false

0001892492

0001892492 2024-09-25

2024-09-25 iso4217:USD

xbrli:shares

iso4217:USD xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date

of Report (Date of earliest event reported): September

25, 2024

| EIGHTCO

HOLDINGS INC.

|

| (Exact

name of registrant as specified in its charter) |

| Delaware |

|

001-41033 |

|

87-2755739 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

101

Larry Holmes Drive

Suite

313

Easton,

PA

18042 |

|

34695 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (888)

765-8933

(Former

name or former address, if changed since last report)

Not

Applicable

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| |

☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

|

| |

☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

|

| |

☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

|

| |

☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, $0.001 par value |

|

OCTO |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

7.01. Regulation FD Disclosure.

On

September 25, 2024, Eightco Holdings Inc. (the “Company”) issued a press release announcing a $100 million revenue forecast

and a 2025 strategic plan. The press release is included as Exhibit 99.1 hereto.

The

information furnished under this Item 7.01, including the exhibit related thereto, shall not be deemed “filed” for purposes

of Section 18 of the Securities Exchange Act of 1934, nor shall it be deemed incorporated by reference in any disclosure document of

the Company, except as shall be expressly set forth by specific reference in such document.

Item

9.01. Financial Statements and Exhibits.

(d)

Exhibits.

| Exhibit

No. |

|

Description |

| 99.1 |

|

Press

release. |

| 104 |

|

Cover

Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| Date:

September 25, 2024 |

|

|

| |

Eightco

Holdings Inc. |

| |

|

|

| |

By: |

/s/

Paul Vassilakos |

| |

Name: |

Paul

Vassilakos |

| |

Title: |

Chief

Executive Officer |

Exhibit

99.1

Eightco

Announces $100 million Revenue Forecast – Releases 2025 Strategic Plan

Improved

Financial Condition Allows Focus on Revenue Growth & Profitability

Easton,

PA, September 25, 2024 (GLOBE NEWSWIRE) – Eightco Holdings Inc. (NASDAQ: OCTO) (the “Company” or “Eightco”)

is pleased to provide an update to its shareholders regarding its achievements year to date and 2025 initiatives.

2024

Achievements

The

Company has made significant progress in 2024 by improving its balance sheet, most notably through the elimination of $5.4 million in

convertible notes and increasing shareholder equity by $23 million. An aggregate of 5,846,627 dilutive shares related to warrants and

convertible securities were cancelled in connection therewith, as well as several one-time accounting events.

Operationally,

during the 6 months ended June 30, 2024:

| ● | Gross

profit margin was increased to 22%, versus 12% in the prior year period; and |

| ● | SG&A

was reduced to $6.9 million, down 23% from $9.0 million in the prior year period |

These

improvements helped the Company regain compliance with two NASDAQ requirements, as was announced yesterday.

2025

Plan

The

Company’s primary focus is the growth of its primary operating subsidiary, Forever 8 Fund LLC (“Forever 8”), which

operates in two main areas: providing inventory solutions for small to mid-sized e-commerce sellers in the US & UK, as well as supplying

refurbished Apple products for sellers in the UK and Europe. Forever 8 buys existing inventory from e-commerce sellers and commits to

purchasing future inventory directly from their suppliers, maintaining specific inventory levels to enhance sales and growth. The sellers

are invoiced after sales occur on a monthly basis, at which point Forever 8 charges them its cost plus a markup. Forever 8’s tech

platform facilitates this entire process end-to-end, making it seamless and scalable.

In

the short term, the Company intends to seek additional non-dilutive senior debt financing to replace the capital used to repay its dilutive

convertible notes in the first quarter of 2024. The Company currently has approximately 1.8 million shares outstanding. By deploying

this capital, the Company aims to deliver 2025 revenues of $100 million, with the Company achieving positive EBITDA at the public company

level. Such funding would also support further growth in 2025. Forever 8 believes it can deploy significant additional capital via its

scalable platforms due to high inbound demand for its services from existing and new customers.

Paul

Vassilakos, CEO of Eightco and President of Forever 8, said “The Company is excited to focus on prioritizing the Forever 8 business

to deliver growth and shareholder value through 2025. With regaining compliance with the NASDAQ rules behind us and a significantly improved

balance sheet, we believe 2025 has the potential to be our best year since our inception in 2020.”

About

Eightco

Eightco

(NASDAQ: OCTO) is committed to growth of its subsidiaries, made up of Forever 8 Fund LLC, an inventory capital and management platform

for e-commerce sellers, and Ferguson Containers, Inc., a provider of complete manufacturing and logistical solutions for product and

packaging needs, through strategic management and investment. In addition, the Company is actively seeking new opportunities to add to

its portfolio of technology solutions focused on the e-commerce ecosystem through strategic acquisitions. Through a combination of innovative

strategies and focused execution, Eightco aims to create significant value and growth for its portfolio companies and stockholders.

For

additional information, please visit www.8co.holdings

Forward-Looking

Statements

This

press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements

in this press release other than statements of historical fact could be deemed forward looking. Words such as “plans,” “expects,”

“will,” “anticipates,” “continue,” “expand,” “advance,” “develop”

“believes,” “guidance,” “target,” “may,” “remain,” “project,”

“outlook,” “intend,” “estimate,” “could,” “should,” and other words and terms

of similar meaning and expression are intended to identify forward-looking statements, although not all forward-looking statements contain

such terms. Forward-looking statements are based on management’s current beliefs and assumptions that are subject to risks and

uncertainties and are not guarantees of future performance. Actual results could differ materially from those contained in any forward-looking

statement as a result of various factors, including, without limitation: Eightco’s ability to regain and maintain compliance with

the Nasdaq’s continued listing requirements; unexpected costs, charges or expenses that reduce Eightco’s capital resources;

Eightco’s inability to raise adequate capital to fund its business; the inability to innovate and attract users for Eightco’s

and its subsidiaries’ products; future legislation and rulemaking negatively impacting digital assets; and shifting public and

governmental positions on digital asset mining activity. Given these risks and uncertainties, you are cautioned not to place undue reliance

on such forward-looking statements. For a discussion of other risks and uncertainties, and other important factors, any of which could

cause Eightco’s actual results to differ from those contained in forward-looking statements, see Eightco’s filings with the

Securities and Exchange Commission (the “SEC”), including in its Annual Report on Form 10-K filed with the SEC on April 1,

2024, as amended. All information in this press release is as of the date of the release, and Eightco undertakes no duty to update this

information or to publicly announce the results of any revisions to any of such statements to reflect future events or developments,

except as required by law.

For

further information, please contact:

Investor

Relations

investors@8co.holdings

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

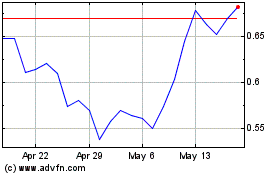

Eightco (NASDAQ:OCTO)

Historical Stock Chart

From Dec 2024 to Jan 2025

Eightco (NASDAQ:OCTO)

Historical Stock Chart

From Jan 2024 to Jan 2025