0001718227FALSE290 Healthwest Drive, Suite 2DothanAlabama3630300017182272025-02-072025-02-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): February 7, 2025

CONSTRUCTION PARTNERS, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-38479 | | 26-0758017 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (I.R.S. Employer

Identification Number) |

| | | | | | | | | | | | | | |

290 Healthwest Drive, Suite 2 Dothan, Alabama 36303 (Address of principal executive offices) (ZIP Code) |

|

(334) 673-9763 (Registrant’s telephone number, including area code) |

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading symbol(s) | | Name of each exchange

on which registered |

| Class A common stock, $0.001 par value | | ROAD | | The Nasdaq Stock Market LLC |

| | | | (Nasdaq Global Select Market) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On February 7, 2025, Construction Partners, Inc. issued a press release announcing its financial results for the fiscal quarter ended December 31, 2024. A copy of the press release is furnished as Exhibit 99.1 hereto, and the information contained in Exhibit 99.1 is incorporated herein by reference.

The information furnished pursuant to this Item 2.02, including Exhibit 99.1, shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, and will not be incorporated by reference into any registration statement filed under the Securities Act of 1933, as amended, unless specifically identified therein as being incorporated therein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | | | | | | | |

| Exhibit No. | Description |

| 99.1** | |

| 104* | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

* Filed herewith.

** Furnished herewith.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| CONSTRUCTION PARTNERS, INC. |

| |

| Date: February 7, 2025 | By: | /s/ Gregory A. Hoffman |

| | Gregory A. Hoffman |

| | Senior Vice President and Chief Financial Officer |

Construction Partners, Inc. Announces Fiscal 2025 First Quarter Results

Revenue Up 42% Compared to Q1 FY24

Adjusted Net Income Up 35% Compared to Q1 FY24

Adjusted EBITDA Up 68% Compared to Q1 FY24

Record Backlog of $2.66 Billion

Company Raises FY25 Outlook

DOTHAN, AL, February 7, 2025 – Construction Partners, Inc. (NASDAQ: ROAD) (“CPI” or the “Company”), a vertically integrated civil infrastructure company specializing in the construction and maintenance of roadways in local markets throughout the Sunbelt, today reported financial and operating results for the fiscal quarter ended December 31, 2024.

Fred J. (Jule) Smith, III, the Company’s President and Chief Executive Officer, said, “Today we are reporting strong first quarter performance, with revenue growth of 42% and Adjusted EBITDA growth of 68% compared to the first quarter last year, which led to an exceptional first quarter Adjusted EBITDA margin of 12.25%. The outstanding operational performance of our family of companies throughout the Sunbelt and favorable weather during the quarter produced these strong results. We also continued to win more project work, growing our project backlog to a record $2.66 billion. We were pleased to have completed the transformational acquisition of Lone Star Paving, our new platform company in Texas, during the first quarter. In addition, we have completed two acquisitions since January 2025. In January, we entered Oklahoma by acquiring our eighth platform company, Overland Corporation, which is well-positioned to participate in the strong economic activity occurring in southern Oklahoma and northern Texas. Earlier this week, we announced our latest strategic acquisition with the purchase of Mobile Asphalt Company in Mobile, Alabama. This represents a significant expansion of our presence in the Mobile metro area and the surrounding southwestern Alabama markets following our initial entry into Mobile last September. Reflecting these strong first quarter results and incorporating the expected contribution of these two newly acquired companies, we are raising our fiscal 2025 outlook ranges.”

Revenues were $561.6 million in the first quarter of fiscal 2025, an increase of 41.6% compared to $396.5 million in the same quarter last year. The $165.1 million revenue increase included $120.9 million of revenues attributable to acquisitions completed during or subsequent to the three months ended December 31, 2023, and an increase of approximately $44.2 million of revenues in the Company’s existing markets. The mix of total revenue growth for the quarter was approximately 11.2% organic and approximately 30.4% from recent acquisitions.

Gross profit was $76.6 million in the first quarter of fiscal 2025, compared to $51.9 million in the same quarter last year.

