UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the Month of August 2009

_______________________

Commission File Number

000-28998

ELBIT SYSTEMS LTD.

(Translation of Registrant’s Name into English)

Advanced Technology Center, P.O.B. 539, Haifa 31053, Israel

(Address of Principal Corporate Offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form

40-F:

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule

101(b)(1):

o

Note

: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely

to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

o

Note

: Regulation S-T Rule 101(b)(7) only permits the submission in

paper of a Form 6-K submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to

be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

Indicate by check mark whether the registrant by furnishing the information contained in this form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934:

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82-______________

Attached hereto as Exhibit 1 and incorporated herein by reference is the Registrant’s press release dated August 12, 2009.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

ELBIT SYSTEMS LTD.

(Registrant)

By:

/s/ Ronit Zmiri

Name: Ronit Zmiri

Title: Corporate Secretary

|

Dated: August 13, 2009

EXHIBIT INDEX

|

Exhibit No.

|

Description

|

|

1.

|

Press Release dated August 12, 2009

|

Exhibit 1

ELBIT SYSTEMS REPORTS

SECOND QUARTER 2009 RESULTS

Revenues increased by 11.5% YoY to $728.3 million;

Net income increased by 91.7% YoY to $59.7 million;

Diluted net earnings per share increased to $1.39

Haifa, Israel, August 12, 2009 – Elbit Systems Ltd. (the “Company”) (NASDAQ: ESLT, TASE: ESLT)

, the international defense electronics company, today reported its consolidated financial results for the second quarter ended June 30, 2009.

Revenues

increased by 11.5% to $728.3 million in the second quarter of 2009, as compared to $653.2 million in the second quarter of 2008. This increase was primarily due to an increase in revenues from C4ISR systems as a result of increased sales of communication equipment and unmanned air vehicle systems mainly in Israel, and was partly offset by a reduction in land systems

related equipment sales, mainly in the U.S.

Gross profit

increased by 7.2% to $211.9 million (29.1% of revenues) in the second quarter of 2009, as compared with gross profit of $197.7 million (30.3% of revenues) in the second quarter of 2008. The lower gross profit percentage primarily resulted from a significant reduction in revenues from short turn-around orders, mainly in the U.S. during the second quarter of 2009 as

compared to the second quarter of 2008. Short turn-around orders generally have contributed to improvement in overall gross margins.

Net research and development (“R&D”) expenses

were $53.0 million (7.3% of revenues) in the second quarter of 2009, as compared to $38.1 million (5.8% of revenues) in the second quarter of 2008. The higher level of R&D expenses in the current quarter reflects increased spending on R&D projects to maintain and further advance the Company’s

technologies, in accordance with its long-term plans.

Marketing and selling expenses

were $67.5 million (9.3% of revenues) in the second quarter of 2009, as compared to $55.2 million (8.4% of revenues) in the second quarter of 2008. The increase in marketing and selling expenses was due to increased marketing activities in pursuit of business opportunities in the U.S. and other international markets.

General and administrative (“G&A”) expenses

were $29.4 million (4.0% of revenues) in the second quarter of 2009, as compared to $44.4 million (6.8% of revenues) in the second quarter of 2008. The decrease in G&A expense reflects the Company’s continued focus on efficiency and cost reduction efforts. Also, the second quarter 2008 expenses included

expenses related to a legal settlement of a subsidiary in the U.S.

Net financial income

was $11.4 million in the second quarter of 2009, as compared to net financial expenses of $12.4 million in the second quarter of 2008. The net financial income was mainly due to the Company’s hedging activity, which reduced the Company’s exposure to changes in the value of U.S. Dollar versus the Israeli Shekel. While the weakening of the U.S.

Dollar against the Israeli Shekel negatively impacted the Company’s gross and operating income, it increased the value of the Company’s currency hedge derivatives in Israeli Shekels.

Taxes on income

were $14.0 million (effective tax rate of 19.3%) in the second quarter of 2009, as compared to taxes on income of $3.8 million (effective tax rate of 7.9%) in the second quarter of 2008. The change in the effective tax rate was attributable mainly to the mix of the tax rates in the various jurisdictions in which the Company’s entities generate taxable

income.

Net income attributable to non-controlling interests

was $2.5 million in the second quarter of 2009, as compared to $16.2 million in the second quarter of 2008. The decrease in net income attributable to non-controlling interests was mainly a result of the Company’s purchase during the second quarter of 2009 of the remaining 49% of Kinetics shares not then owned by the

Company.

