Robbins Arroyo LLP: Esperion Therapeutics, Inc. (ESPR) Misled Shareholders According to a Recently Filed Class Action

January 15 2016 - 2:27PM

Business Wire

Shareholder rights law firm Robbins Arroyo LLP announces that a

class action complaint was filed in the U.S. District Court for the

Eastern District of Michigan. The complaint alleges that officers

and directors of Esperion Therapeutics, Inc. (NASDAQGM: ESPR)

violated the Securities Exchange Act of 1934 between August 18,

2015 and September 28, 2015, by making materially false and

misleading statements about Esperion's business prospects.

Esperion, a biopharmaceutical company, focuses on the research,

development, and commercialization of oral and low-density

lipoprotein cholesterol-lowering therapies for the treatment of

patients with hypercholesterolemia and other cardiometabolic risk

markers. Its lead product candidate is ETC-1002, a once-daily small

molecule designed to lower LDL-cholesterol levels.

View this information on the law firm's Shareholder Rights Blog:

www.robbinsarroyo.com/shareholders-rights-blog/esperion-therapeutics-inc

Esperion Accused of Lying to Investors About Its Meeting with

the FDA

According to the complaint, by early August 2015, Esperion

completed ETC-1002's Phase 2b clinical trials and was meeting with

the U.S. Food and Drug Administration to discuss moving forward

with the Phase 3 segment of the approval process. Up to that point,

Esperion never mentioned to investors that it would need to conduct

a lengthy and expensive cardiovascular outcomes trial ("CVOT")

prior to ETC-1002 being approved. On August 17, 2015, Esperion

relayed to investors material events from its meeting with the FDA,

and stated that the FDA informed the company that it would not have

to complete a CVOT to gain approval of ETC-1002. Esperion further

stated that the company was pleased with the outcome of the meeting

and that it had a "clear regulatory path forward for development

and approval of ETC-1002."

On September 28, 2015, Esperion reversed course about the FDA

meeting, stating that the FDA had actually encouraged the company

to initiate a CVOT and it may be necessary to have a completed CVOT

prior to approval. Thus, the complaint alleges, Esperion officials'

prior statements about the meeting were false because they were

aware that the FDA had actually encouraged the company to initiate

a CVOT prior to their contradictory announcement to investors. On

this news, Esperion stock fell by $16.76 per share, or nearly 50%,

to close at $18.33 per share on September 29, 2015.

Esperion Shareholders Have Legal Options

Concerned shareholders who would like more information about

their rights and potential remedies can contact attorney Darnell R.

Donahue at (800) 350-6003, DDonahue@robbinsarroyo.com, or via the

shareholder information form on the firm's website.

Robbins Arroyo LLP is a nationally recognized leader in

shareholder rights law. The firm represents individual and

institutional investors in shareholder derivative and securities

class action lawsuits, and has helped its clients realize more than

$1 billion of value for themselves and the companies in which they

have invested.

Attorney Advertising. Past results do not guarantee a similar

outcome.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160115005828/en/

Robbins Arroyo LLPDarnell R. Donahue(619) 525-3990 or Toll Free

(800) 350-6003DDonahue@robbinsarroyo.comwww.robbinsarroyo.com

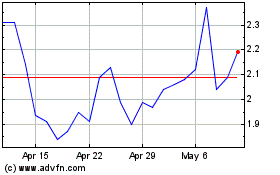

Esperion Therapeutics (NASDAQ:ESPR)

Historical Stock Chart

From Jun 2024 to Jul 2024

Esperion Therapeutics (NASDAQ:ESPR)

Historical Stock Chart

From Jul 2023 to Jul 2024