First Financial Northwest, Inc. Announces Receipt of Shareholder Approval for Transaction with Global Credit Union

July 19 2024 - 1:30PM

First Financial Northwest, Inc. (the “Company”) (NASDAQ GS: FFNW),

the holding company for First Financial Northwest Bank (the

“Bank”), today announced that the preliminary vote count indicates

that its shareholders approved the Purchase and Assumption

Agreement, dated January 10, 2024, by and among the Company,

the Bank and Global Federal Credit Union (“Global”), which provides

for Global’s acquisition of substantially all of the assets and

assumption of substantially all of the liabilities (including

deposit liabilities) of the Bank (the “asset sale”). Based on the

preliminary vote counts, shareholders also approved a proposal to

voluntarily dissolve the Company and distribute its net assets

following the completion of the asset sale and approved, on an

advisory basis, the compensation that may be paid or may become

payable to certain executive officers of the Company in connection

with the asset sale. Final voting results of the special meeting of

shareholders held on July 19, 2024, will be filed by the

Company on a Form 8-K within four business days.

The Bank previously received required regulatory

approvals from the Washington State Department of Financial

Institutions in connection with the asset sale and Bank

liquidation, but consummation of the asset sale remains subject to

the required regulatory approvals from the Federal Deposit

Insurance Corporation (“FDIC”) and the National Credit Union

Administration (“NCUA”), which have not yet been obtained. The

Company cannot provide any assurance as to whether they will obtain

the required final regulatory approvals from the FDIC and the NCUA,

when such approvals will be received, or whether there will be

conditions in such approvals that are unacceptably burdensome to

the Company or Global.

First Financial Northwest, Inc. is the parent

company of First Financial Northwest Bank; an FDIC insured

Washington State-chartered commercial bank headquartered in Renton,

Washington, serving the Puget Sound Region through 15 full-service

banking offices. For additional information about us, please visit

our website at ffnwb.com and click on the “Investor Relations” link

at the bottom of the page.

Forward-looking statements:When used in this

press release and in other documents filed with or furnished to the

Securities and Exchange Commission (the “SEC”), in press releases

or other public shareholder communications, or in oral statements

made with the approval of an authorized executive officer, the

words or phrases “believe,” “will,” “will likely result,” “are

expected to,” “will continue,” “is anticipated,” “estimate,”

“project,” “plans,” or similar expressions are intended to identify

“forward-looking statements” within the meaning of the Private

Securities Litigation Reform Act of 1995. Forward-looking

statements are not historical facts but instead represent

management’s current expectations and forecasts regarding future

events many of which are inherently uncertain and outside of our

control. Forward-looking statements include statements with respect

to our beliefs, plans, objectives, goals, expectations, assumptions

and statements about, among other things, our pending transaction

with Global Federal Credit Union (“Global”) whereby Global,

pursuant to the definitive purchase and assumption agreement (the

“P&A Agreement”), will acquire substantially all of the assets

and assume substantially all of the liabilities of the Bank,

expectations of the business environment in which we operate,

projections of future performance or financial items, perceived

opportunities in the market, potential future credit experience,

and statements regarding our mission and vision. These

forward-looking statements are based on current management

expectations and may, therefore, involve risks and uncertainties.

Actual results may differ, possibly materially from those currently

expected or projected in these forward-looking statements made by,

or on behalf of, us and could negatively affect our operating and

stock performance. Factors that could cause our actual results to

differ materially from those described in the forward-looking

statements, include, but are not limited to, the following: the

occurrence of any event, change or other circumstances that could

give rise to the right of one or all of the parties to terminate

the P&A Agreement; delays in completing the P&A Agreement;

the failure to obtain necessary regulatory approvals or to satisfy

any of the other conditions to the Global transaction, including

the P&A Agreement, on a timely basis or at all; delays or other

circumstances arising from the dissolution of the Bank and the

Company following completion of the P&A Agreement; diversion of

management’s attention from ongoing business operations and

opportunities during the pending Global transaction; potential

adverse reactions or changes to business or employee relationships,

including those resulting from the announcement of the Global

transaction; potential adverse impacts to economic conditions in

our local market areas, other markets where the Company has lending

relationships, or other aspects of the Company’s business

operations or financial markets, including, without limitation, as

a result of employment levels, labor shortages and the effects of

inflation, a potential recession or slowed economic growth; changes

in the interest rate environment, including the recent increases in

the Federal Reserve benchmark rate and duration at which such

increased interest rate levels are maintained, which could

adversely affect our revenues and expenses, the value of assets and

obligations, and the availability and cost of capital and

liquidity; the impact of continuing high inflation and the current

and future monetary policies of the Federal Reserve in response

thereto; the effects of any federal government shutdown; increased

competitive pressures; legislative and regulatory changes; the

impact of bank failures or adverse developments at other banks and

related negative press about the banking industry in general on

investor and depositor sentiment; disruptions, security breaches,

or other adverse events, failures or interruptions in, or attacks

on, our information technology systems or on the third-party

vendors who perform several of our critical processing functions;

effects of critical accounting policies and judgments, including

the use of estimates in determining the fair value of certain of

our assets, which estimates may prove to be incorrect and result in

significant declines in valuation; the effects of climate change,

severe weather events, natural disasters, pandemics, epidemics and

other public health crises, acts of war or terrorism, and other

external events on our business; and other factors described in the

Company’s latest Annual Report on Form 10-K and Quarterly Reports

on Form 10-Q and other reports filed with or furnished to the

Securities and Exchange Commission – that are available on our

website at www.ffnwb.com and on the SEC’s website at

www.sec.gov.

Any of the forward-looking statements that we

make in this Press Release and in the other public statements are

based upon management’s beliefs and assumptions at the time they

are made and may turn out to be wrong because of the inaccurate

assumptions we might make, because of the factors illustrated above

or because of other factors that we cannot foresee. Therefore,

these factors should be considered in evaluating the

forward-looking statements, and undue reliance should not be placed

on such statements. We do not undertake and specifically disclaim

any obligation to revise any forward-looking statements to reflect

the occurrence of anticipated or unanticipated events or

circumstances after the date of such statements.

For more information, contact:Joseph W. Kiley

III, President and Chief Executive OfficerRich Jacobson, Executive

Vice President and Chief Financial Officer(425) 255-4400

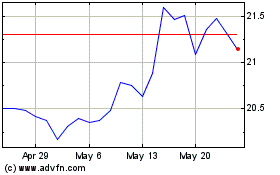

First Financial Northwest (NASDAQ:FFNW)

Historical Stock Chart

From Nov 2024 to Dec 2024

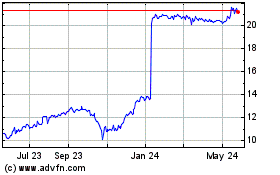

First Financial Northwest (NASDAQ:FFNW)

Historical Stock Chart

From Dec 2023 to Dec 2024