Form 8-K - Current report

February 03 2025 - 6:07AM

Edgar (US Regulatory)

false

0001708527

0001708527

2025-02-03

2025-02-03

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C.

20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13

or 15(d)

of the Securities Exchange Act of 1934

Date

of report (Date of earliest event reported): February

3, 2025

ELUTIA

INC.

(Exact name of registrant as specified in its

charter)

| Delaware |

|

001-39577 |

|

47-4790334 |

(State

or other jurisdiction

of incorporation) |

|

(Commission

File

Number) |

|

(I.R.S.

Employer

Identification

No.) |

12510

Prosperity Drive, Suite 370

Silver

Spring, MD

20904

(Address

of principal executive offices) (Zip Code)

(240)

247-1170

(Registrant’s

telephone number, include area code)

N/A

(Former

name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbols |

|

Name

of each exchange

on which registered |

| Class A

Common Stock, $0.001 par value per share |

|

ELUT |

|

The

Nasdaq Capital

Market |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act.

| Item 2.02 | Results of Operations and Financial Condition. |

The information set forth under Item 8.01 below

is incorporated by reference into this Item 2.02.

Elutia

Inc. (“we,” “us,” “our,” the “Company” and “Elutia”) is in the process of

finalizing its results for the year ended December 31, 2024. The Company estimates its net sales for the year ended December 31, 2024

to be as follows (in thousands, except percentages):

| | |

Year Ended December

31, | | |

| | |

| |

| | |

Preliminary 2024 | | |

2023 | | |

Change | |

| | |

Amount | | |

% of Net

Sales | | |

Amount | | |

% of Net

Sales | | |

$ | | |

% | |

| Products: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Device protection | |

$ | 9,905 | | |

| 41 | % | |

$ | 9,401 | | |

| 38 | % | |

$ | 504 | | |

| 5 | % |

| Women’s health | |

| 11,554 | | |

| 47 | % | |

| 10,304 | | |

| 42 | % | |

| 1,250 | | |

| 12 | % |

| Cardiovascular | |

| 2,916 | | |

| 12 | % | |

| 5,040 | | |

| 20 | % | |

| (2,124 | ) | |

| (42 | )% |

| Total

Net Sales | |

$ | 24,375 | | |

| | | |

$ | 24,745 | | |

| | | |

$ | (370 | ) | |

| (1 | )% |

The

Company’s preliminary net sales estimates for the year ended December 31, 2024 are based on currently available information and

do not present all necessary information for an understanding of the Company’s financial condition as of December 31, 2024 or the

Company’s results of operations for the year ended December 31, 2024. The Company’s final net sales upon completion of its

closing procedures may vary from the preliminary estimates as a result of the completion of final adjustments, and other developments

arising between now and the time that its net sales results for such period are finalized. Complete

results as of, and for the year ended, December 31, 2024, including net sales, will be included in the Company’s Annual Report

on Form 10-K for the year ended December 31, 2024. See “Forward-Looking Statements” below and the information under the caption

“Risk Factors” in our Annual Report on Form 10-K for the year ended December 23, 2023, as updated by the Company’s

subsequent Quarterly Reports on Form 10-Q, for additional information regarding factors that could result in differences between these

preliminary and the actual net sales results we will report for the year ended December 31, 2024.

The

Company’s independent registered public accounting firm, PricewaterhouseCoopers LLP, has not audited, reviewed, compiled or performed

any procedures with respect to the preliminary net sales estimates. Accordingly, the Company’s independent registered public accounting

firm does not express an opinion or any other form of assurance with respect thereto. Undue reliance should not be placed on the Company’s

preliminary net sales estimates.

Forward-Looking Statements

This Current Report on Form

8-K contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements

can be identified by words such as “projects,” “may,” “will,” “could,” “would,”

“should,” “believes,” “expects,” “anticipates,” “estimates,” “intends,”

“plans,” “potential,” “promise” or similar references to future periods. All statements contained

in this Current Report on Form 8-K that do not relate to matters of historical fact should be considered forward-looking statements,

including any statements and information regarding the Company’s preliminary net sales estimates. These forward-looking statements

are based on our management’s beliefs and assumptions and on information currently available to us. Such beliefs and assumptions

may or may not prove to be correct. Additionally, such forward-looking statements are subject to a number of known and unknown risks,

uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from

any future results, performance or achievements expressed or implied in the forward-looking statements, including, but not limited to

the following: our ability to successfully commercialize, market and sell our newly approved EluPro product; our ability to continue

as a going concern; our ability to achieve or sustain profitability; the risk of product liability claims and our ability to obtain or

maintain adequate product liability insurance; our ability to defend against the various lawsuits and claims related to our recalled

FiberCel and other viable bone matrix products and avoid a material adverse financial consequence from those lawsuits and claims; the

continued and future acceptance of our products by the medical community; our ability to enhance our products, expand our product indications

and develop, acquire and commercialize additional product offerings; our dependence on our commercial partners and independent sales

agents to generate a substantial portion of our net sales; our dependence on a limited number of third-party suppliers and manufacturers,

which, in certain cases are exclusive suppliers for products essential to our business; our ability to successfully realize the anticipated

benefits of the November 2023 sale of our Orthobiologics business; physician awareness of the distinctive characteristics, benefits,

safety, clinical efficacy and cost-effectiveness of our products; our ability to compete against other companies, most of which have

longer operating histories, more established products and/or greater resources than we do; pricing pressure as a result of cost-containment

efforts of our customers, purchasing groups, third-party payors and governmental organizations could adversely affect our sales and profitability;

our ability to obtain regulatory approval or other marketing authorizations by the U.S. Federal Drug Administration and comparable foreign

authorities for our products and product candidates; and our ability to obtain, maintain and adequately protect our intellectual property

rights; and other important factors which can be found in the “Risk Factors” section of Elutia’s public filings with

the U.S. Securities and Exchange Commission (SEC), including Elutia’s Annual Report on Form 10-K for the year ended December 31,

2023, as such factors may be updated from time to time in Elutia’s other filings with the SEC, including Elutia’s Quarterly

Reports on Form 10-Q. Because forward-looking statements are inherently subject to risks and uncertainties, you should not rely on these

forward-looking statements as predictions of future events. Any forward-looking statement made by Elutia in this Current Report on Form

8-K is based only on information currently available and speaks only as of the date on which it is made. Except as required by applicable

law, Elutia expressly disclaims any obligations to publicly update any forward-looking statements, whether written or oral, that may

be made from time to time, whether as a result of new information, future developments or otherwise.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

ELUTIA INC. |

| |

|

| Date: February 3, 2025 |

By: |

/s/

Matthew Ferguson |

| |

|

Matthew Ferguson |

| |

|

Chief Financial Officer |

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

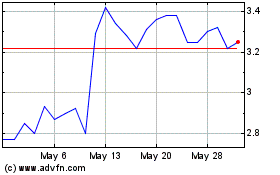

Elutia (NASDAQ:ELUT)

Historical Stock Chart

From Jan 2025 to Feb 2025

Elutia (NASDAQ:ELUT)

Historical Stock Chart

From Feb 2024 to Feb 2025