General and administrative expenses were $44.3 million in the first quarter of fiscal 2025, compared to $35.5 million in the same quarter last year, and as a percentage of total revenues, decreased to 7.9% compared to 8.9% in the same quarter last year.

Due to acquisition-related expenses in the first quarter, net loss was $3.1 million and diluted losses per share were $0.06 in the first quarter of fiscal 2025, compared to net income of $9.8 million and diluted earnings per share of $0.19 in the same quarter last year.

Adjusted net income(1) was $13.3 million in the first quarter of fiscal 2025. This measure adjusts for the impact of certain one-time expenses related to the Lone Star Paving acquisition, which management views as a transformative acquisition. Using adjusted net income, diluted earnings per share for the first quarter would have been $0.25.

(1) Adjusted net income, Adjusted EBITDA and Adjusted EBITDA margin are financial measures not presented in accordance with generally accepted accounting principles (“GAAP”). Please see “Reconciliation of Non-GAAP Financial Measures” at the end of this press release.

Adjusted EBITDA(1) in the first quarter of fiscal 2025 was $68.8 million, an increase of 68% compared to $40.9 million in the same quarter last year.

Project backlog was a record $2.66 billion at December 31, 2024, compared to $1.62 billion at December 31, 2023 and $1.96 billion at September 30, 2024.

Smith added, “In fiscal 2025, we continue to see strong industry tailwinds relative to customer demand for both publicly funded and commercial project work. We operate in well-funded and growing Sunbelt states representing some of the fasting growing areas in the country that are supported by healthy state and federal funding programs. We continue to project growth and enhanced profitability for CPI, and we plan to deliver long-term value to our investors and other stakeholders.”

Fiscal 2025 Outlook

As previously announced, CPI’s outlook for fiscal 2025 with regard to revenue, net income, Adjusted net income, Adjusted EBITDA and Adjusted EBITDA margin is as follows:

•Revenue in the range of $2.66 billion to $2.74 billion

•Net income in the range of $93.0 million to $105.6 million

•Adjusted net income(1) in the range of $109.5 million to $122.1 million

•Adjusted EBITDA(1) in the range of $375.0 million to $400.0 million

•Adjusted EBITDA margin(1) in the range of 14.1% to 14.6%

Ned N. Fleming, III, the Company’s Executive Chairman, stated, “CPI’s growth strategy of partnering with experienced local operators who know how to build and operate great companies that we can further support within our larger organization is a proven and repeatable model that works. With a strong balance sheet and experienced team, we expect to generate strong returns as we grow our geographic footprint and increase the size and scale of the company through this proven strategy to increase profitability and expand margins. Our country’s infrastructure repair and maintenances needs are not only considerable, but also growing as roadway capacity increases throughout the Sunbelt. The Board and I are more bullish about CPI’s future that at any point in the past, as we will continue to benefit from opportunities afforded by a generational investment in infrastructure, the fast-growing economies in the Sunbelt, and numerous organic and acquisitive growth opportunities to scale our organization and deliver value to our stockholders.”

Conference Call

The Company will conduct a conference call today at 10:00 a.m. Eastern Time (9:00 a.m. Central Time) to discuss financial and operating results for the fiscal quarter ended December 31, 2024. To access the call live by phone, dial (412) 902-0003 and ask for the Construction Partners call at least 10 minutes prior to the start time. A telephonic replay will be available through February 14, 2025 by calling (201) 612-7415 and using passcode ID: 13750700#. A webcast of the call will also be available live and for later replay on the Company’s Investor Relations website at www.constructionpartners.net.

About Construction Partners, Inc.

Construction Partners, Inc. is a vertically integrated civil infrastructure company operating in local markets throughout the Sunbelt in Alabama, Florida, Georgia, North Carolina, Oklahoma, South Carolina, Tennessee and Texas. Supported by its hot-mix asphalt plants, aggregate facilities and liquid asphalt terminals, the Company focuses on the construction, repair and maintenance of surface infrastructure. Publicly funded projects make up the majority of its business and include local and state roadways, interstate highways, airport runways and bridges. The company also performs private sector projects that include paving and sitework for office and industrial parks, shopping centers, local businesses and residential developments. To learn more, visit www.constructionpartners.net.

