0000034067FALSE00000340672025-01-302025-01-300000034067us-gaap:CommonStockMember2025-01-302025-01-300000034067boom:StockPurchaseRightsMember2025-01-302025-01-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of Earliest Event Reported): January 30, 2025

DMC Global Inc.

(Exact Name of Registrant as Specified in its Charter)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Delaware | | 001-14775 | | 84-0608431 |

(State or Other Jurisdiction of

Incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

11800 Ridge Parkway, Suite 300, Broomfield, Colorado 80021

(Address of Principal Executive Offices, Including Zip Code)

(303) 665-5700

(Registrant’s Telephone Number, Including Area Code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of exchange on which registered |

| Common Stock, $0.05 Par Value | | BOOM | | The Nasdaq Global Select Market |

| Stock Purchase Rights | | | | | | | | The Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On January 30, 2025, DMC Global Inc. (the “Company”) announced the appointment of James H. Schladen, age 65, as President of the Company’s Arcadia Products, LLC (“Arcadia”) business, effective February 3, 2025.

Mr. Schladen previously served as President of Arcadia from 2000 through its acquisition by the Company in December 2021 and until his retirement from that position on January 2, 2023. He continued as an employee of Arcadia until April 3, 2023, after which time he served as a consultant to Arcadia until March 15, 2024. Mr. Schladen started at Arcadia in 1986 and subsequently departed to co-found Wilson Partitions, a building products business focused on commercial interior products. Wilson Partitions was acquired by Arcadia in 1998, at which time Mr. Schladen rejoined Arcadia and worked in various roles, including Head of Sales for Arcadia Commercial Exteriors and as President of Commercial Interiors, until he was appointed President in 2000. Mr. Schladen has a BS in Business Economics from the University of California, Los Angeles.

In connection with Mr. Schladen’s appointment, the Company entered into an employment offer letter (the “Offer Letter”) with Mr. Schladen setting forth the terms of his employment and compensation. In accordance with the Offer Letter, Mr. Schladen will receive: (i) an annual base salary of $550,000; (ii) an annual bonus at a target of 100% of his base salary, which will be aligned with pre-determined Arcadia financial goals; and (iii) a long-term incentive award targeted to be $1.1 million, (x) one-third (1/3) of which will be time-based restricted stock awards vesting over a two (2)-year period based on his continued employment, with fifty percent (50%) of such time vested awards vesting on each of the first and second anniversary of his employment; and (y) two-thirds (2/3) of which will be performance-based performance share units (“PSUs”) based on the cumulative adjusted EBITDA of Arcadia from 2025 to 2026, with such PSUs to vest on the second anniversary of his employment. In addition, Mr. Schladen will be eligible to participate in Arcadia’s health and welfare programs, 401(k) plan, and other programs available to Arcadia’s full-time employees of equivalent stature.

In the event Arcadia terminates Mr. Schladen’s employment for any reason, he will be entitled to receive: (i) any base salary, accrued vacation, expense reimbursements, and benefits that are accrued but unpaid as of the date of termination; (ii) any earned but unpaid annual bonus for any prior calendar year; and (iii) any portion of the annual bonus payable pursuant to the Offer Letter for the calendar year of such termination. In the event Arcadia terminates Mr. Schladen’s employment without “Cause” or Mr. Schladen terminates his employment for “Good Reason” (in each case, as defined in the Offer Letter), contingent on a release of claims, (i) Mr. Schladen will receive: (x) a one-time lump sum severance payment equal to three months of his then-current base salary, less applicable deductions and withholdings; (y) an amount equal to the target annual bonus for the year of termination, prorated based upon the number of completed months in such year; and (z) full vesting of his restricted stock awards, and (ii) Mr. Schladen’s PSUs will remain outstanding and will vest on the second anniversary of his employment in accordance with their terms.

Mr. Schladen is also expected to execute Arcadia’s form of Confidentiality and Inventions Agreement, and an Indemnification Agreement with the Company in the form applicable to the Company’s senior executive officers.

