may be greater than anticipated, (5) reputational risk and the reaction of each of the parties’ customers, suppliers, employees or other business partners to the proposed merger, (6) the failure of the closing conditions in the merger agreement to be satisfied, or any unexpected delay in closing the proposed Merger, (7) the risks relating to the integration of Touchstone’s operations into the operations of First National, including the risk that such integration will be materially delayed or will be more costly or difficult than expected, (8) the risk of potential litigation or regulatory action related to the proposed Merger, (9) the risk of expansion into new geographic or product markets, (10) the dilution caused by First National’s issuance of additional shares of its common stock in the proposed Merger, and (11) general competitive, economic, political and market conditions. Additional factors that could cause results to differ materially from those described in the forward-looking statements can be found in the joint proxy statement of First National and Touchstone and the prospectus of First National regarding the Merger that was filed with the SEC on July 9, 2024 pursuant to Rule 424(b)(3) by First National and in First National’s reports (such as the Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K) filed with the SEC and available at the SEC’s Internet site (http://www.sec.gov). All subsequent written and oral forward-looking statements concerning First National, Touchstone or any person acting on their behalf are expressly qualified in their entirety by the cautionary statements above. Neither First National nor Touchstone undertake any obligation to update any forward-looking statement to reflect circumstances or events that occur after the date the forward-looking statements are made.

CONTACTS

|

Scott C. Harvard

|

|

James R. Black

|

|

President and CEO

First National Corporation

|

|

President and CEO

Touchstone Bankshares, Inc.

|

|

(540) 465-9121

|

|

(804) 324-7384

|

|

sharvard@fbvirginia.com

|

|

james.black@touchstone.bank

|

v3.24.2.u1

Document And Entity Information

|

Aug. 29, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

FIRST NATIONAL CORPORATION

|

| Document, Type |

8-K

|

| Document, Period End Date |

Aug. 29, 2024

|

| Entity, Incorporation, State or Country Code |

VA

|

| Entity, File Number |

1-38874

|

| Entity, Tax Identification Number |

54-1232965

|

| Entity, Address, Address Line One |

112 West King Street

|

| Entity, Address, City or Town |

Strasburg

|

| Entity, Address, State or Province |

VA

|

| Entity, Address, Postal Zip Code |

22657

|

| City Area Code |

540

|

| Local Phone Number |

465-9121

|

| Written Communications |

true

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

FXNC

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0000719402

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

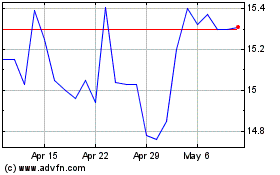

First National (NASDAQ:FXNC)

Historical Stock Chart

From Aug 2024 to Sep 2024

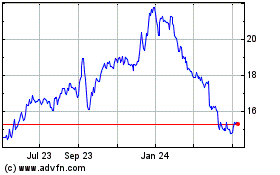

First National (NASDAQ:FXNC)

Historical Stock Chart

From Sep 2023 to Sep 2024