0000351789

false

DEF 14A

0000351789

2022-01-01

2022-12-31

0000351789

2021-01-01

2021-12-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

UNITED STATES SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No.____ )

Filed by the registrant ☒

Filed by a party other than the registrant ☐

Check the appropriate box:

| |

☐ |

Preliminary Proxy Statement |

| |

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

☒ |

Definitive Proxy Statement |

| |

☐ |

Definitive Additional Materials |

| |

☐ |

Soliciting Material Under Section 240.14a-12 |

| |

|

|

ELECTRO-SENSORS, INC.

(Name of Registrant as Specified in Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| |

☒ |

No fee required |

| |

☐ |

Fee paid previously with preliminary materials. |

| |

☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a6(i)(1) and 0-11 |

| |

|

|

|

ELECTRO-SENSORS,

INC. 6111 Blue Circle Drive Minnetonka, Minnesota 55343

(952)

930-0100

NOTICE

OF ANNUAL MEETING OF SHAREHOLDERS

April

27, 2023

To

the Shareholders of Electro-Sensors, Inc.:

Notice

is hereby given that the Annual Meeting of Shareholders of Electro-Sensors, Inc. will be held on Thursday, April 27, 2023 at

2:00 p.m. Central Time. The Annual Meeting will be a virtual meeting of shareholders, which will be conducted via a live

webcast. You will be able to participate in the virtual Annual Meeting, vote and submit your questions via the live webcast

by visiting www.virtualshareholdermeeting.com/ELSE2023 for the following purposes:

| 1. | To

set the number of directors at five; |

| 2. | To

elect five directors to serve until the next Annual Meeting of Shareholders; |

| 3. | To

ratify the selection of Boulay PLLP as independent registered public accounting firm

for the Company for the fiscal year ending December 31, 2023; and |

| 4. | To

take action upon any business as may properly come before the meeting or any adjournment

or postponement thereof. |

Accompanying

this Notice of Annual Meeting is a Proxy Statement, Form of Proxy and the Company’s Annual Report on Form 10-K for the fiscal

year ended December 31, 2022.

The

Board of Directors has fixed the close of business on February 28, 2023 as the record date for the determination of shareholders

entitled to notice of and to vote at the Annual Meeting of Shareholders. All shareholders are cordially invited to attend the

virtual Annual Meeting at www.virtualshareholdermeeting.com/ELSE2023.

To

ensure that we achieve a quorum, however, whether or not you plan to attend the Annual Meeting webcast, the Board of Directors

requests that you either (1) promptly complete, sign, date and return the enclosed proxy card solicited by the Board of Directors,

or (2) vote electronically following the process described in this proxy statement or in other materials you receive. The proxy

is revocable and will not be used if you attend the Annual Meeting and vote in person or otherwise provide notice of your revocation.

If you have any questions regarding the completion of the enclosed proxy card please call the Company at (952) 930-0100.

NOTICE:

Please retain a copy of the 16 Digit Control Number that is printed on your proxy card as you will need it to enter the virtual

Annual Meeting as a verified shareholder.

| |

BY ORDER OF THE BOARD OF

DIRECTORS, |

| |

|

| |

|

| |

David L. Klenk |

| |

President |

Minnetonka,

Minnesota

Dated: March

17, 2023

ELECTRO-SENSORS,

INC. 6111 Blue Circle Drive Minnetonka, Minnesota 55343 (952) 930-0100

PROXY

STATEMENT

FOR

ANNUAL

MEETING OF SHAREHOLDERS

April

27, 2023

GENERAL

INFORMATION

This

Proxy Statement is furnished by the Board of Directors (the “Board”) of Electro-Sensors, Inc., a Minnesota corporation

(the “Company”), to the shareholders of the Company in connection with a solicitation of proxies to be voted at the

Annual Meeting of Shareholders (the “Annual Meeting”) to be held electronically at 2:00 p.m., Central Time, on Thursday,

April 27, 2023, at www.virtualshareholdermeeting.com/ELSE2023 and at any and all adjournments or postponements thereof.

The Annual Meeting will be a completely virtual meeting of shareholders that will be conducted via live webcast. This Proxy Statement

and the accompanying materials are first being mailed to shareholders on or about March 17, 2023.

Questions

at the Annual Meeting

To

facilitate effective communications at the Annual Meeting, the Company requests that any shareholders with questions for Company

management, Company directors, or the Company’s independent registered accounting firm submit those questions prior to the

start of the meeting at https://www.electro-sensors.com/about/investor-info under Investor Contact - Email Gloria. The

Company anticipates that until it resumes in-person meetings, or hybrid meetings, that the opportunity for live question and answer

sessions may be limited, giving the expense and technical difficulties involved. The Company will endeavor to answer any questions

submitted.

Proxy

Process

If

your shares are registered in the name of a bank or brokerage firm, you may be eligible to vote your shares electronically via

the Internet or telephone. A large number of banks and brokerage firms participate in the Broadridge Investor Communication Services

online program. This program provides eligible shareholders who receive notice and access materials or copies of the Annual Report

and Proxy Statement the opportunity to vote via the Internet or telephone. If your bank or brokerage firm participates in this

Broadridge program, your voting form will provide instructions. If your voting form does not refer to Internet or telephone information,

please complete and return the paper proxy card in the postage paid envelope provided.