The foregoing description of the Offer Letter does not purport to be complete and is qualified in its entirety by reference to the full text of the Offer Letter, a copy of which is filed as Exhibit 10.1 to this Current Report on Form 8-K and incorporated herein by reference.

On December 23, 2021, Arcadia entered into eight new leases with Alpine Universal, Inc., of which Mr. Schladen owns 13%. These leases support Arcadia’s manufacturing, warehouse and distribution centers. Additional information with respect to the leases, including the approximate dollar value of Mr. Schladen’s interest in the lease transactions, is provided under the heading “Certain Relationships and Related Transactions” in the Company’s Proxy Statement for its 2024 Annual Meeting of Stockholders filed with the Securities and Exchange Commission on April 2, 2024 and incorporated herein by reference. Updated information with respect to the leases, including updated amounts for the approximate dollar value of Mr. Schladen’s interest in the lease transactions, will be provided under the same heading in the Company’s Proxy Statement for its 2025 Annual Meeting of Stockholders. Michael Schladen, son of Mr. Schladen, became an employee of Arcadia in February 2025. He is eligible to participate in the Company’s incentive bonus program and Arcadia’s employee benefit plans on the same basis as other similarly situated employees. Except as described above, Mr. Schladen does not have any other direct or indirect material interest in any transaction or proposed transaction required to be reported under Item 404(a) of Regulation S-K.

There is no arrangement or understanding between Mr. Schladen and any other persons pursuant to which he was appointed as President of Arcadia. There are no family relationships between Mr. Schladen and any director or executive officer of the Company.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits.

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| Exhibit Number | | Description |

| 10.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | |

|

|

|

|

| | | | | DMC GLOBAL INC. | | |

| | | | | | | | |

| Dated: | February 5, 2025 | | | | By: | /s/ Michelle Shepston |

| | | | | | Name: Michelle Shepston |

| | | | | | Title: Executive Vice President and Chief Legal Officer |

| | | | | | |

January 30, 2025

Mr. James Schladen

[Personal Address]

Dear Jim,

It is my pleasure to offer you a new position of employment with Arcadia Products, LLC (“Arcadia”), upon the terms and conditions contained in this letter (the “Letter”).

Position and Base Salary. You will serve as the President of Arcadia and will solely report to the Board of Directors of Arcadia and the President and CEO of DMC Global Inc. (“DMC”). The position will be based at Arcadia’s headquarters in Vernon, CA, although it will involve travel to Arcadia’s various places of business from time to time. This is an exempt position. You will be the most senior executive officer of Arcadia and you will have duties, authorities and responsibilities commensurate with your title and position. Your annual base salary rate during your employment will be $550,000.00 (less applicable taxes, deductions and withholdings), paid in accordance with Arcadia’s standard payroll procedures. Your base salary will be subject to annual review and may be increased but not decreased.

Annual Performance Bonus. In addition to the base salary, you shall be eligible to receive an annual bonus pursuant to DMC Global’s bonus program applicable to its senior executives generally, as in effect from time to time, which shall not be inconsistent with the terms of this Letter (the “Annual Bonus”). Your target Annual Bonus will be 100% of your base salary (the “Target Bonus”), and the payout range will be 0-200% based on the Adjusted EBITDA of Arcadia for the year versus the target set by the Compensation Committee of the Board of Directors of Arcadia (the “Compensation Committee”). The target metric for such Annual Bonus shall be determined by the Compensation Committee in good faith after consultation with you, with payout to be based on the following:

| | | | | | | | | | | |

Performance Percentage (% of Adjusted EBITDA Target) | 85% | 100% | 120% |

Payout Percentage (% of Target Bonus) | 50% | 100% | 200% |

The Annual Bonus for 2025 will not be prorated, provided that you will not be eligible for such Annual Bonus if your employment is terminated by the Company for Cause. For 2026, the Annual Bonus will be determined based on Arcadia performance against targets set by the Compensation Committee and any amounts payable under the Annual Bonus will be earned on December 31, 2026, subject to your continued employment on such date. Any Annual Bonus paid pursuant to this Letter will be subject to applicable withholdings and deductions and will be paid within seventy-four (74) days after the end of the calendar year to which the bonus relates.

