0001828318False00018283182024-07-312024-07-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 31, 2024

Enovix Corporation

(Exact Name of Registrant as Specified in Its Charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-39753 | | 85-3174357 |

(State or Other Jurisdiction

of Incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

| | | | | | | | |

3501 W Warren Avenue Fremont, California | | 94538 |

| (Address of Principal Executive Offices) | | (Zip Code) |

Registrant’s Telephone Number, Including Area Code: (510) 695-2350

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading

Symbol(s) | | Name of each exchange on which registered |

| Common Stock, par value $0.0001 per share | | ENVX | | The Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On July 31, 2024, Enovix Corporation issued a press release announcing the release of its financial results for the second fiscal quarter ended June 30, 2024. A copy of the press release is attached as Exhibit 99.1 to this report.

The information in this current report on Form 8-K and the exhibits attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

Exhibit Number | | Description |

| 99.1 | | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | | | | |

| | | | Enovix Corporation |

| | | | |

| Date: | July 31, 2024 | By: | /s/ Arthi Chakravarthy |

| | | | Arthi Chakravarthy

Chief Legal Officer |

Exhibit 99.1

Enovix Announces Second Quarter 2024 Financial Results

FREMONT, Calif., July 31, 2024 -- Enovix Corporation (“Enovix”) (Nasdaq: ENVX), a global high-performance battery company, announced today financial results for second quarter 2024, which included the summary below from its President and CEO, Dr. Raj Talluri.

Fellow Shareholders,

In the second quarter of 2024 we began producing our first batteries in Malaysia and demonstrated strong commercial progress with a handful of leading customers.

Our recent highlights include:

•Strong top-line growth: Revenue of $3.8 million in the second quarter of 2024, up from $42,000 in the second quarter of 2023 and above the mid-point of our forecast of $3.0 million to $4.0 million. We expect significant revenue growth from the first half of 2024 to the second half of 2024.

•Commercial progress: We signed an agreement in the second quarter of 2024 with a leading California-based technology company to provide silicon batteries and packs for a mixed reality headset. In addition, we recently signed a collaboration agreement with a Fortune 200 company to provide silicon batteries for a fast-growing IoT product that already has tens of millions of users globally.

•Second deal in Automotive: We signed a memorandum of understanding (“MOU”) with a high-performance global automotive OEM aimed at scaling the Enovix architecture for the automotive market. This is our second agreement signed in 2024 with a leading automotive OEM.

•Malaysia factory buildout: We began production of first batteries in Malaysia on our Agility Line, which recently completed site acceptance testing (“SAT”). Additionally, we completed factory acceptance testing (“FAT”) for our high-volume Gen2 Autoline for all key modules.

•Extended runway: We are on track to execute upon our goal of over $35 million in annualized savings based on relocating our high-cost California manufacturing to Malaysia. We additionally took actions to strengthen our balance sheet through an at-the-market (“ATM”) offering, completed in the second quarter, giving us a strong runway.

We enter the third quarter of 2024 beginning to scale up in Malaysia and we are excited to show off our Fab2 at a grand opening ceremony next week. We have already begun production of first batteries from our Agility Line in Malaysia and plan to sample these EX-1M cells to customers once we complete testing.

Customer interest in our silicon batteries remains high given the movement toward devices infused with artificial intelligence (“AI”) features. As we demonstrated last year in both internal studies and our work with Tirias Research, AI processing puts a tremendous strain on battery life. Smartphone OEMs have recognized that there are limited options to deliver the battery capacity needed in a suitable form factor. This is driving our strong engagement activity in the category. In addition, there are IoT markets where form factor constraints are driving a need for more energy dense batteries. Our products are uniquely suited to address this issue. Last, we believe we are the beneficiary of a trend towards a greater diversity of suppliers in the battery industry.

We are focused on categories where delivering an improved battery drives a high value to the product, resulting in premium pricing for our solution and supportive of strong long-term margins. We are pleased to see validation of our thesis playing out in our customer engagements.

Our task now is to execute and prove our ability to scale manufacturing of leading batteries that usher in the next era of products for our customers.