Any

proxy delivered pursuant to this solicitation is revocable at the option of the person giving the proxy at any time before it

is exercised. A proxy may be revoked, prior to its exercise, by executing and delivering a later-dated proxy via the Internet,

via telephone or by mail, by delivering written notice of the revocation of the proxy to the Company’s President prior to

the Annual Meeting, or by attending and voting at the Annual Meeting. Attendance at the Annual Meeting, in and of itself, will

not constitute a revocation of a proxy. The shares represented by a proxy will be voted in accordance with the shareholder’s

directions if the proxy is duly submitted and not validly revoked prior to the Annual Meeting. If no directions are specified

on a duly submitted proxy, the shares will be voted in accordance with the recommendations of the Board, FOR approval of the number

of directors to be set at five, FOR the election of the directors nominated by the Board, FOR the ratification of the Company’s

selection of independent registered public accounting firm for the fiscal year ending December 31, 2023, and in accordance with

the discretion of the persons appointed as proxies on any other matters properly brought before the Annual Meeting any and all

adjournments or postponements thereof.

The

expense of preparing, printing, and mailing this Proxy Statement and the proxies solicited hereby will be borne by the Company.

The Company will request brokerage firms, banks, nominees, custodians, and fiduciaries to forward proxy materials to the beneficial

owners of shares of Common Stock of the Company (“Common Stock”) as of the record date and reimburse these firms for

the cost of forwarding the proxy materials in accordance with customary practice. In addition to the use of the Internet and mail,

proxies may be solicited by officers, directors, and regular employees of the Company, without additional remuneration, in person

or by telephone or facsimile transmission.

For

a shareholder proposal to be considered for inclusion in our Proxy Statement for the 2024 Annual Meeting, the written proposal

must be received at our principal executive offices by the close of business on November 18, 2023. The proposal must comply

with SEC regulations regarding the inclusion of shareholder proposals in company-sponsored proxy materials.

Important

Notice Regarding the Availability of Proxy Materials for the Annual Meeting:

The

Proxy Statement, Form of Proxy, and Annual Report on Form 10-K are available at

http://www.idelivercommunications.com/proxy/else

OUTSTANDING

SHARES & VOTING RIGHTS

The

Company fixed the close of business on February 28, 2023 as the record date for determining shareholders entitled to notice of

and to vote at the Annual Meeting. At February 28, 2023, the Company had outstanding 3,428,021 shares of Common Stock, the only

outstanding class of capital stock of the Company. Each share of Common Stock outstanding on the record date entitles the holder

thereof to one vote on each matter to be voted upon by shareholders at the Annual Meeting. Holders of Common Stock are not entitled

to cumulative voting rights.

For

the election of directors, each shareholder will be entitled to vote for five nominees and the five nominees with the greatest

number of votes will be elected. With respect to the proposal to set the number of directors at five, ratification of our independent

registered public accounting firm for the fiscal year ending December 31, 2023, and any other matter that properly comes before

the meeting, the affirmative vote of the holders of a majority of the shares of Common Stock represented in person or by proxy

and entitled to vote on the proposal will be required for approval. A properly executed proxy marked “ABSTAIN” with

respect to any proposal will not be voted, although it will be counted for purposes of determining whether there is a quorum.

Accordingly, an abstention will have the effect of a negative vote with respect to all proposals.

A

majority of the shares of Common Stock entitled to vote at the Annual Meeting, present in person or by proxy, constitutes a quorum

that is required for the transaction of business at the Annual Meeting. Proxies relating to “street name” shares that

are voted by brokers on some matters, but not on other matters as to which authority to vote is withheld from the broker (“broker

non-votes”) absent voting instructions from the beneficial owner, will be treated as shares present for purposes of determining

the presence or absence of a quorum but will not be deemed to be represented at the meeting for purposes of determining the approval

of any matter submitted to the shareholders for which voting authority is withheld. The Inspector of Election appointed by the

Board will determine the shares represented at the meeting and the validity of proxies and ballots and will count all votes and

ballots.

CORPORATE

GOVERNANCE

The

business affairs of the Company are conducted under the direction of the Board in accordance with the Minnesota Business Corporation

Act and our Articles of Incorporation and Bylaws. The Board of Directors currently has five members: David L. Klenk, Jeffrey D.

Peterson, Joseph A. Marino, Scott A. Gabbard, and Michael C. Zipoy. Members of the Board are informed of our business through

discussions with management, by reviewing materials provided to them and by participating in meetings of the Board and its committees,

among other activities. The corporate governance practices that we follow are summarized below.

Board

Leadership Structure and Risk Management

The

Board believes that independent director Joseph A. Marino is best suited to serve as Chairman of the Board due to his extensive

familiarity with the Company’s business and industry as well as his proven track record of leading dynamic and growing organizations.

Additionally, the Board believes Mr. Marino is most capable of effectively identifying strategic priorities and leading the discussion

and execution of strategy. The Board believes having an independent director as chairman provides for good governance and effectively

balances the roles of internal and external directors. Mr. Marino and the Company’s other independent directors bring experience,

oversight and expertise from outside the Company and industry, while Mr. David L. Klenk, as President, Chief Executive Officer

and Chief Financial Officer, brings company-specific experience and expertise. The Board believes that Mr. Klenk’s participation

on the Board in his role of Chief Executive Officer promotes strategy development and execution, and facilitates information flow

between management and the Board, which are essential to effective governance.

One key Board responsibility is to hold management accountable for the execution of strategy once it is developed. The Board believes

that its independent directors work together effectively to serve this oversight function, with no individual director serving

as a “lead” independent director.

The

Board believes that oversight of the Company’s risk management efforts is another key responsibility that is shared by the

entire Board. The Board regularly reviews risk management information regarding the Company’s liquidity and operations.

Board members receive regular financial statements, which are discussed at quarterly meetings of the Board. In addition,

Mr. Klenk frequently has informal discussions with Board members regarding key business issues and risk management.

