0001914605false00019146052024-07-252024-07-25

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): July 25, 2024

ECB BANCORP, INC.

(Exact Name of Registrant as Specified in Its Charter)

|

|

|

Maryland |

001-41456 |

88-1502079 |

(State or Other Jurisdiction |

(Commission |

(IRS Employer |

of Incorporation or Organization) |

File Number) |

Identification No.) |

419 Broadway, Everett, Massachusetts 02149

(Address of principal executive offices) (Zip Code)

(617) 387-1110

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

Title of each class |

Trading symbol(s) |

Name of each exchange on which registered |

Common Stock, par value $0.01 per share |

ECBK |

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition

On July 25, 2024, ECB Bancorp, Inc., the holding company for Everett Co-operative Bank, issued a press release announcing its financial results at and for the three and six months ended June 30, 2024.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned thereunto duly authorized.

ECB BANCORP, INC.

Date: July 25, 2024 By: /s/Brandon N. Lavertu

Brandon N. Lavertu

Chief Financial Officer

For Immediate Release

Date: July 25, 2024

|

|

|

|

|

|

Contact: |

|

Richard J. O’Neil, Jr. |

|

|

President and Chief Executive Officer |

|

|

Phone: |

|

617-387-1110 |

Email: |

|

rjoneil@everettbank.com |

ECB Bancorp, Inc. Reports Second Quarter Results

EVERETT, MA, July 25, 2024 - ECB Bancorp, Inc. (NASDAQ-ECBK) (the “Company”), the holding company for Everett Co-operative Bank (the “Bank”), a state-chartered co-operative bank headquartered in Everett, Massachusetts, today reported net income of $791,000, or $0.09 per diluted share, for the quarter ended June 30, 2024, compared to $1.4 million, or $0.17 per diluted share, for the quarter ended June 30, 2023, a decrease of $634,000 in net income. For the six months ended June 30, 2024, the Company reported net income of $1.4 million, or $0.17 per diluted share, as compared to net income of $2.3 million, or $0.27 per diluted share, for the six months ended June 30, 2023, a decrease of $914,000 in net income.

Richard J. O’Neil, Jr., President and Chief Executive Officer, said, "Our second quarter results indicate positive movement across our major asset classes. In an environment of increasing economic uncertainty our continuing attention to, and focus on, our customers, expenses, credit and responsible growth continue to be our guiding principles."

NET INTEREST AND DIVIDEND INCOME

Net interest and dividend income before provision for credit losses was $6.0 million for the quarter ended June 30, 2024, a decrease of $386,000, or 6.0%, from $6.4 million for the quarter ended June 30, 2023. This decrease was primarily due to a decrease in the net interest margin, as increases in earning asset yields were more than offset by increased funding costs. Our net interest margin for the quarter ended June 30, 2024 was 1.82% as compared to 2.18% for the quarter ended June 30, 2023. The provision for credit losses increased to $292,000 for the quarter ended June 30, 2024 from $0 for the quarter ended June 30, 2023. The provision for credit losses for the quarter ended June 30, 2024 was driven by loan growth. The $0 provision for credit losses for the quarter ended June 30, 2023 included a provision for loan losses, offset by a benefit to the provision for off balance sheet commitments. The combination of these items resulted in a decrease of $678,000, or 10.6%, in net interest and dividend income after provision for credit losses for the quarter ended June 30, 2024 as compared to the quarter ended June 30, 2023.

Net interest and dividend income before provision for credit losses was $11.9 million for the six months ended June 30, 2024, a decrease of $852,000, or 6.7%, from $12.8 million for the six months ended June 30, 2023. This decrease was primarily due to a decrease in the net interest margin, as increases in earning asset yields were more than offset by increased funding costs. Our net interest margin for the six months ended June 30, 2024 was 1.83% as compared to 2.28% for the six months ended June 30, 2023. The provision for credit losses decreased $441,000, to $438,000 for the six months ended June 30, 2024, from $879,000 for the six months ended June 30, 2023. The decrease in the provision for credit losses was driven by lower loan growth during the six months ended June 30, 2024 as compared to the six months ended June 30, 2023. The combination of these items resulted in a decrease of $411,000, or 3.5%, in net interest and dividend income after provision for credit losses for the six months ended June 30, 2024 as compared to the six months ended June 30, 2023.