Business Update

Manufacturing. Fab2 in Malaysia has begun to take shape with the Agility Line having completed SAT and now producing EX-1M batteries. We also made great progress with our high-volume Gen2 Autoline, which has completed FAT for all key modules and is in the process of being fully shipped and installed. We expect the last module of equipment to arrive in Penang in the coming weeks.

Our operations team additionally took on the task of 1) setting up a test and safety lab in Penang and 2) moving R&D pilot line equipment from Fab1 in Fremont to Fab2 in Penang. Our safety lab is operational, and we expect our R&D pilot line to become operational at Fab2 in the third quarter of 2024.

Commercialization. During the second quarter of 2024, we built, tested, and shipped initial samples of our breakthrough EX-1M battery from our Fremont facility. We did this prior to our Malaysia cutover to begin initial customer evaluation. As we complete production of samples from the Agility Line in Malaysia, we plan to replicate the intensive testing protocols we obtained from our customers before shipping out samples from Fab2.

During the quarter, we made progress with the leading smartphone OEM customer announced in May, completing an important strategic milestone within the development agreement. We also signed an MOU with Elentec Co., Ltd., a leading consumer electronic battery pack manufacturing company in Asia.

We also, during the quarter, identified incremental growth opportunities for the conventional battery business we acquired last year in Korea. Specifically, we see the unique high-rate capability of these batteries that is well-suited for Korean military applications today as also applicable for other allied military customers in addition to markets such as power tools.

Technology and Products. During the second quarter of 2024, we continued to work on our EX-1M and EX-2M technology nodes for customer sampling. This included achieving targeted yield on Fab1 equipment for EX-1M for large cells ahead of the move to enhanced Gen2 equipment in Fab2. On EX-2M, we already have built early prototype batteries that have validated our targeted high-energy density by utilizing next generation chemistries.

We have grown our R&D team significantly in the last year. Excluding our acquisition of Routejade, our core R&D headcount nearly doubled from the second quarter of 2023 to the second quarter of 2024. Including Routejade, our R&D headcount is up 167% year-over-year.

Our lab in India is operational and continues to evaluate many next-generation battery materials for future technology nodes. We have also established a core R&D team in Malaysia that we intend to more than double by year-end.

Financials. Total revenue in the second quarter of 2024 was $3.8 million.

Our GAAP cost of revenue of $4.4 million in the second quarter of 2024 was down from $7.1 million in the first quarter of 2024. Our non-GAAP cost of revenue of $4.3 million in the second quarter of 2024 was down from $5.2 million in the first quarter of 2024.

Our GAAP operating expenses of $88.1 million in the second quarter of 2024 were up from $68.3 million in the first quarter of 2024 and included $38.1 million in restructuring expenses associated with the actions we took to shift our manufacturing operations from the U.S. to Malaysia while reducing our fixed expenses. Our non-GAAP operating expenses of $30.9 million in the second quarter of 2024 were down from $54.4 million in the first quarter of 2024.

Our GAAP net loss attributable to Enovix of $115.9 million in the second quarter of 2024 was up from $46.4 million in the first quarter of 2024, which included $38.1 million in restructuring expenses, of which $35.1 million were noncash charges. Our GAAP net loss attributable to Enovix for the second quarter of 2024 also included $33.7 million of expense due to an increase in the fair value of our common stock warrants during the quarter.

Adjusted EBITDA in the second quarter of 2024 was a loss of $23.1 million compared to an adjusted EBITDA loss of $26.3 million in the first quarter of 2024.

Earnings per share in the second quarter of 2024 were a loss of $0.67 on a GAAP basis and a loss of $0.14 on a non-GAAP basis compared to a loss of $0.28 on a GAAP basis and a loss of $0.31 on a non-GAAP basis in the first quarter of 2024.

We exited the second quarter of 2024 with $249.9 million of cash, cash equivalents, and short-term investments due to cash used in operating activities of $26.9 million and capital expenditures of $25.2 million during the quarter, partially offset by cash proceeds of $34.2 million from utilizing an ATM offering during the quarter.

A full reconciliation of our GAAP to non-GAAP results is available later in this report.

Outlook

For the third quarter of 2024, we expect revenue between $3.5 million and $4.5 million, a GAAP EPS loss of $0.30 to $0.36, an adjusted EBITDA loss of $23.0 million to $29.0 million, and a non-GAAP EPS loss of $0.17 to $0.23.