Independence

The

Board of Directors has determined that Messrs. Gabbard, Marino, Peterson, and Zipoy are independent directors as defined by the

listing standards of the Nasdaq Stock Market, because none of them are believed to have any relationships that, in the opinion

of the Board of Directors, would interfere with the exercise of independent judgment in carrying out the responsibilities of a

director. If Messrs. Gabbard, Marino, Peterson, and Zipoy are all elected at the Annual Meeting, they will constitute a majority

of the Board of Directors. Mr. Klenk is precluded from being considered independent by Nasdaq rules since he currently serves

as an executive officer of the Company.

The

Board has determined that all members of the Company’s Audit Committee, Compensation Committee and Nominating Committee

are independent under listing standards of the Nasdaq Stock Market.

Code

of Ethics and Business Conduct

The

Company has adopted the Electro-Sensors Code of Ethics and Business Conduct (the “Code of Conduct”), which applies

to all of our directors, officers and employees. A copy of the Code of Conduct may be obtained upon written request to the Chief

Executive Officer. If we make any substantive amendments to the Code of Conduct or grant any waiver, including any implicit waiver

from a provision of the Code of Conduct to our directors or executive officers, we will disclose the nature of the amendments

or waiver on our website.

Director

Attendance at Annual Meeting

We

expect all directors to attend the Annual Meeting of Shareholders. The 2022 Annual Meeting was held virtually and all five of

the directors attended the Meeting.

Communications

with the Board

Shareholders

may communicate directly with the Board. All communications should be directed to the Chairman of our Audit Committee at the address

below and should prominently indicate on the outside of the envelope that the communication is intended for the Board or for non-management

directors. If no director is specified, the communication will be forwarded to the entire Board. Shareholder communications to

the Board should be sent to:

Board

of Directors

Attention:

Chairman, Audit Committee

Electro-Sensors,

Inc.

6111

Blue Circle Drive

Minnetonka,

Minnesota 55343-9108

Committees

and Meetings of the Board of Directors

Information

about the Board and its Committees are set forth below.

Board

Meetings

The

Board met nine times during 2022. Each Board member attended all of the meetings of the Board and committees on which he served.

Director

Compensation

The

compensation of directors who are not Company employees is set forth below under “Director Compensation.”

Audit

Committee

Messrs.

Marino, Gabbard (Chair), and Zipoy currently serve as members of the Audit Committee. This Committee met twice during 2022. The

Audit Committee is responsible for selecting the Company’s independent registered public accounting firm, and for assisting

the Board in its oversight of corporate accounting and internal controls, reporting practices of the Company and the quality and

integrity of the financial reports of the Company. In addition to regularly scheduled Audit Committee meetings, the Audit Committee

Chair meets quarterly with the Company’s independent accounting firm to discuss quarterly results. The Audit Committee Charter

specifies the Committee’s composition and responsibilities. For more information concerning the Audit Committee, see the

Report of the Audit Committee on page 14 and the Audit Committee Charter posted on our corporate website under “Investor

Information - Corporate Governance.” Given his significant experience serving as a chief financial officer of companies,

the Board has determined that Mr. Gabbard is an “audit committee financial expert” as defined by Item 407(d)(5)(ii)

of SEC Regulation S-K.

Compensation

Committee

Messrs.

Marino, Gabbard, and Zipoy (Chair) currently serve as members of the Compensation Committee (the “Compensation Committee”).

The Compensation Committee acts pursuant to a charter and met twice during 2022. For more information concerning the Compensation

Committee, see the Compensation Committee Charter posted on our corporate website under “Corporate Governance.” The

Compensation Committee is responsible for making recommendations to the Board concerning compensation of the Company’s employees,

officers, and directors, and is authorized to determine the compensation of the Company’s executive officers. The Compensation

Committee is authorized to administer the various incentive plans of the Company and has all powers of the attendant thereto,

including the power to grant employee stock options.

Nominating

Committee

Messrs.

Marino, Peterson, and Zipoy (Chair) currently serve as members of the Nominating Committee. The Nominating Committee met once

during 2022. The Nominating Committee is responsible for evaluating and nominating or recommending candidates for the Company’s

Board of Directors. A copy of the Nominating Committee Charter, which has been adopted by the Company’s Board, is posted

on our corporate website under “Corporate Governance.”

Nominating

Policy

The

Nominating Committee will consider candidates for nomination as a director recommended by shareholders. The Nominating Committee

believes that director or candidates should have certain minimum qualifications.

In

evaluating director nominees who meet the Company’s minimum qualifications, the Nominating Committee considers the following

factors and qualifications, among others:

| ● | when

evaluating candidates for nomination as new directors, the Committee will consider, and

ask any search firm that it engages, to provide a set of candidates that includes qualified

women and individuals from historically underrepresented groups. |

| ● | the

appropriate size and the diversity of the Company’s Board of Directors; |

| ● | the

needs of the Board for the particular talents and experience of its directors; |

| ● | the

knowledge, skills and experience of nominees, including experience in technology, business,

finance, administration or public service, in light of prevailing business conditions

and the knowledge, skills and experience already possessed by other members of the Board; |

| ● | familiarity

with domestic and international business matters; |

| ● | age

and legal and regulatory requirements; |

| ● | experience

with accounting rules and practices; |

| ● | read

and understand basic financial statements; |

| ● | appreciation

of the relationship of the Company’s business to the changing needs of society;

and |

| ● | the

desire to balance the considerable benefit of continuity with the periodic injection

of the fresh perspective provided by new members. |

The

Nominating Committee will consider the attributes of the candidates and the needs of the Board and will review all candidates

in the same manner. The Nominating Committee seeks to nominate candidates with a diverse range of knowledge, experience, skills,

expertise, and other qualities that will contribute to the overall effectiveness of the Board.