Cautionary Note Regarding Forward-Looking Statements

Certain statements contained herein that are not statements of historical or current fact constitute “forward-looking statements” within the meaning of Section 21E of the Securities Exchange Act of 1934. These statements may be identified by the use of words such as “may,” “will,” “expect,” “should,” “anticipate,” “intend,” “project,” “outlook,” “believe” and “plan.” The

forward-looking statements contained in this press release include, without limitation, statements related to financial projections, future events, business strategy, future performance, future operations, backlog, financial position, estimated revenues and losses, projected costs, prospects, plans and objectives of management. These and other forward-looking statements are based on management’s current views and assumptions and involve risks and uncertainties that could significantly affect expected results. Important factors could cause actual results to differ materially from those expressed in the forward-looking statements, including, among others: our ability to successfully manage and integrate acquisitions; failure to realize the expected economic benefits of acquisitions, including future levels of revenues being lower than expected and costs being higher than expected; failure or inability to implement growth strategies in a timely manner; declines in public infrastructure construction and reductions in government funding, including the funding by transportation authorities and other state and local agencies; risks related to our operating strategy; competition for projects in our local markets; risks associated with our capital-intensive business; government requirements and initiatives, including those related to funding for public or infrastructure construction, land usage and environmental, health and safety matters; unfavorable economic conditions and restrictive financing markets; our ability to obtain sufficient bonding capacity to undertake certain projects; our ability to accurately estimate the overall risks, requirements or costs when we bid on or negotiate contracts that are ultimately awarded to us; the cancellation of a significant number of contracts or our disqualification from bidding for new contracts; risks related to adverse weather conditions; our substantial indebtedness and the restrictions imposed on us by the terms thereof; our ability to maintain favorable relationships with third parties that supply us with equipment and essential supplies; our ability to retain key personnel and maintain satisfactory labor relations; property damage, results of litigation and other claims and insurance coverage issues; risks related to our information technology systems and infrastructure; our ability to maintain effective internal control over financial reporting; and the risks, uncertainties and factors set forth under “Risk Factors” in the Company’s most recent Annual Report on Form 10-K and its subsequently filed Quarterly Reports on Form 10-Q. Forward-looking statements speak only as of the date they are made. The Company assumes no obligation to update forward-looking statements to reflect actual results, subsequent events, or circumstances or other changes affecting such statements except to the extent required by applicable law.

Contacts:

Rick Black / Ken Dennard

Dennard Lascar Investor Relations

ROAD@DennardLascar.com

(713) 529-6600

- Financial Statements Follow -

Construction Partners, Inc.

Consolidated Statements of Comprehensive Income (Loss)

(unaudited, in thousands, except share and per share data)

| | | | | | | | | | | | | | | | |

| | For the Three Months Ended December 31, |

| | 2024 | | 2023 | | |

| Revenues | | $ | 561,580 | | | $ | 396,505 | | | |

| Cost of revenues | | 485,009 | | | 344,625 | | | |

| Gross profit | | 76,571 | | | 51,880 | | | |

| General and administrative expenses | | (44,266) | | | (35,454) | | | |

| Acquisition-related expenses | | (19,552) | | | (527) | | | |

| Gain on sale of property, plant and equipment, net | | 1,055 | | | 836 | | | |

| | | | | | |

| Operating income | | 13,808 | | | 16,735 | | | |

| Interest expense, net | | (18,130) | | | (3,746) | | | |

| Other (expense) income | | 421 | | | (28) | | | |

| Income (loss) before provision for income taxes | | (3,901) | | | 12,961 | | | |

