Q2 Net Sales of $93.2 Million, Up 31%

Year-Over-Year

Q2 Net Income of $6.2 Million, Up 387%

Year-Over-Year

Q2 Adjusted EBITDA of $19.3 Million, Up 91%

Year-Over-Year

New Customer Additions Contribute to Strong

Growth

Stock Begins Trading on Nasdaq

CPI Card Group Inc. (Nasdaq: PMTS; TSX: PMTS) (“CPI” or the

“Company”) today reported financial results for the second quarter

and first half ended June 30, 2021.

“Our strong second quarter and first half results reflect the

continued successful execution of our strategy, as demonstrated by

on-boarding new customers, including in the growing FinTech space,”

said Scott Scheirman, President and Chief Executive Officer of CPI.

“Our focus on meeting our customers’ needs with high quality and

differentiated products and solutions drove strong performance

across our segments.”

Scheirman continued, “Our success reflects the commitment of our

organization to be the partner of choice to our customers by

providing market-leading quality products and customer

service.”

First Half 2021 Business Highlights

- CPI’s comprehensive end-to-end solutions contributed to earning

new FinTech and traditional financial services customers.

- CPI’s market leading quality and tamper-evident prepaid

packaging solutions drove higher demand and volumes, including

earning the prepaid portfolio of another large U.S. national

chain.

- We generated incremental net sales from customer demand for

higher-priced contactless sales, as the U.S. payment card market

continues its ongoing transition to contactless solutions.

- We continued to lead the eco-focused payment card market, as

evidenced by selling over 33 million eco-focused cards, including

Second Wave®, since launch in 2019.

- Our innovative personalization services also contributed to net

sales growth over the prior year, including from our Card@Once®

Software-as-a-Service instant issuance solutions and CPI

On-Demand®.

- The Company refinanced its debt, extending maturities and

enhancing liquidity, and reduced outstanding debt by more than $30

million since December 31, 2020, resulting in net leverage ratio of

less than 4x at June 30, 2021.

Second Quarter 2021 Financial Highlights

Net sales increased 31% year-over-year to $93.2 million in the

second quarter of 2021.

- Debit and Credit segment net sales increased 25% year-over-year

to $72.9 million in the second quarter. Net sales growth was driven

by new customers, and by the ongoing transition to higher-priced

contactless card sales and related card personalization.

- Prepaid Debit segment net sales increased 51% year-over-year to

$20.4 million in the second quarter, primarily due to higher

volumes from existing customers.

Net sales in the prior year second quarter were impacted by

lower customer demand than expected in both segments, which CPI

believes was primarily attributable to the COVID-19 pandemic.

Gross profit increased 61% year-over-year in the second quarter

of 2021 to $37.1 million and gross profit margin increased to 39.8%

compared to 32.3% in the prior year, primarily due to operating

leverage.

Income from operations increased 218% year-over-year to $15.8

million in the second quarter of 2021, compared to $5.0 million in

the prior year.

Second quarter 2021 net income was $6.2 million, or $0.53

earnings per diluted share, an increase of 387% year-over-year from

net income of $1.3 million, or $0.11 earnings per diluted share, in

the second quarter of 2020.

Adjusted EBITDA increased 91% year-over-year to $19.3 million in

the second quarter as a result of net sales growth and operating

leverage.

First Half 2021 Financial Highlights

Net sales increased 25% year-over-year to $182.3 million in the

first half of 2021.

- Debit and Credit segment net sales increased 21% year-over-year

to $142.7 million in the first half of 2021. Net sales growth was

driven by new customers and the ongoing transition to contactless

card sales and related card personalization.

- Prepaid Debit segment net sales increased 42% year-over-year to

$39.8 million in the first half of 2021 due to higher volumes from

our customers including the acquisition of new customer

portfolios.

Net sales in the prior year were impacted by lower customer

demand than expected in both segments, which CPI believes was

primarily attributable to the COVID-19 pandemic.

First half 2021 gross profit increased 49% year-over-year to

$72.8 million and gross profit margin increased to 39.9% from 33.5%

in the prior year.

First half 2021 income from operations increased 169%

year-over-year to $33.6 million, compared to $12.5 million in the

prior year.

For the year-to-date period, net income was $8.6 million, or

$0.74 earnings per diluted share, in 2021 compared to net income of

$3.0 million, or $0.27 earnings per diluted share, in 2020, an

increase of 185% year-over-year. Year-to-date net income and

diluted earnings per share were adversely impacted by $5.0 million

of debt extinguishment costs and $2.6 million of make-whole

interest expense incurred during the first quarter of 2021 when the

Company refinanced its debt.