A

shareholder who wishes to recommend one or more directors must provide a written recommendation to the Company at the address

below by November 18, 2023. Notice of a recommendation must include the name and address of the shareholder and number

of shares the shareholder owns. The shareholder should include the nominee’s name, age, business address, residence address,

current principal occupation, five-year employment history with employer names and a description of the employer’s business,

the number of shares beneficially owned by the nominee, whether the nominee can read and understand basic financial statements,

and other Board memberships, if any.

Electro-Sensors,

Inc.

Attn:

Chair, Nominating Committee

6111

Blue Circle Drive

Minnetonka,

MN 55343-9108

The

recommendation must be accompanied by a written consent of the nominee to stand for election at the Annual Meeting if nominated

by the Nominating Committee and to serve if elected by the shareholders. The Company may require any nominee to furnish additional

information that may be needed to determine the eligibility of the nominee and whether the nominee has the attributes the Board

believes are important in its composition.

ELECTION

OF DIRECTORS

Proposals

#1 and #2

The

Bylaws of the Company provide that at each Annual Meeting, the shareholders will determine the number of directors, which must

be at least one. The Nominating Committee and the Board recommend that the number of directors be currently set at five and that

five directors be elected at the Annual Meeting to serve until the 2024 Annual Meeting or until their successors are duly elected

and qualified. Under applicable Minnesota law and the Bylaws of the Company, approval of the proposal to set the number of directors

at five requires the affirmative vote of the holders of a majority of the voting power of the shares present in person or by proxy

at the Annual Meeting with authority to vote on this matter.

The

Nominating Committee recommended and the Board selected the persons named below for election to the Board. All nominees are currently

directors of the Company. If, prior to the Annual Meeting, the Board determines that any of these nominees would be unable to

serve as a director after the Annual Meeting by reason of death, incapacity or other unexpected occurrence, the proxies will be

voted for such substitute nominee as the Board selects. The Board has no reason to believe that any of the following nominees

will be unable to serve. The Bylaws of the Company provide that directors will be elected by a plurality of the votes cast by

holders of shares present in person or by proxy and entitled to vote on the election of directors at a meeting at which a quorum

is present.

The

following table sets forth the principal occupations (for at least the last five years) and directorships of the nominees:

| Name

|

Principal

Occupation and Directorships |

Age |

Director

Since |

| |

|

|

|

| David

L. Klenk |

President,

CEO, and CFO of the Company since 2013 |

58 |

2013 |

| |

|

|

|

| Joseph

A. Marino |

President

and CEO of Cardia, Inc. (a medical equipment manufacturer) since 1998 |

71 |

1994 |

| |

|

|

|

| Scott

A. Gabbard |

Retired,

Finance Executive 2000 through 2021. CFO and COO of Magenic Technologies, Inc. (a software consulting organization) from April

2006 to August 2021 |

56 |

2013 |

| |

|

|

|

| Jeffrey

D. Peterson |

Private

investor since 1998. Previously employed by John G. Kinnard and Company, a regional brokerage firm. |

66 |

2011 |

| |

|

|

|

| Michael

C. Zipoy |

Retired,

Investment executive from 1978-2018; Feltl and Company investment executive (brokerage and investment banking firm) from 2005

through 2018 |

75 |

2012 |

The

Board believes the following key characteristics are important in the selecting these five nominees:

Mr.

Marino’s executive leadership experience in building both private and public companies, including strategy formulation,

execution, and investor relations;

Mr.

Zipoy’s investment experience in small and micro-cap companies and his participation in public and private equity financing;

Mr.

Peterson’s significant experience in the investment industry and personal connections with many regional businesses;

Mr.

Gabbard’s extensive management experience, expertise, and background on strategic, operational, accounting and financial

matters for both public and private companies; and

Mr.

Klenk’s years of leadership experience with emerging technology companies, his high levels of customer and employee focus,

and his demonstrated ability to lead companies through significant growth cycles.

SECURITY

OWNERSHIP OF CERTAIN

BENEFICIAL

OWNERS AND MANAGEMENT

The

following table sets forth information, as of February 28, 2023, regarding the beneficial ownership of the outstanding shares

of Common Stock by persons known by the Company to beneficially own more than 5% of the outstanding shares of Common Stock, by

directors and director nominees, by the only executive officer named in the Summary Compensation Table, and by the Company’s

current directors and executive officer as a group.

| |

Common

Stock |

| Name

and Address |

Number

of Shares |

Percent |

| of

Beneficial Owner |

Beneficially

Owned(1) |

of

Class |

Jeffrey

D. Peterson

15708

Woodknoll Lane

Minnetonka,

MN 55345

|

403,438

(2) |

11.6% |

| |

|

|

Patricia

N. Peterson

6005

Erin Terrace

Edina,

MN 55439

|

364,768

(3) |

10.6% |

| |

|

|

Lynne

E. Peterson

10254

Nottingham Trail

Eden

Prairie, MN 55347

|

350,893

(4) |

10.2% |

| |

|

|

John

E. Peterson

815

Buttonbush Lane

Naples,

FL 34108

|

350,893

(5) |

10.2% |

| |

|

|

Paul

R. Peterson

227

Cedar Drive West

Hudson,

WI 54016

|

350,893

(3) |

10.2% |

| |

|

|

Caldwell

Sutter Capital, Inc.