NONINTEREST INCOME

Noninterest income increased $49,000, or 20.4%, to $289,000 for the quarter ended June 30, 2024 from $240,000 for the quarter ended June 30, 2023. The increase was driven by increases in income from bank-owned life insurance, net gains on sales of loans and customer service fees.

Noninterest income increased $124,000, or 26.4%, to $594,000 for the six months ended June 30, 2024 from $470,000 for the six months ended June 30, 2023. The increase was driven by increases in net gains on sales of loans, income from bank-owned life insurance and customer service fees.

NONINTEREST EXPENSE

Noninterest expense increased $236,000, or 5.0%, to $4.9 million for the quarter ended June 30, 2024 from $4.7 million for the quarter ended June 30, 2023. Significant changes are as follows:

•Salaries and employee benefits increased $307,000, or 10.9%, driven by $242,000 in stock based compensation recorded in the quarter ended June 30, 2024, related to the 2023 Equity Incentive Plan. There were no stock based compensation costs in the quarter ended June 30, 2023 related to this plan;

•Director compensation increased $90,000, or 75.6%, driven by $82,000 in stock based compensation recorded in the quarter ended June 30, 2024, related to the 2023 Equity Incentive Plan. There were no stock based compensation costs in the quarter ended June 30, 2023 related to this plan;

•Advertising and promotions decreased $102,000, or 49.0%. We have strategically reduced certain advertising costs in an effort to manage overall noninterest expenses;

•Professional fees decreased $64,000, or 21.7%, primarily due to higher legal and consulting costs during the 2023 period related to operating a new publicly traded company; and

•FDIC deposit insurance expense decreased $88,000, or 31.2%. During the second quarter of 2023 there were increases in the assessment rates charged by the FDIC.

Noninterest expense increased $968,000, or 10.5%, to $10.2 million for six months ended June 30, 2024 from $9.2 million for the six months ended June 30, 2023. Significant changes are as follows:

•Salaries and employee benefits increased $732,000, or 12.8%, driven by $484,000 in stock based compensation recorded in the six months ended June 30, 2024, related to the 2023 Equity Incentive Plan. There were no stock based compensation costs in the six months ended June 30, 2023 related to this plan;

•Director compensation increased $176,000, or 73.3%, driven by $165,000 in stock based compensation recorded in the six months ended June 30, 2024, related to the 2023 Equity Incentive Plan. There were no stock based compensation costs in the six months ended June 30, 2023 related to this plan; and

•Advertising and promotions decreased $139,000, or 37.0%. We have strategically reduced certain advertising costs in an effort to manage overall noninterest expenses.

INCOME TAXES

We recorded a provision for income tax expense of $272,000 for the quarter ended June 30, 2024, compared to a provision for income tax expense of $503,000 for the quarter ended June 30, 2023, reflecting effective tax rates of 25.6% and 26.1%, respectively.

We recorded a provision for income tax expense of $482,000 for the six months ended June 30, 2024, compared to a provision for income tax expense of $823,000 for the six months ended June 30, 2023, reflecting effective tax rates of 25.4% and 26.1%, respectively.

BALANCE SHEET

Total assets increased $55.6 million, or 4.3%, to $1.34 billion at June 30, 2024 from $1.28 billion at December 31, 2023.

Total net loans increased $63.1 million, or 6.1%, to $1.10 billion at June 30, 2024 from $1.04 billion at December 31, 2023.

•Multi-family real estate loans increased $28.8 million, or 10.0%, to $316.2 million at June 30, 2024 from $287.4 million at December 31, 2023.

•Commercial real estate loans increased $14.5 million, or 7.4%, to $210.9 million at June 30, 2024 from $196.4 million at December 31, 2023.

•Residential real estate loans increased $8.2 million, or 2.0%, to $418.3 million at June 30, 2024 from $410.1 million at December 31, 2023.

•Commercial loans increased $5.0 million, or 53.9%, to $14.2 million at June 30, 2024 from $9.2 million at December 31, 2023.

•Home equity lines of credit increased $4.6 million, or 14.0%, to $38.0 million at June 30, 2024 from $33.4 million at December 31, 2023.

•Construction loans increased $2.6 million, or 2.3%, to $114.6 million at June 30, 2024 from $112.0 million at December 31, 2023.

Cash and cash equivalents decreased $7.6 million, or 6.4%, to $111.4 million at June 30, 2024 from $119.0 million at December 31, 2023. The decrease in cash and cash equivalents was driven by loan growth.

Deposits increased $64.6 million, or 7.4%, to $932.8 million at June 30, 2024 from $868.2 million at December 31, 2023.