Summary

We made substantial progress in the second quarter of 2024 as Fab2 went operational, and we took actions to lengthen our runway while striking agreements with multiple leading customers. We are focused on continuing this strong execution and look forward to initiating multiple customer qualifications in the second half of the year.

Conference Call Information

Enovix will hold a video conference call at 2:00 PM PT / 5:00 PM ET today, July 31, 2024, to discuss the company’s business updates and financial results. To join the call, participants must use the following link to register: https://enovix-q2-2024.open-exchange.net/registration. This link will also be available via the Investor Relations section of Enovix’s website at https://ir.enovix.com. An archived version of the call will be available on the Enovix website for one year at https://ir.enovix.com.

About Enovix

Enovix is on a mission to deliver high-performance batteries that unlock the full potential of technology products. Everything from IoT, mobile, and computing devices, to the vehicle you drive, needs a better battery. Enovix partners with OEMs worldwide to usher in a new era of user experiences. Our innovative, materials-agnostic approach to building a higher performing battery without compromising safety keeps us flexible and on the cutting-edge of battery technology innovation.

Enovix is headquartered in Silicon Valley with facilities in India, Korea and Malaysia. For more information visit www.enovix.com and follow us on LinkedIn.

Non-GAAP Financial Measures

EBITDA, Adjusted EBITDA, and other non-GAAP measures are intended as supplemental financial measures of our performance that are neither required by, nor presented in accordance with GAAP. We believe that the use of non-GAAP measures provides an additional tool for investors to use in evaluating ongoing operating results, trends, and in comparing our financial measures with those of comparable companies, which may present similar non-GAAP financial measures to investors.

However, you should be aware that when evaluating the non-GAAP measures, we may incur future expenses similar to those excluded when calculating these measures. In addition, the presentation of these measures should not be construed as an inference that our future results will be unaffected by unusual or nonrecurring items. Our computation of EBITDA, Adjusted EBITDA, and other non-GAAP measures may not be comparable to other similarly titled measures computed by other companies, because all companies may not calculate the non-GAAP measures in the same fashion. Reconciliations of each non-GAAP financial measure to the most directly comparable GAAP financial measure can be found in the tables at the end of this report.

While Enovix provides third quarter 2024 guidance for adjusted EBITDA loss and non-GAAP EPS loss, we are unable to provide without unreasonable efforts at this time a GAAP to non-GAAP reconciliation of any forward-looking figures. Such qualitative reconciliation to the corresponding forward-looking GAAP financial measure cannot be provided without unreasonable effort because of the inherent difficulty of accurately forecasting the occurrence and financial impact of the various adjusting items necessary for such reconciliation that have not yet occurred, are out of our control, or cannot be reasonably predicted, including but not limited to warrant liabilities and stock-based compensation. For the same reasons, we are unable to assess the probable significance of the unavailable information, which could have a material impact on our future GAAP financial result.

Forward-Looking Statements

This letter to shareholders contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements generally relate to future events or our future financial or operating performance and can be identified by words such as anticipate, believe, continue, could, estimate, expect, intend, may, might, plan, possible, potential, predict, project, should, would and similar expressions that convey uncertainty about future events or outcomes. Forward-looking statements in this letter to shareholders include, without limitation, our expectations regarding, and our ability to respond to, market and customer demand; our expectations regarding the level of customers’ interest in our batteries, the demand for more energy dense batteries and the suitability of our products to address this demand, and the impact of artificial intelligence (“AI”) features on the foregoing; our financial and business performance; projected improvements in our manufacturing, commercialization and R&D activities at Fab2, including the operational capabilities of our safety line and R&D pilot line; our expectations regarding EX-1M sample production on the Agility Line following the completion of site acceptance testing; our ability to meet goals for yield and throughput; our expectations regarding the Malaysia factory buildout and its capacity to support multiple customer qualifications; the anticipated contributions of and benefits of our growing R&D teams in Malaysia and India; our revenue funnel; our efforts in the portable electronics and EV markets, including the IoT, smartphone and virtual reality categories; our ability to meet milestones and deliver on our objectives and expectations, including our ability to test and sample batteries from our Agility Line to customers; the implementation and success of our business model and growth strategy, including our focus on the addressable market categories in which we believe an improved battery drives a high value to the product and premium pricing for our solutions; our ability to manage our expenses and realize our annual cost savings goals; our ability to manage and achieve the benefits of our ongoing restructuring efforts; our ability to effectively leverage our Routejade acquisition to take advantage of incremental growth opportunities in the conventional battery business by targeting complementary customer segments; and our forecasts of our financial and performance guidance and metrics.

