EXHIBIT

99.1

SCHEDULE

A

Funds

| Date |

Number

of Shares Bought |

Price

Per Share($) (1)(2) |

| 10/18/2024 |

2,410 |

12.917504(3) |

| 10/21/2024 |

3,297 |

12.138269(4) |

| 10/22/2024 |

1,932 |

11.861352(5) |

| 10/25/2024 |

30 |

11.502906(6) |

| 11/12/2024 |

3,422 |

10.620428(7) |

| 11/13/2024 |

4,095 |

10.252791(8) |

| 11/14/2024 |

429 |

9.642175(9) |

| 12/2/2024 |

2,358 |

11.185089(10) |

| 12/3/2024 |

316 |

11.208425(11) |

| 12/4/2024 |

652,042 |

18.096773

(12) |

| 12/5/2024 |

387,450 |

18.101830

(13) |

| 12/6/2024 |

122,436 |

18.091399

(14) |

| 12/9/2024 |

125,322 |

18.063930(15) |

| 12/10/2024 |

110,726 |

18.062610(16) |

| 12/11/2024 |

119,201 |

18.073543(17) |

| 12/12/2024 |

64,707 |

18.05993

(18) |

| 12/13/2024 |

88,706 |

18.058730(19) |

| 12/16/2024 |

146,406 |

17.967914(20) |

| 12/17/2024 |

52,730 |

17.913389(21) |

| 12/18/2024 |

77,208 |

17.905068(22) |

(1)

Excludes commissions and other execution-related costs.

(2)

Upon request by the staff of the Securities and Exchange Commission, full information regarding the number of shares bought or sold (as

the case may be) at each separate price will be provided.

(3)

Reflects a weighted average purchase price of $12.917504 per share, at prices ranging from $12.85 to $13.05 per share.

(4)

Reflects a weighted average purchase price of $12.138269 per share, at prices ranging from $11.98 to $12.38 per share.

(5)

Reflects a weighted average purchase price of $11.861352 per share, at prices ranging from $11.67 to $12.00 per share.

(6)

Reflects a weighted average purchase price of $11.50290 6per share, at prices ranging from $11.47 to $11.54 per share.

(7)

Reflects a weighted average purchase price of $10.620428 per share, at prices ranging from $10.43 to $11.00 per share.

(8)

Reflects a weighted average purchase price of $10.252791 per share, at prices ranging from $10.04 to $10.52 per share.

(9)

Reflects a weighted average purchase price of $9.642175 per share, at prices ranging from $9.59 to $9.72 per share.

(10)

Reflects a weighted average purchase price of $11.185089 per share, at prices ranging from $10.82 to $11.58 per share.

(11)

Reflects a weighted average purchase price of $11.208425 per share, at prices ranging from $11.10 to $11.31 per share.

(12)

Reflects a weighted average purchase price of $18.096773 per share, at prices ranging from $17.97 to $18.15per share.

(13)

Reflects a weighted average purchase price of $18.101830 per share, at prices ranging from $18.06 to $18.15 per share.

(14)

Reflects a weighted average purchase price of $18.091399 per share, at prices ranging from $18.07 to $18.15 per share.

(15)

Reflects a weighted average purchase price of $18.063930 per share, at prices ranging from $18.04 to $18.13 per share.

(16)

Reflects a weighted average purchase price of $18.062610 per share, at prices ranging from $18.04 to $18.08 per share.

(17)

Reflects a weighted average purchase price of $18.073543 per share, at prices ranging from $18.04 to $18.11 per share.

(18)

Reflects a weighted average purchase price of $18.05993 per share, at prices ranging from $18.06 to $18.11 per share.

(19)

Reflects a weighted average purchase price of $18.05873 per share, at prices ranging from $$18.05 to $18.10 per share.

(20)

Reflects a weighted average purchase price of $17.967914 per share, at prices ranging from $17.86 to $18.07per share.

(21)

Reflects a weighted average purchase price of $17.913389 per share, at prices ranging from $17.90 to $17.96 per share.

(22)

Reflects a weighted average purchase price of $17.905068 per share, at prices ranging from $17.89 to $19.95 per share.

SCHEDULE

B

Funds

| Date |

Number

of Shares Sold |

Price

Per Share($) (1)(2) |

| 10/25/2024 |

1 |

11.540000(3) |

| 11/4/2024 |

5,168 |

11.188540(4) |

| 11/5/2024 |

3,486 |

11.456947(5) |

| 11/6/2024 |

2,266 |

12.254716(6) |

| 11/7/2024 |

3,401 |

12.203100(7) |

| 11/8/2024 |

458 |

10.724816(8) |

| 11/11/2024 |

1,589 |

10.593886(9) |

| 11/14/2024 |

1 |

9.885000(10) |

| 11/15/2024 |

3,819 |

9.876587

(11) |

| 11/18/2024 |

3,039 |

10.421105(12) |

| 11/25/2024 |

318 |

10.887562(13) |

| 12/4/2024 |

2,958 |

18.115063(14) |

| 12/5/2024 |

485 |

18.110865(15) |

(1)

Excludes commissions and other execution-related costs.

(2)

Upon request by the staff of the Securities and Exchange Commission, full information regarding the number of shares bought or sold (as

the case may be) at each separate price will be provided.

(3)

Reflects a weighted average purchase price of $11.540000 per share, at prices ranging from $11.54 to $11.54 per share.

(4)

Reflects a weighted average purchase price of $11.188540 per share, at prices ranging from $11.01 to $11.41 per share.

