Fangdd unveils 2024 strategic layout, aims to enter the real estate stock asset services sector

March 08 2024 - 4:10PM

Due to urbanization slowdown and per capita housing saturation in

China, the traditional real estate industry is constantly shrinking

in development scale, and the Chinese real estate market is

gradually shifting from an "incremental market" to a "stock

market". In the long term, stock assets will be continuously

accumulated in scale and value, and the operation of stock assets

will become increasingly significant, which will inevitably replace

incremental real estate development as the main track. In the

United States and Japan where the real estate markets are mature, a

group of excellent asset service enterprises have emerged in the

areas of long-term rental apartments, commercial real estate, and

other stock assets. In response to this trend of the real estate

industry, Fangdd plans to enter the trillion dollar market of real

estate stock asset services and actively explore related business.

In 2024, Fangdd has planned a strategic blueprint

for real estate stock asset services: by filling gaps, elongating

strengths, and forging new strengths, Fangdd aims to build a

leading platform of real estate stock asset services with

comprehensive service capabilities of operation, sales, and

technology. To this end, Fangdd will focus on the following two

aspects in 2024: 1. improving asset revitalization capabilities by

establishing the operational and technological services required

for real estate stock assets; 2. increasing service asset projects

by seizing potential opportunities of stock assets mainly in the

areas of apartments, commercial properties and industries.

With many years of experience in real estate

transaction services, Fangdd has self-operated business in 15

cities of China. Due to an average of nearly 20 years of real

estate operating experience, our founding team has a profound

understanding of real estate industry in terms of operation and

management.

In the short term, under the continuous downward

trend of the real estate transaction business, Fangdd, through the

strategic layout of real estate stock asset services, can diversify

income sources and resist the operational risks from sole

dependence on transaction commissions. In the long run, real estate

stock asset services can bring new business opportunities and

growth momentum and opportunities and new growth poles, which will

contribute to our business transformation and upgrading.

About FangDD

Fangdd Network Group Ltd. (Nasdaq: DUO) is a customer-oriented

property technology company in China, focusing on providing real

estate transaction digitalization services. Through innovative use

of mobile internet, cloud, big data, artificial intelligence, among

others, FangDD has fundamentally revolutionized the way real estate

transaction participants conduct their business through a suite of

modular products and solutions powered by SaaS tools, products and

technology. For more information, please visit

http://ir.fangdd.com.

Safe Harbor Statement

This announcement contains forward-looking statements. These

statements are made under the “safe harbor” provisions of the U.S.

Private Securities Litigation Reform Act of 1995. These

forward-looking statements can be identified by terminology such as

“aim,” “anticipate,” “believe,” “estimate,” “expect,” “hope,”

“going forward,” “intend,” “ought to,” “plan,” “project,”

“potential,” “seek,” “may,” “might,” “can,” “could,” “will,”

“would,” “shall,” “should,” “is likely to” and the negative form of

these words and other similar expressions. Among other things,

statements that are not historical facts, including statements

about the Company’s beliefs and expectations are or contain

forward-looking statements. Forward-looking statements involve

inherent risks and uncertainties. A number of factors could cause

actual results to differ materially from those contained in any

forward-looking statement. All information provided in this press

release is as of the date of this press release and is based on

assumptions that the Company believes to be reasonable as of this

date, and the Company does not undertake any obligation to update

any forward-looking statement, except as required under applicable

law.

Investor Relations Contact

Ms. Linda LiDirector, Capital Markets DepartmentPhone:

+86-0755-2699-8968E-mail: ir@fangdd.com

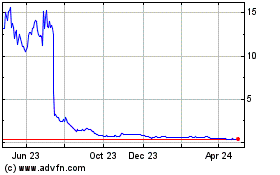

FangDD Network (NASDAQ:DUO)

Historical Stock Chart

From Nov 2024 to Dec 2024

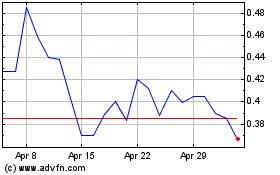

FangDD Network (NASDAQ:DUO)

Historical Stock Chart

From Dec 2023 to Dec 2024