Net income attributable to the Company’s ordinary shareholders

increased by 91.7% to $59.7 million (8.2% of revenues) for the second quarter of 2009, as compared with $31.2 million (4.8% of revenues) in the second quarter of 2008.

It should also be noted that according to SFAS No. 160, which is applicable to the Company’s results starting from the beginning of 2009, consolidated net income attributable to the Company’s ordinary shareholders is calculated after eliminating net income or loss attributable to non-controlling interests.

Diluted net earnings per share

attributable to the Company’s

ordinary shareholders

were $1.39 for the second quarter of 2009, as compared with $0.73 for the second quarter of 2008, an increase of 90.4%.

The Company’s backlog of orders

totaled $5,096 million as of June 30, 2009, as compared with $5,030 million as of December 31, 2008. Approximately 66% of the current backlog is due to orders from outside Israel. Approximately 69% of the current backlog is scheduled to be performed during the second half of 2009 and 2010.

Operating cash flow

was $93.6 million in the first half of 2009, as compared to $129.8 million in the first half of 2008. The decrease in the operating cash flow was mainly a result of a reduction in the overall amount of advances received from customers.

Recent Events:

The following events occurred subsequent to the announcement of the financial results for the quarter ended March 31, 2009. Each event is described in greater detail in the separate announcements made for each such event.

On June 1, 2009, together with Alliant Techsystems (ATK), the Company successfully conducted flight tests of the Guided Advanced Tactical Rocket (GATR) from a helicopter using a “lock-on before launch” method to engage an off-boresight target. ATK and Elbit Systems validated flight worthiness, safe separation launch and autonomous laser designated guided flight through a series of

tests.

On June 15, 2009, together with Sikorsky Aircraft Corp., the Company successfully completed the test phase for the Armed Black Hawk helicopter. The demonstrator configuration includes the Company’s cockpit displays, a Mission Management system with Digital Map, Forward-Looking Infrared (FLIR) equipment and ANVIS/HUD® helmet systems.

On June 15, 2009, the Company invested $18 million in Mikal Ltd. in the form of a loan, which following receipt of applicable government approvals will be converted into shares of Mikal’s capital stock representing approximately 19% of Mikal’s shares, and the Company will have an option to purchase all of the remaining shares of Mikal from its shareholders at a valuation to be determined by an

independent appraisal. The Mikal group is engaged in the fields of artillery, armored fighting vehicles and optronics.

On June 16, 2009, Vision Systems International, LLC (VSI), the Company’s joint venture with Rockwell Collins, received several new contracts worth more than $54.1 million from Lockheed Martin Corporation, for the delivery of 52 F-35 Helmet Mounted Displays and 30 additional aircraft systems. VSI also received initial funding for the Pilot Fit Facility Standup at Eglin Air Force Base for the F-35

Helmet Mounted Display System program.

On June 25, 2009, the Israeli Ministry of Transportation awarded the Company a $76 million contract for C-MUSIC, a commercial multi-spectral infrared countermeasure system. C-MUSIC is a direct infra-red countermeasure technology for military and commercial aircraft and helicopters that disrupts missiles fired at aircraft and causes them to veer off course.

On July 7, 2009, the Company was awarded a contract by the Israeli Ministry of Defense for the operation and maintenance of the Israeli Air Force’s new trainer, the Beechcraft T-6 “Effroni”.

On July 15, 2009, the Company was awarded a $55 million contract from the Israeli Ministry of Defense for the establishment of a mission training center for the Israeli Air Force’s F-16 pilots. The center will be operated through a Private Financing Initiative concept and will include a development phase as well as instruction and maintenance services over a 15-year period.

On July 20, 2009, the Company signed a contract to purchase all of BVR Systems (1998) Ltd.’s assets for $34 million, which may be subject to adjustment depending on the outcome of various conditions in the coming months. The closing of the transaction is subject to the fulfillment of certain conditions including receipt of all approvals required by law. BVR Systems is engaged in the area of

development and production of training, simulation and debriefing systems for air, sea and ground forces.

On August 11, 2009, Yael Efron was elected by the Company’s shareholders to a three-year term as an External Director on the Company’s Board of Directors. Mrs. Efron replaces Yaacov Lifshitz, whose second term as an External Director has expired.

