Revolution Medicines, Inc. (Nasdaq: RVMD), a clinical-stage

oncology company developing targeted therapies for RAS-addicted

cancers, and EQRx, Inc. (Nasdaq: EQRX), announced that earlier

today, at their respective special meetings, Revolution Medicines

and EQRx stockholders voted to approve Revolution Medicines’

proposed acquisition of EQRx.

The final votes will be certified by an independent inspector of

elections for each company and publicly reported following this

certification. The transaction is expected to close in November

2023, as soon as all customary closing conditions are

satisfied.

Upon completion of the transaction, each share of common stock

of EQRx issued and outstanding immediately prior to the merger will

be converted into the right to receive 0.1112 shares of common

stock of Revolution Medicines. Revolution Medicines expects to

issue approximately 55 million shares of its common stock in

connection with the merger (excluding assumed warrants and earn-out

shares). No fractional shares will be issued and EQRx stockholders

will receive cash in lieu of any fractional shares as part of the

merger consideration, as specified in the merger agreement.

About Revolution Medicines, Inc.Revolution

Medicines is a clinical-stage oncology company developing novel

targeted therapies for RAS-addicted cancers. The company’s R&D

pipeline comprises RAS(ON) Inhibitors designed to suppress diverse

oncogenic variants of RAS proteins, and RAS Companion Inhibitors

for use in combination treatment strategies. The company’s RAS(ON)

Inhibitors RMC-6236 (RASMULTI), RMC-6291 (RASG12C) and RMC-9805

(RASG12D) are currently in clinical development. Additional RAS(ON)

Inhibitors in the company’s pipeline include RMC-5127 (G12V),

RMC-0708 (Q61H) and RMC-8839 (G13C) which are currently in

IND-enabling development, and additional compounds targeting other

RAS variants.

About EQRx, Inc.EQRx is a biopharmaceutical

company committed to developing and commercializing innovative

medicines for some of the most prevalent disease areas.

Forward Looking Statements This press release

contains forward-looking statements within the meaning of federal

securities laws, including the “safe harbor” provisions of the

Private Securities Litigation Reform Act of 1995. Such statements

are based upon current plans, estimates and expectations of

management of Revolution Medicines and EQRx in light of historical

results and trends, current conditions and potential future

developments, and are subject to various risks and uncertainties

that could cause actual results to differ materially from such

statements. The inclusion of forward-looking statements should not

be regarded as a representation that such plans, estimates and

expectations will be achieved. Words such as “anticipate,”

“expect,” “project,” “intend,” “believe,” “may,” “will,” “should,”

“plan,” “could,” “continue,” “target,” “contemplate,” “estimate,”

“forecast,” “guidance,” “predict,” “possible,” “potential,”

“pursue,” “likely,” and words and terms of similar substance used

in connection with any discussion of future plans, actions or

events identify forward-looking statements. All statements, other

than historical facts, including express or implied statements

regarding the proposed transaction; the conversion of equity

interests contemplated by the merger agreement; the issuance of

common stock of Revolution Medicines contemplated by the merger

agreement; the expected timing of the closing of the proposed

transaction; the ability of the parties to complete the proposed

transaction considering the various closing conditions; and any

assumptions underlying any of the foregoing, are forward-looking

statements. Important factors that could cause actual results to

differ materially from Revolution Medicines’ and EQRx’s plans,

estimates or expectations described in such forward-looking

statements could include, but are not limited to: (i) the risk that

the proposed transaction may not be completed in a timely manner or

at all, which may adversely affect Revolution Medicines’ and EQRx’s

businesses and the price of their respective securities; (ii)

