false

0001342958

0001342958

2024-08-01

2024-08-01

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Form

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date

of Report (Date of earliest event reported): August 1, 2024

DIGITAL

ALLY, INC.

(Exact

Name of Registrant as Specified in Charter)

| Nevada |

|

001-33899 |

|

20-0064269 |

| (State

or other Jurisdiction |

|

(Commission |

|

(IRS

Employer |

| of

Incorporation) |

|

File

Number) |

|

Identification

No.) |

14001

Marshall Drive, Lenexa, KS 66215

(Address

of Principal Executive Offices) (Zip Code)

(913)

814-7774

(Registrant’s

telephone number, including area code)

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of exchange on which registered |

| Common

stock, $0.001 par value |

|

DGLY |

|

The

Nasdaq Capital Market LLC |

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☒ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

8.01 Regulation FD Disclosure.

On

June 1, 2023, Digital Ally, Inc. (the “Company”) entered into an Agreement and Plan of Merger (the “Merger Agreement”)

with Clover Leaf Capital Corp., a Delaware corporation (together with its successors, “Clover Leaf”), CL Merger Sub, Inc.,

a Nevada corporation and a wholly-owned subsidiary of Clover Leaf (“Merger Sub”), Yntegra Capital Investments LLC, a Delaware

limited liability company, in the capacity as the representative from and after the effective time for the stockholders of Clover Leaf

in accordance with the terms and conditions of the Merger Agreement, and Kustom Entertainment, Inc., a Nevada corporation, and a wholly

own subsidiary of the Company (“Kustom”). Pursuant to the Merger Agreement, subject to the terms and conditions set forth

therein upon the consummation of the transactions contemplated by the Merger Agreement (the “Closing”), Merger Sub will merge

with and into Kustom (the “Merger”), with Kustom continuing as the surviving corporation in the Merger and a wholly-owned

subsidiary of Clover Leaf. In the Merger, all of the issued and outstanding capital stock of Kustom immediately prior to the effective

time shall no longer be outstanding and shall automatically be cancelled and shall cease to exist in exchange for the right for the Company

to receive the Merger Consideration (as defined herein).

The

aggregate merger consideration to be paid pursuant to the Merger Agreement to the Company as of immediately prior to the effective time

will be an amount equal to (the “Merger Consideration”) (i) $125 million, minus (ii) the estimated consolidated indebtedness

of Kustom as of the Closing (“Closing Indebtedness”). The Merger Consideration to be paid to the Company will be paid solely

by the delivery of new shares of Clover Leaf Class A common stock, each valued at $11.14 per share. The Closing Indebtedness (and the

resulting Merger Consideration) is based solely on estimates determined shortly prior to the Closing and is not subject to any post-Closing

true-up or adjustment.

On

August 1, the board of directors of the Company (the “Board”) set the record date for the dividend distribution to August

12, 2024 for determining stockholders entitled to receive the dividend distribution (the “Record Date”).

On

August 5, 2024, the Company issued a press release announcing that the Company and the Board has set the Record Date for the dividend distribution on the common stock. As mentioned above, the Record

Date for the holders of the common stock to participate in the dividend is August 12, 2024.

The

press release is furnished herewith as Exhibit 99.1 and is incorporated by reference herein. The information contained in the press release

is being furnished and shall not be deemed filed for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), or otherwise subject to the liability of that Section, and shall not be incorporated by reference into any registration

statement or other document filed under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set

forth by specific reference in such filing.

Item

9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

Date:

August 5, 2024

| |

Digital

Ally, Inc. |

| |

|

|

| |

By: |

/s/

Stanton E. Ross |

| |

Name: |

Stanton

E. Ross |

| |

Title: |

Chairman

and Chief Executive Officer |

Exhibit

99.1

Kustom

Entertainment, Inc. and Clover Leaf Capital Corp. Announce Effectiveness of Registration Statement as Digital Ally Announces Record Date

for Distribution

KANSAS

CITY, August 5, 2024 (GLOBE NEWSWIRE) – Digital Ally, Inc. (Nasdaq: DGLY) – Kustom Entertainment, Inc. (“Kustom Entertainment”),

a premier live event marketing and concert production company and current subsidiary of Digital Ally Inc. (“Digital Ally”),

today announced that Clover Leaf Capital Corp.’s (“Clover Leaf”) registration

statement on Form S-4 has been declared effective by the U.S. Securities and Exchange Commission (the “SEC”) as of Tuesday,

July 30, 2024, relating to the previously announced proposed business combination by and among Clover Leaf, Kustom Entertainment, Inc.

and CL Merger Sub, Inc.

Clover

Leaf has mailed the definitive proxy statement/prospectus (the “Proxy Statement”) to stockholders of record as of the close

of business on July 24, 2024. The Proxy Statement contains information and a proxy card relating to the special meeting of Clover

Leaf’s stockholders (the “Special Meeting”).

The

Special Meeting to approve the proposed business combination is scheduled on August 20, 2024 at 10:00 a.m. Eastern Time

via a virtual meeting format at www.cstproxy.com/cloverlcc/bc2024.