Joseph

F. Helmer

30

Liberty Ship Way #3225

Sausalito,

CA 94965

|

229,581

(6) |

6.7% |

| |

|

|

David

L. Klenk

|

103,060

(7) |

2.9% |

| |

|

|

Scott

A. Gabbard

|

50,000

(8)

|

1.4% |

| |

|

|

Joseph

A. Marino

|

52,500

(9) |

1.5% |

| |

|

|

Michael

C. Zipoy

|

62,500

(10) |

1.8% |

| |

|

|

| Officers

and Directors as a Group (5 persons) |

671,498 |

18.0% |

| (1) | Except

as otherwise indicated, each person named or included in the group has the sole power

to vote and sole power to direct the disposition of all shares listed as beneficially

owned by him or her. Beneficial ownership information is based on information furnished

by the specified persons and is determined in accordance with Rule 13d-3 under the Securities

Exchange Act of 1934 (the “Exchange Act”), as required for purposes of this

Proxy Statement. Accordingly, it includes shares of Common Stock that are issuable upon

the exercise of stock options exercisable within 60 days of February 28, 2023 as noted

below. |

| (2) | Includes

50,000 shares issuable upon the exercise of stock options exercisable within 60 days

of February 28, 2023 and 46 shares held by the Electro-Sensors, Inc. Employee Stock Ownership

Plan (“ESOP”) for the account of Mr. Peterson. |

| (3) | Based

on a Form 3 dated December 30, 2021 and filed with the SEC on December 30, 2021 |

| (4) | Based

on a Form 4 dated December 30, 2021 and filed with the SEC on December 30, 2021 |

| (5) | Based

on a Form 3 dated December 30, 2021 and filed with the SEC on January 3, 2022 |

| (6) | Based

on a Schedule 13G dated February 10, 2023 and filed with the SEC on February 10, 2023.

Includes shares owned by Caldwell Sutter Capital, Inc. and Joseph F. Helmer of which

they have shared voting and dispositive control of 213,536 shares and Mr. Helmer has

sole voting and dispositive control of 16,045 shares. |

| (7) | Includes

100,000 shares issuable upon the exercise of stock options exercisable within 60 days

of February 28, 2023 and 3,060 shares held by the Electro-Sensors, Inc. Employee Stock

Ownership Plan (“ESOP”) for the account of Mr. Klenk. |

| (8) | Represents

shares issuable upon the exercise of stock options exercisable within 60 days of February

28, 2023. |

| (9) | Includes

50,000 shares issuable upon the exercise of stock options exercisable within 60 days

of February 28, 2023. |

| (10) | Includes

50,000 shares issuable upon the exercise of stock options exercisable within 60 days

of February 28, 2023 and 10,000 shares held by the Barbara J. Zipoy and Michael C. Zipoy

Revocable Trust of which Mr. Zipoy is a Trustee. |

| Board

Diversity Matrix (As of February 28, 2023) |

| |

Male |

Female |

| Total

Number of Directors |

5 |

| Part

I: Gender Identity |

|

|

| Directors |

5 |

0 |

| Part

II: Demographic Background |

|

|

| White |

5 |

0 |

TRANSACTIONS

WITH RELATED PERSONS,

PROMOTERS

AND CERTAIN CONTROL PERSONS

The

Company was not a party to any transactions with related persons, promoters or control persons during the last fiscal year and

is not currently contemplating any such transactions.

EXECUTIVE

COMPENSATION

Compensation

Summary

The

following table summarizes information concerning the compensation awarded or paid to, or earned by, the Company’s Named

Executive Officer during 2022 and 2021.

Summary

Compensation Table

Name

and

principal position |

Year |

Salary

($)

|

Bonus

($)

|

Option

Awards ($) |

Non-equity

incentive

plan

($)

|

All

other

compensation

($)(3)

|

Total

($)

|

David

L. Klenk,

President,

CEO, CFO |

2022

2021 |

241,769

230,000 |

50,000

(1)

20,000

(2) |

0

0 |

|

0

0 |

|

35,537

35,334 |

327,306

285,334 |

| (1) | Discretionary

payment made under the 2022 Management Incentive Bonus Plan. |

| (2) | Discretionary

payment made under the 2021 Management Incentive Bonus Plan. |

| (3) | Amounts

reflect allocations to individual’s account of Company contributions to the ESOP,

401(k) Plan, and standard employee benefit plans. The Company matches 100% of the first

3% of employee 401(k) Plan contributions and 50% of the next 2% of employee contributions. |

Compensation

of Executive Officer

Mr.

Klenk does not have a written employment agreement with the Company. As of January 1, 2023, his annual salary is $250,000 per

year, and he is eligible to receive a bonus as determined by either the Board of Directors or the Compensation Committee. See

“2023 Management Incentive Bonus Plan” and “2022 Management Incentive Bonus Plan” information below.

Outstanding

Equity Awards as of December 31, 2022

The

following table sets forth certain information concerning outstanding option equity awards outstanding to the Named Executive

Officer at December 31, 2022. There were no outstanding share awards and therefore, these columns are omitted from the table.

| Outstanding

Equity Awards at Fiscal Year-End |

| Option

Awards |

| Name |

|

Number

of

securities

underlying

unexercised options

(#) exercisable |

Number

of securities

underlying unexercised

options (#)

unexercisable |

Option

Exercise Price

($)

|

Option

Expiration

Date |

| Mr. Klenk |

|

50,000 |

None |

4.21 |

7/22/2023 |

| Mr. Klenk |

|

50,000 |

None |

3.41 |

2/8/2026 |

2022

Management Incentive Bonus Plan

On

February 1, 2022, the Compensation Committee approved the 2022 Management Incentive Plan (the “2022 Plan”) for the

Company’s President, Chief Executive Officer, and Chief Financial Officer David L. Klenk. The 2022 Plan had both annual

financial performance and strategic goals. The financial performance goals were primarily based on the achievement of specified

revenue levels, with additional amounts available for exceeding certain levels. The strategic goals were primarily related to

initiatives related to expanding our customer base and product offerings. The Company allocated 75% of the potential bonus to

financial performance and 25% to strategic initiatives. If the Company achieved the specified goals, the incentive cash payment

to Mr. Klenk would have been approximately 21% of his base salary. Furthermore, the Committee retained discretion under the 2022

Plan to make incentive plan cash payments in amounts higher or lower than would otherwise be required under the 2022 Plan. Although

the Company did not achieve specified revenue levels, the Company did achieve a strong ”Adjusted Net Income,” excluding

the costs related to the potential merger with Mobile X Global, Inc. as described in the “Non-GAAP Financial Measure “

section of the Company’s Form 10-K for the year ended December 31, 2022. The Compensation Committee approved a discretionary

$50,000 bonus to Mr. Klenk under the 2022 Plan in light of the Company’s bottom-line performance and efforts in coordinating

a potential merger with Mobile X Global, Inc.

