Cutera Reports Second Quarter 2012 Results

August 06 2012 - 4:00PM

Cutera, Inc. (Nasdaq:CUTR), a leading provider of laser and other

energy-based aesthetic systems for practitioners worldwide, today

reported financial results for the second quarter ended June 30,

2012.

Key financial highlights for the second quarter of 2012 compared

to same period last year are as follows:

- Revenue grew 32%, to $19.6 million.

- Net loss was $1.5 million, or $0.10 per diluted share, compared

to a loss of $0.18 per diluted share.

- The $1.5 million loss includes $1.2 million of non-cash

stock-based compensation and amortization and depreciation.

Kevin Connors, president and CEO of Cutera, stated, "This is our

fifth consecutive quarter of revenue growth in excess of 22%,

compared to the same period one year ago. We continue to see growth

in most of our major geographical regions. In the second quarter of

2012, our US revenue increased 38%, when compared to the second

quarter of 2011. International revenue expanded by 28% during the

second quarter of 2012, compared to the same period in 2011. This

revenue improvement was driven primarily by:

- Continued increased penetration of our premier ExcelV vascular

system;

- Increased revenue from our flagship Xeo platform;

- Expansion and improved effectiveness of our North American

sales organization;

- Incremental revenue from the Iridex aesthetic acquisition that

contributed to higher service, cross selling opportunities and

product revenue."

"Revenue shipments of our truSculpt product designed for the

fast growing non-invasive body contouring market commences in the

third quarter of 2012. Our extensive research and unique energy

delivery technology enables this product to achieve efficacious

clinical outcomes, while minimizing patient discomfort. We are

excited to be entering this aesthetic category and believe this

will contribute to our revenue growth in the

future."

Mr. Connors concluded, "We believe the market outlook for

aesthetic laser and other energy based equipment continues to

improve and we are well positioned to capitalize on our expanding

market. We remain focused on many initiatives in order to continue

delivering revenue growth, improving gross margins, improving

leverage in our business model, and cash generation in the second

half of this year."

Conference Call

The conference call to discuss these results is scheduled to

begin at 2:00 p.m. PT (5:00 p.m. ET) on August 6, 2012.

Participating in the call will be Kevin Connors, President and

Chief Executive Officer, and Ron Santilli, Executive Vice President

and Chief Financial Officer. The call will be broadcast live over

the Internet hosted at the Investor Relations section of Cutera's

website at www.cutera.com, and will be archived online within one

hour of its completion through 8:59 p.m. PT (11:59 p.m. ET) on

August 20, 2012. In addition, you may call 877-407-3982 to listen

to the live broadcast.

About Cutera, Inc.

Brisbane, California-based Cutera is a leading provider of laser

and other energy-based aesthetic systems for practitioners

worldwide. Since 1998, Cutera has been developing innovative,

easy-to-use products that enable physicians and other qualified

practitioners to offer safe and effective aesthetic treatments to

their patients. For more information, call 1-888-4CUTERA or visit

www.cutera.com.

This press release contains forward-looking statements within

the meaning of the U.S. Private Securities Litigation Reform Act of

1995. Specifically, statements concerning Cutera's ability to

leverage its business model, increase revenue, generate additional

cash, increase profitability, develop and commercialize existing

and new products and applications, experience market adoption for

its products, realize benefits from additional investment, and

statements regarding long-term prospects and opportunities as well

as the timing and expected benefits of integration activities are

forward-looking statements within the meaning of the Safe Harbor.

Forward-looking statements are based on management's current,

preliminary expectations and are subject to risks and

uncertainties, which may cause Cutera's actual results to differ

materially from the statements contained herein. Potential risks

and uncertainties that could affect Cutera's business and cause its

financial results to differ materially from those contained in the

forward-looking statements include the Company may not be

successful in its efforts to improve sales productivity, revenue

growth and profitability improvement through the leverage of its

operating expenses; the Company's ability to successfully develop

and launch new products and applications and market them to both

its installed base and new customers; the length of the sales cycle

process; unforeseen events and circumstances relating to the

Company's operations; government regulatory actions; and those

other factors described in the section entitled, "Risk

Factors" in its most recent Form 10-Q as filed with the

Securities and Exchange Commission on August 6, 2012. Undue

reliance should not be placed on forward-looking statements, which

speak only as of the date they are made. Cutera undertakes no

obligation to update publicly any forward-looking statements to

reflect new information, events or circumstances after the date

they were made, or to reflect the occurrence of unanticipated

events. Cutera's second quarter ended June 30, 2012 financial

performance, as discussed in this release, is preliminary and

unaudited, and subject to adjustment.