Actual results could differ materially from these forward-looking statements as a result of certain risks and uncertainties, including, without limitation, our ability to improve energy density among our products, establish sufficient manufacturing and optimize manufacturing processes to meet demand, source materials and establish

supply relationships, and secure adequate funds to execute on our operational and strategic goals; the safety hazards associated with our batteries and the manufacturing process; a concentration of customers in the military market; certain unfavorable terms in our commercial agreements that may expose us to liability and/or limit our ability to market our products; market acceptance of our products; changes in consumer preferences or demands; changes in industry standards; the impact of technological development and competition; and global economic conditions, including inflationary and supply chain pressures, and political, social, and economic instability, including as a result of armed conflict, war or threat of war, or trade and other international disputes that could disrupt supply or delivery of, or demand for, our products.

For additional information on these risks and uncertainties and other potential factors that could affect our business and financial results or cause actual results to differ from the results predicted, please refer to our filings with the Securities and Exchange Commission (“SEC”), including in the “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of our most recently filed annual report on Form 10-K and quarterly report on Form 10-Q and other documents that we have filed, or that we will file, with the SEC. Any forward-looking statements in this letter to shareholders speak only as of the date on which they are made. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

For investor and media inquiries, please contact:

Enovix Corporation

Charles Anderson

Phone: +1 (612) 229-9729

Email: canderson@enovix.com

Enovix Corporation

Condensed Consolidated Balance Sheets

(Unaudited)

(In Thousands, Except Share and per Share Amounts) | | | | | | | | | | | |

| June 30,

2024 | | December 31,

2023 |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 235,103 | | | $ | 233,121 | |

| Short-term investments | 14,826 | | | 73,694 | |

| Accounts receivable, net | 1,665 | | | 909 | |

| Notes receivable, net | 3 | | | 1,514 | |

| Inventory | 9,508 | | | 8,737 | |

| | | |

| Prepaid expenses and other current assets | 8,844 | | | 5,202 | |

| Total current assets | 269,949 | | | 323,177 | |

| Property and equipment, net | 151,024 | | | 166,471 | |

| Customer relationship intangibles and other intangibles, net | 38,774 | | | 42,168 | |

| Operating lease, right-of-use assets | 14,333 | | | 15,290 | |

| Goodwill | 12,217 | | | 12,098 | |

| | | |

| Other assets, non-current | 2,691 | | | 5,100 | |

| Total assets | $ | 488,988 | | | $ | 564,304 | |

| Liabilities and Stockholders’ Equity | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 19,431 | | | $ | 21,251 | |

| Accrued expenses | 16,530 | | | 13,976 | |

| Accrued compensation | 8,856 | | | 10,731 | |

| Short-term debt | 10,989 | | | 5,917 | |

| Deferred revenue | 7,007 | | | 6,708 | |

| Other liabilities | 5,090 | | | 2,435 | |

| Total current liabilities | 67,903 | | | 61,018 | |

| Long-term debt, net | 168,500 | | | 169,099 | |

| Warrant liability | 55,440 | | | 42,900 | |

| Operating lease liabilities, non-current | 14,182 | | | 15,594 | |

| Deferred revenue, non-current | 3,774 | | | 3,774 | |

| Deferred tax liability | 6,115 | | | 10,803 | |

| Other liabilities, non-current | 11 | | | 13 | |

| Total liabilities | 315,925 | | | 303,201 | |

| Commitments and Contingencies | | | |

| Stockholders’ equity: | | | |

| Common stock, $0.0001 par value; authorized shares of 1,000,000,000; issued and outstanding shares of $175,302,694 and $167,392,315 as of June 30, 2024 and December 31, 2023, respectively | 18 | | | 17 | |

| | | |

| Additional paid-in-capital | 931,363 | | | 857,037 | |

| Accumulated other comprehensive gain (loss) | 15 | | | (62) | |

| Accumulated deficit | (761,085) | | | (598,845) | |

| Total Enovix's stockholders’ equity | 170,311 | | | 258,147 | |

| Non-controlling interest | 2,752 | | | 2,956 | |

| Total equity | 173,063 | | | 261,103 | |

| Total liabilities and equity | $ | 488,988 | | | $ | 564,304 | |

Enovix Corporation

Condensed Consolidated Statements of Operations

(Unaudited)

