UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

August 24, 2023

Commission File Number: 0-29374

EDAP TMS S.A.

Parc Activite La Poudrette Lamartine

4/6 Rue du Dauphine

69120 Vaulx-en-Velin - France

Indicate by check mark whether the registrant files or will file annual reports under cover

of Form 20-F or Form 40-F.

Form 20-F [ x] Form 40-F [ ]

SIGNATURES

Pursuant to the requirements of the Securities Act of 1934, the registrant has duly caused

this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: August 24, 2023

EDAP TMS S.A.

/s/ FRANCOIS DIETSCH

FRANCOIS DIETSCH

CHIEF FINANCIAL OFFICER

EDAP Announces Second Quarter 2023 Financial Results

- Record second quarter and first half revenues

of EUR 14.3 million (USD 15.5 million) and EUR 29.1 million (USD 31.5 million), respectively -

- Total HIFU Q2 2023 year-over-year revenue

growth of 63.6% -

- Strong Q2 2023 year-over-year U.S. Focal

One® HIFU procedure growth of 85% -

- Received reimbursement approval in Switzerland

for use of HIFU in the treatment of prostate cancer -

- More than half of patients now enrolled in

Phase 3 study evaluating Focal One HIFU in endometriosis -

- Appointment of Ryan Rhodes to Board of Directors

-

- Company to host conference call and webcast

today, Thursday, August 24th at 8:30 am EDT -

LYON, France, August 24, 2023 - EDAP TMS SA (Nasdaq:

EDAP), the global leader in robotic energy-based therapies, reported today unaudited financial results for the second quarter ending

June 30, 2023, and announced the appointment of Ryan Rhodes to the Board of Directors of the Company.

“Our record second quarter and first half

revenues and strong system placements reflect continued business momentum, as Focal One HIFU is one of the fastest-growing technology

platforms enabling urologists to ablate targeted tissue in low to intermediate-risk and salvage prostate cancer patients,” said

Ryan Rhodes, Chief Executive Officer of EDAP. “We also continue to make notable progress in the growth of our sales pipeline. We

experienced strong year over year system placement growth in the quarter, with four Focal One units sold as compared to just one system

in the second quarter of 2022. We are also pleased with strong U.S. Focal One HIFU procedure growth, which grew 85% during the second

quarter of 2023 versus the second quarter of 2022. Though still in the early adoption phase, we believe there is a growing appreciation

of Focal One amongst community urology practices, and we continue to make excellent progress in cultivating these relationships to help

drive Focal One adoption across this large segment of the market.

“Looking ahead, our commercial success

in prostate cancer and the expansion of our pipeline have created a strong foundation for growth. Increased adoption of Focal One HIFU

is being driven by our state-of the-art technology platform that can be seamlessly integrated into urology practices. Further supporting

growth and adoption are Focal One’s strong clinical outcomes that clearly demonstrate excellent oncologic control and faster patient

recovery times. Additionally, ease of use, reduced procedure times and higher CMS reimbursement are also contributing to the adoption

of Focal One HIFU technology. As we have referenced in the past, we are supporting a current Phase 3 clinical trial evaluating Focal

One HIFU in the treatment of deep-infiltrating endometriosis. This trial supports Focal One HIFU as a potentially viable and less invasive

treatment option for women suffering from this painful and debilitating condition. More than half of the patients are now enrolled in

our 60-patient trial and we are encouraged by the progress and pace of enrollment.”

On August 23rd, 2023, the Board of

Directors appointed Ryan Rhodes as a new Director of EDAP TMS. Ryan replaces Robrecht Michiels, who has resigned. As previously announced,

Ryan was appointed Chief Executive Officer of Company on May 1, 2023, to lead, strengthen and accelerate the Company’s corporate

strategy and development. “We would like to thank Robrecht for his significant contribution and guidance to the Board and the Company

over the last several years,” said Marc Oczachowski, Chairman of the Board.

