Cyclo Therapeutics’ TransportNPC™ Phase 3

clinical trial for Trappsol® Cyclo™ for the treatment of

Niemann-Pick Disease Type C1, a rare and fatal genetic disease, is

fully enrolled and results from the 48-week interim analysis are

expected in the middle of 2025

Rafael Holdings, Inc. (NYSE: RFL), and Cyclo Therapeutics, Inc.

(Nasdaq: CYTH) today announced that they have entered into a

definitive merger agreement to combine the two companies to focus

on the development of Trappsol® Cyclo™ for the treatment of

Niemann-Pick Disease Type C1. On consummation of the merger, Rafael

Holdings will issue shares of its Class B common stock to Cyclo

Therapeutics’ shareholders, based on an exchange ratio valuing

Cyclo Therapeutics shares at $.95 per share and Rafael Holdings at

its cash value combined with the value of its marketable securities

and certain other investments less certain current liabilities. In

addition, the cash value will take into account the funding of

Cyclo’s operations by Rafael with convertible notes through

closing. Following the closing, Rafael Holdings intends to fund the

TransportNPC™ clinical trial to its 48-week interim analysis. The

boards of directors of Rafael Holdings and Cyclo Therapeutics have

approved this transaction and expect it to close in late 2024,

pending approval of the companies’ shareholders, the effectiveness

of a registration statement to register the shares of Class B

common stock of Rafael Holdings to be issued in the transaction and

other customary closing conditions.

Rafael Holdings made its first strategic investment in Cyclo

Therapeutics in March 2023 to help drive treatment innovation for

patients with the debilitating diagnosis of Niemann-Pick Disease

Type C1. Rafael Holdings led another financing round in the fall of

2023 and has continued to support Cyclo Therapeutics via

convertible debt financings in 2024.

“The proposed merger with Cyclo Therapeutics is a major step

forward in our strategy to invest in, develop and commercialize

clinical stage assets in areas of high unmet medical need,” said

Bill Conkling, President and CEO of Rafael Holdings. Bill added,

“Cyclo Therapeutics continues to make substantial progress in

advancing its lead asset, Trappsol® Cyclo™, announcing the

completion of enrollment in its pivotal TransportNPC™ Phase 3

clinical study for the treatment of Niemann-Pick Disease Type C1 at

the end of May 2024. We are impressed with the execution by the

Cyclo Therapeutics team in fully enrolling a comprehensive clinical

trial in NPC and we eagerly await the 48-week interim analysis in

the middle of 2025. Rafael Holdings is excited to join forces with

Cyclo Therapeutics to make Trappsol® Cyclo™ our lead clinical

program. We are committed to the program and will leverage our

resources to help bring this much needed treatment option to NPC

patients.”

N. Scott Fine, Chief Executive Officer of Cyclo Therapeutics,

commented, “Our partnership with Rafael Holdings during the last

year and a half has enabled Cyclo to get to where we are today. We

are extremely pleased to announce our merger agreement with Rafael

Holdings and believe that the strength of Rafael’s balance sheet

and its strong management team will solidify our commitment to

deliver the results of the TransportNPC™ trial for our shareholders

and patients.”

Cassel Salpeter & Co. is acting as financial advisor to

Cyclo Therapeutics in connection with the transaction. Schwell

Wimpfheimer & Associates is serving as legal advisor to Rafael

Holdings and Fox Rothschild LLP is serving as legal advisor to

Cyclo Therapeutics.

About Rafael Holdings, Inc.

Rafael Holdings is a holding company with interests in clinical

and early-stage pharmaceutical companies including an investment

and planned merger with Cyclo Therapeutics, Inc. (Nasdaq: CYTH), a

clinical-stage biotechnology company dedicated to developing

life-changing medicines for patients and families living with

challenging diseases through its lead therapeutic asset, Trappsol®

Cyclo™, a majority investment in Cornerstone Pharmaceuticals, Inc.,

formerly known as Rafael Pharmaceuticals Inc., a cancer

metabolism-based therapeutics company, a majority equity interest

in LipoMedix Pharmaceuticals Ltd., a clinical stage pharmaceutical

company, the Barer Institute Inc., a wholly-owned preclinical

cancer metabolism research operation, a majority investment in Day

Three Labs, Inc., a company which reimagines existing cannabis

offerings with pharmaceutical-grade technology and innovation like

Unlokt™ to bring to market better, cleaner, more precise and

predictable products in the cannabis industry, and a majority

interest in Rafael Medical Devices, LLC, an orthopedic-focused

medical device company developing instruments to advance minimally

invasive surgeries. Rafael’s primary goal has been to expand its

investment portfolio through opportunistic and strategic

investments including therapeutics which address high unmet medical

needs. Upon closing of the merger transaction with Cyclo

Therapeutics, Rafael intends to focus its efforts on making

Trappsol® Cyclo™ its lead clinical program.

About Cyclo Therapeutics, Inc.

Cyclo Therapeutics, Inc. is a clinical-stage biotechnology

company dedicated to developing life-changing medicines through

science and innovation for patients and families living with

disease. The Company’s Trappsol® Cyclo™, an orphan drug designated

product in the United States and Europe, is the subject of four

formal clinical trials for Niemann-Pick Disease Type C, a rare and

fatal genetic disease, (www.ClinicalTrials.gov NCT02939547,

NCT02912793, NCT03893071 and NCT04860960). The Company is

conducting a Phase 2b clinical trial using Trappsol® Cyclo™

intravenously in early Alzheimer’s disease (NCT05607615) based on

encouraging data from an Expanded Access program for Alzheimer’s

disease (NCT03624842). Additional indications for the active

ingredient in Trappsol® Cyclo™ are in development. For additional

information, visit the Company’s website:

www.cyclotherapeutics.com.

