FALSE000087291200008729122023-11-132023-11-13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

_____________________

FORM 8-K

_____________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 13, 2023

_____________________

DELCATH SYSTEMS, INC.

(Exact Name of Registrant as Specified in its Charter)

_____________________

| | | | | | | | | | | | | | |

| Delaware | | 001-16133 | | 06-1245881 |

| (State or other jurisdiction of incorporation or organization) | | (Commission File Number) | | (IRS Employer Identification No.) |

1633 Broadway, Suite 22C

New York, NY 10019

(Address of principal executive offices) (Zip Code)

(212) 489-2100

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

_____________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | | |

Title of each class | Trading | Name of each exchange | |

symbol(s) | on which registered | |

Common Stock, $.01 par value | | DCTH | | The NASDAQ Capital Market | |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02

Results of Operations and Financial Condition.

On November 13, 2023, Delcath Systems, Inc. (“Delcath”) issued a press release announcing business updates and financial results for the quarter ended September 30, 2023 (the “Press Release”). A copy of the press release is furnished pursuant to Item 2.02 as Exhibit 99.1 hereto and is incorporated herein by reference.

The information contained in this Current Report on Form 8-K, including the Press Release, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section or Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended. The information contained herein and in the Press Release shall not be incorporated by reference into any filing with the U.S. Securities and Exchange Commission by Delcath whether made before or after the date hereof, regardless of any general incorporation language in such filing.

Item 9.01

Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | | | | |

| | | |

| DELCATH SYSTEMS, INC. |

| |

Date: November 13, 2023 | By: | | /s/ Gerard Michel |

| | | Name: Gerard Michel |

| | | Title: Chief Executive Officer |

Delcath Systems Reports Third Quarter 2023 Results and Provides Business Update

NEW YORK – November 13, 2023, Delcath Systems, Inc. (Nasdaq: DCTH) (“Delcath” or the “Company”), an interventional oncology company focused on the treatment of primary and metastatic cancers of the liver, today reported business highlights and financial results for the third quarter ended September 30, 2023.

Recent Business Highlights

•Received approval from the US Food and Drug Administration (FDA) for HEPZATO KIT™ (melphalan)/Hepatic Delivery System) as a liver-directed treatment for adult patients with metastatic uveal melanoma (mUM) with unresectable hepatic metastases affecting less than 50% of the liver and no extrahepatic disease, or extrahepatic disease limited to the bone, lymph nodes, subcutaneous tissues, or lung that is amenable to resection or radiation;

•Raised approximately $35 million through the exercise of all the Tranche A warrants issued as part the previously announced March 29, 2023, financing with up to an additional $25 million available upon the achievement of $10 million in quarterly revenue;

•Announced publication by independent investigators of a retrospective comparative study of CHEMOSAT® Hepatic Delivery System for Melphalan percutaneous hepatic perfusion (PHP) and Selective Internal Radiation Therapy (SIRT) citing a statistically significant difference in median overall survival with 301 days for SIRT and 516 days for PHP;

•Announced that independent investigators at Leiden University recruited 55 of 76 planned patients in the CHOPIN trial studying the impact of CHEMOSAT and immune checkpoint inhibitor combination therapy in the treatment of metastatic uveal melanoma and expect the trial to be fully enrolled mid-2024. An interim futility analysis conducted in September resulted in the independent data monitoring committee recommending continuing the study without modification; and

•Partnered with seven clinical treatment sites to satisfy the initial training requirements to be able to treat their first commercial patient, subject to proctor availability and the sites’ value analysis committee approvals, upon the planned launch in January.

“The Company has been preparing for a January launch of HEPZATO KIT by building our commercial team and engaging with potential treating centers” said Gerard Michel, Chief Executive Officer of Delcath. Mr. Michel added, “We have been encouraged by the reception that HEPZATO KIT has received from the medical oncologist community and are confident that by the end of 2024 at least 15 centers will be actively treating metastatic uveal melanoma patients with HEPZATO KIT.”

Third Quarter 2023 Results

Total revenue for the three months ended September 30, 2023, was approximately $0.4 million, compared to $0.9 million for the prior year period, from our sales of CHEMOSAT in Europe.

Research and development expenses for the quarter were $4.7 million, compared to $4.1 million in the prior year quarter. The increase in R&D expense is primarily due to completing clinical trial activities and expenses related to the FDA inspection and other requests in advance of the approval received for HEPZATO.

Selling, general and administrative expenses for the quarter increased to $6.2 million, compared to $4.8 million in the prior year quarter primarily relating to activities to prepare for a commercial launch. The increase in fair value warrant liability adjustment during the quarter ended September 20, 20223 was a result of our final valuation for the Tranche A warrants exercised and outstanding Tranche B warrants.