Business Update

| · | Sold

four Focal One units in the U.S. during the second quarter of 2023. The Company saw continued

strong momentum in securing new placements across both academic medical centers and community

hospitals, as clinicians and providers increasingly recognize Focal One as an essential option

to effectively treat select prostate cancer patients. |

| · | In

July, the Company announced reimbursement approval in Switzerland for the use of High-intensity

Focused Ultrasound in the treatment of prostate cancer; reimbursement took effect on July

1, 2023. Switzerland is a member of the DACH market region (including Germany, Austria and

Switzerland) with over 100 million combined total inhabitants. Switzerland has many hospitals

ranked amongst the best 250 in the world according to Newsweek’s “The World’s

Best Hospitals 2023”. Included in this list is the University of Zurich, an active

prominent Focal One site and the leading innovation center for HIFU in the country, and a

member of the League of European Research Universities, placing it among Europe's most prestigious

research institutions. |

| · | In

May, the Company initiated a double-blind, randomized controlled Phase 3 study to evaluate

Focal One HIFU therapy for the treatment of deep-infiltrating rectal endometriosis. Patient

recruitment has started at a strong pace, with more than 30 patients now enrolled across

6 different treatment centers. The Phase 3 study is expected to enroll a total of 60 patients. |

| · | In

April, EDAP received approval from Japan’s Pharmaceutical and Medical Devices Agency

for commercialization of ExactVuTM micro-ultrasound. ExactVu is a platform that

enables urologists to gain unparalleled visualization of prostate ultrasound images, including

detection of suspicious areas in real-time to better assess cancer aggressiveness during

the performance of a precision biopsy. The Japanese market is the second largest global market

for advanced medical device technology, with prostate cancer as the most common cancer diagnosis

in Japanese men, with over 100,000 new prostate cancer diagnoses made annually. |

| · | In

April, the Company hosted a webcast featuring a live broadcast of a Focal One procedure performed

by Andre Abreu, MD and Amir H. Lebastchi, MD, Assistant Professors of Clinical Urology at

Keck Medicine of the University of Southern California (USC), the first U.S. institution

to acquire and adopt Focal One technology. |

| · | Several

plenary presentations and instructional courses were delivered by leading academic urologists

at the Annual Meeting of the American Urological Association (AUA), held April 28th

to May 1st, showcasing the Focal One platform’s ability to meet accepted

oncological standards for the management of prostate cancer, while preserving sexual function

and urinary control. Additionally, ExactVu micro-ultrasound was featured in the AUA Accredited

Hands-on Ultrasound Skills Training Course under the guidance of expert faculty. |

Upcoming Corporate Presentations

| · | H.C.

Wainwright Global Investment Conference, September 12, New York, NY |

| · | Morgan

Stanley 21st Annual Global Healthcare Conference, September 13, New York, NY |

| · | Jefferies

LLC Global Healthcare Conference, November 14-16, London, UK |

Second Quarter 2023 Results

Total revenue for the second quarter of 2023 was EUR 14.3 million (USD

15.5 million), an increase of 0.9% as compared to total revenue of EUR 14.2 million (USD 15.0 million) for the same period in 2022.

Total revenue in the HIFU business for the second quarter of 2023 was

EUR 4.9 million (USD 5.3 million), as compared to EUR 3.0 million (USD 3.2 million) for the second quarter of 2022. The increase was

driven by four Focal One units sold in the second quarter 2023 versus one unit sold in the second quarter of 2022.

Total revenue in the LITHO business for the second quarter of 2023 was

EUR 2.2 million (USD 2.4 million), as compared to EUR 3.6 million (USD 3.8 million) for the second quarter of 2022. The decline in LITHO

revenue was driven by two lithotripsy units sold in the second quarter of 2023 as compared to eight units sold in the second quarter

of 2022.

Total revenue in the Distribution business for the second quarter of 2023

was EUR 7.2 million (USD 7.8 million), as compared to EUR 7.6 million (USD 8.1 million) for the second quarter of 2022. The decline in

Distribution revenue was driven primarily by nine ExactVu units sold during the second quarter of 2023 as compared to fifteen units sold

during the second quarter of 2022.