2023

Management Incentive Bonus Plan

On

February 8, 2023, the Compensation Committee approved the 2023 Management Incentive Plan (the “2023 Plan”) for Mr.

Klenk. The 2023 Plan has both annual financial performance and strategic goals. The financial performance goals are primarily

based on the achievement of specified revenue levels, with additional amounts available for exceeding certain levels. The strategic

goals are primarily related to initiatives related to strategic business development. The 2023 Plan allocates 40% of the potential

bonus to financial performance and 60% to strategic initiatives. If the Company achieves the specified goals, the incentive cash

payment to Mr. Klenk will equal approximately 20% of his base salary. Furthermore, the Committee retains discretion under the

2023 Plan to make incentive plan cash payments in amounts higher or lower than would otherwise be required under the 2023 Plan.

Pay

Versus Performance

| |

|

|

|

|

|

| Year |

Summary

Compensation

Table Total for PEO

($)

|

Compensation

actually paid to

PEO

($)

|

Average

Summary

compensation table

total for non-PEO

named executive

officers

($)

|

Compensation

actually paid to

non-PEO named

officers

($)

|

Net

Income

($)

|

| 2022 |

327,306 |

327,306 |

Not

applicable |

Not

applicable |

101,000 |

| 2021 |

285,334 |

285,334 |

Not

applicable |

Not

applicable |

409,000 |

The

Company’s principle executive officer, David L. Klenk, currently also serves as the Company’s chief financial officer.

There are no other Named Executive Officers of the Company. The compensation actually paid to Mr. Klenk in 2022 and 2021 is the

same as the amount appearing in the Summary Compensation Table. There were no defined benefit plans or actuarial pension plans

covering the principle executive officer in 2022 or 2021. In addition, there were no equity awards granted to Mr. Klenk in 2022

or 2021 and no equity awards from prior years that first vested in either 2022 or 2021.

DIRECTOR

COMPENSATION

Compensation

Summary

The

following table summarizes information concerning the compensation awarded or paid to, or earned by, the Company’s

non-employee directors during 2022. Directors who are not employees of the Company received $2,000 per Board meeting. The Chairman

of the Board of Directors received $17,500 per year for his service on the Board. The Audit Committee Chair, Compensation Committee

Chair, and Nominating Committee Chair received $8,750 per year and each other Audit Committee member, Compensation Committee member,

and Nominating Committee member received $4,000 per year for their service on each committee. Directors may receive additional

amounts for special committee or other Board work as determined by the Board.

Director

Compensation Table

| Director

Name |

Fees

earned

or paid in

cash ($) |

| Joseph

A. Marino |

47,500 |

| Scott

A. Gabbard |

30,750 |

| Jeffrey

D. Peterson |

22,000 |

| Michael

C. Zipoy |

39,500 |

At

December 31, 2022, Messrs. Gabbard. Marino, Peterson, and Zipoy each had 50,000 shares in stock option grants outstanding. These

options were granted prior to 2022.

RATIFICATION

OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Proposal

#3

The

Company’s Board retained Boulay PLLP as its principal independent registered public accounting firm for the year ended December 31,

2022 and has selected Boulay PLLP to serve as the Company’s independent registered public accounting firm for the year ending

December 31, 2023. The Board desires that the selection of this independent registered public accounting firm be submitted

to the shareholders for ratification, which ratification requires the affirmative vote of the holders of a majority of the shares

of Common Stock represented at the Annual Meeting in person or by proxy and entitled to vote. If the selection is not ratified,

the Board of Directors will reconsider its decision.

The

Company expects a representative of Boulay PLLP to be present at the Annual Meeting. Any shareholder with a question for Boulay

PLLP should follow the procedure set forth above under the section “Questions at the Annual Meeting.”

DISCLOSURE

OF FEES PAID TO INDEPENDENT AUDITORS

The

following fees were paid to Boulay PLLP in 2022 and 2021:

| | |

2022 | | |

2021 | |

| Audit Fees | |

$ | 80,000 | | |

$ | 74,956 | |

| Audit-Related fees | |

$ | 0 | | |

$ | 0 | |

| Tax Fees | |

$ | 5,995 | | |

$ | 4,205 | |

| All Other Fees | |

$ | 3,555 | | |

$ | 8,440 | |

| Total | |

$ | 89,550 | | |

$ | 87,601 | |

Audit

Fees were for professional services rendered for the audit of the Company’s financial statements and review of the interim

financial statements included in quarterly reports and services in connection with statutory and regulatory filings or engagements.

Audit-Related

Fees consist of the review of, and discussion with, management regarding the treatment of certain accounting matters.

Tax

Fees were for professional services rendered for preparation of the Company’s annual tax return, quarterly estimates,

and state returns. Tax examination consulting is also included.

All

Other Fees represent fees for any professional services not included in the first three categories listed above. Those fees

were approved by the audit committee and related to business development activities.

