MORNING UPDATE: Man Securities Issues Alerts for BRCD, ESPR, KRB, AV, and MXO

November 06 2003 - 9:31AM

PR Newswire (US)

MORNING UPDATE: Man Securities Issues Alerts for BRCD, ESPR, KRB,

AV, and MXO CHICAGO, Nov. 6 /PRNewswire/ -- Man Securities issues

the following Morning Update at 8:30 AM EST with new PriceWatch

Alerts for key stocks. (Logo:

http://www.newscom.com/cgi-bin/prnh/20020214/MANSECLOGO ) Before

the open... PriceWatch Alerts for BRCD, ESPR, KRB, AV, and MXO,

Market Overview, Today's Economic Calendar, and the Quote Of The

Day. QUOTE OF THE DAY "The Cisco numbers came in better than

expectations, and the real emphasis is that they do see a

turnaround." -- Peter Cardillo, chief strategist, Global Partners

Securities Inc. New PriceWatch Alerts for BRCD, ESPR, KRB, AV, and

MXO... PRICEWATCH ALERTS - HIGH RETURN COVERED CALL OPTIONS --

Brocade Communications Systems Inc. (NASDAQ:BRCD) Last Price 6.93 -

DEC 7.00 CALL OPTION@ $0.50 -> 8.9 % Return assigned* --

Esperion Therapeutics, Inc. (NASDAQ:ESPR) Last Price 23.60 - NOV

22.50 CALL OPTION@ $2.35 -> 5.9 % Return assigned* -- MBNA Corp.

(NYSE:KRB) Last Price 24.99 - JAN 25.00 CALL OPTION@ $1.15 ->

4.9 % Return assigned* -- Avaya Inc. (NYSE:AV) Last Price 13.12 -

DEC 12.50 CALL OPTION@ $1.10 -> 4 % Return assigned* -- Maxtor

Corp. (NYSE:MXO) Last Price 13.62 - DEC 12.50 CALL OPTION@ $1.65

-> 4.4 % Return assigned* * To learn more about how to use these

alerts and for our FREE report, "The 18 Warning Signs That Tell You

When To Dump A Stock", go to: http://www.investorsobserver.com/mu18

(Note: You may need to copy the link above into your browser then

press the [ENTER] key) ** For the FREE report, "WiFi - The Buzz,

The Facts, and a Company That Could Be The Next Microsoft", go to:

http://www.investorsobserver.com/freewifimu NOTE: All stocks and

options shown are examples only. These are not recommendations to

buy or sell any security. MARKET OVERVIEW Overseas markets are

looking a little pancaked in flat trade as ten of the 15 markets

that we track have managed to hold positive. The cumulative average

return on the group stands at a minus 0.203 percent. The big drag

on the average was supplied by the 2.63 percent decline in the

Nikkei overnight. If you are looking for a rationale for the

decline, many are simply claiming profit taking (especially in

banking issues) ahead of the general election in Japan to be held

this weekend. Meanwhile, the number of jobless in Germany declined

by 12,000 in October on expectations for a more muted 3,000

decline. The seasonally adjusted unemployment held at 10.5 percent,

unchanged from September. Before the market open today, Initial

Jobless Claims for the week ending November 1 are expected to have

declined by 6,000 on the heels of the 5,000 drop off to an

annualized 386,000 in the prior week. In the last report, the

four-week moving average declined by 4750 to 388,750 and has held

below the key 400,000 level since the week ending September 27.

This, of course, will be the final weekly report before the big

monthly report due out tomorrow. And speaking of employment

numbers, analysts see Third-Quarter Productivity surging by 9.0

percent, following the second quarter's efficient 6.8 percent rise.

The rise in productivity allows employers to keep work force growth

constrained, but there will become a level where productivity

becomes strained and the work force must expand. In theory this

added productivity helps the employer keep the cost of finished

goods lower, still make a profit and hopefully pass wage increases

on to the worker without sacrificing profit. I guess what goes

round must come round! At 10:00 a.m., Federal Reserve Chairman

Greenspan addresses the Securities Industry Association annual

meeting via satellite in Boca Raton, Florida. These comments may

have an impact on the market. Be prepared for the investing week

ahead with Bernie Schaeffer's FREE Monday Morning Outlook. For more

details and to sign up, go to:

http://www.investorsobserver.com/freemo TODAY'S ECONOMIC CALENDAR

8:30 a.m.: Initial Jobless Claims for the week ending November 1

(seen lower by 6,000, last minus 5,000). 8:30 a.m.: Third-Quarter

Productivity and Costs (seen higher by 9.0 percent, last plus 6.8

percent). 10:00 a.m.: DJ-BTM Business Barometer for week of October

25 (last plus 0.6 percent). 10:00 a.m.: Federal Reserve Chairman

Greenspan addresses the Securities Industry Association annual

meeting via satellite in Boca Raton, Florida. 12:45 p.m.: Federal

Reserve Governor Bernanke speaks on the jobless recovery at

Carnegie Mellon Business school conference in Pittsburgh. 3:00

p.m.: October Treasury STRIPS. 4:30 p.m.: Money Supply. Man

Financial Inc is one of the world's major futures and options

brokers and has been recognized as a leading option order execution

firm for individuals and institutions. Member CBOE/NASD/SIPC

(CRD#6731). For more information and a free CD with educational

tools to help you invest smarter, see

http://www.mansecurities.com/mu.html . This Morning Update was

prepared with data and information provided by:

InvestorsObserver.com -- Better Strategies for Making Money ->

For Investors With a Sense of Humor. Only $1 for your first month

plus seven free bonuses worth over $420, see:

http://www.investorsobserver.com/must Schaeffer's Investment

Research -- Sign up for your FREE e-weekly, Monday Morning Outlook,

Bernie Schaeffer's look ahead at the markets. Sign Up Now

http://www.investorsobserver.com/freemo PowerOptionsPlus -- The

Best Way To Find, Compare, Analyze, and Make Money On Options

Investments. For a 14-Day FREE trial and 5 FREE bonuses go to:

http://www.poweroptionsplus.com/ All stocks and options shown are

examples only. These are not recommendations to buy or sell any

security and they do not represent in any way a positive or

negative outlook for any security. Potential returns do not take

into account your trade size, brokerage commissions or taxes which

will affect actual investment returns. Stocks and options involve

risk and are not suitable for all investors and investing in

options carries substantial risk. Prior to buying or selling

options, a person must receive a copy of Characteristics and Risks

of Standardized Options available from Sharon at 800-837-6212 or at

http://www.cboe.com/Resources/Intro.asp . Privacy policy available

upon request.

http://www.newscom.com/cgi-bin/prnh/20020214/MANSECLOGO

http://photoarchive.ap.org/ DATASOURCE: Man Securities CONTACT:

Michael Lavelle of Man Securities, +1-800-837-6212 Web site:

http://www.mansecurities.com/mu.html

Copyright

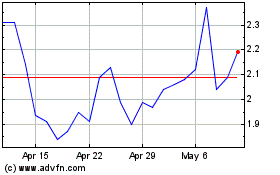

Esperion Therapeutics (NASDAQ:ESPR)

Historical Stock Chart

From Jun 2024 to Jul 2024

Esperion Therapeutics (NASDAQ:ESPR)

Historical Stock Chart

From Jul 2023 to Jul 2024