Gross profit for the second quarter of 2023 was EUR 5.7 million (USD 6.1

million), compared to EUR 6.2 million (USD 6.6 million) for the year-ago period. Gross profit margin on net sales was 39.6% in the second

quarter of 2023, compared to 43.8% in the year-ago period. The decrease in gross profit margin year-over-year was primarily due to three

main factors: Distribution product mix, global inflationary price pressure on components which increased manufacturing costs, and continued

investments in our U.S. service and clinical application organizations to support HIFU and long-term revenue growth.

Operating expenses were EUR 9.9 million (USD 10.7 million) for the second

quarter of 2023, compared to EUR 6.6 million (USD 7.0 million) for the same period in 2022. The increase in operating expenses was primarily

due to the strategic and planned build-out of the U.S. team and commercial infrastructure, variable compensation, and increased marketing

activities.

Operating loss for the second quarter of 2023 was EUR 4.2 million (USD

4.6 million), compared to an operating loss of EUR 0.4 million (USD 0.5 million) in the second quarter of 2022.

Net loss for the second quarter of 2023 was EUR 4.7 million (USD 5.1 million),

or EUR 0.13 per diluted share, as compared to net income of EUR 1.8 million (USD 1.9 million), or EUR 0.05 per diluted share in the year-ago

period.

Year-to-Date Results

Total revenue for the six months ended June 30,

2023, was EUR 29.1 million (USD 31.5 million), an increase of 7.1% from total revenue of EUR 27.1 million (USD 29.5 million) for the

same period in 2022.

Total revenue in the HIFU business for the six

months ended June 30, 2023, was EUR 10.1 million (USD 11.0 million), an increase of 49.0% as compared to EUR 6.8 million (USD 7.4 million)

for the six months ended June 30, 2022.

Total revenue in the LITHO business for the six

months ended June 30, 2023, was EUR 5.0 million (USD 5.4 million), a decrease of 13.9% from EUR 5.8 million (USD 6.3 million) for the

six months ended June 30, 2022.

Total revenue in the Distribution business for

the six months ended June 30, 2023, was EUR 14.0 million (USD 15.1 million), a 4.1% decrease compared to EUR 14.6 million (USD 15.9 million)

for the six months ended June 30, 2022.

Gross profit for the six months ended June 30, 2023, was EUR 11.7 million

(USD 12.7 million), compared to EUR 12.0 million (USD 13.0 million), for the year-ago period. Gross profit margin on net sales was 40.2%

for the six months ended June 30, 2023, compared to 44.0% for the comparable period in 2022. The decrease in gross profit margin year-over-year

was primarily due to three main factors: Distribution product mix, global inflationary price pressure on components which increased manufacturing

costs, and continued investments in our U.S. service and clinical application organizations to support HIFU and long-term revenue growth.

Operating expenses were EUR 22.5 million (USD

24.3 million) for the six months ended June 30, 2023, compared to EUR 12.5 million (USD 13.6 million) for the same period in 2022. The

increase in operating expenses is mainly due to the strategic and planned build-out of the U.S. team and commercial infrastructure, and

non-recurring expenses linked to the leadership succession plan.

Operating loss for the six months ended June

30, 2023, was EUR 10.8 million (USD 11.7 million), compared to an operating loss of EUR 0.5 million (USD 0.6 million) for the six months

ended June 30, 2022.

Net loss for the six months ended June 30, 2023,

was EUR 12.2 million (USD 13.2 million), or EUR 0.33 per diluted share, as compared to a net income of EUR 2.2 million (USD 2.4 million),

or EUR 0.06 per diluted share in the year-ago period.

As of June 30, 2023, the Company held cash and cash equivalents of EUR

51.3 million (USD 56.0 million) as compared to EUR 63.1 million (USD 67.5 million) as of December 31, 2022.

