Wynnefield Group Offers Compromise Agreement to Crown Crafts Board for Amicable Resolution of Proxy Contest

July 30 2007 - 3:59PM

PR Newswire (US)

- Largest Stockholder in Crown Crafts Reiterates Commitment to

Create Shareholder Value - NEW YORK, July 30 /PRNewswire/ -- The

Wynnefield Group, the largest shareholder in Crown Crafts Inc.

(NASDAQ:CRWS), today released a letter sent to the Board of

Directors of Crown Crafts, offering a compromise agreement allowing

for an amicable resolution of the proxy contest currently underway.

Wynnefield, a long-term investor in Crown Crafts, also reiterated

its commitment to continue its campaign to elect two of its

nominees to the Board, should this offer of a compromise agreement

be rejected. Full text of Wynnefield's letter follows: July 30,

2007 VIA FACSIMILE AND FEDERAL EXPRESS Board of Directors c/o E.

Randall Chestnut, Chairman, President and Chief Executive Officer

Crown Crafts, Inc. 916 South Burnside Avenue Gonzales, Louisiana

70737 Re: Crown Crafts, Inc. (the "Company") 2007 Annual Meeting

Gentlemen: As you know, the Wynnefield Group, as Crown Crafts's

largest stockholder, has long sought full voting representation on

the Company's Board of Directors ("Board") in order to provide the

shareholders' point of view in developing a long-term strategic

vision for the Company. The Board's steadfast refusal to honor our

request left the Wynnefield Group with no alternative but to

commence its current proxy solicitation to elect two members to

Crown Crafts Board. The election of our nominees, Messrs. Nelson

Obus and Frederick G. Wasserman, will provide the Board and the

Company's stockholders experienced, independent Board members who

serve with distinction on other boards and are committed to working

constructively with the other Board members to develop a long-term

strategic and business plan and implement best practices of

corporate governance in order to enhance shareholder value. A

number of the Company's significant shareholders who support our

efforts have indicated that they would prefer to see this matter

resolved amicably, if possible. In that spirit, and consistent with

our history of cooperation and support of the Company, we submit to

the Board an offer of compromise to end the proxy contest, which we

never sought, but were compelled to undertake because of the

Board's refusal to work cooperatively with us to address the

critical issues facing Crown Crafts today. We will agree to drop

our opposition to the re-election of William T. Deyo, Jr. and

Steven E. Fox as directors of the Company, provided that the

Company agrees to: (i) immediately increase the size of the current

Board from seven (7) members to nine (9) members; (ii) elect Nelson

Obus and Frederick G. Wasserman as directors to fill the vacancies

thereby created; (iii) form a nominating and governance committee

immediately, with either Nelson Obus or Frederick G. Wasserman as

one of the members; (iv) form a strategic planning committee

immediately, with E. Randall Chestnut as one of the members and

either Nelson Obus or Frederick G. Wasserman as one of other

members, with the intention of hiring a qualified independent

consultant to assist management and the Board in determining a

future strategic path and aligning future capital allocations to

fulfill the agreed upon strategic plan; (v) commit to putting to a

stockholder vote at the 2008 Annual Meeting of stockholders, and

supporting, a binding resolution to de-classify the Board; and (vi)

amend the non-employee director fee structure to provide that the

cash fees paid to non-employee directors, which currently consist

of payments of $20,000 per year, plus $2,500 for each Board meeting

attended, $2,000 for each committee meeting held not in conjunction

with a Board meeting, plus $2,500 for travel time, be paid 50% in

cash and 50% in restricted stock of the Company. We believe that

these changes reflect current best practice in the area of

corporate governance. Furthermore, amending the nature of the cash

portion of the non-employee director fee structure will not only

more than offset the cash cost of two additional directors, it will

more closely align the financial interests of directors with those

of the shareholders in accordance with best practice in director

compensation. Our nominees have accepted and are committed to

implementing this compensation arrangement, if our proposal is

accepted by the Company. We believe this proposal to be in the best

interests of all concerned parties. The Company would gain the

benefit of new directors, who are highly qualified, experienced,

effective businessmen who have a history of successful service on

other boards and whose background and skills and fresh view point

will be an enormous asset to the Company. Stockholders would gain

two members of the Board directly representing their interests. As

we have demonstrated in our past dealings with the Company, we are

confident that our nominees will be able to work constructively

with the other Board members to address the many challenges facing

the Company. Upon Frederick G. Wasserman's election to the Board,

he will resign one of his other public board memberships in order

to devote the attention necessary to fulfill his duties and

responsibilities to Crown Crafts. We urge your serious

consideration of our offer and look forward to your prompt

response. However, please do not misconstrue the good faith intent

of our initiative or under-estimate our resolve in this matter.

Should the Company reject our proposal, we shall vigorously press

our campaign to elect our nominees at the Company's annual meeting

of stockholders and let the Company's shareholders determine the

outcome. Sincerely, Wynnefield Partners Small Cap Value, L.P., By:

Wynnefield Capital Management, LLC, its General Partner By: Nelson

Obus, Co-Managing Member ADDITIONAL INFORMATION: Shareholders are

advised to read the Wynnefield Group's definitive proxy statement,

which contains important information. Shareholders may obtain a

free copy of the proxy statement and other documents filed by the

Wynnefield Group with the SEC at the SEC's Internet website at

http://www.sec.gov/. The proxy statement, a proxy card, and other

documents may also be obtained free of charge from the Wynnefield

Group's proxy solicitor or from the Wynnefield Group by request to:

Lawrence E. Dennedy or Nelson Obus Daniel M. Sullivan The

Wynnefield Group MacKenzie Partners, Inc. 450 Seventh Avenue, Suite

509 105 Madison Avenue Phone: (212) 760-0134 New York, NY 10016

Phone: (800) 322-2885 If you have lost your proxy card from the

Wynnefield Group, or did not receive one, you may obtain another

proxy statement and card by contacting MacKenzie Partners, Inc. or

The Wynnefield Group at the phone numbers listed above. ABOUT THE

WYNNEFIELD GROUP: The Wynnefield Group is Crown Crafts' largest

shareholder, holding 14.6% of the company's outstanding common

stock. Wynnefield is a long-term investor in Crown Crafts, having

first invested in the company about eight years ago. The Wynnefield

Group includes several affiliates of Wynnefield Capital, Inc.

(WCI), a value investor specializing in U.S. small cap situations

that have company- or industry-specific catalysts. WCI was

established in 1992. Its founding partners, Nelson Obus and Joshua

Landes, held senior research and institutional equity positions at

Lazard Freres & Co. during the 1980s, and the initial

Wynnefield investors included many of their colleagues at Lazard.

The fund has grown to approximately $450 million under management.

Nelson Obus currently serves on the board of directors of Layne

Christensen Company, serving on its audit committee and

compensation committee. CONTACT: Eric Berman Joseph Kuo of Kekst

and Company 212-521-4800 DATASOURCE: The Wynnefield Group CONTACT:

Eric Berman or Joseph Kuo, both of Kekst and Company for The

Wynnefield Group, +1-212-521-4800

Copyright

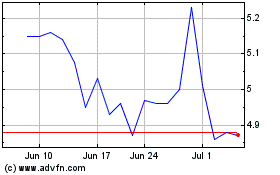

Crown Crafts (NASDAQ:CRWS)

Historical Stock Chart

From Dec 2024 to Jan 2025

Crown Crafts (NASDAQ:CRWS)

Historical Stock Chart

From Jan 2024 to Jan 2025