The

combined company will be known as Kustom Entertainment and will operate under the same management team, led by Stanton E. Ross, the current

CEO. The transaction contemplates an equity value of $125 million for Kustom Entertainment, Inc. The combined company is expected to

have an implied initial pro forma equity value of approximately $222.2 million. Additionally, Digital Ally will distribute to its shareholders

30% of the shares obtained in Kustom Entertainment immediately following the closing of the merger and intends to distribute the balance

of such shares following a six-month lock-up period. The initial distribution will be made to all stockholders of record of Digital Ally

as of the close of business on August 12, 2024.

About

Kustom Entertainment, Inc.

Kustom

Entertainment, Inc., a recently formed wholly-owned subsidiary of Digital Ally, will provide oversight to currently wholly-owned subsidiaries

TicketSmarter, Kustom 440, and BirdVu Jets.

TicketSmarter

offers tickets to more than 125,000 live events ranging from concerts to sports and theatre shows. TicketSmarter is the official ticket

resale partner of over 35 collegiate conferences, over 300 universities, and hundreds of events and venues nationally. TicketSmarter

is a primary and secondary ticketing solution for events and high-profile venues across North America. For more information on TicketSmarter,

visit www.Ticketsmarter.com.

Established

in late 2022, Kustom 440 is an entertainment division of Kustom Entertainment, Inc., whose mission it is to attract, manage and promote

concerts, sports and private events. Kustom 440 is unique in that it brings a primary and secondary ticketing platform, in addition to

its well-established relationships with artists, venues, and municipalities. For more information on Kustom 440, visit www.Kustom440.com.

Kustom

Entertainment operates through its wholly-owned subsidiaries TicketSmarter, Inc. (“TicketSmarter”), Kustom 440, Inc. (“Kustom

440”), and BirdVu Jets, Inc. (“BirdVu Jets”). Following the closing of the Business Combination, TicketSmarter, Kustom

440, and BirdVu Jets will combine their management teams and focus on concerts, entertainment and garnering additional ticketing partnerships,

as well as using existing sponsorships and sports property partnerships to develop alternative entertainment options for consumers.

About

Clover Leaf Capital Corp.

Clover

Leaf Capital Corp. is a newly organized blank check company formed for the purpose of effecting a merger, capital stock exchange, asset

acquisition, stock purchase, reorganization or similar business combination with one or more businesses.

For

more information, contact:

Stanton

E. Ross, CEO

Info@kustoment.com

Info@cloverlcc.com

Forward-Looking

Statements

This

press release contains certain forward-looking statements within the meaning of the “safe harbor” provisions of the Private

Securities Litigation Reform Act of 1955. These forward-looking statements include, without limitation, CLOE’s and Kustom Entertainment’s

expectations with respect to the proposed business combination between CLOE and Kustom Entertainment, including statements regarding

the benefits of the transaction, the anticipated timing of the transaction, the implied valuation of Kustom Entertainment, the products

offered by Kustom Entertainment and the markets in which it operates, and Kustom Entertainment’s projected future results. Words

such as “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,”

“strategy,” “future,” “opportunity,” “plan,” “may,” “should,”

“will,” “would,” “will be,” “will continue,” “will likely result,” and similar

expressions are intended to identify such forward-looking statements. Forward-looking statements are predictions, projections and other

statements about future events that are based on current expectations and assumptions and, as a result, are subject to significant risks

and uncertainties that could cause the actual results to differ materially from the expected results. Most of these factors are outside

CLOE’s and Kustom Entertainment’s control and are difficult to predict. Factors that may cause actual future events to differ

materially from the expected results, include, but are not limited to: (i) the risk that the transaction may not be completed in a timely

manner or at all, which may adversely affect the price of CLOE’s securities, (ii) the risk that the transaction may not be completed

by CLOE’s business combination deadline, even if extended by its stockholders, (iii) and the potential failure to obtain an extension

of the business combination deadline if sought by Clover Leaf; (iv) the failure to satisfy the conditions to the consummation of the

transaction, including the adoption of the agreement and plan of merger (“Merger Agreement”) by the stockholders of CLOE,

(v) the occurrence of any event, change or other circumstance that could give rise to the termination of the Merger Agreement, (vi) the

failure to obtain any applicable regulatory approvals required to consummate the business combination; (vii) the receipt of an unsolicited

offer from another party for an alternative transaction that could interfere with the business combination, (viii) the effect of the

announcement or pendency of the transaction on Kustom Entertainment’s business relationships, performance, and business generally,

