DMC Global Inc. (Nasdaq: BOOM), a diversified holding company, has

signed a definitive agreement to acquire a 60% controlling interest

in privately held Arcadia Inc. for $282.5 million in cash and DMC

stock. Arcadia is a leading U.S. supplier of architectural building

products, which include exterior and interior framing systems for

low and mid-rise commercial buildings, windows, curtain walls,

interior partitions, and highly engineered windows and doors for

the high-end residential real estate market.

Transaction details

- DMC will purchase a 60% interest in

Arcadia for $282.5 million, subject to final purchase price

adjustments and closing conditions

- $262.0 million of the purchase

price to be paid in cash and $20.5 million will be paid in DMC

stock

- Cash portion to be financed with

cash and marketable securities on DMC’s balance sheet and funds

from a $150.0 million senior credit facility

- DMC’s total debt-to-adjusted EBITDA

leverage ratio after closing will be 2.79 based on total borrowings

of $150.0 million and pro forma adjusted EBITDA of $53.7 million;

total net debt-to-adjusted EBITDA leverage ratio will be 2.25 based

on net debt of $120.8 million and pro forma adjusted EBITDA of

$53.7 million

- Closing is expected to occur prior

to December 31, 2021

- DMC to acquire the remaining 40%

interest in Arcadia through a three-year put and call option with a

floor valuation of $187.1 million

- Total implied transaction value is

$469.6 million

- Transaction value is 8.6x Arcadia’s

trailing 12-month adjusted EBITDA of $54.6 million as of September

30, 2021

Kevin Longe, DMC’s president and CEO, said,

“This is a milestone transaction for DMC and aligns with our

strategy of building a diversified portfolio of industry-leading

businesses with differentiated products and services. The

acquisition of Arcadia will double DMC’s consolidated sales,

strengthen our gross margins and provide diversification outside

our more cyclical energy and industrial infrastructure markets.

“Arcadia’s strong position in a $4.5 billion

segment of the architectural products industry will also

significantly expand DMC’s addressable market. We look forward to

supporting Arcadia’s growth plans, and I am delighted to welcome

CEO Jim Schladen and the company’s 850 employees to the DMC

family.”

Schladen added, “This is an exciting transaction

for Arcadia, its employees and our customers. We look forward to

DMC’s support as we expand Arcadia’s capacity and increase its

position in the commercial and high-end residential architectural

products markets. I am confident this will be an outstanding

partnership that will provide long-term benefits to Arcadia, DMC,

and our stakeholders.”

Inclusive of Arcadia, DMC’s consolidated pro

forma sales for the trailing 12 months ended September 30, 2021,

would be $491 million, while consolidated adjusted EBITDA would be

$53.7 million. Arcadia recorded unaudited sales of $245.7 million

and adjusted EBITDA of $54.6 million for the trailing 12-month

period. Under the structure of the agreement, 60% of Arcadia’s

adjusted EBITDA will be reported by DMC.

From 2010 through 2020, Arcadia increased its

sales at a 13% compound annual growth rate (CAGR) and increased

adjusted EBITDA at a 23% CAGR.

DMC expects the acquisition will be accretive to

earnings within the first year. Arcadia will operate as a

standalone business of DMC and will be led by Jim Schladen and his

management team.

Based in Vernon, California, Arcadia operates

three divisions. Its commercial architectural products business,

Arcadia Inc., primarily serves the low and mid-rise commercial

buildings market. Its differentiated business model is focused on

providing a broad selection of architectural framing solutions,

short lead times, reliable product availability, and exceptional

service. Its customer base includes more than 2,000 glass and

glazing contractors, building owners, and commercial architects.

Arcadia Inc. has established a leading position in the western and

southwestern United States, and it serves a diverse range of end

markets that include commercial offices, healthcare, higher

education, retail, civic and public facilities, and religious

buildings.

Arcadia’s commercial interiors business, Wilson

Partitions, provides a national customer base with custom interior

architectural framing systems. Its products are used in new

construction and repair and remodel projects, and address noise

control, fire rating, functionality, and aesthetics.