•Certificates of deposit increased $66.1 million, or 13.3%, to $564.6 million at June 30, 2024 from $498.5 million at December 31, 2023.

•Money market deposit accounts increased $26.7 million, or 20.3%, to $158.1 million at June 30, 2024 from $131.4 million at December 31, 2023.

•Savings accounts decreased $25.2 million, or 18.4%, to $112.6 million at June 30, 2024 from $137.8 million at December 31, 2023.

•Interest bearing checking accounts decreased $2.4 million, or 10.8%, to $19.8 million at June 30, 2024 from $22.2 million at December 31, 2023.

•Demand deposit accounts decreased $541,000, or 0.7%, to $77.8 million at June 30, 2024 from $78.3 million at December 31, 2023.

FHLB advances decreased $10.0 million, or 4.3%, to $224.0 million at June 30, 2024 from $234.0 million at December 31, 2023.

Total shareholders' equity increased $1.6 million, or 0.9%, to $166.5 million as of June 30, 2024 from $164.9 million as of December 31, 2023. This increase is primarily the result of earnings of $1.4 million and an increase of $427,000 in accumulated other comprehensive income (“AOCI”). The increase in AOCI was driven by an increase in the fair value of cash flow hedges entered into during the six months ended June 30, 2024. Partially offsetting these increases to shareholders' equity was a decrease in additional paid-in capital of $457,000. This decrease was driven by $1.2 million in shares repurchased under our share repurchase plan, partially offset by an increase in additional paid in capital of $699,000 related to stock based compensation and ESOP shares committed to be released. Our book value per share increased $0.34 to $18.09 at June 30, 2024 from $17.75 at December 31, 2023.

ASSET QUALITY

Asset quality remains strong. The allowance for credit losses in total and as a percentage of total loans as of June 30, 2024 was $9.0 million and 0.81%, respectively, as compared to $8.6 million and 0.82%, respectively, as of December 31, 2023. For the six months ended June 30, 2024 and June 30, 2023 the Company recorded net charge offs of $3,000 and $0, respectively. Total non-performing assets were $1.2 million, or 0.09%, of total assets as of June 30, 2024 and $1.2 million, or 0.09% of total assets, as of December 31, 2023.

Company Profile

ECB Bancorp, Inc. is headquartered in Everett, Massachusetts and is the holding company for Everett Co-operative Bank. The Bank provides financial services to individuals, families, municipalities and businesses through its three full-service branch offices located in Everett, Lynnfield and Woburn, Massachusetts. The Company's common stock is traded on the NASDAQ Capital Market under the symbol "ECBK." For more information, visit the Company's website at www.everettbank.com.

Forward-looking statements

Certain statements herein constitute "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, as amended. These statements are based on the beliefs and expectations of management, as well as the assumptions made using information currently available to management. Since these statements reflect the views of management concerning future events, these statements involve risks, uncertainties and assumptions. As a result, actual results may differ from those contemplated by these statements. Forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts. They often include words like "believe," "expect," "anticipate," "estimate," and "intend" or future or conditional verbs such as "will," "would," "should," "could" or "may." Certain factors that could cause actual results to differ materially from expected results include changes in the interest rate environment, changes in general economic conditions, the Company's ability to continue to increase loans and deposit growth, legislative and regulatory changes that adversely affect the businesses in which the Company is engaged and changes in the securities market. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this release. The Company disclaims any intent or obligation to update any forward-looking statements, whether in response to new information, future events or otherwise, except as may be required by law.

ECB Bancorp, Inc. and Subsidiary

Consolidated Balance Sheets

June 30, 2024 (unaudited) and December 31, 2023

(in thousands except share data)

|

|

|

|

|

|

|

|

|

|

|

June 30, 2024 |

|

|

December 31, 2023 |

|

|

|

|

|

|

|

|

ASSETS |

|

|

|

|

|

|

Cash and due from banks |

|

$ |

2,783 |

|

|

$ |

3,786 |

|

Short-term investments |

|

|

108,659 |

|

|

|

115,250 |

|

Total cash and cash equivalents |

|

|

111,442 |

|

|

|

119,036 |

|

Investments in available-for-sale securities (at fair value) |

|

|

— |

|

|

|

5,003 |

|

Investments in held-to-maturity securities, at cost (fair values of $74,047 at June 30,

