false

0001817004

0001817004

2024-09-25

2024-09-25

0001817004

dei:FormerAddressMember

2024-09-25

2024-09-25

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C., 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date

of Report (Date of earliest event reported): September 25, 2024

EZFILL

HOLDINGS, INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-40809 |

|

84-4260623 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

67

NW 183rd Street, Miami, Florida 33169

(Address

of principal executive offices, including Zip Code)

305

-791-1169

(Registrant’s

telephone number, including area code)

2999

NE 191st Street, Ste 500, Aventura Florida 33180

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13a-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, $0.0001 par value per share |

|

EZFL |

|

NASDAQ

Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

1.01 Entry into a Material Definitive Agreement.

Entry

into the second amendment to the second amended and restated exchange agreement

As

previously reported on EzFill Holdings, Inc.’s (the “Company”) Current Report on Form 8-K filed with the Securities

and Exchange Commission (the “Commission”) on August 16, 2023 and November 8, 2023, the Company, the members of Next Charging

LLC (the “Members”) and Michael Farkas, an individual, as the representative of the Members entered into an Exchange Agreement

dated August 10, 2023 as amended by the Amended and Restated Exchange Agreement, dated November 2, 2023 (as so amended the “Original

Exchange Agreement”), pursuant to which the Company agreed to acquire from the Members 100% of the membership interests of Next

Charging LLC in exchange for the issuance by the Company to the Members of shares of common stock, par value $0.0001 per share, of the

Company (the “Common Stock”). Subsequently, Next Charging LLC converted to a corporation organized in the State of Nevada

named NextNRG Holding Corp. (“NextNRG”) effective as of March 1, 2024 (the “Conversion”), which Conversion continued

the existence of the prior entity in the new corporate form and the prior members of Next Charging LLC remained as shareholders of NextNRG.

As reported on the Company’s Current Report on Form 8-K filed with the Commission on June 14, 2024, on June 11, 2024, in order

to reflect the Conversion, the Company, all of the shareholders of NextNRG (the “Shareholders”) and Michael Farkas as the

representative of the Shareholders (the “Shareholders’ Representative”) executed a second amended and restated agreement

to replace the Original Exchange Agreement in its entirety (the “Second Amended and Restated Exchange Agreement”). Pursuant

to the Second Amended and Restated Exchange Agreement, the Company agreed to acquire from the Shareholders 100% of the shareholding of

NextNRG in exchange for the issuance by the Company to the Shareholders of Common Stock. As reported on the Company’s Current Report

on Form 8-K filed with the Commission on July 25, 2024, on July 22, 2024, the Company and the Shareholders’ Representative entered

into the first amendment to the Second Amended and Restated Exchange Agreement (“First Amendment Agreement”) to add a new

section 2.10 to the Second Amended and Restated Exchange Agreement providing that, in the event that the Company at any time prior to

the Closing undertakes any forward split of the Common Stock, or any reverse split of the Common Stock, any references to numbers of

shares of Common Stock and the number of Exchange Shares as set forth in the Second Amended and Restated Exchange Agreement shall be

deemed automatically updated and adjusted to the extent still applicable.

On

September 25, 2024, the Company and the Shareholders’ Representative entered into the second amendment to the Second Amended and

Restated Exchange Agreement (“Second Amendment Agreement”). Under the Second Amendment Agreement, the consideration to be

paid to the Shareholders was revised from 40,000,000 to 100,000,000 shares of Common Stock (“Exchange Shares”) of which,

25,000,000 or 50,000,000 shares out of the Exchange Shares will vest on the Closing Date, and the remaining 75,000,000 or 50,000,000

shares out of the Exchange Shares will be subject to vesting or forfeiture. The Second Amendment Agreement also provides that in the

event that the acquisition of the acquisition Target by NextNRG, directly or indirectly through NextNRG or a subsidiary of NextNRG, has

been completed prior to the Closing, then 50,000,000 of the Exchange Shares shall be the “Vested Shares” and 50,000,000 of

the Exchange Shares shall be the “Restricted Shares” subject to vesting. In the event that the acquisition of the acquisition

