Fangdd Network Group Ltd. (NASDAQ: DUO) (“FangDD” or “the

Company”), a customer-oriented property technology company in

China, today announced its unaudited financial results for the six

months ended June 30, 2024.

First Half 2024 Financial

Highlights

- Revenue for the six

months ended June 30, 2024 slightly decreased by 8.8% to RMB140.0

million (US$19.3 million) from RMB153.5 million for the same period

of 2023.

- Net income for the

six months ended June 30, 2024 was RMB16.4 million (US$2.3

million), compared to net income of RMB9.4 million for the same

period of 2023.

- Non-GAAP net

income1 for the six months ended June 30, 2024 was RMB16.4 million

(US$2.3 million), compared to non-GAAP net income of RMB9.4 million

for the same period of 2023.

First Half 2024 Operating

Highlights

- Total closed-loop

GMV2 facilitated on the Company’s platform decreased by 24.9%

to RMB6.2 billion (US$0.9 billion) for the six months ended June

30, 2024 from RMB8.3 billion for the same period of 2023. This

decline in closed-loop GMV was mainly due to the continued downturn

in the real estate market and the Company’s careful selection of

new property projects for collaboration.

Mr. Xi Zeng, Chairman and Chief Executive Officer of FangDD,

commented, “According to the National Bureau of Statistics of

China, the total area of new property sales in the first half of

2024 decreased by 19% year-on-year and the total value of these

sales decreased by 25% year-on-year. This decline in both market

volume and value has led to a second bottoming out.” Looking

forward to the second half of the year, it is anticipated that with

policy support and a reduced high base effect, the real estate

market is expected to begin a stabilization process, with annual

sales remaining above 10 trillion yuan. In the first half of 2024,

the Company prioritized sustainable operations by enhancing

operational management and cost control, as well as optimizing and

adjusting organizational structures to improve cash flow security

and adaptability to market changes. Additionally, by focusing on

high gross profit businesses and developing innovative services and

products, the Company aims to achieve revenue diversification and

stable profitability.

First Half 2024 Financial

Results

REVENUE Revenue for the six

months ended June 30, 2024 slightly decreased by 8.8% to RMB140.0

million (US$19.3 million) from RMB153.5 million for the same period

of 2023. This decrease was mainly attributed to the majority of

real estate buyers maintaining a wait-and-see attitude, resulting

in overall transaction volumes in the real estate market remaining

low, despite a series of positive policies implemented by the PRC

government to promote stable and healthy development of the real

estate market.

COST OF REVENUECost of revenue

for the six months ended June 30, 2024 slightly decreased by 8.4%

to RMB122.5 million (US$16.9 million) from RMB133.7 million for the

same period of 2023. This decrease was primarily due to three

factors: (i) a corresponding decrease in the cost of revenue due to

a decrease in revenue, (ii) the Company’s continuous efforts to

adjust and optimize the structure of its business lines, and (iii)

the Company’s continuous cost optimization initiatives aimed at

improving operational efficiency.

GROSS PROFIT AND GROSS

MARGINGross profit for the six months ended June 30, 2024

decreased by 11.9% to RMB17.5 million (US$2.4 million) from RMB19.8

million for the same period of 2023. Gross margin rate for the six

months ended June 30, 2024 was 12.5%, compared to 12.9% for the

same period of 2023. This decrease was mainly due to the majority

of real estate buyers maintaining a wait-and-see attitude,

resulting in the overall transaction volumes in the real estate

market remaining low, despite a series of positive policies

implemented by the PRC government to promote stable and healthy

development of the real estate market.

OPERATING EXPENSESOperating

expenses for the six months ended June 30, 2024, which included

share-based compensation expenses of RMB10.0 thousand (US$1.4

thousand), decreased by 3.0% to RMB86.1 million (US$11.8 million)

from RMB88.8 million for the same period of 2023, which included

share-based compensation expenses of RMB82.0 thousand for the same

period of 2023.

- Sales and marketing

expenses for the six months ended June 30, 2024 decreased to RMB513

thousand (US$71 thousand) from RMB1.9 million for the same period

of 2023. This decrease was primarily due to an optimized sales

department structure, reduced spending on marketing activities

related to new property transaction services, and a reduced scale

of sales labor expenditures.