Under

its Charter, the Audit Committee is required to pre-approve all audit services, as well as all non-audit services performed by

the Company’s independent registered public accounting firm to ensure that the provision of these non-audit services does

not impair the auditor’s independence. Unless a particular service has received general pre-approval by the Audit Committee

in accordance with the Audit Committee’s pre-approval policy, each service provided must be specifically pre-approved. Any

proposed services exceeding pre-approved costs levels will require specific pre-approval by the Audit Committee.

As

part of the Company’s annual engagement agreement with its independent registered public accounting firm, the Audit Committee

pre-approves the following:

| ● | Audit

services to be provided by the independent auditor: statutory and financial audits for

the Company and audit services associated with SEC registration statements, periodic

reports and other documents filed with the SEC, production of other documents issued

by the independent registered public accounting firm in connection with securities offerings

(e.g., comfort letters, consents), and assistance in responding to SEC comment letters. |

| ● | Consulting

services provided by the independent registered public accounting firm related to the

accounting or disclosure treatment of transactions or events and the actual or potential

impact of final or proposed rules, standards or interpretations by the SEC, FASB, or

other regulatory or standard-setting bodies. |

| ● | Specific

non-audit services, primarily tax services. The Audit Committee does not believe that

performance of these tax services impairs the auditor’s independence. The Audit

Committee has given the independent registered public accounting firm pre-approval for

U.S. federal, state, and local tax planning and advice, U.S. federal, state, and local

tax compliance, international tax planning and advice, international tax compliance,

and tax planning and advice related to merger and acquisition activities. The Company’s

independent registered public accounting firm must inform the Audit Committee whenever

it provides pre-approved service. The aggregate amount of fees for these pre-approved

tax services may not exceed $15,000 without additional explicit approval by the Audit

Committee. |

The

term of any pre-approval is 12 months from the date of pre-approval, unless the Audit Committee specifically provides for a different

term. The Audit Committee retains the right to periodically revise the above list of pre-approved services.

REPORT

OF THE AUDIT COMMITTEE

The

Audit Committee of the Board of Directors is comprised of three directors who are independent of the Company and management as

required by the Nasdaq corporate governance listing standards and by SEC rules. The Audit Committee operates under a written charter

adopted by the Board of Directors.

The

Audit Committee oversees the Company’s financial reporting process on behalf of the Board of Directors. Management is responsible

for the Company’s financial statements and the financial reporting process, including implementing and maintaining effective

internal control over financial reporting and for the assessment of, and reporting on, the effectiveness of internal control over

financial reporting. The independent auditors are responsible for expressing an opinion on the conformity of those audited financial

statements with accounting principles generally accepted in the United States.

The

Audit Committee has reviewed and discussed with management and the independent auditors the Company’s audited financial

statements for the year ended December 31, 2022, and discussed with management the effectiveness of the Company’s internal

control over financial reporting as of December 31, 2022 contained in the Company’s Annual Report on Form 10-K for the year

ended December 31, 2022, including a discussion of the reasonableness of significant judgments and the clarity of disclosures

in the financial statements. The Audit Committee also reviewed and discussed with management and the independent auditors the

disclosures made in “Management’s Discussion and Analysis of Financial Condition and Results of Operations”

included in the Company’s 2022 Annual Report to Shareholders and its Annual Report on Form 10-K for the year ended December

31, 2022.

The

Audit Committee has discussed with the independent auditors the matters required to be discussed by Public Company Accounting

Oversight Board (“PCAOB”). In addition, the Audit Committee has discussed with the independent auditors the auditor’s

independence from the Company and its management, including the matters in the written disclosures and the letter provided by

the independent auditors to the Audit Committee as required by applicable requirements of the PCAOB regarding the independent

auditor’s communications with the Audit Committee concerning independence, and has considered the compatibility of non-audit

services with the auditor’s independence.

The

Committee discussed with the Company’s independent auditors the overall scope and plans for their integrated audit. The

Committee meets with the independent auditors, with and without management present, to discuss the results of their examinations,

their evaluations of the Company’s internal controls and the overall quality of the Company’s financial reporting.

Based

on the reviews and discussions referred to above, the Audit Committee recommended to the Board of Directors, and the Board has

approved, that the audited financial statements for the year ended December 31, 2022 be included in the Company’s Annual

Report on Form 10-K for the year ended December 31, 2022 for filing with the SEC.

Audit

Committee

Scott

A. Gabbard, Chair

Joseph

A. Marino

Michael

C. Zipoy

OTHER

MATTERS

The

Board of Directors knows of no other matters to be brought before the Annual Meeting. However, if any other matters are properly

brought before the Annual Meeting, it is the intention of the persons named in the accompanying proxy to vote in accordance with

their judgment on these matters.

SHAREHOLDER

PROPOSALS

Shareholder

proposals for the proxy statement for the 2024 Annual Meeting of Shareholders of the Company must be received no later than November

18, 2023 at the Company’s principal executive offices, 6111 Blue Circle Drive, Minnetonka, Minnesota 55343, directed

to the attention of the Chairman of the Audit Committee, or the Chairman of the Nominating Committee if the proposal relates to

the nomination of a director, in order to be considered by the Board of Directors for inclusion in next year’s Annual Meeting

proxy materials under the SEC’s proxy rules.

Also,

if a shareholder proposal intended to be presented at the next Annual Meeting but not included in the Company’s proxy statement

and proxy is received by the Company after February 1, 2024, then management named in the Company’s proxy form for

the next Annual Meeting will have discretionary authority to vote shares represented by such proxies on the shareholder proposal,

if presented at the meeting, without including information about the proposal in the Company’s proxy material.

