Current Report Filing (8-k)

December 20 2022 - 4:59PM

Edgar (US Regulatory)

0001602409

false

0001602409

2022-12-20

2022-12-20

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

December

20, 2022

Date of Report (Date of earliest event reported)

FINGERMOTION, INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-41187 |

|

20-0077155 |

(State

or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

1460 Broadway

New York, New York |

|

10036 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

(347)

349-5339

Registrant’s telephone number, including area code

Not

applicable.

(Former name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of

the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

Trading

Symbol (s) |

Name

of each exchange on which registered |

| Common

Stock |

FNGR |

The Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933

(Section 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (Section 240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

SECTION

7 – REGULATION FD

Item

7.01 Regulation FD Disclosure

On

December 20, 2022, FingerMotion, Inc. (the “Company” or “FingerMotion”) issued a news release to announce that

it has entered into a service agreement with ShareIntel-Shareholder Intelligence Services, LLC (“ShareIntel”) to further

assist The Christian Levine Law Group, as well as Warshaw Burstein, LLP (“Christian Warshaw Group”), each already

retained by the Company, to review the trading history of the Company’s common stock for the past two years and to track same going

forward. ShareIntel utilizes a patented process called DRIL-Down™ to aggregate and analyze repository

data from reporting entities, broker-dealers and shareholders enabling FingerMotion Inc. to proactively track shareholder ownership,

identify parties to suspicious, aberrant or unusual trading activity and deploy corrective action steps to help curtail such activity.

Christian Warshaw Group has been pursuing investment banking and brokerage firms on Wall Street for over 20 years for illegal naked short

selling, which is a sophisticated form of stock manipulation. The Company believes it may have been the target of a market manipulation

scheme involving illegal naked short selling of its common stock over the last two years and has decided to investigate and expose any

wrongdoing.

“It

is obvious when our stock trades in multiples of the outstanding shares in a single day that the markets’ checks and balances failed,”

said Martin Shen, CEO of FingerMotion Inc. “Since we know that the trading in our stock was irregular, it is our duty to our shareholders

to understand the magnitude of the issue and we will leverage ShareIntel’s patented processes and proprietary analytics to find

reporting anomalies among market makers, banks, broker-dealers and clearing firms. ShareIntel also has the ability to track share ownership

and identify any suspicious, aberrant and or unusual trading activity, which supports our continuing commitment to protect our investors

and maximize shareholder value. Based on the pedigree of our investigating firms we believe they will be able to help prove whether or

not our Company is and or has been the subject and victim of illegal naked short selling.”

“We

have the hands-on experience to identify parties that have potentially engaged in illegal naked short selling. We work in parallel with

The Christian Levine Law Group to implement action to address such activity,” said David Wenger, President and Chief Executive

Officer of ShareIntel.

A

copy of the news release is attached as Exhibit 99.1 hereto.

SECTION

9 – FINANCIAL STATEMENTS AND EXHIBITS

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

FINGERMOTION,

INC. |

| |

|

|

| DATE:

December 20, 2022 |

By: |

/s/ Martin J. Shen |

| |

|

Martin

J. Shen |

| |

|

CEO |

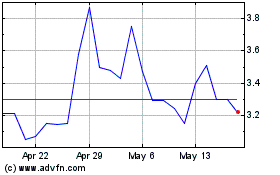

FingerMotion (NASDAQ:FNGR)

Historical Stock Chart

From Dec 2024 to Jan 2025

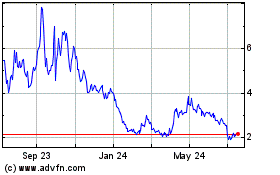

FingerMotion (NASDAQ:FNGR)

Historical Stock Chart

From Jan 2024 to Jan 2025