Management Comment

:

The President and CEO of Elbit Systems, Joseph Ackerman, commented: “We are pleased to report another strong quarter, with improved financial performance. This improvement in profitability and reduction in general expenses attests to the success of our efficiency processes and to the creation of synergies between the Company’s

business units.”

Ackerman added: “We have made significant investments in developing new markets while enhancing the potential in existing key markets, such as our recent joint venture with General Dynamics aimed at capturing the great potential of the UAV market in the U.S. In addition, consistent with our long-term M&A strategy, we recently entered into agreements to acquire interests in Mikal and BVR. These

acquisitions will contribute to the Company’s growth and support our continued participation in large-scale projects that offer our customers more comprehensive and advanced solutions.”

“We also continue to pursue our R&D strategy in order to maintain our technological edge. The Israeli Ministry of Transportation’s recent decision to equip all of the Israeli commercial aviation fleets with C-MUSIC systems, which we developed for protection from enemy missiles, represents a successful example of our R&D strategy. We see market potential for installation of C-MUSIC

systems aboard the commercial aircraft fleets of other countries as well.”

“We believe all of these measures will help maintain the Company’s continued growth.”

Dividend

:

The Board of Directors declared a dividend of $0.36 per share for the second quarterof 2009. The dividend’s record date is August 30, 2009, and the dividend will be paid on September 15, 2009, net of taxes and levies, at the rate of 16.03%.

The Company will also be hosting a conference call today, Wednesday, August 12, 2009 at 9:00am ET. On the call, management will review and discuss the Company’s second quarter 2009 results and will be available to answer questions.

To participate, please call one of the teleconferencing numbers that follow. Please begin placing your calls at least 10 minutes before the conference call commences. If you are unable to connect using the toll-free numbers, please try the international dial-in number.

US Dial-in Numbers: 1 866 345 5855

UK Dial-in Number: 0 800 404 8418

ISRAEL Dial-in Number: 03 918 0609

INTERNATIONAL Dial-in Number: +972 3 918 0609

at:

9:00am Eastern Time; 6:00am Pacific Time; 2:00pm UK Time; 4:00pm Israel Time

This call will also be broadcast live on Elbit Systems’ web-site at

http://www.elbitsystems.com

. An online replay will be available from 24 hours after the call ends.

Alternatively, for two days following the end of the call, investors will be able to dial a replay number to listen to the call. The dial-in numbers are:

1 888 269 0005 (US)

or

+972 3 925 5951

(Israel and International)

.

About Elbit Systems Ltd.

Elbit Systems Ltd. Is an international defense electronics company engaged in a wide range of defense-related programs throughout the world. The Company, which includes Elbit Systems and its subsidiaries, operates in the areas of aerospace, land and naval systems, command, control, communications, computers, intelligence surveillance and reconnaissance (“C4ISR”), unmanned air vehicle (UAV)

systems, advanced electro-optics, electro-optic space systems, EW suites, airborne warning systems, ELINT systems, data links and military communications systems and radios. The Company also focuses on the upgrade of existing military platforms and the development new technologies for defense, homeland security and commercial aviation applications.

Attachments:

Consolidated balance sheet

Consolidated statements of income

Condense consolidated statements of cash flow

Consolidated revenue distribution by areas of operation and by geographical regions

|

Company Contact:

|

IR Contact:

|

|

|

|

|

Joseph Gaspar, Executive VP & CFO

|

Ehud Helft / Kenny Green

|

|

Dalia Rosen, Head of Corporate Communications

|

|

|

Elbit Systems Ltd.

|

GK Investor Relations

|

|

Tel: +972-4 831-6663

Fax: +972-4-831-6944

|

Tel: 1 646 201 9246

|

|

E-mail:

|

j.gaspar@elbitsystems.com

dalia.rosen@elbitsystems.com

|

E-mail:

|

info@gkir.com

|

This press release contains forward-looking statements (within the meaning of Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended) regarding Elbit Systems Ltd. And/or its subsidiaries (collectively the Company), to the extent such statements do not relate to historical or current fact. Forward Looking Statements are based on

management’s expectations, estimates, projections and assumptions. Forward-looking statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, as amended. These statements are not guarantees of future performance and involve certain risks and uncertainties, which are difficult to predict. Therefore, actual future results, performance and trends may differ materially from these forward-looking statements due to a variety of

factors, including, without limitation: scope and length of customer contracts; governmental regulations and approvals; changes in governmental budgeting priorities; general market, political and economic conditions in the countries in which the Company operates or sells, including Israel and the United States among others; differences in anticipated and actual program performance, including the ability to perform under long-term fixed-price contracts; and the outcome of legal and/or

regulatory proceedings. The factors listed above are not all-inclusive, and further information is contained in Elbit Systems Ltd.’s latest annual report on Form 20-F, which is on file with the U.S. Securities and Exchange Commission. All forward-looking statements speak only as of the date of this release. The Company does not undertake to update its forward-looking statements.