Adjusted EBITDA increased 84% year-over-year to $41.4 million in

the first half of 2021.

Balance Sheet, Liquidity, and Cash Flow

As of June 30, 2021, cash and cash equivalents was $30.7

million. Cash provided by operating activities in the first half of

2021 was $22.7 million, which is net of $15.6 million in inventory

investments to support the business and includes $6.0 million in

cash tax refunds primarily from CARES Act filings. Capital

expenditures were $3.7 million in the first half of 2021, yielding

Free Cash Flow of $19.0 million, an $8.6 million increase compared

to the first half of 2020.

During the second quarter of 2021, the Company used $15 million

of cash on hand to pay down the ABL Revolver to zero and had no

borrowings outstanding thereunder as of June 30, 2021, consistent

with the Company’s capital structure strategy to maintain ample

liquidity, invest in the business and de-leverage the balance

sheet. At quarter end, $50 million was available for borrowing

under the ABL Revolver. Total long-term debt principal outstanding

as of June 30, 2021 was comprised of the Company’s $310 million

Senior Notes.

“Our excellent financial performance in the first half drove

strong free cash flow, allowing us to reduce debt while continuing

to make investments in the business,” said John Lowe, Chief

Financial Officer. “We are proud of our first half growth and our

recent listing on the Nasdaq stock exchange, and will continue to

pursue our strategic initiatives and execute our business

plan.”

Conference Call and Webcast

CPI Card Group Inc. will hold a conference call on August 12,

2021 at 9:00 a.m. Eastern Time (ET) to review its second quarter

and first half of 2021 results. To participate in the Company's

conference call via telephone or online:

Toll-Free Dial-In Number, U.S. Participants: (844) 200-6205

United States (Local): (646) 904 5544 All Other Locations: + 44 208

0682 558 Conference ID: 716604 Webcast Link: 2Q21 Earnings

Webcast

Participants are advised to login for the webcast 10 minutes

prior to the scheduled start time.

A replay of the conference call and webcast will be available

until August 26, 2021 at: Toll-Free Dial-In Number, U.S.

Participants: (844) 200-6205 International Dial-In Number: (646)

904-5544 Conference ID: 941788 Webcast replay: 2Q21 Earnings

Webcast Replay

A webcast replay and transcript of the conference call will be

available on CPI Card Group Inc.’s Investor Relations web site:

https://investor.cpicardgroup.com/

Non-GAAP Financial Measures

In addition to financial results reported in accordance with

U.S. generally accepted accounting principles (“GAAP”), we have

provided the following non-GAAP financial measures in this release,

all reported on a continuing operations basis: EBITDA, Adjusted

EBITDA, Adjusted EBITDA margin, Free Cash Flow, LTM Adjusted EBITDA

and Net Leverage Ratio. These non-GAAP financial measures are

utilized by management in comparing our operating performance on a

consistent basis between fiscal periods. We believe that these

financial measures are appropriate to enhance an overall

understanding of our underlying operating performance trends

compared to historical and prospective periods and our peers.

Management also believes that these measures are useful to

investors in their analysis of our results of operations and

provide improved comparability between fiscal periods. Non-GAAP

financial measures should not be considered in isolation from, or

as a substitute for, financial information calculated in accordance

with GAAP. Our non-GAAP measures may be different from similarly

titled measures of other companies. Investors are encouraged to

review the reconciliation of these historical non-GAAP measures to

their most directly comparable GAAP financial measures included in

Exhibit E to this press release.

Adjusted EBITDA

Adjusted EBITDA is presented on a continuing operations basis

and is defined as EBITDA (which represents earnings before

interest, taxes, depreciation and amortization) adjusted for

stock-based compensation expense; estimated sales tax expense

(benefit); restructuring and other charges; loss on debt

extinguishment; foreign currency gain or loss; and other items that

are unusual in nature, infrequently occurring or not considered

part of our core operations, as set forth in the reconciliation in

Exhibit E. Adjusted EBITDA is intended to show our unleveraged,

pre-tax operating results and therefore reflects our financial

performance based on operational factors, excluding

non-operational, unusual or non-recurring losses or gains. Adjusted

EBITDA has important limitations as an analytical tool, and you

should not consider it in isolation, or as a substitute for,

analysis of our results as reported under GAAP. For example,

Adjusted EBITDA does not reflect: (a) our capital expenditures,

future requirements for capital expenditures or contractual

commitments; (b) changes in, or cash requirements for, our working

capital needs; (c) the significant interest expenses or the cash

requirements necessary to service interest or principal payments on

our debt; (d) tax payments that represent a reduction in cash

available to us; (e) any cash requirements for the assets being

depreciated and amortized that may have to be replaced in the

future; (f) the impact of earnings or charges resulting from

matters that we and the lenders under our credit agreement may not

consider indicative of our ongoing operations; or (g) the impact of

any discontinued operations. In particular, our definition of

Adjusted EBITDA allows us to add back certain non-operating,

unusual or non-recurring charges that are deducted in calculating

net income, even though these are expenses that may recur, vary

greatly and are difficult to predict and can represent the effect

of long-term strategies as opposed to short-term results. In

addition, certain of these expenses represent the reduction of cash

that could be used for other purposes. Adjusted EBITDA margin

percentage as shown in Exhibit E is computed as Adjusted EBITDA

divided by total net sales.