(In Thousands, Except Share and per Share Amounts)

| | | | | | | | | | | | | | | | | | | | | | | |

| Quarters Ended | | Fiscal Years-to-Date Ended |

| June 30, 2024 | | July 2, 2023 | | June 30, 2024 | | July 2, 2023 |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Revenue | $ | 3,768 | | | $ | 42 | | | $ | 9,040 | | | $ | 63 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Cost of revenue | 4,423 | | | 14,235 | | | 11,495 | | | 26,483 | |

| Gross margin | (655) | | | (14,193) | | | (2,455) | | | (26,420) | |

| Operating expenses: | | | | | | | |

| Research and development | 29,065 | | | 16,553 | | | 77,853 | | | 40,302 | |

| Selling, general and administrative | 20,884 | | | 16,688 | | | 40,432 | | | 43,962 | |

| Impairment of equipment | — | | | 4,411 | | | — | | | 4,411 | |

| Restructuring cost | 38,146 | | | — | | | 38,146 | | | — | |

| Total operating expenses | 88,095 | | | 37,652 | | | 156,431 | | | 88,675 | |

| Loss from operations | (88,750) | | | (51,845) | | | (158,886) | | | (115,095) | |

| Other income (expense): | | | | | | | |

| Change in fair value of common stock warrants | (33,660) | | | (14,340) | | | (12,540) | | | (27,180) | |

| | | | | | | |

| | | | | | | |

| Interest income | 3,326 | | | 3,150 | | | 6,886 | | | 5,616 | |

| Interest expense | (1,691) | | | (1,270) | | | (3,350) | | | (1,270) | |

| Other income (loss), net | 242 | | | (1) | | | 708 | | | 20 | |

| Total other expense, net | (31,783) | | | (12,461) | | | (8,296) | | | (22,814) | |

| Loss before income tax benefit | (120,533) | | | (64,306) | | | (167,182) | | | (137,909) | |

| Income tax benefit | (4,586) | | | — | | | (4,738) | | | — | |

| Net loss | (115,947) | | | (64,306) | | | (162,444) | | | (137,909) | |

| Net loss attributable to non-controlling interests | (75) | | | — | | | (204) | | | — | |

| Net loss attributable to Enovix | $ | (115,872) | | | $ | (64,306) | | | $ | (162,240) | | | $ | (137,909) | |

| | | | | | | |

| Net loss per share attributable to Enovix shareholders, basic and diluted | $ | (0.67) | | | $ | (0.41) | | | $ | (0.95) | | | $ | (0.88) | |

| Weighted average number of common shares outstanding, basic and diluted | 172,399,172 | | | 157,151,386 | | | 170,272,069 | | | 156,397,145 | |

| | | | | | | |

| | | | | | | |

Enovix Corporation

Condensed Consolidated Statements of Cash Flows

(Unaudited)

(In Thousands)

| | | | | | | | | | | |

| Fiscal Years-to-Date Ended |

| June 30, 2024 | | July 2, 2023 |

| Cash flows used in operating activities: | | | |

| Net loss | $ | (162,444) | | | $ | (137,909) | |

| Adjustments to reconcile net loss to net cash used in operating activities | | | |