| CUTERA,

INC. |

| CONDENSED CONSOLIDATED

BALANCE SHEETS |

| (in

thousands) |

|

(unaudited) |

| |

|

|

|

| |

June 30, 2012 |

March 31, 2012 |

June 30, 2011 |

| Assets |

|

|

|

| Current assets: |

|

|

|

| Cash and cash equivalents |

$ 17,788 |

$ 12,787 |

$ 17,483 |

| Marketable investments |

62,794 |

66,137 |

73,557 |

| Accounts receivable, net |

6,203 |

4,496 |

3,279 |

| Inventories |

12,722 |

13,434 |

8,301 |

| Deferred tax asset |

52 |

50 |

20 |

| Other current assets and prepaid

expenses |

1,443 |

1,363 |

2,042 |

| Total current assets |

101,002 |

98,267 |

104,682 |

| |

|

|

|

| Property and equipment, net |

946 |

1,019 |

771 |

| Long-term investments |

840 |

2,928 |

3,908 |

| Deferred tax asset, net of current

portion |

463 |

450 |

328 |

| Intangibles, net |

3,186 |

3,504 |

541 |

| Goodwill |

1,339 |

1,339 |

-- |

| Other long-term assets |

539 |

458 |

-- |

| Total assets |

$ 108,315 |

$ 107,965 |

$ 110,230 |

| |

|

|

|

| Liabilities and Stockholders'

Equity |

|

|

|

| Current liabilities: |

|

|

|

| Accounts payable |

$ 2,199 |

$ 2,674 |

$ 2,180 |

| Accrued liabilities |

9,382 |

8,936 |

6,909 |

| Deferred revenue |

6,285 |

5,770 |

5,474 |

| |

|

|

|

| Total current liabilities |

17,866 |

17,380 |

14,563 |

| |

|

|

|

| Deferred rent |

1,400 |

1,450 |

1,455 |

| Deferred revenue, net of current portion |

905 |

917 |

898 |

| Income tax liability |

469 |

469 |

494 |

| Total liabilities |

20,640 |

20,216 |

17,410 |

| |

|

|

|

| Stockholders' equity: |

|

|

|

| Common stock |

14 |

14 |

14 |

| Additional paid-in capital |

98,044 |

97,043 |

93,515 |

| Retained earnings (Accumulated

deficit) |

(10,058) |

(8,592) |

425 |

| Accumulated other comprehensive loss |

(325) |

(716) |

(1,134) |

| Total stockholders' equity |

87,675 |

87,749 |

92,820 |

| Total liabilities and stockholders'