| Provision (benefit) for income taxes | | (849) | | | 3,118 | | | |

| Earnings from investment in joint venture | | 1 | | | — | | | |

| Net income (loss) | | (3,051) | | | 9,843 | | | |

| Other comprehensive income (loss), net of tax | | | | | | |

| Unrealized gain (loss) on interest rate swap contract, net | | 2,869 | | | (7,105) | | | |

| Unrealized gain (loss) on restricted investments, net | | (333) | | | 400 | | | |

| Other comprehensive income (loss) | | 2,536 | | | (6,705) | | | |

| Comprehensive income (loss) | | $ | (515) | | | $ | 3,138 | | | |

| | | | | | |

| Net income (loss) per share attributable to common stockholders: | | | | | | |

| Basic | | $ | (0.06) | | | $ | 0.19 | | | |

| Diluted | | $ | (0.06) | | | $ | 0.19 | | | |

| | | | | | |

| Weighted average number of common shares outstanding: | | | | | | |

| Basic | | 54,160,317 | | | 51,892,426 | | | |

| Diluted | | 54,160,317 | | | 52,430,864 | | | |

| | | | | | |

| | | | | | |

Construction Partners, Inc.

Consolidated Balance Sheets

(in thousands, except share and per share data)

| | | | | | | | | | | |

| December 31, | | September 30, |

| 2024 | | 2024 |

| (unaudited) | | |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 132,504 | | | $ | 74,686 | |

| Restricted cash | 564 | | | 1,998 | |

| Contracts receivable including retainage, net | 384,076 | | | 350,811 | |

| Costs and estimated earnings in excess of billings on uncompleted contracts | 35,705 | | | 25,966 | |

| Inventories | 145,208 | | | 106,704 | |

| Prepaid expenses and other current assets | 25,059 | | | 24,841 | |

| Total current assets | 723,116 | | | 585,006 | |

| Property, plant and equipment, net | 1,030,892 | | | 629,924 | |

| Operating lease right-of-use assets | 42,513 | | | 38,932 | |

| Goodwill | 644,206 | | | 231,656 | |

| Intangible assets, net | 88,120 | | | 20,549 | |

| Investment in joint venture | 85 | | | 84 | |

| Restricted investments | 17,473 | | | 18,020 | |

| Other assets | 21,511 | | | 17,964 | |

| | | |

| Total assets | $ | 2,567,916 | | | $ | 1,542,135 | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 171,608 | | | $ | 182,572 | |

| Billings in excess of costs and estimated earnings on uncompleted contracts | 136,660 | | | 120,065 | |

| Current portion of operating lease liabilities | 10,586 | | | 9,065 | |

| Current maturities of long-term debt | 37,719 | | | 26,563 | |

| Accrued expenses and other current liabilities | 113,176 | | | 42,189 | |

| Total current liabilities | 469,749 | | | 380,454 | |

| Long-term liabilities: | | | |

| Long-term debt, net of current maturities and deferred debt issuance costs | 1,183,132 | | | 486,961 | |

| Operating lease liabilities, net of current portion | 32,650 | | | 30,661 | |

| Deferred income taxes, net | 53,335 | | | 53,852 | |

| Other long-term liabilities | 17,982 | | | 16,467 | |

| Total long-term liabilities | 1,287,099 | | | 587,941 | |

| Total liabilities | 1,756,848 | | | 968,395 | |

| Commitments and contingencies | | | |

| Stockholders’ equity: | | | |

Preferred stock, par value $0.001; 10,000,000 shares authorized and no shares issued and outstanding at December 31, 2024 and September 30, 2024 | — | | | — | |

Class A common stock, par value $0.001; 400,000,000 shares authorized, 47,550,777 shares issued and 47,158,599 shares outstanding at December 31, 2024, and 44,062,830 shares issued and 43,819,102 shares outstanding at September 30, 2024 | 47 | | | 44 | |

Class B common stock, par value $0.001; 100,000,000 shares authorized, 11,691,408 shares issued and 8,765,803 shares outstanding at December 31, 2024 and 11,784,650 shares issued and 8,861,698 shares outstanding at September 30, 2024 | 12 | | | 12 | |

| Additional paid-in capital | 527,986 | | | 278,065 | |

Treasury stock, Class A common stock, par value $0.001, at cost, 392,178 shares at December 31, 2024 and 243,728 shares at September 30, 2024 | (23,128) | | | (11,490) | |