Conference Call

A conference call and webcast to discuss second quarter 2023 financial

results will be hosted Ryan Rhodes, Chief Executive Officer, François Dietsch, Chief Financial Officer and Ken Mobeck, Chief Financial

Officer of the U.S. subsidiary, today, Thursday, August 24th, 2023 at 8:30am EDT. Please refer to the information below for

conference call dial-in information and webcast registration.

| Date: | |

Thursday, August 24th @ 8:30am Eastern Time |

| Domestic: | |

1-877-451-6152 |

| International: | |

1-201-389-0879 |

| Passcode: | |

13740016 |

| CallMe™: | |

LINK (active 15 minutes prior to conference call) |

| Webcast: | |

https://viavid.webcasts.com/starthere.jsp?ei=1624521&tp_key=5f05cd313e |

About EDAP TMS SA

A recognized leader

in the global therapeutic ultrasound market, EDAP TMS develops, manufactures, promotes and distributes worldwide minimally invasive medical

devices for various pathologies using ultrasound technology. By combining the latest technologies in imaging and treatment modalities

in its complete range of Robotic HIFU devices, EDAP TMS introduced the Focal One® in Europe and in the U.S. as an answer

to all requirements for ideal prostate tissue ablation. With the addition of the ExactVu™ Micro-Ultrasound device, EDAP TMS is

now the only company offering a complete solution from diagnostics to focal treatment of Prostate Cancer. EDAP TMS also produces and

distributes other medical equipment including the Sonolith® i-move lithotripter and lasers for the treatment of urinary

tract stones using extra-corporeal shockwave lithotripsy (ESWL). For more information on the Company, please visit http://www.edap-tms.com, us.hifu-prostate.com and www.focalone.com.

Forward-Looking Statements

In addition to historical information, this press

release contains forward-looking statements within the meaning of applicable federal securities laws, including Section 27A of the U.S.

Securities Act of 1933 (the “Securities Act”) or Section 21E of the U.S. Securities Exchange Act of 1934, which may be identified

by words such as “believe,” “can,” “contemplate,” “could,” “plan,” “intend,”

“is designed to,” “may,” “might,” “potential,” “objective,” “target,”

“project,” “predict,” “forecast,” “ambition,” “guideline,” “should,”

“will,” “estimate,” “expect” and “anticipate,” or the negative of these and similar expressions,

which reflect our views about future events and financial performance. Such statements are based on management's current expectations

and are subject to a number of risks and uncertainties, including matters not yet known to us or not currently considered material by

us, and there can be no assurance that anticipated events will occur or that the objectives set out will actually be achieved. Important

factors that could cause actual results to differ materially from the results anticipated in the forward-looking statements include,

among others, the clinical status and market acceptance of our HIFU devices and the continued market potential for our lithotripsy and

distribution divisions, as well as risks associated with the current worldwide inflationary environment, the uncertain worldwide economic,

political and financial environment, geopolitical instability, climate change and pandemics like the COVID 19 pandemic, or other public

health crises, and their related impact on our business operations, including their impacts across our businesses or demand for our devices

and services.

Other factors that may cause such a difference

may also include, but are not limited to, those described in the Company's filings with the Securities and Exchange Commission and in

particular, in the sections "Cautionary Statement on Forward-Looking Information" and "Risk Factors" in the Company's

Annual Report on Form 20-F.

Forward-looking statements speak only as of the

date they are made. Other than required by law, we do not undertake any obligation to update them in light of new information or future

developments. These forward-looking statements are based upon information, assumptions and estimates available to us as of the date of

this press release, and while we believe such information forms a reasonable basis for such statements, such information may be limited

or incomplete.

Company Contact

Blandine Confort

Investor Relations / Legal Affairs

EDAP TMS SA

+33 4 72 15 31 50

bconfort@edap-tms.com

Investor Contact

John Fraunces

LifeSci Advisors, LLC

(917) 355-2395

jfraunces@lifesciadvisors.com

EDAP TMS S.A.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Amounts in thousands of Euros and U.S. Dollars, except per share data)