About Delcath Systems, Inc., CHEMOSAT and HEPZATO KIT

Delcath Systems, Inc. is an interventional oncology company focused on the treatment of primary and metastatic liver cancers. The company's proprietary products, HEPZATO KIT (Hepzato (melphalan) for Injection/Hepatic Delivery System) and CHEMOSAT® Hepatic Delivery System for Melphalan percutaneous hepatic perfusion (PHP) are designed to administer high-dose chemotherapy to the liver while controlling systemic exposure and associated side effects during a PHP procedure.

In the United States, HEPZATO KIT is considered a combination drug and device product and is regulated and approved for sale as a drug by the FDA. HEPZATO KIT is comprised of the chemotherapeutic drug melphalan and Delcath's proprietary Hepatic Delivery System (HDS). The HDS is used to surgically isolate the liver while simultaneously filtrating hepatic venous blood during melphalan infusion and washout. The use of the HDS results in loco-regional delivery of a relatively high melphalan dose, which can potentially induce a clinically meaningful tumor response with minimal hepatotoxicity and reduce systemic exposure. HEPZATO KIT is approved in the United States as a liver-directed treatment for adult patients with metastatic uveal melanoma (mUM) with unresectable hepatic metastases affecting less than 50% of the liver and no extrahepatic disease, or extrahepatic disease limited to the bone, lymph nodes, subcutaneous tissues, or lung that is amenable to resection or radiation. Please see the full Prescribing Information, including BOXED WARNING for the HEPZATO KIT.

In Europe, the device-only configuration of the HDS is regulated as a Class III medical device and is approved for sale under the trade name CHEMOSAT Hepatic Delivery System for Melphalan, or CHEMOSAT, where it has been used in the conduct of percutaneous hepatic perfusion procedures at major medical centers to treat a wide range of cancers of the liver.

Safe Harbor / Forward-Looking Statements

The Private Securities Litigation Reform Act of 1995 provides a safe harbor for forward-looking statements made by the Company or on its behalf. This news release contains forward-looking statements, which are subject to certain risks and uncertainties that can cause actual results to differ materially from those described in particular, the statements regarding our private placement and expected gross proceeds and the expected uses of the proceeds from the private placement. Factors that may cause such differences include, but are not limited to, uncertainties relating to: anticipated use of proceeds from the private placement, achievement of milestones, the Company’s ability to commercialize HEPZATO, necessary financing to fund commercialization of HEPZATO in the U.S., the Company’s ability to generate revenue from HEPZATO, clinical adoption, use and resulting sales, if any, for the CHEMOSAT system to deliver and filter melphalan in; the Company’s ability to successfully commercialize the HEPZATO KIT/CHEMOSAT system and the potential of the HEPZATO KIT/CHEMOSAT system as a treatment for patients with primary and metastatic disease in the liver; approval of the future HEPZATO KIT/CHEMOSAT system for delivery and filtration of melphalan or other chemotherapeutic agents for various indications in the U.S. and/or in foreign markets; actions by the FDA or foreign regulatory agencies; uncertainties related to the continued supply of melphalan, necessary materials and other critical components for the HEPZATO KIT/CHEMOSAT; uncertainties relating to manufacturing delays or difficulties; the Company’s ability to mitigate risks from single-source suppliers; uncertainties relating to the timing and results of research

and development projects; and uncertainties regarding the Company’s ability to obtain financial and other resources for any research, development, clinical trials and commercialization activities. These factors, and others, are discussed from time to time in our filings with the SEC. You should not place undue reliance on these forward-looking statements, which speak only as of the date they are made. We undertake no obligation to publicly update or revise these forward-looking statements to reflect events or circumstances after the date they are made.

Investor Relations Contact:

Ben Shamsian

Lytham Partners

646-829-9701

shamsian@lythampartners.com

DELCATH SYSTEMS, INC.

Condensed Consolidated Balance Sheets

(Unaudited)

(in thousands, except share and per share data)