Treasury stock, Class B common stock, par value $0.001, at cost, 2,925,605 shares at December 31, 2024 and 2,922,952 shares at September 30, 2024 | (16,046) | | | (15,603) | |

| Accumulated other comprehensive income, net | 10,038 | | | 7,502 | |

| Retained earnings | 312,159 | | | 315,210 | |

| Total stockholders’ equity | 811,068 | | | 573,740 | |

| Total liabilities and stockholders’ equity | $ | 2,567,916 | | | $ | 1,542,135 | |

| | | |

Construction Partners, Inc.

Consolidated Statements of Cash Flows

(unaudited, in thousands)

| | | | | | | | | | | | | |

| For the Three Months Ended December 31, |

| 2024 | | 2023 | | |

| Cash flows from operating activities: | | | | | |

| Net income (loss) | $ | (3,051) | | | $ | 9,843 | | | |

| Adjustments to reconcile net income to net cash, cash equivalents and restricted cash provided by operating activities: | | | | | |

| Depreciation, depletion, accretion and amortization | 31,184 | | | 21,121 | | | |

| Amortization of deferred debt issuance costs | 495 | | | 74 | | | |

| | | | | |

| Unrealized loss on derivative instruments | — | | | 226 | | | |

| Provision for bad debt | 92 | | | 281 | | | |

| Gain on sale of property, plant and equipment | (1,055) | | | (836) | | | |

| | | | | |

| Realized loss on restricted investments | 19 | | | 23 | | | |

| Share-based compensation expense | 14,403 | | | 2,889 | | | |

| Earnings from investment in joint venture | (1) | | | — | | | |

| | | | | |

| Deferred income tax benefit | (1,411) | | | (404) | | | |

| Other non-cash adjustments | (229) | | | (86) | | | |

| Changes in operating assets and liabilities: | | | | | |

| Contracts receivable including retainage, net | 62,560 | | | 63,507 | | | |

| Costs and estimated earnings in excess of billings on uncompleted contracts | (5,767) | | | (2,203) | | | |

| Inventories | (10,434) | | | (9,880) | | | |

| Prepaid expenses and other current assets | (143) | | | 1,079 | | | |

| Other assets | 410 | | | (320) | | | |

| Accounts payable | (47,490) | | | (26,330) | | | |

| Billings in excess of costs and estimated earnings on uncompleted contracts | 6,302 | | | 8,554 | | | |

| Accrued expenses and other current liabilities | (6,554) | | | (8,322) | | | |

| Other long-term liabilities | 1,333 | | | 1,162 | | | |

| Net cash provided by operating activities, net of acquisitions | 40,663 | | | 60,378 | | | |

| Cash flows from investing activities: | | | | | |

| Purchases of property, plant and equipment | (26,832) | | | (26,783) | | | |

| Proceeds from sale of property, plant and equipment | 1,843 | | | 2,460 | | | |

| | | | | |

| Proceeds from sale of restricted investments | 2,417 | | | 1,013 | | | |

| Purchases of restricted investments | (2,258) | | | — | | | |

| Business acquisitions, net of cash acquired | (654,200) | | | (81,351) | | | |

| | | | | |

| Net cash used in investing activities | (679,030) | | | (104,661) | | | |

| Cash flows from financing activities: | | | | | |

| | | | | |

| Proceeds from revolving credit facility | — | | | 90,000 | | | |

| Proceeds from issuance of long-term debt, net of debt issuance costs and discount | 834,995 | | | — | | | |

| Repayments of long-term debt | (128,163) | | | (23,750) | | | |

| | | | | |

| Purchase of treasury stock | (12,081) | | | (1,336) | | | |

| | | | | |

| | | | | |

| | | | | |

| Net cash provided by financing activities | 694,751 | | | 64,914 | | | |

| Net change in cash, cash equivalents and restricted cash | 56,384 | | | 20,631 | | | |