| | |

Three

Months Ended: | |

Three

Months Ended: |

| | |

June 30, | |

June 30, | |

June 30, | |

June 30, |

| | |

2023 | |

2022 | |

2023 | |

2022 |

| | |

Euros | |

Euros | |

$US | |

$US |

| Sales of medical equipment | |

| 9,804 | | |

| 9,684 | | |

| 10,657 | | |

| 10,245 | |

| Net Sales of RPP and Leases | |

| 1,751 | | |

| 1,646 | | |

| 1,903 | | |

| 1,741 | |

| Sales of spare parts, supplies and Services | |

| 2,724 | | |

| 2,820 | | |

| 2,961 | | |

| 2,984 | |

| TOTAL NET SALES | |

| 14,278 | | |

| 14,151 | | |

| 15,522 | | |

| 14,969 | |

| Other revenues | |

| — | | |

| — | | |

| — | | |

| — | |

| TOTAL REVENUES | |

| 14,278 | | |

| 14,151 | | |

| 15,522 | | |

| 14,969 | |

| Cost of sales | |

| (8,623 | ) | |

| (7,952 | ) | |

| (9,374 | ) | |

| (8,412 | ) |

| GROSS PROFIT | |

| 5,655 | | |

| 6,198 | | |

| 6,148 | | |

| 6,557 | |

| Research & development expenses | |

| (1,677 | ) | |

| (1,174 | ) | |

| (1,823 | ) | |

| (1,242 | ) |

| S, G & A expenses | |

| (8,203 | ) | |

| (5,455 | ) | |

| (8,917 | ) | |

| (5,770 | ) |

| Total operating expenses | |

| (9,880 | ) | |

| (6,629 | ) | |

| (10,740 | ) | |

| (7,012 | ) |

| OPERATING PROFIT (LOSS) | |

| (4,225 | ) | |

| (430 | ) | |

| (4,592 | ) | |

| (455 | ) |

| Interest (expense) income, net | |

| 255 | | |

| (29 | ) | |

| 278 | | |

| (31 | ) |

| Currency exchange gains (loss), net | |

| (508 | ) | |

| 2,412 | | |

| (552 | ) | |

| 2,551 | |

| INCOME (LOSS) BEFORE TAXES AND MINORITY INTEREST | |

| (4,477 | ) | |

| 1,952 | | |

| (4,867 | ) | |

| 2,065 | |

| Income tax (expense) credit | |

| (221 | ) | |

| (128 | ) | |

| (240 | ) | |

| (136 | ) |

| NET INCOME (LOSS) | |

| (4,698 | ) | |

| 1,824 | | |

| (5,107 | ) | |

| 1,930 | |

| Earning per share – Basic | |

| (0.13 | ) | |

| 0.05 | | |

| (0.14 | ) | |

| 0.06 | |

| Average number of shares used in computation of EPS | |

| 36,985,934 | | |

| 33,469,053 | | |

| 36,985,934 | | |

| 33,469,053 | |

| Earning per share – Diluted | |

| (0.13 | ) | |

| 0.05 | | |

| (0.14 | ) | |

| 0.06 | |

| Average number of shares used in computation of EPS for positive net income | |

| 36,985,934 | | |

| 34,130,859 | | |

| 36,985,934 | | |

| 34,130,859 | |

NOTE: Translated for convenience of the reader to U.S. dollars at the 2023 average three months’

noon buying rate of 1 Euro = 1.0871 USD, and 2022 average three months noon buying rate of 1 Euro = 1.0579 USD

EDAP TMS S.A.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Amounts in thousands of Euros and U.S. Dollars, except per share data)