| Depreciation, accretion and amortization | 30,917 | | | 7,100 | |

| Stock-based compensation | 31,797 | | | 44,199 | |

| Changes in fair value of common stock warrants | 12,540 | | | 27,180 | |

| | | |

| Impairment and loss on disposals of long-lived assets | 35,107 | | | 4,411 | |

| Others | 172 | | | — | |

| | | |

| Changes in operating assets and liabilities: | | | |

| Accounts and notes receivables | 669 | | | 128 | |

| Inventory | (771) | | | (163) | |

| Prepaid expenses and other assets | (1,562) | | | 3,145 | |

| Accounts payable | (8,250) | | | 892 | |

| Accrued expenses and compensation | 3,465 | | | 1,849 | |

| Deferred revenue | 299 | | | — | |

| | | |

| Deferred tax liability | (5,366) | | | — | |

| Other liabilities | 1,434 | | | 5 | |

| Net cash used in operating activities | (61,993) | | | (49,163) | |

| Cash flows from investing activities: | | | |

| Purchase of property and equipment | (40,297) | | | (15,724) | |

| | | |

| Purchases of investments | (31,812) | | | (65,736) | |

| Maturities of investments | 91,621 | | | — | |

| Net cash provided by (used in) investing activities | 19,512 | | | (81,460) | |

| Cash flows from financing activities: | | | |

| Proceeds from issuance of Convertible Senior Notes and loans | 4,572 | | | 172,500 | |

| Repayment of debt | (73) | | | — | |

| Payments of debt issuance costs | — | | | (5,228) | |

| Purchase of Capped Calls | — | | | (17,250) | |

| Payroll tax payments for shares withheld upon vesting of RSUs | (3,315) | | | (1,226) | |

| Proceeds from the exercise of stock options and issuance of common stock, net of issuance costs | 42,753 | | | 972 | |

| Proceeds from issuance of common stock under employee stock purchase plan | 1,145 | | | 1,169 | |

| Repurchase of unvested restricted common stock | (1) | | | (13) | |

| Net cash provided by financing activities | 45,081 | | | 150,924 | |

| Effect of exchange rate changes on cash, cash equivalents and restricted cash | (748) | | | — | |

| Change in cash, cash equivalents, and restricted cash | 1,852 | | | 20,301 | |

| Cash and cash equivalents and restricted cash, beginning of period | 235,123 | | | 322,976 | |

| Cash and cash equivalents, and restricted cash, end of period | $ | 236,975 | | | $ | 343,277 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

Net Loss Attributable to Enovix to Adjusted EBITDA Reconciliation

While we prepare our consolidated financial statements in accordance with GAAP, we also utilize and present certain financial measures that are not based on GAAP. We refer to these financial measures as “non-GAAP” financial measures. In addition to our financial results determined in accordance with GAAP, we believe that EBITDA and Adjusted EBITDA are useful measures in evaluating its financial and operational performance distinct and apart from financing costs, certain non-cash expenses and non-operational expenses.

These non-GAAP financial measures should be considered in addition to results prepared in accordance with GAAP but should not be considered a substitute for or superior to GAAP. We endeavor to compensate for the limitation of the non-GAAP financial measures presented by also providing the most directly comparable GAAP measures.

We use non-GAAP financial information to evaluate our ongoing operations and for internal planning, budgeting and forecasting purposes. We believe that non-GAAP financial information, when taken collectively, may be helpful to investors in assessing its operating performance and comparing its performance with competitors and other comparable companies. You should review the reconciliations below but not rely on any single financial measure to evaluate our business.

“EBITDA” is defined as earnings (net loss) attributable to Enovix adjusted for interest expense, income tax benefit, depreciation and amortization expense. “Adjusted EBITDA” includes additional adjustments to EBITDA such as stock-based compensation expense, change in fair value of common stock warrants, inventory step-up, impairment of equipment and other special items as determined by management which it does not believe to be indicative of its underlying business trends.

Below is a reconciliation of net loss attributable to Enovix on a GAAP basis to the non-GAAP EBITDA and Adjusted EBITDA financial measures for the periods presented below (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| Quarters Ended | | Fiscal Years-to-Date Ended |

| June 30, 2024 | | July 2, 2023 | | June 30, 2024 | | July 2, 2023 |

| Net loss attributable to Enovix | $ | (115,872) | | | $ | (64,306) | | | $ | (162,240) | | | $ | (137,909) | |

| Interest expense | 1,691 | | | 1,270 | | | 3,350 | | | 1,270 | |

| Income tax benefit | (4,586) | | | — | | | (4,738) | | | — | |

| Depreciation and amortization | 5,943 | | | 3,502 | | | 30,917 | | | 7,100 | |

| EBITDA | (112,824) | | | (59,534) | | | (132,711) | | | (129,539) | |

Stock-based compensation expense (1) | 17,932 | | | 15,042 | | | 30,692 | | | 44,199 | |

| Change in fair value of common stock warrants | 33,660 | | | 14,340 | | | 12,540 | | | 27,180 | |

| Inventory step-up | — | | | — | | | 1,907 | | | — | |

| Impairment of equipment | — | | | 4,411 | | | — | | | 4,411 | |

Restructuring cost (1) | 38,146 | | | — | | | 38,146 | | | — | |

| | | | | | | |

| | | | | | | |

| Adjusted EBITDA | $ | (23,086) | | | $ | (25,741) | | | $ | (49,426) | | | $ | (53,749) | |