| Cash, cash equivalents and restricted cash: | | | | | |

| Cash, cash equivalents and restricted cash, beginning of period | 76,684 | | | 49,080 | | | |

| Cash, cash equivalents and restricted cash, end of period | $ | 133,068 | | | $ | 69,711 | | | |

| | | | | |

| Supplemental cash flow information: | | | | | |

| Cash paid for interest | $ | 15,051 | | | $ | 4,692 | | | |

| | | | | |

| Cash paid for operating lease liabilities | $ | 3,233 | | | $ | 884 | | | |

| Non-cash items: | | | | | |

| Operating lease right-of-use assets obtained in exchange for operating lease liabilities | $ | 3,961 | | | $ | 4,698 | | | |

| Property, plant and equipment financed with accounts payable | $ | 3,694 | | | $ | 7,088 | | | |

| Issuance of stock for business acquisition | $ | 236,250 | | | $ | — | | | |

| Amounts payable to sellers in business combination | $ | 86,000 | | | $ | — | | | |

| | | | | |

Reconciliation of Non-GAAP Financial Measures

Adjusted EBITDA represents net income before, as applicable from time to time, (i) interest expense, net, (ii) provision (benefit) for income taxes, (iii) depreciation, depletion, accretion and amortization, (iv) share-based compensation expense, (v) loss on the extinguishment of debt and (vi) nonrecurring expenses related to transformative acquisitions, which management considers to include acquisitions requiring clearance under federal antitrust laws, such as the acquisition of Lone Star Paving (the “Lone Star Acquisition”). Adjusted EBITDA margin represents Adjusted EBITDA as a percentage of revenues for each period. Adjusted net income represents net income before (i) nonrecurring expenses related to transformative acquisitions, which management considers to include acquisitions requiring clearance under federal antitrust laws, such as the Lone Star Acquisition, and (ii) nonrecurring fees associated with financing arrangements incurred in connection with transformative acquisitions, such as a bridge loan associated with the Lone Star Acquisition. These metrics are supplemental measures of our operating performance that are neither required by, nor presented in accordance with, GAAP. These measures have limitations as analytical tools and should not be considered in isolation or as an alternative to net income or any other performance measure derived in accordance with GAAP as an indicator of our operating performance. We present Adjusted EBITDA, Adjusted EBITDA margin and Adjusted net income because management uses these measures as key performance indicators, and we believe that securities analysts, investors and others use these measures to evaluate companies in our industry. Our calculation of Adjusted EBITDA, Adjusted EBITDA margin and Adjusted net income may not be comparable to similarly named measures reported by other companies. Potential differences may include differences in capital structures, tax positions and the age and book depreciation of intangible and tangible assets.

The following table presents a reconciliation of net income (loss), the most directly comparable measure calculated in accordance with GAAP, to Adjusted EBITDA and the calculation of Adjusted EBITDA Margin for the periods presented:

Construction Partners, Inc.

Net Income (Loss) to Adjusted EBITDA Reconciliation

Fiscal Quarters Ended December 31, 2024 and 2023

(unaudited, in thousands, except percentages)

| | | | | | | | | | | |

| For the Three Months Ended December 31, |

| 2024 | | 2023 |

| Net income (loss) | $ | (3,051) | | | $ | 9,843 | |

| Interest expense, net | 18,130 | | | 3,746 | |

| Provision for income taxes | (849) | | | 3,118 | |

| Depreciation, depletion, accretion and amortization | 31,184 | | | 21,121 | |

| Share-based compensation expense | 4,920 | | | 3,046 | |

| | | |

| Transformative acquisition expenses | 18,463 | | | — | |

| Adjusted EBITDA | $ | 68,797 | | | $ | 40,874 | |

| Revenues | $ | 561,580 | | | $ | 396,505 | |

| Adjusted EBITDA Margin | 12.3 | % | | 10.3 | % |

The following table presents a reconciliation of net income (loss), the most directly comparable measure calculated in accordance with GAAP, to adjusted net income for the periods presented:

Construction Partners, Inc.