| | |

Six

Months Ended: | |

Six

Months Ended: |

| | |

June 30, | |

June 30, | |

June 30, | |

June 30, |

| | |

2023 | |

2022 | |

2023 | |

2022 |

| | |

Euros | |

Euros | |

$US | |

$US |

| Sales of medical equipment | |

| 20,123 | | |

| 18,650 | | |

| 21,782 | | |

| 20,287 | |

| Net Sales of RPP and Leases | |

| 3,329 | | |

| 2,963 | | |

| 3,604 | | |

| 3,223 | |

| Sales of spare parts, supplies and Services | |

| 5,622 | | |

| 5,536 | | |

| 6,085 | | |

| 6,021 | |

| TOTAL NET SALES | |

| 29,074 | | |

| 27,148 | | |

| 31,472 | | |

| 29,531 | |

| Other revenues | |

| — | | |

| — | | |

| — | | |

| — | |

| TOTAL REVENUES | |

| 29,074 | | |

| 27,148 | | |

| 31,472 | | |

| 29,531 | |

| Cost of sales | |

| (17,387 | ) | |

| (15,190 | ) | |

| (18,821 | ) | |

| (16,524 | ) |

| GROSS PROFIT | |

| 11,687 | | |

| 11,958 | | |

| 12,651 | | |

| 13,008 | |

| Research & development expenses | |

| (3,135 | ) | |

| (2,255 | ) | |

| (3,393 | ) | |

| (2,453 | ) |

| S, G & A expenses | |

| (19,333 | ) | |

| (10,242 | ) | |

| (20,928 | ) | |

| (11,141 | ) |

| Total operating expenses | |

| (22,467 | ) | |

| (12,497 | ) | |

| (24,321 | ) | |

| (13,594 | ) |

| OPERATING PROFIT (LOSS) | |

| (10,781 | ) | |

| (539 | ) | |

| (11,670 | ) | |

| (586 | ) |

| Interest (expense) income, net | |

| 511 | | |

| (58 | ) | |

| 554 | | |

| (63 | ) |

| Currency exchange gains (loss), net | |

| (1,653 | ) | |

| 2,981 | | |

| (1,789 | ) | |

| 3,243 | |

| INCOME (LOSS) BEFORE TAXES AND MINORITY INTEREST | |

| (11,922 | ) | |

| 2,384 | | |

| (12,905 | ) | |

| 2,593 | |

| Income tax (expense) credit | |

| (267 | ) | |

| (200 | ) | |

| (289 | ) | |

| (218 | ) |

| NET INCOME (LOSS) | |

| (12,189 | ) | |

| 2,184 | | |

| (13,194 | ) | |

| 2,375 | |

| Earning per share – Basic | |

| (0.33 | ) | |

| 0.07 | | |

| (0.36 | ) | |

| 0.07 | |

| Average number of shares used in computation of EPS | |

| 36,954,439 | | |

| 33,467,594 | | |

| 36,954,439 | | |

| 33,467,594 | |

| Earning per share – Diluted | |

| (0.33 | ) | |

| 0.06 | | |

| (0.36 | ) | |

| 0.07 | |

| Average number of shares used in computation of EPS for positive net income | |

| 36,954,439 | | |

| 34,075,033 | | |

| 36,954,439 | | |

| 34,075,033 | |

NOTE: Translated for convenience of the reader to U.S. dollars at the 2023 average six months’

noon buying rate of 1 Euro = 1.0825 USD, and 2022 average six months noon buying rate of 1 Euro = 1.0878 USD

EDAP TMS S.A.

UNAUDITED CONSOLIDATED BALANCE SHEETS HIGHLIGHTS

(Amounts in thousands of Euros and U.S. Dollars)