Target (as defined under the Second Amended and Restated Exchange Agreement) by NextNRG, directly or indirectly through NextNRG or a

subsidiary of NextNRG, has not been completed prior to the Closing, then 25,000,000 of the Exchange Shares shall be the “Vested

Shares” and 75,000,000 of the Exchange Shares shall be the “Restricted Shares” subject to vesting. The Second Amendment

Agreement also amends and restates the vesting schedule for the Restricted Shares and includes amendments to omit and amend certain provisions

of the Second Amended and Restated Exchange Agreement in light of the amendment to the Company’s certificate of incorporation.

The

Shareholders’ Representative is the chief executive officer and the controlling shareholder of NextNRG Holding Corp. and is also

the beneficial owner of approximately 70% of the Company’s issued and outstanding common stock.

The

information set forth above is qualified in its entirety by reference to the Second Amendment Agreement, which is incorporated herein

by reference and attached hereto as Exhibit 10.1. Any terms not defined herein have the same meaning ascribed to them in the Second Amendment

Agreement and the Second Amended and Restated Exchange Agreement.

Item

3.02. Unregistered Sales of Equity Securities.

To

the extent required by this Item 3.02, the information contained in Item 1.01 is incorporated herein by reference.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

Date:

September 27, 2024

| EZFILL

HOLDINGS, INC. |

|

| |

|

|

| By: |

/s/

Yehuda Levy |

|

| Name: |

Yehuda

Levy |

|

| Title: |

Interim

Chief Executive Officer |

|

Exhibit

10.1

Second

Amendment to Second Amended and Restated Exchange Agreement

Dated

as of September 25, 2024

This

Second Amendment to Second Amended and Restated Exchange Agreement (this “Amendment”) is made and entered into as of the

date first set forth above (the “Amendment Date”) by and among (i) EzFill Holdings, Inc., a Delaware corporation (the “Company”);

and (ii) Michael Farkas (the “Shareholders’ Representative”). The Company and the Shareholders’ Representative

may be referred to herein individually as a “Party” and, collectively, as the “Parties.”

WHEREAS

the Parties and all the shareholders of NextNRG Holding Corp., a Nevada corporation (the “Shareholders”) are the parties

to that certain Second Amended and Restated Exchange Agreement, dated as of June 11, 2024, as amended by the First Amendment to Second

Amended and Restated Exchange Agreement dated as of July 10, 2024 (as so amended, the “Exchange Agreement”);

WHEREAS,

pursuant to the provisions of Section 6.05 of the Exchange Agreement, the Shareholders have each constituted and appointed the Shareholders’

Representative as their Representative (as defined in the Exchange Agreement) and their true and lawful attorney in fact, with full power

and authority in its name and on its behalf to act on such Shareholders’ behalf in the absolute discretion of Shareholders’

Representative with respect to all matters relating to the Exchange Agreement, including execution and delivery of any amendment, supplement,

or modification of the Exchange Agreement, and Section 9.11 of the Exchange Agreement provides that the Exchange Agreement may be amended

and modified by a written instrument executed by the Company and the Shareholders’ Representative; and

WHEREAS,

the Parties now desire to amend the Exchange Agreement;

NOW

THEREFORE, in consideration of the mutual agreements contained herein and for good and valuable consideration, the receipt and sufficiency

of which are hereby acknowledged, and intending to be legally bound hereby, the Parties hereby agree as follows:

| 1. | Definitions.

Capitalized terms used but not defined herein shall have the meanings assigned to such terms

in the Exchange Agreement. |

| 2. | Amendment.