- Product development

expenses for the six months ended June 30, 2024 decreased to

RMB12.0 million (US$1.6 million) from RMB17.7 million for the same

period of 2023. This decrease was attributable to reduced

personnel-related expenses following the Company’s decision to

adopt a more conservative approach on investments in research and

development.

- General and

administrative expenses for the six months ended June 30, 2024

increased to RMB73.6 million (US$10.1 million) from RMB69.2 million

for the same period of 2023. This slight increase was mainly due

to: (i) an increase in provisions for the impairment of certain

assets, such as loans to individuals and other accounts receivable

of project deposits, and (ii) actions taken by the Company to

improve operational efficiency, including the action to reduce

expense positions.

NET INCOME

Net income for the six months ended June 30,

2024 was RMB16.4 million (US$2.3 million), compared to net income

of RMB9.4 million for the same period of 2023.

Non-GAAP net income for the six months ended June 30, 2024 was

RMB16.4 million (US$2.3 million), compared to non-GAAP net income

of RMB9.4 million for the same period of 2023.

NET INCOME PER ADSBasic and

diluted net income per American Depositary Share (“ADS”) for the

six months ended June 30, 2024 were both RMB4.50 (US$0.62). In

comparison, the Company’s basic and diluted net income attributable

to ordinary shareholders per ADS for the same period of 2023 were

both RMB3.94. Each ADS represents 5,625 of our Class A ordinary

shares as of June 30, 2024.

LIQUIDITY As of June 30, 2024,

the Company had cash and cash equivalents, restricted cash, and

short-term investments of RMB154.2 million (US$21.2 million). For

the six months ended June 30, 2024, net cash used in operating

activities was RMB5.9 million (US$807.3 thousand).

Exchange RateThis press release

contains translations of certain Renminbi amounts into U.S. dollars

at specified rates solely for the convenience of readers. Unless

otherwise noted, all translations from Renminbi to U.S. dollars, in

this press release, were made at a rate of RMB7.2672 to US$1.00,

the exchange rate set forth in the H.10 statistical release of the

Federal Reserve Board on June 28, 2024. The Company makes no

representation that the Renminbi or U.S. dollar amounts referred

could be converted into U.S. dollar or Renminbi, as the case may

be, at any particular rate or at all.

Non-GAAP Financial MeasuresTo

supplement the financial measures prepared in accordance with

generally accepted accounting principles in the United States, or

GAAP, this press release presents non-GAAP income (loss) from

operations, non-GAAP operating margin, non-GAAP net income (loss)

and non-GAAP net margin by excluding share-based compensation

expenses from income (loss) from operations and net income (loss).

The non-GAAP financial measures are not defined under U.S. GAAP and

are not presented in accordance with U.S. GAAP. The Company

believes these non-GAAP financial measures are important to help

investors understand the Company’s operating and financial

performance, compare business trends among different reporting

periods on a consistent basis and assess the Company’s core

operating results, as they exclude certain expenses that are not

expected to result in cash payments. Using the above non-GAAP

financial measures has certain limitations. Share-based

compensation expenses have been and will continue to be incurred in

the future and are not reflected in the presentation of the

non-GAAP financial measures, but should be considered in the

overall evaluation of the Company’s results. These non-GAAP

financial measures should be considered in addition to financial

measures prepared under GAAP, but should not be considered a

substitute for, or superior to, financial measures prepared under

GAAP. The Company compensates for these limitations by reconciling

these non-GAAP financial measures to the most directly comparable

U.S. GAAP measures, which should be considered when evaluating the

Company’s performance. Reconciliation of each of these non-GAAP

financial measures to the most directly comparable GAAP financial

measure is set forth at the end of this release.

About FangDDFangdd Network

Group Ltd. (Nasdaq: DUO) is a customer-oriented property technology

company in China, focusing on providing real estate transaction

digitalization services. Through innovative use of mobile internet,

cloud, big data, artificial intelligence, among others, FangDD has

fundamentally revolutionized the way real estate transaction

participants conduct their business through a suite of modular

products and solutions powered by SaaS tools, products and

technology. For more information, please visit

http://ir.fangdd.com.