equity |

$ 108,315 |

$ 107,965 |

$ 110,230 |

| |

| |

| CUTERA,

INC. |

| CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS |

| (in thousands, except

per share data) |

|

(unaudited) |

| |

|

|

|

| |

Three Months

Ended |

| |

June 30, 2012 |

March 31, 2012 |

June 30, 2011 |

| Net revenue |

$ 19,591 |

$ 15,727 |

$ 14,895 |

| Cost of revenue |

9,274 |

7,845 |

6,476 |

| Gross profit |

10,317 |

7,882 |

8,419 |

| |

|

|

|

| Operating expenses: |

|

|

|

| Sales and marketing |

7,112 |

7,437 |

6,348 |

| Research and development |

1,872 |

2,216 |

2,346 |

| General and administrative |

2,854 |

3,495 |

2,588 |

| Total operating expenses |

11,838 |

13,148 |

11,282 |

| Loss from operations |

(1,521) |

(5,266) |

(2,863) |

| Interest and other income, net |

144 |

96 |

199 |

| Loss before income taxes |

(1,377) |

(5,170) |

(2,664) |

| Provision (benefit) for income

taxes |

89 |

97 |

(208) |

| Net loss |

$ (1,466) |

$ (5,267) |

$ (2,456) |

| |

|

|

|

| Net loss per share: |

|

|

|

| Basic and Diluted |

$ (0.10) |

$ (0.38) |

$ (0.18) |

| |

|

|

|

| Weighted-average number of shares |

|

|

|

| used in per share calculations: |

|

|

|

| Basic and Diluted |

14,095 |

13,960 |

13,765 |

| |

| |

| CUTERA,

INC. |

| CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS |

| (in

thousands) |

|

(unaudited) |

| |

|

|

|

| |

Three Months

Ended |

| |

June 30, 2012 |

March 31, 2012 |

June 30, 2011 |

| Cash flows from operating

activities: |

|

|

|

| Net loss |

$ (1,466) |

$ (5,267) |

$ (2,456) |

| Adjustments to reconcile net loss

to net cash used in operating activities: |

|

|

| Stock-based compensation |

787 |

738 |

1,325 |

| Tax benefit from stock-based

compensation |

-- |

-- |

16 |

| Excess tax benefit related to stock-based

compensation |

-- |

-- |

(16) |

| Depreciation and amortization |

425 |

343 |

162 |

| Other |

(14) |

14 |

(79) |

| Changes in assets and liabilities: |

|

|

|

| Accounts receivable |

(1,697) |

640 |

53 |

| Inventories |

712 |

(1,153) |

(1,033) |

| Other current assets and prepaid

expenses |

59 |

444 |

(70) |

| Other long-term assets |

(81) |

28 |

-- |

| Accounts payable |

(475) |

101 |

635 |

| Accrued liabilities |

420 |

(661) |

1,028 |

| Deferred rent |

(24) |

27 |

(3) |

| Deferred revenue |

503 |

(118) |

(344) |

| Income tax liability |

-- |

(9) |

15 |

| Net cash used in operating

activities |

(851) |

(4,873) |

(767) |

| |

|

|

|

| Cash flows from investing

activities: |

|

|

|

| Acquisition of property and equipment |

(34) |

(277) |

(217) |

| Business acquisition |

-- |

(5,091) |

-- |

| Proceeds from sales of marketable and

long-term investments |

7,066 |

10,729 |

6,200 |

| Proceeds from maturities of marketable

investments |

8,700 |

11,135 |

16,311 |

| Purchase of marketable investments |

(10,094) |

(13,442) |

(17,347) |

| Net cash provided by investing

activities |

5,638 |

3,054 |

4,947 |

| |

|

|

|

| Cash flows from financing

activities: |

|

|

|

| Proceeds from exercise of stock options and

employee stock purchase plan |

214 |

586 |

123 |

| Excess tax benefit related to stock-based

compensation |

-- |

-- |

16 |

| Net cash provided by financing

activities |

214 |

586 |

139 |

| |

|

|

|

| Net increase (decrease) in cash and cash

equivalents |

5,001 |

(1,233) |

4,319 |

| Cash and cash equivalents at beginning of

period |

12,787 |

14,020 |

13,164 |

| Cash and cash equivalents at end of

period |

$ 17,788 |

$ 12,787 |

$ 17,483 |

| |

| |

| CUTERA,

INC. |

| CONSOLIDATED FINANCIAL

HIGHLIGHTS |

| (in thousands, except

percentage data) |

|

(unaudited) |

| |

|

|

|

|

|

|

| |

Three Months

Ended |

| |

June 30, 2012 |

% of

Revenue |

March 31, 2012 |

% of

Revenue |

June 30, 2011 |

% of

Revenue |

| Revenue By Geography: |

|

|

|

|

|

|

| United States |

$7,834 |

40% |

$6,311 |

40% |

$ 5,697 |

38% |

| International |

11,757 |

60% |

9,416 |

60% |

9,198 |

62% |

| |

$19,591 |

|

$15,727 |

|

$14,895 |

|

| |

|

|

|

|

|

|

| Revenue By Product

Category: |

|

|

|

|

|

|

| Products |

$11,690 |

60% |

$8,433 |

54% |

$8,142 |

55% |

| Upgrades |

797 |

4% |

825 |

5% |

856 |

6% |

| Service |

4,435 |

23% |

3,873 |

25% |

3,594 |

24% |

| Titan hand piece refills |

1,216 |

6% |

1,130 |

7% |

1,249 |

8% |

| Dermal fillers and cosmeceuticals |

1,453 |

7% |

1,466 |

9% |

1,054 |

7% |

| |

$19,591 |

|

$15,727 |

|

$14,895 |

|

| |

|

|

|

|

|

|

| |

| |

|

|

|

|

|

|

| |

Three Months

Ended |

|

| |

June 30, 2012 |

|

March 31, 2012 |

|

June 30, 2011 |

|

| Pre-tax Stock-Based Compensation

Expense: |

|

|

|

|

|

|

| Cost of revenue |

$168 |

|

$143 |

|

$183 |

|

| Sales and marketing |

159 |

|

140 |

|

177 |

|

| Research and development |

147 |

|

146 |

|

197 |

|

| General and administrative |

313 |

|

309 |

|

768 |

|

| |

$787 |

|

$ 738 |

|

$1,325 |

|

CONTACT: Cutera, Inc.

Ron Santilli

Chief Financial Officer

415-657-5500

Investor Relations

John Mills

Integrated Corporate Relations, Inc.

310-954-1105

john.mills@icrinc.com

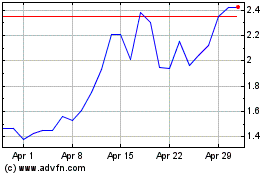

Cutera (NASDAQ:CUTR)

Historical Stock Chart

From Nov 2024 to Dec 2024

Cutera (NASDAQ:CUTR)

Historical Stock Chart

From Dec 2023 to Dec 2024