Arcadia’s residential business, Arcadia Custom,

provides premium, energy-efficient steel, aluminum, and wood

windows and doors to the America’s fast-growing, high-end home

market. The division works closely with architects, contractors,

and installers. It sells through a national network of sales

agents, and approximately 140 high-end window and door dealers.

New Senior Secured Credit

FacilitiesTo fund a portion of the purchase price for the

acquisition, DMC expects to enter into a new

five-year syndicated credit facility, which includes a $150

million term loan and a $50 million revolving line of credit.

The term loan will be fully funded and will be used to complete the

acquisition, while the revolving line of credit will be fully

undrawn and available. The term loan and revolving credit facility

will bear interest at the Secured Overnight Financing Rate (SOFR)

plus 2.5% at inception.

PresentationA presentation on

the transaction, Arcadia’s business and pertinent financial data is

available here: https://dmc.mobi/arcadia

Conference CallDMC will conduct

an investor conference call to discuss the planned acquisition

today at 9:00 a.m. Mountain (8:00 a.m. Pacific and 11:00 a.m.

Eastern). The call is available live via the Internet at:

https://www.webcaster4.com/Webcast/Page/2204/43976, or by dialing

888-506-0062 (973-528-0011 for international callers) and entering

the code 741823. A telephonic replay will be available through

January 17, 2022, by calling 877-481-4010 (919-882-2331 for

international callers) and entering the Conference ID 43976.

Additional information about Arcadia is

available on its

websites:https://arcadiainc.com/https://arcadiacustom.com/https://www.wilsonpart.com/

Houlihan Lokey acted as sole financial advisor

to Arcadia and Proskauer Rose LLP acted as legal advisor to certain

shareholders of Arcadia. Davis Graham & Stubbs LLP served as

legal advisor to DMC Global. KeyBank National Association (NYSE:

KEY) is the Administrative Agent under the senior secured credit

facility. KeyBanc Capital Markets Inc. is Sole Bookrunner and

KeyBanc Capital Markets Inc. and U.S. Bank National Association are

Joint Lead Arrangers. U.S. Bank National Association is Syndication

Agent and BOKF, NA is Documentation Agent.

About DMC GlobalDMC Global

operates a portfolio of innovative, asset-light businesses that

provide differentiated products and services to their respective

industries. The Company’s strategy is to identify well-run

businesses with strong management teams, and support them with

long-term capital and strategic, financial, legal, technology and

operating resources. DMC helps portfolio companies grow their core

businesses, launch new initiatives, upgrade technologies and

systems to support their long-term growth strategies, and make

acquisitions that improve their competitive positions and expand

their markets. The Company’s current portfolio consists of

DynaEnergetics, which serves the global energy industry, and

NobelClad, which addresses the global industrial process and

transportation sector. Based in Broomfield, Colorado, DMC trades on

Nasdaq under the symbol “BOOM.”

Cautionary Note Regarding

Forward-Looking StatementsThis release contains

“forward-looking statements” within the meaning of applicable

securities laws regarding events or conditions that may occur in

the future, including the closing of the acquisition, the entry

into and terms of the credit facilities, the acquisition of the

remaining 40% of Arcadia, future financial results and the benefits

of the acquisition. Factors that could cause actual results to

differ materially from any forward-looking statements include, but

are not limited to, the risk that the transactions described herein

will not be completed as planned and the risk that the acquisition

will not have the expected benefits, including as a result of

unanticipated liabilities, integration or performance issues and/or

general economic conditions, and other factors described in the

public filings made by DMC Global at www.sec.gov. Readers should

not place undue reliance on forward-looking statements. The

forward-looking statements contained herein are based on the

beliefs, expectations and opinions of management as of the date

hereof and DMC Global disclaims any intent or obligation to update

them or revise them to reflect any change in circumstances or in

management’s beliefs, expectations or opinions that occur in the

future.

*Use of Non-GAAP Financial

MeasuresAdjusted EBITDA is a non-GAAP (generally accepted

accounting principles) financial measure used by management to

measure operating performance and liquidity. Non-GAAP results are

presented only as a supplement to the financial statements based on

U.S. generally accepted accounting principles (GAAP). The non-GAAP

financial information is provided to enhance the reader’s

understanding of DMC’s financial performance, but no non-GAAP

measure should be considered in isolation or as a substitute for

financial measures calculated in accordance with GAAP.