(FINANCIAL TABLES TO FOLLOW)

ELBIT SYSTEMS LTD.

CONSOLIDATED BALANCE SHEETS

(In thousands of US Dollars)

|

|

|

June 30

|

|

December 31

|

|

|

|

|

2009

|

|

2008

|

|

|

|

|

Unaudited

|

|

Audited

|

|

|

Assets

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current assets:

|

|

|

|

|

|

|

Cash and Cash equivalents

|

|

174,361

|

|

204,670

|

|

|

Short term bank deposits

|

|

90,410

|

|

69,642

|

|

|

Available for sale marketable securities

|

|

28,355

|

|

3,731

|

|

|

Trade receivables, net

|

|

482,378

|

|

477,010

|

|

|

Other receivables and pre-paid expenses

|

|

175,689

|

|

203,990

|

|

|

Inventories, net of advances

|

|

626,097

|

|

644,107

|

|

|

Total current assets

|

|

1,577,290

|

|

1,603,150

|

|

|

|

|

|

|

|

|

|

Investment in affiliated companies and a partnership

|

|

66,893

|

|

62,300

|

|

|

Long-term deposits and marketable securities

|

|

51,219

|

|

34,355

|

|

|

Long-term receivables

|

|

7,821

|

|

6,390

|

|

|

Deferred income taxes

|

|

6,538

|

|

9,201

|

|

|

Severance pay fund

|

|

248,728

|

|

236,928

|

|

|

|

|

381,199

|

|

349,174

|

|

|

|

|

|

|

|

|

|

Property and equipment, net

|

|

391,880

|

|

384,086

|

|

|

Goodwill and other intangible assets, net

|

|

590,820

|

|

594,283

|

|

|

Total assets

|

|

2,941,189

|

|

2,930,693

|

|

|

|

|

|

|

|

|

|

Liabilities and Shareholders’ Equity

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Short-term bank credit and loans

|

|

1,027

|

|

15,413

|

|

|

Trade payables

|

|

291,040

|

|

340,315

|

|

|

Other payables and accrued expenses

|

|

527,594

|

|

468,224

|

|

|

Advances from customers, net

|

|

383,405

|

|

489,192

|

|

|

|

|

1,203,066

|

|

1,313,144

|

|

|

|

|

|

|

|

|

|

Long-term loans

|

|

431,455

|

|

269,760

|

|

|

Accrued termination liability

|

|

336,054

|

|

332,236

|

|

|

Deferred income taxes

|

|

68,430

|

|

70,068

|

|

|

Advances from customers

|

|

111,499

|

|

115,470

|

|

|

Other long-term liabilities

|

|

32,129

|

|

29,707

|

|

|

|

|

979,567

|

|

817,241

|

|

|

|

|

|

|

|

|

|

Elbit Systems Ltd.’s shareholders’ equity

|

|

738,127

|

|

723,833

|

|

|

Non-controlling interests

(*)

|

|

20,429

|

|

76,475

|

|

|

Total shareholders’ equity

|

|

758,556

|

|

800,308

|

|

|

Total liabilities and shareholders’ equity

|

|

2,941,189

|

|

2,930,693

|

|

|

|

|

|

|

|

|

|

|

(*)

The Company has adopted SFAS No. 160, “Non-controlling Interests in Consolidated Financial Statements, an amendment to ARB No. 51,” as of January 1, 2009. Pursuant to SFAS No. 160, net income attributable to non-controlling interests is presented in the statement of income as part of consolidated net income and then shown on a separate line item as a

reduction to arrive at net income attributable to Elbit Systems Ltd., which is the equivalent of “net income” presented in previous statements of income. Cumulative net income attributable to non-controlling interests is presented on the balance sheets as part of total shareholders’ equity and is else shown on a separate line item. Total shareholders equity ,net of the comulative net income attributable to non-controling interests,represents the shareholders’

equity attributable to the company’s ordinary shareholders equity,which is the equivalent of “shareholders equity” presented in previous balance sheets.