| | | | | | | | | | | |

| September 30,

2023 | | December 31,

2022 |

| Assets | | | |

| Current assets | | | |

| Cash and cash equivalents | $ | 40,462 | | | $ | 7,671 | |

| Restricted cash | 50 | | | 4,151 | |

| Accounts receivable, net | 205 | | | 366 | |

| Inventory | 2,667 | | | 1,998 | |

| Prepaid expenses and other current assets | 2,712 | | | 1,969 | |

| Total current assets | 46,096 | | | 16,155 | |

| Property, plant and equipment, net | 1,374 | | | 1,422 | |

| Right-of-use assets | 107 | | | 285 | |

| Total assets | $ | 47,577 | | | $ | 17,862 | |

| Liabilities and Stockholders’ Equity | | | |

| Current liabilities | | | |

| Accounts payable | $ | 753 | | | $ | 2,018 | |

| Accrued expenses | 5,230 | | | 4,685 | |

| Lease liabilities, current | 35 | | | 186 | |

| Loan payable, current | 5,080 | | | 7,846 | |

| Convertible notes payable, current | 2,876 | | | — | |

| Total current liabilities | 13,974 | | | 14,735 | |

| Warrant liability | 5,773 | | | — |

| Other liabilities, non-current | 1,111 | | | 1,144 | |

| Loan payable, non-current | — | | | 3,070 | |

| Convertible notes payable, non-current | 2,000 | | | 4,772 | |

| Total liabilities | 22,858 | | | 23,721 | |

| Commitments and contingencies | | | |

| Stockholders’ equity (deficit) | | | |

Preferred stock, $0.01 par value; 10,000,000 shares authorized; 37,787 and 11,357 shares issued and outstanding at September 30, 2023 and December 31, 2022, respectively | — | | | — | |

Common stock, $.01 par value; 80,000,000 shares authorized; 19,688,991 shares and 10,046,571 shares issued and outstanding at September 30, 2023 and December 31, 2022, respectively | 197 | | | 100 | |

| Additional paid-in capital | 518,607 | | | 451,608 | |

| Accumulated deficit | (494,026) | | | (457,484) | |

| Accumulated other comprehensive loss | (59) | | | (83) | |

| Total stockholders’ equity (deficit) | 24,719 | | | (5,859) | |

| Total liabilities and stockholders’ equity | $ | 47,577 | | | $ | 17,862 | |

DELCATH SYSTEMS, INC.

Condensed Consolidated Statements of Operations and Comprehensive Loss

(Unaudited)

(in thousands, except share and per share data)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended September 30, | | Nine months ended September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Product revenue | $ | 434 | | | $ | 906 | | | $ | 1,526 | | | $ | 1,909 | |

| Other revenue | — | | | — | | | — | | | 171 | |

| Total revenues | 434 | | | 906 | | | 1,526 | | | 2,080 | |

| Cost of goods sold | (133) | | | (235) | | | (464) | | | (449) | |

| Gross profit | 301 | | | 671 | | | 1,062 | | | 1,631 | |

| Operating expenses: | | | | | | | |

| Research and development expenses | 4,662 | | | 4,065 | | | 12,793 | | | 14,152 | |

| Selling, general and administrative expenses | 6,195 | | | 4,779 | | | 15,147 | | | 13,477 | |

| Total operating expenses | 10,857 | | | 8,844 | | | 27,940 | | | 27,629 | |

| Operating loss | (10,556) | | | (8,173) | | | (26,878) | | | (25,998) | |

| Change in fair value of warrant liability | (9,384) | | | — | | | (8,224) | | | — | |

| Interest expense, net | (395) | | | (730) | | | (1,454) | | | (2,040) | |

| Other income (expense) | (5) | | | 26 | | | 14 | | | 2 | |

| Net loss | (20,340) | | | (8,877) | | | (36,542) | | | (28,036) | |

| Other comprehensive income: | | | | | | | |

| Foreign currency translation adjustments | 5 | | | (46) | | | 24 | | | (82) | |

| Total other comprehensive loss | $ | (20,335) | | | $ | (8,923) | | | $ | (36,518) | | | $ | (28,118) | |

| Common share data: | | | | | | | |

| Basic and diluted loss per common share | $ | (1.14) | | | $ | (0.96) | | | $ | (2.61) | | | $ | (3.29) | |

| Weighted average number of basic and diluted shares outstanding | 17,863,078 | | 9,215,786 | | 13,985,248 | | 8,536,006 |

v3.23.3

Cover

|

Nov. 13, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Nov. 13, 2023

|

| Entity Registrant Name |

DELCATH SYSTEMS, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-16133

|

| Entity Tax Identification Number |

06-1245881

|

| Entity Address, Address Line One |

1633 Broadway

|

| Entity Address, Address Line Two |

Suite 22C

|

| Entity Address, City or Town |

New York

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10019

|

| City Area Code |

212

|

| Local Phone Number |

489-2100

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $.01 par value

|

| Trading Symbol |

DCTH

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0000872912

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

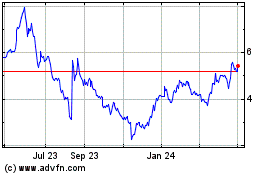

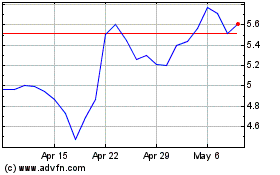

Delcath Systems (NASDAQ:DCTH)

Historical Stock Chart

From Jun 2024 to Jul 2024

Delcath Systems (NASDAQ:DCTH)

Historical Stock Chart

From Jul 2023 to Jul 2024