Reconciliations of the most directly comparable GAAP measures to

non-GAAP measures are provided within the schedules attached to

this release.

EBITDA is defined as net income plus or minus

net interest plus taxes, depreciation and amortization. Adjusted

EBITDA excludes from EBITDA stock-based compensation, restructuring

and impairment charges and, when appropriate, other items that

management does not utilize in assessing DMC’s operating

performance (as further described in the attached financial

schedules).

Management uses adjusted EBITDA in its

operational and financial decision-making, believing that it is

useful to eliminate certain items in order to focus on what it

deems to be a more reliable indicator of ongoing operating

performance. As a result, internal management reports used during

monthly operating reviews feature adjusted EBITDA measures.

Management believes that investors may find this non-GAAP financial

measure useful for similar reasons, although investors are

cautioned that non-GAAP financial measures are not a substitute for

GAAP disclosures. In addition, management incentive awards are

based, in part, on the amount of adjusted EBITDA achieved during

relevant periods. EBITDA and adjusted EBITDA are also used by

research analysts, investment bankers and lenders to assess

operating performance. For example, a measure similar to adjusted

EBITDA is required by the lenders under DMC’s credit facility.

Net debt is defined as total debt less cash and

cash equivalents and marketable securities. Net debt is used by

management to supplement GAAP financial information and evaluate

DMC’s performance, and management believes this information may be

similarly useful to investors.

Because not all companies use identical

calculations, DMC’s presentation of non-GAAP financial measures may

not be comparable to other similarly titled measures of other

companies. However, these measures can still be useful in

evaluating the company’s performance against its peer companies

because management believes the measures provide users with

valuable insight into key components of GAAP financial disclosures.

For example, a company with greater GAAP net income may not be as

appealing to investors if its net income is more heavily comprised

of gains on asset sales. Likewise, eliminating the effects of

interest income and expense moderates the impact of a company’s

capital structure on its performance.

All of the items included in the reconciliation

from net income to EBITDA and adjusted EBITDA are either (i)

non-cash items (e.g., depreciation, amortization of purchased

intangibles and stock-based compensation) or (ii) items that

management does not consider to be useful in assessing DMC’s

operating performance (e.g., income taxes, restructuring and

impairment charges). In the case of the non-cash items, management

believes that investors can better assess the company’s operating

performance if the measures are presented without such items

because, unlike cash expenses, these adjustments do not affect

DMC’s ability to generate free cash flow or invest in its business.

For example, by adjusting for depreciation and amortization in

computing EBITDA, users can compare operating performance without

regard to different accounting determinations such as useful life.

In the case of the other items, management believes that investors

can better assess operating performance if the measures are

presented without these items because their financial impact does

not reflect ongoing operating performance.