We define LTM Adjusted EBITDA as Adjusted EBITDA (defined

previously) for the last twelve months. LTM Adjusted EBITDA is used

in the computation of Net Leverage Ratio, and is reconciled in

Exhibit E.

Free Cash Flow

We define Free Cash Flow as cash flow provided by (used in)

operating activities less capital expenditures. We use this metric

in analyzing our ability to service and repay our debt. However,

this measure does not represent funds available for investment or

other discretionary uses since it does not deduct cash used to

service our debt, nor does it reflect the cash impacts of

discontinued operations. Free Cash Flow should not be considered in

isolation, or as a substitute for, cash (used in) provided by

operating activities or any other measures of liquidity derived in

accordance with GAAP.

Net Leverage Ratio

Management and various investors use the ratio of total debt,

plus finance lease obligations, less cash, divided by LTM Adjusted

EBITDA, or “Net Leverage Ratio”, as a measure of our financial

strength when making key investment decisions and evaluating us

against peers.

About CPI Card Group Inc.

CPI Card Group® is a payment technology company and leading

provider of credit, debit and prepaid solutions delivered

physically, digitally and on-demand. CPI helps our customers foster

connections and build their brands through innovative and reliable

solutions, including financial payment cards, personalization and

Software-as-a-Service (SaaS) instant issuance. CPI has more than 20

years of experience in the payments market and is a trusted partner

to financial institutions and payments services providers. Serving

customers from locations throughout the United States, CPI has a

large network of high security facilities, each of which is

registered as PCI compliant by one or more of the payment brands:

Visa, Mastercard®, American Express® and Discover®. Learn more at

www.cpicardgroup.com.

Forward-Looking Statements

Certain statements and information in this release (as well as

information included in other written or oral statements we make

from time to time) may contain or constitute “forward-looking

statements” within the meaning of the Private Securities Litigation

Reform Act of 1995, Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. The words “believe,” “estimate,” “project,” “expect,”

“anticipate,” “plan,” “intend,” “foresee,” “should,” “would,”

“could,” “continue,” “committed,” “guides,” “provides guidance,”

“provides outlook” or other similar expressions are intended to

identify forward-looking statements, which are not historical in

nature. These forward-looking statements, including statements

about our strategic initiatives and market opportunities, are based

on our current expectations and beliefs concerning future

developments and their potential effect on us and other information

currently available. Such forward-looking statements, because they

relate to future events, are by their very nature subject to many

important risks and uncertainties that could cause actual results

or other events to differ materially from those contemplated.

These risks and uncertainties include, but are not limited to:

the potential effects of COVID-19 on our business, including our

supply-chain, customer demand, workforce, operations and ability to

comply with certain covenants in our indebtedness; a disruption or

other failure in our supply chain or labor pool resulting in

increased costs and inability to pass those costs on to our

customers; our inability to recruit, retain and develop qualified

personnel, including key personnel; our lack of eligibility to

participate in government relief programs related to COVID-19 or

inability to realize material benefits from such programs; our

substantial indebtedness, including inability to make debt service

payments or refinance such indebtedness; the restrictive terms of

our indebtedness and covenants of future agreements governing

indebtedness and the resulting restraints on our ability to pursue

our business strategies; our limited ability to raise capital in

the future; the effects of current or additional U.S. government

tariffs as well as economic downturns or disruptions, including

delays or interruptions in our ability to source raw materials and

components used in our products; system security risks, data

protection breaches and cyber-attacks; interruptions in our

operations, including our information technology systems, or in the

operations of the third parties that operate the data centers or

computing infrastructure on which we rely; our transition to being

an accelerated filer and complying with Section 404 of the

Sarbanes-Oxley Act of 2002 and the costs associated with such

compliance and implementation of procedures thereunder; failure to

comply with regulations, customer contractual requirements and

evolving industry standards regarding consumer privacy and data use

and security; disruptions in production at one or more of our

facilities; our failure to retain our existing customers or

identify and attract new customers; our inability to adequately

protect our trade secrets and intellectual property rights from

misappropriation, infringement claims brought against us and risks

related to open source software; defects in our software; problems

in production quality, materials and process; a loss of market

share or a decline in profitability resulting from competition; our

inability to develop, introduce and commercialize new products; new

and developing technologies that make our existing technology

solutions and products obsolete or less relevant or our failure to

introduce new products and services in a timely manner; costs and

impacts to our financial results relating to the obligatory

collection of sales tax and claims for uncollected sales tax in

states that impose sales tax collection requirements on

out-of-state businesses, as well as potential new U.S. tax

legislation increasing the corporate income tax rate and challenges

to our income tax positions; failure to meet the continued listing

standards of the Toronto Stock Exchange or the Nasdaq Global

Market; a decrease in the value of our common stock combined with

our common stock not being traded on a United States national

securities exchange, which may prevent investors or potential

investors from investing or achieving a meaningful degree of

liquidity; quarterly variation in our operating results; our

inability to realize the full value of our long-lived assets; our

failure to operate our business in accordance with the Payment Card

Industry Security Standards Council security standards or other

industry standards; a decline in U.S. and global market and

economic conditions and resulting decreases in consumer and

business spending; costs relating to product defects and any

related product liability and/or warranty claims; our dependence on

licensing arrangements; risks associated with international

operations; non-compliance with, and changes in, laws in the United

States and in foreign jurisdictions in which we operate and sell

our products and services; the effect of legal and regulatory

proceedings; our ability to comply with a wide variety of

environmental, health and safety laws and regulations and the

exposure to liability for any failure to comply; risks associated

with the majority stockholders’ ownership of our stock; the

influence of securities analysts over the trading market for and

price of our common stock; our inability to sell, exit, reconfigure

or consolidate businesses or facilities that no longer meet with

our strategy; potential conflicts of interest that may arise due to

our board of directors being comprised in part of directors who are

principals of our majority stockholders; certain provisions of our

organizational documents and other contractual provisions that may

delay or prevent a change in control and make it difficult for

stockholders other than our majority stockholders to change the

composition of our board of directors; and other risks that are

described in Part I, Item 1A – Risk Factors in our Annual Report on

Form 10-K for the year ended December 31, 2020, in Part II, Item 1A

– Risk Factors of our Quarterly Report on Form 10-Q for the quarter

ended June 30, 2021 and our other reports filed from time to time

with the Securities and Exchange Commission (the “SEC”).

We caution and advise readers not to place undue reliance on

forward-looking statements, which speak only as of the date hereof.

These statements are based on assumptions that may not be realized

and involve risks and uncertainties that could cause actual results

or other events to differ materially from the expectations and

beliefs contained herein. We undertake no obligation to publicly

update or revise any forward-looking statements after the date they

are made, whether as a result of new information, future events or

otherwise.

For more information:

CPI encourages investors to use its investor relations website

as a way of easily finding information about the Company. CPI

promptly makes available on this website, free of charge, the

reports that the Company files or furnishes with the SEC, corporate

governance information and press releases. CPI uses its investor

relations site (http://investor.cpicardgroup.com) as a means of

disclosing material information and for complying with its

disclosure obligations under Regulation FD.

CPI Card Group Inc. Earnings Release Supplemental

Financial Information

Exhibit A

Condensed Consolidated Statements of

Operations and Comprehensive Income - Unaudited for the three and

six months ended June 30, 2021 and 2020

Exhibit B

Condensed Consolidated Balance Sheets –

Unaudited as of June 30, 2021 and December 31, 2020

Exhibit C

Condensed Consolidated Statements of Cash

Flows - Unaudited for the six months ended June 30, 2021 and

2020

Exhibit D

Segment Summary Information – Unaudited

for the three and six months ended June 30, 2021 and 2020

Exhibit E

Supplemental GAAP to Non-GAAP

Reconciliations - Unaudited for the three and six months ended June

30, 2021 and 2020

EXHIBIT A

CPI Card Group Inc. and

Subsidiaries

Condensed Consolidated

Statements of Operations and Comprehensive Income

(Amounts in Thousands, Except

Share and Per Share Amounts)

(Unaudited)

Three Months Ended June

30,

Six Months Ended June

30,

2021

2020

2021

2020

Net sales:

Products

$

47,156

$

39,077

$

94,169

$

81,578

Services

46,063

32,301

88,142

63,769

Total net sales

93,219

71,378

182,311

145,347

Cost of sales:

Products (exclusive of depreciation and

amortization shown below)

27,928

25,911

55,215

52,290

Services (exclusive of depreciation and

amortization shown below)