FORM

10-K

A

copy of the Company’s Annual Report to the Securities and Exchange Commission on Form 10-K for the fiscal year ended December

31, 2022 has been provided with this Proxy Statement. The Company will furnish to any shareholder, upon written request, any exhibit

described in the list accompanying the Form 10-K upon the payment, in advance, of reasonable fees related to the Company’s

furnishing such exhibits(s). Any such request should include a representation that the shareholder was the beneficial owner of

shares of Electro-Sensors Common Stock on February 28, 2023, the record date for the 2023 Annual Meeting, and should be directed

to Mr. David Klenk, Chief Executive Officer, at the Company’s principal address.

The

foregoing Notice of Annual Meeting and Proxy Statement are sent by order of the Board of Directors.

David

L. Klenk

President

March

17, 2023

| |

|

|

ELECTRO-SENSORS, INC.

6111 BLUE CIRCLE DRIVE

MINNETONKA, MN 55343-9108 |

|

VOTE BY INTERNET - www.proxyvote.com

or scan the QR Barcode above

Use the Internet to transmit your voting instructions

and for electronic delivery of information up until 11:59 p.m. Eastern Time the day before the cut-off date or meeting date.

Have your proxy card in hand when you access the web site and follow the instructions to obtain your records and to create

an electronic voting instruction form. During The Meeting - Go to www.virtualshareholdermeeting.com/ELSE2023

You may attend the meeting via the Internet and vote during the meeting. Have the information that is printed in the

box marked by the arrow available and follow the instructions. |

| |

|

VOTE BY PHONE - 1-800-690-6903 |

| |

|

Use any touch-tone telephone to transmit your

voting instructions up until 11:59 p.m. Eastern Time the day before the cut-off date or meeting date. Have your proxy card

in hand when you call and then follow the instructions. |

| |

|

VOTE BY MAIL |

| |

|

Mark, sign and date your proxy card and return it in the postage-paid envelope we have provided or return it to Vote Processing,

c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717. |

| TO VOTE, MARK BLOCKS BELOW IN BLUE OR BLACK INK AS FOLLOWS: |

KEEP THIS PORTION FOR YOUR RECORDS |

| |

THIS

PROXY CARD IS VALID ONLY WHEN SIGNED AND DATED. |

DETACH AND RETURN THIS PORTION ONLY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

For |

Withhold |

For All |

|

To withhold authority to vote for any individual nominee(s), mark “For All Except” and write the number(s) of

the nominee(s) on the line below. |

|

|

|

|

|

|

| |

|

The Board of Directors recommends

you vote FOR

the following: |

All |

All |

Except |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

☐ |

☐ |

☐ |

|

|

|

|

|

|

|

|

| |

|

1. |

To elect five directors to serve until the next

annual meeting of shareholders: |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

Nominees |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

01) Scott A. Gabbard 02)

David L. Klenk 03)

Joseph A. Marino 04)

Jeffrey D. Peterson 05)

Michael C. Zipoy |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

The Board of Directors recommends you vote FOR proposals 2 and 3. |

|

|

|

For |

Against |

Abstain |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

2. |

To set the number of directors at five. |

|

☐ |

☐ |

☐ |

|

|

| |

|

|

|

|

|

|

|

|

|

| |

|

3. |

To ratify the appointment of Boulay PLLP as Independent Registered Public Accounting Firm for the fiscal year ending December

31, 2023. |

|

☐ |

☐ |

☐ |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

NOTE: To transact such other business as may properly come before the meeting or any adjournment.

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Please sign exactly as your name(s) appear(s) hereon. When signing as attorney, executor, administrator, or other fiduciary,

please give full title as such. Joint owners should each sign personally. All holders must sign. If a corporation or partnership,

please sign in full corporate or partnership name by authorized officer. |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Signature [PLEASE SIGN WITHIN BOX] |

|

Date |

|

|

|

|

|

Signature (Joint Owners) |

Date |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0000590404_1 R1.0.0.6

Important

Notice Regarding the Availability of Proxy Materials for the Annual Meeting:

The Proxy Statement, Form of Proxy, and Annual Report on Form 10-K are available at

http://www.idelivercommunications.com/proxy/else

| |

ELECTRO-SENSORS, INC.

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS

PROXY FOR ANNUAL MEETING

April 27, 2023

|

|

| |

The undersigned

hereby appoints DAVID L. KLENK, with full power of substitution, as his or her Proxy to represent and vote, as designated

below, all shares of the Common Stock of Electro-Sensors, Inc. registered in the name of the undersigned at the Annual Meeting

of Shareholders of the Company to be held at 2:00 p.m. Central time, on April 27, 2023 at www.virtualshareholdermeeting.com/ELSE2023,

and at any adjournment thereof. The undersigned hereby revokes all proxies previously granted with respect to this meeting. |

|

| |

|

|

| |

THIS PROXY WHEN PROPERLY EXECUTED WILL BE VOTED

AS DIRECTED OR, IF NO DIRECTION IS GIVEN FOR A PARTICULAR PROPOSAL, WILL BE VOTED FOR SUCH PROPOSAL AND FOR THE ELECTION OF

EACH DIRECTOR. |

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

Continued and to

be signed on reverse side |

|

| |

|

|

0000590404_2

R1.0.0.6

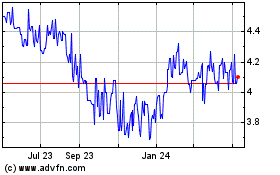

Electro Sensors (NASDAQ:ELSE)

Historical Stock Chart

From Jan 2025 to Feb 2025

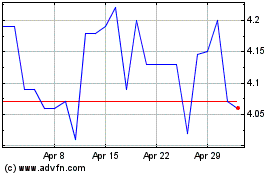

Electro Sensors (NASDAQ:ELSE)

Historical Stock Chart

From Feb 2024 to Feb 2025