Higher Bookings in First Half 2024 and

Continued Strength from New Customer Wins Amid Broader Market

Softness

Significant Operating Expense Reductions and

Improvement in Direct Product Costs

Data I/O Corporation (NASDAQ: DAIO), the leading global provider

of advanced security and data deployment solutions for

microcontrollers, security ICs and memory devices, today announced

financial results for the second quarter ended June 30, 2024.

Second Quarter 2024 Highlights

- Net sales of $5.1 million; bookings of $5.6 million

- Quarter-end backlog of $5.4 million

- Gross margin as a percentage of sales of 54.5%

- Net loss of ($797,000) or ($0.09) per share

- Adjusted EBITDA* of $3,000

- Cash & Equivalents of $11.4 million; no debt

- 8 new customer wins

- Repatriated $3.4 million of cash from China subsidiary,

incurring dividend withholding tax of $337,000

*Adjusted EBITDA is a non-GAAP financial measure. A

reconciliation is provided in the tables of this press release.

Management Comments

Commenting on the second quarter ended June 30, 2024, Anthony

Ambrose, President and CEO of Data I/O Corporation, said, “Bookings

and revenue were soft in the second quarter and below our

expectations. We saw divergent business conditions across our sales

regions. Through the first half of the year, Asia and EMEA sales

regions are performing ahead of expectations and the Americas have

been substantially below expectations. We have seen strength in

programming centers and industrial markets in the first half of

2024, with weakness in automotive electronics. We also have strong

traction in new customer and location acquisitions with 8 new wins

in the second quarter, totaling 13 for the year. Capacity additions

from existing customers are seeing significant pushouts, as

customers are being very selective on new capacity spending. With

all of these factors, our bookings of $13.7 million in the first

half 2024 increased slightly from $13.3 million in the prior year

period. Backlog of $5.4 million at the end of the second quarter

increased from $4.5 million at March 31, 2024 and $3.8 million at

the end of the second quarter of last year.

“We made significant progress on spending controls, process

efficiencies and direct product costs. Successful implementation of

this strategy is evident in our second quarter performance. Gross

margin as a percentage of sales increased 170 basis points from the

first quarter 2024 even as sales declined sequentially. Operating

expenses in the second quarter were reduced by 21% from the prior

year period and 19% from the first quarter of this year.

“We also improved the flexibility of our cash position as we

repatriated $3.4 million of cash from our China subsidiary, and

recorded a cash tax withholding expense of approximately 10%.

Ongoing expense reductions and product cost improvements will lower

our breakeven point and aid in our near and longer term

profitability goals.

“Looking ahead, there is a significant amount of our contractual

backlog that is expected to be shipped and recognized as revenue in

the second half of 2024. We look forward to benefiting from the

improved operating leverage in our model given the progress made on

managing costs and expenses.”

Financial Results

Net sales in the second quarter 2024 were $5.1 million, down 32%

compared with $7.4 million in the second quarter 2023. The decrease

from the prior year period primarily reflects timing of the

bookings in the first quarter expected to be shipped in the second

half 2024 and lower second quarter bookings. Total second quarter

bookings were $5.6 million, down from $7.6 million in the prior

year, on strong opportunity conversion in Asia offset by softness

in the Americas. First quarter 2024 backlog at $4.5 million

increased by $900,000 to $5.4 million as of June 30, 2024.

Gross margin as a percentage of sales was 54.5% in the second

quarter 2024, as compared to 59.1% in the prior year period. The

difference in gross margin as a percentage of sales primarily

reflects lower sales volume on relatively fixed manufacturing and

service costs and product mix. Material, production and service

costs were all lower than the prior quarter and prior year from

ongoing cost reduction initiatives which partially offset the sales

decline impact.

Operating expenses in the second quarter 2024 were $3.3 million,

down $886,000 or 21% from the prior year period and down $757,000

or 19% from the first quarter 2024. Second quarter R&D and

SG&A expenses were significantly lower than both comparative

periods due to continued efficiency improvements and cost reduction

efforts. Personnel, facilities, IT and other outside services costs

declined through prioritization of critical programs and overall

efficiency improvements.