ELBIT SYSTEMS LTD.

CONSOLIDATED STATEMENTS OF INCOME

(In thousands of US Dollars, except for share and per share amounts)

|

|

|

Six Months Ended

June 30

|

|

Three Months Ended

June 30

|

|

Year Ended

December 31

|

|

|

|

|

2009

|

|

2008

|

|

2009

|

|

2008

|

|

2008

|

|

|

|

|

Unaudited

|

|

Audited

|

|

|

Revenues

|

|

1,385,221

|

|

1,269,230

|

|

728,289

|

|

653,167

|

|

2,638,271

|

|

|

Cost of revenues

|

|

965,084

|

|

902,635

|

|

516,420

|

|

455,494

|

|

1,870,830

|

|

|

Gross profit

|

|

420,137

|

|

366,595

|

|

211,869

|

|

197,673

|

|

767,441

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development, net

|

|

98,888

|

|

76,124

|

|

53,008

|

|

38,089

|

|

184,984

|

|

|

Marketing and selling

|

|

124,465

|

|

106,059

|

|

67,549

|

|

55,153

|

|

198,274

|

|

|

General and administrative

|

|

58,286

|

|

75,924

|

|

29,398

|

|

44,448

|

|

134,182

|

|

|

Acquired IPR&D

|

|

—

|

|

—

|

|

—

|

|

—

|

|

1,000

|

|

|

Total operating expenses

|

|

281,639

|

|

258,107

|

|

149,955

|

|

137,690

|

|

518,440

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income

|

|

138,498

|

|

108,488

|

|

61,914

|

|

59,983

|

|

249,001

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Financial income (expenses), net

|

|

(7,602

|

)

|

(16,973

|

)

|

11,437

|

|

(12,373

|

)

|

(36,815

|

)

|

|

Other income (expenses), net

|

|

(646

|

)

|

4,213

|

|

(551

|

)

|

117

|

|

94,294

|

|

|

Income before taxes on income

|

|

130,250

|

|

95,728

|

|

72,800

|

|

47,727

|

|

306,480

|

|

|

Taxes on income

|

|

26,248

|

|

11,684

|

|

14,036

|

|

3,762

|

|

54,367

|

|

|

|

|

104,002

|

|

84,044

|

|

58,764

|

|

43,965

|

|

252,113

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Equity in net earnings of affiliated

companies and partnership

|

|

8,193

|

|

5,946

|

|

3,417

|

|

3,382

|

|

14,435

|

|

|

Consolidated net income

|

|

112,195

|

|

89,990

|

|

62,181

|

|

47,347

|

|

266,548

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Less: net income attributable to

non-controlling interests

(*)

|

|

(9,221

|

)

|

(26,682

|

)

|

(2,461

|

)

|

(16,191

|

)

|

(62,372

|

)

|

|

Net income attributable to Elbit Systems Ltd.

|

|

102,974

|

|

63,308

|

|

59,720

|

|

31,156

|

|

204,176

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings per share attributable to

Elbit Systems Ltd.’s Ordinary shareholders:

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic net earnings per share

|

|

2.44

|

|

1.50

|

|

1.42

|

|

0.74

|

|

4.85

|

|

|

Diluted net earnings per share

|

|

2.41

|

|

1.48

|

|

1.39

|

|

0.73

|

|

4.78

|

|

|

Weighted average number of shares used in computation of basic earnings per share

|

|

42,149

|

|

42,071

|

|

42,200

|

|

42,074

|

|

42,075

|

|

|

Weighted average number of shares used in computation of diluted earnings per share

|

|

42,729

|

|

42,876

|

|

42,924

|

|

42,867

|

|

42,758

|

|

(*)

The Company has adopted SFAS No. 160, “Non-controlling Interests in Consolidated Financial Statements, an amendment to ARB No. 51,” as of January 1, 2009. Pursuant to SFAS No. 160, net income attributable to non-controlling interests is presented in the statement of income as part of consolidated net income and then shown on a separate line item as a reduction to

arrive at net income attributable to Elbit Systems Ltd., which is the equivalent of “net income” presented in previous statements of income. Cumulative net income attributable to non-controlling interests is presented on the balance sheets as part of total shareholders’ equity and is else shown on a separate line item. Total shareholders equity ,net of the comulative net income attributable to non-controling interests,represents the shareholders’ equity

attributable to the company’s ordinary shareholders equity,which is the equivalent of “shareholders equity” presented in previous balance sheets.