|

|

Trailing Twelve Months Ended September 30, 2021 |

|

|

|

|

Redeemable |

Pro Forma |

|

|

|

DMC |

Arcadia |

Noncontrolling |

Arcadia |

Pro Forma |

|

In Millions |

(Unaudited) |

(Unaudited) |

Interest (1) |

(Unaudited) |

(Unaudited) |

|

Net sales |

$ |

245,384 |

|

$ |

245,653 |

|

|

$ |

245,653 |

|

$ |

491,037 |

|

|

Gross profit |

|

58,732 |

|

|

87,006 |

|

|

|

87,006 |

|

|

145,738 |

|

|

Gross profit % |

|

23.9 |

% |

|

35.4 |

% |

|

|

35.4 |

% |

|

29.7 |

% |

|

|

|

|

|

|

|

|

Selling, general, and administrative expenses |

|

55,050 |

|

|

34,243 |

|

|

|

34,243 |

|

|

89,293 |

|

|

|

|

|

|

|

|

|

Amortization |

|

1,196 |

|

|

|

|

- |

|

|

1,196 |

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

12,061 |

|

|

1,789 |

|

|

|

1,789 |

|

|

13,850 |

|

|

Stock-based compensation expense |

|

6,425 |

|

|

|

|

- |

|

|

6,425 |

|

|

Adjusted EBITDA * |

|

20,972 |

|

|

54,552 |

|

(21,821 |

) |

|

32,731 |

|

|

53,703 |

|

|

Adjusted EBITDA % * |

|

8.5 |

% |

|

22.2 |

% |

|

|

13.3 |

% |

|

10.9 |

% |

|

|

Nine Months Ended September 30, 2021 |

|

|

|

|

Redeemable |

Pro Forma |

|

|

|

DMC |

Arcadia |

Noncontrolling |

Arcadia |

Pro Forma |

|

In Millions |

(Unaudited) |

(Unaudited) |

Interest (1) |

(Unaudited) |

(Unaudited) |

|

Net sales |

$ |

188,271 |

|

$ |

183,692 |

|

|

$ |

183,692 |

|

$ |

371,963 |

|

|

Gross profit |

|

46,546 |

|

|

66,080 |

|

|

|

66,080 |

|

|

112,626 |

|

|

Gross profit % |

|

24.7 |

% |

|

36.0 |

% |

|

|

36.0 |

% |

|

30.3 |

% |

|

|

|

|

|

|

|

|

Selling, general, and administrative expenses |

|

42,501 |

|

|

25,496 |

|

|

|

25,496 |

|

|

67,997 |

|

|

|

|

|

|

|

|

|

Amortization |

|

823 |

|

|

|

|

- |

|

|

823 |

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

9,223 |

|

|

1,286 |

|

|

|

1,286 |

|

|

10,509 |

|

|

Stock-based compensation expense |

|

4,904 |

|

|

|

|

- |

|

|

4,904 |

|

|

Adjusted EBITDA * |

|

17,349 |

|

|

41,870 |

|

(16,748 |

) |

|

25,122 |

|

|

42,471 |

|

|

Adjusted EBITDA % * |

|

9.2 |

% |

|

22.8 |

% |

|

|

13.7 |

% |

|

11.4 |

% |

|

|

Trailing Twelve Months September 30, 2021 |

|

|

DMC |

Arcadia |

Combined |

|

$000 |

Unaudited |

Unaudited |

Unaudited |

|

Net income |

$ |

1,632 |

|

$ |

52,970 |

|

$ |

54,602 |

|

|

Interest expense, net |

|

397 |

|

|

|

397 |

|

|

Income tax provision |

|

437 |

|

|

889 |

|

|

1,326 |

|

|

Depreciation |

|

10,865 |

|

|

1,789 |

|

|

12,654 |

|

|

Amortization |

|

1,196 |

|

|

|

1,196 |

|

|

EBITDA |

|

14,527 |

|

|

55,648 |

|

|

70,175 |

|

|

Restructuring |

|

209 |

|

|

|

209 |

|

|

Due diligence adjustments (1) |

|

|

(1,096 |

) |

|

(1,096 |

) |

|

Stock-based compensation |

|

6,425 |

|

|

|

6,425 |

|

|

Other (income), net |

|

(189 |

) |

|

|

(189 |

) |

|

Adjusted EBITDA |

|

20,972 |

|

|

54,552 |

|

|

75,524 |

|

|

Adjusted EBITDA attributable to redeemable noncontrolling interest

(2) |

|

|

(21,821 |

) |

|

(21,821 |

) |

|

Adjusted EBITDA attributable to DMC |

|

20,972 |

|

|

32,731 |

|

|

53,703 |

|

| |

|

|

|

|

|

|

|

|

|

CONTACT:Geoff HighVice

President of Investor Relations303-604-3924

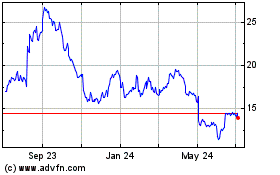

DMC Global (NASDAQ:BOOM)

Historical Stock Chart

From Oct 2024 to Nov 2024

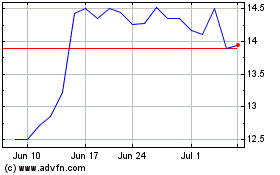

DMC Global (NASDAQ:BOOM)

Historical Stock Chart

From Nov 2023 to Nov 2024