Net loss in the second quarter 2024 was ($797,000), or ($0.09)

per share, compared with net income of $300,000, or $0.03 per

share, in the second quarter 2023. Adjusted earnings before

interest, taxes, depreciation and amortization (“Adjusted EBITDA”),

which excludes equity compensation, was $3,000 in the second

quarter 2024, compared to Adjusted EBITDA of $870,000 in the second

quarter 2023.

The Company’s balance sheet remained strong with cash of $11.4

million at the end of the second quarter 2024 compared to $12.3

million on December 31, 2023. Cash declined due to higher cash

expenses paid annually in the first quarter and financial

performance in the second quarter including the tax repatriation

expense of approximately $337,000.

Inventories at $6.7 million at the end of the second quarter

2024 increased from $5.9 million on December 31, 2023, due to lower

system shipments in the first two quarters of the year and

anticipation of backlog reduction shipments in the second half of

2024. Data I/O had net working capital of $17.6 million on June 30,

2024 compared to $18.4 million on December 31, 2023. The company

continues to have no debt.

Conference Call Information

A conference call discussing financial results for the second

quarter ended June 30, 2024 will follow this release today at 2

p.m. Pacific Time/5 p.m. Eastern Time. To listen to the conference

call, please dial 412-317-5788. A replay will be made available

approximately one hour after the conclusion of the call. To access

the replay, please dial 412-317-0088, access code 1486982. The

conference call will also be simultaneously webcast over the

Internet; visit the Webcasts and Presentations section of the Data

I/O Corporation website at www.dataio.com to access the call from

the site. This webcast will be recorded and available for replay on

the Data I/O Corporation website approximately one hour after the

conclusion of the conference call.

About Data I/O Corporation

Since 1972, Data I/O has developed innovative solutions to

enable the design and manufacture of electronic products for

automotive, Internet-of-Things, medical, wireless, consumer

electronics, industrial controls and other electronics devices.

Today, our customers use Data I/O’s data programming solutions and

security deployment platform to secure the global electronics

supply chain and protect IoT device intellectual property from

point of inception to deployment in the field. OEMs of any size can

program and securely provision devices from early samples all the

way to high volume production prior to shipping semiconductor

devices to a manufacturing line. Data I/O enables customers to

reliably, securely, and cost-effectively bring innovative new

products to life. These solutions are backed by a portfolio of

patents and a global network of Data I/O support and service

professionals, ensuring success for our customers. Learn more at

dataio.com/Company/Patents.

Learn more at dataio.com

Forward Looking Statement and Non-GAAP financial

measures

Statements in this news release concerning economic outlook,

expected revenue, expected margins, expected savings, expected

results, expected expenses, orders, deliveries, backlog and

financial positions, semiconductor chip shortages, supply chain

expectations, as well as any other statement that may be construed

as a prediction of future performance or events are forward-looking

statements which involve known and unknown risks, uncertainties and

other factors which may cause actual results to differ materially

from those expressed or implied by such statements.

Forward-looking statement disclaimers also apply to the demand

for the Company’s products and the impact from geopolitical

conditions including any related international trade restrictions.

These factors include uncertainties as to the ability to record

revenues based upon the timing of product deliveries, shipping

availability, installations and acceptance, accrual of expenses,

coronavirus related business interruptions, changes in economic

conditions, part shortages and other risks including those

described in the Company’s filings on Forms 10-K and 10-Q with the

Securities and Exchange Commission (SEC), press releases and other

communications.

Non-GAAP financial measures, such as EBITDA and Adjusted EBITDA,

excluding equity compensation, should not be considered a

substitute for, or superior to, measures of financial performance

prepared in accordance with GAAP. We believe that these non-GAAP

financial measures provide meaningful supplemental information

regarding the Company’s results and facilitate the comparison of

results.