| | |

June 30, | |

December 31, | |

June 30, | |

December 31, |

| | |

2023 | |

2022 | |

2023 | |

2022 |

| | |

Euros | |

Euros | |

$US | |

$US |

| Cash, cash equivalents and short-term treasury investments | |

| 51,326 | | |

| 63,136 | | |

| 56,045 | | |

| 67,539 | |

| Account receivables, net | |

| 18,020 | | |

| 14,943 | | |

| 19,677 | | |

| 15,985 | |

| Inventory | |

| 13,310 | | |

| 11,780 | | |

| 14,534 | | |

| 12,601 | |

| Other current assets | |

| 761 | | |

| 660 | | |

| 831 | | |

| 706 | |

| TOTAL CURRENT ASSETS | |

| 83,417 | | |

| 90,518 | | |

| 91,086 | | |

| 96,832 | |

| Property, plant and equipment, net | |

| 7,215 | | |

| 5,984 | | |

| 7,879 | | |

| 6,401 | |

| Goodwill | |

| 2,412 | | |

| 2,412 | | |

| 2,634 | | |

| 2,580 | |

| Other non-current assets | |

| 2,284 | | |

| 2,210 | | |

| 2,494 | | |

| 2,364 | |

| TOTAL ASSETS | |

| 95,328 | | |

| 101,123 | | |

| 104,093 | | |

| 108,177 | |

| Accounts payable & other accrued liabilities | |

| 16,761 | | |

| 13,087 | | |

| 18,302 | | |

| 14,000 | |

| Deferred revenues, current portion | |

| 4,192 | | |

| 4,050 | | |

| 4,578 | | |

| 4,333 | |

| Short term borrowing | |

| 1,610 | | |

| 1,846 | | |

| 1,758 | | |

| 1,975 | |

| Other current liabilities | |

| 2,634 | | |

| 2,725 | | |

| 2,876 | | |

| 2,916 | |

| TOTAL CURRENT LIABILITIES | |

| 25,197 | | |

| 21,708 | | |

| 27,514 | | |

| 23,223 | |

| Obligations under operating and finance leases non-current | |

| 783 | | |

| 1,222 | | |

| 855 | | |

| 1,308 | |

| Long term debt, non-current | |

| 2,769 | | |

| 3,587 | | |

| 3,024 | | |

| 3,837 | |

| Deferred revenues, non-current | |

| 620 | | |

| 264 | | |

| 677 | | |

| 282 | |

| Other long term liabilities | |

| 2,745 | | |

| 2,710 | | |

| 2,997 | | |

| 2,899 | |

| TOTAL LIABILITIES | |

| 32,114 | | |

| 29,492 | | |

| 35,067 | | |

| 31,549 | |

| TOTAL SHAREHOLDERS’EQUITY | |

| 63,214 | | |

| 71,632 | | |

| 69,026 | | |

| 76,628 | |

| TOTAL LIABILITIES & SHAREHOLDERS’

EQUITY | |

| 95,328 | | |

| 101,123 | | |

| 104,093 | | |

| 108,177 | |

NOTE: Translated for convenience of the reader to U.S. dollars at the

noon buying rate of 1 Euro = 1.0919 USD, on June 30, 2023 and at the noon buying rate of 1 Euro = 1.0697 USD, on December 31, 2022.

EDAP TMS S.A.

UNAUDITED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Amounts in thousands of Euros)

