Cool Company Ltd. - Approval of Long-Term Incentive Plan

November 25 2022 - 2:13PM

Bermuda, November 25, 2022: The board of

directors (the “Board”) of Cool Company Ltd.

(“CoolCo” or the “Company”) has

resolved to implement a long-term incentive plan (the

“LTIP”) for employees, management and board

members of the Company and its affiliates. The overall purpose of

the LTIP is to promote the success of the Company for the benefit

of its shareholders, by providing a framework for the retention and

incentivization of employees using the Company’s equity and thereby

aligning their interests with the Company and its affiliates.

The LTIP provides for the grant of equity

awards, with the intention being for the initial awards to be

granted as options (“Options”) and restricted

stock units (the “RSUs”), as further detailed

below. Shares used under the LTIP are expected to be covered by the

Board's authorization to issue authorized and unissued shares in

connection with a grant of warrants, options or other securities

with rights to convert such securities into shares of the Company,

pursuant to the bye-laws of the Company.

The Board also resolved that the number of

shares in the Company to be used for awards granted under the LTIP

will be approved by the Board on an annual basis.

(i) Options:

Pursuant to the LTIP, Options will be granted at

an exercise price to be determined as at the date of grant (with

the initial Options to be granted with an exercise price of $10).

The initial recipients of Options will be management and directors

of the Company and its affiliates. Options will vest subject to a

vesting schedule as determined at grant, with the initial Options

vesting equally in four installments on each of November 30, 2023,

November 29, 2024, November 30, 2025, and November 30, 2026. The

LTIP rules allow the Company to determine the exercise price and

applicable vesting and performance conditions for future awards as

appropriate. Options may be exercised from the vesting date and

will lapse and become void on the 10th anniversary of the grant

date if not exercised. Upon exercise of the Options, the holder

will receive one share per Option in CoolCo at the exercise price.

Where a grantee ceases employment by reason of death, disability or

termination without cause (or for any other reason at the

discretion of CoolCo), Options will vest immediately. Where a

grantee ceases employment for any other reason, any unvested

Options will immediately lapse.

The Options will be granted under the terms of

an option agreement (the “Option Agreement”) and

the LTIP, and a duly completed Option Agreement will be provided to

each proposed grantee, for each individual to enter into with the

Company in order to effect the grant of their Option.

A grant of Options according to the LTIP in one

year does not entitle the grantee to receive Options or any other

award under the LTIP in subsequent years.

(ii) RSUs:

Pursuant to the LTIP, RSUs vest into shares of

the Company (“RSUs”). The RSUs vest subject

to a vesting schedule to be determined at grant. It is

intended that the RSUs initially be operated for Norwegian

employees, and employees in certain other jurisdictions. The

initial RSUs will vest equally in four installments on each of

November 30, 2023, November 29, 2024, November 30, 2025, and

November 30, 2026. The LTIP rules allow the Company to determine

applicable vesting and performance conditions for future awards as

appropriate. Where a grantee ceases employment by reason of death,

disability or termination without cause (or for any other reason at

the discretion of CoolCo), RSUs will vest immediately. Where a

grantee ceases employment for any other reason, any unvested RSUs

will immediately lapse. The RSUs will be granted under the terms of

an RSU agreement (the “RSU Agreement”) and the

LTIP, and a duly completed RSU Agreement will be provided to each

proposed grantee, for each individual to enter into with the

Company in order to effect the grant of their RSUs.

A grant of RSUs according to the LTIP in one

year does not entitle the grantee to receive RSUs or any other

award under the LTIP in subsequent years.

ABOUT COOLCO

CoolCo is a growth-oriented owner, operator and

manager of fuel-efficient liquefied natural gas

(“LNG”) carriers. Using its integrated, in-house

vessel management platform, CoolCo provides charterers and

third-party LNG vessel owners with modern and flexible management

and transportation solutions, delivering a lesser-emitting form of

energy that supports decarbonization efforts, economic growth,

energy security, and improvements in quality of life. CoolCo also

intends to leverage its industry relationships to make further

accretive acquisitions of in-service LNGCs, and to selectively

pursue newbuild opportunities.

Additional information about CoolCo can be found

at www.coolcoltd.com.

For further information, please contact:

Richard Tyrrell, CEOEmail:

richard.tyrrell@coolcoltd.comPhone: +44 2076591111John Boots,

CFOEmail: john.boots@coolcoltd.comPhone: +44 2076591111

This information is subject to the disclosure

requirements in Regulation EU 596/2014 (MAR) article 19 number 3

and section 5-12 of the Norwegian Securities Trading Act.

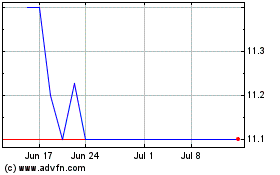

Corner Growth Acquisition (NASDAQ:COOL)

Historical Stock Chart

From Jun 2024 to Jul 2024

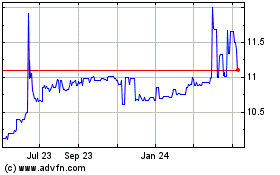

Corner Growth Acquisition (NASDAQ:COOL)

Historical Stock Chart

From Jul 2023 to Jul 2024