Net Income (Loss) to Adjusted Net Income Reconciliation

Fiscal Quarters Ended December 31, 2024 and 2023

(unaudited, in thousands)

| | | | | | | | | | | |

| For the Three Months Ended December 31, |

| 2024 | | 2023 |

| Net income (loss) | $ | (3,051) | | | $ | 9,843 | |

| Transformative acquisition expenses | 18,463 | | | — | |

| Financing fees related to transformative acquisitions | 3,057 | | | — | |

| Tax impact due to above reconciling items | (5,199) | | | — | |

| Adjusted net income | $ | 13,270 | | | $ | 9,843 | |

| | | |

Construction Partners, Inc.

Net Income to Adjusted EBITDA Reconciliation

Fiscal Year 2025 Updated Outlook

(unaudited, in thousands, except percentages)

| | | | | | | | | | | |

| For the Fiscal Year Ending September 30, 2025 |

| Low | | High |

| Net income | $ | 93,000 | | | $ | 105,600 | |

| Interest expense, net | 74,100 | | | 72,700 | |

| Provision for income taxes | 31,750 | | | 36,150 | |

| Depreciation, depletion, accretion and amortization | 135,900 | | | 145,300 | |

| Share-based compensation expense | 21,500 | | | 21,500 | |

| | | |

| Transformative acquisition expenses | 18,750 | | | 18,750 | |

| Adjusted EBITDA | $ | 375,000 | | | $ | 400,000 | |

| Revenues | $ | 2,660,000 | | | $ | 2,740,000 | |

| Adjusted EBITDA Margin | 14.1 | % | | 14.6 | % |

Construction Partners, Inc.

Net Income to Adjusted Net Income Reconciliation

Fiscal Year 2025 Updated Outlook

(unaudited, in thousands)

| | | | | | | | | | | |

| For the Fiscal Year Ending September 30, 2025 |

| Low | | High |

| Net income | $ | 93,000 | | | $ | 105,600 | |

| Transformative acquisition expenses | 18,750 | | | 18,750 | |

| Financing fees related to transformative acquisitions | 3,057 | | | 3,057 | |

| Tax impact due to above reconciling items | (5,267) | | | (5,267) | |

| Adjusted net income | $ | 109,540 | | | $ | 122,140 | |

| | | |

v3.25.0.1

Cover Page

|

Feb. 07, 2025 |

| Cover [Abstract] |

|

| Entity Tax Identification Number |

26-0758017

|

| Entity File Number |

001-38479

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Registrant Name |

CONSTRUCTION PARTNERS, INC.

|

| Document Period End Date |

Feb. 07, 2025

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001718227

|

| Entity Emerging Growth Company |

false

|

| Security Exchange Name |

NASDAQ

|

| Trading Symbol |

ROAD

|

| Title of 12(b) Security |

Class A common stock, $0.001 par value

|

| Pre-commencement Issuer Tender Offer |

false

|

| Pre-commencement Tender Offer |

false

|

| Soliciting Material |

false

|

| Local Phone Number |

(334) 673-9763(Registrant’s telephone number, including area code)

|

| City Area Code |

(334) 673-9763(Registrant’s telephone number, including area code)

|

| Written Communications |

false

|

| Entity Address, Postal Zip Code |

36303

|

| Entity Address, State or Province |

AL

|

| Entity Address, City or Town |

Dothan

|

| Entity Address, Address Line One |

290 Healthwest Drive, Suite 2

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

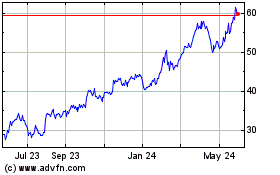

Construction Partners (NASDAQ:ROAD)

Historical Stock Chart

From Jan 2025 to Feb 2025

Construction Partners (NASDAQ:ROAD)

Historical Stock Chart

From Feb 2024 to Feb 2025