Current Report Filing (8-k)

November 04 2021 - 4:29PM

Edgar (US Regulatory)

0000922621false00009226212021-10-292021-10-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

|

|

|

|

|

|

|

Date of Report (Date of Earliest Event Reported):

|

October 29, 2021

|

|

|

|

|

|

|

|

|

|

|

|

|

ERIE INDEMNITY COMPANY

|

|

|

|

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pennsylvania

|

|

0-24000

|

|

25-0466020

|

|

|

|

(State or other jurisdiction

|

|

(Commission

|

|

(IRS Employer

|

|

|

|

of incorporation)

|

|

File Number)

|

|

Identification No.)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

100 Erie Insurance Place,

|

Erie,

|

Pennsylvania

|

|

16530

|

|

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Registrant’s telephone number, including area code:

|

814

|

870-2000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Not applicable

|

|

|

|

Former name or former address, if changed since last report

|

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Class A common stock,

|

stated value $0.0292 per share

|

|

ERIE

|

|

NASDAQ Stock Market, LLC

|

|

(Title of each class)

|

|

(Trading Symbol)

|

|

(Name of each exchange on which registered)

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

On October 29, 2021, Erie Indemnity Company (the “Company,” “we,” “us” or “our”) entered into a Credit Agreement with PNC Bank, National Association (“PNC”), as Administrative Agent for itself and various other financial institutions from time to time party thereto as Lenders (the “Credit Agreement”), to provide for, among other things, revolving credit loans to the Company in an aggregate principal amount of up to $100 million, including up to $25 million for issuances of letters of credit (collectively, the “Revolving Credit Facility”) (all capitalized terms used but not defined in this Current Report on Form 8-K shall have the respective meanings ascribed to them in the Credit Agreement, a copy of which is filed herewith as an exhibit). The Company’s obligations under the Credit Agreement are secured pursuant to the terms of a Pledge Agreement also dated October 29, 2021 between the Company and PNC (the “Pledge Agreement”). The Revolving Credit Facility replaced our existing $100 million credit facility with JPMorgan Chase Bank, National Association (“JPM”), as Administrative Agent for itself, PNC and various other financial institutions from time to time party thereto as Lenders, as amended, (the “Existing JPM Line of Credit”) and is available for working capital, other general corporate purposes and to refinance the Existing JPM Line of Credit. We did not borrow any funds under the Revolving Credit Facility at closing.

The Revolving Credit Facility bears interest, at our option, at a rate based on the Bloomberg Short-Term Bank Yield Index (“BSBY”) Rate or the Base Rate (defined as the highest of (a) the Overnight Bank Funding Rate plus 0.5%, (b) the Administrative Agent’s Prime Rate, and (c) the Daily BSBY Floating Rate plus 1.00%), plus an Applicable Margin that increases in the event the ratio (expressed as a percentage) of our consolidated indebtedness to our total capital (our “Indebtedness to Capitalization Ratio”) exceeds certain thresholds. Based upon our current Indebtedness to Capitalization Ratio, we would pay a variable rate of interest of either the BSBY Rate plus a margin of 0.5% or the Base Rate without an additional margin on any outstanding balance and a quarterly commitment fee of 0.08% on any unused portion of the Revolving Credit Facility.

The Credit Agreement expires October 29, 2026, and contains restrictive covenants, which include limitations on: incurring indebtedness, liens and encumbrances; making of guarantees; investments; dividends and distributions; liquidations, mergers, consolidations and acquisitions; dispositions of assets or subsidiaries; certain transactions with affiliates; material changes in our business; changes to our fiscal year; issuance of capital stock; and changes to our organizational documents or to the agreements by which we are appointed to act as Attorney-in-Fact for the Erie Insurance Exchange (the "Exchange"). The Credit Agreement also contains certain financial covenants pertaining to our Indebtedness to Capitalization Ratio. The foregoing summary of the Credit Agreement and the Pledge Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the agreements which are filed as Exhibits 10.1 and 10.2, respectively, to this Current Report on Form 8-K and are incorporated herein by reference.

Item 1.02 Termination of a Material Definitive Agreement.

The disclosure provided in Item 1.01 of this Current Report on Form 8-K is hereby incorporated by reference into this Item 1.02.

On October 29, 2021, in connection with the Revolving Credit Facility described in Item 1.01, the Company terminated the Existing JPM Line of Credit which was entered into on November 3, 2011 and had a current maturity date of October 30, 2023. Under the terms of the Existing JPM Line of Credit, we paid a variable rate of interest and a commitment fee which, at termination, was LIBO Rate plus a margin of 0.5% on the outstanding balance and an annual commitment fee of 0.08% on the unused capacity. The Existing JPM Line of Credit contained restrictive covenants, which included limitations on: incurring indebtedness, liens and encumbrances; making of guarantees, loans or other advances; mergers, acquisitions and transfers of assets; and changes in business, management and ownership. The Existing JPM Line of Credit also contained certain financial covenants pertaining to our Indebtedness to Capitalization Ratio.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The disclosure provided in Item 1.01 of this Current Report on Form 8-K is hereby incorporated by reference into this Item 2.03.

The Revolving Credit Facility contains standard provisions relating to default and acceleration of our payment obligations upon the occurrence of an Event of Default including, among other things: the failure to pay principal, interest, fees or other amounts when due; cross-default with other indebtedness; failure to comply with specified agreements, covenants or obligations; the making of any materially misleading or untrue representation, warranty or certification; commencement of bankruptcy or other insolvency proceedings by or against us; entry of one or more judgments against us that exceed $50 million either individually or in the aggregate; the failure to pay amounts due to the PBGC or a Plan under Title IV of ERISA; changes in control with respect to the composition of our board of directors; and ceasing to act as Attorney-in-Fact for the Exchange without the prior written consent of the Administrative Agent. Subsequent to an Event of Default all outstanding amounts owed to any Lender shall bear interest at 2.0% over the rate of interest applicable under the Base Rate pricing option, and letter of credit fees shall be 2.0% above the rate otherwise applicable to letters of credit until such time as the Event of Default has been cured or waived.

Item 9.01 Financial Statements and Exhibits.

Exhibit 10.1 Credit Agreement among PNC Bank, National Association, as Administrative Agent; the Lenders named therein; and Erie Indemnity Company, dated October 29, 2021.

Exhibit 10.2 Pledge Agreement made by Erie Indemnity Company in favor of PNC Bank, National Association, as administrative agent, for itself and certain other Lenders, dated October 29, 2021.

Exhibit 104 Cover Page Interactive Data File (embedded within the Inline XBRL document)

Exhibit Index

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

|

10.1

|

|

|

|

10.2

|

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Erie Indemnity Company

|

|

|

|

|

|

|

|

November 4, 2021

|

|

By:

|

|

/s/ Brian W. Bolash

|

|

|

|

|

|

|

|

|

|

|

|

Name: Brian W. Bolash

|

|

|

|

|

|

Title: SVP, Secretary & General Counsel

|

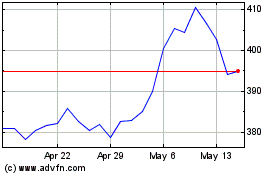

Erie Indemnity (NASDAQ:ERIE)

Historical Stock Chart

From Jun 2024 to Jul 2024

Erie Indemnity (NASDAQ:ERIE)

Historical Stock Chart

From Jul 2023 to Jul 2024