Safe Harbor StatementThis

announcement contains forward-looking statements. These statements

are made under the “safe harbor” provisions of the U.S. Private

Securities Litigation Reform Act of 1995. These forward-looking

statements can be identified by terminology such as “aim,”

“anticipate,” “believe,” “estimate,” “expect,” “hope,” “going

forward,” “intend,” “ought to,” “plan,” “project,” “potential,”

“seek,” “may,” “might,” “can,” “could,” “will,” “would,” “shall,”

“should,” “is likely to” and the negative form of these words and

other similar expressions. Among other things, statements that are

not historical facts, including statements about FangDD’s beliefs

and expectations, the business outlook and quotations from

management in this announcement, as well as FangDD’s strategic and

operational plans, are or contain forward-looking statements.

Forward-looking statements involve inherent risks and

uncertainties. A number of factors could cause actual results to

differ materially from those contained in any forward-looking

statement, including but not limited to the following. The general

economic and business conditions in China may deteriorate. The

growth of Internet and mobile user population in China might not be

as strong as expected. FangDD’s plan to attract new and retain

existing real estate agents, expand property listings, develop new

products and increase service offerings might not be carried out as

expected. FangDD might not be able to implement all of its

strategic plans as expected. Competition in China may intensify

further. All information provided in this press release is as of

the date of this press release and are based on assumptions that

the Company believes to be reasonable as of this date, and FangDD

undertakes no obligation to update any forward-looking statement,

except as required under applicable law.

Investor Relations

ContactFangDDMs. Linda LiDirector, Capital Markets

DepartmentPhone: +86-0755-2699-8968E-mail:ir@fangdd.com

|

Fangdd Network Group Ltd. |

|

|

|

SELECTED UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS

DATA |

|

|

|

(All amounts in thousands of Renminbi, except for share and

per share data) |

| |

|

|

As of December 31, |

|

As of June 30, |

|

|

|

2023 |

|

|

2024 |

|

|

Assets |

|

|

|

|

Current assets |

|

|

|

|

Cash and cash equivalents |

121,733 |

|

|

125,427 |

|

|

Restricted cash |

22,166 |

|

|

16,974 |

|

|

Short-term investments |

15,312 |

|

|

11,845 |

|

|

Accounts receivable, net |

314,638 |

|

|

260,482 |

|

|

Prepayments and other current assets |

126,725 |

|

|

92,273 |

|

|

Inventory |

12,503 |

|

|

6,018 |

|

|

Total current assets |

613,077 |

|

|

513,019 |

|

|

|

|

|

|

|

Total assets |

769,901 |

|

|

673,953 |

|

|

|

|

|

|

|

LIABILITIES |

|

|

|

|

Current liabilities |

|

|

|

|

Accounts payable |

395,432 |

|

|

288,798 |

|

|

Customers’ refundable fees |

31,554 |

|

|

31,863 |

|

|

Accrued expenses and other payables |

117,556 |

|

|

109,435 |

|

|

Income taxes payable |

5,068 |

|

|

5,270 |

|

|

Operating lease liabilities-current |

111 |

|

|

1,499 |

|

|

Total current liabilities |

549,721 |

|

|

436,865 |

|

|

|

|

|

|

|

Total liabilities |

578,404 |

|

|

462,557 |

|

|

|

|

|

|

|

Total Fangdd Network Group Ltd. shareholders'