ELBIT SYSTEMS LTD.

CONSOLIDATED STATEMENTS OF CASH FLOW

(In thousands of US Dollars)

|

|

|

Six Months Ended

June 30,

|

|

Year Ended

December 31,

|

|

|

|

|

2009

|

|

2008

|

|

2008

|

|

|

|

|

Unaudited

|

|

Audited

|

|

|

CASH FLOWS FROM OPERATING ACTIVITIES

|

|

|

|

|

|

|

|

|

Net income

|

|

102,974

|

|

63,308

|

|

204,176

|

|

|

Adjustments to reconcile net income to net cash provided by operating activities:

|

|

|

|

|

|

|

|

|

Depreciation and amortization

|

|

63,196

|

|

60,832

|

|

129,437

|

|

|

Write-off impairment

|

|

—

|

|

—

|

|

10,514

|

|

|

Acquired IPR&D

|

|

—

|

|

—

|

|

1,000

|

|

|

Other-than-temporary impairment of available for sale marketable securities

|

|

—

|

|

2,964

|

|

17,885

|

|

|

Stock based compensation

|

|

2,563

|

|

2,569

|

|

5,067

|

|

|

Deferred income taxes and reserve

|

|

(4,321

|

)

|

(4,293

|

)

|

(8,488

|

)

|

|

Severance, pension and termination indemnities, net

|

|

(8,900

|

)

|

15,787

|

|

15,211

|

|

|

Gain on sale of investments

|

|

208

|

|

1,165

|

|

(100,031

|

)

|

|

Minority interests in earnings (loss) of subsidiaries

|

|

9,221

|

|

26,682

|

|

62,372

|

|

|

Equity in net losses (earnings) of affiliated companies and partnership,

net of dividend received (*)

|

|

(1,630

|

)

|

1,001

|

|

(1,866

|

)

|

|

Changes in operating assets and liabilities:

|

|

|

|

|

|

|

|

|

Decrease (increase) in short and long-term receivables and prepaid expenses

|

|

17,103

|

|

(2,781

|

)

|

(39,698

|

)

|

|

Decrease (increase) in inventories, net

|

|

10,672

|

|

(137,052

|

)

|

(169,482

|

)

|

|

Increase in trade payables, other payables and accrued expenses

|

|

4,046

|

|

139,474

|

|

120,734

|

|

|

Decrease in advances received from customers

|

|

(101,543

|

)

|

(40,273

|

)

|

(37,403

|

)

|

|

Other adjustments

|

|

—

|

|

430

|

|

—

|

|

|

Net cash provided by operating activities

|

|

93,589

|

|

129,813

|

|

209,428

|

|

|

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM INVESTING ACTIVITIES

|

|

|

|

|

|

|

|

|

Purchase of property, plant and equipment

|

|

(47,065

|

)

|

(64,923

|

)

|

(129,241

|

)

|

|

Acquisition of a subsidiary (Schedule A)

|

|

(124,033

|

)

|

(2,685

|

)

|

(20,637

|

)

|

|

Investments in affiliated companies

|

|

(2,552

|

)

|

(602

|

)

|

(4,001

|

)

|

|

Proceeds from sale of property, plant and equipment

|

|

4,240

|

|

3,252

|

|

8,779

|

|

|

Proceeds from sale of investment

|

|

—

|

|

—

|

|

50,254

|

|

|

Investment in short-term and long-term bank deposits, net

|

|

(57,541

|

)

|

(26,741

|

)

|

(76,861

|

)

|

|

Net cash used in investing activities

|

|

(226,951

|

)

|

(91,699

|

)

|

(171,707

|

)

|

|

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM FINANCING ACTIVITIES

|

|

|

|

|

|

|

|

|

Proceeds from exercise of options

|

|

5,692

|

|

209

|

|

188

|

|

|

Repayment of long-term bank loans

|

|

(20,113

|

)

|

(63,969

|

)

|

(333,590

|

)

|

|

Receipt of long-term bank loans

|

|

170,167

|

|

83,561

|

|

183,211

|

|

|

Dividends paid

|

|

(45,839

|

)

|

(15,226

|

)

|

(32,770

|

)

|

|

Tax benefit in respect of options exercised

|

|

—

|

|

—

|

|

116

|

|

|

Change in short-term bank credit and loans, net

|

|

(6,854

|

)

|

(10,396

|

)

|

(13,008

|

)