| | |

Six Months Ended | |

Twelve Months Ended | |

Six Months Ended | |

Twelve Months Ended |

| | |

June 30, | |

December 31, | |

June 30, | |

December 31, |

| | |

2023 | |

2022 | |

2023 | |

2022 |

| | |

(Euros) | |

(Euros) | |

($US) | |

($US) |

| NET INCOME (LOSS) | |

| (12,189 | ) | |

| (2,933 | ) | |

| (13,194 | ) | |

| (3,085 | ) |

| Adjustments to reconcile net income

(loss) to net cash generated by (used in) operating activities(1) | |

| 5,165 | | |

| 4,225 | | |

| 5,591 | | |

| 4,444 | |

| OPERATING CASH FLOW | |

| (7,024 | ) | |

| 1,292 | | |

| (7,603 | ) | |

| 1,359 | |

| Increase/Decrease in operating assets and liabilities | |

| (1,668 | ) | |

| (4,316 | ) | |

| (1,806 | ) | |

| (4,539 | ) |

| NET CASH GENERATED BY (USED IN) OPERATING ACTIVITIES | |

| (8,692 | ) | |

| (3,024 | ) | |

| (9,409 | ) | |

| (3,180 | ) |

| Short term investments (2) | |

| (0 | ) | |

| — | | |

| (0 | ) | |

| — | |

| Additions to capitalized assets produced by the company and other

capital expenditures | |

| (2,653 | ) | |

| (2,378 | ) | |

| (2,872 | ) | |

| (2,501 | ) |

| NET CASH GENERATED BY (USED IN) INVESTING

ACTIVITIES | |

| (2,653 | ) | |

| (2,378 | ) | |

| (2,872 | ) | |

| (2,501 | ) |

| NET CASH GENERATED BY (USED IN) FINANCING

ACTIVITIES | |

| (836 | ) | |

| 21,741 | | |

| (905 | ) | |

| 22,869 | |

| NET EFFECT OF EXCHANGE RATE CHANGES ON CASH

AND CASH EQUIVALENTS | |

| 372 | | |

| (388 | ) | |

| 1,692 | | |

| (3,053 | ) |

| NET INCREASE (DECREASE) IN CASH AND CASH

EQUIVALENTS | |

| (11,810 | ) | |

| 15,952 | | |

| (11,494 | ) | |

| 14,134 | |

(1) including share based compensation expenses

for 3,785 thousand of Euros for the six months ended June 30, 2023 and 2,103 thousand of Euros for the full year ended December 31, 2022.

NOTE: Translated for convenience of the reader to U.S. dollars at the

2023 average six months’ noon buying rate of 1 Euro = 1.0825 USD, and 2022 average twelve months noon buying rate of 1 Euro = 1.0519

USD

EDAP TMS S.A.

UNAUDITED CONDENSED STATEMENTS OF OPERATIONS BY DIVISION

six months ended June 30, 2023

(Amounts in thousands of Euros)

| | |

HIFU | |

| |

ESWL | |

| |

Distribution | |

| |

Reconciling | |

Total After | |

|

| | |

Division | |

| |

Division | |

| |

Division | |

| |

Items | |

Consolidation | |

|

| Sales of goods | |

| 6,406 | | |

| | | |

| 1,846 | | |

| | | |

| 11,870 | | |

| | | |

| — | | |

| 20,123 | | |

| | |

| Sales of RPPs & Leases | |

| 2,670 | | |

| | | |

| 517 | | |

| | | |

| 143 | | |

| | | |

| — | | |

| 3,329 | | |

| | |

| Sales of spare parts & services | |

| 1,047 | | |

| | | |

| 2,613 | | |

| | | |

| 1,962 | | |

| | | |

| — | | |

| 5,622 | | |

| | |

| TOTAL NET SALES | |

| 10,122 | | |

| | | |

| 4,976 | | |

| | | |

| 13,975 | | |

| | | |

| — | | |

| 29,074 | | |

| | |

| Other revenues | |

| — | | |

| | | |

| — | | |

| | | |

| — | | |

| | | |

| — | | |

| — | | |

| | |

| TOTAL REVENUES | |

| 10,122 | | |

| | | |

| 4,976 | | |

| | | |

| 13,975 | | |

| | | |

| — | | |

| 29,074 | | |

| | |

| GROSS PROFIT (% of Net Sales) | |

| 5,247 | | |

| 51.8 | % | |

| 1,971 | | |

| 39.6 | % | |

| 4,469 | | |

| 32.0 | % | |

| — | | |

| 11,687 | | |

| 40.2 | % |

| Research & Development | |

| (2,559 | ) | |

| | | |

| (351 | ) | |

| | | |

| (224 | ) | |

| | | |

| — | | |

| (3,135 | ) | |

| | |

| Total SG&A plus depreciation | |

| (9,055 | ) | |

| | | |

| (1,857 | ) | |

| | | |

| (5,186 | ) | |

| | | |

| (3,235 | ) | |

| (19,333 | ) | |

| | |

| OPERATING PROFIT (LOSS) | |

| (6,367 | ) | |

| | | |

| (238 | ) | |

| | | |

| (941 | ) | |

| | | |

| (3,235 | ) | |

| (10,781 | ) | |

| | |

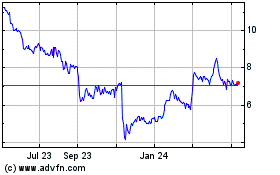

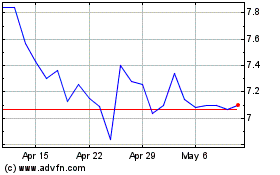

EDAP TMS (NASDAQ:EDAP)

Historical Stock Chart

From Aug 2024 to Sep 2024

EDAP TMS (NASDAQ:EDAP)

Historical Stock Chart

From Sep 2023 to Sep 2024