equity |

195,845 |

|

|

213,561 |

|

|

Non-controlling interests |

(4,348 |

) |

|

(2,165 |

) |

|

Total equity |

191,497 |

|

|

211,396 |

|

|

|

|

|

|

|

Total liabilities and equity |

769,901 |

|

|

673,953 |

|

|

Fangdd Network Group Ltd. |

|

|

|

SELECTED UNAUDITED CONSOLIDATED STATEMENTS OF COMPREHENSIVE

INCOME (LOSS) DATA |

|

|

|

(All amounts in thousands, except for share and per share

data) |

| |

|

|

For the Six Months Ended June 30, |

|

|

2023 |

|

|

2024 |

|

|

Revenue |

153,488 |

|

|

139,969 |

|

|

Cost of revenues |

(133,673 |

) |

|

(122,510 |

) |

|

Gross profit |

19,815 |

|

|

17,459 |

|

|

|

|

|

|

|

Operating expenses: |

|

|

|

|

Sales and marketing expenses |

(1,855 |

) |

|

(513 |

) |

|

Product development expenses |

(17,725 |

) |

|

(11,958 |

) |

|

General and administrative expenses |

(69,204 |

) |

|

(73,613 |

) |

|

Total operating expenses |

(88,784 |

) |

|

(86,084 |

) |

|

|

|

|

|

|

Loss from operations |

(68,969 |

) |

|

(68,625 |

) |

|

|

|

|

|

|

Net income |

9,361 |

|

|

16,411 |

|

| Net

income attributable to minority shareholders |

97 |

|

|

974 |

|

|

Net income attributable to ordinary

shareholders |

9,458 |

|

|

17,385 |

|

|

|

|

|

|

|

Net income |

9,361 |

|

|

16,411 |

|

|

Other comprehensive income |

|

|

|

|

Foreign currency translation adjustment, net of nil income

taxes |

1,267 |

|

|

320 |

|

|

Total comprehensive income , net of income

taxes |

10,628 |

|

|

16,731 |

|

| Total

comprehensive income attributable to minority shareholders |

97 |

|

|

974 |

|

|

Total comprehensive income attributable to ordinary

shareholders |

10,725 |

|

|

17,705 |

|

|

|

|

|

|

| Net

income per share |

|

|

|

|

- Basic |

0.001 |

|

|

0.001 |

|

|

- Diluted |

0.001 |

|

|

0.001 |

|

| Net

income per ADS |

|

|

|

|

- Basic |

3.94 |

|

|

4.50 |

|

|

- Diluted |

3.94 |

|

|

4.50 |

|

|

Weighted average number of ordinary shares used in computing net

income per share, basic and diluted |

|

|

|

|

- Basic |

13,937,948,159 |

|

|

20,827,256,643 |

|

|

- Diluted |

13,937,948,159 |

|

|

20,827,256,643 |

|

|

Reconciliation of GAAP and Non-GAAP Results |

|

|

|

(All amounts in thousands, except for share and per share

data) |

| |

| |

For the Six Months |

|

Ended June 30, |

|

|

2023 |

|

|

2024 |

|

|

GAAP loss from operations |

(68,969 |

) |

|

(68,625 |

) |

|

Share-based compensation expenses |

82 |

|

|

10 |

|

|

Non-GAAP loss from operations |

(68,887 |

) |

|

(68,615 |

) |

|

|

|

|

|

|

GAAP net income |

9,361 |

|

|

16,411 |

|

|

Share-based compensation expenses |

82 |

|

|

10 |

|

|

Non-GAAP net income |

9,443 |

|

|

16,421 |

|

|

|

|

|

|

|

GAAP operating margin |

(44.93 |

)% |

|

(49.03 |

)% |

|

Share-based compensation expenses |

0.05 |

% |

|

0.01 |

% |

|

Non-GAAP operating margin |

(44.88 |

)% |

|

(49.02 |

)% |

|

|

|

|

|

|

GAAP net margin |

6.10 |

% |

|

11.72 |

% |

|

Share-based compensation expenses |

0.05 |

% |

|

0.01 |

% |

|

Non-GAAP net margin |

6.15 |

% |

|

11.73 |

% |

___________________

1 Non-GAAP net income is defined as net income

excluding share-based compensation expenses. For more information

on these non-GAAP financial measures, please see the section

captioned “Non-GAAP Financial Measures” and the tables captioned

“Reconciliation of GAAP and Non-GAAP Results” set forth at the end

of this release.2 “Closed-loop GMV” refers to the GMV of

closed-loop transactions facilitated in the Company’s marketplace

during the specified period. Closed-loop transactions refer to

property transactions in which the major steps are completed or

managed by real estate agents in the Company’s marketplace.

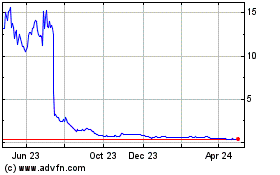

FangDD Network (NASDAQ:DUO)

Historical Stock Chart

From Nov 2024 to Dec 2024

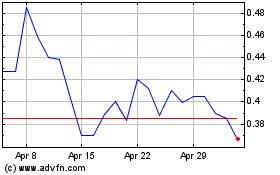

FangDD Network (NASDAQ:DUO)

Historical Stock Chart

From Dec 2023 to Dec 2024