Pursuant to the provisions of Section 6.05 and Section 9.11 of the Exchange Agreement, the

Exchange Agreement is hereby amended as follows: |

| (a) | The

Parties acknowledge and agree that the number “100,000,000” in Section 2.02(b)

of the Exchange Agreement was adjusted to be 40,000,000 as a result of the one-for-two and

a half (1-for-2.5) reverse split of the Common Stock which occurred on July 23, 2024 (the

“Reverse Split”). Such adjusted 40,000,000 number (originally 100,000,000 in

the Second Amended and Restated Exchange Agreement, dated as of June 11, 2024) is hereby

amended to be “100,000,000”. |

| (b) | Section

2.02(c) is hereby amended and restated in its entirety to provide as follows: |

(c) Either

25,000,000 or 50,000,000 of the Exchange Shares (as determined pursuant to Section 2.02(c)(i) and Section 2.02(c)(ii), the “Vested

Shares”) shall be fully earned and vested as of the Closing Date, and the remaining 75,000,000 or 50,000,000 Exchange Shares (as

determined pursuant to Section 2.02(c)(i) and Section 2.02(c)(ii), the “Restricted Shares”) shall be subject to vesting or

forfeiture as set forth in Section 2.07.

(i) In

the event that the acquisition of the Target (as defined below) by NextNRG, directly or indirectly through NextNRG or a subsidiary of

NextNRG, has been completed prior to the Closing, then 50,000,000 of the Exchange Shares shall be the “Vested Shares” and

50,000,000 of the Exchange Shares shall be the “Restricted Shares” subject to vesting pursuant to Section 2.07(d)(ii) and

Section 2.07(d)(iii) or forfeiture as set forth in the remainder of Section 2.07.

(ii) In

the event that the acquisition of the Target by NextNRG, directly or indirectly through NextNRG or a subsidiary of NextNRG, has not been

completed prior to the Closing, then 25,000,000 of the Exchange Shares shall be the “Vested Shares” and 75,000,000 of the

Exchange Shares shall be the “Restricted Shares” subject to vesting pursuant to Section 2.07(d)(i), Section 2.07(d)(ii) and

Section 2.07(d)(iii) or forfeiture as set forth in the remainder of Section 2.07.

| (c) | Section

2.07(d) of the Exchange Agreement is hereby amended and restated in its entirety to provide

as follows: |

(d) The

Restricted Shares shall vest, if at all, as follows:.

(i) In

the event that, prior to the Closing, NextNRG, directly or indirectly through NextNRG or a subsidiary of NextNRG, has not completed the

acquisition of the acquisition target as set forth in Section 2.07(d)(i) of the Company Disclosure Schedules (the “Target”),

and therefore 25,000,000 of the Exchange Shares were “Vested Shares” as of the Closing pursuant to the provisions of Section

2.02(c), then upon the Company (directly or indirectly through NextNRG or a subsidiary of NextNRG), completing the acquisition of the

Target, 25,000,000 of the Restricted Shares shall vest. In the event that the Shareholders’ Representative determines that the

Target as set forth in Section 2.07(d)(i) of the Company Disclosure Schedules is not capable of being acquired, either prior to or after

the Closing, then the Shareholders’ Representative and the Company shall negotiate in good faith to determine a replacement “Target”,

which shall thereafter be the “Target” for all purposes herein.

(ii) Upon

the Company deploying the third solar, wireless electric vehicle charging, microgrid, and/or battery storage system, 25,000,000 Restricted

Shares shall vest. For purposes herein; (i) a “solar system” means a 500kw to 5MW system in which the Company produces solar

energy and transmits it to the electrical grid, or to a third party which purchase the energy, which third party may be the customer

for the solar energy in the event that such energy powered the Company’s charging stations; (ii) “battery storage system”

means systems in which energy is stored in order to reduce load and capacities on the electrical grid; and “microgrid” means

a local energy grid controlled locally that can exist in isolation or be disconnected from a ‘traditional’ grid and operate

autonomously. Deployment shall be determined by the Company receiving verification from the contractor that the system is functioning

and in use. For a deployment to satisfy this condition it must be a commercial deployment.