uncertainties as to the timing of the consummation of the proposed

transaction; (iii) the potential failure to satisfy the other

conditions to the consummation of the transaction; (iv) that the

proposed transaction may involve unexpected costs, liabilities or

delays; (v) the effect of the announcement, pendency or completion

of the proposed transaction on each of Revolution Medicines’ or

EQRx’s ability to attract, motivate, retain and hire key personnel

and maintain relationships with customers, distributors, suppliers

and others with whom Revolution Medicines or EQRx does business, or

on Revolution Medicines’ or EQRx’s operating results and business

generally; (vi) that the proposed transaction may divert

management’s attention from each of Revolution Medicines’ and

EQRx’s ongoing business operations; (vii) the risk of any legal

proceedings related to the proposed transaction or otherwise, or

the impact of the proposed transaction thereupon, including

resulting expense or delay; (viii) that Revolution Medicines or

EQRx may be adversely affected by other economic, business and/or

competitive factors; (ix) the occurrence of any event, change or

other circumstance that could give rise to the termination of the

merger agreement relating to the proposed transaction, including in

circumstances which would require Revolution Medicines or EQRx to

pay a termination fee; (x) the risk that restrictions during the

pendency of the proposed transaction may impact Revolution

Medicines’ or EQRx’s ability to pursue certain business

opportunities or strategic transactions; (xi) the risk that

Revolution Medicines or EQRx may be unable to obtain governmental

and regulatory approvals required for the proposed transaction, or

that required governmental and regulatory approvals may delay the

consummation of the proposed transaction or result in the

imposition of conditions that could reduce the anticipated benefits

from the proposed transaction or cause the parties to abandon the

proposed transaction; (xii) the risk that the anticipated benefits

of the proposed transaction may otherwise not be fully realized or

may take longer to realize than expected; (xiii) the impact of

legislative, regulatory, economic, competitive and technological

changes; (xiv) risks relating to the value of Revolution Medicines

securities to be issued in the proposed transaction; (xv) the risk

that integration of the proposed transaction post-closing may not

occur as anticipated or the combined company may not be able to

achieve the growth prospects expected from the transaction; (xvi)

the effect of the announcement, pendency or completion of the

proposed transaction on the market price of the common stock of

each of Revolution Medicines and the common stock and publicly

traded warrants of EQRx; (xvii) the implementation of each of

Revolution Medicines’ and EQRx’s business model and strategic plans

for product candidates and pipeline, and challenges inherent in

developing, commercializing, manufacturing, launching, marketing

and selling potential existing and new products; (xviii) the scope,

progress, results and costs of developing Revolution Medicines’ and

EQRx’s product candidates and any future product candidates,

including conducting preclinical studies and clinical trials, and

otherwise related to the research and development of Revolution

Medicines’ and EQRx’s pipeline; (xix) the timing and costs involved

in obtaining and maintaining regulatory approval for Revolution

Medicines’ and EQRx’s current or future product candidates, and any

related restrictions, limitations and/or warnings in the label of

an approved product; (xx) the market for, adoption (including rate

and degree of market acceptance) and pricing and reimbursement of

Revolution Medicines’ and EQRx’s product candidates and their

respective abilities to compete with therapies and procedures that

are rapidly growing and evolving; (xxi) uncertainties in

contractual relationships, including collaborations, partnerships,

licensing or other arrangements and the performance of third-party

suppliers and manufacturers; (xxii) the ability of each of

Revolution Medicines and EQRx to establish and maintain

intellectual property protection for products or avoid or defend

claims of infringement; (xxiii) exposure to inflation, currency

rate and interest rate fluctuations and risks associated with doing

business locally and internationally, as well as fluctuations in

the market price of each of Revolution Medicines’ and EQRx’s traded

securities; (xxiv) risks relating to competition within the

industry in which each of Revolution Medicines and EQRx operate;