Anticipated Start Date. February 3, 2025 (the “Start Date”).

Term. Your employment pursuant to this Letter shall be effective as of the Start Date and shall continue until the second anniversary thereof (the “Term”), unless terminated earlier pursuant to the terms of this Letter. On the second anniversary of the Start Date, the Term and your employment with Arcadia shall automatically terminate.

Vacation/Sick Time Benefit. You will be eligible for vacation accrual, which begins with the first day of employment. You will be eligible for two hundred (200) hours of vacation. You will also be eligible for 40 hours of sick leave, available for use as of the 90th day of employment.

Long Term Incentive. You will be eligible for a long term incentive grant of $1.1 million, which shall consist of the following grants under DMC’s equity incentive plan: (x) one-third (1/3) of such target grant shall be time-based restricted stock awards (“RSAs”) vesting over a two (2)-year period following your Start Date based on your continued employment, with fifty percent (50%) of such time vested awards vesting on each of the first and second anniversary of your Start Date; and (y) two-thirds (2/3) of such target grant shall consist of performance-based Performance Share Units (“PSUs”) based on the cumulative Adjusted EBITDA of Arcadia over 2025-2026, with such PSUs to vest on the second anniversary of your Start Date based on metrics set at the time of grant and your continued employment. The long term incentive award will be granted within thirty (30) days following your Start Date.

Severance Payment. In the event your employment with Arcadia terminates for any reason, Arcadia shall pay you (or, in the event of your death, to your estate or named beneficiary) (a) any base salary, accrued vacation, expense reimbursements, and benefits that are accrued but unpaid as of the date of termination and (b) any earned but unpaid Annual Bonus for any prior calendar year . In addition, if Arcadia terminates your employment without Cause or you terminate your employment for Good Reason (in each case, as defined in Exhibit A), contingent on you signing (and not revoking, if you have a right of revocation) a release of claims in the form attached hereto as Exhibit B, you will receive (a) a one-time lump sum severance payment equal to three months of your then-current base salary, less applicable deductions and withholdings, (b) an amount that is equal to the Target Bonus, prorated based upon the number of completed months in the applicable year of termination, (c) your RSAs will vest in full and (d) your PSUs will remain outstanding and will vest on the second anniversary of your Start Date in accordance with their terms. You will not be eligible to participate in any severance plan or program of DMC or the Company.

Employee Benefits. You will be eligible to participate in Arcadia’s comprehensive benefits programs on a basis no less favorable to you than to other full-time employees of equivalent stature. You will be eligible for healthcare benefits on the first day of the month following the month in which your Start Date occurs. You will be eligible for vacation accrual, which begins with the first day of employment. Participation in any of Arcadia’s benefits plans are subject to the written terms and conditions contained in the various plans. Arcadia reserves the right to modify or discontinue any discretionary benefits at any time in its sole discretion. You will receive a car allowance of $1,200 per month and reimbursement of bona fide business expenses, subject to Arcadia’s standard policies and procedures for such benefits.

Upon hire, you will be automatically enrolled in Arcadia’s 401(k) Plan in accordance with its terms. Arcadia matches your contributions made through payroll starting at 100% of each dollar you contribute up to 3% of your eligible pay and then 50% of each dollar you contribute on the next 2% of your eligible pay for a total match of up to 4% of your eligible pay. As a convenience, you will be automatically enrolled in the 401(k) Plan with a before-tax contribution of 5% of your eligible annual base pay with contributions usually starting sixty (60) days after your employment begins. If you do not wish to be automatically enrolled in Arcadia’s 401(k) Plan or if you wish to contribute a different percentage of eligible pay, you may opt-out or change your contribution election at any time.