25,939

19,666

49,607

38,853

Depreciation and amortization

2,264

2,711

4,680

5,466

Total cost of sales

56,131

48,288

109,502

96,609

Gross profit

37,088

23,090

72,809

48,738

Operating expenses:

Selling, general and administrative

(exclusive of depreciation and amortization shown below)

19,748

16,613

35,894

33,276

Depreciation and amortization

1,553

1,505

3,359

2,990

Total operating expenses

21,301

18,118

39,253

36,266

Income from operations

15,787

4,972

33,556

12,472

Other expense, net:

Interest, net

(7,037

)

(6,772

)

(16,013

)

(12,860

)

Other income (expense), net

4

(32

)

29

(35

)

Loss on debt extinguishment

—

—

(5,048

)

(92

)

Total other expense, net

(7,033

)

(6,804

)

(21,032

)

(12,987

)

Income (loss) from continuing operations

before income taxes

8,754

(1,832

)

12,524

(515

)

Income tax (expense) benefit

(2,522

)

3,115

(3,882

)

3,580

Net income from continuing operations

6,232

1,283

8,642

3,065

Net loss from discontinued operations, net

of tax

—

(4

)

—

(30

)

Net income

$

6,232

$

1,279

$

8,642

$

3,035

Basic and diluted earnings per share:

Basic earnings per share from continuing

operations:

$

0.55

$

0.11

$

0.77

$

0.27

Diluted earnings per share from continuing

operations:

$

0.53

$

0.11

$

0.74

$

0.27

Basic earnings per share:

$

0.55

$

0.11

$

0.77

$

0.27

Diluted earnings per share:

$

0.53

$

0.11

$

0.74

$

0.27

Basic weighted-average shares

outstanding:

11,233,002

11,229,819

11,231,742

11,227,160

Diluted weighted-average shares

outstanding:

11,762,481

11,233,852

11,720,148

11,242,272

Comprehensive income:

Net income

$

6,232

$

1,279

$

8,642

$

3,035

Total comprehensive income

$

6,232

$

1,279

$

8,642

$

3,035

EXHIBIT B

CPI Card Group Inc. and

Subsidiaries

Condensed Consolidated Balance

Sheets

(Amounts in Thousands, Except

Share and Per Share Amounts)

(Unaudited)

June 30,

December 31,

2021

2020

Assets

Current assets:

Cash and cash equivalents

$

30,667

$

57,603

Accounts receivable, net of allowances of

$237 and $289, respectively

55,979

54,592

Inventories

40,273

24,796

Prepaid expenses and other current

assets

6,036

5,032

Income taxes receivable

2,522

10,511

Total current assets

135,477

152,534

Plant, equipment and leasehold

improvements and operating lease right-of-use assets, net

39,257

39,403

Intangible assets, net

23,909

26,207

Goodwill

47,150

47,150

Other assets

2,575

857

Total assets

$

248,368

$

266,151

Liabilities and stockholders’

deficit

Current liabilities:

Accounts payable

$

20,778

$

18,883

Accrued expenses

31,809

28,149

Current portion of long-term debt

—

8,027

Deferred revenue and customer deposits

1,157

1,868

Total current liabilities

53,744

56,927

Long-term debt

302,877

328,681

Deferred income taxes

7,447

7,409

Other long-term liabilities

13,563

11,171

Total liabilities

377,631

404,188

Commitments and contingencies

Series A Preferred Stock; $0.001 par

value—100,000 shares authorized; 0 shares issued and outstanding at

June 30, 2021 and December 31, 2020

—

—

Stockholders’ deficit:

Common stock; $0.001 par value—100,000,000

shares authorized; 11,237,056 and 11,230,482 shares issued and

outstanding at June 30, 2021 and December 31, 2020

11

11

Capital deficiency

(111,726

)

(111,858

)

Accumulated loss

(17,548

)

(26,190

)

Total stockholders’ deficit

(129,263

)

(138,037

)

Total liabilities and stockholders’

deficit

$

248,368

$

266,151

EXHIBIT C

CPI Card Group Inc. and

Subsidiaries

Condensed Consolidated

Statements of Cash Flows

(Amounts in Thousands)

(Unaudited)

Six Months Ended June

30,

2021

2020

Operating activities

Net income

$

8,642

$

3,035

Adjustments to reconcile net income to net

cash provided by operating activities:

Loss from discontinued operations

—

30

Depreciation and amortization expense

8,039

8,457

Stock-based compensation expense

98

59

Amortization of debt issuance costs and

debt discount

1,393

1,565

Loss on debt extinguishment

5,048

92

Deferred income taxes

38

255

Other, net

142

1,199

Changes in operating assets and

liabilities:

Accounts receivable

(1,384

)

(2,381

)

Inventories

(15,600

)

