Embrace Change Acquisition Corp. (“Embrace Change”) (NASDAQ: EMCG,

EMCGU, EMCGR), a publicly traded special purpose acquisition

company, and Tianji Tire Global (Cayman) Limited (“Tianji,” or the

“Company”), a leading tire manufacturer with operations mainly

conducted by its subsidiaries based in mainland China, today

announced that they have entered into a definitive merger agreement

(the “Merger Agreement”) that will result in Tianji becoming a

publicly listed company upon the closing of the transaction

contemplated there in (the “Proposed Transaction”) on January 26,

2025. Upon closing, the combined company will be renamed “Tianji

Tire Global Group (Cayman) Limited” (the “Combined Company”) and

expects to list its Class A ordinary shares on Nasdaq.

Tianji is a leading tire manufacturer with

operations mainly conducted by its subsidiaries based in mainland

China, specializing in the design, research and development,

production and sales of tires, with a primary focus on all-steel,

tubeless radial tires for medium- and short-distance

transportation.

Key Transaction Terms

As provided in the Merger Agreement, the merger

consideration is $450 million, payable by newly-issued securities

of the Combined Company valued at $10.00 per share.

Cash proceeds raised will consist of Embrace

Change’s approximately $26 million in trust (assuming no

redemptions by Embrace Change’s existing public shareholders) which

is anticipated to support the Company’s growth capital needs and to

be used for general working capital purposes. After the closing,

Tianji shareholders are expected to retain a majority of the

outstanding shares of the Combined Company and Tianji will

designate a majority of proposed directors for the Combined

Company’s board.

The Tianji management team, led by its CEO

Hailong Cheng, will continue to run the Combined Company after the

closing of the Proposed Transaction.

The boards of directors of Tianji, Embrace

Change and Embrace Change’s two merger subsidiaries have

unanimously approved the Proposed Transaction, which is expected to

be completed in mid–2025, subject to, among other things, approval

by Embrace Change’ and Tianji’ shareholders, and satisfaction (or

waiver, as applicable) of the conditions provided in the Merger

Agreement, including regulatory approvals and other customary

closing conditions, including a registration statement in

connection with the Proposed Transaction being declared effective

by the U.S. Securities and Exchange Commission (the “SEC”).

Additional information about the Proposed

Transaction, including a copy of the Merger Agreement, will be

provided in a Current Report on Form 8-K to be filed by Embrace

Change with the SEC and available at www.sec.gov. Additional

information about the Proposed Transaction will be described in the

Registration Statement, which Embrace Change and/or its subsidiary

will file with the SEC.

Advisors

Loeb & Loeb LLP, Ogier (Cayman) LLP and

Beijing Dacheng Law Offices, LLP are serving as legal advisor to

Embrace Change. Han Kun Law Offices LLP and Harney Westwood &

Riegels are serving as legal advisor to Tianji.

About Tianji

Tianji is a leading tire manufacturer with

operations mainly conducted by its subsidiaries based in mainland

China, specializing in the design, research and development,

production and sales of tires, with a primary focus on all-steel,

tubeless radial tires for medium- and short-distance

transportation. The Company’s collection of tires is curated under

six renowned brands, namely the premium brand SEMES, the mid- to

high-end brand Tianxin, the mass-market brands Lunaite, Aoben and

GFT Rider, as well as the brand Kuangshan Jiuhao designed

specifically for mining transportation. Each of these brands stands

out in quality and technical performance characteristics with

distinctive features and precise identities.

Founded in 2020, Tianji has successfully

established an extensive presence in China, and is continuing to

expand its footprint nationwide to reach more potential

customers.

About Embrace Change Acquisition

Corp.

Embrace Change Acquisition Corp. is a blank

check company, also commonly referred to as a special purpose

acquisition company, or SPAC, formed for the purpose of effecting a

merger, share exchange, asset acquisition, share purchase,

reorganization or similar business combination with one or more

businesses or entities.

Additional Information and Where to Find

It

In connection with the Proposed Transaction,

Embrace Change and/or its subsidiary will file with the SEC a

Registration Statement on Form F-4 (as amended, the “Registration

Statement”), which will include a proxy statement/prospectus. After

the Registration Statement is declared effective, Embrace Change

will send the proxy statement/prospectus and other relevant

documents to its shareholders. This press release is not a

substitute for the proxy statement/prospectus. INVESTORS AND

SECURITY HOLDERS AND OTHER INTERESTED PARTIES ARE URGED TO READ THE

PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS THAT

HAVE BEEN FILED OR WILL BE FILED WITH THE SEC, AS WELL AS ANY

AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN

THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN

IMPORTANT INFORMATION ABOUT TIANJI, EMBRACE CHANGE, THE PROPOSED

TRANSACTION AND RELATED MATTERS. The Registration Statement and any

other relevant filed documents (when they are available) can be

obtained free of charge from the SEC’s website at www.sec.gov.

These documents (when they are available) can also be obtained free

of charge from Embrace Change at https://www.Embrace

Change.com/insights or upon written request at Embrace Change

Acquisition Corp., 5186 CARROLL CANYON RD, SAN DIEGO, CA,

92121.