(5)

Reflects a weighted average purchase price of $11.456947 per share, at prices ranging from $11.29 to $12.61 per share.

(6)

Reflects a weighted average purchase price of $11.502906 per share, at prices ranging from $11.96 to $12.47 per share.

(7)

Reflects a weighted average purchase price of $12.254716 per share, at prices ranging from $11.77 to $12.41 per share.

(8)

Reflects a weighted average purchase price of $12.203100 per share, at prices ranging from $10.60 to $10.88 per share.

(9)

Reflects a weighted average purchase price of $10.593886 per share, at prices ranging from $10.50 to $10.70 per share.

(10)

Reflects a weighted average purchase price of $9.885000 per share, at prices ranging from $9.89 to $9.89 per share.

(11)

Reflects a weighted average purchase price of $9.876587 per share, at prices ranging from $9.78 to $9.96 per share.

(12)

Reflects a weighted average purchase price of $10.421105 per share, at prices ranging from $10.31 to $10.56 per share.

(13)

Reflects a weighted average purchase price of $10.887562 per share, at prices ranging from $10.87 to $10.90 per share.

(14)

Reflects a weighted average purchase price of $18.115063 per share, at prices ranging from $17.98 to $18.21 per share.

(15)

Reflects a weighted average purchase price of $18.110865 per share, at prices ranging from $18.10 to $18.13 per share.

EXHIBIT 99.2

JOINT FILING AGREEMENT

The

undersigned hereby agree that the statement on Schedule 13D with respect to the Shares of Cross Country Healthcare, Inc. dated

as of December 20, 2024 is, and any amendments thereto (including amendments on Schedule 13D) signed by each of the undersigned shall

be, filed on behalf of each of us pursuant to and in accordance with the previsions of Rule13d-1(k) under the Securities Exchange Act

of 1934, as amended.

| Date: December

20, 2024 |

magnetar

financial llc |

| |

By:

Magnetar Capital Partners LP, its Sole Member |

| |

By: |

/s/

Hayley Stein |

| |

Name: |

Hayley

Stein |

| |

Title: |

Attorney-in-fact

for David J. Snyderman, Manager of Supernova Management LLC |

| Date: December

20, 2024 |

magnetar

capital partners LP |

| |

By: Supernova

Management LLC, its General Partner |

| |

By: |

/s/

Hayley Stein |

| |

Name: |

Hayley

Stein |

| |

Title: |

Attorney-in-fact

for David J. Snyderman, Manager of Supernova Management LLC |

| Date: December

20, 2024 |

supernova

management llc |

| |

By: |

/s/

Hayley Stein |

| |

Name: |

Hayley

Stein |

| |

Title: |

Attorney-in-fact

for David J. Snyderman, Manager |

| Date: December

20, 2024 |

DAVID

J. SNYDERMAN |

| |

By: |

/s/

Hayley Stein |

| |

Name: |

Hayley

Stein |

| |

Title: |

Attorney-in-fact

for David J. Snyderman |

EXHIBIT

99.3

LIMITED

POWER OF ATTORNEY

Know

all by these present, that I, David J. Snyderman, hereby make, constitute and appoint each of Michael Turro, Karl Wachter

and Hayley Stein, or any of them acting individually, and with full power of substitution, as my true and lawful attorney-in-fact

for the purpose of executing in my name, (a) in my personal capacity or (b) in my capacity as Manager or in other capacities of

Supernova Management LLC, a Delaware limited liability company, and each of its affiliates or entities advised or controlled

by me or Supernova Management LLC, all documents, certificates, instruments, statements, filings and agreements (“documents”)

to be filed with or delivered to the United States Securities and Exchange Commission (the “SEC”) pursuant to the Securities

and Exchange Act of 1934, as amended (the “Act”), and the rules and regulations promulgated thereunder, including, without

limitation, all documents relating to the beneficial ownership of securities required to be filed with the SEC pursuant to Section 13(d)

or Section 16(a) of the Act, including, without limitation: (a) any acquisition statements on Schedule 13D or Schedule 13G and any amendments

thereto, (b) any joint filing agreements pursuant to Rule 13d-1(k) under the Act, and (c) any initial statements of, or statements of

changes in, beneficial ownership of securities on Form 3, Form 4 or Form 5.

All

past acts of the attorney-in-fact in furtherance of the foregoing are hereby ratified and confirmed.

This

Power of Attorney shall remain in full force and effect until the earlier of it being (a) revoked by the undersigned in a signed writing

delivered to the foregoing attorney-in-fact or (b) superseded by a new power of attorney regarding the purposes outlined herein as of

a later date.

IN

WITNESS WHEREOF, the undersigned has caused this Power of Attorney to be executed as of this 22 day of December, 2022.

| |

/s/

David J. Snyderman |

| |

David J. Snyderman |

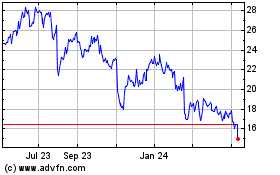

Cross Country Health (NASDAQ:CCRN)

Historical Stock Chart

From Dec 2024 to Jan 2025

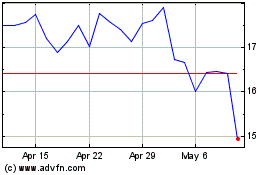

Cross Country Health (NASDAQ:CCRN)

Historical Stock Chart

From Jan 2024 to Jan 2025