259

Prepaid expenses and other assets

(752

)

1,136

Income taxes receivable, net

7,989

(3,799

)

Accounts payable

2,548

(1,660

)

Accrued expenses

6,530

3,275

Deferred revenue and customer deposits

(715

)

629

Other liabilities

730

(105

)

Cash provided by operating activities -

continuing operations

22,746

12,046

Cash used in operating activities -

discontinued operations

—

(30

)

Investing activities

Capital expenditures for plant, equipment

and leasehold improvements

(3,703

)

(1,644

)

Other

156

—

Cash used in investing activities

(3,547

)

(1,644

)

Financing activities

Principal payments on First Lien Term

loan

(312,500

)

-

Principal payments on Senior Credit

Facility

(30,000

)

-

Principal payments on ABL Revolver

(15,000

)

-

Proceeds from Senior Notes

310,000

-

Proceeds from ABL Revolver, net of

discount

14,750

-

Proceeds from Senior Credit Facility, net

of discount

-

29,100

Proceeds from exercises of stock

options

34

-

Debt issuance costs

(9,452

)

(2,507

)

Payments on debt extinguishment

(2,685

)

-

Payments on finance lease obligations

(1,287

)

(1,181

)

Cash (used in) provided by financing

activities

(46,140

)

25,412

Effect of exchange rates on cash

5

(21

)

Net (decrease) increase in cash and cash

equivalents

(26,936

)

35,763

Cash and cash equivalents, beginning of

period

57,603

18,682

Cash and cash equivalents, end of

period

$

30,667

$

54,445

Supplemental disclosures of cash flow

information

Cash paid (refunded) during the period

for:

Interest

$

8,604

$

11,519

Income taxes paid

$

2,284

$

275

Income taxes (refunded)

$

(6,003

)

$

(259

)

Right-to-use assets obtained in exchange

for lease obligations:

Operating leases

$

3,363

$

141

Financing leases

$

484

$

763

Accounts payable, and accrued expenses for

capital expenditures for plant, equipment and leasehold

improvements

$

399

$

528

EXHIBIT D

CPI Card Group Inc. and

Subsidiaries

Segment Summary

Information

For the Three and Six Months

Ended June 30, 2021 and June 30, 2020

(Dollars in Thousands)

(Unaudited)

Net Sales

Three Months Ended June

30,

2021

2020

$ Change

% Change

Net sales by segment:

Debit and Credit

$

72,860

$

58,306

$

14,554

25.0

%

Prepaid Debit

20,383

13,536

6,847

50.6

%

Eliminations

(24

)

(464

)

440

*

%

Total

$

93,219

$

71,378

$

21,841

30.6

%

* Calculation not meaningful

Six Months Ended June

30,

2021

2020

$ Change

% Change

Net sales by segment:

Debit and Credit

$

142,677

$

118,145

$

24,532

20.8

%

Prepaid Debit

39,841

28,076

11,765

41.9

%

Eliminations

(207

)

(874

)

667

*

%

Total

$

182,311

$

145,347

$

36,964

25.4

%

* Calculation not meaningful

Gross Profit

Three Months Ended June

30,

2021

% of Net Sales

2020

% of Net Sales

$ Change

% Change

Gross profit by segment:

Debit and Credit

$

28,263

38.8

%

$

18,553

31.8

%

$

9,710

52.3

%

Prepaid Debit

8,825

43.3

%

4,537

33.5

%

4,288

94.5

%

Total

$

37,088

39.8

%

$

23,090

32.3

%

$

13,998

60.6

%

Six Months Ended June

30,

2021

% of Net Sales

2020

% of Net Sales

$ Change

% Change

Gross profit by segment:

Debit and Credit

$

55,812

39.1

%

$

38,961

33.0

%

$

16,851

43.3

%

Prepaid Debit

16,997

42.7

%

9,777

34.8

%

7,220

73.8

%

Total

$

72,809

39.9

%

$

48,738

33.5

%

$

24,071

49.4

%

Income from Operations

Three Months Ended June

30,

2021

% of Net Sales

2020

% of Net Sales

$ Change

% Change

Income (loss) from operations by

segment:

Debit and Credit

$

20,258

27.8

%

$

10,704

18.4

%

$

9,554

89.3

%

Prepaid Debit

7,550

37.0

%

3,434

25.4

%

4,116

119.9

%

Other

(12,021

)

*

%

(9,166

)

*

%

(2,855

)

31.1

%

Total

$

15,787

16.9

%

$

4,972

7.0

%

$

10,815

217.5

%

* Calculation not meaningful

Six Months Ended June

30,

2021

% of Net Sales

2020

% of Net Sales

$ Change

% Change

Income (loss) from operations by

segment:

Debit and Credit

$

40,412

28.3

%

$

23,180

19.6

%

$

17,232

74.3

%

Prepaid Debit

14,568

36.6

%

7,550

26.9

%

7,018

93.0

%

Other

(21,424

)

*

%

(18,258

)

*

%

(3,166

)

17.3

%

Total

$

33,556

18.4

%

$

12,472

8.6

%

$

21,084

169.1

%

* Calculation not meaningful

EBITDA

Three Months Ended June

30,

2021

% of Net Sales

2020

% of Net Sales

$ Change

% Change

EBITDA by segment:

Debit and Credit

$

22,322

30.6

%

$

13,121

22.5

%

$

9,201

70.1

%

Prepaid Debit

8,106

39.8

%

3,982

29.4

%

4,124

103.6

%

Other

(10,820

)

*

%

(7,947

)

*

%

(2,873

)

36.2

%

Total

$

19,608

21.0

%

$

9,156

12.8

%

$

10,452

114.2

%

* Calculation not meaningful

Six Months Ended June

30,

2021

% of Net Sales

2020

% of Net Sales

$ Change

% Change

EBITDA by segment:

Debit and Credit

$

44,722

31.3

%

$

28,080

23.8

%

$

16,642

59.3

%

Prepaid Debit

15,679

39.4

%

8,642

30.8

%

7,037

81.4

%

Other

(23,825

)

*

%

(15,921

)

*

%

(7,904

)

49.6

%

Total

$

36,576

20.1

%

$

20,801

14.3

%

$

15,775

75.8

%

* Calculation not meaningful

Reconciliation of Income (loss)

from

Operations by Segment to EBITDA by

Segment

Three Months Ended June 30,

2021

Debit and Credit

Prepaid Debit

Other

Total

EBITDA by segment:

Income (loss) from operations

$

20,258

)

$

7,550

$

(12,021

)

$

15,787

)

Depreciation and amortization

2,060

558

1,199

3,817

Other income (expenses)

4

(2

)

2

4

EBITDA

$

22,322

$

8,106

$

(10,820

)

$

19,608

Three Months Ended June 30,

2020

Debit and Credit

Prepaid Debit

Other

Total

EBITDA by segment:

Income (loss) from operations

$

10,704

$

3,434

$

(9,166

)

$

4,972

Depreciation and amortization

2,453

549

1,214

4,216

Other (expenses)

(36

)

(1

)

5

(32

)

EBITDA

$

13,121

$

3,982

$

(7,947

)

$

9,156

Six Months Ended June 30,

2021

Debit and Credit

Prepaid Debit

Other

Total

EBITDA by segment:

Income (loss) from operations

$

40,412

$

14,568

$

(21,424

)

$

33,556

Depreciation and amortization

4,297

1,097

2,645

8,039

Other income (expenses)

13

14

(5,046

)

(5,019

)

EBITDA

$

44,722

$

15,679

$

(23,825

)

$

36,576

Six Months Ended June 30,

2020

Debit and Credit

Prepaid Debit

Other

Total

EBITDA by segment:

Income (loss) from operations

$

23,180

$

7,550

$

(18,258

)

$

12,472

Depreciation and amortization

4,946

1,097

2,413

8,456

Other (expenses)

(46

)

(5

)

(76

)

(127

)

EBITDA

$

28,080

$

8,642

$

(15,921

)

$

20,801

EXHIBIT E

CPI Card Group Inc. and

Subsidiaries

Supplemental GAAP to Non-GAAP

Reconciliation

(Dollars in Thousands)

(Unaudited)

Three Months Ended June

30,

Six Months Ended June

30,

2021

2020

2021

2020

EBITDA and Adjusted EBITDA:

Net income

$

6,232

$

1,279

$

8,642

$

3,035

Net loss from discontinued operations

—

4

—

30

Interest expense, net

7,037

6,772

16,013

12,860

Income tax expense (benefit)

2,522

(3,115

)

3,882

(3,580

)

Depreciation and amortization

3,817

4,216

8,039

8,456

EBITDA

$

19,608

$

9,156

$

36,576

$

20,801

Adjustments to EBITDA:

Stock-based compensation expense

47

18

98

59

Sales tax (benefit) expense (1)

(385

)

172

(465

)

293

Restructuring and other charges (2)

40

762

161

1,229

Loss on debt extinguishment (3)

—

—

5,048

92

Foreign currency (gain) loss

(4

)

25

(29

)

33

Subtotal of adjustments to EBITDA

(302

)

977

4,813

1,706

Adjusted EBITDA

$

19,306

$

10,133

$

41,389

$

22,507

Net income (% Change 2021 vs. 2020)

387.3

%

184.7

%

Adjusted EBITDA margin (% of Net

Sales)

20.7

%

14.2

%

22.7

%

15.5

%

Adjusted EBITDA growth (% Change 2021 vs.