Confidentiality and Inventions Agreement. As an employee of Arcadia, you may create or have access to information, trade secrets and inventions relating to the business or interest of Arcadia or other parties with whom Arcadia has had relationships which is valuable to Arcadia or such other parties and which may lose value if disclosed. In order to protect such information, Arcadia will require that you re-execute Arcadia’s standard confidentiality and inventions agreement, in the form attached hereto as Exhibit C, as a condition of your employment in your new position.

At-Will Employment. As an at-will employer, Arcadia cannot guarantee your employment for any specific duration. You are free to quit, and Arcadia is entitled to terminate your employment at any time, with or without Cause or prior warning.

Indemnification Agreement. DMC will enter into an indemnification agreement with you upon your Start Date consistent with agreements applicable to all senior executive officers of DMC and substantially in the form attached hereto as Exhibit D, as such form may be changed from time to time by mutual written agreement of the parties. DMC will maintain Directors and Officers insurance with coverage applicable to you during your employment and after your employment consistent with the coverage available to senior executives of DMC generally. The foregoing obligations shall survive the termination of your employment.

Governing Law and Choice of Forum. Your employment will be governed by and interpreted under the laws of the State of California without regard to its conflict of law principles. The parties hereby agree that all demands, claims, actions, causes of action, suits, proceedings and litigation between or among the parties or arising out of the employment relationship shall be filed, tried and litigated exclusively in a state or federal court located in California. In connection with the foregoing, the parties hereto irrevocably consent to the jurisdiction and venue of such courts and expressly waive any claims or defenses for lack of jurisdiction, non-convenience, or proper venue by such courts.

Section 409A. This Letter is intended to comply with or be exempt from Section 409A of the Internal Revenue Code of 1986 (the “Code”), as amended, and Treasury Regulations promulgated thereunder (“Section 409A”) and shall be construed accordingly. It is the intention of the parties hereto that payments or benefits payable under this Letter not be subject to the additional tax or interest imposed pursuant to Section 409A. To the extent such potential payments or benefits are or could become subject to Section 409A, the parties hereto shall cooperate to amend this Letter with the goal of giving you the economic benefits described herein in a manner that does not result in such tax or interest being imposed; provided, however, that in no event shall Arcadia or anyone have any liability to you for any taxes, interest, or penalties due as a result of the application of Section 409A to any payments or benefits provided hereunder. You shall, at the request of Arcadia, take any reasonable action (or refrain from taking any action), required to comply with any correction procedure promulgated pursuant to Section 409A. Each payment to be made under this Letter shall be a separate payment, and a separately identifiable and determinable payment, to the fullest extent permitted under Section 409A. Notwithstanding any other provision of this Letter to the contrary, if (a) on the date of your separation from service (as such term is used or defined in Section 409A(a)(2)(A)(i), Treasury Regulation Section 1.409A-1(h), or any successor law or regulation), any of Arcadia’s equity is publicly traded on an established securities market or otherwise (within the meaning of Section 409A(a)(2)(B)(i) of the Code) and (b) as a result of such separation from service, you would receive any payment that, absent the application of this sentence, would be subject to interest and additional tax imposed pursuant to Section 409A as a result of the application of Section 409A(2)(B)(i), then, to the extent necessary to avoid the imposition of such interest and additional tax, such payment shall be deferred until the earlier of (i) 6 months after your separation from service, (ii) your death, (iii) of such earlier time as may be permitted under Section 409A. If your termination of employment occurs within thirty (30) days prior to the end of a calendar year or the period for reviewing and not revoking the release of claims spans two calendar years, the payments pursuant to severance payments described in this Letter shall not be made earlier than January 1 of the second of such calendar years.

Counterparts. This Letter may be executed in any number of counterparts, each of which when so executed and delivered shall be deemed an original, and all of which together shall constitute one and the same.