(xxv) the unpredictability and severity of catastrophic events,

including, but not limited to, acts of terrorism or outbreak of war

or hostilities; (xxvi) whether the termination of EQRx’s license

agreements and/or discovery collaboration agreements may impact its

or Revolution Medicines’ ability to license in additional programs

in the future and the risk of delays or unforeseen costs in

terminating such arrangements; (xxvii) risks that restructuring

costs and charges may be greater than anticipated or incurred in

different periods than anticipated; (xxviii) the risk that EQRx’s

restructuring efforts may adversely affect its programs and its

ability to recruit and retain skilled and motivated personnel, and

may be distracting to employees and management; and (xxix) the risk

that EQRx’s restructuring or wind-down efforts may negatively

impact its business operations and reputation with or ability to

serve counterparties or may take longer to realize than expected,

as well as each of Revolution Medicines’ and EQRx’s response to any

of the aforementioned factors. Additional factors that may affect

the future results of Revolution Medicines and EQRx are set forth

in their respective filings with the U.S. Securities and Exchange

Commission (the “SEC”), including each of Revolution Medicines’ and

EQRx’s most recently filed Annual Reports on Form 10-K, subsequent

Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and

other filings with the SEC, which are available on the SEC’s

website at www.sec.gov. See in particular Item 1A of Revolution

Medicines’ Quarterly Report on Form 10-Q for the quarterly period

ended September 30, 2023 under the heading “Risk Factors,” and Item

1A of each of EQRx’s Annual Report on Form 10-K for the fiscal year

ended December 31, 2022 and Quarterly Reports on Form 10-Q for the

quarterly periods ended March 31, 2023, June 30, 2023 and September

30, 2023 under the headings “Risk Factors.” The risks and

uncertainties described above and in the SEC filings cited above

are not exclusive and further information concerning Revolution

Medicines and EQRx and their respective businesses, including

factors that potentially could materially affect their respective

businesses, financial conditions or operating results, may emerge

from time to time. Readers are urged to consider these factors

carefully in evaluating these forward-looking statements, and not

to place undue reliance on any forward-looking statements, which

speak only as of the date hereof. Readers should also carefully

review the risk factors described in other documents that

Revolution Medicines and EQRx file from time to time with the SEC.

Except as required by law, each of Revolution Medicines and EQRx

assume no obligation to update or revise these forward-looking

statements for any reason, even if new information becomes

available in the future.

Additional Information and Where to Find ItIn

connection with the proposed transaction, Revolution Medicines and

EQRx filed with the SEC and mailed or otherwise provided to their

respective security holders a joint proxy statement/prospectus

regarding the proposed transaction (as amended or supplemented from

time to time, the “Joint Proxy Statement/Prospectus”). INVESTORS

AND REVOLUTION MEDICINES’ AND EQRX’S RESPECTIVE SECURITY HOLDERS

ARE URGED TO CAREFULLY READ THE JOINT PROXY STATEMENT/PROSPECTUS IN

ITS ENTIRETY AND ANY OTHER DOCUMENTS FILED BY EACH OF REVOLUTION

MEDICINES AND EQRX WITH THE SEC IN CONNECTION WITH THE PROPOSED

TRANSACTION OR INCORPORATED BY REFERENCE THEREIN BECAUSE THEY WILL

CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND

THE PARTIES TO THE PROPOSED TRANSACTION.

Revolution Medicines’ investors and security holders may obtain

a free copy of the Joint Proxy Statement/Prospectus and other

documents that Revolution Medicines files with the SEC (when

available) from the SEC’s website at www.sec.gov and Revolution

Medicines’ website at ir.revmed.com. In addition, the Joint Proxy

Statement/Prospectus and other documents filed by Revolution

Medicines with the SEC (when available) may be obtained from

Revolution Medicines free of charge by directing a request to

Morrow Sodali LLC at RVMD@info.morrowsodali.com.

EQRx’s investors and security holders may obtain a free copy of

the Joint Proxy Statement/Prospectus and other documents that EQRx

files with the SEC (when available) from the SEC’s website at

www.sec.gov and EQRx’s website at investors.eqrx.com. In addition,

the Joint Proxy Statement/Prospectus and other documents filed by

EQRx with the SEC (when available) may be obtained from EQRx free

of charge by directing a request to EQRx’s Investor Relations at

investors@eqrx.com.

No Offer or SolicitationThis communication is

not intended to and shall not constitute an offer to buy or sell or

the solicitation of an offer to buy or sell any securities, nor

shall there be any offer, solicitation or sale of securities in any

jurisdiction in which such offer, solicitation or sale would be

unlawful prior to registration or qualification under the

securities laws of any such jurisdiction. No offering of securities

shall be made except by means of a prospectus meeting the

requirements of Section 10 of the Securities Act of 1933, as

amended.

Investors & Media Contact:

Erin Graves

650-779-0136

egraves@revmed.com

EQRx Media Contact:

Chris Kittredge/Stephen Pettibone/Hayley Cook

FGS Global

EQRx@fgsglobal.com

EQRx Investor Contact:

investors@eqrx.com

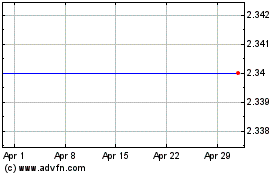

EQRx (NASDAQ:EQRX)

Historical Stock Chart

From Oct 2024 to Nov 2024

EQRx (NASDAQ:EQRX)

Historical Stock Chart

From Nov 2023 to Nov 2024