(1) $1.1 million of stock-based compensation expense is included in the restructuring cost line of the table above for the quarter and fiscal year-to-date ended June 30, 2024.

Free Cash Flow Reconciliation

We define “Free Cash Flow” as (i) net cash from operating activities less (ii) capital expenditures, net of proceeds from disposals of property and equipment, all of which are derived from our Consolidated Statements of Cash Flow. The presentation of non-GAAP Free Cash Flow is not intended as an alternative measure of cash flows from operations, as determined in accordance with GAAP. We believe that this financial measure is useful to investors because it provides investors to view our performance using the same tool that we use to gauge our progress in achieving our goals and it is an indication of cash flow that may be available to fund investments in future growth initiatives. Below is a reconciliation of net cash used in operating activities to the Free Cash Flow financial measures for the periods presented below (in thousands):

| | | | | | | | | | | |

| Fiscal Years-to-Date Ended |

| June 30, 2024 | | July 2, 2023 |

| Net cash used in operating activities | $ | (61,993) | | | $ | (49,163) | |

| Capital expenditures | (40,297) | | | (15,724) | |

| Free Cash Flow | $ | (102,290) | | | $ | (64,887) | |

Other Non-GAAP Financial Measures Reconciliation

(In Thousands, Except Share and per Share Amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Quarters Ended | | Fiscal Years-to-Date Ended |

| | June 30, 2024 | | July 2, 2023 | | June 30, 2024 | | July 2, 2023 |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Revenue | | $ | 3,768 | | | $ | 42 | | | $ | 9,040 | | | $ | 63 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| GAAP cost of revenue | | $ | 4,423 | | | $ | 14,235 | | | $ | 11,495 | | | $ | 26,483 | |

| Stock-based compensation expense | | (95) | | | (1,654) | | | (95) | | | (2,605) | |

| Inventory step-up | | — | | | — | | | (1,907) | | | — | |

| Non-GAAP cost of revenue | | $ | 4,328 | | | $ | 12,581 | | | $ | 9,493 | | | $ | 23,878 | |

| | | | | | | | |

| GAAP gross margin | | $ | (655) | | | $ | (14,193) | | | $ | (2,455) | | | $ | (26,420) | |

| Stock-based compensation expense | | 95 | | | 1,654 | | | 95 | | | 2,605 | |

| Inventory step-up | | — | | | — | | | 1,907 | | | — | |

| Non-GAAP gross margin | | $ | (560) | | | $ | (12,539) | | | $ | (453) | | | $ | (23,815) | |

| | | | | | | | |

| GAAP research and development (R&D) expense | | $ | 29,065 | | | $ | 16,553 | | | $ | 77,853 | | | $ | 40,302 | |

| Stock-based compensation expense | | (7,303) | | | (5,456) | | | (13,857) | | | (17,123) | |

| Amortization of intangible assets | | (415) | | | — | | | (831) | | | — | |

| Non-GAAP R&D expense | | $ | 21,347 | | | $ | 11,097 | | | $ | 63,165 | | | $ | 23,179 | |

| | | | | | | | |

| GAAP selling, general and administrative (SG&A) expense | | $ | 20,884 | | | $ | 16,688 | | | $ | 40,432 | | | $ | 43,962 | |

| Stock-based compensation expense | | (10,534) | | | (7,932) | | | (16,740) | | | (24,471) | |

| Amortization of intangible assets | | (774) | | | — | | | (1,530) | | | — | |

| | | | | | | | |

| Non-GAAP SG&A expense | | $ | 9,576 | | | $ | 8,756 | | | $ | 22,162 | | | $ | 19,491 | |