2020)

90.5

%

83.9

%

Three Months Ended June

30,

Six Months Ended June

30,

2021

2020

2021

2020

Free Cash Flow:

Cash provided by operating activities

$

22,602

$

8,842

$

22,746

$

12,046

Capital expenditures for plant, equipment

and leasehold improvements

(1,179

)

(706

)

(3,703

)

(1,644

)

Free Cash Flow

$

21,423

$

8,136

$

19,043

$

10,402

(1)

Represents estimated sales tax (benefit)

expense relating to a contingent liability due to historical

activity in certain states where it is probable that the Company

will be subject to sales tax plus interest and penalties. During

the year ended December 31, 2020, the Company revised its prior

period financial statements to adjust immaterial items, primarily

due to estimated sales tax expense relating to 2017 through the

second quarter of 2020. Refer to Note 1 of the Form 10-Q for the

quarter ended June 30, 2021 and Note 2 of the Form 10-K for the

year ended December 31, 2020 for an explanation of the immaterial

prior period adjustments.

(2)

Represents restructuring severance

charges.

(3)

The Company terminated and repaid its

Senior Credit Facility and First Lien Term Loan during the first

quarter of 2021 and expensed the unamortized deferred financing

costs and debt discount. Additionally, the Company terminated its

previous Revolving Credit Facility during the first quarter of 2020

and expensed the remaining unamortized deferred financing

costs.

Last Twelve Months

Ended

June 30,

December 31,

2021

2020

Reconciliation of net income to LTM

EBITDA and Adjusted EBITDA

Net income

$

21,736

$

16,129

Net loss from discontinued operations

31

61

Interest expense, net

28,550

25,397

Income tax expense (benefit)

4,157

(3,305

)

Depreciation and amortization

16,410

16,827

EBITDA

$

70,884

$

55,109

Adjustments to EBITDA:

Stock-based compensation expense

175

136

Sales tax expense (1)

168

926

Restructuring and other charges (2)

201

1,269

Loss on debt extinguishment (3)

5,048

92

Foreign currency (gain) loss

(55

)

7

Subtotal of adjustments to EBITDA

$

5,537

$

2,430

LTM Adjusted EBITDA

$

76,421

$

57,539

(1)

Represents estimated sales tax (benefit)

expense relating to a contingent liability due to historical

activity in certain states where it is probable that the Company

will be subject to sales tax plus interest and penalties. During

the year ended December 31, 2020, the Company revised its prior

period financial statements to adjust immaterial items, primarily

due to estimated sales tax expense relating to 2017 through the

second quarter of 2020. Refer to Note 1 of the Form 10-Q for the

quarter ended June 30, 2021 and Note 2 of the Form 10-K for the

year ended December 31, 2020 for an explanation of the immaterial

prior period adjustments.

(2)

Represents restructuring severance

charges.

(3)

The Company terminated and repaid its

Senior Credit Facility and First Lien Term Loan during the first

quarter of 2021 and expensed the unamortized deferred financing

costs and debt discount. Additionally, the Company terminated its

previous Revolving Credit Facility during the first quarter of 2020

and expensed the remaining unamortized deferred financing

costs.

As of

June 30,

December 31,

2021

2020

Calculation of Net Leverage

Ratio:

Debt principal outstanding

$

310,000

$

342,500

Finance lease obligations

4,380

5,192

Total Debt

314,380

347,692

Less: Cash and cash equivalents

(30,667

)

(57,603

)

Total Net Debt (a)

$

283,713

$

290,089

LTM Adjusted EBITDA (b)

$

76,421

$

57,539

Net Leverage Ratio (a)/(b)

3.7

5.0

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210812005239/en/

CPI Card Group Inc. Investor Relations: (877) 369-9016

InvestorRelations@cpicardgroup.com

CPI Card Group Inc. Media Relations:

Media@cpicardgroup.com

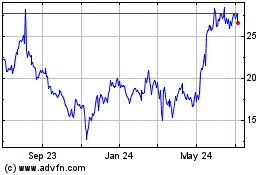

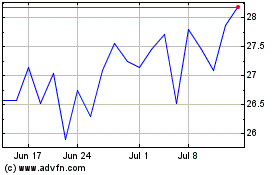

CPI Card (NASDAQ:PMTS)

Historical Stock Chart

From Aug 2024 to Sep 2024

CPI Card (NASDAQ:PMTS)

Historical Stock Chart

From Sep 2023 to Sep 2024