|

|

Net cash provided by (used in) financing activities

|

|

103,053

|

|

(5,821

|

)

|

(195,853

|

)

|

|

|

|

|

|

|

|

|

|

|

NET INCREASE (DECREASE) IN CASH AND CASH EQUIVALENTS

|

|

(30,309

|

)

|

32,293

|

|

(158,132

|

)

|

|

CASH AND CASH EQUIVALENTS AT THE BEGINNING OF THE PERIOD

|

|

204,670

|

|

362,802

|

|

362,802

|

|

|

CASH AND CASH EQUIVALENTS AT THE END OF THE PERIOD

|

|

174,361

|

|

395,095

|

|

204,670

|

|

|

* Dividend received

|

|

7,324

|

|

6,947

|

|

12,569

|

|

ELBIT SYSTEMS LTD.

DISTRIBUTION OF REVENUES

Consolidated revenue by areas of operation:

|

|

|

Six Months Ended

|

|

Three Months Ended

|

|

|

|

|

June 30

|

|

June 30

|

|

|

|

|

2009

|

|

2008

|

|

2009

|

|

2008

|

|

|

|

|

$ millions

|

|

%

|

|

$ millions

|

|

%

|

|

$ millions

|

|

%

|

|

$ millions

|

|

%

|

|

|

Airborne systems

|

|

346.5

|

|

25.0

|

|

312.8

|

|

24.6

|

|

173.7

|

|

23.8

|

|

157.6

|

|

24.1

|

|

|

Land systems

|

|

252.2

|

|

18.2

|

|

309.4

|

|

24.4

|

|

110.3

|

|

15.2

|

|

153.4

|

|

23.5

|

|

|

C4ISR systems

|

|

530.1

|

|

38.3

|

|

416.5

|

|

32.8

|

|

300.0

|

|

41.2

|

|

234.6

|

|

36.0

|

|

|

Electro-optics

|

|

190.4

|

|

13.7

|

|

161.5

|

|

12.7

|

|

107.7

|

|

14.8

|

|

73.4

|

|

11.2

|

|

|

Other (mainly non-defense engineering and production services)

|

|

66.0

|

|

4.8

|

|

69.0

|

|

5.5

|

|

36.6

|

|

5.0

|

|

34.2

|

|

5.2

|

|

|

Total

|

|

1,385.2

|

|

100.0

|

|

1,269.2

|

|

100.0

|

|

728.3

|

|

100.0

|

|

653.2

|

|

100.0

|

|

Consolidated revenues by geographical regions:

|

|

|

Six Months Ended

|

|

Three Months Ended

|

|

|

|

|

June 30

|

|

June 30

|

|

|

|

|

2009

|

|

2008

|

|

2009

|

|

2008

|

|

|

|

|

$ millions

|

|

%

|

|

$ millions

|

|

%

|

|

$ millions

|

|

%

|

|

$ millions

|

|

%

|

|

|

Israel

|

|

300.8

|

|

21.7

|

|

226.8

|

|

17.9

|

|

176.3

|

|

24.2

|

|

103.7

|

|

15.9

|

|

|

United States

|

|

393.5

|

|

28.4

|

|

432.8

|

|

34.1

|

|

182.7

|

|

25.1

|

|

217.7

|

|

33.3

|

|

|

Europe

|

|

349.6

|

|

25.3

|

|

336.5

|

|

26.5

|

|

187.4

|

|

25.7

|

|

199.4

|

|

30.5

|

|

|

Other countries

|

|

341.3

|

|

24.6

|

|

273.1

|

|

21.5

|

|

181.9

|

|

25.0

|

|

132.4

|

|

20.3

|

|

|

Total

|

|

1,385.2

|

|

100.0

|

|

1,269.2

|

|

100.0

|

|

728.3

|

|

100.0

|

|

653.2

|

|

100.0

|

|

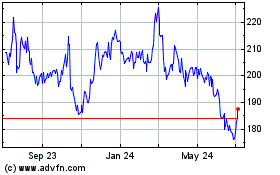

Elbit Systems (NASDAQ:ESLT)

Historical Stock Chart

From Jun 2024 to Jul 2024

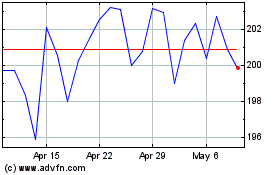

Elbit Systems (NASDAQ:ESLT)

Historical Stock Chart

From Jul 2023 to Jul 2024