(iii) Upon

the Company attaining one or more of the milestones in the following sentence, 25,000,000 Restricted Shares shall vest. The milestones

shall be any one or more of (1) the Company reaching annual revenues exceeding $100 million; (2) the Company completing projects with

deployment costs greater than $100 million; and (3) the Company completing a capital raise greater than $25 million.

| (d) | A

new Section 2.11 is hereby added to the Exchange Agreement, immediately following Section

2.10 thereof, providing as follows: |

Section

2.11 Additional Shareholders. Notwithstanding anything herein to the contrary, the Parties acknowledge and agree that, prior to

the Closing, NextNRG may issue additional shares of NextNRG Stock to one or more additional Persons and, in such event, such Persons

shall execute a joinder to this Agreement and shall become a Party hereto and a Shareholder for all purposes hereunder. In addition,

notwithstanding anything herein to the contrary, the Parties acknowledge and agree that, prior to the Closing, subject to the approval

of the Shareholders’ Representative, certain Shareholders may transfer their shares of NextNRG Stock to persons who are currently

Shareholders or who would become new shareholders of NextNRG. Upon any such new issuances of NextNRG Common Stock, or transfers of NextNRG

Stock, the Parties shall update the Capitalization Table and other Transaction Documents accordingly, the representations and warranties

in Article III and Article IV shall be deemed automatically updated to reflect such events, and any such additional Shareholders shall

participate in the Transactions at the Closing as any other Shareholder. Each of the Parties agrees to execute such documents and to

undertake such actions as may be reasonably requested by the Company or the Shareholders’ Representative in order for compliance

with the provisions of this Section 2.11.

| (e) | The

Parties acknowledge and agree that the Certificate Amendment has been completed, and therefore

the provisions relating thereto in the Exchange Agreement are being removed, and the following

amendments to the Exchange Agreement are hereby made in furtherance thereof: |

| (i) | Section

1.01(g) of the Exchange Agreement is amended and restated in its entirety to provide as follows: |

(g)

[Intentionally omitted]

| (ii) | Section

2.01 of the Exchange Agreement is amended and restated in its entirety to provide as follows: |

Section

2.01 [Intentionally omitted]

| (iii) | The

first sentence of Section 5.02 of the Exchange Agreement is amended and restated in its entirety

to provide as follows: |

The

execution, delivery and performance, of this Agreement does not, and the consummation of the Transactions will not, violate any provision

of the Company Organizational Documents.

| (iv) | Section

6.04(a) of the Exchange Agreement is amended and restated in its entirety to provide as follows: |

(a)

As promptly as practicable after the date hereof, the Company shall undertake such actions to obtain the approval of the stockholders

of the Company for (i) the adoption and approval of this Agreement and the Transactions, including the issuance of the Exchange Shares

and the shares of Common Stock which may be issued upon the Closing, in accordance with the Company Organizational Documents, the Securities

Act, the DGCL and the rules and regulations of the SEC and Nasdaq, and (ii) such other matters as the Company and Shareholders’

Representative shall hereafter mutually determine to be necessary or appropriate in order to effect the Transactions (the approvals described

in foregoing clauses (i) through (ii), collectively, the “Stockholder Approval Matters”).

| (v) | Section

7.01(f) of the Exchange Agreement is amended and restated in its entirety to provide as follows: |

(f)

[Intentionally omitted]

| 3. | Agreement.

For the avoidance of doubt, the Parties acknowledge and agree that the revised numbers of

Exchange Shares, Vested Shares, Restricted Shares and other references to the number of shares

of Common Stock as set forth herein are each amended as of the Amendment Date, and are the

agreements of the Parties as to the number of such shares of Common Stock in the Transactions

following the consummation Reverse Split. |

| 4. | Effect

of Amendment; Full Force and Effect. This Amendment shall form a part of the Exchange

Agreement for all purposes, and each Party and the Shareholders shall be bound hereby and

this Amendment and the Exchange Agreement shall be read and interpreted as one combined instrument.