2024 (unaudited) and $70,590 at December 31, 2023) |

|

|

80,458 |

|

|

|

76,979 |

|

Loans held-for-sale |

|

|

624 |

|

|

|

— |

|

Loans, net of allowance for credit losses of $9,025 at June 30, 2024 (unaudited)

and $8,591 at December 31, 2023 |

|

|

1,102,886 |

|

|

|

1,039,789 |

|

Federal Home Loan Bank stock, at cost |

|

|

9,600 |

|

|

|

9,892 |

|

Premises and equipment, net |

|

|

3,663 |

|

|

|

3,754 |

|

Accrued interest receivable |

|

|

4,211 |

|

|

|

3,766 |

|

Deferred tax asset, net |

|

|

4,604 |

|

|

|

4,767 |

|

Bank-owned life insurance |

|

|

14,706 |

|

|

|

14,472 |

|

Other assets |

|

|

3,744 |

|

|

|

2,877 |

|

Total assets |

|

$ |

1,335,938 |

|

|

$ |

1,280,335 |

|

|

|

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS' EQUITY |

|

|

|

|

|

|

Deposits: |

|

|

|

|

|

|

Noninterest-bearing |

|

$ |

77,801 |

|

|

$ |

78,342 |

|

Interest-bearing |

|

|

854,976 |

|

|

|

789,872 |

|

Total deposits |

|

|

932,777 |

|

|

|

868,214 |

|

Federal Home Loan Bank advances |

|

|

224,000 |

|

|

|

234,000 |

|

Other liabilities |

|

|

12,697 |

|

|

|

13,220 |

|

Total liabilities |

|

|

1,169,474 |

|

|

|

1,115,434 |

|

|

|

|

|

|

|

|

Shareholders' Equity: |

|

|

|

|

|

|

Preferred Stock, par value $0.01; Authorized: 1,000,000 shares; Issued and outstanding: 0 shares and 0 shares, respectively |

|

|

— |

|

|

|

— |

|

Common Stock, par value $0.01; Authorized: 30,000,000 shares; Issued and outstanding: 9,200,219 shares and 9,291,810 shares, respectively |

|

|

92 |

|

|

|

93 |

|

Additional paid-in capital |

|

|

86,974 |

|

|

|

87,431 |

|

Retained earnings |

|

|

85,266 |

|

|

|

83,854 |

|

Accumulated other comprehensive income |

|

|

556 |

|

|

|

129 |

|

Unallocated common shares held by the Employee Stock Ownership Plan |

|

|

(6,424 |

) |

|

|

(6,606 |

) |

Total shareholders' equity |

|

|

166,464 |

|

|

|

164,901 |

|

Total liabilities and shareholders' equity |

|

$ |

1,335,938 |

|

|

$ |

1,280,335 |

|

|

|

|

|

|

|

|

Shareholders' Equity Ratios |

|

|

|

|

|

|

Book value per common share |

|

$ |

18.09 |

|

|

$ |

17.75 |

|

|

|

|

|

|

|

|

Regulatory Capital Ratios (Everett Co-operative Bank) |

|

|

|

|

|

|

Total capital to risk weighted assets |

|

|

16.94 |

% |

|

|

17.30 |

% |

Tier 1 capital to risk weighted assets |

|

|

15.85 |

% |

|

|

16.22 |

% |

Tier 1 capital to average assets |

|

|

10.78 |

% |

|

|

11.31 |

% |

ECB Bancorp, Inc. and Subsidiary

Consolidated Statements of Income

(unaudited)

(in thousands except share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended |

|

|

Six months ended |

|

|

|

June 30, |

|

|

June 30, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Interest and dividend income: |