| | | | | | | | |

| GAAP operating expenses | | $ | 88,095 | | | $ | 37,652 | | | $ | 156,431 | | | $ | 88,675 | |

| Stock-based compensation expense included in R&D expense | | (7,303) | | | (5,456) | | | (13,857) | | | (17,123) | |

| Stock-based compensation expense included in SG&A expense | | (10,534) | | | (7,932) | | | (16,740) | | | (24,471) | |

| Amortization of intangible assets | | (1,189) | | | — | | | (2,361) | | | — | |

| Impairment of equipment | | — | | | (4,411) | | | — | | | (4,411) | |

Restructuring cost (1) | | (38,146) | | | — | | | (38,146) | | | — | |

| | | | | | | | |

| Non-GAAP operating expenses | | $ | 30,923 | | | $ | 19,853 | | | $ | 85,327 | | | $ | 42,670 | |

| | | | | | | | |

(1) $1.1 million of stock-based compensation expense is included in the restructuring cost line of the table above for the quarter and fiscal year-to-date ended June 30, 2024.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Quarters Ended | | Fiscal Years-to-Date Ended |

| | June 30, 2024 | | July 2, 2023 | | June 30, 2024 | | July 2, 2023 |

| GAAP loss from operations | | $ | (88,750) | | | $ | (51,845) | | | $ | (158,886) | | | $ | (115,095) | |

Stock-based compensation expense (1) | | 17,932 | | | 15,042 | | | 30,692 | | | 44,199 | |

| Amortization of intangible assets | | 1,189 | | | — | | | 2,361 | | | — | |

| Inventory step-up | | — | | | — | | | 1,907 | | | — | |

| Impairment of equipment | | — | | | 4,411 | | | — | | | 4,411 | |

Restructuring cost (1) | | 38,146 | | | — | | | 38,146 | | | — | |

| | | | | | | | |

| Non-GAAP loss from operations | | $ | (31,483) | | | $ | (32,392) | | | $ | (85,780) | | | $ | (66,485) | |

| | | | | | | | |

| GAAP net loss attributable to Enovix | | $ | (115,872) | | | $ | (64,306) | | | $ | (162,240) | | | $ | (137,909) | |

Stock-based compensation expense (1) | | 17,932 | | | 15,042 | | | 30,692 | | | 44,199 | |

| Change in fair value of common stock warrants | | 33,660 | | | 14,340 | | | 12,540 | | | 27,180 | |

| Inventory step-up | | — | | | — | | | 1,907 | | | — | |

| Amortization of intangible assets | | 1,189 | | | — | | | 2,361 | | | — | |

| Impairment of equipment | | — | | | 4,411 | | | — | | | 4,411 | |

Restructuring cost (1) | | 38,146 | | | — | | | 38,146 | | | — | |

| | | | | | | | |

| | | | | | | | |

| Non-GAAP net loss attributable to Enovix shareholders | | $ | (24,945) | | | $ | (30,513) | | | $ | (76,594) | | | $ | (62,119) | |

| | | | | | | | |

| GAAP net loss per share attributable to Enovix, basic and diluted | | $ | (0.67) | | | $ | (0.41) | | | $ | (0.95) | | | $ | (0.88) | |

| GAAP weighted average number of common shares outstanding, basic and diluted | | 172,399,172 | | | 157,151,386 | | | 170,272,069 | | | 156,397,145 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Non-GAAP net loss per share attributable to Enovix, basic and diluted | | $ | (0.14) | | | $ | (0.19) | | | $ | (0.45) | | | $ | (0.40) | |

| GAAP weighted average number of common shares outstanding, basic and diluted | | 172,399,172 | | | 157,151,386 | | | 170,272,069 | | | 156,397,145 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

(1) $1.1 million of stock-based compensation expense is included in the restructuring cost line of the table above for the quarter and fiscal year-to-date ended June 30, 2024.

v3.24.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

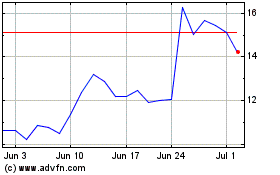

Enovix (NASDAQ:ENVX)

Historical Stock Chart

From Oct 2024 to Nov 2024

Enovix (NASDAQ:ENVX)

Historical Stock Chart

From Nov 2023 to Nov 2024