Forward-Looking Statements

This press release contains certain

“forward-looking statements” within the meaning of the Securities

Act of 1933 and the Securities Exchange Act of 1934, both as

amended. Statements that are not historical facts, including

statements about the pending transactions described herein, and the

parties’ perspectives and expectations, are forward-looking

statements. Such statements include, but are not limited to,

statements regarding the proposed transaction, including the

anticipated initial enterprise value and post-closing equity value,

the benefits of the proposed transaction, integration plans,

expected synergies and revenue opportunities, anticipated future

financial and operating performance and results, including

estimates for growth, the expected management and governance of the

combined company, and the expected timing of the transactions. The

words “expect,” “believe,” “estimate,” “intend,” “plan” and similar

expressions indicate forward-looking statements. These

forward-looking statements are not guarantees of future performance

and are subject to various risks and uncertainties, assumptions

(including assumptions about general economic, market, industry and

operational factors), known or unknown, which could cause the

actual results to vary materially from those indicated or

anticipated.

Such risks and uncertainties include, but are

not limited to: (i) risks related to the expected timing and

likelihood of completion of the pending business combination,

including the risk that the transaction may not close due to one or

more closing conditions to the transaction not being satisfied or

waived, such as regulatory approvals not being obtained, on a

timely basis or otherwise, or that a governmental entity

prohibited, delayed or refused to grant approval for the

consummation of the transaction or required certain conditions,

limitations or restrictions in connection with such approvals; (ii)

risks related to the ability of Embrace Change and the Company to

successfully integrate the businesses; (iii) the occurrence of any

event, change or other circumstances that could give rise to the

termination of the applicable transaction agreements; (iv) the risk

that there may be a material adverse change with respect to the

financial position, performance, operations or prospects of the

Company or Embrace Change; (v) risks related to disruption of

management time from ongoing business operations due to the

Proposed Transaction; (vi) the risk that any announcements relating

to the Proposed Transaction could have adverse effects on the

market price of Embrace Change’s securities; (vii) the risk that

the Proposed Transaction and its announcement could have an adverse

effect on the ability of the Company to retain customers and retain

and hire key personnel and maintain relationships with their

suppliers and customers and on their operating results and

businesses generally; (viii) the Company’s estimates of expenses

and profitability; and (ix) risks relating to the Combined

Company’s ability to enhance its services and products, execute its

business strategy, expand its customer base and maintain stable

relationship with its business partners.

A further list and description of risks and

uncertainties can be found in the Prospectus filed on August 9,

2022 relating Embrace Change’s initial public offering and in the

Registration Statement and proxy statement that will be filed with

the SEC by Embrace Change and/or its subsidiary in connection with

the proposed transactions, and other documents that the parties may

file or furnish with the SEC, which you are encouraged to read.

Should one or more of these risks or uncertainties materialize, or

should underlying assumptions prove incorrect, actual results may

vary materially from those indicated or anticipated by such

forward-looking statements. Accordingly, you are cautioned not to

place undue reliance on these forward-looking statements.

Forward-looking statements relate only to the date they were made,

and Embrace Change, the Company and their subsidiaries undertake no

obligation to update forward-looking statements to reflect events

or circumstances after the date they were made except as required

by law or applicable regulation.

No Offer or Solicitation

This press release is not a proxy statement or

solicitation of a proxy, consent or authorization with respect to

any securities or in respect of the transactions described above

and shall not constitute an offer to sell or a solicitation of an

offer to buy the securities of Embrace Change or the Company, nor

shall there be any sale of any such securities in any state or

jurisdiction in which such offer, solicitation, or sale would be

unlawful prior to registration or qualification under the

securities laws of such state or jurisdiction. No offering of

securities shall be made except by means of a prospectus meeting

the requirements of Section 10 of the Securities Act of 1933, as

amended, or an exemption therefrom.

Participants in the

Solicitation

Embrace Change and the Company, and certain

shareholders of Embrace Change, and their respective directors,

executive officers and employees and other persons may be deemed to

be participants in the solicitation of proxies from the holders of

Embrace Change ordinary shares in respect of the proposed

transaction. Information about Embrace Change’s directors and

executive officers and their ownership of Embrace Change ordinary

shares is set forth in the Prospectus filed on August 9, 2022 and

filed with the SEC as modified or supplemented by any Form 3 or

Form 4 filed with the SEC since the date of that filing. Other

information regarding the interests of the participants in the

proxy solicitation will be included in the Registration

Statement/proxy statement pertaining to the proposed transaction

when it becomes available. These documents can be obtained free of

charge from the sources indicated above.

Tianji and its directors and executive officers

may also be deemed to be participants in the solicitation of

proxies from the stockholders of Embrace Change in connection with

the proposed business combination. A list of the names of such

directors and executive officers and information regarding their

interests in the proposed business combination will be included in

the Registration Statement/proxy statement pertaining to the

proposed transaction when it becomes available for the proposed

business combination.

Contacts:

Embrace Change Acquisition

Corp. contact@embracechange.top

Tianji Tire Global (Cayman)

LimitedRay Jinray966@msn.com

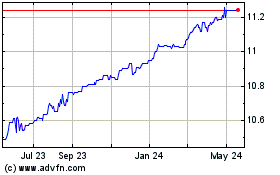

Embrace Change Acquisition (NASDAQ:EMCG)

Historical Stock Chart

From Jan 2025 to Feb 2025

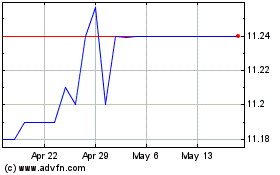

Embrace Change Acquisition (NASDAQ:EMCG)

Historical Stock Chart

From Feb 2024 to Feb 2025