|

|

|

|

|

|

|

|

|

|

|

|

Interest and fees on loans |

|

$ |

14,174 |

|

|

$ |

12,122 |

|

|

$ |

27,619 |

|

|

$ |

23,049 |

|

Interest and dividends on securities |

|

|

779 |

|

|

|

667 |

|

|

|

1,543 |

|

|

|

1,227 |

|

Other interest income |

|

|

1,433 |

|

|

|

862 |

|

|

|

2,917 |

|

|

|

1,437 |

|

Total interest and dividend income |

|

|

16,386 |

|

|

|

13,651 |

|

|

|

32,079 |

|

|

|

25,713 |

|

Interest expense: |

|

|

|

|

|

|

|

|

|

|

|

|

Interest on deposits |

|

|

8,159 |

|

|

|

5,055 |

|

|

|

15,684 |

|

|

|

8,973 |

|

Interest on Federal Home Loan Bank advances |

|

|

2,214 |

|

|

|

2,197 |

|

|

|

4,482 |

|

|

|

3,975 |

|

Total interest expense |

|

|

10,373 |

|

|

|

7,252 |

|

|

|

20,166 |

|

|

|

12,948 |

|

Net interest and dividend income |

|

|

6,013 |

|

|

|

6,399 |

|

|

|

11,913 |

|

|

|

12,765 |

|

Provision for credit losses |

|

|

292 |

|

|

|

- |

|

|

|

438 |

|

|

|

879 |

|

Net interest and dividend income after provision for credit losses |

|

|

5,721 |

|

|

|

6,399 |

|

|

|

11,475 |

|

|

|

11,886 |

|

Noninterest income: |

|

|

|

|

|

|

|

|

|

|

|

|

Customer service fees |

|

|

143 |

|

|

|

130 |

|

|

|

284 |

|

|

|

251 |

|

Income from bank-owned life insurance |

|

|

117 |

|

|

|

99 |

|

|

|

234 |

|

|

|

197 |

|

Net gain on sales of loans |

|

|

19 |

|

|

|

5 |

|

|

|

54 |

|

|

|

5 |

|

Other income |

|

|

10 |

|

|

|

6 |

|

|

|

22 |

|

|

|

17 |

|

Total noninterest income |

|

|

289 |

|

|

|

240 |

|

|

|

594 |

|

|

|

470 |

|

Noninterest expense: |

|

|

|

|

|

|

|

|

|

|

|

|

Salaries and employee benefits |

|

|

3,130 |

|

|

|

2,823 |

|

|

|

6,441 |

|

|

|

5,709 |

|

Director compensation |

|

|

209 |

|

|

|

119 |

|

|

|

416 |

|

|

|

240 |

|

Occupancy and equipment expense |

|

|

263 |

|

|

|

248 |

|

|

|

538 |

|

|

|

452 |

|

Data processing |

|

|

285 |

|

|

|

293 |

|

|

|

596 |

|

|

|

535 |

|

Computer software and licensing |

|

|

75 |

|

|

|

71 |

|

|

|

160 |

|

|

|

128 |

|

Advertising and promotions |

|

|

106 |

|

|

|

208 |

|

|

|

237 |

|

|

|

376 |

|

Professional fees |

|

|

231 |

|

|

|

295 |

|

|

|

591 |

|

|

|

658 |

|

Federal Deposit Insurance Corporation deposit insurance |

|

|

194 |

|

|

|

282 |

|

|

|

372 |

|

|

|

407 |

|

Other expense |

|

|

454 |

|

|

|

372 |

|

|

|

824 |

|

|

|

702 |

|

Total noninterest expense |

|

|

4,947 |

|

|

|

4,711 |

|

|

|

10,175 |

|

|

|

9,207 |

|

Income before income tax expense |

|

|

1,063 |

|

|

|

1,928 |

|

|

|

1,894 |

|

|

|

3,149 |

|

Income tax expense |

|

|

272 |

|

|

|

503 |

|

|

|

482 |

|

|

|

823 |

|

Net income |

|

$ |

791 |

|

|

$ |

1,425 |

|

|

$ |

1,412 |

|

|

$ |

2,326 |

|

Share data: |

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding, basic |

|

|

8,265,579 |

|

|

|

8,490,128 |

|

|

|

8,282,677 |

|

|

|

8,485,610 |

|

Weighted average shares outstanding, diluted |

|

|

8,342,516 |

|

|

|

8,490,128 |

|

|

|

8,358,818 |

|

|

|

8,485,610 |

|

Basic earnings per share |

|

$ |

0.10 |

|

|

$ |

0.17 |

|

|

$ |

0.17 |

|

|

$ |

0.27 |

|

Diluted earnings per share |

|

$ |

0.09 |

|

|

$ |

0.17 |

|

|

$ |

0.17 |

|

|

$ |

0.27 |

|

v3.24.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

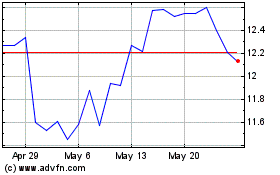

ECB Bancorp (NASDAQ:ECBK)

Historical Stock Chart

From Jan 2025 to Feb 2025

ECB Bancorp (NASDAQ:ECBK)

Historical Stock Chart

From Feb 2024 to Feb 2025