SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

For the month of August 2024 (Report No. 3)

Commission File Number

001-40554

Eco Wave Power Global AB (publ)

(Translation of registrant’s name into

English)

52 Derech Menachem Begin St.

Tel Aviv – Yafo, Israel 6713701

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover Form 20-F or Form 40-F.

Form 20-F ☒ Form

40-F ☐

CONTENTS

On August 8, 2024, Eco Wave Power Global AB (publ)

issued a press release titled “Eco Wave Power Receives Green Light for the Repurchase of its American Depositary Shares,”

a copy of which is furnished as Exhibit 99.1 with this Report of Foreign Private Issuer on Form 6-K.

The first, second, third,

fourth, and sixth paragraphs and the paragraph titled “Forward-Looking Statements” in the press release furnished as

Exhibit 99.1 hereto are incorporated by reference into the Company’s Registration Statement on Form F-3 (Registration No. 333-275728)

filed with the Securities and Exchange Commission to be a part thereof from the date on which this Report of Foreign Private Issuer on

Form 6-K is submitted, to the extent not superseded by documents or reports subsequently filed or furnished.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Eco Wave Power Global AB (publ) |

| |

|

|

| |

By: |

/s/ Aharon Yehuda |

| |

|

Aharon Yehuda |

| |

|

Chief Financial Officer |

Date: August 8, 2024

2

Exhibit 99.1

Eco

Wave Power Receives Green Light for the Repurchase of its American Depositary Shares

Stockholm, Sweden (August 8, 2024) – Eco

Wave Power Global AB (publ) (Nasdaq: WAVE) (“Eco Wave Power” or the “Company”), a leading, publicly traded onshore

wave energy company, is pleased to announce that following its official request, submitted to the Swedish Financial Supervisory Authority

(the “SFSA”) on the 21st of December, 2023, for authorization for the repurchase of American Depositary Shares (the

“ADS”) representing up to 10 percent of the total number of shares in the Company, the SFSA responded that in its opinion,

the ADS are not considered equivalent to shares in accordance with Chapter 19 of the Swedish Companies Act. As a result, the Company should

be able to repurchase ADSs, in accordance with Swedish law.

In accordance with this decision, Eco Wave Power

will enter into relevant agreements with a bank for the execution of any necessary steps related to the buyback.

As previously announced, the repurchase of the

ADS was previously approved by Eco Wave Power’s shareholders at the 2024 Annual General Meeting (the “AGM”).

Shareholders at the AGM resolved the authorization

for the Company’s board of directors to make purchases of the ADS in accordance with the following main terms:

| 1. | ADS repurchases may be made only on the Nasdaq Capital Market

or any other regulated market. |

| 2. | The authorization may be exercised on one or more occasions before the 2025 annual general meeting. |

| 3. | The maximum number of ADS that may be repurchased so that the Company’s holding of shares at any

given time does not exceed 10 percent of the total number of shares in the Company. |

| 4. | Repurchases of the ADS on the Nasdaq Capital Market may only be made at a price within the range of the

highest purchase price and lowest selling price at any given time. |

| 5. | Payment for the ADS shall be made in cash. |

“We are very excited to finally be able

to proceed with the buyback. We believe that our ADS buyback program will allow our leadership to have a greater scope to act and have

the opportunity to improve the Company’s capital structure, driving greater shareholder value and improving the investment value

of our company,” said Eco Wave Power’s Founder and Chief Executive Officer Inna Braverman.

The authorization from the SFSA and shareholder

approval from the AGM does not obligate the Company to repurchase any ADSs. Any repurchases will be made through open market purchases,

privately-negotiated transactions, or otherwise in compliance with Rule 10b-18 under the U.S. Securities Exchange Act of 1934, as

amended. The timing, manner, and amount of any repurchase will be determined by the Company’s management based on its evaluation

of business, market, and economic conditions, corporate and regulatory requirements, and other considerations.

About Eco Wave Power

Global AB (publ)

Eco Wave Power is a leading

onshore wave energy company that developed a patented, smart and cost-efficient technology for turning ocean and sea waves into green

electricity.

Eco Wave Power’s

mission is to assist in the fight against climate change by enabling commercial power production from the ocean and sea waves.

The Company owns and

operates a grid connected wave energy project in Israel, with co-investment from EDF Renewables IL and the Israeli Energy Ministry, which

recognized Eco Wave Power’s technology as “Pioneering Technology.” The Israeli wave energy project marks the first

grid-connected wave energy system in Israel’s history.

Eco Wave Power will soon

commence the installation of its third and fourth wave energy projects, in the Port of Los Angeles, and in Portugal. The Company also

holds a total projects pipeline of 404.7MW.

Eco Wave Power received

funding from the European Union Regional Development Fund, Innovate UK and the European Commission’s Horizon 2020 framework program

and was honored with the “Global Climate Action Award” from the United Nations.

Eco Wave Power’s

American Depositary Shares (WAVE) are traded on the Nasdaq Capital Market.

Read more about Eco Wave

Power at www.ecowavepower.com.

Forward-Looking Statements

This press release contains forward-looking statements

within the meaning of the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995 and other

Federal securities laws. For example, the Company is using forward-looking statements in this press release when it discusses its

belief that the share repurchase program will allow its leadership to have greater scope to act and the opportunity to improve the Company’s

capital structure, driving greater shareholder value and improving the investment value of the Company, its potential future agreements

it may enter into with a bank concerning the buyback and the potential repurchase of the Company’s ADSs. Forward-looking statements

can be identified by words such as: “anticipate,” “intend,” “plan,” “goal,” “seek,”

“believe,” “project,” “estimate,” “expect,” “strategy,” “future,”

“likely,” “may,” “should,” “will”, or variations of such words, and similar references

to future periods. These forward-looking statements and their implications are neither historical facts nor assurances of future performance

and are based on the current expectations of the management of Eco Wave Power and are subject to a number of factors, uncertainties and

changes in circumstances that are difficult to predict and may be outside of Eco Wave Power’s control that could cause actual results

to differ materially from those described in the forward-looking statements. Therefore, you should not rely on any of these forward-looking

statements. Except as otherwise required by law, Eco Wave Power undertakes no obligation to publicly release any revisions to these forward-looking

statements to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events. More detailed

information about the risks and uncertainties affecting Eco Wave Power is contained under the heading “Risk Factors” in Eco

Wave Power’s Annual Report on Form 20-F for the fiscal year ended December 31, 2023 filed with the SEC on March 28, 2024, which

is available on the on the SEC’s website, www.sec.gov, and other documents filed or furnished to the SEC. Any forward-looking statement

made in this press release speaks only as of the date hereof. References and links to websites have been provided as a convenience and

the information contained on such websites is not incorporated by reference into this press release.

For more information,

please contact the Company at:

info@ecowavepower.com

+97235094017

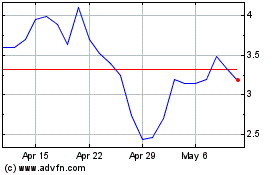

Eco Wave Power Global AB (NASDAQ:WAVE)

Historical Stock Chart

From Oct 2024 to Nov 2024

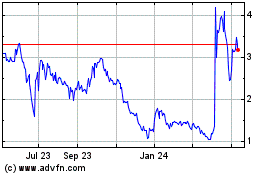

Eco Wave Power Global AB (NASDAQ:WAVE)

Historical Stock Chart

From Nov 2023 to Nov 2024