Third Proxy Advisory Firm Recommends Shareholders Vote Wynnefield ``GOLD'' Proxy Card

August 07 2007 - 11:19AM

Business Wire

The Wynnefield Group, the largest stockholder in Crown Crafts Inc.

(NASDAQ: CRWS), announced today that Egan-Jones, a third leading

independent proxy voting advisory firm, has recommended that Crown

Crafts stockholders vote Wynnefield�s GOLD proxy card. Last week,

both Institutional Shareholder Services (ISS) and PROXY Governance

recommended that stockholders vote Wynnefield�s GOLD card.

Egan-Jones recommended that stockholders support both of

Wynnefield�s director-nominees, Frederick Wasserman and Nelson

Obus. In its report, Egan-Jones concluded: �We�believe

that�the�nominees of the�Wynnefield Group,�namely Nelson Obus and

Frederick G. Wasserman,�to serve as Class I Directors of the

Company (to replace director nominees William T. Deyo and Steven E.

Fox) appear qualified, and that their inclusion on the Board would

make healthy changes. We recommend the clients vote for them

using�the GOLD PROXY CARD provided by the dissidents�.� (emphasis

added). In reaching that conclusion, Egan-Jones stated that it had

considered the following factors: �The Company�s sales have

continued to shrink over the past two fiscal years. Net sales -

which fell by some 13.4% from FY 2005 to FY 2006 - continue their

seven-year decline in 2007. Operating income remains essentially

flat over the past four years, ranging from $7.4 million in FY 2004

to $7.9 million in 2007, and is trending downwards over the last

six months of FY 2007 compared to the year-before period.�While the

Company�s two principal publicly traded competitors trade at

multiples between 7.9 and 21.8 times earnings, according to

Bloomberg, the Company�s stock trades at a multiple of only 4.1

times earnings. �In a highly competitive industry, Crown Crafts�

small size puts it at a significant disadvantage in winning

customer shelf space and market penetration. The Company is�reliant

on its�top three customers for approximately 78% of its gross

sales,�and it remains dependent on the sale of licensed products

for 39% of its gross sales, which risks substantial loss of revenue

in the event it is unable to renew or win new licenses. �The

Company�s share price declined approximately 33% from its February

2007 high over the past few months before rebounding somewhat after

the announcement of the intent to nominate the dissident�s nominees

to the Board.�While the Company completed a financial restructuring

in 2006, that does not replace the need for improved operating

performance and additional measures. In fact, the Company appears

to have only announced the $6 million share repurchase program that

Wynnefield had long championed following the announcement that

Wynnefield would conduct a proxy campaign to help effectuate such

measures. �The dissidents have observed that�the current Board has

failed to develop or implement a plan to systematically grow the

Company�s business - neither developing significant new products,

improving market penetration of existing products, nor making

inroads with major new customers.�As the Company's largest

shareholder, it is reasonable that Wynnefield should be part of the

development of a strategic plan for the Company.�Wynnefield has

recommended that the Company engage a recognized financial advisor

to help identify and analyze appropriate strategy options. �The

Company has a�staggered board structure, which may�serve�to

entrench existing directors and management, rather than benefiting

stockholders� (emphasis added). The Wynnefield Group urges all

Crown Crafts stockholders to follow the recommendations of

Egan-Jones and vote the GOLD proxy card. IF STOCKHOLDERS HAVE

ALREADY VOTED THE WHITE PROXY CARD AND WISH TO CHANGE THEIR VOTE,

THEY HAVE EVERY LEGAL RIGHT TO DO SO. ONLY THE LATEST VOTE FROM A

STOCKHOLDER WILL COUNT. Any stockholders with questions or

requiring assistance in voting their GOLD proxy card should please

call MacKenzie Partners at (800) 322-2885. The Annual Meeting of

Crown Crafts Stockholders will be held on August 14, 2007 at 10:00

a.m. Central Daylight Time at the Company�s executive offices,

located at 916 South Burnside Avenue, Third Floor, Gonzales,

Louisiana 70737. Permission to use quotations from the Egan-Jones

report in this press release was neither sought nor obtained.

ADDITIONAL INFORMATION: Shareholders are advised to read the

Wynnefield Group's definitive proxy statement, which contains

important information. Shareholders may obtain a free copy of the

proxy statement and other documents filed by the Wynnefield Group

with the SEC at the SEC�s Internet website at www.sec.gov. The

proxy statement, a proxy card, and other documents may also be

obtained free of charge from the Wynnefield Group's proxy solicitor

or from the Wynnefield Group by request to: Lawrence E. Dennedy

Daniel M. SullivanMacKenzie Partners, Inc.105 Madison AvenueNew

York, NY 10016Phone: (800) 322-2885 or Nelson ObusThe Wynnefield

Group450 Seventh Avenue, Suite 509Phone: (212) 760-0134 If you have

lost your proxy card from the Wynnefield Group, or did not receive

one, you may obtain another proxy statement and card by contacting

MacKenzie Partners, Inc. or The Wynnefield Group at the phone

numbers listed above. ABOUT THE WYNNEFIELD GROUP: The Wynnefield

Group is Crown Crafts� largest shareholder, holding 14.6% of the

company�s outstanding common stock. Wynnefield is a long-term

investor in Crown Crafts, having first invested in the company more

than eight years ago. The Wynnefield Group includes several

affiliates of Wynnefield Capital, Inc. (WCI), a value investor

specializing in U.S. small cap situations that have company- or

industry-specific catalysts. WCI was established in 1992. Its

founding partners, Nelson Obus and Joshua Landes, held senior

research and institutional equity positions at Lazard Freres &

Co. during the 1980s, and the initial Wynnefield investors included

many of their colleagues at Lazard. The fund has grown to

approximately $450 million under management. Nelson Obus currently

serves on the board of directors of Layne Christensen Company

(NASDAQ: LAYN), serving on its audit committee and compensation

committee.

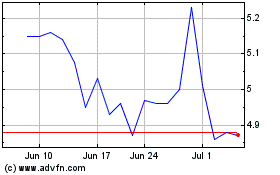

Crown Crafts (NASDAQ:CRWS)

Historical Stock Chart

From Dec 2024 to Jan 2025

Crown Crafts (NASDAQ:CRWS)

Historical Stock Chart

From Jan 2024 to Jan 2025