Entire Agreement. By signing this Letter, you agree that the terms in this Letter (and the terms set forth in the standard proprietary information, inventions and non-solicitation agreement and indemnification agreement) constitute the entire agreement between the parties with respect to the subject matter hereof and supersede all other agreements or understandings related thereto.

Jim, we are excited to offer you this role at Arcadia and we look forward to your contributions to the organization. To confirm that you agree to the terms stated in this Letter, please sign and date an enclosed copy of this Letter and return a scanned copy to me at [•].

Sincerely,

| | | | | | | | |

| /s/ James O'Leary | | |

| Name: James O'Leary | | |

| Title: Chair of Arcadia Products, LLC | | |

| and Interim President and Chief Executive Officer of DMC Global Inc. | | |

| | |

| | |

| | |

| | |

| | |

| | |

ACKNOWLEDGEMENT:

I accept this offer on the terms set forth above.

| | | | | | | | |

| By: /s/James Schladen | | |

| Name: James Schladen | | |

| Date: 1/30/2025 | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Exhibit A

For purposes of this Letter, the following definitions shall apply:

a.“Cause” shall mean your: (i) theft or embezzlement of Arcadia’s funds or assets; (ii) conviction of, or guilty plea or no contest plea, to a felony charge or any misdemeanor involving moral turpitude; (iii) noncompliance with any laws or regulations, foreign or domestic, that materially and adversely affects the operation of Arcadia’s business; (iv) violation of any lawful express direction of, or any material violation of a rule, regulation or policy established by Arcadia or DMC, so long as such rule, regulation or policy is consistent with the terms of this Letter, that materially and adversely affects the operation of Arcadia’s business; or (v) material breach of this Letter, or breach of your fiduciary duties, in each case, that materially and adversely affects the operation of Arcadia’s business; provided however, that Cause shall not exist for subparagraph (iv) or (v) unless you have been given written notice specifying the act, omission, or circumstances alleged to constitute Cause and, to the extent curable, you fail to cure or remedy such act, omission, or circumstances within thirty (30) days after receipt of such notice, as determined by the Board of DMC reasonably and in good faith. For the avoidance of doubt, the termination of your employment due to your resignation, death, or disability (meaning your inability to perform the essential functions of the position even with the provision of reasonable accommodations) shall not be considered a termination without Cause.

b.“Good Reason” shall mean, in the context of your resignation, a resignation that occurs within sixty (60) days following Arcadia’s failure to cure any of the following within sixty (60) days of receiving written notice delivered to Arcadia and DMC from you of the existence of any of the following, which written notice must be provided within sixty (60) days of the initial occurrence of such item and must specify in detail the facts and circumstances giving rise to such item: (i) any material and adverse change in the your office or title, reporting relationship(s), authority, duties or responsibilities to Arcadia and DMC; (ii) any assignment of duties that are materially and adversely inconsistent with and result in a diminution of the your position and duties with Arcadia; (iii) any material reduction in your base salary (but excluding any reduction due to tax withholdings) or nonpayment of your base salary, (iv) any material change in the primary geographic location at which you must perform services, or (v) any material breach of this Letter by Arcadia.

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a security having no trading symbol.

| Name: |

dei_NoTradingSymbolFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:trueItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=boom_StockPurchaseRightsMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

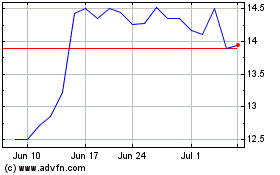

DMC Global (NASDAQ:BOOM)

Historical Stock Chart

From Jan 2025 to Feb 2025

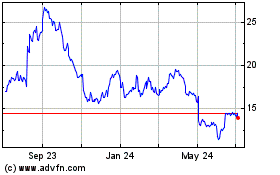

DMC Global (NASDAQ:BOOM)

Historical Stock Chart

From Feb 2024 to Feb 2025