Forward Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. All statements contained in this press release that do not

relate to matters of historical fact should be considered

forward-looking statements, including without limitation statements

regarding our expectations surrounding the potential, safety,

efficacy, and regulatory and clinical progress of our product

candidates; plans regarding the further evaluation of clinical data

in the success of the potential combination with Cyclo

Therapeutics; and the potential of our pipeline. These statements

are neither promises nor guarantees, but involve known and unknown

risks, uncertainties and other important factors that may cause our

actual results, performance or achievements to be materially

different from any future results, performance or achievements

expressed or implied by the forward-looking statements Among other

things, these risks include that there can be no guarantee that the

proposed business combination will be completed in the anticipated

timeframe or that the conditions required to complete the proposed

combination will be met. In addition, these risks include, but are

not limited to, those disclosed under the caption “Risk Factors” in

Rafael’s Annual Report on Form 10-K for the year ended July 31,

2023, and Cyclo’s Annual Report on Form 10-K for the year ended

December 31, 2023 and the companies’ other filings with the SEC.

All these factors could cause actual results to differ materially

from those indicated by the forward-looking statements made in this

press release. Any such forward-looking statements represent the

companies’ management’s estimates as of the date of this press

release. While they may elect to update such forward-looking

statements at some point in the future, the companies disclaim any

obligation to do so, even if subsequent events cause views to

change.

No Offer or Solicitation

This press release is not a proxy statement or solicitation of a

proxy, consent or authorization with respect to any securities or

in respect of the proposed business combination and shall not

constitute an offer to sell or a solicitation of an offer to buy

any securities, nor shall there be any sale of securities in any

state or jurisdiction in which such offer, solicitation, or sale

would be unlawful prior to registration or qualification under the

securities laws of any such state or jurisdiction. No offer of

securities shall be made except by means of a prospectus meeting

the requirements of the Securities Act.

Important Additional Information Will Be Filed with the

SEC

Rafael Holdings plans to file with the SEC a Registration

Statement on Form S-4 in connection with the transactions and both

Rafael Holdings and Cyclo Therapeutics plan to file with the SEC

and mail to their respective stockholders a Joint Proxy

Statement/Prospectus in connection with the transactions. Investors

and security holders are urged to read the Registration Statement

and the Joint Proxy Statement/Prospectus and other relevant

documents filed with the SEC in connection with the proposed

transaction or incorporated by reference into the Joint Proxy

Statement/Prospectus (if any) carefully when they are available

before making any voting or investment decision with respect to the

proposed transactions. The Registration Statement, the Joint Proxy

Statement/Prospectus and other documents filed with the SEC in

connection with the proposed transaction or incorporated by

reference into the Joint Proxy Statement/Prospectus (if any) will

contain important information about Rafael Holdings, Cyclo

Therapeutics, the transactions and related matters. Investors and

security holders will be able to obtain free copies of the

Registration Statement and the Joint Proxy Statement/Prospectus and

other documents filed with the SEC by Rafael Holdings and Cyclo

Therapeutics through the web site maintained by the SEC at

www.sec.gov. In addition, investors and security holders will be

able to obtain free copies of the Registration Statement and the

Joint Proxy Statement/Prospectus from Rafael Holdings by contacting

david.polinsky@rafaelholdings.com or Cyclo Therapeutics by

contacting cyth@jtcir.com.

Participants in the Solicitation

Rafael and Cyclo and their respective directors and executive

officers may be deemed to be participants in the solicitation of

proxies in respect of the transactions contemplated by the merger

agreement. Information regarding Rafael’s directors and executive

officers is contained in Rafael proxy statement dated November 20,

2023, which is filed with the SEC. Information regarding Cyclo’s

directors and executive officers is contained in Cyclo’s Annual

Report on Form 10-K for the year ended December 31, 2023, which is

filed with the SEC. Additional information regarding the persons

who may be deemed participants in the proxy solicitation and a

description of their direct and indirect interests in the proposed

business combination will be available in the Registration

Statement and the Joint Proxy Statement/Prospectus.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240822425306/en/

Rafael Holdings Investor Relations Barbara Ryan

Barbara.ryan@rafaelholdings.com (203) 274-2825

Cyclo Therapeutics Investor Relations JTC Team, LLC Jenene

Thomas (833) 475-8247 CYTH@jtcir.com

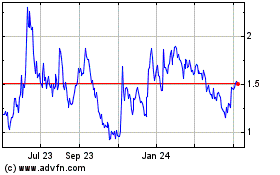

Cyclo Therapeutics (NASDAQ:CYTH)

Historical Stock Chart

From Dec 2024 to Jan 2025

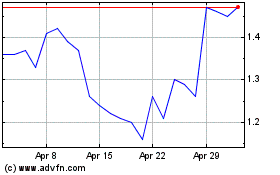

Cyclo Therapeutics (NASDAQ:CYTH)

Historical Stock Chart

From Jan 2024 to Jan 2025