- tables follow -

DATA I/O CORPORATION

CONSOLIDATED STATEMENTS OF

OPERATIONS

(in thousands, except per

share amounts)

(UNAUDITED)

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Net Sales

$5,062

$7,398

$11,161

$14,629

Cost of goods sold

2,305

3,025

5,184

5,954

Gross margin

2,757

4,373

5,977

8,675

Operating expenses:

Research and development

1,413

1,720

2,995

3,345

Selling, general and administrative

1,910

2,489

4,408

4,997

Total operating expenses

3,323

4,209

7,403

8,342

Operating income (loss)

(566)

164

(1,426)

333

Non-operating income (loss):

Interest income

73

49

153

84

Foreign currency transaction gain

(loss)

49

196

62

122

Total non-operating income (loss)

122

245

215

206

Income (loss) before income taxes

(444)

409

(1,211)

539

Income tax (expense) benefit

(353)

(109)

(393)

(144)

Net income (loss)

($797)

$300

($1,604)

$395

Basic earnings (loss) per share

($0.09)

$0.03

($0.18)

$0.04

Diluted earnings (loss) per share

($0.09)

$0.03

($0.18)

$0.04

Weighted-average basic shares

9,104

8,904

9,063

8,861

Weighted-average diluted shares

9,104

9,075

9,063

9,052

DATA I/O CORPORATION

CONSOLIDATED BALANCE

SHEETS

(in thousands, except share

data)

(UNAUDITED)

June 30, 2024

December 31, 2023

ASSETS

CURRENT ASSETS:

Cash and cash equivalents

$11,440

$12,341

Trade accounts receivable, net of

allowance for

credit losses of $21 and $72,

respectively

3,341

5,707

Inventories

6,741

5,875

Other current assets

601

690

TOTAL CURRENT ASSETS

22,123

24,613

Property, plant and equipment – net

932

1,359

Other assets

1,032

1,429

TOTAL ASSETS

$24,087

$27,401

LIABILITIES AND STOCKHOLDERS’

EQUITY

CURRENT LIABILITIES:

Accounts payable

$1,041

$1,272

Accrued compensation

$949

$2,003

Deferred revenue

$1,279

$1,362

Other accrued liabilities

$1,176

$1,438

Income taxes payable

$49

$113

TOTAL CURRENT LIABILITIES

4,494

6,188

Operating lease liabilities

421

702

Long-term other payables

254

192

STOCKHOLDERS’ EQUITY

Preferred stock -

Authorized, 5,000,000 shares,

including

200,000 shares of Series A Junior

Participating

Issued and outstanding, none

$0

$0

Common stock, at stated value -

Authorized, 30,000,000 shares

Issued and outstanding, 9,219,838 shares

as of June 30,

2024 and 9,020,819 shares as of December

31, 2023

$23,172

$22,731

Accumulated earnings (deficit)

($4,249)

($2,645)

Accumulated other comprehensive income

($5)

$233

TOTAL STOCKHOLDERS’ EQUITY

18,918

20,319

TOTAL LIABILITIES AND STOCKHOLDERS’

EQUITY

$24,087

$27,401

DATA I/O CORPORATION

NON-GAAP FINANCIAL MEASURE

RECONCILIATION

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

(in thousands)

Net Income (loss)

($797)

$300

($1,604)

$395

Interest (income)

($73)

($49)

($153)

($84)

Taxes

$353

$109

$393

$144

Depreciation and amortization

$138

$130

$340

$288

EBITDA earnings

($379)

$490

($1,024)

$743

Equity compensation

$382

$380

$663

$629

Adjusted EBITDA, excluding equity

compensation

$3

$870

($361)

$1,372

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240725189099/en/

Gerald Ng Vice President and CFO Data I/O Corporation

Investor-Relations@dataio.com Darrow Associates, Inc. Jordan Darrow

(512) 551-9296 jdarrow@darrowir.com

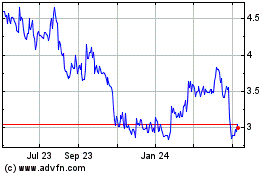

Data I O (NASDAQ:DAIO)

Historical Stock Chart

From Dec 2024 to Jan 2025

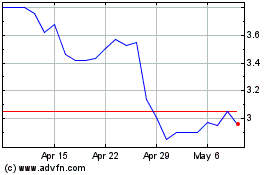

Data I O (NASDAQ:DAIO)

Historical Stock Chart

From Jan 2024 to Jan 2025