From and after the Amendment Date, each reference in the Exchange Agreement to “this

Agreement,” “hereof,” “hereunder,” “herein,” “hereby”

or words of like import referring to the Exchange Agreement shall mean and be a reference

to the Exchange Agreement as amended by this Amendment. Except as herein expressly amended

or otherwise provided herein, each and every term, condition, warranty and provision of the

Exchange Agreement shall remain in full force and effect, and such are hereby ratified, confirmed

and approved by the Parties. |

| 5. | Governing

Law. This Amendment, and any and all claims, proceedings or causes of action relating

to this Agreement or arising from this Amendment or the transactions contemplated herein,

including, without limitation, tort claims, statutory claims and contract claims, shall be

interpreted, construed, governed and enforced under and solely in accordance with the substantive

and procedural Laws of the State of Delaware, in each case as in effect from time to time

and as the same may be amended from time to time, and as applied to agreements performed

wholly within the State of Delaware. |

| 6. | Counterparts.

This Amendment may be executed in one or more counterparts, each of which shall be deemed

to be an original, but all of which shall constitute one and the same agreement. Delivery

of an executed counterpart of a signature page to this Amendment by electronic means, including

DocuSign, Adobe Sign or other similar e-signature services, e-mail or scanned pages shall

be effective as delivery of a manually executed counterpart to this Amendment. |

[Signature

Pages Follow]

IN

WITNESS WHEREOF, each of the Parties has caused this Amendment to be duly executed on its behalf as of the Amendment Date.

| |

Shareholders’

Representative |

| |

|

| |

By:

|

/s/

Michael Farkas |

| |

Name:

|

Michael

Farkas |

| |

Title:

|

CEO |

| |

|

|

| |

EzFill

Holdings, Inc. |

| |

|

| |

By: |

/s/

Yehuda Levy |

| |

Name:

|

Yehuda

Levy |

| |

Title:

|

Interim

Chief Executive Officer |

v3.24.3

Cover

|

Sep. 25, 2024 |

| Entity Addresses [Line Items] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Sep. 25, 2024

|

| Entity File Number |

001-40809

|

| Entity Registrant Name |

EZFILL

HOLDINGS, INC.

|

| Entity Central Index Key |

0001817004

|

| Entity Tax Identification Number |

84-4260623

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

67

NW 183rd Street

|

| Entity Address, City or Town |

Miami

|

| Entity Address, State or Province |

FL

|

| Entity Address, Postal Zip Code |

33169

|

| City Area Code |

305

|

| Local Phone Number |

791-1169

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, $0.0001 par value per share

|

| Trading Symbol |

EZFL

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Former Address [Member] |

|

| Entity Addresses [Line Items] |

|

| Entity Address, Address Line One |

2999

NE 191st Street

|

| Entity Address, Address Line Two |

Ste 500

|

| Entity Address, City or Town |

Aventura

|

| Entity Address, State or Province |

FL

|

| Entity Address, Postal Zip Code |

33180

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLine items represent financial concepts included in a table. These concepts are used to disclose reportable information associated with domain members defined in one or many axes to the table.

| Name: |

dei_EntityAddressesLineItems |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

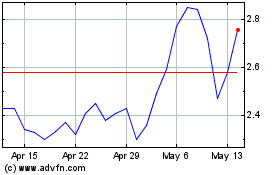

EzFill (NASDAQ:EZFL)

Historical Stock Chart

From Oct 2024 to Nov 2024

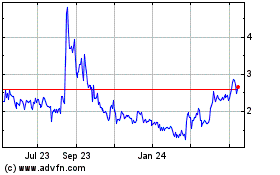

EzFill (NASDAQ:EZFL)

Historical Stock Chart

From Nov 2023 to Nov 2024