(ix) the inability to recognize the anticipated benefits of the business combination, which may be affected by, among other things, competition

and the ability of the post-combination company to grow and manage growth profitability and retain its key employees, (x) costs related

to the business combination, (xi) the outcome of any legal proceedings that may be instituted against Kustom Entertainment or CLOE following

the announcement of the proposed business combination, (xii) the ability to maintain the listing of CLOE’s securities on the Nasdaq

prior to the business combination, (xiii) the ability to implement business plans, forecasts, and other expectations after the completion

of the proposed business combination, and identify and realize additional opportunities, (xiv) the risk of downturns and the possibility

of rapid change in the highly competitive industry in which Kustom Entertainment operates, (xv) the risk that demand for Kustom Entertainment’s

services may be decreased due to a decrease in the number of large-scale sporting events, concerts and theater shows, (xvi) the risk

that any adverse changes in Kustom Entertainment’s relationships with buyer, sellers and distribution partners may adversely affect

the business, financial condition and results of operations, (xvii) the risk that Changes in Internet search engine algorithms and dynamics,

or search engine disintermediation, or changes in marketplace rules could have a negative impact on traffic for Kustom Entertainment’s

sites and ultimately, its business and results of operations; (xviii) the risk that any decrease in the willingness of artists, teams

and promoters to continue to support the secondary ticket market may result in decreased demand for Kustom Entertainment’s services;

(xix) the risk that Kustom Entertainment is not able to maintain and enhance its brand and reputation in its marketplace, adversely affecting

Kustom Entertainment’s business, financial condition and results of operations, (xx) the risk of the occurrence of extraordinary

events, such as terrorist attacks, disease epidemics or pandemics, severe weather events and natural disasters, (xxi) the risk that because

Kustom Entertainment’s operations are seasonal and its results of operations vary from quarter to quarter and year over year, its

financial performance in certain financial quarters or years may not be indicative of, or comparable to, Kustom Entertainment’s

financial performance in subsequent financial quarters or years; (xxii) the risk that periods of rapid growth and expansion could place

a significant strain on Kustom Entertainment’s resources, including its employee base, which could negatively impact Kustom Entertainment’s

operating results; (xxiii) the risk that Kustom Entertainment may never achieve or sustain profitability; (xxiv) the risk that Kustom

Entertainment may need to raise additional capital to execute its business plan, which many not be available on acceptable terms or at

all; (xxv) the risk that third-parties suppliers and manufacturers are not able to fully and timely meet their obligations, (xxvi) the

risk that Kustom Entertainment is unable to secure or protect its intellectual property, (xxvii) the risk that the post-combination company’s

securities will not be approved for listing on Nasdaq or if approved, maintain the listing and (xxviii) other risks and uncertainties

indicated from time to time in the proxy statement and/or prospectus relating to the business combination, including those under the

“Risk Factors” section therein and in CLOE’s other filings with the SEC. The foregoing list of factors is not exhaustive.

Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking

statements, and Kustom Entertainment and CLOE assume no obligation and do not intend to update or revise these forward-looking statements,

whether as a result of new information, future events, or otherwise.

Important

Information and Where to Find It

In

connection with the transaction, CLOE has filed the Registration Statement with the SEC, which includes a proxy statement to be distributed

to holders of CLOE’s common stock in connection with CLOE’s solicitation of proxies for the vote by CLOE’s stockholders

with respect to the transaction and other matters as described in the Registration Statement, as well as a prospectus relating to the

offer of the securities to be issued to Kustom Entertainment’s stockholder in connection with the transaction. Before making

any voting or investment decision, investors and security holders and other interested parties are urged to read the Registration

Statement, any amendments thereto and any other documents filed with the SEC carefully and in their entirety because they contain important

information about CLOE, Kustom Entertainment and the transaction. Investors and security holders may obtain free copies of the proxy

statement/prospectus and other documents filed with the SEC by CLOE through the website maintained by the SEC at http://www.sec.gov,

or by directing a request to: 1450 Brickell Avenue, Suite 2520, Miami, FL 33131.

Participants

in Solicitation

CLOE

and Kustom Entertainment and their respective directors and certain of their respective executive officers and other members of management

and employees may be considered participants in the solicitation of proxies with respect to the transaction. Information about the directors

and executive officers of CLOE is set forth in its Annual Report on Form 10-K for the fiscal year ended December 31, 2023 filed with

the SEC on March 22, 2024. Additional information regarding the participants in the proxy solicitation and a description of their direct

and indirect interests, by security holdings or otherwise, are included in the proxy statement/ prospectus and other relevant materials

to be filed with the SEC regarding the transaction. Stockholders, potential investors and other interested persons should read the proxy

statement/prospectus carefully before making any voting or investment decisions. These documents can be obtained free of charge from

the sources indicated above.

No

Offer or Solicitation

This

press release shall not constitute a solicitation of a proxy, consent or authorization with respect to any securities or in respect of

the proposed business combination. This communication shall not constitute an offer to sell or the solicitation of an offer to buy any

securities, nor shall there be any sale of securities in any state or jurisdiction in which such offer, solicitation or sale would be

unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction. No offering of securities

shall be made except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended,

or an exemption therefrom.

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

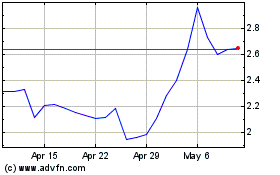

Digital Ally (NASDAQ:DGLY)

Historical Stock Chart

From Aug 2024 to Sep 2024

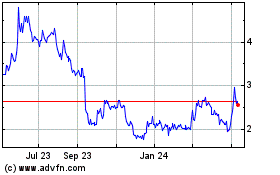

Digital Ally (NASDAQ:DGLY)

Historical Stock Chart

From Sep 2023 to Sep 2024